1.Bank of America Now Has A Larger Market Cap than the 6 Largest European Banks Combined.

The result: Six leading European banks— UBS (UBS), Credit Suisse Group (CS), Barclays (BCS), BNP Paribas (BNP.France), Société Générale(GLE.France), and Deutsche Bank (DB) now have a combined market value of around $200 billion, less than that of Bank of America (BAC) alone.

5 Year Chart BAC +100% vs. EUFN (Euro financials) -22%

2.Follow up to Yesterday’s Private Equity Comments…Blackstone Assets Under Management Rose 24% to $545 Billion.

The industry leader, the Blackstone Group (BX), is enjoying enormous inflows as assets under management rose 24%, to $545 billion, in the second quarter from the quarter a year earlier. But sustaining high returns is tougher.

Why Stocks Are Still the Best Investment, Even After a 10-Year Run–Andrew Bary

Putting the Equity Back Into Private Equity

Private-equity firms are spending more of their own cash to win deals as soaring purchase prices push debt markets to the limit

Equity ChecksPrivate-equity firms are putting more of their own cash into buyouts.Average equity contribution in U.S. buyoutsSource: Covenant Review

By

Matt Wirz

Updated July 15, 2019 5:36 pm ET

Rising stock valuations are forcing private-equity firms to contribute more cash to their leveraged buyouts. That is likely to drag down performance in the long term even as pensions and other investors increasingly turn to private equity to boost returns.

Private-equity firms contributed 52% to the purchase prices of companies they bought in the second quarter of the year, according to data from research firm Covenant Review, a unit of Fitch Solutions, up from 45% in the first quarter. That compares to an average of 47% and marks the highest quarterly figure since Covenant Review began tracking the data in January 2017.

“It’s because of the high stock prices today,” said Covenant Review’s CEO, Steve Miller. Private-equity buyers need to put up more cash to win the deals they want because “lenders are only willing to go so far,” he said.

Private-equity funds buy companies with a combination of cash they raise from outside investors and money they get their acquisition targets to borrow by issuing so-called leverage loans and junk bonds. The more borrowed money, or leverage, goes into a deal, the higher the average return on the cash. But the sticker prices of recent deals are exceeding debt-market capacity.

Lenders don’t typically provide debt to target companies in excess of six times earnings before interest, taxes, depreciation and amortization, or Ebitda, and almost 40% of U.S. leveraged buyouts last year raised debt that was seven times Ebitda, according to research by consulting firm Bain & Co. With debt markets already pushing their upper limit, buyout firms have to put in more of their own cash to hit currently elevated asking prices.

Leonard Green & Partners and Ares Management Corp. , for example, announced in June their purchase of health-care company Press Ganey Associates. The deal involves $1.7 billion of debt—roughly 7.5 times Ebitda—and $2.6 billion of equity, which represents 60% of the total purchase price, according to data from Covenant Review affiliate LevFin Insights.

That will likely translate to lower average returns in the next five years or so for private-equity firms as they sell off the companies they buy under current conditions.

Private-equity funds raised from 2011 to 2015 delivered median returns of 16%-21%, according to data provider Preqin Ltd. but about 30% of the investors the data firm polled in 2018 said they expect their private-equity portfolios to perform worse in 2019 than in 2018. That compares to 20% polled in 2017 who said they expected performance to deteriorate.

“Pension funds are turning more to private equity to boost their returns but there’s a real question about whether that thesis holds,” Mr. Miller said.

U.S. government bond yields fell Monday with the yield on the benchmark 10-year Treasury note settling at 2.092% from 2.106% Friday amid reports that Chinese growth slowed in the second quarter. Yields fall as bond prices rise.

The WSJ Dollar Index, which measures the U.S. currency against 16 others, rose less than 0.1% to 89.97.

Write to Matt Wirz at matthieu.wirz@wsj.com

Copyright ©2019 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

Appeared in the July 16, 2019, print edition as ‘Funding Shifts for Leveraged Buyouts.’

3.As Tech Dominates and Value Continues to Lag….Warren Buffett Having Tough Year.

