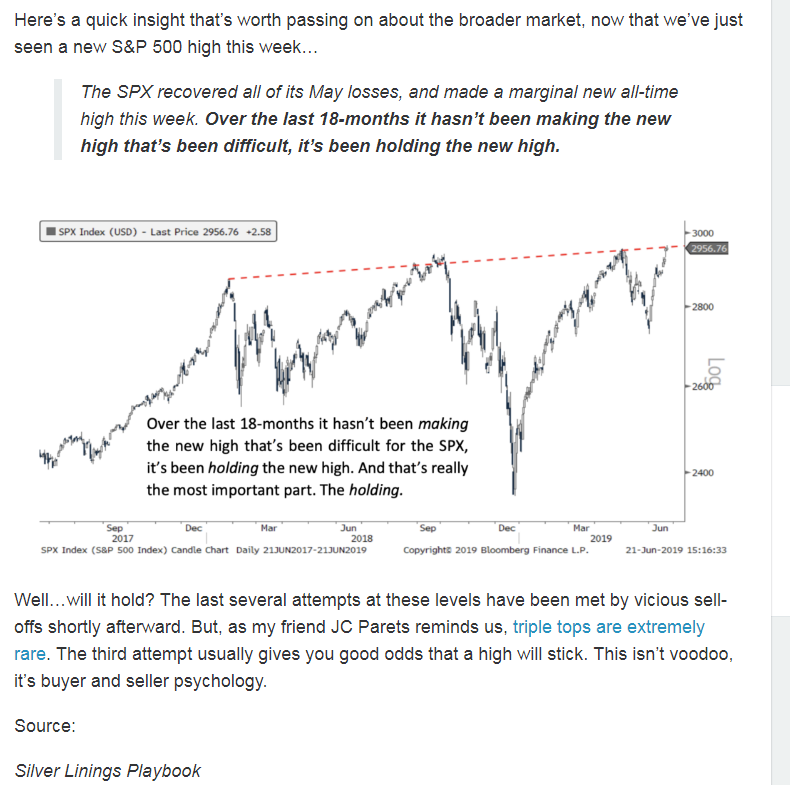

1.S&P Holding New High…What Does it Mean?

From Josh Brown Blog…Reformed Broker

https://allstarcharts.com/triple-tops-rare-quad-tops-fuggedaboutit/

https://thereformedbroker.com/2019/06/23/will-it-hold-2/

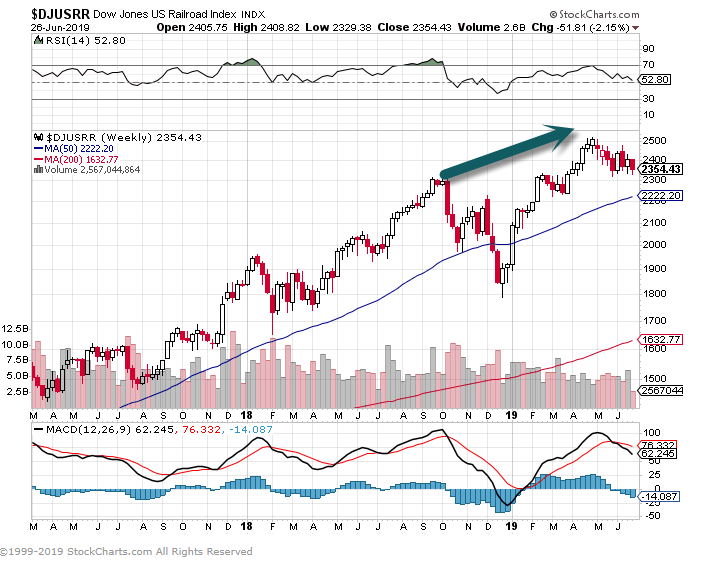

2.Dow Jones Trucking Index Still -18% from Highs.

Interesting chart-we’ve been showing Dow Transports far from new highs…Trucking touching 2017 levels.

