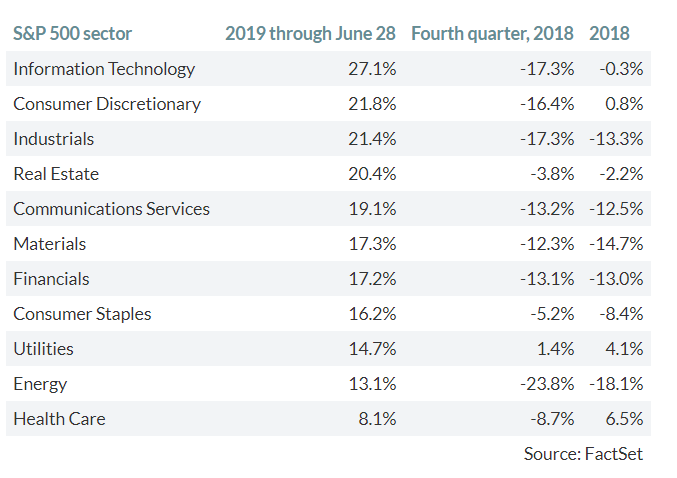

1.S&P Sector Returns 2019

Philip van Doorn-Marketwatch

2.MJ-Pot ETF Over $1B in Assets…26% Off Highs.

MJ-Down -26% Since March.

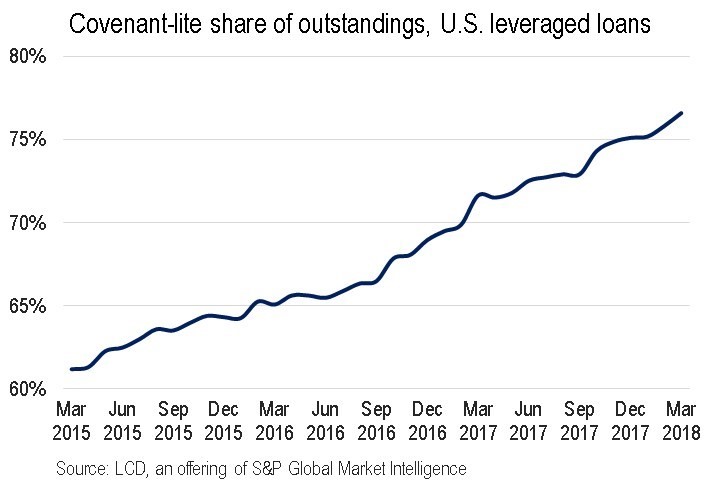

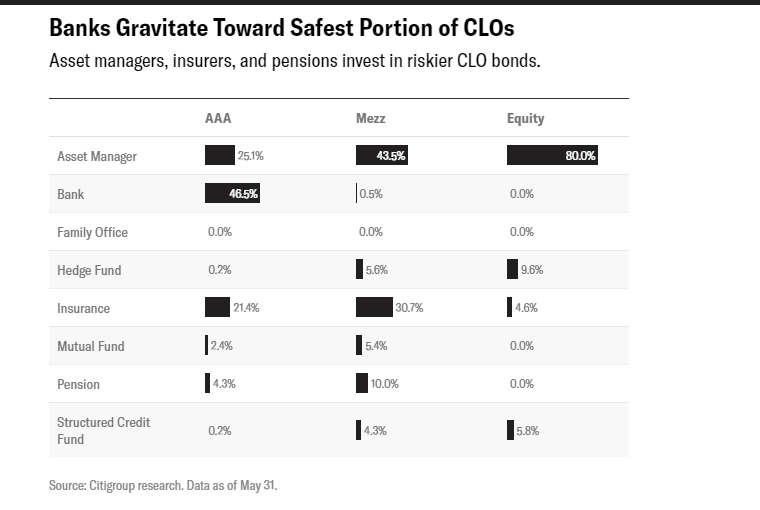

3.Private Equity is Fueling the Boom in Non-Bank Lending.

The High-Octane, In-Demand, and Worrying World of Risky Loans

Investors love debt. But is shadow banking hiding risks that should be plainly visible?

In the world of shadow banking, private equity firms are everywhere — and are fueling its boom.

They’ve been on a tear raising buyout funds that purchase companies small and large, relying on nonbank lenders to finance their deals. They turn to direct lending funds for acquisitions in the midmarket, and for larger deals, ask CLOs and other investors for deal financing.

