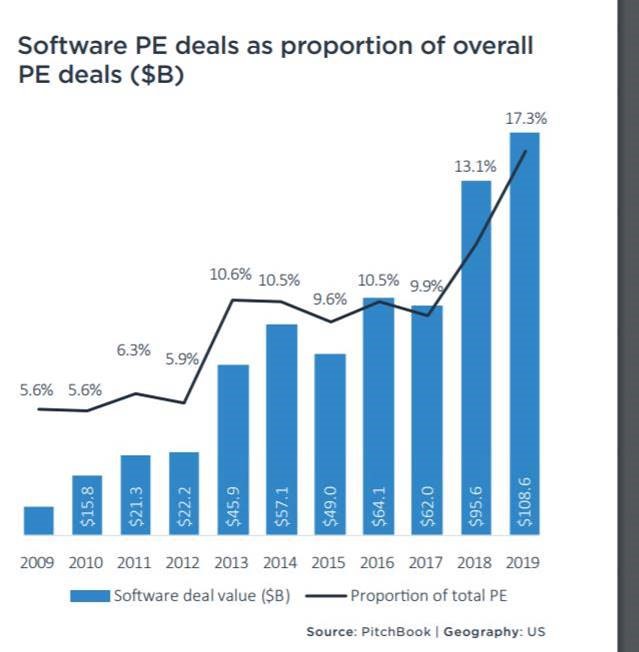

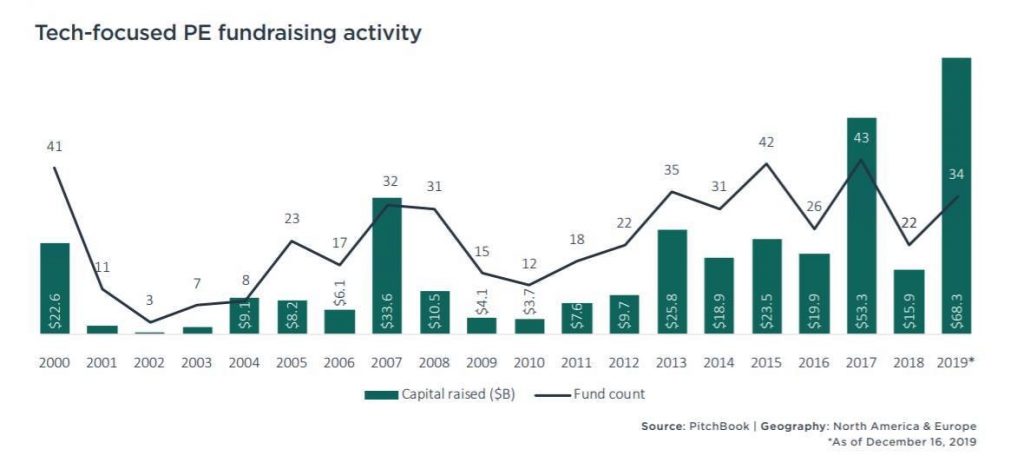

1.Software Private Equity Deals Jump to 17% of Overall PE.

