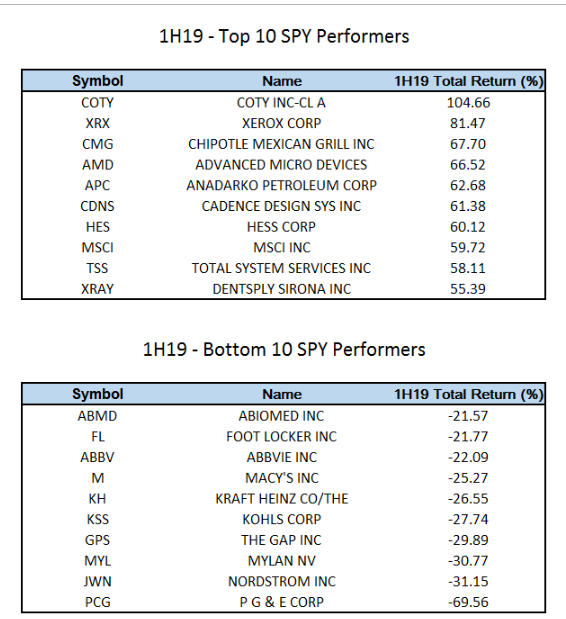

1.S&P Top 10 and Bottom 10 Performers YTD.

Retailers Bunched Up in Bottom 10

From Nasdaq Dorsey Wright www.dorseywright.com

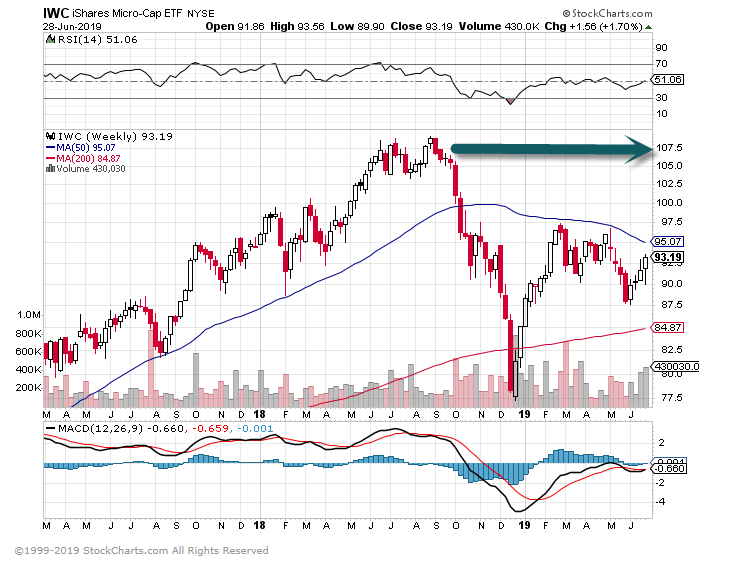

2.Another Stock Group that is Well Below Highs….Microcaps.

Microcap ETF well below highs…Private Equity Holds All the Microcap Today

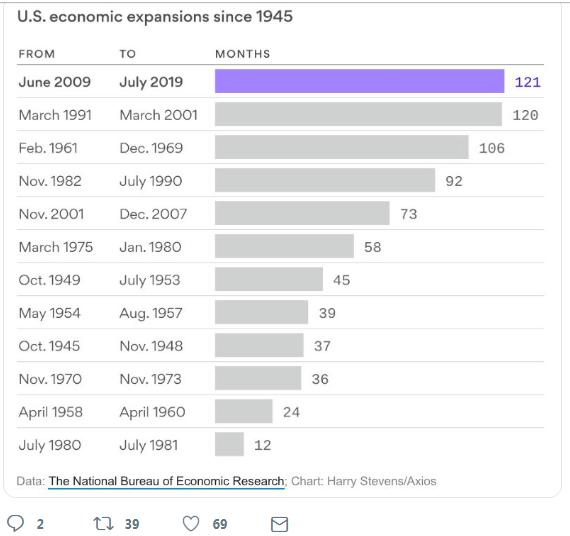

3.July 1 2019 Kicks Off Official Longest Economic Expansion Since WWII.

