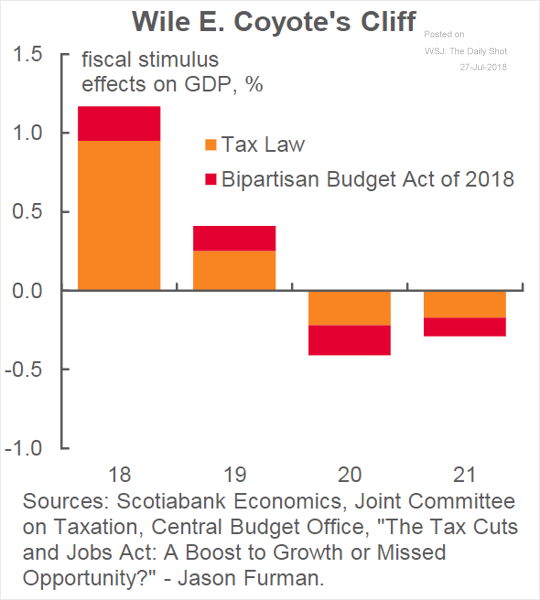

1.Similar Charts Leading Popular Argument That Government Stimulus Will Run Out in 2020.

The United States: A significant portion of this year’s GDP growth is due to the federal government stimulus. But the party ends in 2020.

Source: Scotiabank Economics

https://blogs.wsj.com/dailyshot/

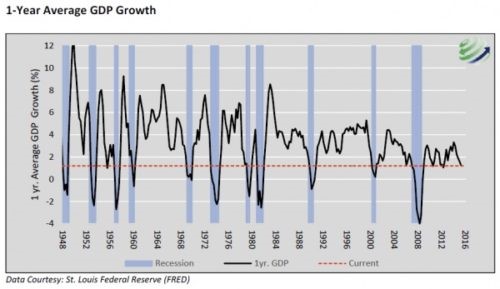

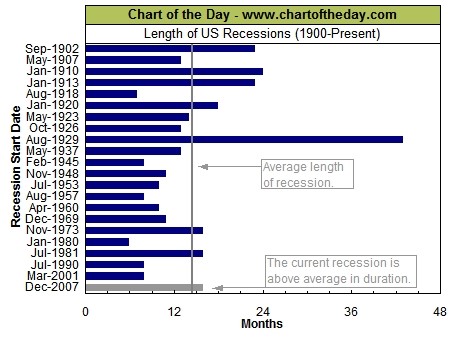

2.Recessions Happening Less Often and They are Getting Shorter.

In the United States, an NBER-classified recession is a relatively narrow set of events in which a contraction is observed across a wide array of indicators. Since 1953, according to the NBER, the United States has been in recession only 14% of the time; since 1990, this has fallen to 10%. Arguably, a more granular framework than a binary “in” or “out of” recession could be a more valuable tool for investors.