https://files.pitchbook.com/website/files/pdf/2019_Annual_US_PE_Breakdown.pdf

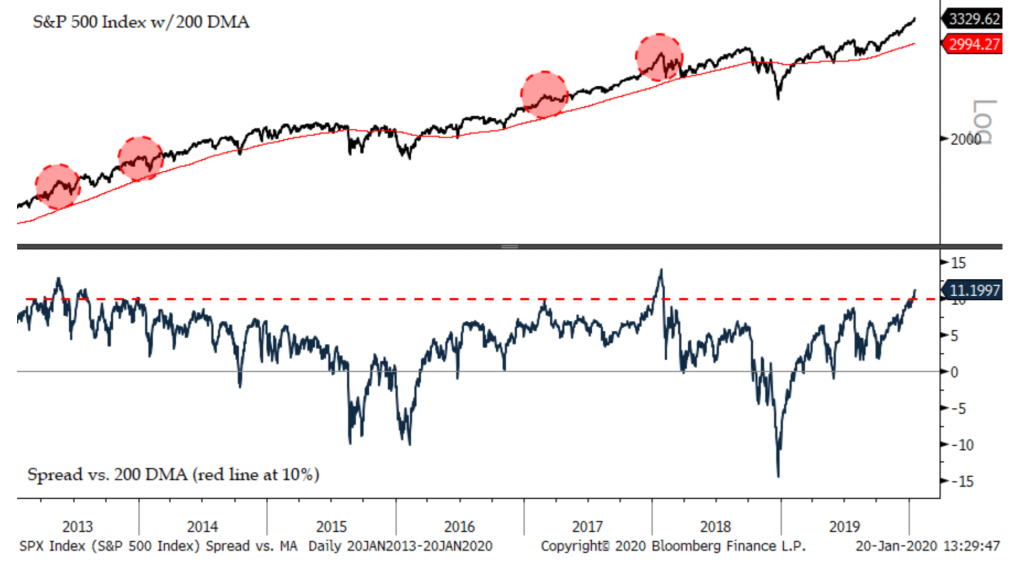

2.How high above the 200-day can the S&P 500 get?

Posted January 21, 2020 by Joshua M Brown-Reformed Broker

The big news this past week is that the S&P 500 got way out ahead of its 200-day moving average – more than 11% above, in fact.

Michael wrote about how shitty of a timing signal this measure is here, if you haven’t read it yet you CANNOT miss it.

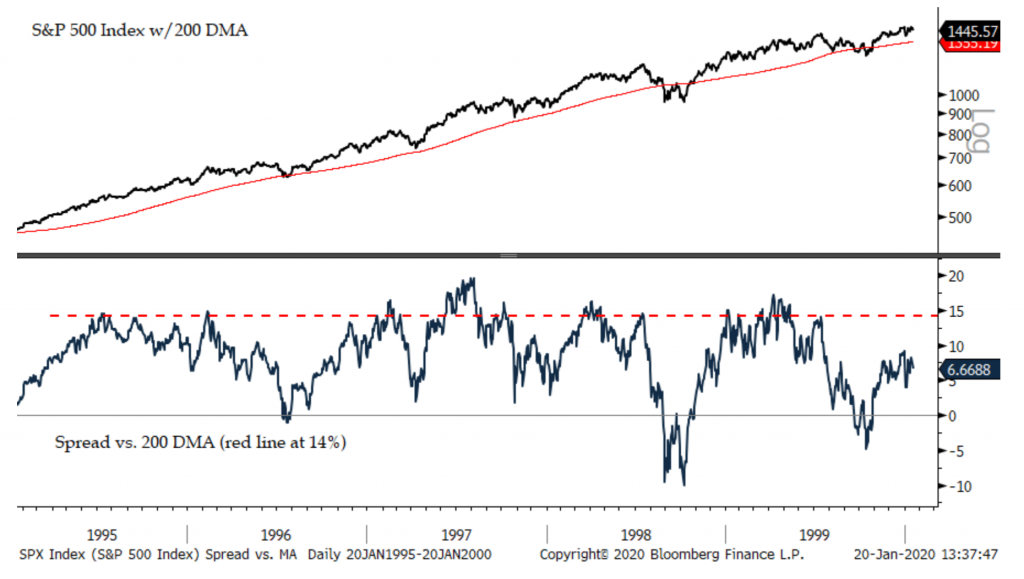

In the meanwhile, Jon Krinsky notes that while we may be stretched based on recent history, in the 1990’s, the S&P was routinely more than 10% above the 200-day moving average, which led to consolidation periods followed by even higher new highs.

Here’s two charts from Jon:

It’s notable that this extreme breadth surge has happened with the SPX stretched vs. its 200 DMA. It is now at the widest spread (over 11%) since January 2018. Of course when momentum gets strong like it was two years ago, and it is now, there is no rule for how stretched things can become. It peaked at around 14% in Jan. ’18, and routinely was above 15% in the late 1990’s

By mid 1995, the SPX was 14% above its 200 DMA. You can see it routinely traded above that threshold over the last half of the decade, and while it did check back to its 200 DMA many times, there were other times where the market moved sideways or pushed even higher

What Happens When You Have a Breadth Surge

and the SPX is Stretched?

