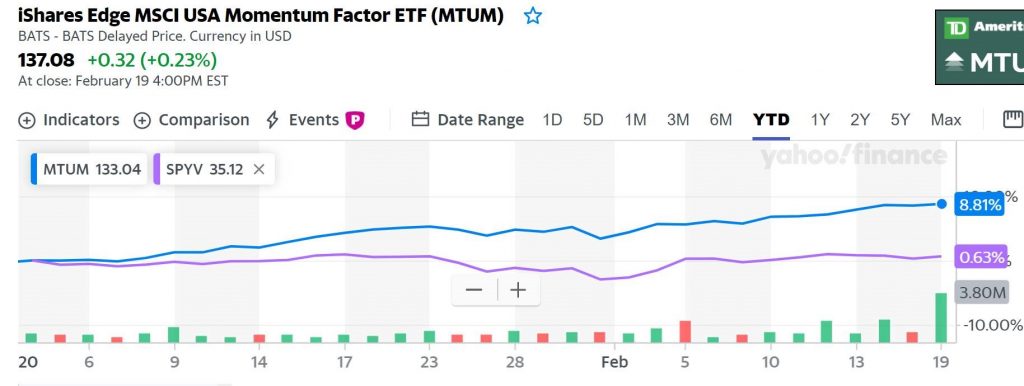

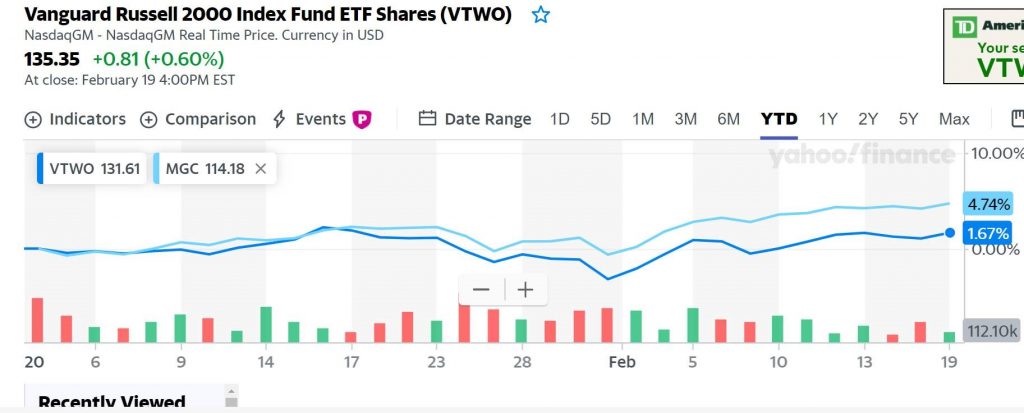

1.Momentum Vs. Value and Large Cap vs. Small Cap Themes Continue.

