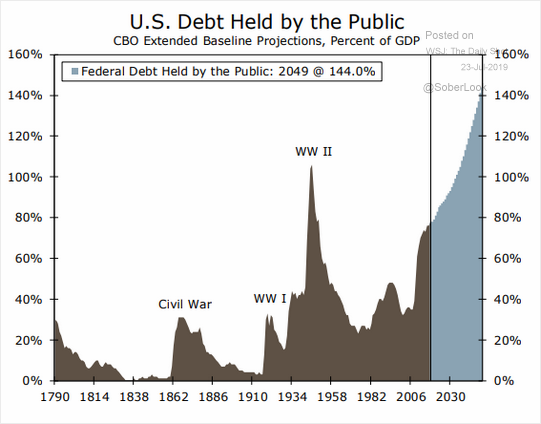

1.U.S. Debt Since 1790

The Daily Shot https://dailyshotbrief.com/the-daily-shot-brief-july-23rd-2019/

2.Boeing Earnings

With all the headlines on BA…2 years ago it was trading below $200

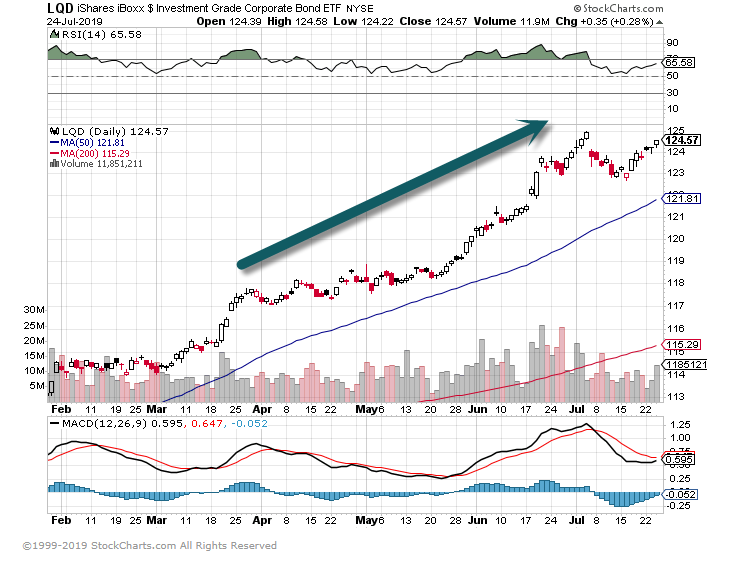

3.Gundlach on Junk Bonds Vs. Investment Grade.

Jeff Gundlach comments at Advisor Perspectives

Avoid high-yield bonds, according to Gundlach, which are more sensitive to economic weakness that other bond market sectors. He said that junk market resembles late 2006 early 2007. He recalled that, in late 2006, he said, “It’s okay to dance the risk dance, but you better be dancing near the exits.” Six months later he said to “get out now.”

Investment-grade bond prices have risen more than junk prices, based on the LQD and JNK ETFs. That is a bad sign, he said, and is showing there is more risk than the stock market reflects.

He was asked how negative monetary policy can go before there is a run on a bank. Based on Deutsche Bank, he said, it is “not far from now.”

The dollar has “lots of room to do down,” Gundlach said, because Fed policy will support that movement.

https://www.advisorperspectives.com/

LQD Rally on Fed Lowering Rates

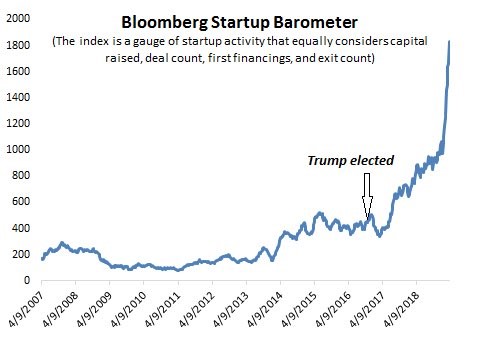

4.Bloomberg Startup Barometer.

I am not familiar with this measure.

.