Holger Zschaepitz @Schuldensuehner 1h1 hour ago

Tomorrow is July, which means that we will officially be entering the longest economic expansion the U.S. has ever seen. https://www.axios.com/newsletters/axios-edge-b333a2bd-e9ac-4a7b-ba5d-bca2a660a9b1.html?chunk=5&utm_term=twsocialshare#story5 …

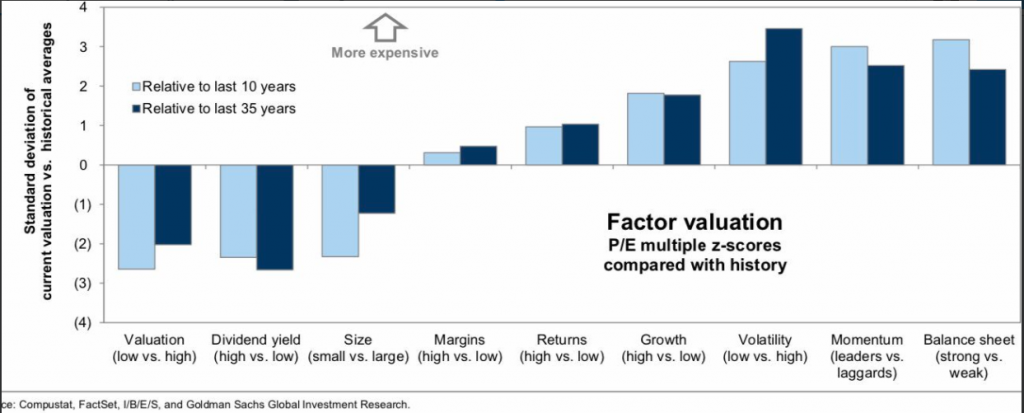

4.What Factors are Cheap and Expensive Versus 10 Year and 35 Year History

Value and Small Cap Cheap?

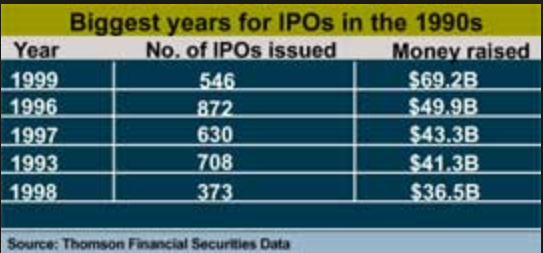

5.The Median Age of Tech Companies Going Public in 1999 was 4; Last Year it was 12

Barrons

Initial offerings could raise a record level of capital in 2019, potentially breaking the nearly $97 billion record set in 2000. But Wainwright, and IPO investors, have returned wiser and more disciplined.

In a sense, the IPO market has simply grown up. For one thing, the median age of tech companies going public in 1999 was four; last year, it was 12. And having been burned in the bubble years by IPOs for wildly speculative and ultimately failed businesses, such as theGlobe.com and eToys, investors have tightened their standards. They now want established businesses with substantial revenue and high growth.

The RealReal Is No Pets.com and Today’s IPO Market Is Not the Next Dot-Com BubbleBy Eric J. Savitz

Flashback to 1990’s IPO Boom

https://money.cnn.com/1999/12/27/investing/century_ipos/

https://www.cbinsights.com/research/tech-ipo-dead/

6..80% of the stock market is now on autopilot

PUBLISHED SAT, JUN 29 2019 8:30 AM EDTYun Li@YUNLI626

KEY POINTS

- Passive investments control about 60% of the equity assets, while quantitative funds — those relying on trend-following models instead of fundamental research — now account for 20% of the market share, according to estimates from J.P. Morgan.

- Passive funds have attracted $39 billion of inflows so far this year, whereas active funds lost a whopping $90 billion in 2019, the bank said.

It’s no secret that machines are taking up a bigger and bigger share of investing, but the extent of their influence is approaching shocking proportions. It is as high as 80%, according to one major investing firm.

Passive investments such as index funds and exchange-traded funds control about 60% of the equity assets, while quantitative funds, those which rely on trend-following models instead of fundamental research from humans, now account for 20% of the market share, according to estimates from J.P. Morgan.

This means so much of stock trading is now in the hands of automated buyers and sellers that the market is increasingly sensitive to headlines and more prone to sharp price swings, many notable investors believe.

Omega Advisors founder Leon Cooperman previously said computer trading is creating a “Wild West” with the markets, calling for an investigation by the Securities and Exchange Commission.

DoubleLine Capital CEO Jeffrey Gundlach has taken a shot at passive investing, saying it is causing widespread problems in global stock markets. He called it a “herding behavior.”

“I’m not at all a fan of passive investing. In fact, I think passive investing … has reached mania status as we went into the peak of the global stock market,” Gundlach said in December.

