1.Personal Savings Rate Going Down Consumer Spending Up.

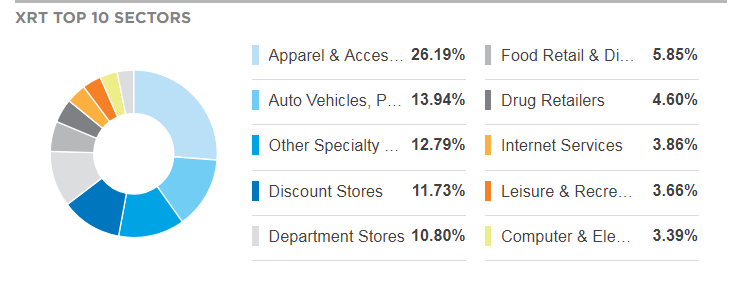

XRT Retail Index Breakout…Death by Amazon putting poor operators out of business and forcing existing players to step up game.

XRT Retail Index Weekly 50 day thru 200day to upside.

http://www.etf.com/XRT

www.stockcharts.com

2.Inflation Increasing But Moderately.

U.S. monthly consumer prices increase moderately in May

WASHINGTON (Reuters) – U.S. monthly consumer inflation rose moderately in May as gasoline price increases slowed, suggesting the Federal Reserve could continue to gradually raise interest rates this year.

A woman shops in the Health & Beauty section of a Whole Foods in Upper St. Clair, Pennsylvania, U.S., February 15, 2018. Picture taken February 15, 2018. REUTERS/Maranie Staab

The Labor Department’s inflation report was published ahead of the start of the Fed’s two-day policy meeting on Tuesday. Steadily rising inflation and a tightening labor market are seen encouraging the U.S. central bank to hike rates for a second time this year on Wednesday.

“Neither too hot nor too cold,” said Michael Feroli, an economist at JPMorgan in New York. “As such, today’s news won’t change the terms of the inflation debate, and is likely to do little to stir the pot at the Fed meeting.”

The Consumer Price Index increased 0.2 percent last month, also as food prices were unchanged. That followed a similar gain in the CPI in April. In the 12 months through May, the CPI accelerated 2.8 percent, the biggest advance since February 2012, after rising 2.5 percent in April.

The surge in the annual CPI is largely the result of last year’s weak readings, which were driven by big declines in the prices of cell phone service plans and doctor fees, falling from the calculation.

Excluding the volatile food and energy components, the CPI rose 0.2 percent, supported by a rebound in new motor vehicle prices and a pickup in the cost of healthcare, after edging up 0.1 percent in April. That lifted the year-on-year increase in the so-called core CPI to 2.2 percent, the largest rise since February 2017, from 2.1 percent in April.

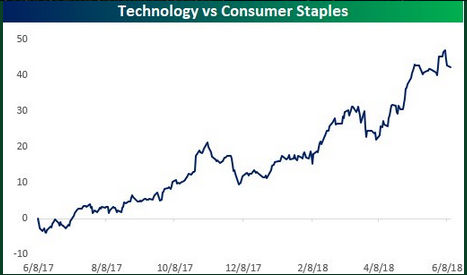

3.Dispersion Between Tech Stocks and Consumer Staples 40%

3.Dispersion Between Tech Stocks and Consumer Staples 40%

“At over 40 percentage points, the outperformance of Technology vs Consumer Staples and Utilities over the last year has been devastating” noted Bespoke

https://www.bespokepremium.com/think-big-blog/

4.Most Shorted Stocks in Market Up 25%…Breadth of Market Crushing Shorts.

Thomson Reuters Most Shorted Index has gained 25% since Jun 2017 vs an S&P 500 rise of ~14%. Shares in some heavily shorted stocks rallied Monday w/Tesla, Chipotle, Hertz, Avis Budget seeing strong gains.

From Dave Lutz at Jones.

