1.Coronavirus Maps

Bloomberg

Mapping the Coronavirus Outbreak Across the WorldBy Cedric Sam, Chloe Whiteaker, Hannah Recht and Demetrios Pogkas https://www.bloomberg.com/graphics/2020-wuhan-novel-coronavirus-outbreak/?srnd=premium

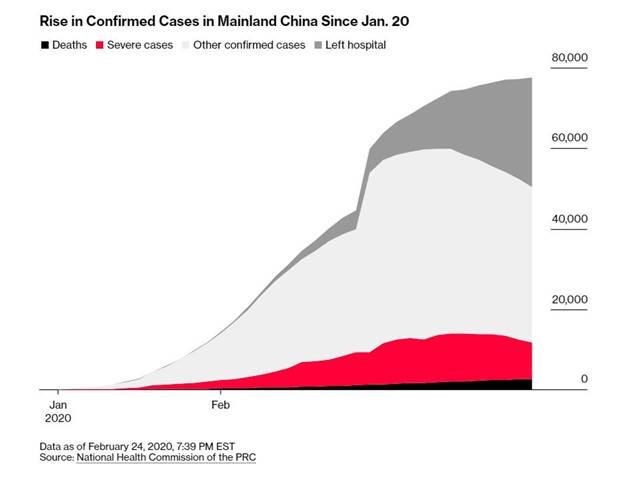

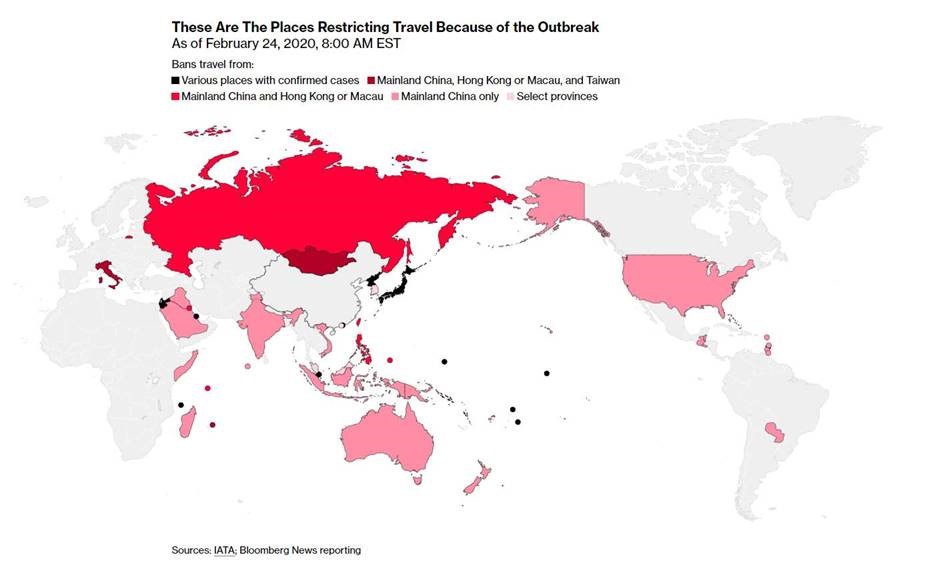

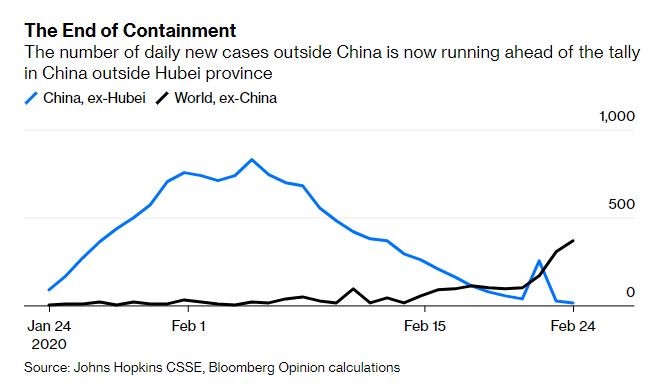

2.Primary Concern Coronavirus….Places Where Cases Increased Fastest Over the Past 7 Days are Outside of China.