MTUM Large Cap Momentum ETF +8% vs. SPYV Large Cap Value ETF Flat

Mega Cap ETF +5% vs. Russell 2000 Small Cap +1.67%

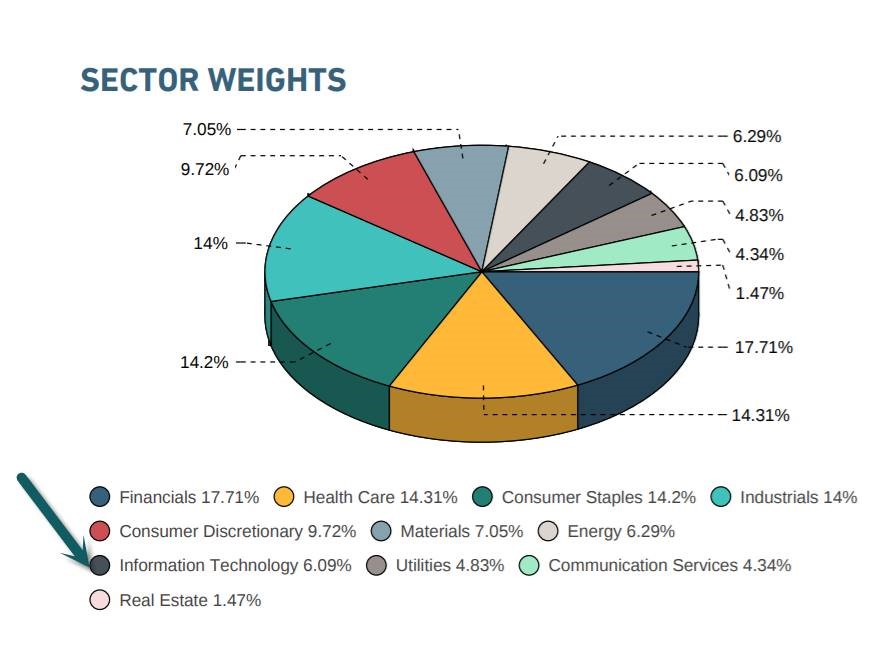

2.MSCI Europe Sector Weight Technology 6%…..So EU Decides to Ramp Up Regulation on Foreign Tech

https://www.msci.com/documents/10199/db217f4c-cc8c-4e21-9fac-60eb6a47faf0

Morning Brew

| REGULATION EU Better Shape Up, Big Tech EU Commissioner for Competition Margrethe Vestager. EMMANUEL DUNAND/AFP via Getty Images Yesterday, the EU rolled out plans to develop new restrictions on the largest tech firms. As in, plans to make rules As in, no new rules just yet. But by the end of the year, the EU says it will draft legislation to impose tougher limits on major tech firms—meaning the non-European ones. Aside from a few success stories like Sweden’s Spotify, Europe has largely missed the tech boat. The EU is anxious about its member states relying on South Korean phones, U.S. social networks and e-commerce, and Chinese wireless networks. So the European Commission (the EU’s executive arm) outlined a blueprint to both rein in foreign tech firms and nurture homegrown tech champions. First, the stick Is for outside companies. And there are actually three. Stick 1: Artificial intelligence. Users and developers of AI in sensitive fields like health, transportation, and policing could be subjected to new legal requirements. Like warm soda, privacy is more valued in Europe than the U.S. That means he use of facial recognition technology for remotely identifying people is generally prohibited in the EU, except in certain cases. The bloc will keep debating whether to allow those exceptions. Stick 2: Antitrust. The EU is targeting “gatekeeper” companies that stand between other businesses and their customers. Proposed penalties for platforms found guilty of anticompetitive behavior could involve forcing those companies to share data with their smaller rivals. Stick 3: Content liability. The EU is toying with holding tech platforms responsible for harmful content users post. Facebook CEO Mark Zuckerberg met with officials on Monday. He encouraged them to…not do that, suggesting instead a liability system that splits the difference between newspaper publishers (who can be 100% liable for their content) and telcos (who are 0% liable). And now the carrot The EU proposed a boost in spending on homegrown tech firms to $21.6 billion/year in public and private investments. |