While algorithmic models have gained popularity on Wall Street, low-cost passive vehicles keep raking in assets from Main Street. Passive funds have attracted $39 billion of inflows so far this year, whereas active funds lost a whopping $90 billion in 2019, according to J.P. Morgan.

“The pace of outflows from Active is at a cycle high while the pace of passive equity inflows has bottomed and [is] beginning to reaccelerate,” Dubravko Lakos-Bujas, J.P. Morgan’s chief U.S. equity strategist, said in a note on Friday.

https://www.cnbc.com/2019/06/28/80percent-of-the-stock-market-is-now-on-autopilot.html

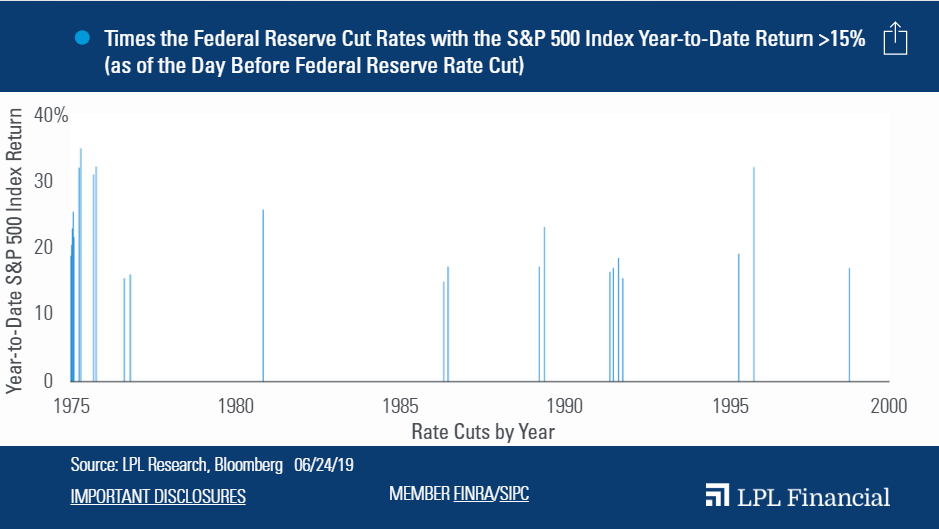

7.Can The Fed Cut With Stocks Up Big?

Posted by lplresearch

The Federal Reserve (Fed) will likely cut rates at its next meeting in late July. This begs the question: Will the Fed really cut rates with stocks up so much year to date and near all-time highs? “It might sound strange for the Fed to cut rates with stocks up a lot for the year,” explained LPL Senior Market Strategist Ryan Detrick. “But since 1975, the Fed has cut rates 26 times with the S&P 500 Index up at least 15% for the year, most recently in 1995 and 1998.”

Here’s the catch: A year after those cuts, the S&P 500 was higher 23 out of 26 times—with a very solid average gain of 13.4%. So it would appear monetary policy could be a continued tailwind.

As our LPL Chart of the Day, “Will the Fed Really Cut Rates When Stocks Are Up Big?”, shows, rate cuts when stocks have been up big for the year have actually occurred quite often over the years.

https://lplresearch.com/2019/06/25/can-the-fed-cut-with-stocks-up-big/

8.Oregon Supply of Weed Running 2x Demand

Oregon Has So Much Extra Weed it Could Take Years to Smoke it All

MAY 31, 2019

SALEM, Ore. — Oregon is awash in pot, glutted with so much legal weed that if growing were to stop today, it could take more than six years by one estimate to smoke or eat it all.

Now, the state is looking to curb production.

Five years after voters legalized recreational marijuana, lawmakers are moving to give the Oregon Liquor Control Commission more leeway to deny new pot-growing licenses based on supply and demand.

The bill, which passed the Senate and is now before the House, is aimed not just at reducing the huge surplus but at preventing diversion of unsold legal marijuana into the black market and forestalling a crackdown by federal prosecutors.

“The harsh reality is we have too much product on the market,” said Democratic Gov. Kate Brown, who intends to sign the bill if it wins final passage as expected.

