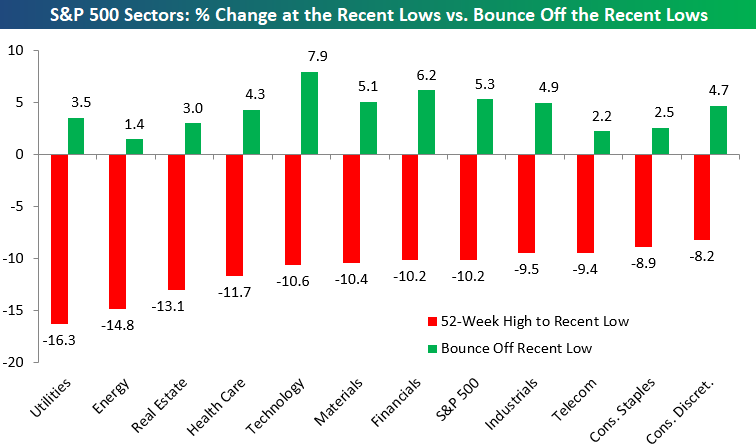

1.Sector Leadership-Tech and Financials Bounce the Most Off Lows. No Sector Leadership Rotation Yet.

Bespoke Investment Group

Below is one of the many charts included in this week’s Sector Snapshot, which highlights how much each S&P 500 sector fell from its 52-week highs to its recent low as well as how much each sector has now rallied off of its low. As you can see, Tech has bounced the most off of its low, followed by Financials and then Materials. Energy has struggled the most. It had been down 14.8% from its 52-week high, but it’s only up 1.4% off of its low.

https://www.bespokepremium.com/think-big-blog/

2.Historically Investors Have Gained Significantly in Periods of Rising Rates.

Despite the recent turbulence, historically, “equities have gained significantly in periods of rising rates,” wrote Jodie Gunzberg, managing director and head of U.S. equities at S&P Dow Jones Indices, in an email. “Since 1971, the S&P 500 has gained about 20% on average in rising rate periods, has gained 8 of 9 times and has gained nearly 40% twice, with less than a 4% loss for its worst rising rate period.” Gunzberg’s analysis evaluated the benchmark U.S. index on a total-return basis.

Why investors shouldn’t fear a rising-rate environment, in one chart

3.High Yield Second Biggest Weekly Outflows on Record.

Corporate bond investors finally joined a selloff that has shaken stocks to Treasuries as investors spooked by U.S. interest-rate risk headed for the exits.

Investors pulled $14.1 billion from debt funds, the fifth-largest stretch of redemptions in the week through Feb. 14, according to a Bank of America Merrill Lynch report, citing EPFR data. High-yield bonds lost $10.9 billion alone, the second highest outflow on record. As benchmark Treasury yields traded at a four-year high, it shook the foundations of a key support for risk assets — low rates.

“Investors don’t sell their cash bonds in a big way until they are forced to, which happens when the outflows start picking up more sustainably,” Morgan Stanley strategists led by Adam Richmond wrote in a recent note to clients.

“It’s a wake-up call that central banks are withdrawing liquidity, and that the process is not going to be smooth,” Morgan Stanley strategist wrote.

The iShares iBoxx $ Investment Grade Corporate Bond exchange-traded fund posted a record one-day outflow Wednesday, the most among U.S.-listed passive vehicles across asset classes.

Fund Flows

Corporate bond funds saw outflows last week

Source: BofAML, EPFR Global

4.Over the Long-Term, Higher Yields Lead to Higher Return.

Rates Are Rising. That’s Good News for Long-Term Bond Investors.

Should investors worry about the recent rise in US Treasury yields? If they’re high-frequency bond traders—maybe. But for income-oriented investors with a longer investment horizon, our advice is simple: relax.

The 10-year US Treasury yield rose 0.3% in January and hit a four-year high in early February after strong employment and wage data fed concern about inflation. But here’s the good news: rising rates don’t mean disaster for bond portfolios.

First, it’s important to note that yield spikes of this magnitude don’t happen often—just 11% of the time over the last 25 years. Second, when they do happen, history shows that the longer you hold your bonds, the better you’re likely to do. Since 1993, the Bloomberg Barclays US Aggregate Index, dominated by government and investment-grade corporate bonds, fell 1.2% on average during months when yields increased by at least 0.3%. But it rose 2.6% over the next six months.

US high yield didn’t decline at all, returning 1.3% and 3.7%, respectively.