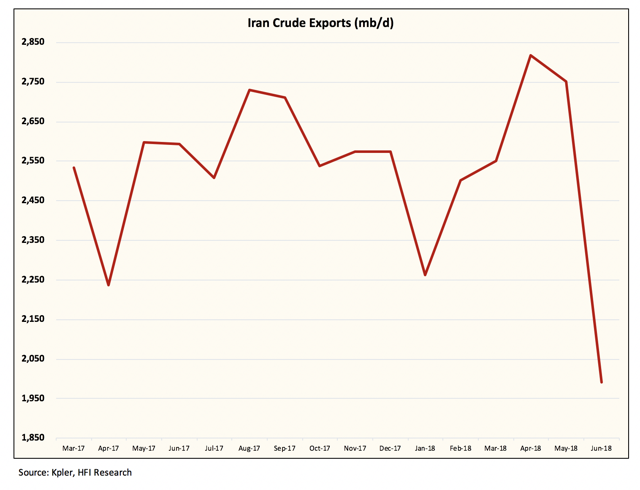

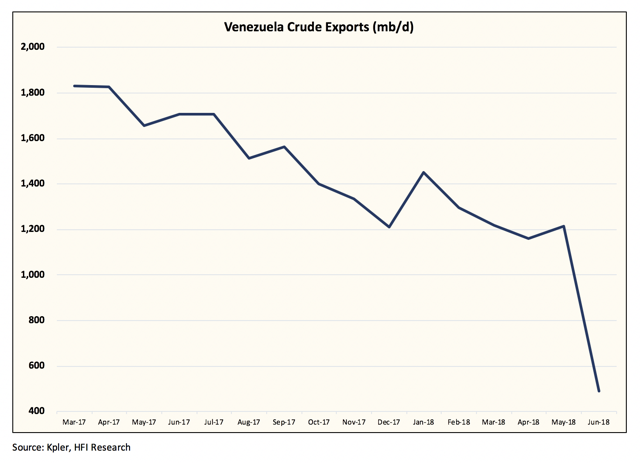

5.Oil Prices…On Top of Saudis Trying to Slap Aramaco on Tape at Highest Price….Iran and Venezuela Production Plummeting.

Oil: Short-Term Pain For Long-Term Gain

https://seekingalpha.com/article/4180870-oil-short-term-pain-long-term-gain

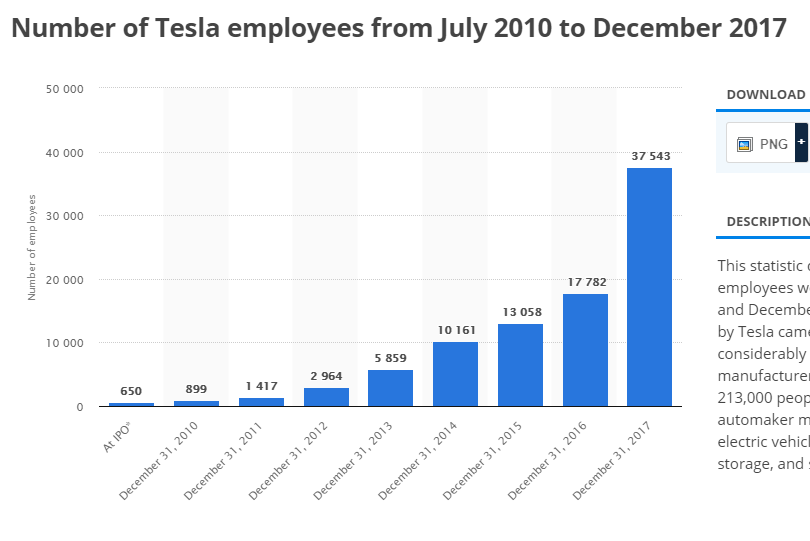

6.Tesla Cutting 9% of Workforce.

It’s never good news when Elon sends a late-day, company-wide memo. And this time was no different—Tesla (+3.21%) is cutting 9% of its 46,000-person workforce.

Per Elon:

- “Tesla has grown and evolved rapidly over the past several years, which has resulted in some duplication of roles.”

- “What drives us is our mission to accelerate the world’s transition to sustainable, clean energy, but we will never achieve that mission unless we eventually demonstrate that we can be sustainably profitable.”