https://www.researchaffiliates.com

Shaded areas show recessions

http://thegreatrecession.info/blog/us-2016-recession/

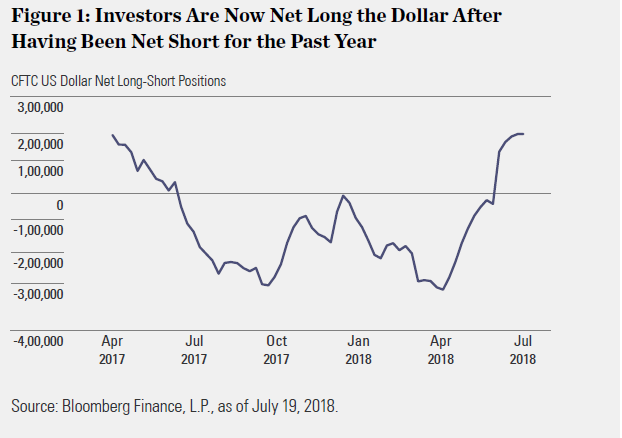

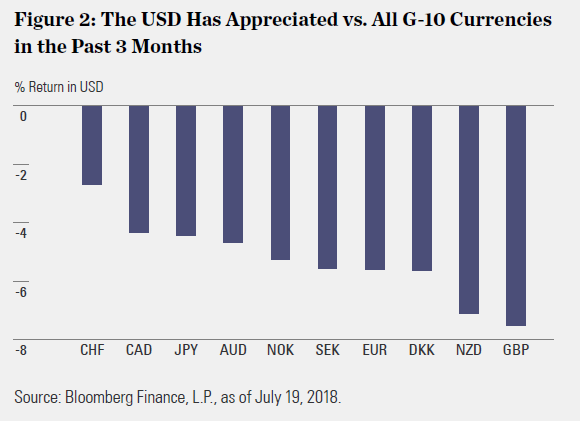

3.Follow Up to my Recent Comments About the U.S. Dollar.

SPDR FUNDS

Investors Cover Shorts and Now Net Long Dollar.

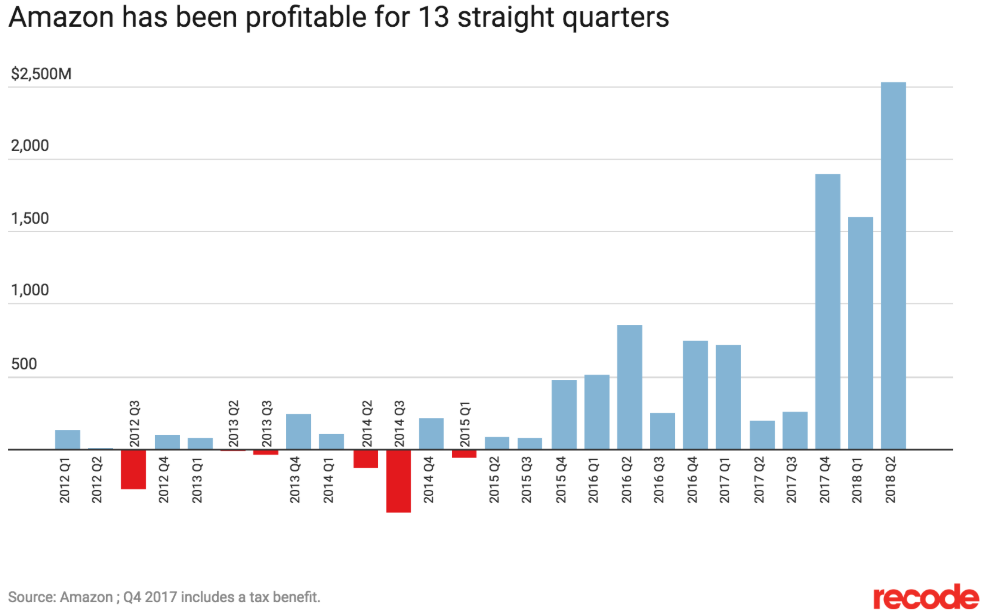

4.Amazon Profitable for 13 Straight Quarters.

From Barry Ritholtz Blog

Amazon Leads Tech Rivals in an Era of Shifts

By

Tiernan Ray

Amazon is dominant in cloud computing, which has an operating profit margin of 26.9% versus Amazon’s corporate average of 5.6%. Its newer advertising business is on pace to reach $8 billion to $10 billion annually, according to Youssef Squali of SunTrust Robinson Humphrey. Amazon doesn’t disclose financials for the ad business, but Squali believes it “operates at a very high margin,” and Amazon’s CFO, Brian Olsavsky, has made a point of saying it is helping to boost profit.

https://www.barrons.com/articles/amazon-leads-tech-rivals-in-an-era-of-shifts-1532736002