Supply is running twice as high as demand, meaning that the surplus from last year’s harvest alone could amount to roughly 2.3 million pounds of marijuana, by the liquor commission’s figures. That’s the equivalent of over 1 billion joints.

https://time.com/5598922/oregon-weed-pot-supply/

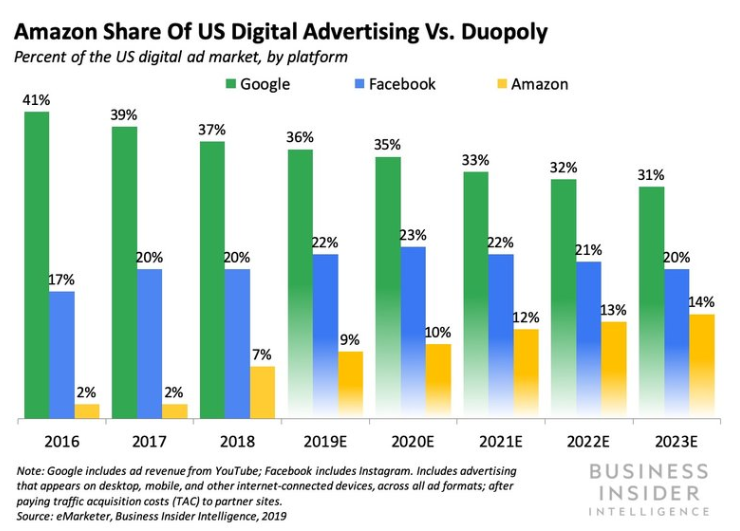

9.Amazon Share of Digital Advertising.

THE RISE OF AMAZON ADVERTISING: This is exactly what Amazon is doing to siphon billions of ad dollars from Google and Facebook and why brands love it

Jun. 4, 2019, 1:07 P

https://www.businessinsider.com/the-rise-of-amazon-advertising-2019-5

10. 5 PRINCIPLES FOR MAKING BETTER LIFE DECISIONS

Marovember 19, 2018 Mark Manson

Mark Manson

One massive plot of land out in the frigid wasteland of the northern Yukon and build a vast complex of unnecessarily poorly-designed buildings. There will be no roads that lead there. No utilities. No central heating. And insufficient staff to maintain the structure. I’ll then call it, “The Hall of Fame of Bad Decisions.”

It will be perfect. Because not only will the hall itself be a bad decision, but anyone who ever attempts to visit it will clearly be making a bad decision as well.

Inside the hall, we will have exhibits for all of the worst decisions ever made. There’d be one for that time when Kodak, despite owning 90% of the market share of the camera industry and inventing the digital camera, decided not to sell them and went bankrupt as a result. There will be another for the time when Decca Records passed on signing The Beatles because they thought “guitar bands are on the way out.” There will be a whole wing for stupid military leaders who tried to invade Russia. And we’ll have a special “Tiger Woods” wing where we rotate in/out celebrities who wreck their own careers by doing something exceedingly dumb.

It’ll be great.

And I guess, while people are there, we’ll trot out a speaker or two and give seminars on how to not make such awful choices. They’ll offer some principles on how to make better life decisions.

Maybe that seminar would go something like this:

1. UNDERSTAND VALUE AND BIASES

All tough decisions are essentially about weighing values. There’s financial value, emotional value, social value, intellectual value, and so on. You have to consider all of them, weighing them appropriately. And not just in the short-term, but in the long-term as well.

This “weighting” of values is incredibly difficult, largely because we struggle to see things clearly.

As a general rule, we are all heavily biased towards the short-term rewards and towards emotional value. We are biased towards our pre-existing beliefs and protecting our reputation. And we’re also bad at seeing long-term rewards clearly because it’s difficult to look past our immediate fears and anxieties. Our emotions color everything we see.

Our “default” decision-making also makes it incredibly painful emotionally to give up on something we’ve worked a long time on, or to consider that we may have been wrong for years.

The fact is, we’ve all been wrong for years. We’re all wrong about our value estimates. And until we can be honest about how wrong we were in the past, we won’t learn to make better value judgments moving into the future.

Our “default” decision-making also encourages us to avoid short-term failures, even if that means missing out on long-term successes.

No, the sweet spot in decision-making is to find the short-term failures that enable the huge long-term successes to happen in the first place. Because this is what most people are bad at. And because people are bad at it, this is where most of the opportunity lies…

2. LOSE ON PURPOSE (SOMETIMES)

Ever hear those stories of wildly successful entrepreneurs and how they had, like, 23 failed businesses before they made it big?

The lesson we’re all supposed to take from this is that persistence and hard work is the key to extraordinary success.

And sure, whatever…

Usually, we can’t help but look at them and think about how “lucky” they got. I mean, Amazon! Who knew?!