Description of Barometer

https://www.bloomberg.com/graphics/startup-barometer/

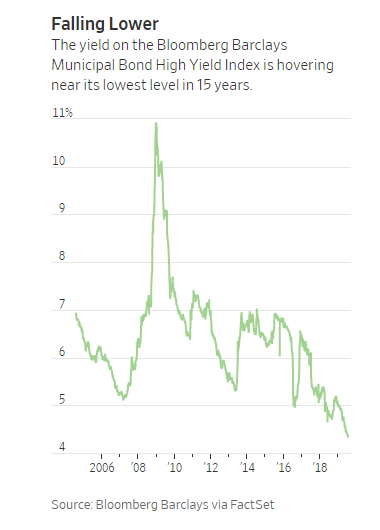

5.Muni Bond Yields at 15 Year Lows and A Few Players Dominate.

By

Heather Gillers and Gunjan Banerji

July 24, 2019 5:30 am ET

A few behemoths are increasingly dominating the municipal market, helping to lower prices for many investors but also sparking worries about concentration and influence.

There has been a mammoth shift in the $4 trillion muni market over the past decade as investors have increasingly used professional money managers to invest in both high- and low-grade state and local government debt. Mutual-fund holdings of municipal bonds now total $738.6 billion, according to Federal Reserve data, a more than 50% increase since 2009.

The Municipal-Bond Market Is Now Controlled by Just a Few Firms

Concentration benefits firms like Nuveen and Vanguard, as well as some investors, but critics see risks if the market cools

6.Nasdaq 100 New Highs….Adds 2000 Points Since Dec. 18 Lows.

NDX +33% from lows.

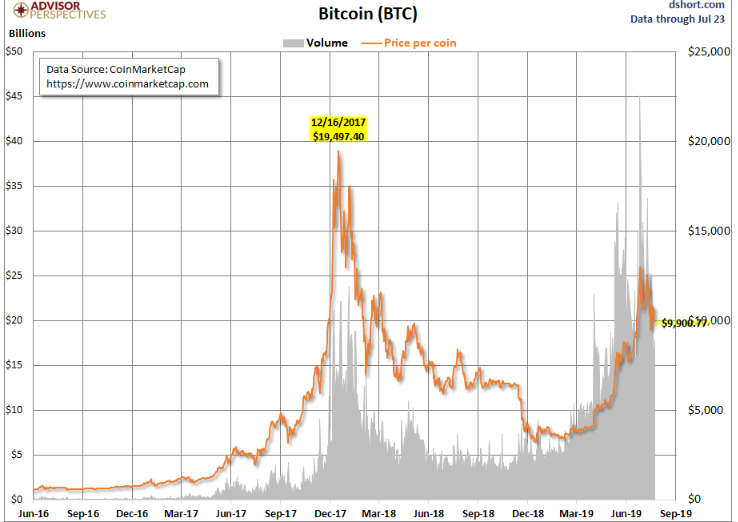

7.Bitcoin Doubles Off Lows…Dec. 2017 was All-Time Highs.

https://www.advisorperspectives.com/dshort/updates/2019/07/24/the-three-largest-cryptocurrencies

8.You May Have Longer Than You Think to Invest For Retirement

Posted July 23, 2019 by Ben Carlson

Maybe one of the reasons collective retirement savings statistics are so depressing is because retirement is really only a few generations old. Most people in the past never had 20, 30, or 40 years of life after work to plan for. There aren’t many real-life examples people can point to when trying to plan for this stuff.

So retirement will likely be different than most people expect. Some will have to work longer. Others will never be able to stop working. And still others are going to need their money to last many decades. Here’s a new piece I wrote at Fortune that deals with expanding life expectancies and what it means for retirement planning.

Retirement is still is a relatively new concept.

In the past, most people simply worked until they died, with little time for leisure in their later years. In the year 1870, for those who lived past age 65, the labor force participation ratio for males was close to 90%. Today it’s less than 20%. Well into the nineteenth century, about 50% of all 80-year-old men in America were still working to support themselves or their families.

