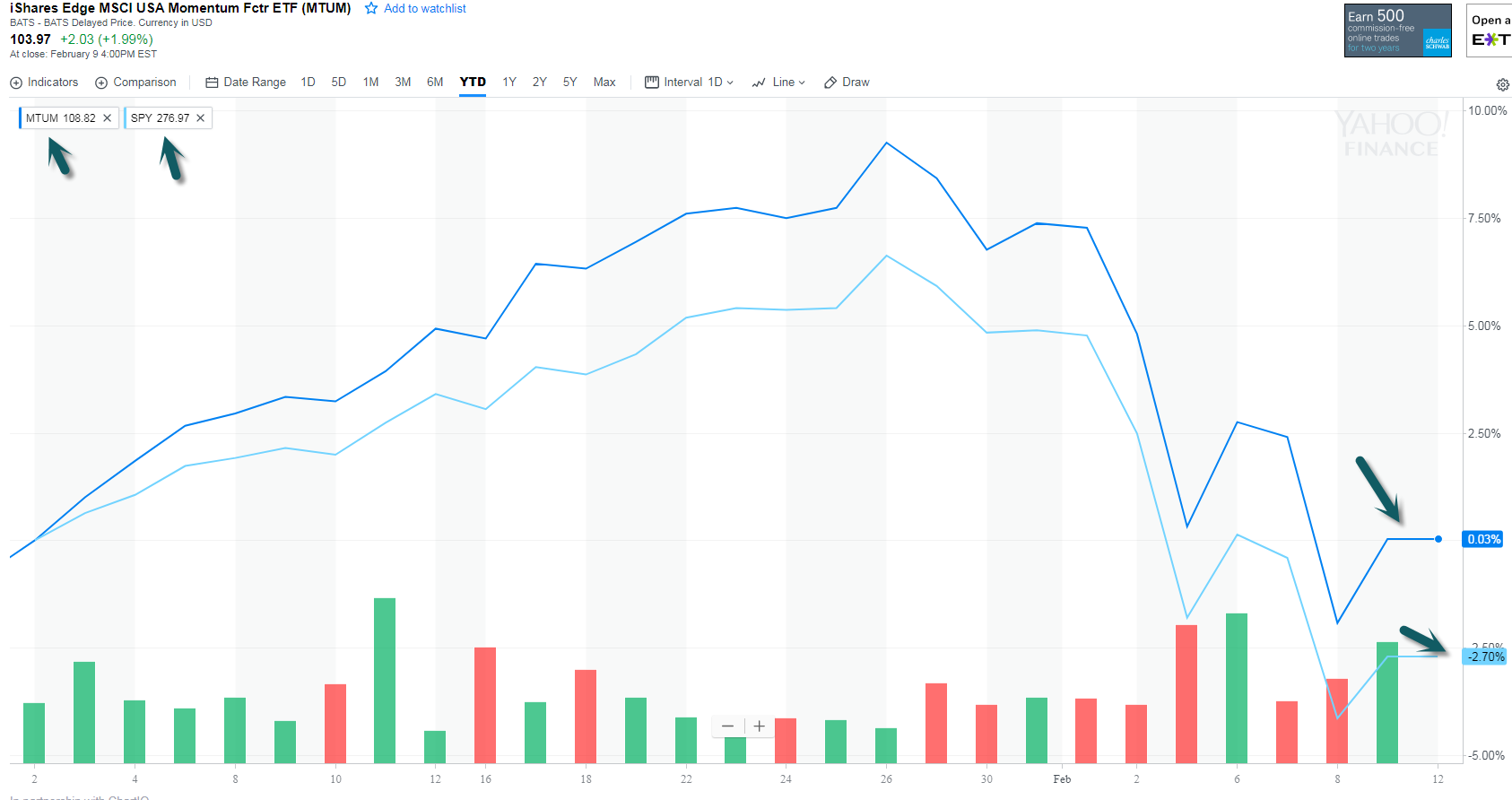

1.Follow Up to Yesterday’s Sector Performance Chart….Momentum Outperforms on Pullback.

MTUM Momentum ETF-Prior to yesterday’s rally, during the market’s 11% pullback MTUM went down less than S&P…Signaling no shift to defensive sectors.