- “This will not affect our ability to reach Model 3 production targets in the coming months.”

- “We’ve decided not to renew our residential sales agreement with Home Depot in order to focus our efforts on selling solar power in Tesla stores and online.”

https://www.statista.com/statistics/314768/number-of-tesla-employees/

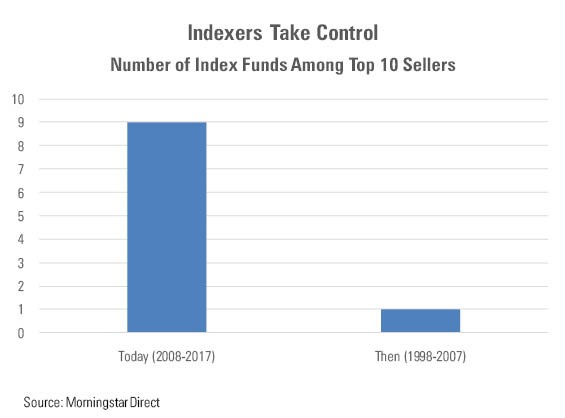

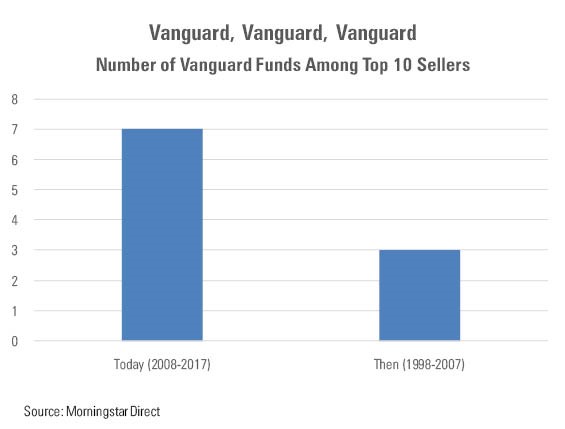

7.The Vanguard Decade…2008-2017

What a Difference a Decade Makes

John Rekenthaler

The Mightiest of Kings

The sales success of the largest funds, and the dominance of indexing, intersect in Valley Forge, Pennsylvania. Vanguard is not only larger than any U.S. fund company has ever been (although it is not the largest overall money manager; that title is held by BlackRock), but it also boasts a larger market share than any U.S. fund company has ever held. The fund-industry’s pie has never been heftier, and Vanguard’s slice is the widest ever cut.

Ten years ago, Vanguard had only one fund among the top 10 sellers: Vanguard Total Stock Market Index (VTSAX). (I would have guessed Vanguard 500 Index (VFINX).) Today, it has seven funds. Three are domestic-stock funds, two are international-stock funds, and two are bond funds. Vanguard began the decade maintaining, against significant opposition, that if indexing made sense for blue-chip U.S. stocks, then it also would suit other asset classes. Clearly, it won that argument.

http://www.morningstar.com/articles/868932/what-a-difference-a-decade-makes.html

Found at Barry Ritholtz The Big Picture http://ritholtz.com/

8.One Area of ETFs Is Not Growing: Options

By Nathan Reiff | June 12, 2018 — 5:58 PM EDT

While digital currencies tend to dominate the headlines for their flashy, highly volatile price antics, many investors have turned their attention to exchange-traded funds (ETFs). Over the past several years, ETFs have grown at an astonishing pace. With well over 2,000 of these funds available to investors now, and with more launching all the time, the total assets funneled into the ETF space could reach as high as $25 trillion by 2025, according to some estimates.

For the time being, ETFs have seen years with consecutive months of inflows, while the percentage of investors owning ETFs remains low enough that analysts predict steady growth for the immediate and foreseeable future. Nonetheless, despite all of these signs that ETFs as investment vehicles are continuing to gain in dominance over other areas of investing, there is at least one area of the ETF space that has struggled. Indeed, a report by ETF Trends suggests that options on ETFs have been stagnant for many years. (For more, see: ETF Growth Spurt Will Continue.)