Railroad index did make new highs

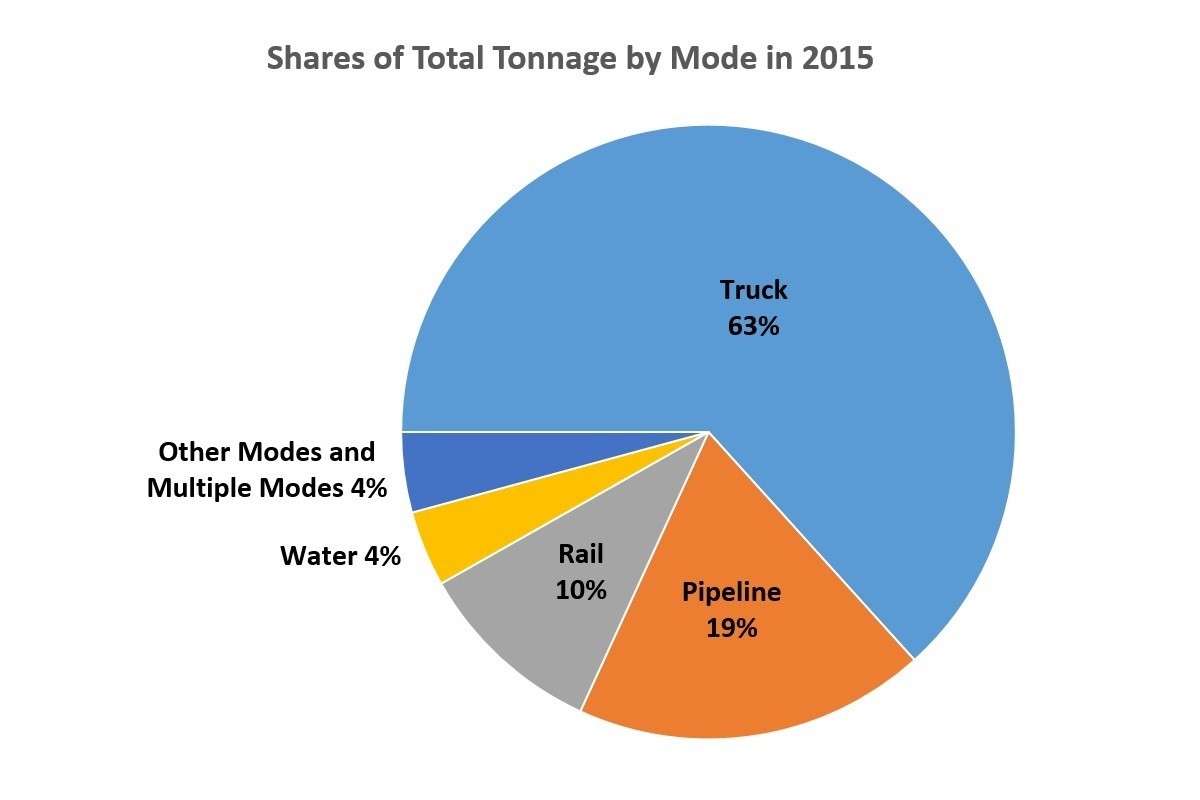

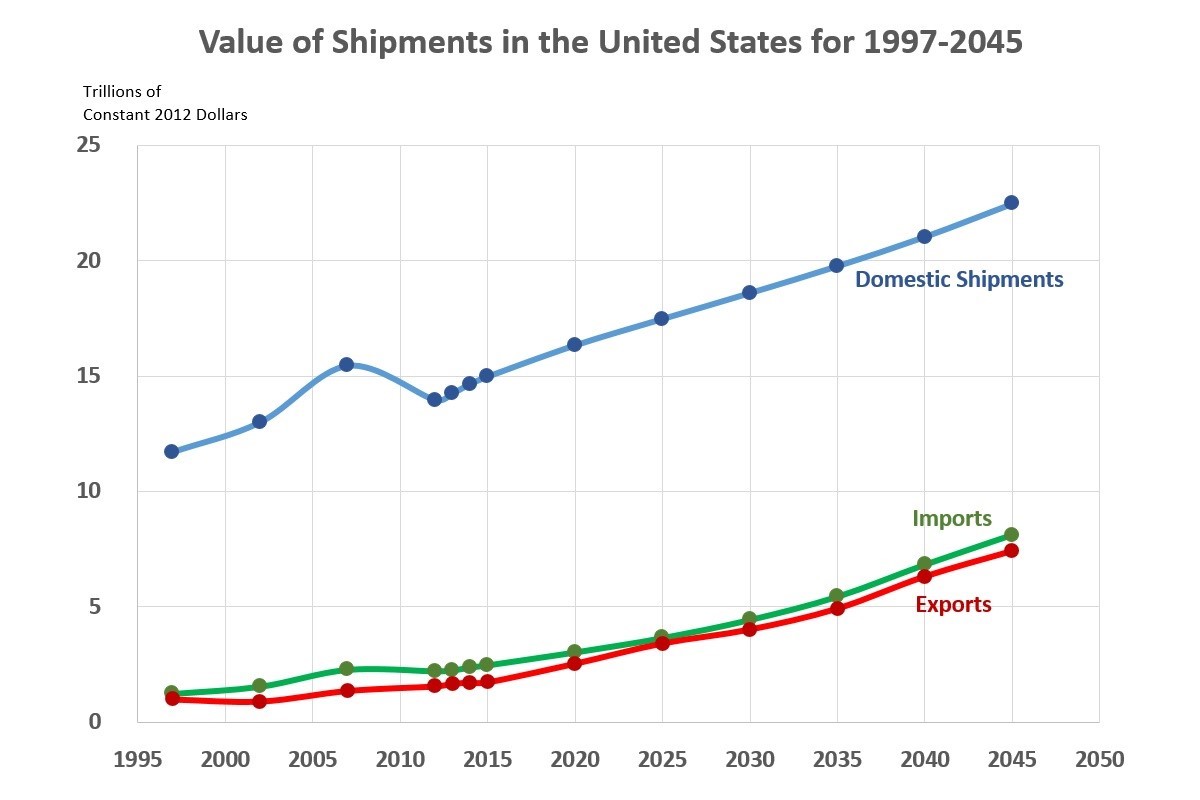

3.Projected Shipments Growth.

The FAF4 projections show that total freight tons moving on the nation’s transportation network will grow 49 percent in the next three decades, while the value of freight will almost double, increasing by 98 percent. By 2045, total freight on all modes – air, vessel, pipeline, rail, and trucks – is projected to reach 27 billion tons while the value is expected to grow to $38 trillion.

https://www.transportation.gov/connections/freight-shipments-projected-continue-grow

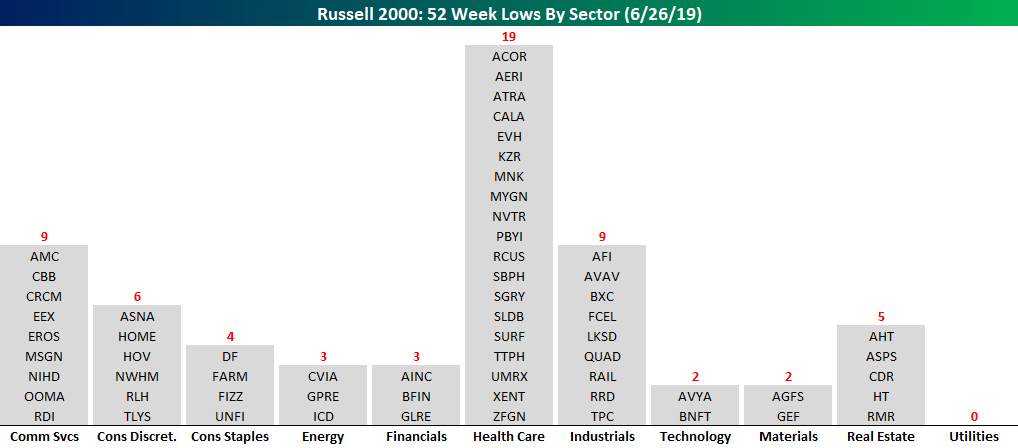

4.Small Cap Continues to Lag.

Russell 2000 New Lows By Sector

Wed, Jun 26, 2019

With the S&P 500 right near 52-week and all-time highs, there aren’t a lot of new lows to speak of in the index. So far today, for example, the only stocks in the index to hit a 52-week low are Iron Mountain (IRM), Kroger (KR), Macerich (MAC), and Simon Property (SPG). While the S&P 500 hasn’t seen much in the way of new lows, small-cap stocks have really lagged their large-cap peers which has resulted in significantly more stocks on the new low list. Through this afternoon, we have actually seen more than 60 new lows in the Russell 2,000.