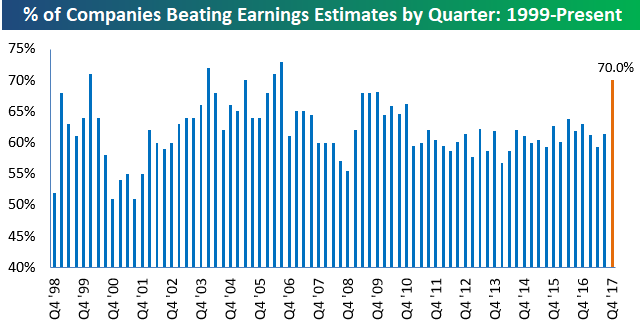

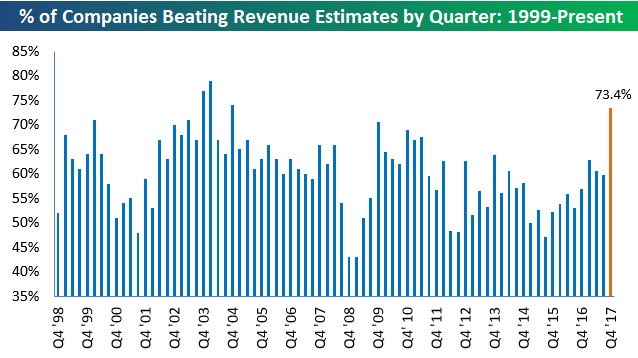

2.Problem for Bears…Companies are Beating Earnings Estimates at the Strongest Pace in a Decade.

Tracking Multi-Year Highs in Beat Rates

Feb 12, 2018

The S&P 500 just experienced its first 10%+ correction in two years right in the middle of earnings season. So how do beat rates look this earnings season? Excellent.

Even with analysts hiking their Q4 EPS estimates at the fastest rate in a decade coming into earnings season, companies have had no problem beating those estimates. Thus far, with more than 1,000 companies having reported, 70% have beaten consensus analyst EPS estimates. The 70% beat rate puts this quarter on track for the strongest bottom-line beat rate in more than ten years.

And while bottom-line numbers have been really impressive, top-line revenue beat rates have been even stronger this season. As shown below, 73.4% of companies that have reported have beaten consensus analyst revenue estimates. That’s tracking to be the strongest top-line beat rate since Q3 2004!

Again, these beat rates would be impressive in any quarter, but what makes them really stand out is that analysts were hiking estimates coming into this season, and companies have still managed to beat estimates at a very high clip. So far, analysts have not hiked estimates enough!

https://www.bespokepremium.com/think-big-blog/

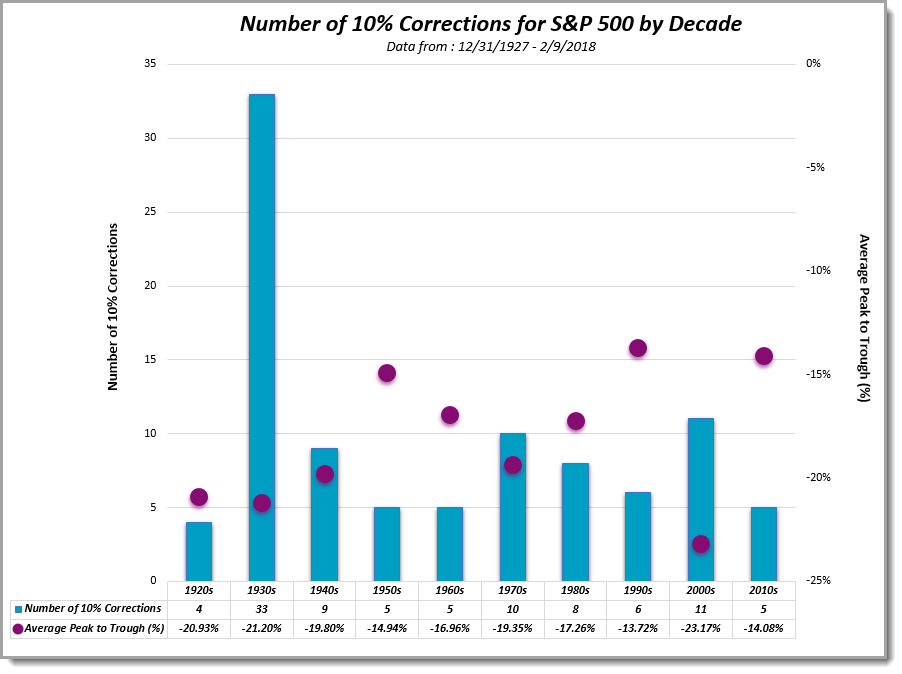

3.History of 10% Corrections.