One of the reasons people didn’t plan for their golden years back then is because not many people expected to live very long. In 1800, among all babies who were ever born, roughly half died during their childhood. Life expectancy was just 30 years and no country had a life expectancy above 40. Life expectancy at birth was only 45 years in 1870. The average life expectancy around the world today is 72.

In the year 1900, close to 20% of males born in the U.S. died before their first birthday. Today the mortality rate doesn’t reach that high until you get to age 62. The average American now retires at age 62 while 100 years ago, the average American died at age 51.

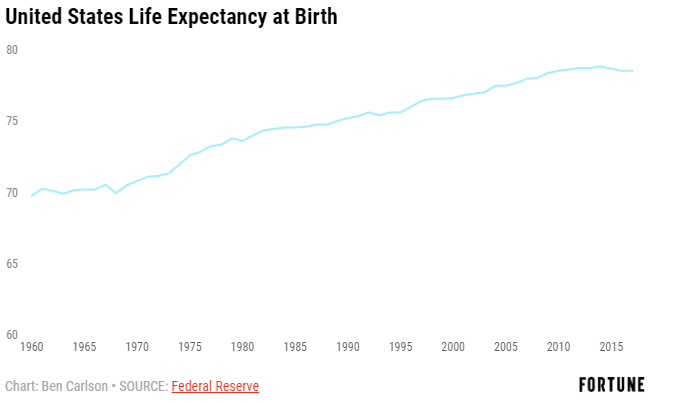

The gains have slowed in recent decades, but you can still see an upward trajectory in the data:

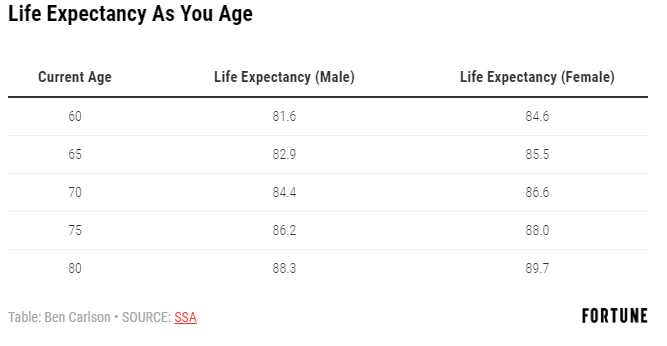

And for those who do make it to retirement age, your life expectancy could be in the two-to- three-decade range:

There are a number of investor and market implications from this data.

9.Madoff Scheme Lasted 45 Years.

A decade after Bernie Madoff’s arrest, FBI agents reveal more about his Ponzi scheme

by Erin Arvedlund, Posted: December 6, 2018

You may have heard of Wall Street scammer Bernard “Bernie” Madoff, who ripped off investors for the colossal sum of $64.8 billion.

What you may not know? His crimes lasted roughly 45 years, according to FBI agents now speaking publicly about the case for the first time, a decade after Madoff’s arrest.

Special Agent Patrick J. Duffy of the Federal Bureau of Investigation helped oversee the government’s probe. A South Jersey native and 2002 LaSalle University graduate, Duffy worked as a KPMG accountant in Philadelphia until joining the FBI in 2008.

He and Special Agent Paul E. Roberts, who trained as an actuary, present regularly to business and fraud investigator conferences about the FBI’s six-year-long Madoff investigation. But this is the first time FBI case agents have publicly broken down the notorious Madoff crime, which required the efforts of 14 agents, forensic accountants and financial analysts, not to mention a platoon of prosecutors.

They also describe what it took to convict Madoff and his fraudster co-conspirators and aspects of the investigation not released to the public, such as the duration and scale of the crime. It’s a fascinating study of a scandal that cost victims billions and a trial that resulted in the convictions of five Madoff employees on 31 guilty counts.

But in many ways, the scandal was not a surprise to the investors who were fleeced. “A lot of Madoff victims thought it was too good to be true. But they were OK with that, they went along with it,” Roberts said. “Greed can silence people.”