That prospect is looking increasingly remote now. For most of the past month, just a percentage point of so of new daily infections have occurred outside China. Since Thursday, that proportion has risen to a fifth. Nearly half of cases so far found outside of China have been reported in the past four days.

https://twitter.com/TheStalwart

3. Scoop: Coronavirus threatens shortages of about 150 drugs Caitlin Owens

About 150 prescription drugs — including antibiotics, generics and some branded drugs without alternatives — are at risk of shortage if the coronavirus outbreak in China worsens, according to two sources familiar with a list of at-risk drugs compiled by the Food and Drug Administration.

Why it matters: China is a huge supplier of the ingredients used to make drugs that are sold in the U.S. If the virus decreases China’s production capability, Americans who rely on the drugs made from these ingredients could be in trouble.

What they’re saying: The FDA declined to comment on the list, but said in a statement that it’s “keenly aware that the outbreak could impact the medical product supply chain,” and has devoted additional resources toward identifying potential vulnerabilities to U.S. medical products stemming specifically from the outbreak.

- The agency has been in contact with hundreds of drug and medical device manufacturers, and it’s also coordinating with global regulators like the European Medicines Agency.

- It pointed out that there aren’t any vaccines, gene therapies or blood derivatives licensed by the FDA that are manufactured in China, although raw materials for many products do come from China and other southeastern Asian countries. The agency is in contact with biologics manufacturers to monitor supply concerns.

- “If a potential shortage or disruption of medical products is identified by the FDA, we will use all available tools to react swiftly and mitigate the impact to U.S. patients and health care professionals,” said an FDA spokesperson.

The intrigue: FDA commissioner Stephen Hahn is not a member of the task force that the administration has assembled to handle the coronavirus. Only two of the dozen members of the task force are physician-scientists, BioCentury noted on Friday.

- Politico reported Friday night that the White House is worried about how the coronavirus outbreak could shape President Trump’s re-election prospects, and some administration officials are concerned that the virus is already spreading within the U.S., undetected.

The bottom line: Whether or not the coronavirus spreads within the U.S., any potential drug shortages would be felt acutely by the American patients that rely on them.

Go deeper: Coronavirus outbreak fuels concerns about pharma’s global supply chain https://www.axios.com/coronavirus-threatens-drug-shortage-318c9e7b-5d92-4a5e-b992-2478023c6d01.html?utm_source=morning_brew

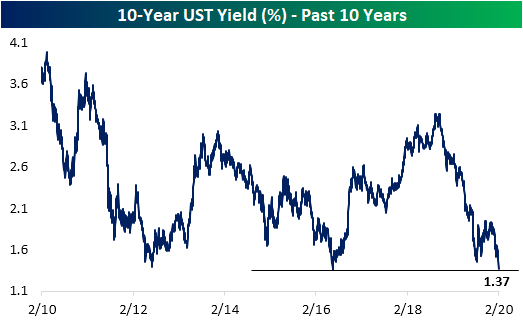

4 Dividend and Treasury Yield Spreads At Multiyear Highs

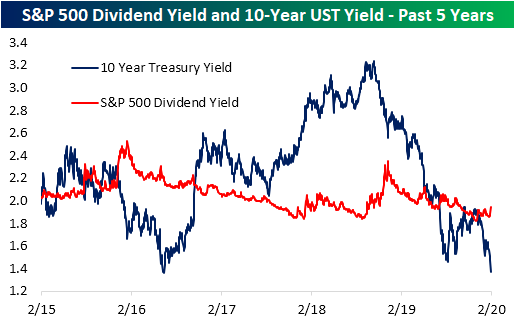

Meanwhile, Treasury yields are cratering with the 10-Year down over 10 bps. That is the largest one-day decline in the 10-Year yield since August 14th of last year when it fell 12.43 bps. That brings the yield down to 1.37%, which is the lowest level since July 2016.

