1.U.S. Dollar Weakens…This Could be Most Important Chart in 2019.

U.S. dollar weakens…Still much lower than early 2017

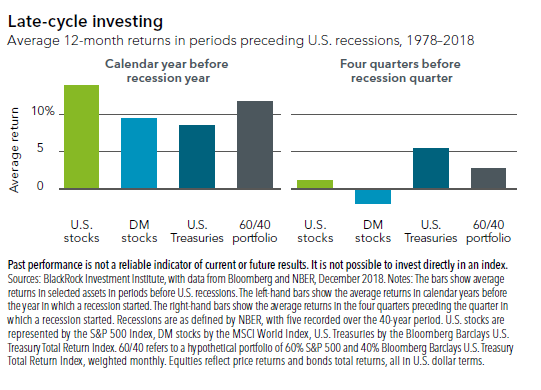

2.Average Returns in Periods Preceding Recessions.

Blackrock.

https://www.blackrockblog.com/

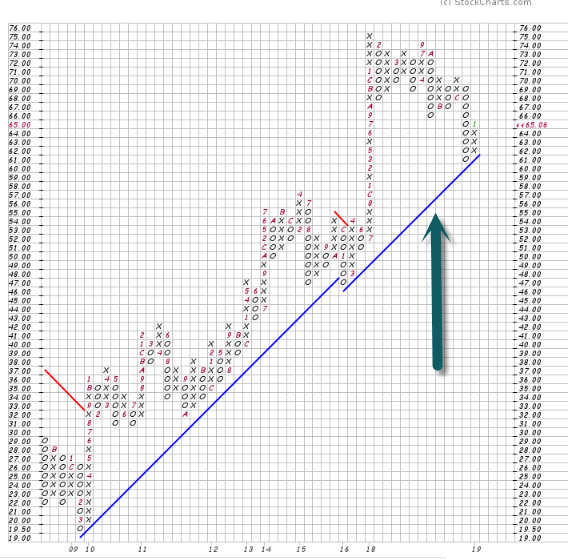

3.Broad World Equity Index ACWI

Traded right down to blue trend line going back to 2008 crisis.

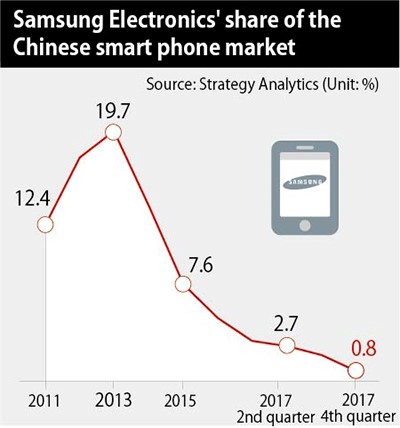

Country Exposure

https://www.ishares.com/us/products/239600/ishares-msci-acwi-etf

4.Alerian MLP Index Yield Now 9%

-19% in 2018…now yields 9%

www.stockcharts.com

From Barrons

Best Income Investments for 2019

Andrew Bary

https://www.barrons.com/articles/the-best-income-ideas-for-2019-51546632171?mod=article_signInButton

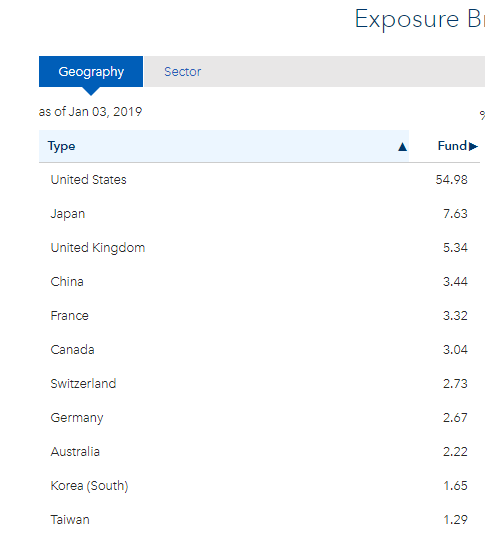

5.Why Investors Worry About AAPL Shrinking Chinese Market Share? Samsung Went from 20% Share to Less Than 1% in 5 Years

http://english.hani.co.kr/arti/english_edition/e_business/839497.html

Barrons

Why There’s Still Plenty of Value in Apple’s Core

By Tae Kim

https://www.barrons.com/articles/why-theres-still-plenty-of-value-in-apples-core-51546650001