Dec. 11, 2008

Duffy had only recently joined the FBI when he got a call from Pat Carroll, supervisor of a white-collar crime squad. With an accounting background, Duffy was quickly assigned to the investigation of Madoff, who had confessed to stealing a staggering $64.8 billion.

Duffy’s first thought: “Who’s Bernie Madoff?”

The FBI would soon learn that the Wall Street financier had pulled off a crime for the ages. He promised investors that he would never lose money, and his hedge fund delivered enviable 10 percent annual returns even when the markets tanked.

“When we talk to groups about the case, their eyes widen. A lot of people know Madoff’s name, but not the scale of the crime,” Duffy said.

Net cash lost? About $20 billion. Roughly $15 billion has been recovered, about 75 cents on the dollar.

“It’s hard to know the true number, because there were so few bank account records before 1981,” Roberts said.

“We’re very proud of that” recovery, Duffy added. “In most Ponzi schemes, the rate of recovery is zero.”

How many victims? At least 10,000 investors lost money.

And the biggest surprise? Madoff’s crime dated to the Lyndon Johnson presidency and possibly earlier.

“In the early to mid-1960s, the scam began after Madoff opened up shop,” and later his brother Peter Madoff joined, Roberts explained. He kept raising new money to pay off earlier investors.

To uncover the truth, FBI agents spread out in Madoff’s offices on the 17th floor of New York’s Lipstick Building on the city’s tony east side to investigate.

“We knew it was ground zero for the fraud. We needed a chain of custody for all the documents. It was important to organize,” Roberts said.

There, the FBI discovered nearly 1,500 boxes of paper documents and the keys to a Queens, N.Y., warehouse storing an additional 10,000 boxes of records — much of which the team combed through by hand.

How did Madoff get away with the crime for decades?

More than a dozen Madoff employees helped manufacture phony statements, account balances, and profits, the agents found. Madoff kept his darkest secrets from everyone — his investors, regulators and financial examiners, and even the workers upstairs at the legitimate broker-dealer one floor up.

At the time that Madoff started his phony hedge fund, Bernie and his brother Peter started a legitimate trading firm that grew to represent as much as 10 percent of all the volume on the New York Stock Exchange. Though successful for some years, the brokerage ended up becoming just a storefront for the Ponzi scheme.

A pathological liar, Madoff held no regard for his investors. He would kick them out when they revealed that he was their money manager. Agents said his attitude was typified by Soft Screw, a large table-top Claes Oldenburg sculpture that sat by his office window. Madoff would hide the giant screw in the bathroom ceiling when regulators and investigators showed up.

“The judge wouldn’t allow it into evidence at trial, but we think it’s evidence of his frame of mind,” Roberts said.

Madoff would turn down Palm Beach and Hollywood millionaires, knowing the rejections would attract them even more. And it worked on everyone from director Stephen Spielberg and actor Kevin Bacon to former Eagles owner Norman Braman and Mets owner Fred Wilpon.

The Inquirer interviewed many of Madoff’s victims after his sentencing to prison for 150 years. Among them were middle-class Pennsylvanians such as Michael DeVita and his elderly mother, Emma. The DeVitas, of Chalfont, had opened accounts with Madoff in the early 1990s, believing the fund was a great retirement savings opportunity. “The Securities and Exchange Commission failed me,” Emma DeVita told me at the time.

Others I won’t forget: a woman at Madoff’s sentencing who resorted to dumpster-diving for food, and Holocaust survivor Elie Wiesel, whose foundation lost $15 million to Madoff. Wiesel said afterward: “We have seen worse.”

10.11 crucial things that many people don’t know.

At age 69, with perhaps too much of it spent thinking about what’s important, and trying ideas out on clients, friends, and myself, I offer 11 things I deeply believe are true, important, and little recognized.

Spend time with people who bring out the best in you. Sure, you may be forced to spend time with coworkers or family members who are deleterious to you but, when you have discretion, rather than succumb to a rescuer fantasy or a feeling that you deserve to be treated poorly, spend as much time as you can with people who bring out the best in you. Or be alone. Indeed, solo time can be among the most rewarding and pleasurable. The statement, “Man is a social animal” is an oversimplification.