Berkshire flat vs. QQQ +24%

4.Gold Miners +55% From 2018 Lows.

GDX Gold Miners ETF

5.Small Cap Energy Names Break to New Lows

6.Honk Kong Protests Turn Violent…Market Well Below Highs.

Hong Kong protests: Night of violence shocks city after seventh week of mass marches

By Helen Regan, Chermaine Lee, Eric Cheung and Anna Coren, CNN

Updated 1:52 PM ET, Mon July 22, 2019

Hong Kong (CNN)Hong Kong descended into scenes of chaos Sunday night, after riot police fired tear gas and rubber bullets at protesters, and a mob armed with batons attacked people in a metro station.

The unrest came after tens of thousands took to the street for the seventh consecutive weekend amid an ongoing political crisis over a now-suspended extradition bill.

Footage posted on social media showed a marauding gang of masked men, wearing white T-shirts, attacking people wearing black, the color of the protest, on the platform and inside train carriages at Yuen Long MTR station, in the north of the city — an about an hour from where the day’s protest had taken place.

Forty-five people were hospitalized following the violence in Yuen Long, with one person in critical condition, according to Hong Kong’s Information Services Department. Five people remain in serious condition.

The incident has raised fears that organized crime gangs, who are known to operate in the outer areas of the city, are becoming involved in the political crisis. In a statement Monday, police said they would not tolerate “violent behavior” and were actively following up the two incidents “in order to bring the offenders to justice.”

https://www.cnn.com/2019/07/21/asia/hong-kong-protest-july-21-intl-hnk/index.html

7.Hedge Fund Assets Hit Record in 2nd Quarter

Fees lowest, returns highest in a decade

Investors poured the most money ever into hedge funds during the second quarter, surpassing a 2018 record, as returns soared.

Assets managed by hedge funds ballooned to $3.245 trillion at June 30, exceeding their previous record of $3.244 trillion set in the third quarter of 2018, Hedge Fund Research Inc. reported Friday. Year to date through June, assets grew by $142.5 billion, increasing by $63.7 billion in the second quarter and $78.8 billion in the first quarter.

Meanwhile, few investors were retrieving their money from professional long-short asset managers. Net redemptions were nearly flat at $4.8 billion, reflecting a significant slowdown from net $45 billion taken back over the previous two quarters.

A robust market and strong performance magnetized investors to the industry in the first half of 2019. The HFRI Weighted Composite Index, which measures hedge fund performance, rose 7.44% in the year’s first half, its highest first-half gain since 2009. The average hedge fund still fell short of the S&P 500 index, which returned 17.2% for the same period.

Gathering the most assets were the “largest and most established funds,” HFR President Kenneth Heinz said. Firms managing more than $5 billion experienced inflows, while firms managing less than $5 billion saw outflows, HFRI found. It was the first time these firms had seen inflows since the fourth quarter of 2017, as the investment picture brightened.

“Constructive, yet fluid developments in ongoing trade negotiations, as well as expectations for lower US interest rates in the near term have also contributed to an evolving macroeconomic outlook which has resulted in record levels for U.S. equites, but also represents a forward risk for valuations, especially with trillions of dollars of fixed income obligations trading with negative yields,” Heinz said. “Funds which are effectively positioned for the complexities of this environment, maintaining tactical long and short exposures across not only hedge fund strategies, but also across cryptocurrency and risk parity exposures, are likely to attract institutional investor capital throughout second-half 2019.”

In the second quarter, investors showed most interest in event-driven strategies focused on mergers and acquisitions and corporate transactions, plowing $5.3 billion into the funds. Equity hedge fund capital soared by $14.1 billion, led by strong performance gains and offset by outflows of $5.5 billion. The funds ended the quarter with $931.1 billion in capital, making it the largest strategy.

Though flows in and out have been mixed, the hedge fund industry has been booming for some time. A year ago, it was celebrating setting its new record for capital for its eighth consecutive quarter.

The same research group, HFRI, reported that new hedge fund launches increased in the first quarter as risk tolerance returned to the market. But many have not been faring well, with liquidations exceeding launches for the third consecutive quarter, which followed a four-quarter streak of net growth in the number of funds.