We were curious to see if there was any specific sector driving the relatively high number of new lows in the Russell 2000, so the chart below breaks the stocks hitting new lows today out by sector. Looking at the list, we were somewhat surprised to see that the Health Care sector alone accounts for nearly a third of all the new lows today with 19. Behind Health Care, the next closest sectors are Communication Services and Industrials, each with nine. On the other extreme, not a single stock in the Russell 2000 Utilities sector traded at a new low today, but with the 10-year yield right around 2.0%, that should not come as a surprise. One sector with relatively few stocks on the new low list today is Energy with three. With oil rallying over the last few days, the sector has gotten a reprieve, but as recently as a week or two ago, there were regularly more than 30 stocks from the sector on the new low list.

©2019 Bespoke Investment Group

Bespoke Investments

https://www.bespokepremium.com/interactive/posts/think-big-blog/russell-2000-new-lows-by-sector

5.TAN Solar ETF +51% YTD

Solar ETF Breakout.

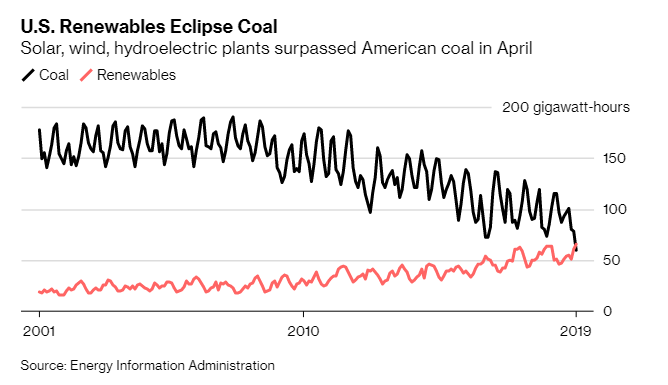

6.U.S. Renewables Eclipse Coal

For First Time, Renewables Surpass Coal in U.S. Power Mix By Chris Martin

New wind, solar farms helped boost renewable energy output

Some coal plants were idled for routine spring maintenance

For the clearest sign yet that renewable energy has gone mainstream, consider this: Clean-energy resources supplied more of America’s electricity than coal for the first time ever in April.

Hydroelectric dams, solar panels and wind turbines generated almost 68.5 million megawatt-hours of power in April, eclipsing the 60 million that coal produced that month, Energy Information Administration data released late Tuesday show. That’s the most clean power the U.S. has ever made — and the least coal it has burned for power in years.

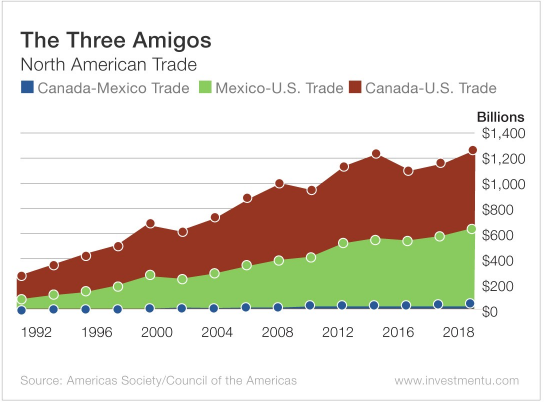

7.Growth of U.S. Trade with Canada/Mexico Since 1990

These Three Amigos Can Boost Your Portfolio by James Hires

https://www.investmentu.com/article/detail/61859/usmca-beats-china#.XRSjshZKhhE

8.Drugmaker Deals Are Near Record Pace in 2019, but Investors Don’t Love Them All

Shares of AbbVie, which makes the drug Humira, fell 16 percent after it agreed on Tuesday to buy Allergan in a $63 billion deal.CreditTannen Maury/EPA, via Shutterstock

Shares of AbbVie, which makes the drug Humira, fell 16 percent after it agreed on Tuesday to buy Allergan in a $63 billion deal.CreditCreditTannen Maury/EPA, via Shutterstock

By Stephen Grocer

June 27, 2019

A rush of acquisitions this year is reshaping the drug industry. But investors haven’t universally welcomed the deal-making.

