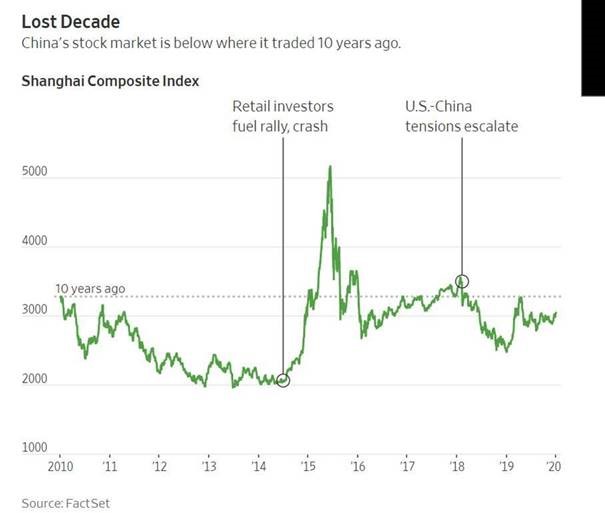

1.Energy and China Have Lost Decade.

It Was a Lost Decade for China’s Stock Market, but Investors Bet on Better Times Ahead-https://www.wsj.com/articles/it-was-a-lost-decade-for-chinas-stock-market-but-investors-bet-on-better-times-ahead-11578133803

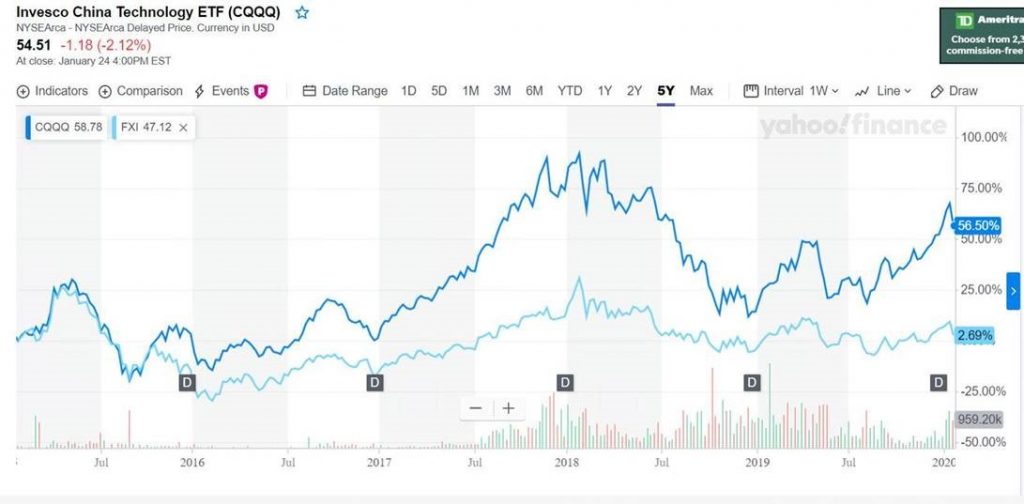

2.Clean Energy Outshining

Fri, Jan 24, 2020

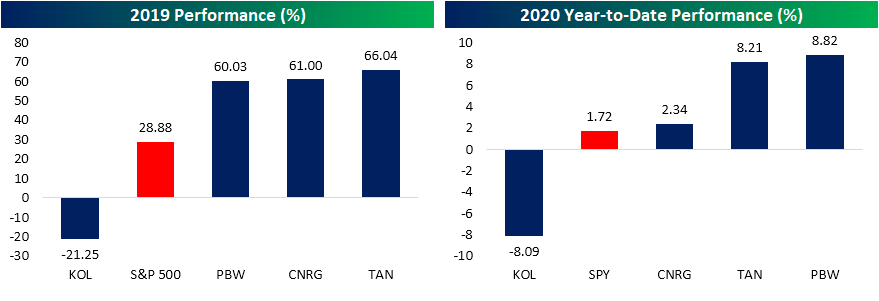

Looking across the ETF space, there are only a handful with dividend yields above 10%. While most high yielding ETFs are income-focused funds there is currently one outlier: the VanEck Vectors Coal ETF (KOL). This ETF focuses on equities associated with coal mining, equipment, and transportation. As investors have favored more sustainable options over fossil fuels, the deterioration in KOL’s share price over the past couple of years has elevated the yield to more than 11.5%. In other words, that high yield has come at a cost.