Options an Important Aspect of ETFs

ETFs are typically compared to mutual funds. In doing so, investors frequently overlook one important aspect of exchange-traded funds: the ability to trade options contracts. These can be used to manage risk, to generate added income, for the purposes of speculation and even for use in resolving tax issues. However, options on ETFs seem to have stagnated in recent years.

Many investors have historically (and even up to the present day) seen ETFs as trading vehicles. In early ETFs, it was common for options to be listed, and the resulting options markets became especially robust. One need look back to the first 100 ETFs launched for evidence of this; at least 87 of those 100 funds had listed options.

This trend continued for many years, with the mid-2000s seeing a high point for options listings in ETFs. By 2006, about 75% of all ETFs listed options. However, since that time, ETF launches have begun to shift considerably. (See also: Scared by ETF Risks? Try Hedging With ETF Options.)

More ETF Launches, Fewer Options

Beginning in the mid-2000s, the pace of ETF launches increased considerably. While in the years leading up to that time it was common for there to be anywhere from 20 to 70 ETFs launched per year, from 2006 onward, that number pushed up to 200 to 300. The large majority of the newly launched ETFs from that time onward did not offer options trading. Indeed, even as there were more ETFs being launched on an annual basis, the number of ETFs offering options trading actually dwindled from a high point in 2007.

The financial crisis helped to launch the popularity of ETFs to new heights. From 2007 to 2009, the number of total ETFs available doubled. By the end of that period, however, only half of the ETFs available offered options. By today, only about one-third of all ETFs have options available. However, as a result of the top-heavy nature of current ETF assets, nearly 9 out of 10 ETFs have options available on an asset-weighted basis.

In addition to the dwindling percentage of ETFs offering options trading, options volume has been stagnant over the past few years. Of all ETF options trading volume, 60% happens in just three popular ETFs: SPDR S&P 500 (

). Each of these ETFs launched before 2001. Of the remaining options trading volume, a good portion happens in other ETFs that are also equally established. Overall, about 95% of all options trading volume in the ETF space for the past decade has happened in just 35 ETFs. (See also: 3 Reasons to Use ETF Options Over Futures.)

There are many possible explanations for the stagnation. The Chicago Board Options Exchange’s Volatility Index (VIX), launched in 2006, provides investors with access to other ways of hedging portfolio risk. Index options and futures volumes have also climbed during that time. Generally speaking, investors have been unlikely to view new, cheap ETFs as good options vehicles. Perhaps most importantly, many of the newly launched ETFs focus on smart beta, thematic or actively managed products. Many investors view these funds not as trading vehicles but as means of gaining exposure to certain asset classes, thereby reducing the need for speculation.

It may be that the options dominance of many years ago will never return to the ETF space. In any case, as ETFs continue to evolve, there is no doubt that the industry will continue to provide investors with new tools and possibilities, regardless. (For additional reading, check out: Writing Covered Calls on ETFs.)

Read more: One Area of ETFs Is Not Growing: Options | Investopedia https://www.investopedia.com/investing/one-area-etfs-not-growing-options/#ixzz5IIzZQE8I

Follow us: Investopedia on Facebook

9.Read of the Day…U.S. Charitable Giving Tops $400 Billion

By

Fang Block

Michael Dell, chairman and chief executive officer of Dell Inc., and his wife Susan attend the Allen & Company Sun Valley Conference on July 10, 2015 in Sun Valley, Idaho. The couple made over $1 billion donation last year. ILLUSTRATION: GETTY IMAGES

Boosted by a bull market and a strong economy, charitable giving in the United States surpassed the $400 billion mark for the first time in 2017, according to an annual report on philanthropy released Tuesday.

Last year, American individuals, bequests, foundations, and corporations—the four sources of charity giving—donated an estimated $410.02 billion, an increase of 5.2% over the revised total of $389.64 billion in 2016, the report shows.