AbbVie’s agreement on Tuesday to buy Allergan, in a deal valued at $63 billion, provided the latest evidence: AbbVie’s shares fell 16 percent, their worst day in six years. Months earlier, investors pushed the stock of Bristol-Myers Squibb down 14 percent after the announcement that it would buy Celgene for $74 billion, the year’s biggest pharmaceutical deal.

In both deals, the rationale for the companies — as well as the immediate negative reaction in the markets — reflect the industry’s dependence on blockbuster drugs to drive revenue growth, and the vulnerability of the companies when those drugs lose patent protections.

It’s a dynamic that has pushed drugmakers to make deals. Both Celgene and AbbVie have best-selling drugs that will lose patent protection in the next five years.

So far in 2019, companies have announced nine transactions valued at more than $4 billion, including Pfizer’s proposed $11 billion purchase of Array BioPharma, Eli Lilly’s $8 billion deal for Loxo Oncology and Roche’s $4.8 billion acquisition of Spark Therapeutics. The value of this year’s acquisitions of American drugmakers hit $256 billion, according to the data provider Dealogic, which is on a par with the record for annual totals. (Adjusted for inflation, the value for health care deals in 2015 was slightly higher.)

Investors received most of the merger announcements this year more warmly than they did the Allergan or Celgene acquisitions.

So why have investors punished Bristol-Myers and AbbVie? Part of the explanation has to do with size. Big transactions carry greater risk, and both the deals rank among the largest health care transactions on record.

But the stock market reaction also appears to reflect concerns that the companies are spending a lot on acquisitions that may not deliver the next blockbuster.

AbbVie needs to diversify. Sales of its best-selling medicine, Humira, an anti-inflammatory drug, topped $20 billion last year and accounted for 60 percent of its revenue. But as Humira approaches a so-called patent cliff, losing its protection for exclusivity in the United States, AbbVie has already begun to feel the pinch. Competing versions are already available in Europe, and they are scheduled to go on sale in the United States in 2023.

Global sales of the drug in the first quarter fell 23 percent from a year earlier, and shareholders pushed down the company’s stock price over concerns that it will not make up for Humira’s falling revenue.

Worries about what drugs are in the pipeline dragged down Bristol-Myers’s stock price after it announced its deal for Celgene, whose popular cancer drug, Revlimid, accounts for about two-thirds of sales. That drug is also facing a patent cliff, with its protection going away in 2022. Questions over Celgene’s ability to replace Revlimid pushed its shares down about 40 percent in 2018.

Tuesday’s deal may ultimately have little to do with buying the next big thing. On a conference call to discuss it, Richard A. Gonzalez, AbbVie’s chairman and chief executive, said the acquisition “is not a transaction that’s highly dependent on pipeline.”

Instead, the deal, as Mr. Gonzalez pointed out, will make AbbVie less dependent on Humira.

That may buy AbbVie some time, but it doesn’t solve one of the question for investors: What will make up for Humira’s shrinking revenue?

https://www.nytimes.com/2019/06/27/business/dealbook/abbvie-allergan-drugmakers.html

9.Top 10 Largest Corporate Bankruptcies In The US History

11:08 am by Vikas Shukla

geralt / Pixabay

A large number of companies borrow heavily or take shortcuts to drive short-term profits and revenue growth. But sometimes their risky moves backfire, leading to the collapse of the entire corporation. Almost all of the billion-dollar bankruptcies in the US history had at least one of the following characteristics: massive debts, shady management, or risks that went unnoticed or were deliberately overlooked. Here we take a look at the top 10 largest corporate bankruptcies in the US history.

The ranking below is based on the total assets of the respective company before it declared bankruptcy. The largest corporations that went bankrupt belong to different industries such as utilities, automobiles, telecom, investment banking, and others. All of them wanted to grow rapidly at any cost.

10- Chrysler (2009), $39.3 billion in assets pre-bankruptcy

The 2008 financial crisis hit Chrysler hard as people stopped buying expensive vehicles. Its sales tumbled 30% in 2008 compared to the previous year. Chrysler was the first US automaker to fall due to the 2008 crisis. The $4 billion government bailout was not enough to rescue it. It filed for bankruptcy in April 2009. The US government later forced it to merge with Italian automaker Fiat. It received a total of $12.5 billion in federal bailouts.