KOL has already fallen over 8% in 2020 and that is in the context of a 21.25% decline in 2019 and more general weakness of the energy sector. While KOL has majorly lagged the S&P 500, its underperformance is even more dramatic when compared to clean-energy focused ETFs which have gained favor as ESG investing has stepped into the spotlight as we discussed in last week’s Bespoke Report. As shown below, the Solar ETF (TAN) was actually one of the top-performing of these in 2019, notching a 66% gain and now adding another 8.21% YTD. Likewise, the SPDR S&P Kensho Clean Power ETF (CNRG) and Invesco WilderHill Clean Energy ETF (PBW) also rose twice as much as the S&P 500 in 2019. Though CNRG’s year to date outperformance versus the S&P 500 is marginal, the general trend has remained in place so far.

KOL has not only been in a downtrend over the past year but over the past week it has broken down further. That comes after a gap down in late December which broke through support that had been in place since August. While KOL has legged lower, clean energy ETFs have gone parabolic.

Overall, the price changes of these ETFs and their underlying stocks helps to illustrate the general rotation out of fossil fuel focused stocks and into those that are more climate-conscious. Some of this recent strength for CNRG and PBW comes as a result of the strong performance of electric vehicle stocks like Tesla (TSLA) and Nio (NIO) which are some of the largest holdings. Similarly, TAN owes some of its gains in recent weeks to the strong performance of its top holdings. While not as large as TSLA’s 30% gain in 2020, TAN’s top holding of SolarEdge (SEDG) has experienced a similar rally to NIO of around 15% year to date. That is after it rose 167.8% in 2019.

https://www.bespokepremium.com/interactive/posts/think-big-blog/clean-energy-outshining

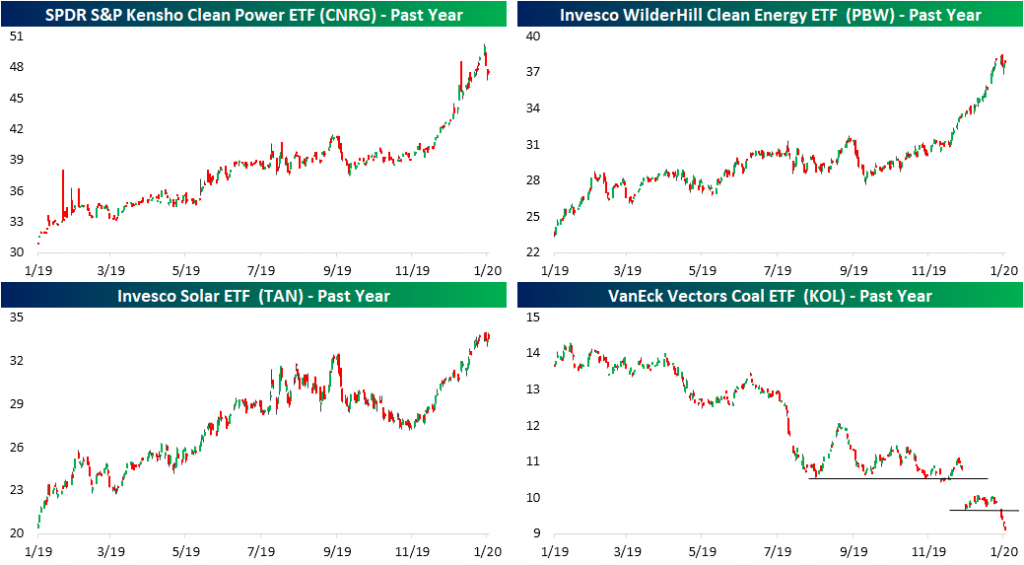

3.Chinese Tecnology Index Has Crushed Broader Chinese Market.

CQQQ (China Tech) vs. FXI (china etf)

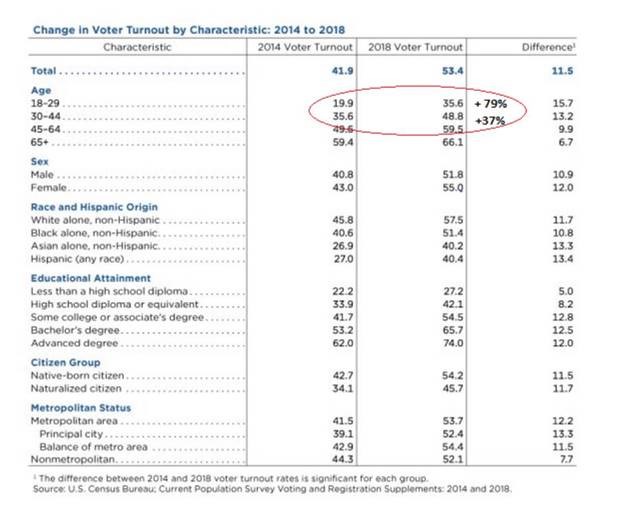

4.Election Year Statistics.