Be picky about who you date and much moreso still before marrying,despite any social pressure to marry. It’s infinitely better to stay single than to be trapped in an even just mediocre marriage, let alone a bad one.

Time is treasure. Many people treat it like dross. Many of the people who are most satisfied with their life and are most contributory tend to make the most of every hour, even every minute. Sure, they spend some time unproductively but they make the choice to do so consciously. It’s central that you be time-conscious: Decide whether an activity is a wise use of your time or whether this is a time that you want to be unproductive.

Procrastination is a career and personal life decimator. It’s like running a race while wearing leg weights. Keeping procrastination under control comes down to forcing yourself, yes forcing yourself, to take baby steps forward. Take that onerous task you’re tempted to procrastinate, break it into baby steps, and take the first one.

If you need more structure, try the Pomodoro Technique: Work for 20 minutes, break for 5, work for 20, break for 5, work for 20, break for 10. That constitutes a “Pomodoro.” After four Pomodoros, take a long break. “Pomodoro” is “tomato” in Italian. The technique was named after those tomato-shaped kitchen timers but, of course, you can use any timer including the one in your phone. Or use one of the Pomodoro apps.

Choose your career early. After just modest exploration, the benefits of additionally keeping your options open are usually outweighed by the time you could have spent becoming expert as well as by the likelihood that after all that exploratory time, you won’t find anything sufficiently better. As they say about answering multiple-choice questions, your first instinct is usually right. Except within broad categories (e.g., people- vs word- vs data-centric careers), career success and happiness are more about the diligence you apply to your career than to which career you apply it to.

Learn outside of school. School is a bizarrely inefficient way to learn anything: You’re being taught a mass of information selected by an often theory-rich, practicality-light professor, only a small percentage of which you likely perceive of value, and an even smaller percentage of which you’ll remember and use in your life. And a course’s pace is often too fast or too slow.

article continues after advertisement

Yes, the piece of paper that colleges dispense has value, even is a necessity for some careers, but its value is often outweighed by the cost in time, money, and crucially, in opportunity cost: what you otherwise could have been doing with the time and money: for example, self-study of articles and videos unearthed in a YouTube search, augmented perhaps by a tutor, short courses offered on LinkedIn Learning, Udemy, Udacity, and Coursera, learning on the job and/or with a mentor.

Spend modestly, especially on the big things: housing, education, and cars, but also on vacations, clothes, furniture, etc. The benefit and pleasure of the extra spend are too small relative to the costs: reduced financial security, eliminating enjoyable but not lucrative career options from consideration, increased ethical temptations, and distraction from what’s more likely to contribute to the life well-led: making a difference. And spending on the not-essential is addictive, requiring an ever larger dose to get Shopper’s High.

Accept your weight. Most dieters gain it all back and often more—dangerous. And dieting is no fun, nor is seeing the weight creep back and being unable to fit into the new skinny clothes you bought. Yes, try to eat moderately but avoid diets. If your BMI is over 30 or you have other potentially relevant health conditions, your situation may be more complicated and so a talk with your health practitioner may well be wise.

Do not do drugs, and yes that includes marijuana. Weed is far more dangerous than the Big-Tobacco-funded or -cheered PR campaigns would have you believe. (See reviews of the literature that are not sponsored by the tobacco industry, for example, THIS and THIS.

article continues after advertisement

Think twice before expressing politically incorrect views, especially regarding race, gender, ethnicity, and immigration. We’re living in inordinately censorious and censurious times. People who disagree with you too often exert powerful retribution, even distorting things said years ago in a perfectly defensible context. But that context is often inadequately reported or is downplayed. Instead, some people and yes some in the media use, for example, the free and easy yet powerful social media to assault a person with weaponized words such as “sexist” and most powerful today, “racist.”

Compete with your best self, not with others. Focusing on keeping up with the Joneses is foolish. Their stature may be unattainable or they’re not worth keeping “up” with. Far better to spend the time trying to be your best self.

I read this aloud on YouTube.

https://www.psychologytoday.com/us/blog/how-do-life/201907/practical-wisdom