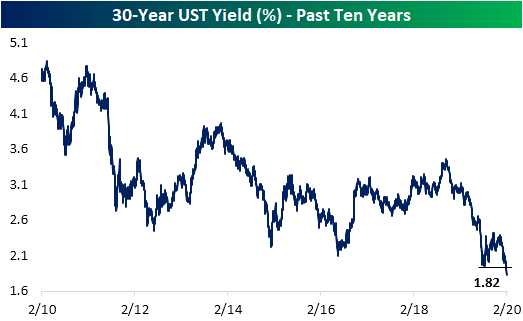

Going further out on the curve, the yield on the 30-Year Treasury bond is now at a record low of 1.82%. Similar to the 10 Year, that is nearly a 10 basis point decline from Friday.

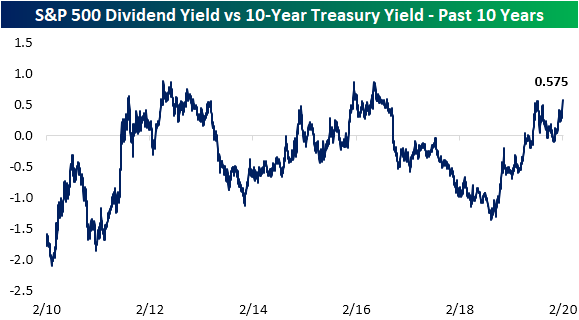

Given these moves, holding constant the difference in risks associated with the two assets, the spread between the S&P 500’s dividend yield is higher than the 10-Year yield by its widest margin since September of 2016 at 0.575, eclipsing the previous high from last August. Prior to 2016, the spread was higher throughout much of 2012.

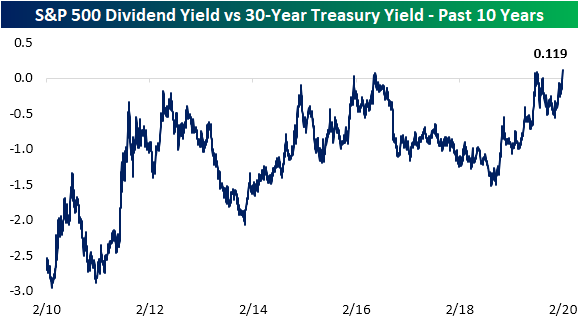

The spread between the S&P 500’s dividend yield and the 30-Year Treasury, on the other hand, is at its highest level in over a decade. The spread now stands at 0.119 which is the widest the spread has been since January 2009, and is favoring stocks (positive spread) for the first time since September. Unlike the spread between the S&P 500’s dividend yield and the 10-Year yield which has flipped back and forth between favoring stocks and Treasuries over the past decade, the 30-Year yield has much more consistently favored bonds. In fact, outside of today and briefly last September, the only other time we’ve seen a positive spread was in 2016. Get Bespoke’s most actionable ideas and analysis with a Bespoke Premium membership. Click here to start a two-week free trial.

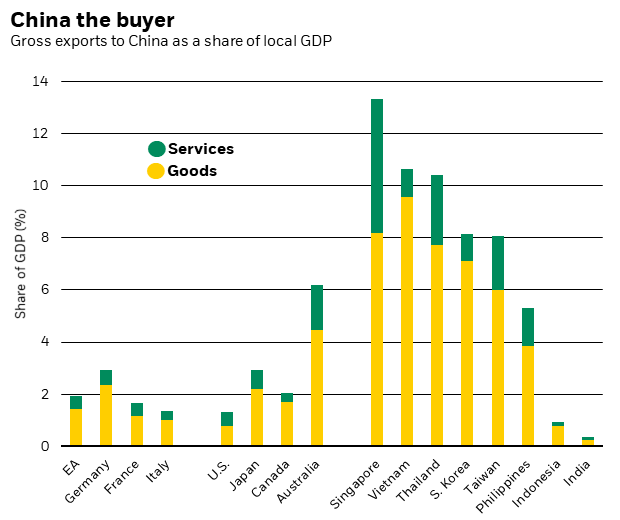

5.Europe’s Gross Exports to China by Country

Blackrock–The euro area is more exposed to Chinese export demand than the U.S. See the chart above. And it has extra exposure to China through foreign affiliate sales, especially in the car industry. But the euro area also relies less on intermediate inputs from China in its domestic production than the U.S. or Japan, making it less susceptible to any supply chain disruptions.