“The increase in giving in 2017 was generated in part by increases in the stock market, as evidenced by the nearly 20% growth in the S&P 500,” says Amir Pasic, dean of the Indiana University Lilly Family School of Philanthropy, which prepares the report for the Giving USA Foundation.

Investment returns help fund a multiple of very large gifts, including two of at least $1 billion by Michael and Susan Dell and Mark Zuckerberg and Priscilla Chan to their respective foundations.

Other economic factors, such as increase in disposable personal income, also contributed to the strong growth in philanthropy in 2017.

Giving by individuals, which makes up 70% of U.S. charitable giving, totaled an estimated $286.65 billion in 2017, an increase of $14.72 billion, or 5.2%, over 2016.

“As people have more resources available, they are choosing to use them to make a difference,” says Aggie Sweeney, chair of Giving USA Foundation and senior counsel at Campbell & Company.

Giving by corporations, although still the smallest share (5%), had the strongest growth in 2017. It rose 8% to $20.77 billion, mainly due to the $405 million in contributions for relief related to natural and manmade disasters, according to the report.

On the receiving side, all but one of nine categories of organizations saw their funds grow in 2017. Foundations ($45.89 billion) and Arts, Culture, and Humanities ($19.51 billion) registered the largest gains, increasing 15.5% and 8.7%, respectively

10.5 Tips for Better Decision Making

Jeremy Nicholson M.S.W., Ph.D.

When to use slow cognition versus fast intuition to make a decision.

Traditional economics does an excellent job explaining human decision-making in situations where people have all the facts and are thinking logically. Nevertheless, in our everyday lives, we often do not have complete information and decisions can have an emotional impact as well. Dealing with these uncertain and risky day-to-day decisions can often lead to bias, require emotional regulation, and may result in habit formation too.

Therefore, to help explain these choices under uncertainty and risk, the discipline of behavioral economics taps into theories and research from various domains within psychology. Together, they offer some unique insights into how we can make better day-to-day decisions (and “nudge” the choices of other people too).

To begin to understand and apply those insights, we must first start with a basic premise—that we don’t always think about our choices and decisions the same way. Sometimes, we may think about things in more of a fast and automatic way. At other times, we may consider things more slowly and deliberately. In turn, each of these ways of making choices has its own pros-and-cons.

Thinking Fast and Slow

In his book, Thinking, Fast and Slow, behavioral economist Daniel Kahneman discusses these finer points of thinking in detail. Specifically, he uses the framework of two “systems” of cognition. Kahneman (2011) explains:

“System 1 operates automatically and quickly, with little or no effort and no sense of voluntary control.

System 2 allocates attention to the effortful mental activities that demand it, including complex computations. The operations of System 2 are often associated with the subjective experience of agency, choice, and concentration” (p. 20-21).

In the rest of the book, Kahneman (2011) goes into detail about the differences between these two general processes of thinking and their impact on various types of decision-making. Particularly, he notes that, while System 1 thinking may be fast and effortless, it often jumps to the wrong conclusions, relies on hunches and biases, and may be overconfident. In contrast, System 2 thinking is usually more balanced, acquiring greater information and using more reliable decision-rules—but requires attention and effort (which is often limited). Taken together then, making the most of our decision-making capacity is often about balancing and managing when we are thinking fast versus when we are thinking slow.

Simple Rules for Better Decision-Making

Given the above, a few general tips can help improve your decision-making.

1) Rest or Sleep on It

When you have to make a big and important decision, it may be best to do it when you are rested, focused, and motivated. According to Kahneman (2011) complex and effortful thinking (system 2) requires attention, motivation, and self-control. All of those resources are more limited and depleted when we are already busy, stressed, and tired.

article continues after advertisement

Although there have been some challenges to this idea, a recent review by Baumister, Tice, and Vohs (2018) noted the negative effects of such depletion on the decision-making of children in academic settings, hospital staff, judges, and voters. Therefore, when possible, think through important decisions when you are well rested, clear-headed, and have the energy and motivation to dedicate to the task. Your mother telling you to “sleep on it and decide in the morning” was probably good advice.