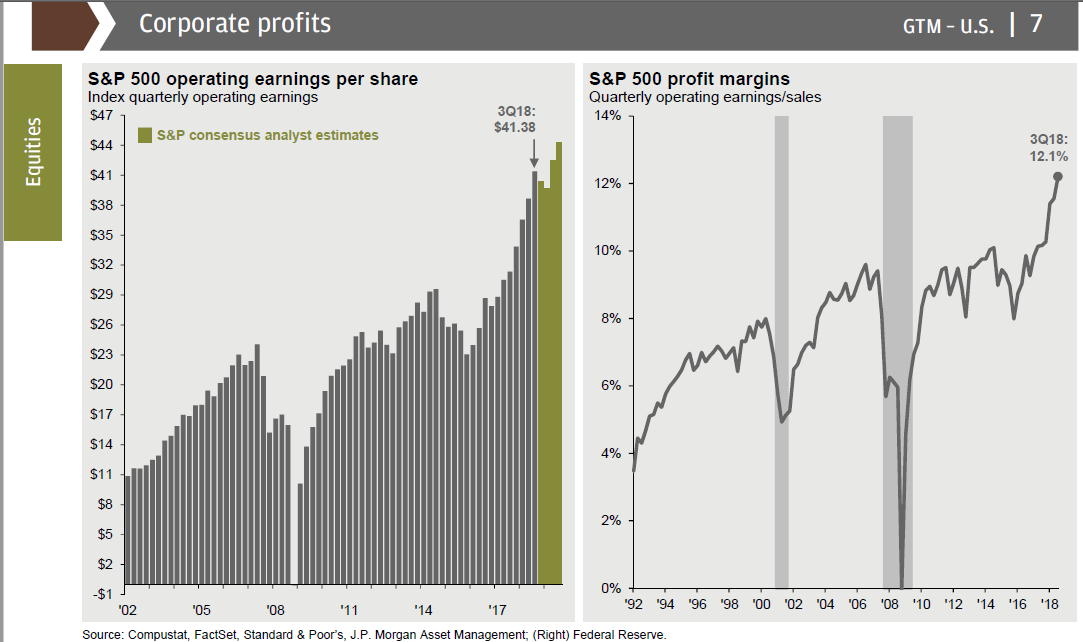

6.The Market in a Nutshell…Investors Asking…Is This Sustainable?

Jp Morgan

https://am.jpmorgan.com/blobcontent/1383598874518/83456/MI-GTM_1Q19_.pdf

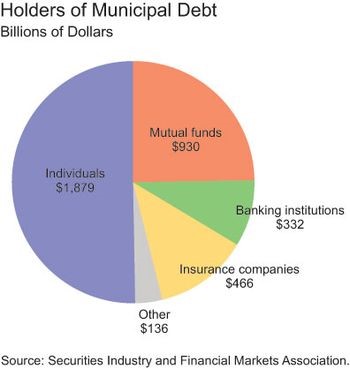

7.Total Municipal Bond Debt in U.S. $3.8T

8.U.S. Stock Funds Post Record December Withdrawals: Estimate

U.S. Stock Funds Post Record December Withdrawals: Estimate

A trader looks at price monitors as he works on the floor at the New York Stock Exchange (NYSE) in New York City, New York, U.S., January 3, 2019. REUTERS/Shannon StapletonReuters

By Trevor Hunnicutt

NEW YORK (Reuters) – Investors pulled $98 billion from U.S.-based stock funds in December, a calendar-month record that emphasizes the diminishing goodwill in financial markets, preliminary Lipper estimates showed on Thursday.

Fund investors trimmed their risk in the final days of 2018 to hunker down in case the Federal Reserve is too aggressively tightening monetary policy ahead of an economic slowdown and as the United States and China spar over trade. Some people see recent equity declines as a buying opportunity and are stockpiling cash to take advantage should prices fall further. The S&P 500 fell 9 percent last month.

“I used to feel comfortable saying we’re not headed toward an economic recession or an earnings recession – that means we’re in a correction, not a bear market,” said Hugh Johnson, chief investment officer of Hugh Johnson Advisors LLC in Albany, New York. “It’s getting harder and harder to do that, and with the Apple news today it’s getting even harder.”

Apple Inc warned on Wednesday about weak iPhone demand in the holiday quarter due to slower sales in China, foreshadowing similar problems for other companies in the coming earnings season. The widely owned company’s shares fell nearly 10 percent on Thursday.

December’s withdrawals easily top the prior record, when investors yanked $48.8 billion from U.S. stock funds as Congress and then-President George W. Bush tried to stop banks failing in October 2008.

Yet, while elevated, the monthly withdrawals amount to about 0.8 percent of the nearly $12 trillion of U.S.-based stock mutual fund and exchange-traded fund (ETF) assets tracked by Lipper, a research service. That data may be revised in coming days as more fund companies report their results.

During the most recent week, ended Jan. 2, investors pulled $18.7 billion from stocks and $13.3 billion from bonds, according to Lipper. Money market funds, where investors park cash, attracted $6.1 billion for the week and $122 billion in December, the preliminary numbers showed.

In a break with most recent weeks, both mutual funds and ETFs sold stocks at the same time during the latest seven-day period. ETFs, used heavily by institutional investors, had bought a net $9 billion in stocks in December. Mutual fund investors have sold stocks for the last 28 weeks.

(Reporting by Trevor Hunnicutt; Additional reporting by Caroline Valetkevitch; Editing by Leslie Adler and Lisa Shumaker)

Copyright 2019 Thomson Reuters.