Would bonds hold up just as well in a bigger sell-off? To find out, we ran an analysis that assumed a sudden 1% rise in yields across the US curve. The results suggested that investors who take the long view can rest easy. A year after the 1% spike, the seven-year US Treasury, whose duration is similar to the US Aggregate’s, would be down almost 2%. But over time, higher yields lead to higher returns. Our analysis suggested that investors who sat tight for three years and reinvested their coupons could have earned a cumulative return of 6%. Six years later, the return in our analysis was nearly 17%.

With bonds, time heals most wounds.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.

https://blog.alliancebernstein.com/library/rates-are-rising-thats-good-news

5.Bonds and Stocks Correlated During 2018 Pullback.

Larry Bonds

Posted February 12, 2018 by Joshua M Brown

My friend Larry McDonald put out a note to subscribers of his Bear Traps Report last night about the “game changer” that has happened in the interplay between bonds and stocks this past week.

He notes that, unlike previous spikes in volatility for the stock market, this time around bonds did not act as a great diversifier, having shown investors a drawdown of their own as yields rose.

And I can tell that Larry is concerned about this development because the font sizes in his note range from normal 11pt to 24pt to 36pt IN BOLD.

Some stats he shares:

(you can subscribe to his stuff here, btw)

Anyway, one of the most interesting things going on right now is the fact that bonds and stocks have indeed become correlated on this very short-term time horizon. As of Friday, the Barclays Aggregate Bond Index ETF, AGG, was in almost a 5% drawdown from its high as US stocks had fallen about 10% at their lowest levels. Diversification between the two major asset classes did not do anyone any favors.

http://thereformedbroker.com/2018/02/12/larry-bonds/

6.Dollar Goes Back to Lows.

UUP Dollar Chart.

From Deutsche Bank:

Blame the dollar on yields

We are well into 2018 and our feedback from recently attending the TradeTech FX conference in Miami is that the market is still struggling to understand or embrace dollar weakness. How can it be that US yields are rising sharply, yet the dollar is so weak at the same time? The answer is simple: the dollar is not going down despite higher yields but because of them. Higher yields mean lower bond prices and US bonds are lower because investors don’t want to buy them. This is an entirely different regime to previous years.

Dollar weakness ultimately goes back to two major problems for the greenback this year. First, US asset valuations are extremely stretched. As we argued in our 2018 FX outlook a combined measure of P/E ratios for equities and term premia for bonds is at its highest levels since the 1960s. Simply put, US bond and equity prices cannot continue going up at the same time. This correlation breakdown is structurally bearish for the dollar because it inhibits sustained inflows into US bond and equity markets.

The second dollar problem is that irrespective of asset valuations the US twin deficit (the sum of the current account and fiscal balance) is set to deteriorate dramatically in coming years. Not only does the additional fiscal stimulus recently agreed by Congress push the fair value of bonds even lower via higher issuance and inflation risk premia effects, but the current account that also needs to be financed will widen via import multiplier effects. When an economy is stimulated at full employment the only way to absorb domestic demand is higher imports. Under conservative assumptions the US twin deficit is set to deteriorate by well over 3% of GDP over the next two years.

From Zero Hedge

7.Inflation Since 2000

Doug Short Advisor Perspectives

8.The Amazing Collapse of Strikes.

Jesse Felder @jessefelder 22h22 hours ago

‘The all-time low in the number of work stoppages is a result of a new militancy by employers in bargaining and a willingness of the public to break strikes [and] to provide striker replacements.’ https://blogs.wsj.com/economics/2018/02/09/why-workers-are-striking-less-than-ever/ … ht @SoberLook

https://twitter.com/jessefelder?ref_src=twsrc%5Egoogle%7Ctwcamp%5Eserp%7Ctwgr%5Eauthor

9.The Rising Speed of Technological Adoption

Technological progress is not the only thing rising at an exponential rate.

The rate at which newly commercialized technologies get adopted by consumers is also getting faster, too.

In the modern world, through increased connectivity, instant communication, and established infrastructure systems, new ideas and products can spread at speeds never seen before – and this enables a new product to get in the hands of consumers in the blink of an eye.

Found on Abnormal Returns BLog

https://abnormalreturns.com/2018/02/15/thursday-links-totally-asinine/

http://www.visualcapitalist.com/rising-speed-technological-adoption/

10.Don’t Know What You Want? Improve These 7 Universal Skills

What does success look like? What do you want from life? What career do you want?

Most of us answer “I don’t know.”

And you know what? There’s nothing wrong with that. And yet, we think it’s the worst thing in the world if you don’t know what you want to do in life.