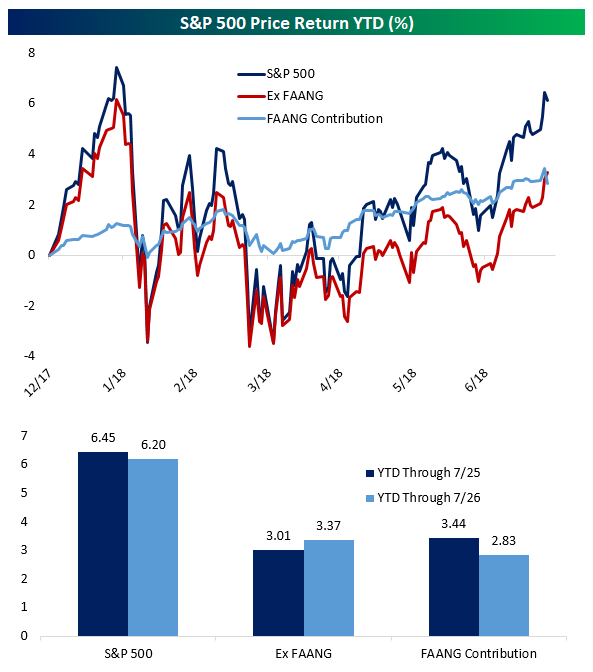

5.FAANG Contribution to S&P Post FB Sell Off.

FAANG Still Helping

Jul 27, 2018

Below is a chart showing the S&P 500’s price return year-to-date and the impact that the five FAANG (FB, AAPL, AMZN, NFLX, GOOGL) stocks have had. While Facebook’s horrific reaction to earnings and the worst day in the stock’s history had a negative market impact, the overall performance of the market YTD has been supported by the group. While they’re only a 13.6% weight in the S&P 500’s market cap, they’re driving the market up to the tune of almost half of its YTD gains. Impressive stuff for 5 stocks on their own, even in spite of Facebook’s brutal collapse.

Bespoke

https://www.bespokepremium.com/think-big-blog/

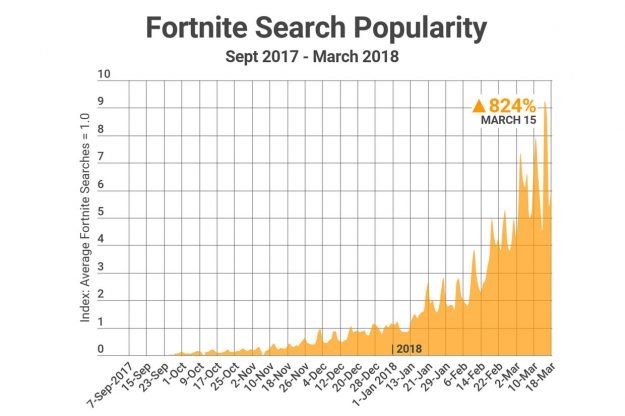

6.Fortnite Estimated Worth $8B…I would like to throw my son’s out window but ….