They also sit on the other side of the table, creating CLOs and powering the private credit boom with their own direct lending funds. For example, Carlyle Group announced this month that it closed a $2.4 billion fund that will provide direct loans to upper-midmarket borrowers, including companies that are not backed by private equity firms. With leverage, Carlyle Credit Opportunities Fund can invest as much as $3.1 billion, the firm said.

Many of the same concerns about loose lending standards in the broadly syndicated leveraged loan market — where Wall Street banks arrange and sell the debt to investors — have shown up in the smaller, but expanding, universe of direct lending funds in the midmarket, often backing private equity deals. Lenders are vigilant but can’t escape the forces of supply and demand that may lead to terms favoring borrowers, according to David Lyon, co-head of private credit at Neuberger Berman.

That may mean lower interest rates as well as weaker lender protections. Lyon is paying close attention to covenants that govern how much flexibility a private equity firm may have to take cash out of a company, a borrower’s ability to incur additional debt, and the ability to remove collateral from deals. “Those are bright lines,” he says.

Yet for all the worries about shadow banking, the expansion of private debt funds may actually help provide a cushion in a downturn, according to Brady of Paul Hastings.

As capital becomes harder for borrowers to access because banks are pulling back from lending in volatile markets, managers of private debt funds may show up. “I think the biggest difference between whenever the next recession hits and the last recession is all that dry powder sitting on the sidelines,” he says. It may be “a softer landing.”

But some funds are avoiding midmarket buyout loans on purpose.

In a crowded market of direct lending funds focused on private equity firms, J.P. Morgan Asset Management and UBS O’Connor, to name two, are searching elsewhere for opportunities.

Full Article-Good Read

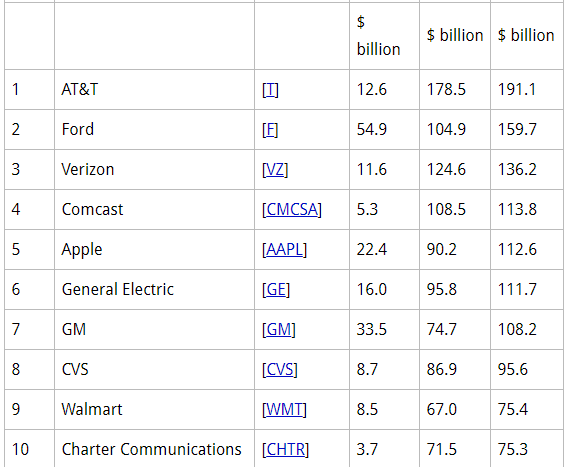

4.The Companies with the Most Debt in America

by Wolf Richter • Jul 26, 2019 • 99 Comments • Email to a friend

The concentration of corporate debt: The top 46.

I’m counting only non-financial companies. This excludes financial companies such as banks that borrow money to lend money. But there are some gray areas in this distinction. This gray area includes the Number 2 most indebted US company, Ford with $159.7 billion in debt. Its wholly-owned subsidiary Ford Credit is its financial arm and captive auto lender that borrows money to lend money. So be it. Several companies in this group have financial subsidiaries.

Apple is Number 5 with $112.6 billion in debt, a result of its all-time record-breaking share buybacks with which it blew past GE, another share buyback queen before its house of cards threatened to collapse, with $111.7 billion in Debt.

Those are the six non-financial publicly traded companies, each with more than $100 billion in debt.

In fact, the top 10 most indebted companies combined have a breath-taking $1.2 trillion in debt. These days we throw “trillions” around to stay fit on a daily basis, but it’s still “real money,” so to speak. This is the outgrowth of the massive concentration of debt in the US corporate world.

5.The Fed’s Financial Accounts: What Is Uncle Sam’s Largest Asset?

by Jill Mislinski, 7/9/19

Note: We’ve updated the quiz based on this month’s release of Q1 2019 Financial Accounts of the United States (previously referred to as the Flow of Funds Accounts). Hint: The correct answer is the same as it was for the last quiz.

Pop Quiz! Without recourse to your text, your notes or a Google search, what line item is the largest asset in Uncle Sam’s financial accounts?

- A) U.S. Official Reserve Assets

- B) Total Mortgages

- C) Taxes Receivable

- D) Student Loans

The correct answer, as of the latest quarterly data, is … Student Loans.