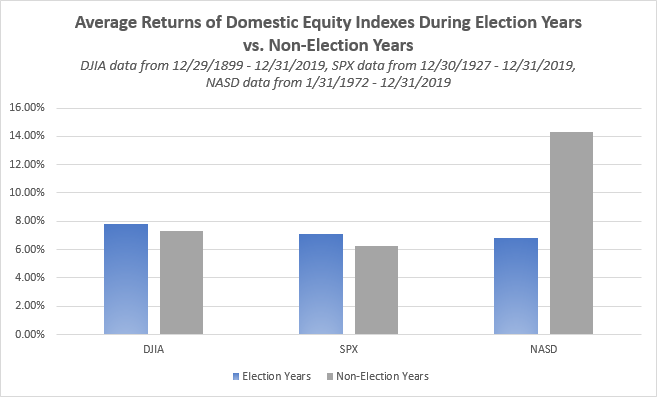

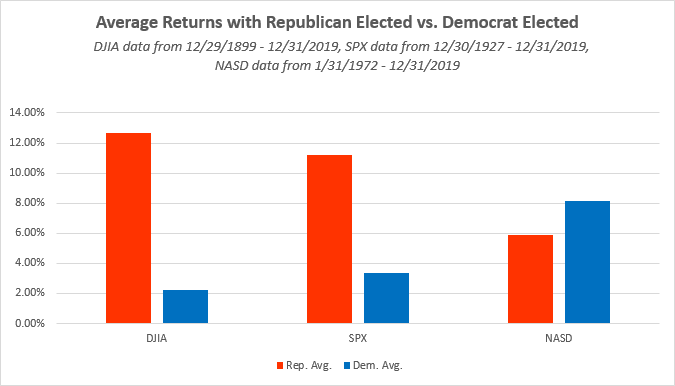

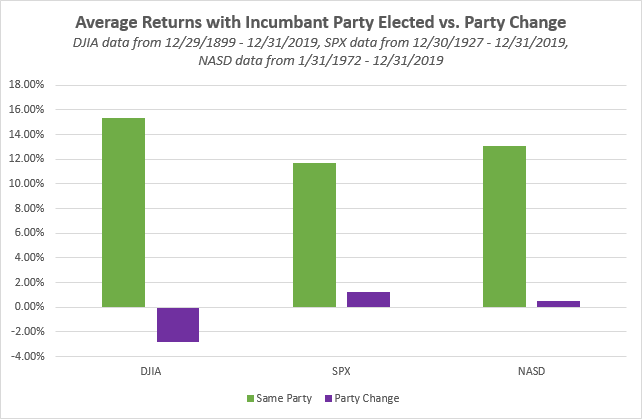

The first breakdown we will examine today is average returns in election years against average yearly returns outside of election years. For both the Dow Jones Industrial Average and the S&P 500, we see that election years actually lead to slightly enhanced returns on average, with the DJIA improving by 7.80% on average and SPX averaging a 7.11% gain during election years. The Nasdaq Composite, however, has actually underperformed during the average election year, with a 6.82% return compared to an average of just over 14% including every other year. Although, it is important to keep in mind that NASD has the smallest sample size at only 12 election cycles examined, which include the declines of about 40% in both 2000 and 2008. If we remove these outliers from the average, NASD falls more in line with the other indexes with an average outperformance of about 2% in election years. It is also interesting to note that if we break down the yearly averages into quarters, the third quarter was the only period in which the election year average return bested the off-year average return across each of the three indices.

The returns above are price returns and do not include dividends or all potential transaction costs. Past performance is not indicative of future results. Potential for profits is accompanied by the possibility of loss.