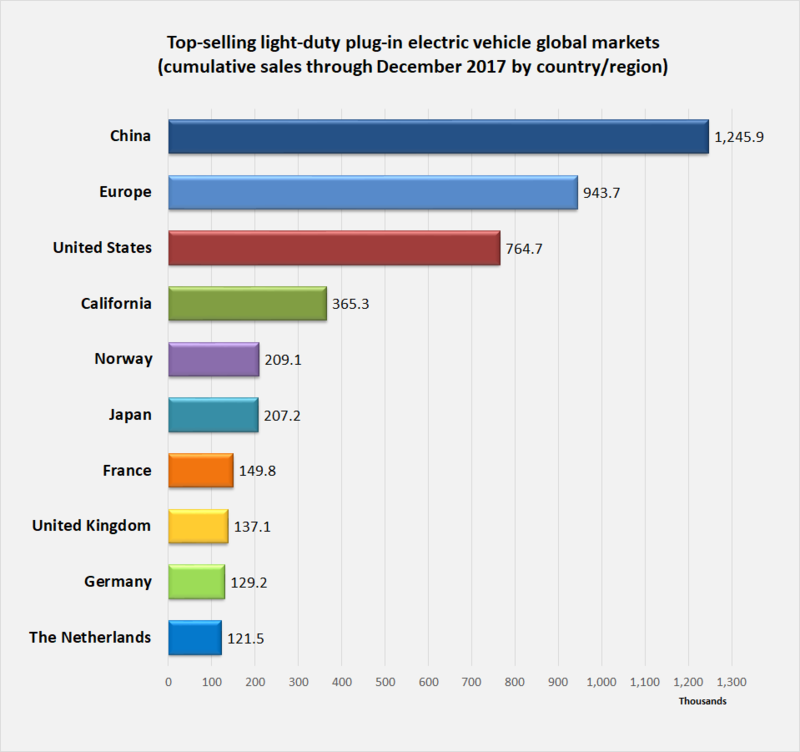

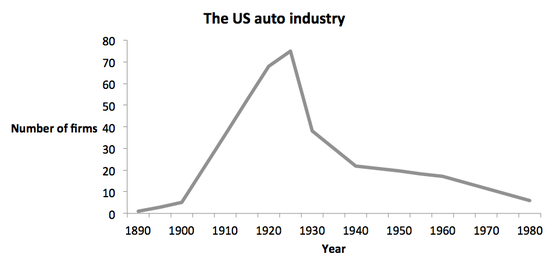

7.487 Chinese Electric Car Makers.

The U.S. had 80 car makers in 1920s

8.The ‘alarming’ way 1 in 3 millennial homeowners get the money to buy homes

Megan Leonhardt | @Megan_Leonhardt

Roughly 98 percent of people want to own a home, according to a recent Bank of the West survey. But coming up with the required funds can be tough — especially for cash-strapped millennials in today’s competitive market.

To finance their purchases, one in three millennial homeowners withdrew money from or took loans against their retirement accounts, according to Bank of the West’s survey of over 600 U.S. adults ages 21-34. Meanwhile, one in five millennials who are planning to buy a home expect to do the same.

It’s an “alarming” trend, according to Ryan Bailey, head of Bank of the West’s retail banking group. “Millennials are so eager to become homeowners that some may be inadvertently cutting off their nose to spite their face.” He recommends relying on savings rather than dipping into your retirement funds.

“Borrowing from your retirement may make sense in special circumstances, but it’s definitely not a recommendation we tell people to do,” Bailey tells CNBC Make It.

What’s the problem?

If you don’t have quite enough saved for your first home, you are allowed to pull money out of your retirement accounts, such as a 401(k) or an IRA. But while dipping into your retirement savings may help you put down a bigger down payment and lower your mortgage rate, it also may mean those savings could experience a long-term setback.

Think of it this way: You are not allowed to draw on your future Social Security payments to buy real estate and your grandparents weren’t allowed to use their pensions, Colorado-based financial planner Kristin Sullivan tells CNBC Make It. “For millennials, the 401(k) is going to be the major component of their retirement. It is a sacred pact with your older self to take care of that older self,” she says. If you can’t afford to buy a house without raiding your retirement plan, she adds, you may not be able to afford to be a homeowner at this point.

Technically, you can withdraw the money from a Roth IRA if you’ve had one for at least five years: Those under 59 ½ years old can take out up to $10,000 without penalty if you’re a first-time homebuyer, according to the IRS. And because you’ve already paid taxes on this money, you won’t have to worry about any additional fees.

If you’ve been contributing to your Roth IRA for less than five years, you can still pull out up to $10,000 — but you’ll have to pay income taxes on the amount.

If you have a 401(k), you’ll want to borrow the money as a loan, rather than taking it outright. Getting the money as a loan (up to 50 percent or $50,000, whichever is lower) helps you to avoid income taxes and a 10 percent early withdrawal penalty. But keep in mind that, as with any loan, you’ll have to pay the money back, plus interest. Also, should you fail to pay back the loan on time, you may incur a 10 percent early withdrawal penalty.

Worse, the terms of the loan generally require that you keep your current job. If you want to switch or are let go for any reason, the full balance of the loan is typically due within 60 days. “This is even the case if you are fired from your job. You would have to pay back a loan at what may be the most inopportune time,” New York-based financial advisor Paul Tramontozzi tells CNBC Make It.

What are the alternatives?

Before using retirement savings to purchase a new home, review your current spending. Look for any expenses you can cut to save money.

“If someone is contemplating dipping into retirement savings, they likely they haven’t been able to save up the required down payment to buy the house in the first place, which likely means they don’t have a good handle on their finances to begin with,” Illinois-based advisor Stephen Jordan tells CNBC Make It.