Baycrest Partners – January 20th, 2020

Follow Jon Krinsky on Twitter!

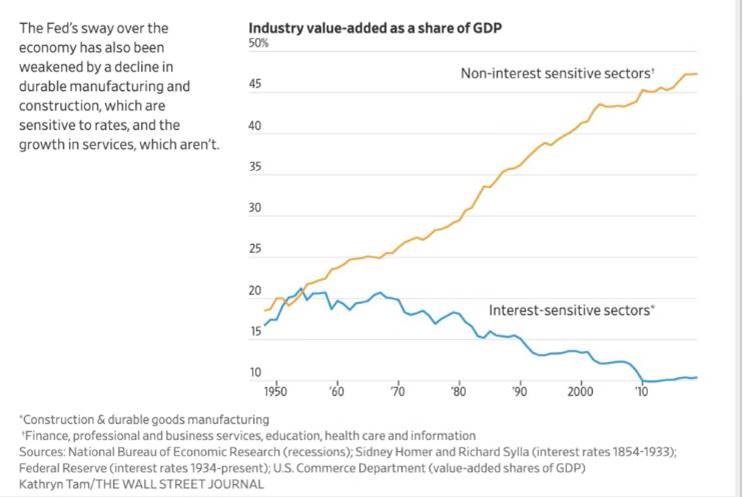

3.The Growth of Non-Interest Rate Sensitive Sectors.

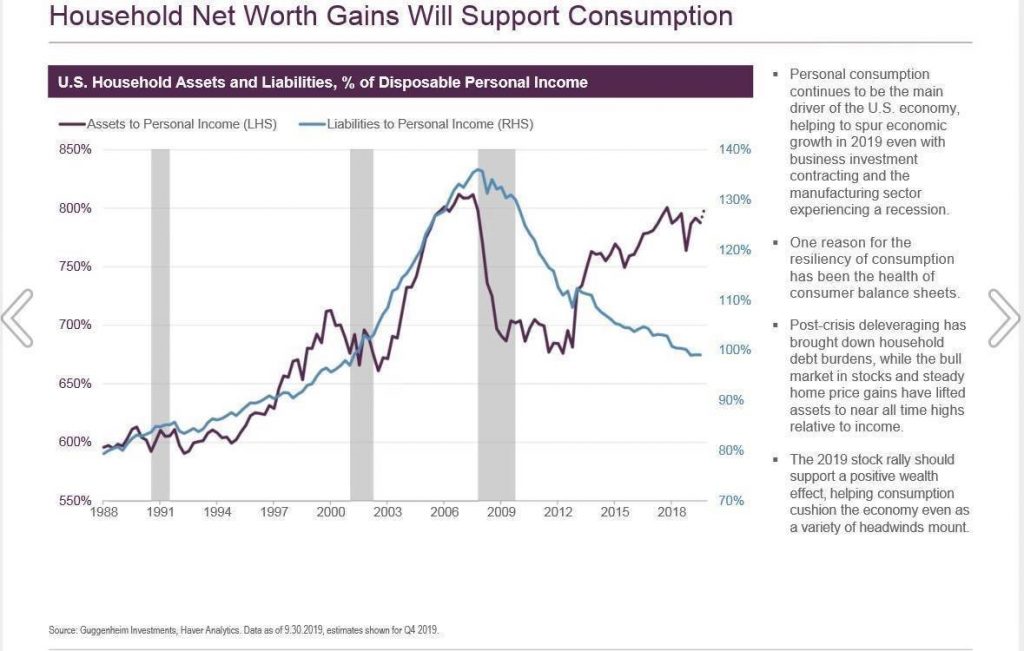

4.Household Liabilities to Net Worth Support Spending.

5.Financial Stress Index At All-Time Lows.