9- MF Global (2011), $41 billion

Not happy with making small money in the brokerage business, MF Global CEO and former New Jersey Governor Jon Corzine started trading extremely risky, high-yield debts issued by struggling European economies such as Italy, Greece, Spain, and Portugal in the midst of the Eurozone Debt Crisis. MF Global structured its trades such that it could make short-term profits. When things didn’t work out as planned, the company started using its customers’ brokerage assets – of course, illegally – to cover its own losses from trades. Eventually, MF Global declared bankruptcy in August 2011.

8- Conseco (2002), $61 billion

Conseco was an insurance and financial holding company. Its aggressive acquisition strategies went horribly wrong as it took massive debts on its books. Since its inception in 1982, it had acquired 44 insurance firms before it went bankrupt in 2002. Things took an ugly turn when it purchased consumer lending firm Green Tree Financial for $7.6 billion in 1998. Immediately after the acquisition, Conseco had to infuse more cash into Green Tree Financial, whose financial condition kept deteriorating due to declining interest rates and weakening credit standards.

7- Enron (2001), $66 billion

Enron was one of the biggest corporate frauds in the US history. At one point, Enron was the largest seller of natural gas in the country. The company’s top management was pursuing aggressive growth at all costs. It started using fraudulent accounting practices to show more revenues and profits, at least on paper. It created Special Purpose Entities (SPEs) to hide its liabilities.

Enron was forced to declare bankruptcy after company insiders exposed the accounting fraud. Thousands of people lost their jobs overnight, their pensions vanished. Its top executives including the CEO, COO, and CFO were convicted of fraud, insider trading, and conspiracy. Enron’s bankruptcy also drove its accounting firm Arthur Anderson to extinction.

6- Pacific Gas & Electric (2019), $71 billion

Pacific Gas & Electric is the only company in this list to have declared bankruptcy twice within a span of 20 years. The first time, it filed for Chapter 11 bankruptcy in 2001 when it was buried under a pile of massive debts. The state of California tried to bail it out, and the company emerged out of bankruptcy in 2004.

Pacific Gas & Electric filed for Chapter 11 bankruptcy again in January 2019 in response to the financial liabilities arising from the massive wildfires in California in 2017 and 2018. The company has admitted that its equipment might have caused the Camp Fire in November last year. The fire has caused damages worth up to $10 billion. The Camp fire began on November 8, 2018 in Butte County and burned through 153,336 acres of land. It is estimated to have destroyed close to 19,000 homes and claimed 89 lives.

5- CIT Group (2009), $71 billion

CIT Group was a financial services firm that offered commercial and consumer financing. It invested heavily in the subprime mortgages at the peak of the US housing bubble. The company filed for bankruptcy in January 2009 and had received about $2.3 billion in federal bailouts. It emerged from one of the largest corporate bankruptcies within weeks of filing for it.

4- General Motors (2009), $82 billion

One of the world’s largest automakers filed for bankruptcy in June 2009. The then-CEO of General Motors Fritz Henderson said at the time that the bankruptcy filing could force the company to move out of Detroit. The automaker received $68.2 billion in federal bailouts. Poor automobile sales coupled with massive pension obligations are what drove GM to bankruptcy. Its bankruptcy ended up costing the US taxpayers close to $9 billion. When the company came out of bankruptcy, the US government held more than 60% shares of the restructured General Motors. The government has since sold its stake.

3- WorldCom (2002), $104 billion

Before its bankruptcy, WorldCom was the second largest telecom carrier in the United States. WorldCom is one of the largest corporate bankruptcies in the US history, all because its top management was pulling off a massive accounting scandal. The company was growing rapidly by acquiring smaller operators, fueling the purchases by borrowing more money. At one point, it had proposed to merge with Sprint in a $115 billion deal. Its CEO Bernard Ebbers was sentenced to 25 years in prison.