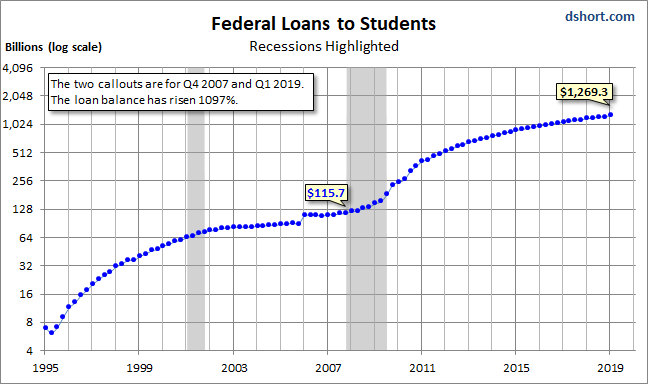

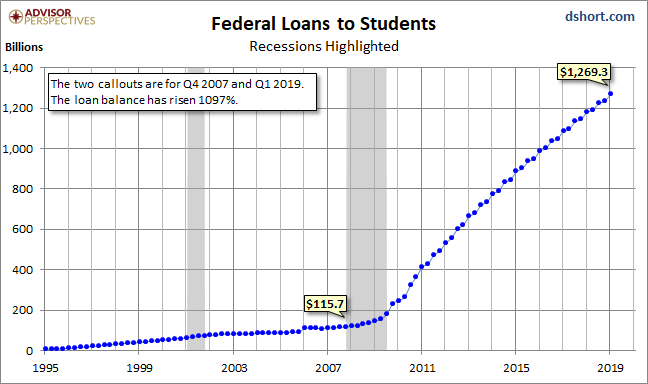

The rapid growth in student debt has been an ongoing topic in the financial press. A stunning chart that continues to haunt us illustrates the rapid growth in federal loans to students since the onset of the great recession. The chart is based on the Federal Reserve’s Financial Accounts data (available here) for government’s assets and liabilities. We’ve used a log-scale vertical axis.

For a more dramatic look at the same data, here it is with a standard linear axis.

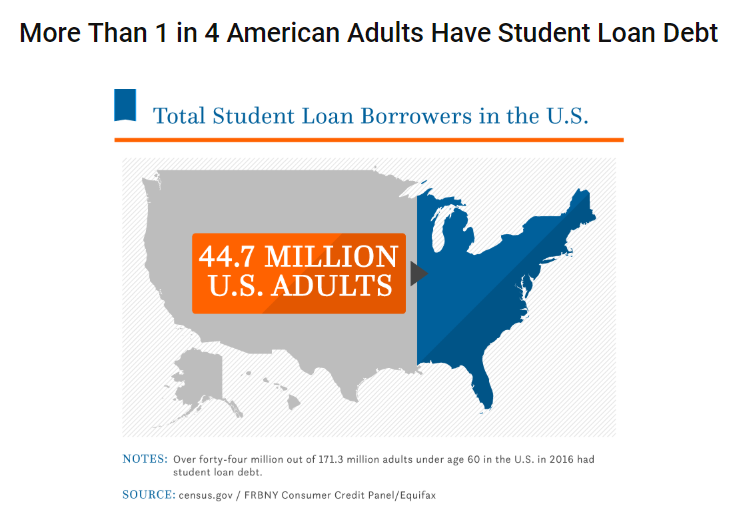

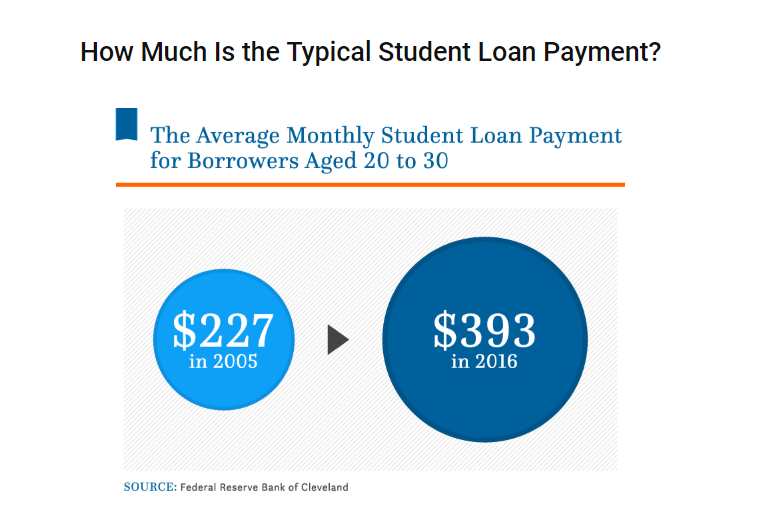

6.1 in 4 Americans Now Have Student Loans.