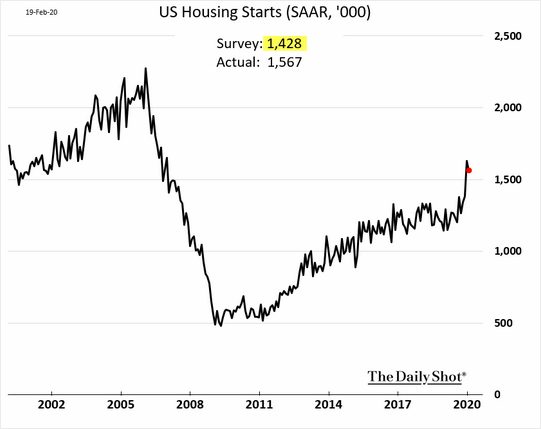

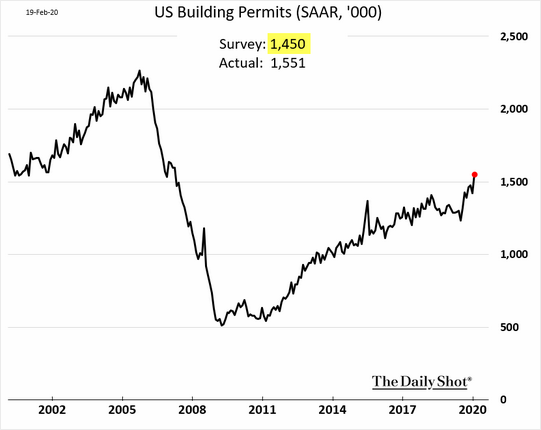

3.January Housing Starts and Building Permits Surprise to Updise

Residential construction continues to surprise to the upside. The January housing starts and building permits exceeded market expectations.

The Daily Shot https://blogs.wsj.com/dailyshot/2020/02/20/the-daily-shot-has-wage-growth-peaked/

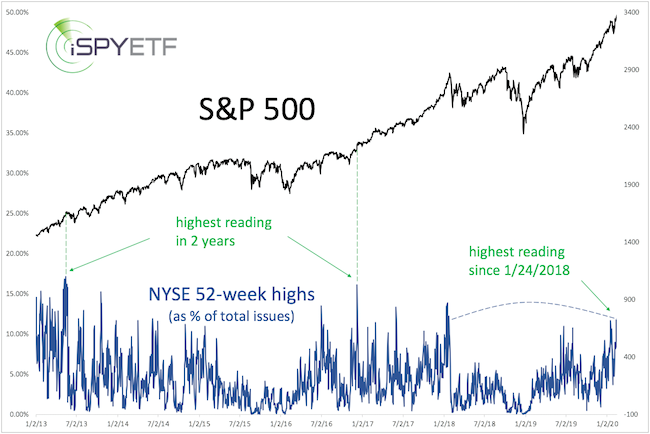

4.Shares of Stocks on the NYSE that are at 52 Week High Sets Two-Year Record

The chart below (green lines) highlights the last two times the share of stocks on the NYSE that were at 52-week highs set a two-year record. Since 1975, it happened 13 other times. How did stocks respond? Two, six and 12 months later, the S&P 500 traded higher 11 of 13 times (85%). That kind of strength is a reflection of momentum, and momentum does not die quickly.

Opinion: Stock market bulls will trample the bears this year, according to the weight of the evidence

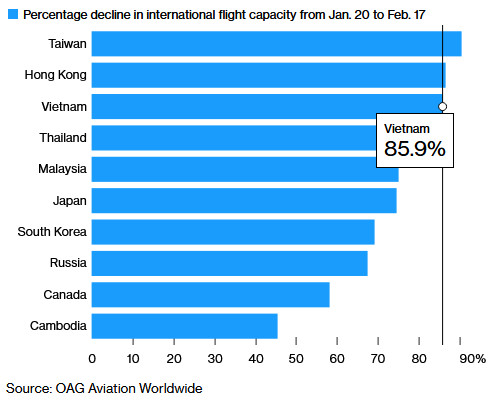

5.China Taking Massive Steps to Bail Out Airlines.

Dave Lutz Jones Trading

Global Carriers Stopped 80% of Flights to China-China is considering measures such as direct cash infusions and mergers to bail out an airline industry crippled by the coronavirus outbreak – One proposal involves allowing some of the nation’s biggest carriers to absorb smaller ones suffering the most from the collapse of travel. In an unprecedented move, global carriers stopped about 80% of their China flights and local airlines grounded enough planes to carry 10.4 million passengers. The disruptions have reduced China’s aviation market to the size of Portugal’s