Millennials should also consider scaling down their home dreams in order to reduce the cost. Take a hard look at your finances so you don’t get in over your head, Danielle Hale, chief economist for Realtor.com, tells CNBC Make It. Just over 40 percent of millennial homeowners said in a recent survey said they had regrets after they purchased because they felt stretched financially.

“It takes being honest with yourself when you’re making a home purchase,” she says, adding that you should take advantage of filters on home search sites to make sure you’re not shopping for something that’s too expensive.

“With careful financial planning, millennials can have it all – the dream home today, without compromising their retirement security tomorrow,” Bailey says.

9.Read of the Day……Investing in Fine Wine Is More Lucrative Than Ever

Once an exotic market, parking your assets inside expensive bottles can yield tremendous profits.

Buying rare wines is like investing in a startup: You need 10 years of runway to see significant returns. But unlike a startup, wine is a lot more lucrative these days.

Had you allocated $100,000 to Cult Wines, a U.K.-based wine portfolio manager, your money—which is to say your wine—would have returned an average of 13 percent annually. In 2016, its index performance was actually 26 percent. The fine wine secondary market hovers at about $5 billion, a fraction of the $302 billion global wine market. But Euromonitor International Ltd. projects that while “key luxury players face mounting risks in 2018,” the wine and Champagne category is set to increase by an estimated 7 percent.

When it comes to what private bank Coutts & Co. calls the “passion index,” wine is right up there with fancy cars and rare coins.

Because of the unique nature of wine, however, investors should hire a manager. Cult Wines, Farr Vintners and Berry Bros. & Rudd are a few within a small network that will invest your money depending on your risk level, suggest purchases and track your portfolio. Tom Gearing, co-founder of Cult Wines, said his more than 1,700 clients should hold on to their wine for at least 3 to 7 years before trying to sell them. The management fees, 15 percent of the total investment value, are paid upfront and include storage. Farr Vintners charges 10 percent commission on purchase of wine and 10 percent on the sale.

Such managers buy from only trusted sources so they can confirm authenticity. Cult Wines does guarantee the wine, should it be opened, but this is less than 1 percent of the total value of their annual trades. Most stay corked.

Investment wine even has its very own exchange. The London International Vintners Exchange, which came online in 1999, shed some much-needed light on what had been a very opaque market. It’s now the industry standard for tracking prices of luxury wine and includes the Liv-ex Fine Wine 100 Index, which follows the top 100 most-sought-after wines.

So what to buy? To anyone that knows wine, French is the must-have and French Bordeaux the absolute must-have. The apex is the premier crus, or first growth wines, a classification system begun in 1855 that created a ranking of importance and that’s still in place today. On the list are Haut-Brion, Lafite-Rothschild, Latour, Margaux and Mouton Rothschild. Each chateau can also have secondary labels, which may not be as valuable as the first.

A case of Chateau Mouton Rothschild from 1982.

The problem with premier crus is that it’s at the very top of the market. Unless you get in early, your wine won’t see massive increases in value. Jamie Ritchie, worldwide head of Sotheby’s Wine, reports that a diversification has begun. “Last year it was Bordeaux and Burgundy at 40 percent each,” he said. In the past, Burgundy was 20 percent of the total investment wine. “We’ve seen a huge, growing demand in Burgundy. Great Bordeaux is selling well, but there’s actually too much of it.”

One other French quirk is the en primeur market, which refers to the opportunity to invest in wines while still in the barrels. It’s risky business, though, given that the vintage could end up with poor marks from critics. But when the wine turns out well, there are more profits to be had. For investors who don’t mind the risk, there’s a chance for a 20 percent to 40 percent increase in value after only one or two years.

Knowing when to sell is why you trust someone else with your bottles. “There’s a huge market for mature wine, from restaurants and drinkers,” said Stephen Browett, chairman of Farr Vintners, which opened in 1978. “People want mature wine—they aren’t in the market for the wine when it’s first released. We buy the wine back from investment customers and sell it to drinking customers. Private people find it to be a fantastically efficient investment.” With about 14,000 active clients, U.K.-based Farr manages about $523 million of wine in bonded storage.