https://www.nitrocollege.com/research/average-student-loan-debt

7. Why US bond yields could be going the way of Germany and Japan

https://www.ft.com/content/f1bc6ba0-aece-11e9-8030-530adfa879c2

Why US bond yields could be going the way of Germany and Japan

Without a dose of ‘shock and awe’ from the Fed, long-term rates could drop below zero © AP Share on Twitter (opens new window) Share on

Ten-year US Treasury yields could be headed to zero. This is not a forecast. This is not a bold prediction. This is not something that we hope happens. This is an observation of what is unfolding in the markets right in front of us. The 10-year yield peaked at 3.25 per cent in November last year and has fallen relentlessly, to as low as 1.93 per cent earlier this month. Today, about one-third of the global government bond market and one quarter of the global aggregate bond market have negative yields. We should consider it a warning: that this is the path the US market is on unless there is an adequate policy response.

What is surprising is that the dramatic decline in yields has happened against a backdrop which would have suggested otherwise. The last move by the Federal Reserve was to raise interest rates in December. The central bank is also in the process of running down its balance sheet by up to $35bn per month. Assets in US money market funds have increased steadily over the last nine months to about $3.3tn, the highest level since the financial crisis, when the Fed provided an unlimited guarantee to these funds. Equities, gold and cryptocurrencies have all risen strongly. Further, the US economy could be characterized as “OK”. So, what is driving the flows into US government bonds, and where is the money coming from? More importantly, if all of these factors turn, where do yields go from current levels?

Quite simply, the money is pouring into the US bond market from overseas. As the volume of negative-yielding debt grows across Europe and Japan, investors are seeking a safe haven that has a positive return. US investors have neither embraced the decline nor pushed back against it. As trade tensions escalate, the probability of recession rises. There is also the very real risk that inflation expectations have become unanchored and central banks are gradually becoming powerless. New York Fed president John Williams captured this risk nicely this month by saying that “investors are increasingly viewing these low inflation readings not as an aberration, but rather a new normal”.

While there has already been a dramatic decline in US yields, an accelerated move lower is potentially in the offing. If, as expected, the Fed begins a rate-cutting cycle at the end of this month, money will be shaken out of money-market funds into bond funds in an effort to lock up a higher yield. A second vast pool would come from a return to balance sheet expansion: the Fed is expected to end its balance sheet run-off in September just as the European Central Bank returns to quantitative easing. A third pool of money could come from de-risking. An escalation in the trade war has surely raised the probability of recession. From current levels, the combination of central bank action and de-risking would accelerate the journey of US bond yields toward zero. This is not healthy for savers who rely on a fixed income or for insurance companies and pension funds that have returns targets to meet.

There needs to be a policy response that is swift and dramatic enough to stop this descent in its tracks, while reigniting growth and inflation expectations. A starting point is with the central banks and the Fed in particular. It must respond at month-end with “shock and awe” to regain control. A mere 25 basis-point cut by the Fed will probably be dismissed by the markets, and investors will pile into intermediate and long duration bonds. Whether policymakers cut by 25bp or 50bp, they must make it clear that they mean business and will do whatever it takes from that point onward to raise inflation expectations. For their part, the ECB and outgoing president Mario Draghi got the ball rolling on Thursday by indicating that a significant degree of monetary stimulus is both needed and forthcoming.

While multiple significant central bank policy responses are likely to happen, it is important to remember that monetary accommodation alone is not enough to avoid recession this late in an economic expansion. Otherwise, we would never have recessions. Will it buy enough time for a policy response to happen elsewhere? While there could be a de-escalation in trade tariffs, the direction of travel over the past 18 months has not been encouraging. It would also be nice to see some co-ordinated fiscal stimulus.

But which government has the courage and ability to embark on a big spending programme? The central banks must take the lead, and they must start this month. They must bring front-end real yields so low and so fast, that the yield curve steepens. That will cause investors to question the wisdom of holding longer maturity bonds in the face of central banks committed, on a co-ordinated basis, to reflation. Anything short of that risks the 10-year US Treasury remaining on the well-worn path, forged by Japan and Germany, toward zero.

Bob Michele is global head of fixed-income at JPMorgan Asset Management

8.Keeping NFLX in Perspective.

NFLX -15% correction….It had -40% correction in December 18….It was trading at $140 in late 2017-200 points lower.

9.The High Cost of Avoidable Hospital Emergency Department Visits

7/22/2019

Health care spending in the United States is expected to grow from $3.5 trillion in 2017 to $6 trillion by 2027, according to the Centers for Medicare & Medicaid Services. As a result, the health share of GDP is expected to reach nearly 20 percent.