2- Washington Mutual (2008), $328 billion

In 2003, Washington Mutual CEO Kerry Killinger proclaimed that in five years, Washington Mutual would do to the savings and loan holding industry what Walmart had done to the retail business. But five years later, Washington Mutual ended up filing for bankruptcy due to its extensive exposure to subprime mortgages. Much of its retail operations are now owned by JPMorgan Chase.

1- Lehman Brothers (2008), $691 billion

Lehman Brothers is by far the largest corporate bankruptcy in the US history. The investment bank filed for bankruptcy on September 15, 2008 amid the subprime mortgage crisis. The 158-year-old investment bank’s failure has been the subject of a number of movies. Following its bankruptcy filing, Barclays purchased its North American investment banking and trading operations. Nomura Holdings acquired its Asia-Pacific operations, as well as its investment banking assets in Europe.

Value Walk

https://www.valuewalk.com/2019/06/top-10-largest-corporate-bankruptcies-us-history/

10.3 Ways Music Heals the Soul

An examination of the biological basis for music’s relaxing effects.

Modern society is teeming with stress. Given the extensive demands on both our personal and professional lives, this probably comes as no surprise. What might be surprising, however, is the discovery that ongoing stress over expanded periods of time can lead to certain irregularities in the stress response system. This, in turn, can give rise to a range of conditions including high blood pressure, stomach ulcers, and depression. Thus, it is essential for people to be able to cope with stress on a daily basis.

Enter music therapy, which has been gaining increasing popularity as an effective way to combat stress. Using music to improve health has been well-documented. But how does listening to music actually relax us? This question was the focus of a recent study led by Kenichi Itao of Juntendo University in Japan. In order to pursue this inquiry, Itao and his collaborators built on previous research and devised an experimental procedure in which participants arrived at the laboratory, took a seat, completed a short test. From there, they listened to five minutes of silence, followed by three minutes of music, followed by five more minutes of silence.

The participants listened to three pieces of music:

- Classical music (“Pachelbel’s Canon” by Orchestre de chambre Jean- François Paillard)

- Healing music (“Harukanaru Kage” by Yumi Nanatsutani, which is a cover of “(They Long to Be) Close to You” by The Carpenters)

- Japanese pop music (J-Pop) (“Exile Pride — Konna Sekai wo Aisuru tame” by Exile)

All the while, participants were attached to both a heart rate sensor as well as a blood flow sensor, and they had their body surface temperature measured during the protocol to assess their stress levels before, during, and after they listened to each type of music. The researchers honed in on the activity of these three physiological processes, since they can reveal information about tension, stimulation, and stress levels.

The investigators recruited 12 women ranging in age from their 20s through their 40s and grouped them by age (20s, 30s, and 40s). The experiments were conducted three times (once for classical, healing, and J-Pop music) for each of the participants.

What did the researchers find?

Heart Rate Variability

To assess heart rate variability, participants had a heart rate sensor attached to their chests that measured the ratio of low-frequency to high-frequency heart rate (LF/HF). When the ratio is smaller, it indicates lower autonomic nervous system activity, and thus lower stress levels. The investigators found that, overall, participants’ LF/HF decreased significantly while listening to the music compared to before and after the music was playing. In other words, they were more relaxed when the music played. In particular, participants’ LF/HF ratio fell significantly when listening to classical and healing music when compared to the measurements after the music finished. These results demonstrate that when listening to music, and especially the classical and healing pieces, the sympathetic nervous system is suppressed while the parasympathetic nervous system is heightened, indicating relaxation.

Blood Flow Volume

The investigators measured blood flow volume by attaching a sensor to the participants’ fingertip and recording the levels before and during listening to music. The scientists discovered that listeners’ blood flow volume tended to rise when listening to classical music, demonstrating a relaxing effect. This was in contrast to J-Pop and healing music, for which no effect was found.

Body Surface Temperature

The investigators compared the difference in body surface temperature before the music played and while listening to the music. On average, participants’ body surface temperature rose after listening to both classical and healing music, signaling greater relaxation. Of note, the increase in body surface temperature after listening to healing music was particularly pronounced.

Taken together, these results demonstrate that listening to music soothes the body, mind, and soul. As the poet and author Berthold Auerbach once stated, “Music washes away from the soul the dust of everyday life.” While he likely didn’t have scientific research on his mind, the findings of this study support his sentiment.