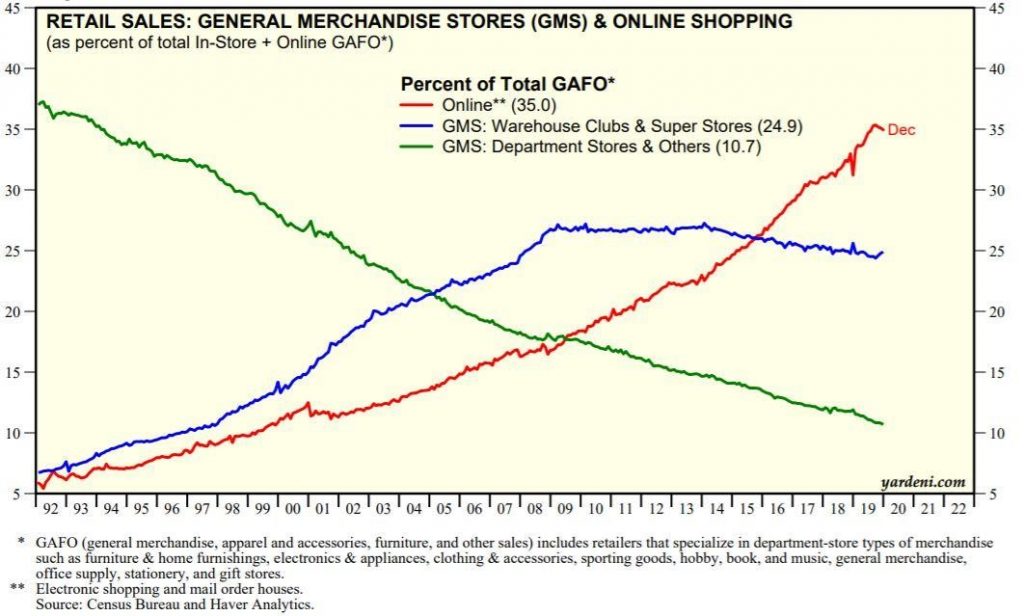

6.Updated Retail Sales Breakdown …Online, Warehouse Stores and Department Stores.

Ed Yardeni

https://www.linkedin.com/in/edward-yardeni/

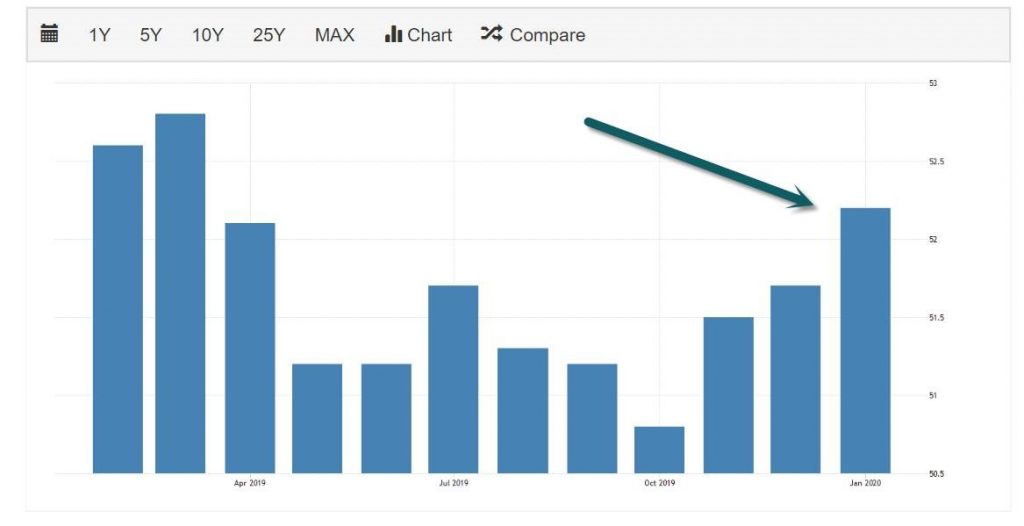

7.80% of Countries Had PMI Above 50 in January

Trading Economics

https://tradingeconomics.com/world/composite-pmi

Definition of ‘Global Manufacturing PMI’

The

manufacturing data will always be published on the first US working day of

every month, one hour after publication of the ISM manufacturing

survey.

The following is from JP Morgan’s marketing material and as such is promotional

in nature:

- It is the earliest indicator of Global economic and business conditions, produced on a monthly basis ~ released at the start of every month with data relating to the month just passed.