Client portfolios typically hold 65 percent of their wines from Bordeaux and 15 percent from Burgundy. Wines from France’s Rhone Valley, Italy and even California follow, but bottles from Napa Valley or other locales in the Golden State are a tiny fraction of what’s traded. To many investors, California winemaking history is still considered young. Farr prefers California wines with French roots, like Opus One and Dominus.

“When you’re looking at French producers, they’re the ones who’ve been doing it with that kind of intensity for quite some time. It’s dependable. That’s one of the things you have to have in a collectible product,” said Rob McMillan, executive vice president of Silicon Valley Bank, which invests heavily in wineries on the West Coast. Despite their success on American restaurant menus, only a small subset of California wineries gets investment attention.

Gearing co-founded Cult Wines in 2007, seeing it as a tool for diversification. “It’s got a long-term record, it’s low volatility, and it’s an asset uncorrelated to the financial market,” he said. “We didn’t want to be a wine broker or merchant or carry inventory. We wanted to be a financial market approach to wine.” Today, Cult Wines manages about $100 million in assets.

To date this year, Sotheby’s has sold $64 million in wine with about 80 percent going to private collectors who plan on drinking it someday and 20 percent to investors. While Cult Wines does buy from auctions, deals aren’t generally to be had there. Despite this, Sotheby’s and Cult Wines are seeing the same shift: an investing boom coming from Asia. In addition to Hong Kong, Cult Wines is opening an office in Singapore this fall.

According to Gearing, 30, Cult Wines has more than 800 unique brands under management. The top holdings, Lafite and Pavie, are each 6 percent of his total, at an average bottle price of $621 and $304, respectively. While “the vast majority is traded daily,” he said, there are areas of opportunity. “While Bordeaux and Burgundy can demonstrate periods of higher shorter-term growth, the long-term stability of Champagne adds important diversification benefits,” he said.

Chad Walsh, head sommelier of Michelin-starred restaurant Agern in New York, registers online for auctions where he’ll bid for both work and personal investment. “It’s one thing to chase the blue-chip stuff at a good price,” he said. “But the best investments are when you’re finding the thing that everyone is buying when they’re squeezed out of whatever the blue chip was.”

Of course, in the world of collectibles there are risks. Famously, there was the cataclysm that befell WineCare, a storage business in New York City that flooded during Hurricane Sandy in 2012. A U.S. bankruptcy court judge ordered that the owner “liquidate the company.” Bill Carmody, a trial attorney in New York who used WineCare for his small collection, said: “It was a total loss. The bottom line was, there was no insurance.”

The lesson? Check out the insurance plan before you start investing, not to mention pay attention to where your bottles are kept. All of Cult Wines clients’ assets are stored in a sophisticated, static, temperature-controlled facility inside a government-bonded warehouse (which keeps the wine exempt from taxes and duties) and includes an insurance policy that covers up to 110 percent of the market value. Each bottle has a “passport,” like a bar code, that’s recognized within the fine wine trade and ensures it has been checked for provenance and condition.

Cult Wines said it only accepts ex-chateau (wine bought direct from a vineyard) or SIB stock, both in the original wooden casing, which is the most valuable. Buying and holding wine in a bonded warehouse caries with it an audit trail for every case and a trusted method for tracing its origin.

Sophie Skarbek-Borowska began investing with Cult Wines in 2014. The marketing executive knows her wine (she has a certificate from Wine & Spirit Education Trust), but still wanted help. “I understand more about wine than cryptocurrency, microchips and even Coca-Cola,” she said. “I would never be able to invest in wine on my own.” She invested just a small sum, and while any profits are quickly reinvested, in aggregate, her account has seen a 41 percent increase—not excluding fees.

One of the most in-demand wines is Domaine de la Romanée-Conti. A bottle of the most recent vintage, 2015, would set you back $17,000, and that’s if you beat out other bidders. For Skarbek-Borowska, it was an opportunity of a lifetime.

“There was no way I could get it, but because this poor person was doing a fire sale, Cult Wines got it and sold it to me,” Skarbek-Borowska said. She bought it for $8,510 in 2015. Today, it’s worth $15,210.

(Updates with company owner’s age in 15th paragraph.)