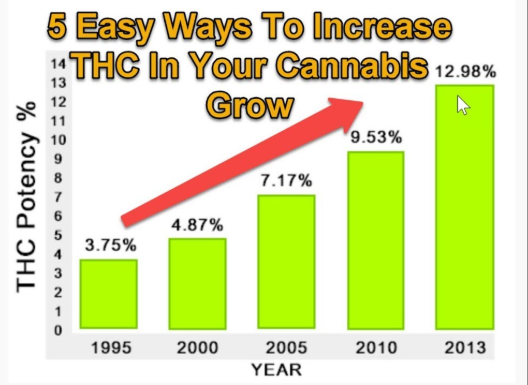

9.THC in Weed from 3% to 25% in 30 Years.

Dated chart but you get the idea.

https://www.youtube.com/watch?v=5aCpIAB4fJI

https://slideplayer.com/slide/9430439/

10.How To Determine if a Risk is Worth Taking

5 tips to help you weigh the value of taking a risk.

You take risks regularly, from backing your car into the street to trying a new restaurant. You only hesitate when you feel something important is at stake. Whether you love adventure or you always focus on what could go wrong, guidelines can help you objectively assess the value of taking risks.

I’ve had many coachingconversations start with, “I need to make a decision.” Yet after describing their options, it’s clear my clients want to take a risk but fear or guilt is stopping them from acting. I often ask, “A year from now, what will you most regret not doing?” They always know the answer. The coaching then focuses on the consequences of making the changes they desire.

I am not advocating for you to take risks; some risks aren’t worth the consequences. And If you are considering a decision that will change your life, you need to flesh out a vision of the job, relationship, or lifestyle you want to create and a plan for getting there before you leap. This post is intended to help you decide what’s best for you.

Some risks are based in how much pleasure you will gain, such as choosing an exotic vacation, buying a new car, or getting a new tattoo. Dan Gilbert says in Stumbling on Happiness, there’s no way to predict how you will feel in the future. You can look at what value you will get from taking the risk and then weigh that against the value of not doing it. There’s no guarantee you will feel happier but you will be clearer about what you might gain.

Other risks are based on relieving present discomfort. Although you feel frustrated, resentful, or bored, you shouldn’t take a risk just because you don’t like what you have now. You need to be clear on what you want instead so you know the risk will move you forward.

Here are some guidelines to help you determine if your risk is worth taking:

- Use a sounding board. Your brain wants to keep you within your personal safety zone, which differs for each situation depending on past experiences and your taste for challenge. It is better to talk through options with someone who will not be affected by your choice. Also, don’t choose someone who likes to tell others what they should do (especially family). As you explain the pros and cons of risking, notice how you feel. How badly do you want what the risk will give you? Do your reasons make you feel proud or satisfied? Your emotions may indicate how important taking the risk is to you.

Note – Try the Coin Trick. Assign your options to heads or tails. Flip the coin. The moment you see the result, are you disappointed or relieved? The trick might help you uncover what you really want to do. - Catch your “shoulds.” It’s hard to make a decision when you are attached to other people’s opinions. What do you think they will say if you take the risk? Write these statements down to identify your fears of their judgements and your guilt about disappointing others. Recognition of your should-based actions can also free you from black-and-white, stay or go, decisions. You might find other options available to you when you clearly understand what you want for yourself in the future.

- Know your why. Be mindful of being driven by needs for recognition or acceptance. When you assess the value of your risk, what type of satisfaction do you gain? What outcome will you be most proud of over time? What would you do if you had no people to take care of or please? Twenty years from now, what would you love to tell people about the risk you took? What story do you want to be living?For life-changing risks, consider the strengths you love to exercise. Can you envision using these strengths in a deeply satisfying way? Activist Audre Lorde said, “When I dare to be powerful, to use my strengths in the service of my vision, then it becomes less and less important whether I am afraid.”

- Ask your heart and gut. Although the science of intuition is debatable, you may get insights from this exercise. After you list out the pros and cons, open your heart by looking at pictures that make you smile. You probably have shots on your phone of your family, pets, or sunrises. Once you feel joy or gratitude, ask your heart if the risk feels right. Review your pros and cons from this perspective. Then open your gut by recalling a time in your life when you spoke up or acted in spite of your fear. Feel your courage pulse in your gut. Then ask your gut what to do. Use this perspective to determine new ways to deal with possible consequences.

- Be honest about what could go wrong. Don’t ignore hazards. When you look at possible problems, how would you handle them? When I left my last job to start my business, I knew if I failed, I would find another job. Fear can blind you to your options once you take a risk. Consider bad outcomes, determine the likelihood they will happen, and what you would do next.

If you decide the risk is worth taking, commit to taking a few steps, even if the steps are small. You might read a book, have a conversation with someone about the direction you want to take, or sign up for a class on starting a business. Do something to keep moving. Then, if things don’t go as you hoped for, allow for self-correction. Learn along the way.

No matter what you decide, you will encounter difficulties. You will question your choices. You may even find your choice was just a step to the next as you create many chapters in your life.

Which risks will you regret NOT making a year from now? Decide what risks are worth taking and take the first step today.

https://www.psychologytoday.com/us/blog/wander-woman/201901/how-determine-if-risk-is-worth-taking