What we don’t consider is that out of those dozens of failed, half-baked business ideas were all wagers with limited downside and extremely high upside. That is, if they lose, they lose a little. But if they win, they win a lot.

Let’s say I gave you a pair of dice and I told you that if you roll double ones, I’ll give you $10,000. But each roll costs $100. How many times would you roll?

If you’re not bad at math, you would know that you should spend all the money you have rolling those damn dice.

Most people look at each decision as a single roll of the dice. They don’t think about the fact that life is a never-ending sequence of dice rolls. And a strategy that loses a lot per roll can actually make you a big winner in the long run.

Yes, you will lose the dice game way more than you win. But when you win, your winnings will far outstrip your losses, making it a worthwhile wager.

You can apply the same “risky” behavior in your life to achieve more optimal long-term results:

- Propose “moonshot” ideas at work knowing that 90% of them will get shot down, but also that if one of them gets accepted it will be a huge boost to your career.

- Expose your kids to difficult subjects at an early age, knowing that most likely they won’t take to it. But if they do, it will give them a huge advantage throughout their life.

- Be excessively bold in your dating life, stating exactly who and what you want, knowing that the vast majority of people will not be compatible.

- Buy a bunch of difficult books expecting that most of them won’t be useful or comprehensible to you, but also that, occasionally, one will completely change your life.

- Say yes to every invitation knowing that most of the events/people will be kind of dull and you’ll just go home early, but that occasionally you’ll meet someone really important or interesting.

When you think purely in terms of the immediate result, you cut yourself off from the biggest potential gains in life. And the reason most of us do this is because of our pesky emotions. Our emotions are short-term biased. They are obsessed with the present moment. And this prevents good decision-making.

3. TREAT YOUR EMOTIONS LIKE YOU’D TREAT A DOG

Here’s one thing I’ve noticed over the years: shitty dogs almost always have shitty owners. The dog’s level of discipline is reflected in the owner’s emotional maturity and self-discipline. It’s very rare to see a dog that’s wrecking the house, eating all the toilet paper and pooping all over the couch and the owner has their own shit together.

This is because our connections with dogs are purely emotional. And if we suck at dealing with our own emotions, then we’ll suck at dealing with our dogs. It’s that simple. If you don’t know how to limit yourself and tell yourself “no” when necessary, then, well, don’t get a dog. And if you do, don’t fucking move into my building.

Our emotions are kind of like our dog that’s living inside our head. We have this part of ourselves that just wants to eat, sleep, fuck and play, but has no conception of future consequences or risks.

That’s the part of ourselves we need to train.

Our emotions are important. But they’re also kind of dumb. They’re not able to think through consequences or consider multiple factors when acting.

Our emotions overreact to things by design. They evolved to keep us alive when we were hunting water buffalo on the savannah and shit like that. When we’re scared we want to run away or hide. When we’re angry we want to break stuff.

Thankfully, our brains evolved logic and the ability to consider the past and the future and all that great stuff. That’s what makes us humans. And not dogs.

The problem is, our “dog brain” is actually what controls our behavior. You can intellectually know that eating ice cream for breakfast is a bad idea, but if your dog brain wants fucking ice cream for breakfast, then that’s ultimately where your body is going to go.

It’s only by training your dog brain with your people brain, “No, bad Mark, ice cream for breakfast is bad, go do something else that feels good and is healthy,” that your dog brain gradually learns.

Do that enough and you have a well-behaved dog brain.

Emotions are great for giving you that umph of passion and spirit, the same way a dog is great for running and fetching stuff and being a great friend and barking when someone weird is hanging out by your bedroom window.

But the dog is limited. It needs context and direction to behave well and function. And that’s your job as the dog owner. Similarly, your dog owner brain must train the dog brain to sit down and shut up when necessary. You must give yourself context and direction. Train yourself to adopt the correct habits and make better decisions. Reward and punish yourself.

Love your dog brain (i.e., love yourself), accept your dog brain (i.e., accept your emotions), but also discipline them.

And every once in a while, indulge yourself… that’s a good boy. Yeah, who’s a good boy? Who’s a good boy? Yes, you’re a good boy.

4. OPTIMIZE YOUR LIFE FOR FEWEST REGRETS

Regret is sometimes called a “rational emotion” by psychologists. And not really because regret itself makes us more rational—at least not directly—but rather the way we predictregret is often done in a rational-looking way.1

In making decisions, we’ll often consider the options available to us, imagine our future selves after choosing one of these options, and then try to feel how much regret we experience in this simulated future state. We then run this simulation again, choosing a different option, and compare that simulated state of regret/non-regret to the others.