- It has a strong track record of accurately anticipating global GDP data.

- It is derived from data produced using internationally comparable methodologies covering aound 10,000 survey respondents in over twenty countries, which collectively represent 76% of global economic output.

- It has wide sector coverage, including both manufacturing and services.

https://www.mypivots.com/dictionary/definition/748/global-manufacturing-pmi

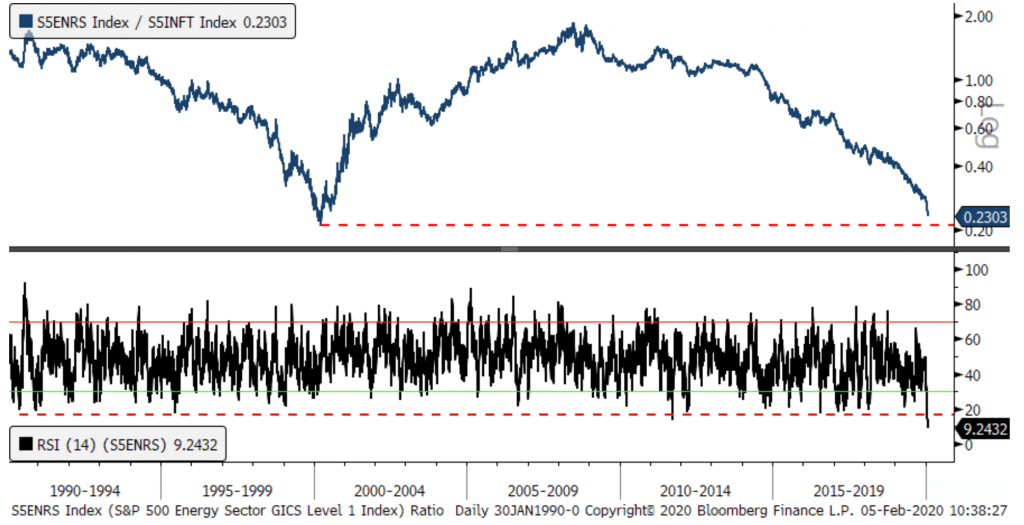

8.Energy vs Tech could be the monster mean reversion of a lifetime

Posted February 5, 2020 by Joshua M Brown

Check out my Chart o’ the Day from Jon Krinsky, I love this stuff. It gets right to heart of all the things we talk about here – cyclical vs secular, and how to tell which is which, value vs growth, innovation vs entrenchment, etc.

Energy vs. Technology – the daily RSI hit 9 yesterday, the lowest reading since we have GICS data back to 1990. Interestingly, the ratio itself is nearing its all-time low made on March 24th, 2000 which was of course the all-time high for the Nasdaq 100.