2) Take Your Time

Thinking clearly and logically takes time too. When we are under time pressure and short deadlines, our fast-thinking (system 1) takes over instead. For example, according to research on financial decisions by Kirchler and associates (2017), individuals are more likely to make risky choices under such time pressure.

Thus, when we are in a rush, we jump to a quick conclusion that may be full of biases and hunches, rather than carefully thinking through the facts and information. Therefore, quick thinking might be helpful for small, habitual, everyday decisions that don’t require much deliberation—or have much risk involved. Nevertheless, if the decision is more complex and important, then take the time to think it through thoroughly.

3) Gather The Facts

Beyond having the time and energy to think clearly, our decisions are only as good as the information we have about our choices and options. We can ponder a choice for hours, but if the information we mull over is very limited, or of poor quality, then all that effort and thought will be much less effective. In the end, with such uncertain decisions, we’re left to rely on our biases and hunches to fill in the gaps anyway (system 1). Therefore, the more reliable facts and information we can gather and consider about a decision, the more we can reduce our uncertainty and make better choices. For example, work by Ariely (2000) notes that the more customers are in control of the flow of information they receive about a consumer decision, the better they can match their preferences, improve their knowledge about the domain, and increase confidence in their judgments.

article continues after advertisement

Nevertheless, there is no such thing as “perfect” information—and endless evaluation is not effective either (sometimes called analysis paralysis). Ariely (2000) also notes that controlling the information flow is demanding and taxing. Given that, the trick is to balance the information with the importance of the decision. So, when you are considering something big and important, feed your system 2 processes with more of the facts to help you make a better choice.

4) Stay Open to All Possibilities

Sometimes, our quick thinking biases how we consider facts, information, and options along the path of decision-making—not just at the final decision. Particularly, as noted by Gilbert (1991), we often automatically accept things as “true” before we carefully deliberate about them. Also, according to Kunda (1990), our reasoning about an issue may be motivated by a “directional bias”, leading us to selectively review only the information and facts that support what we already want to believe.

Given that, we can often jump to conclusions, or be biased to confirm something that we want to believe, rather than honestly looking at what all of the information and facts are really telling us. Therefore, when making important decisions, it is helpful to stay open to all of the facts and possibilities (especially to the ones you don’t want or like). While more challenging and perhaps uncomfortable at times, this mindset can help you avoid making those decisions that may “feel good” in the moment, but blow up in your face later too.

article continues after advertisement

5) Create Rules

Even the best decision-makers are still human. We all get tired, unmotivated, rushed, stressed, and emotional at times. Beyond that, gathering every fact and carefully thinking through every decision is impossible—especially as we move through our day-to-day lives. That is why, when they are thinking clearly, more effective decision-makers often set up simple rules and formulas to make better choices—even when they are rushed at a later date. In Thinking, Fast and Slow, Kahneman (2011) notes that using such strategies, formulas, and algorithms are often superior to intuitive decision-making in a number of fields. Also, in a review article on behavioral finance, Ricciardi and Simon (2000), advise investors to set up an investment checklist as part of a “disciplined trading strategy”, in order to minimize the effect of emotional biases that can impact buying-and-selling decisions in the moment too.

Looking at more everyday examples, an individual might make a grocery list at home while considering what they really need (and stick to it at the store), rather than being tempted by immediate hunger or expensive sweets. Alternatively, they might set a firm upper limit for a big purchase, as they dispassionately consider what they can comfortably afford (rather than getting swept away by “falling in love” with a house or car that they struggle to pay for later). In short, even in situations where we might get caught up in biased and emotional thinking, we can often set up rules or formulas ahead of time to see us through.

Looking for more?

For more information on how these fast and slow decision-making processes impact our romantic partner choices, see my article on The Attraction Doctor blog: Who is Attractive and Compatible as a Romantic Partner?

Also, if you are interested in learning more about Behavioral Economics, you can find me where I teach: The Master’s Degree Program in Behavioral Economics, at The Chicago School of Professional Psychology(link is external).

© 2018 by Jeremy S. Nicholson, M.A., M.S.W., Ph.D. All rights reserved.