Meanwhile, hedge funds have reduced their notoriously high fees to their lowest since HFRI began keeping data in 2008. The average management fee declined by 2 basis points to 1.41%, and the average incentive fee fell by 30 basis points to 16.6%. Hedge funds launching in the first quarter started out even lower for management fees at 1.19%, and charged more for incentive fees at 18.79%.

Read more here:

https://www.gurufocus.com/news/912207&source=webpush&pushi=11500

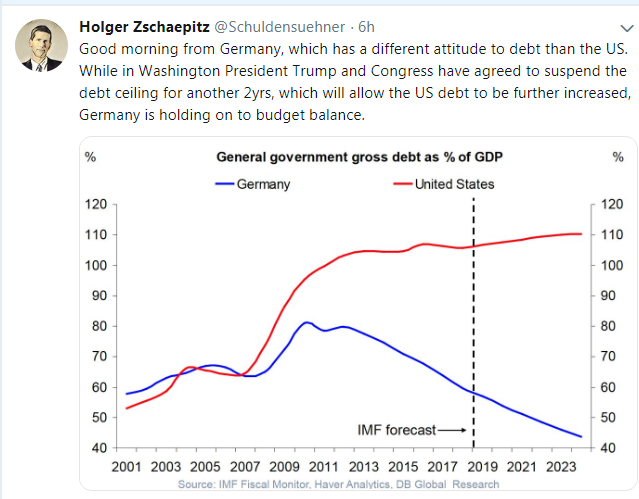

8.U.S. Vs. German Debt.

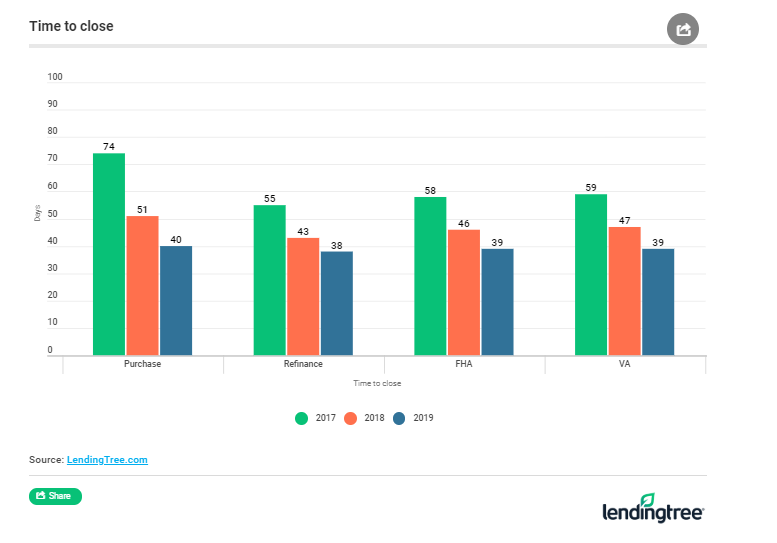

9. It’s Taking Less Time to Close on a Mortgage in 2019

TENDAYI KAPFIDZE

June 25th, 2019

Key findings

- The time to close in new purchase transactions has been steadily declining, from 74 days in 2017 to 51 days in 2018 and just 40 days thus far in 2019.

- For refinances, the decline has been less dramatic: from 55 days in 2017 to 43 days in 2018 and just 38 days so far in 2019.

- Some of the decline can be attributed to lower mortgage volumes, as refinancings have been on a downward trend. But increased digitization is also playing a major role.

- Closing times vary based on the characteristics of the mortgage type and borrower. Having a higher credit score can knock a few days off: Purchase borrowers with scores above 760 averaged 38 days in 2019 compared with 45 days for those below 720. Refinancings did not show much variation by credit score.

- Loan-to-value ratios below 80% had shorter closing times for refinances, at 37 days compared with 42 days on mortgages with a ratio above 95% in 2019.