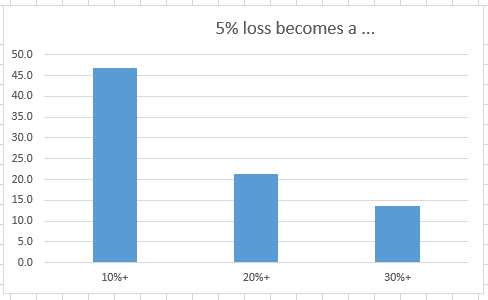

6.How Often Do 5% Sell-Offs Become 10%?

Alpha Architects 5% becomes 10% or 20% or 30%

How often does that 5% sell-off become an even larger sell-off?

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Those 5% sell-offs often become 10% sell-offs at 47% of the time. But only 21% of the time do they hit the dreaded 20% sell-off.

If the 5% sell-off does not become a 20% sell-off, it will reach the reference high, on average, in 80 trading days, or about 4 months, which is not that long.

Market Sell-off Analysis: Baseline Historical Facts By Cesar Alvarez|July 10th, 2019|Research Insights, Trend Following, Tactical Asset Allocation Research

https://alphaarchitect.com/2019/07/10/market-sell-off-analysis-baseline-historical-facts/

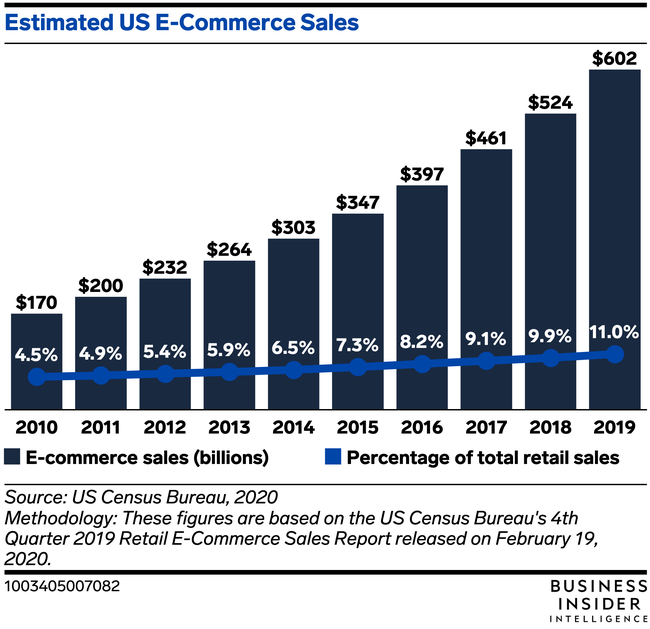

7.Follow Up to Yesterday’s Comments on Q4 2019 Record E-Commerce Sales.

Business Insider

Here are three major takeaways based on the US retail industry’s recently reported performance for Q4 2019 and 2019 overall.

- -E-commerce cracked 10% of total retail sales in 2019, and its performance is still propelling the overall industry’s growth. The segment accounted for approximately 11% of total retail sales in 2019, up from its previous high of 9.9% in 2018. And e-commerce sales grew 14.9% for the year, accelerating from its 13.6% increase a year ago, while total retail sales growth in 2018 actually decelerated from 4.7% in 2018 to 3.4% in 2019. Because merchants must embrace e-commerce to boost their own growth, the roles of solutions providers like BigCommerce and Shopify, as well as marketplaces like Amazon, could expand further in the coming years, due to their ability to help merchants without the resources to develop their own e-commerce platforms to begin selling online.

- -The industry managed to elevate its performance in Q4 despite the short holiday schedule. There were six fewer days between Thanksgiving and Christmas in 2019 than there were in 2018, and since Thanksgiving can serve as a milestone that triggers holiday shopping, the abridged holiday season could have limited retailers’ ability to rack up lucrative holiday sales. Merchants seem to have overcome this obstacle considering the industry’s improved performance in the holiday quarter. Further, this season’s success indicates that deploying tactics like offering sales early — Walmart launched its holiday deals in October this year — should be implemented in years with longer holiday schedules too, in hopes of extending the holiday season and creating more sales opportunities.