What’s driving the dramatic increase in spending? Price variation, which leads to overspending by many consumers.

However, UnitedHealth Group has conducted extensive research on the cost of care and has identified three areas where savings are achievable:

- Avoidable hospital emergency department (ED) visits

- Hospital prices

- High-value physicians

This article focuses on avoidable hospital ED visits. Future articles on reducing the cost of care will examine hospital prices and high-value physicians in Medicare.

18 Million Avoidable Hospital Emergency Department Visits

According to UnitedHealth Group research, two-thirds of hospital ED visits annually by privately insured individuals in the United States – 18 million out of 27 million – are avoidable.

An avoidable hospital ED visit is a trip to the emergency room that is primary care treatable – and not an actual emergency. Ten common primary care treatable conditions frequently treated at hospital EDs are bronchitis, cough, dizziness, flu, headache, low back pain, nausea, sore throat, strep throat and upper respiratory infection.

By the Numbers

The average cost of treating common primary care treatable conditions at a hospital ED is $2,032, according to UnitedHealth Group. That number is 12 times higher than visiting a physician office ($167) and 10 times higher than traveling to an urgent care center ($193) to treat those same conditions. In other words, visiting either a physician’s office or an urgent care facility instead of a hospital would save an average of more than $1,800 per visit – creating a $32 billion annual savings opportunity systemwide.

What is driving the higher costs at hospital EDs? Higher costs are driven in part by hospital facility fees, which increase the cost of an average hospital ED visit by $1,069, and lab, pathology, and radiology services, which average $335 at a hospital ED – 10 times more costly than at a physician office ($31).

10.How to succeed at work, according to Angela Ahrendts, who was one of Apple’s highest-paid executives

REUTERS/Noah Berger

- Angela Ahrendts, Apple’s former retail chief, discussed the importance of leaning into your talents at work on LinkedIn’s “Hello Monday” podcast.

- It’s a lesson that Ahrendts says she passes on to her children.

- Understanding your gifts and focusing on them can help you bring your most valuable contributions to the table, Ahrendts said.

- Visit Business Insider’s homepage for more stories.

When former Apple retail chief Angela Ahrendts started working for the technology giant in 2014, she learned an important lesson — particularly within her first 100 days. “If it teaches you anything, it teaches you that they wanted you for a reason,” she said when speaking with LinkedIn’s Jessi Hempel on the company’s “Hello Monday” podcast in May. “So get in your lane, bring your gifts to the table.”

That lesson of understanding where your strengths lie and applying that to your job, even if it’s a position in a new field you haven’t worked in before, is one that Ahrendts said she passes on her to children.

Ahrendts has a history of working in the fashion industry, having been the CEO of Burberry before joining Apple, and she held executive positions at Liz Claiborne and Donna Karan International before that. Moving to Apple represented a step into a new industry for Ahrendts. “I tell my kids, it’s kind of like water-skiing,” she said on the podcast. “You don’t want to be over here, you want to be in that real smooth place, and try and get yourself there. And then life just takes off.”

Read more: A professional hacker reveals how to create the best possible password

Ahrendts was Apple’s retail chief overseeing the company’s strategic direction for its physical and online retail stores. She was hired from Burberry in 2013, the year before the Apple Watch was announced, and left in April for “new personal and professional pursuits,” according to Apple. Ahrendts recentlyjoined Airbnb’s board of directors in May.

During her tenure, she was among Apple’s highest-paid executives. Her total compensation for 2018 was $26.5 million, according to an Apple proxy filing from January 2019, which was higher than CEO Tim Cook’s total compensation of $15.7 million in 2018.

In 2017, her total compensation was $24.2 million, which was also higher than Cook’s compensation of $12.8 million and slightly higher that of other executives such as Luca Maestri, Apple’s chief financial officers, and Dan Riccio, the company’s senior vice president of hardware engineering, according to a 2018 proxy statement.

Ahrendts also addressed the subject of feeling insecure in one’s role during the podcast. While that feeling doesn’t always go away, Ahrendts said that getting a better grasp on your strong points can give you the necessary assurance to succeed.

“You get stronger and more confident in who you are and what your gifts to this world are,” she said. “And then you keep yourself in a narrower lane, knowing that if I stay in this lane, I will make the contribution that I’m supposed to make while I’m on this planet.”

Are you a current or former Apple Store employee? If you work or have worked at an Apple Store, we want to hear from you. Contact this reporter at leadicicco@businessinsider.com