10. After 10 Years Studying Sleep, the U.S. Military Just Revealed Something Eye-Opening About Caffeine

You might think if you’re tired, just drink coffee until you wake up. Turns out, it’s a bit more complex than that.

By Bill Murphy Jr.Contributing editor, Inc.com@BillMurphyJr

We’ve seen over and over that there are tremendous health benefits to drinking coffee–even a heck of a lot of coffee–including substantial increases in lifespan.

But if you think American office workers are especially sleep-deprived and powered by caffeine, it turns out we’ve got nothing on the U.S. military.

The CDC says normal humans need eight to nine hours of sleep; about 40 percent of U.S. soldiers get fewer than five. And that’s when they’re stationed at home, sleeping their “normal” amount. The sleep deprivation gets even more extreme when they’re in combat.

Their primary self-treatment? Coffee, and lots of it–or else caffeine-laden drinks like soda, diet soda, and energy drinks. (Especially Rip It brand energy drinks.)

All of which explains why the U.S. has spent decades studying sleep deprivation. Now, they’ve pulled it all together in a mathematical formula that can help anyone–military or civilian–figure out the optimal amount of caffeine they need in order to stay alert.

‘Continuous sleep deprivation of 60 hours’

This might go down as the latest innovation that was pursued to support the military, but wound up benefiting civilians even more.

Think of the jeep, the jet airplane, penicillin, and now–the caffeine calculator.

I spoke with Dr. Jaques Reifman of the U.S. Army Medical Research and Materiel Command in Fort Detrick, Maryland, co-author of the latest research, which was published in the journal Sleep (pdf link) and covered recently by Jo Craven McGinty in The Wall Street Journal.

“This is leveraging 10 years of research on sleep deprivation,” he said. “How do humans respond to continuous sleep deprivation of 60 hours? How is that different from when you sleep three hours a night for 10 days? … What we’re dong here now is to develop math equations that describe the phenomenon.”

Specifically, they’re coming up with two things:

- (a) an algorithm that can say how much caffeine the “average” sleep-deprived person needs, in order to be as alert as if they typically got eight hours of sleep, and

- (b) a way to determine specifically, person-by-person in almost real time, what any particular amount of caffeine will do to their level of alertness.

Two cups of coffee when you wake up

Here are a few examples of what the “average” sleep-deprived person in various situations would have to consume to achieve the same level of alertness they’d have with eight hours of sleep:

- Getting by on five hours of sleep a night? You might need to consume the equivalent of two cups of weak coffee when you wake up–followed by another two cups, four hours later.

- Getting reasonable amounts of sleep, but you’re working an overnight shift? You’d be best off drinking a quick two cups of weak coffee right at the start of your shift.

- And, if you’re expecting you won’t be able to sleep much at all for more than a day or two, you’re supposed to drink the equivalent of two cups of coffee at “midnight, 4 a.m., and 8 a.m.”

Reifman said the goal here is to squeeze the maximum benefit from the caffeine you’re consuming, while making sure the total caffeine in your bloodstream doesn’t exceed a threshold of 400 milligrams at any one time.

The “weak cup of coffee” we’re talking about has about 100 milligrams of caffeine. For military folks reading this: Seriously, an 8-ounce can of Rip It has about 80 milligrams of caffeine.

There’s an app for that

The algorithm that Reifman and his colleagues came up with is proprietary, so the second part of their goal, above–the part where they can tell any person specifically how much caffeine he or she should drink to maximize alertness–isn’t something you can use right now.

“The military is trying to license that,” Reifman told me. But in the meantime, they’ve developed a free web app that uses the average data–basically the first of the two goals listed above–so that anybody can use it. You can find that simplified version here.

A downloadable version should also be available soon, Reifman said. Ultimately, he hopes to build something much more robust, that could tell individual soldiers in the field when to consume caffeine so as to achieve maximum alertness in battle.

By the way, I asked Reifman if, given what he’s been studying and writing about, he’s changed his own sleep and coffee patterns.

“I try to get enough sleep, but there are self-imposed pressures. I need to accomplish so much at work. Sometimes I stay late at work and come in earlier than I should,” he said. “But I am trying to practice what I preach, and I do drink a good amount of caffeine.”