In an attempt to avoid focusing on a single indicator at the expense of others, economists and analysts created composite indexes of several of these indicators. In early 2010, the St. Louis Fed created the STLFSI, which uses 18 weekly data series to measure financial stress in the market. Weekly series are used to have a more “real-time” index to measure rapid changes in the market. However, the tradeoff of having a higher-frequency index is greater volatility and potentially more noise.

The STLFSI is constructed from seven interest rate series, six yield spreads and five other indicators.1 Each of these variables captures some aspect of financial stress. Accordingly, as the level of financial stress in the economy changes, the data series are likely to move together.

How should the index be interpreted? The average value of the index, which begins in late 1993, is designed to be zero. Thus, zero is viewed as representing normal financial market conditions. Values below zero suggest below-average financial market stress, while values above zero suggest above-average financial market stress.

https://www.stlouisfed.org/on-the-economy/2014/june/what-is-the-st-louis-fed-financial-stress-index

6.Seven Tips for Helping Elderly Parents With Their Finances

- Published on January 22, 2020

Carrie Schwab-Pomerantz Influencer

Chair & President, Charles Schwab Foundation; SVP, Charles Schwab; Chairman of the Board, Schwab Charitable

Dear Carrie,

My parents are in their early 80s. Fortunately, they’re in relatively good health and still quite independent, but I want to help them be prepared should things change. How can I get involved with their finances without being intrusive?

—A Reader

Dear Reader,

While popular wisdom might say that 80 is the new 60, the reality of aging means that no matter how young we may feel now, chances are we’re going to need some type of help in the future. And while it’s often difficult to get older adults to accept that possibility, being prepared ahead of time is the best way to ease the transition.

That said, money can be a touchy subject at any age, so you’re wise to be sensitive to your parents’ desire for independence and their potential reluctance to discuss the future. But the realities of today—particularly the prevalence of scams targeting the elderly and elder abuse—mean that it’s more important than ever to get the conversation going. Here are seven tips for helping your elderly parents:

#1. Start by asking your parents about their current financial security

A lot of families don’t like to talk about money but if you come from a position of concern for your parents’ current well-being, they might feel more comfortable. And at their age, it only makes sense for them to share certain financial details with their family. Here are some questions to start with.

- Are they easily handling everyday expenses? Do they have enough income to cover the essentials—or even things like a gym membership that help them thrive? If they’re struggling to stay on top of bills or debts, you might help them create a more realistic budget or set up automatic payments for certain monthly expenses. You may take something like auto-pay for granted, but your parents may not have considered it.

- Do they have a financial advisor? Would they be willing to introduce you and perhaps include you in a meeting? If they don’t have an advisor, maybe you can take the lead in helping them do a simple financial plan. At the very least, you might help them take an inventory of their financial resources—pensions, IRAs, brokerage accounts, and Social Security benefits—so they have a clear idea of the money they have available for both the short and long term.

- Have they updated their estate plan? Perhaps you’ve already talked to them about whether or not they have an estate plan in place, including an Advance Healthcare Directive and powers of attorney for both finances and healthcare decisions. If not, don’t hesitate to bring it up because a basic estate plan is something everyone should have no matter their age—yourself included. If they have a plan, when was the last time they reviewed it? Have things changed since then?

- Are important documents accessible? In case of emergency, it’s important that you or someone else your parents trust be able to locate important documents. These can include: wills, trusts, bank and brokerage statements, insurance policies, mortgage documents and safe deposit box information as well as passwords for online accounts.

When introducing these topics, make it clear that you’re not questioning their capability; you just want to be a resource should they need help.

#2. Discuss their views on future living arrangements

The 90-year-old mother of a friend of mine is adamant that she wants to stay in her own home no matter what. On the other end of the spectrum, another friend’s parents decided to move into a continuing care retirement community before it became necessary because they wanted to make the decision while they were still capable. You might want to talk to your parents about their preference should they need physical help. Position it as just an exploration of future possibilities—not any recommendation on your part.

If they’re open to the idea of moving into a senior community at some point, now might be the time to do a little research together on senior living facilities in their area.