- Loan amounts also affect closing times, with lower amounts, perhaps surprisingly, taking the most time. Loans under $150,000 averaged 47 days compared with 39 days for those above the conforming limit ($484,350 in 2019). Why? Higher loan amounts are typically being made to more credit-worthy borrowers. Lower-priced homes may be in some form of distress or have some type of damage; lenders thus may require more extensive appraisals to better estimate the home’s value and this adds time to the process.

https://www.lendingtree.com/home/mortgage/time-to-close-on-a-mortgage-in-2019/

Found at Abnormal Returns Blog www.abnormalreturns.com

10.This Is the Most in-Demand Skill of the Future

The future of work belongs to those who possess emotional and social skills. Here’s why.

By Ryan JenkinsMillennial and Generation Z speaker and generations expert@theRyanJenks

ALEX KNIGHT/UNSPLASH

When artificial intelligence (AI) can diagnose a patient’s condition with greater accuracy than a human doctor, what becomes of doctors?

This is a question I present to my audiences when they ask me, “What skills will Gen-Z need in the future?”

In the AI-abundant world of tomorrow, where technology will do much of the heavy lifting, a doctor’s ability to deliver compassion and empathy to a patient will become much more valuable. While the technical hard skills of doctors will remain important, their emotional intelligence will take on new significance.

The Industrial Revolution required muscle from its workers. The Information Age traded muscle for mental capacity, which explains the rise of “knowledge workers.” The future will require workers to be emotionally intelligent.

Emotional intelligence is the capacity to be aware of, control, and express one’s emotions, and to handle interpersonal relationships judiciously and empathetically.

As the world fills with more sophisticated AI and ubiquitous technology, human skills–compassion, empathy, etc.–will define the competitive edge of workers and entire organizations. So those interested in thriving in a high-tech world must put renewed prioritization on emotional intelligence and soft skills.

ADVERTISING

Soft skills represent the top three missing skills of job applicants, according to the Society of Human Resource Management’s (SHRM) “2019 State of the Workplace.”

The top six missing skills in job applicants are:

- Problem-solving, critical thinking, innovation, and creativity (37 percent)

- Ability to deal with complexity and ambiguity (32 percent)

- Communication (31 percent)

- Trade skills (carpentry, plumbing, welding, machining, etc.) (31 percent)

- Data analysis / data science (20 percent)

- Science / engineering / medical (18 percent)

The significance of developing and applying social and emotional skills is growing. Soft skills are twice as predictive of a student’s academic achievement as home environment and demographics, and 30-40 percent of jobs in growth industries require soft skills. Additionally, 57 percent of leaderssay soft skills are more important than hard skills.

A recent Wall Street Journal article, “Wanted: Employees Who Can Shake Hands, Make Small Talk,” explained the importance of social and emotional skills this way:

“New jobs, meaning those not killed off by automation, require substantially more social skills than the manufacturing and factory jobs that once powered the economy. Robots still can’t be friendly, make small talk and calm disgruntled customers, which offers opportunity for people. Turns out a lot of them aren’t very good at it, either. Bank of America has developed a national training program to help its employees show empathy. Tellers don’t deposit paychecks or handle withdrawal slips anymore, given the dominance of online banking.”

Employers aren’t looking for the same level of deep knowledge and technical skill as they did in the past. In fact, 90 percent of employers say they are open to accepting non-traditional candidates that do not hold four-year college degrees. And they are more open to hiring candidates with a recognized certification (66 percent), complete certificate (66 percent), an online degree from a massive, open online course (MOOC) (47 percent) or a digital badge (24 percent).

At IBM, as many as one-third of U.S. employees lack a traditional four-year degree. And according to César A. Marrero, CEO of Xentient Technology, “Today we are looking more at students with a two-year degree to hire, because they have the baseline knowledge we need and can further expand their skills with our specialized in-house training.”

In addition, 40 percent of employers believe artificial intelligence will help fill the skills gap.

The prevalence of AI will only make social and emotional skills more necessary and valuable because they are the skills robots can’t automate. In today’s fast world, hard skills have a short shelf life, but strengthening the social and emotional skills of your workforce will never go out of style, and soft skills are more transferable across careers and industries.

https://www.inc.com/ryan-jenkins/this-is-most-in-demand-skill-of-future.html?cid=hmside1