www.dorseywright.com Nasdaq Dorsey Wright

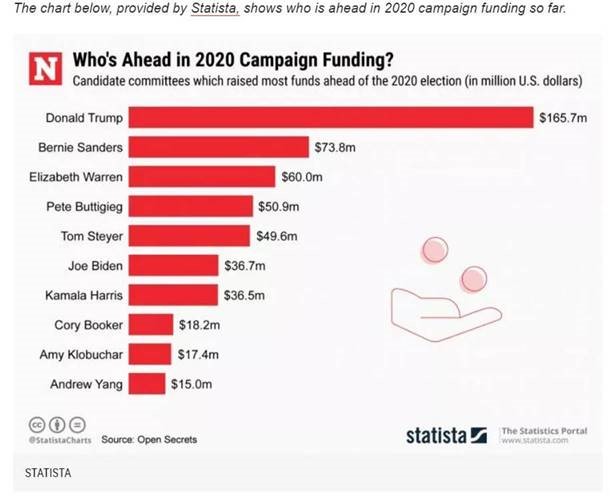

5.2020 Campaign Funding.

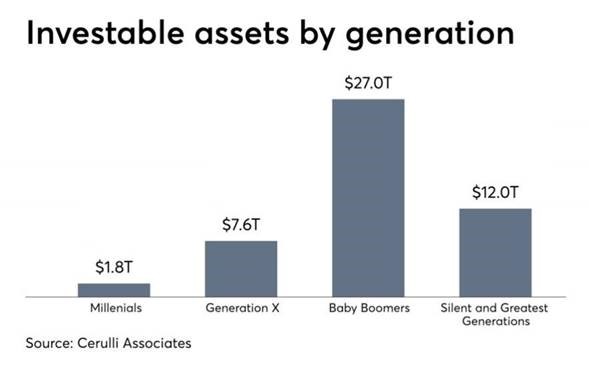

6.Baby Boomers 2/3 of U.S. Wealth

Millennials are the new face of the retirement crisis By Paola Peralta

https://www.financial-planning.com/news/why-millennials-are-the-new-face-of-the-retirement-crisis

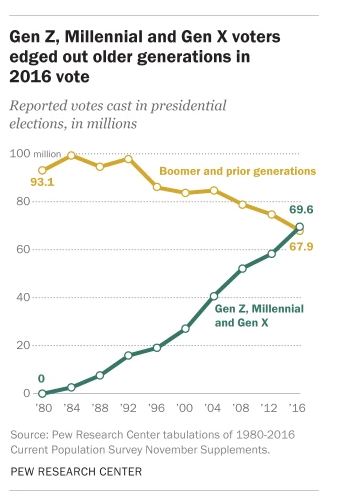

7.Gen Z and Millennials Now Majority of Voters.

Howard Marks https://global-macro-monitor.com/2020/01/20/the-black-swan-chart-of-2020/

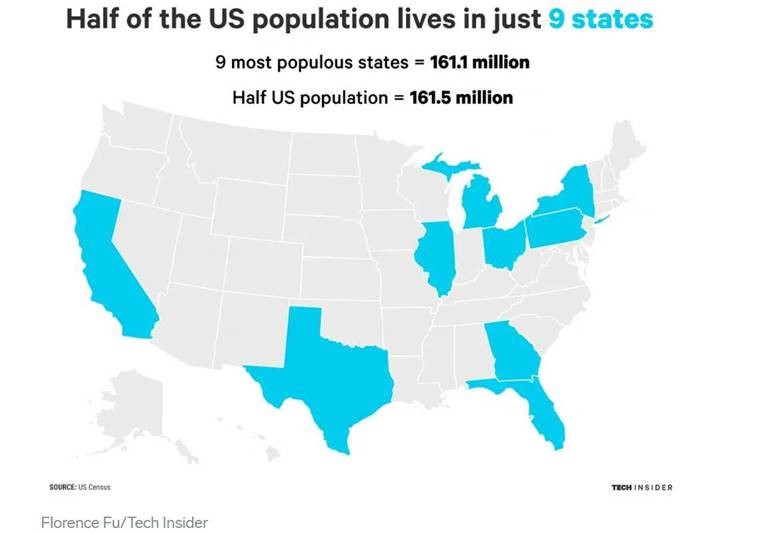

8. Half of the US population lives in these 9 states

https://www.businessinsider.com/half-of-the-us-population-lives-in-just-9-states-2016-6

9. Houston Is Now Less Affordable Than New York City

A new report finds that, when transportation costs are factored in, Texas’s biggest metros aren’t the bargain they often claim to be.BYPETER HOLLEY

Houston’s sprawl drives up transportation costs.For decades, Houston has been a city with one of the nation’s most pragmatic sales pitches: Move here for big-city opportunities at a small-city price. Not a fan of swarming mosquitoes, punishing hurricanes, and soul-melting moisture? What if I told you that you could barricade yourself away from all three inside a sprawling single-family home on one acre near good schools and golf courses for under $200k? Still not sold? Two words: “backyard grotto.”