#3. Plan ahead for the cost of care

Home care and assisted living are both costly propositions. According to the Genworth 2018 Annual Cost of Care survey, the national median annual cost for assisted living is $48,000; a home health aide is slightly higher at $50,336. And so much depends on where you live. In the San Francisco Bay Area, those home care costs are closer to $70,000 a year. In Alabama, they’re under $40,000. And these costs are generally per person.

From a practical standpoint, it makes sense to discuss your parents’ desires and the potential costs ahead of time so they know what their real options are. While future care can be an emotional flashpoint, it’s also an important financial consideration because they—and you—should know what they’re able to afford and if you might need to supplement any costs.

#4. Know what benefits and services are available

According to the Council on Aging, there are more than 2,500 benefits programs nationwide to help with the cost of elder care. And it’s easy to do an online benefits checkup. The Family Care Navigator provided by the National Care Giver Alliance can also help you find support services in your state. Benefits.gov and your local Area on Aging are also helpful resources.

#5. Be on the alert for abuse

Financial fraud is a very real threat these days. According to SIFMA, seniors in the U.S. lose an estimated $2.9 billion every year in financial exploitation. And that’s only the reported cases. While senior investor protection laws are in place in many states and more are in the works, I think everyone needs to be on the alert for any kind of potential scam. SIFMA is a good resource for specifics on what to watch out for and action you can take.

Be sure to discuss this with your parents. As a precaution, it might be wise at some point for you or another trusted family member to have your name on certain of your parents’ accounts to monitor transactions.

#6. Have a family meeting

You don’t say if you have siblings, but if so it’s important that all of you are aware of your parents’ situation and desires, and agree on who is going to take the lead. It’s important for two reasons: 1) to assure there’s no misunderstanding or disagreement if your parents do need help in the future, and 2) to make sure that whoever takes the lead gets the support they need in what could be a very difficult situation.

#7. Keep talking—and listening

In sensitive situations like this, it’s all about communication style and approach. While the burden can often fall on the kids to get the conversation going, I want to encourage any older adults reading this column to help their children out by bringing these things up themselves. The more open you all are and the more mutual understanding there is about the future—both emotional and financial—the more you’ll all be able to enjoy the present.

Have a personal finance question? Leave it in the comments. Carrie cannot respond to questions directly, but your topic may be considered for a future article. For Schwab account questions and general inquiries, contact Schwab.

(0919-9XTF)

The information provided here is for general informational purposes only and is not intended to be a substitute for specific individualized tax, legal or investment planning advice. Where specific advice is necessary or appropriate, consult with a qualified tax advisor, CPA, financial planner or investment manager.

Carrie Schwab-PomerantzChair & President, Charles Schwab Foundation; SVP, Charles Schwab; Chairman of the Board, Schwab

7.Future of work: 5 top insights from Davos experts

Poppie MphuthingEditorial Lead, Global Leadership Fellow, World Economic Forum

Fourth Industrial Revolution

1) It’s smart to hire people smarter than you

This is the top advice from Jack Ma, Executive Chairman Alibaba Group Holding.

“When I hire people, I hire the people who are smarter than I am. People who four, five years later could be my boss. I like people who I like, who are positive and who never give up.”

The best people are optimistic and don’t complain, he says.

Ma noted that he survived the corporate world for 20 years because he was a teacher in his former life.

“You always want your students to be better than you, to be a mayor, not in prison. Rule number one: help people to be better than you are,” he said.

2) New collar workers are the future

IBM CEO Ginni Rometty says that as automation continues apace the skills gap and job insecurity fears are real.

“When we talk of a skills crisis, I really do believe that 100 % of jobs will change,” she said.

But she argues the crisis is not impossible to overcome.

Rometty wants to see the development of a new education and career model: new collar, not blue collar or white collar. This means investing in skills development and responding in real time to the changing skills landscape. It also means breaking free from traditional models of recruiting those with 4-year and advanced degrees.