We say: “OMG! I don’t know what I want!” And then we have a full-on panic attack. Be honest — it happens to all of us.

Especially, when you see that your old college friend just got married. Or that your co-worker, who started at the same time as you, just got promoted.

It’s at those moments of weakness when we shine a spotlight on our own uncertainty about life.

One of the biggest thinking errors that I’ve made was that I thought I needed to know what I exactly wanted to do with my life. The truth is that no one knows what they truly want.

Accept The Uncertainty

You could get killed by a cow tomorrow (really happened). You could lose half of your money on the stock market. Your property could go up in flames.

I don’t have to tell you all those things. But we must realize that we don’t have the answers to most things in life.

Will you stay healthy? Will the stock market crash? Will your business continue to prosper?

NO ONE KNOWS!

That’s the beauty of life. Eleanor Roosevelt said it best:

“If life were predictable it would cease to be life, and be without flavor.”

Some people ask me, “Why do you read so many books? There’s no way you can apply everything you learn.”

They are right. I cannot. Why do I still read about all kinds of different topics?

There might come a time in my life where I will need one particular piece of knowledge. And that one time I need it might just change the whole outcome of my life.

I‘ll give you an example. In 2015, after my friends and mentors told me I should share my ideas about productivity, life, and business with others, I seriously started thinking about doing it.

But there are many ways you can share your knowledge with others. You can give training to groups and host seminars. You can coach people individually. You can create videos for YouTube. You can give talks at conferences. The possibilities are endless.

But because I’ve always had an interest in writing and had read so much about it in the past, I realized that I should start with written ideas. That was the easiest way for me to get started.

I had also learned all about creating websites in the past. So it was very easy for me to get started with all of this. In fact, I created a website in a day.

And I started writing every day for a month. The result? A book and a bunch of articles.

Know Your Direction. Not Your Destination.

When I read about writing and building websites years ago, I didn’t know I would use that knowledge to build my own blog.

To be honest, I didn’t know what I wanted. I only knew what direction I wanted to go in. I knew I wanted to make a contribution and do work that I enjoyed.

So it’s not important to know exactly what you want to do with your life. People change. Economies change. So, it’s not even realistic to boldly claim “I know what I want!”

The only thing every person needs is a sense of direction. A vision of where you’d like to go.

Look, you don’t need to know your exact destination.You often read about people who say they always knew what they wanted.

But that’s just a small portion of the population. I’ve personally never met someone like that. Most of us don’t have that conviction from day one. It grows over time.

If you can’t decide what direction you want to go in life, that’s automatically your #1 goal in life — to figure out where you want to go.

That’s what Jay Abraham also recommends in Getting Everything You Can Out of All You’ve Got (which is one of my favorite business books of all time):

“Your first priority is to identify what you want and then make sure you take the path that’s going to give you that. There’s nothing sadder than to see someone get to be seventy-five or eighty years old and look back regrettably because they pursued the wrong target.”

You see that he doesn’t say you should know exactly what you want? That would not be realistic.

Instead, we need to know where we’re roughly going. I know, it remains intangible. But that’s the only helpful answer that I’ve found in life.

Work On Universal Skills

While you’re figuring everything out, don’t waste your time watching hours of TV, drinking booze, or eating junk food. Spend your time usefully.

Learn skills you can always rely on. Need some inspiration? Here are a few skills that I’m constantly working on:

- Self-Discipline: Get better at ignoring the negative voice in your head. Get out of your bed. Go to the gym. Don’t listen to “I don’t want to.”

- Personal Effectiveness: Learn how to maximize the results you can get during the 16–18 hours you’re awake. Get more done —

- Communication: We think we’re all master communicators. But the truth is that we suck. Communication is both art and science. And our ability to work with others depends on it.

- Negotiation:You negotiate all the time. With your spouse, kids, parents, teachers, friends, co-workers, managers, etc. Learn to get the best deal for all parties.

- Persuasion:Learn how to get what you want in an ethical way.

- Physical Strength & Stamina:Getting stronger is a skill. Pull your own weight. It’s something every human should be able to do.

- Flexibility: Sitting all day long behind your computer or in your car turns you into a stiff being. Learn how to stretch your hips, lower back, hamstrings, and calves — the most common weak points of desk workers.

That’s enough to keep you busy for a lifetime if you want to do it well. Pick a skill that excites you. Get better at it. Then, pick another. And keep on repeating that process.

Soon enough, you’ll know what you want. And if you don’t, it’s not the end of the world. There’s still plenty to learn.