- -While e-commerce is a key growth driver for retailers, offline retail remains the largest sales opportunity — making an omnichannel approach key to a merchant’s success. Retail sales other than e-commerce made up 89% of 2019’s sales, so brick-and-mortar retail remains the focal point of US retail. This is likely why e-tailers like Amazon and several digital brands and payments companies like Stripe have been pushing into physical stores, since it gives them access to the channel and another way to attract volume. Since we are likely still decades away from e-commerce bringing in the majority of retail sales, sellers looking to maximize their performances should be working to sell both online and in-store in order to tap into e-commerce’s growth and physical retail’s size, while also developing offerings like click-and-collect to take advantage of the strengths of both channels.

E-commerce sales surpassed 10% of total retail sales in 2019 for the first time https://www.businessinsider.com/ecommerce-topped-10-percent-of-us-retail-in-2019-2020-2

8.If You Can Truthfully Say ‘Yes’ to Any of These 5 Questions, Your Emotional Intelligence Is Lower Than You Think

Even if the answers are yes, emotional intelligence is something anyone can develop.

By Marcel SchwantesFounder and Chief Human Officer, Leadership From the Core@MarcelSchwantes

I’ve written numerous times about the impact of emotional intelligence, and how people exhibiting high emotional intelligence (EQ) have been found to have more success in life.

Research has determined that EQ determines an employee’s overall success when it comes to work, relationships, and general well-being. In the age of artificial intelligence and automation, emotional intelligence may be not only what saves us from the robots, it may also be what saves us from ourselves. Consider these findings:

- EQ accounts for nearly 90 percent of what moves people up the ladder.

- EQ is responsible for 58 percent of your job performance.

- People with high EQ earn $29,000 more per year, on average, than those with low EQ.

- EQ is one of the top 10 job skills required for workers to thrive in 2020.

Let’s flip the coin. What about low emotional intelligence, or even no emotional intelligence at all? What does that look like in practice, and how can we identify those habits that are holding us back?

5 questions to assess low emotional intelligence

For the record, if you recognize some of your own habits as you read over the signs, cut yourself some slack and know that you’re not broken or bad. What it does mean is, you suffer from blind spots. You may not see them but those around you–peers, co-workers, customers, family members–can firmly nod in agreement that they do, sometimes routinely.

Rest assured that anyone is capable of changing these scenarios to improve their lives or leadership skills. But there’s got to be a first step: identifying whether your EQ is low or not. Here’s how you will know.

1. Are you quick to judge?

People with low EQ often jump to conclusions quickly because they don’t have a good understanding of how to read other people’s emotions or their own. Since those who judge are typically negative and impulsive, they may form a negative impression of someone before assessing the context of a situation and their initial emotions for truth and accuracy. Sadly, what they may be left with is a distorted view of something or someone.

2. Do you have a hard time accepting criticism?

Taking criticism can wreak havoc emotionally on a person who lacks EQ. However, in honest, self-confident, high-EQ individuals, it is much easier to accept criticism because they are able to process their emotions, assess their strengths and weaknesses, and take note of something they need to improve on.

3. Do you increasingly feel stressed or anxious?

I’m not negating stress–we all experience some level of it; it is inevitable. But people with high EQ, as opposed to their low-EQ counterparts, have the capacity to get perspective on a situation, seek input from various angles, and practice mindfulness before spiraling down the devious path of anxiety.

4. Are you a bad listener?

Low-EQ individuals lack empathy; they often neglect to listen to the opinions and thoughts of others to consider another point of view. Recent research published in Harvard Business Review supports evidence that leaders who listen well “are perceived as people leaders, generate more trust, instill higher job satisfaction, and increase their team’s creativity.”

5. Do you find it hard to recover from mistakes?

High-EQ individuals are resilient; low-EQ individuals dwell on mistakes and have a tough time bouncing back. To these people, I offer one simple solution that will change your world for the better: Heal from the hurt, learn from your mistake, let go of the past, and move on to your glorious future.

In closing, building up your EQ could have a profound effect on your personal and work relationships. But first, assess where you stand in relation to the tenets of emotional intelligence and ask some key “hold up the mirror” questions to determine where you measure up.

PUBLISHED ON: FEB 22, 2020

Like this column? Sign up to subscribe to email alerts and you’ll never miss a post.

The opinions expressed here by Inc.com columnists are their own, not those of Inc.com.