“We as a company are passionate that if we don’t fix this issue, to bridge this skill right now, at the rate it’s moving, you will have unrest,” Rometty said. “And so people have to have a route in.”

Watch the full session:

3) Recruiting women into technical roles will make machines learn more efficiently

LinkedIn Co-Founder and Vice-President of Product Allen Blue notes that AI and machine learning are becoming fundamental to how all technology is built, when one considers phones, banking and many other products and activities.

“It’s important, as we go forward, that we are designing and building that tech in the right way,” he said, reflecting on the inherent biases that many algorithms have because they were designed and built by white males.

Blue argues that technology can positively support flexibility of the workplace. It enables learning via online, video-based, non-real time learning. Certain technology also enables people to balance their lives, by working remotely.

4) Invest in training the youth and the unemployed

France’s Minister of Labour, Muriel Pénicaud, described her re-skilling programme, which includes giving employees 500 Euros a year to choose their own training programme.

“Today access to capital is easier than access to skills,” she said, noting the need for pro-action.

“Many of our citizens think they are victims of globalization and technology. When you are not in the driving seat, change is always a threat. You need to be in the driving seat, you need to be able to choose your future.”

5) Survivors of mental health challenges are good for business

Mental health was on the agenda at Davos with a number of discussions on how to break the stigma and create more supporting workplaces. John Flint, the CEO of HSBC, noted that survivors are assets.

“Those who have recovered often possess a resilience and resourcefulness,” he said.

Flint wants to turn the bank into “the healthiest human system.” He described this not as a fuzzy, feel-good effort, but as a question of performance.

Share

https://www.weforum.org/agenda/2019/01/future-of-work-tk-top-trends-from-davos/

8.The Secret to Success is a Question of Habit. Here’s 10 Powerful Habits Practiced by Top Executives, and a Guide For How to Perfect Them.

The secret to success is a question of habit.By Laura Garnett at Business Insider

The new year (and decade!) always brings a renewed energy. We’re excited about change, eager to set resolutions, and have a newfound willingness to work on ourselves.

However, most people fail to conquer their resolutions because they don’t create new habits around the behaviors that they want to change.

Building new habits isn’t hard, but it does require diligence, discipline, and commitment to following a plan for at least 60 to 90 days. The key is to start small and pick one or two habits you want to focus on. Once those habits are ingrained, you can add more over the course of the rest of the year.

Here is a list of the most powerful habits successful people incorporate into their lives. When you’re committed to not only starting these behaviors but to making them an ongoing part of your life, your potential is truly endless.

1. They work smarter, not harder

The most successful executives I know don’t log 90-hour weeks. Instead, they look for ways to be more efficient with their time.

How to build it: Start to notice when you’re most productive. Do you get twice as much done in the mornings? Do you get your second wind after dinner? Identify the times when you do your best work, and carve out an hour or two every day to get a lot done in that time frame.

Breaks are equally important. See if you can “block” your schedule and accomplish brief chunks of focused work, then take breaks to recharge. The Pomodoro technique — 25 minutes of work followed by five-minute breaks — is one method, but choose the lengths of time that work best for you. You’ll be surprised at how much more you can get done.

2. They value who they are

I truly believe that each of us has our own unique genius: the type of work and thinking at which we are best. The most successful people know their genius well — they value it in themselves, and they seek to use it every day.

How to build it: If you’re not sure what your genius is, this article can help you identify it. Every day, read the language that defines your genius, then say to yourself, “I value who I am and the value I bring to the world.” Do this at least twice per day, every day for two months. You will quickly see how amazing it feels.

3. They continually educate themselves

Even the most successful people I know are never content with the status quo. They’re constantly learning and looking for ways to grow.

How to build it: With the abundance of information at our fingertips, this is simple. Think through the skills you’d like to hone or the subjects you’d like to learn more about, and find books, videos, or classes that will take your expertise to the next level. The hard part is sticking to these assignments — but try to make it fun by tackling one per month and rewarding yourself for completing it.