Stranger

Things… Energy vs. Tech spread most oversold since at least 1990, reversion

likely…

Baycrest Partners – February 5th, 2020

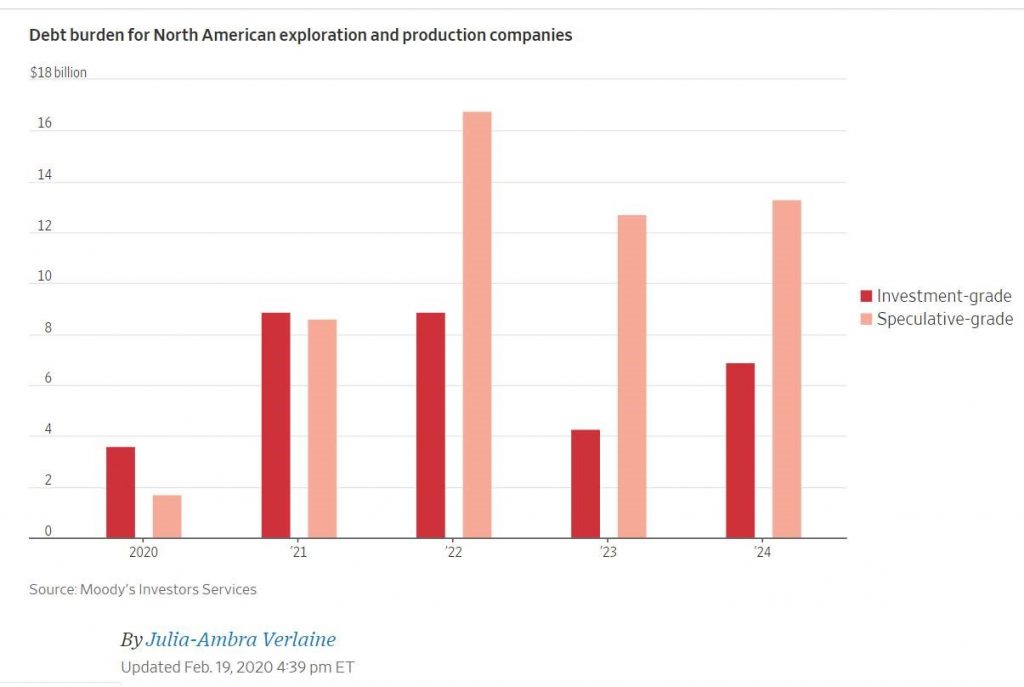

9.The Problem With This Trade….Debt

WSJ

U.S. oil-and-gas companies need cash, but it won’t come at a cheap price.

Explorers and producers have more than $85 billion of debt maturing over the next four years. Those with junk-rated debt will likely have a hard time tapping capital markets in 2020, increasing the odds for wave of defaults, according to a new report by Moody’s Investors Service.

10. 7 Rules for Living

Our personal life rules should be flexible, because life’s always changing.

Our personal life rules should be flexible, simply because life is always changing. It changes as we age, as cultures advance, when finances shift, and when the environment struggles; these things and more force us to change how we deal with life. That being said, here are a few things I have learned over the decades that may help you avoid some of life’s pitfalls.

1. Try to keep things simple. When I’m writing a book or working on a film, I make sure these three things take place. I wake (which includes coffee and visualization), I walk (because if I don’t keep moving, my body will rust), and I work. Between projects, I take care of personal business, and this is also a great time for any focused growth work.

2. Spend more time just being rather than thinking or doing. John Bradshaw once asked his audience, “Are you a human being or a human doing?” Well, I have done a lot (though not nearly enough, as I see it), but balance is key, and spending a little time each day just making my inner life better has an amazing effect on the outer stuff as well.

3. Don’t let your mind lead you into dark places. In most cases, if we are feeling out of sorts, and we are really unable to focus on anything, our minds can be a dangerous place to be alone in. We all have hard memories that can creep in when we are hungry, angry, lonely, or tired (HALT). If you find yourself in that place, grab a sandwich, flip on a comedy, and take a nap.

4. Make small improvements in one area of your life every day. Knowing that you are continuing to move forward is very rewarding, and all it takes is one small step. From cleaning out a junk drawer to writing the next great American novel, it all happens one action at a time.

5. Keep your body moving. I’m glad there are stairs in my house, and I try only to use the upstairs bathroom to ensure climbing a couple of flights a few times a day. Taking walks outdoors is great.

If you’re driving to the mall, try parking at the back of the lot, so there’s a good walk in and out. You can also take the stairs in office buildings. I generally use any opportunity available to move a little more, because I have to make up for the fact that I hate gyms.

6. Be more mindful of what you eat. At least swear off soda of any kind. If you enjoy drinking carbonated beverages, get a SodaStream.

My wife is good at keeping things healthy, so I follow her lead, and there is no question that eating better has given me more energy. See what happens when you eat better too.

7. Keeping busy is one of the keys to contentment. Generally speaking, the person who has too much to do is far less stressed than someone who doesn’t have enough going on. So do what’s in front of you, and if you can’t think of anything, pick up a book and build your brain.

These seven practical little rules of living can make a big difference in how yo feel. In addition to making you feel better, people around you will see the positive effects and naturally become more engaged with you.

https://www.psychologytoday.com/us/blog/emotional-fitness/202002/7-rules-living