This ability is both a) fucking amazing when you think about it and b) incredibly useful as long as we use the most accurate and complete information available to us (by using all the ideas we’re covering here, of course).

Most of us are afraid of failing or screwing something up. But we rarely ask, “Would I regret that failure?” If the answer is “no,” then that is absolutely a risk you should pursue.

Similarly, a lot of us love envisioning massive success. But if we ask, “Would I regret never having that success?” usually we find that the answer is “no.” Only when it’s “yes” should we probably make the sacrifices to achieve it.

Sometimes, the right decision becomes crystal clear when put into these terms. Legend has it that Jeff Bezos left his cushy, high-paying job to start Amazon because it was so obvious to him that he’d regret it if he got old and didn’t at least try this whole “internet thing.” Staying at his job, on the other hand, carried a lot of future regret that was apparently quite palpable for Bezos.

I personally know a lot of people—myself included—who ultimately made big life decisions largely based on the path of least regret. These decisions are almost always described as the best decisions they’ve ever made. Go figure.

Instead of basing your decisions around success/failure, or happiness/pain, base them around regret avoidance. Our regrets are usually the best measurement of what is actually valuable to us in the long-run.

5. WRITE SHIT DOWN

The best way to help you sort out all of your emotional drivel from actual decision-making is to write things down.

Writing things down is a simple but powerful way to clarify everything that’s swirling around in your head. I get emails from readers all the time with long screeds about the issues in their lives only to have them say at the end that they don’t need a reply because writing it all out was so cathartic and revealing for them.

The act of writing forces you to organize and make concrete all the emotional turbulence swirling around in your brain. Vague feelings become structured and measured. Your self-contradictions are laid bare. Rereading what you write reveals your own logic (or lack thereof). And it often reveals new perspectives you hadn’t considered.

And when it comes to mulling over a decision, there are a few specific things you can write about to help you if you’re having difficulties:

- What are the costs and benefits? First, take some time and do a good old-fashioned cost-benefit analysis of your decision. But don’t just do the old-fashioned “pros” and “cons” list. Add a couple more columns. Separate your “pros” into both long-term and short-term. Add a column for regrets associated with each decision. And note if there is any long-shot potential for success (see Principle #2).

- What is your motivation behind the decision and is that a value you want to cultivate in yourself? All the decisions we make, big or small, are motivated in some way or another by our intentions. Sometimes this is very straightforward.

Last night, I was motivated by hunger to eat something and there was a burrito in front of me, so I shoveled it into my face hole.

Sometimes it’s not so straightforward though. Problems arise when our intentions a) aren’t very clear to us and/or b) conflict with our core values.

For example, are you buying that car because you would genuinely benefit from owning it, or because you’re trying to impress the people around you?

Or are you filing for full custody of your kids because you think it’s truly in their best interest, or are you trying to get revenge on your ex after finding out they are dating someone new?

Are you trying to start a business because you enjoy the challenges and ups and downs of making your own way, or are you jealous of your friends that have successful businesses and feel like you don’t quite measure up to them?

If you identify some ulterior motives when weighing a decision, stop and ask yourself if your intentions align with who you want to be.

And if you’re asking yourself, “Well shit, I’ve never thought about who I want to be. What should I do?” Then I think you should take out a fresh piece of paper and start writing that down.

For instance, here’s my Horrible Decisions Hall of Fame Table:

| Pros * It’s funny * Oh, Canada! * Get to research celebrities with hookers | Cons * Expensive * Lot of work * Really, really far away * Joke is only funny for so long | Long-Term * Illiquid asset * Seriously, when am I ever going to travel to this thing? * For the rest of my life, I’ll be the “Dumb Hall of Fame” guy. | Potential Regrets * DOING: Tons, lost time, money, etc. * NOT DOING: Uhh… none, really. | Rep. Value * Do I really want to dedicate a huge portion of my life and legacy to being a clever smart ass? Probably not. |

So there you have it. No “Horrible Decision Hall of Fame.” Why? Because it’s a horrible decision.

HOW TO KNOW WHO YOU REALLY ARE

We all think we know ourselves well, but psychological studies show otherwise. In fact, most of us are somewhat deluded about ourselves. I put together a 22-page ebook explaining how we can come to know ourselves better, just fill out your email in the form.

You’ll also receive updates on new articles, books and other things I’m working on. You can opt out at any time. See my privacy policy.