4. They’re proactive about their career happiness

All of us, from time to time, feel stuck or unhappy at work — or have a sneaking suspicion that something’s not working. But successful people don’t let that paralyze them. They get curious, they start looking for data, and they take action.

How to build it: For starters, download my Performance Tracker, a weekly check-in exercise that helps you measure aspects of your professional life — like how often you’re “in the zone” and doing work that’s meaningful to you. Do this for a month, and you will be able to clearly identify what’s working in your job and what’s not. You will have the data you need to be more proactive with your career, whether that means spending less time on tasks that aren’t fulfilling or looking for a new role altogether.

5. They build their confidence

There are a lot of misconceptions about confidence. Many people think you’re either born with it or you’re not. That’s simply not true. Confidence is a skill, and people who have a great deal of it have typically worked diligently over a long period of time to achieve it.

How to build it: Pay attention to negative messages you’re telling yourself. Do you compare yourself to your colleagues, or beat yourself up after tough conversations? See if you can just notice that thought process for a week or so. Once you’re in the habit of noticing, tell yourself a different, more positive message, like “I am just as talented as my co-workers,” or, “Everyone makes mistakes. I have the skills I need to learn from this and move forward.”

6. They aren’t deterred by failures

Ask any successful person, and each will have a long list of failures. They aren’t deterred by these stumbles; rather, they learn from them.

How to build it: This can be scary, but start tracking your failures as they happen — without judgment or blame. When something doesn’t go the way you want it to, pause and write down what happened. Then (later, if you need to), think through what you might be able to learn from the situation. If it’s hard to find opportunities for growth, think about the advice you might give a friend in a similar situation. Do this for two months, and you’ll start to equate failure with a tool for being better.

7. They ask for feedback regularly

Similarly, the strongest leaders aren’t afraid of feedback — from their peers, their higher-ups, or even their subordinates. Done right, this can be an equally powerful tool for learning and growing.

How to build it: Make a list of 10 people you work closely with or know well and trust. Create three questions that are specific to the feedback you desire.

For example, if you’re looking for feedback on your leadership style, you might ask: “What’s one quality that you really enjoy about my leadership?” or, “What’s one time in the past month you think I could have handled a conversation differently?”

Mention that you’re seeking more feedback and will reach out again in three months with additional questions. Encourage them to do the same and let them know you’re more than willing to reciprocate.

8. They enjoy the process of their work — not just their achievements

Our society tends to focus on achievements: landing a promotion, scoring a big new client, or making a higher salary. But it’s healthier, more fun, and less taxing to enjoy the process of your work, rather than living for the wins.

How to build it: Each day, ask yourself: “Am I enjoying the process of doing my work just as much, if not more, than achieving the goals I’ve set?” When you start to answer “yes” more than “no,” you’re on the right track to receiving happiness from the right place. If you’re not there yet, do the work to understand why achievements are driving you and how you might be able to add more enjoyment into your work.

9. They don’t listen to society’s rules — they make their own

This is all about being who you are — no matter how different that may be from others, your friends, or society. If you can make this a habit now, your career and life will be much happier and better for it.

How to build it: Every time you need to make a big decision, write down all of the pros and cons. Go through them again to reveal the origin of these ideas. Are they true to what you actually believe, or are they messages from your parents, workplace, or society? If it’s the latter, scratch those items out. Do this for every big decision, and you will start to trust yourself and make the decisions that are right for you. You will soon find that you’re living a life for yourself, and not for others.

10. They make health a priority

Finally, remember that success isn’t just about your work; it’s about you as a whole person. You will struggle to thrive if your health and wellness takes a back seat.

How to build it: You’ve heard most of this before, but it bears repeating: Get good sleep (I love Michael Breus’s newsletter, which shares tips and products to help you sleep better). Exercise several times per week . And if you haven’t already, build a meditation practice. Download an app, hire a meditation coach, find a meditation center, or book at least 15 minutes in your calendar to pause and focus on your breath. Do this for at least 30 days, and before you know it it will be something you can’t live without.

Originally published on Business Insider.

https://thriveglobal.com/stories/secret-to-success-question-of-habit/