Though we don’t have up-to-date grotto figures, several million people found Houston’s sales pitch compelling enough to move to the Bayou City in recent decades, with the region gaining 1.1 million residents since 2010 alone, according to the Greater Houston Partnership. Outside a few ritzy pockets intimately tied to oil prices, the city evolved into a sprawling mass of suburban affordability—a Levittown on steroids for the new American South.

Unfortunately for prospective Houstonians, a crucial downside to all that sprawl has arisen, one that has nothing to do with catastrophic flooding. While the seemingly endless suburban growth has traditionally offered the city the veneer of affordability, the sprawl has also spiked transportation costs, so much so that the city’s combined transportation and living costs now place it on par with New York City (cue the early nineties Pace Picante sauce commercial).

That’s one of the big takeaways from a new report by the Citizens Budget Commission, a nonprofit civic organization that crunched 2016 housing and transportation data from the U.S. Department of Housing and Urban Development.

Monthly median housing costs in Houston in 2016 (the most recent year data was available) were $1,379, nearly $400 less than New York City. However, median transportation costs were $1,152, a figure 38 percent higher than for New Yorkers. In total, the study found, living in Houston was only $79 cheaper each month than New York.

Furthermore, when considering housing and transportation costs as a percentage of income, Houston (and Dallas–Fort Worth, for that matter) appear significantly less affordable than cities with much more expensive housing, including New York, San Francisco, Chicago, and Boston. The annual median household income in Houston was just under $61,000 in 2016, while in New York that same figure was just over $69,000. As a result, Houstonians spend just under 50 percent of their income on those combined costs, whereas New Yorkers spend just over 45 percent.

Houstonians hoping to reduce their transportation costs by moving closer to the city center may find themselves out of luck. Gentrification has transformed the urban core of multiple Texas cities since the nineties, according to a report released last week from the Federal Reserve Bank of Dallas. “Similar to other large U.S. metros, major Texas metros have experienced the greatest increases in college-educated residents in areas closest to the city center, with lesser changes occurring farther away,” the report notes, adding that a new generation of urban dwellers have been lured by the promise of restaurants, nightlife, high-paying jobs and a distaste for commutes.

These high costs for Houstonians seem hardly to be slowing population growth, though the story behind that is also more complicated than it’s typically understood to be.

“The region saw fewer births last year, an uptick in deaths, and a significant number of residents leaving Houston,” the Greater Houston Partnership noted in May. “If not for a surge in international migration, Houston’s population growth would have been weaker still.” Yet the region still added more than 90,000 residents in 2018, with each county gaining population. Some experts expect a gain of well over 1 million people in the metro over the next decade.

https://www.texasmonthly.com/news/houston-affordability-transportation-costs/

10. Starting a New Project? Before You Plunge In, Do This to Ensure Success

Ask questions–and keep going until you get the answers you need. By Alison DavisFounder and CEO, Davis & Company@alisonbdavis

You’ve been given an exciting new assignment. So naturally you want to get started as quickly as possible. You assemble the team, start giving out assignments, and expect everyone to swing into action.

Not so fast! There’s something very important you need to do before you take another step.

And that is? Ask dozens of questions.

As Jagdish Sheth and Andrew Sobel write in their book Clients for Life, “The really good professionals ask great questions. Often they enable solutions rather than supply them.”

Why don’t project leads ask enough questions? Here’s Sobel’s take: “First, they are afraid. They lack boldness in asking questions because they don’t want to come across as being aggressive or overly inquisitive.

“Second, they don’t think enough before they speak. It takes time and investment to come up with really good questions to ask someone, until you get practiced at it.

“Finally–and this is the most important reason–in our culture we believe we impress others and demonstrate our worth by being ‘smart’ and having all the answers.”

I’ve learned that it’s actually smarter to ask many, many questions. Here are 15 great questions (or question sets) to give your project a strong start:

- What are the objectives? How do you define success?

- If the project doesn’t succeed, what are the implications?

- Why is this project so important? What is the case for change?

- What are the key milestones? What are the most important dates?

- What are the most important decisions that need to be made? What will prevent us from making those decisions?

- What are the biggest obstacles to getting this done?

- Who are the key stakeholders? Who’s the owner/sponsor? Who influences but doesn’t own? Who has the potential to be an obstacle?

- What are the project’s greatest assets?

- How can we best leverage those assets?

- What are the most important areas we should always focus on?

- How much risk are you willing to take to accomplish this?

- What barriers have you encountered in the past about this issue?

- What keeps you up at night about this?

- What topics haven’t we discussed? What topics would you rather not discuss?

- What is your personal passion about this project? What will this mean to you when we succeed?

Ready to ask great questions? Start now to get the answers you need.