From Dorsey Wright

Volatility over the past couple of years has been low by many different measures. Historically, the S&P 500 has experienced a 5% pullback three to four times per year, and roughly one 10% each year. The last 5% pullback the market experienced was in the Summer of 2016, and the last 10% pullback was in the January/February 2016 time period. In other words, the market had gone two years without experiencing a 10% pullback until the past 10 days where the S&P 500 was down 11.8% from the January 26th peak to the February 9th intraday low. Historically, on average, once a drawdown becomes a 10% correction, it turns out to be a -19.38% correction going back to the end of 1927. Don’t be alarmed though. According to Guggenheim Investments, “the majority of pullbacks during non-recessionary periods registered declines under 20 percent” and “pullbacks falling within the 5–20 percent range historically experience recovery periods of one to four months.” Here are some interesting observations from our historical analysis of 10% corrections:

- During the 2010’s, the average drawdown for corrections of -10% or more is -14.08%

- The average number of -10% drawdowns per decade is 9.6. Since 2010 we have had instances.

- The decades with the fewest amount of -10% corrections were the 1950s, 1960s, and 1990s. (Excluding 1920s because of the data starts in 1928.)

- Since 1990, the S&P 500 is up an average of 16.85% six months after a 10% correction. 12 months after the correction, the S&P 500 is up an average of 20.49%. The two major blemishes, however, were in 2001 and 2008 when the market produced negative returns a year after finding a “trough” during a 10% correction.

4.For Technical Traders…Watching Big Bond Holders.

BND second biggest bond ETF –50 day about to go thru 200 day to downside

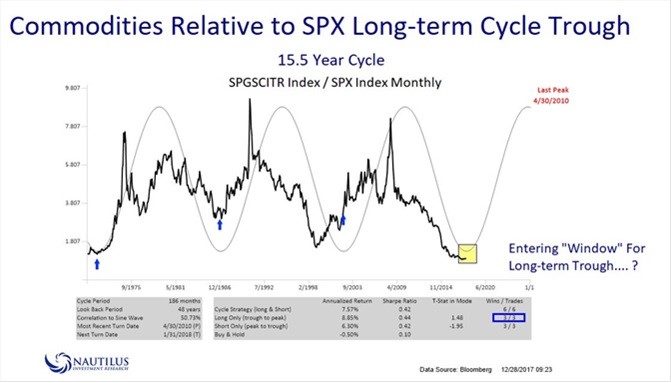

5.Commodities Move in Long Cycles.

Why Commodities On Cusp Of Supercycle

February 13, 2018

Maxwell Gold is director of investment strategy and research at ETF Securities, an issuer focused on commodity and currency exchange-traded funds. ETF.com recently spoke with Gold to discuss the latest outlook for commodities, including his view that the asset class may be on the cusp of another supercycle.

ETF.com: You’ve mentioned we could be at the beginning of a commodities supercycle. Would you elaborate?

Maxwell Gold: The commodity market tends to move in much longer periods than a traditional business or market cycle that stocks typically move in, or even a typical economic cycle, which historically has been about five to seven years. Commodity cycles are usually about 10 to 15 years long.

We had a sell-off and an oversupply of commodities for the past several years. The turning point was 2016. Since then, we’ve been seeing a drawdown of the supply glut, as well as a reduction of output due to reduced capital investment and more supply discipline from a lot of producers, especially in the energy and mining sectors.

ETF.com: How long will this supercycle last, and how much can commodities rally from here?

Gold: It depends on a lot of factors that we just don’t know right now. The important takeaway is that we’re at the very early stage of this. Certainly, there’s more rebalancing needed in terms of drawing down on existing supply. But we’re beginning to move back into balance in certain commodities and the fundamentals are becoming much more attractive.

Over the next couple of years, commodities will be an area where we’ll begin to see a lot of improvement fundamentally, including a better macroeconomic backdrop with rising growth and rising inflation.

From an investment standpoint, investors will begin to look towards the asset class more favorably. They’ve been absent for the past few years, ever since that large drawdown in 2013/2014.

ETF.com: When a lot of investors see the economy doing well, they tend to gravitate toward equities. But you’ve mentioned commodities could do even better than stocks at this point in the cycle. Why is that?

Gold: We typically see commodities outperform stocks and other risk assets in the late stages of a business cycle. Right when we’re beginning to see capacity overshoot and we hit a slowdown in equity markets, commodities perform better.

The Fed and other central banks want to increase interest rates to slow down and control economic growth to prevent the economy from overheating too much. That typically goes hand in hand with a period where there’s increased demand for inputs, raw materials and resources―primarily commodities.

It’s very typical to see commodity prices increase when we’re in a rate-hiking cycle and interest rates are rising.

Read full story below

http://www.etf.com/sections/features-and-news/why-commodities-cusp-supercycle

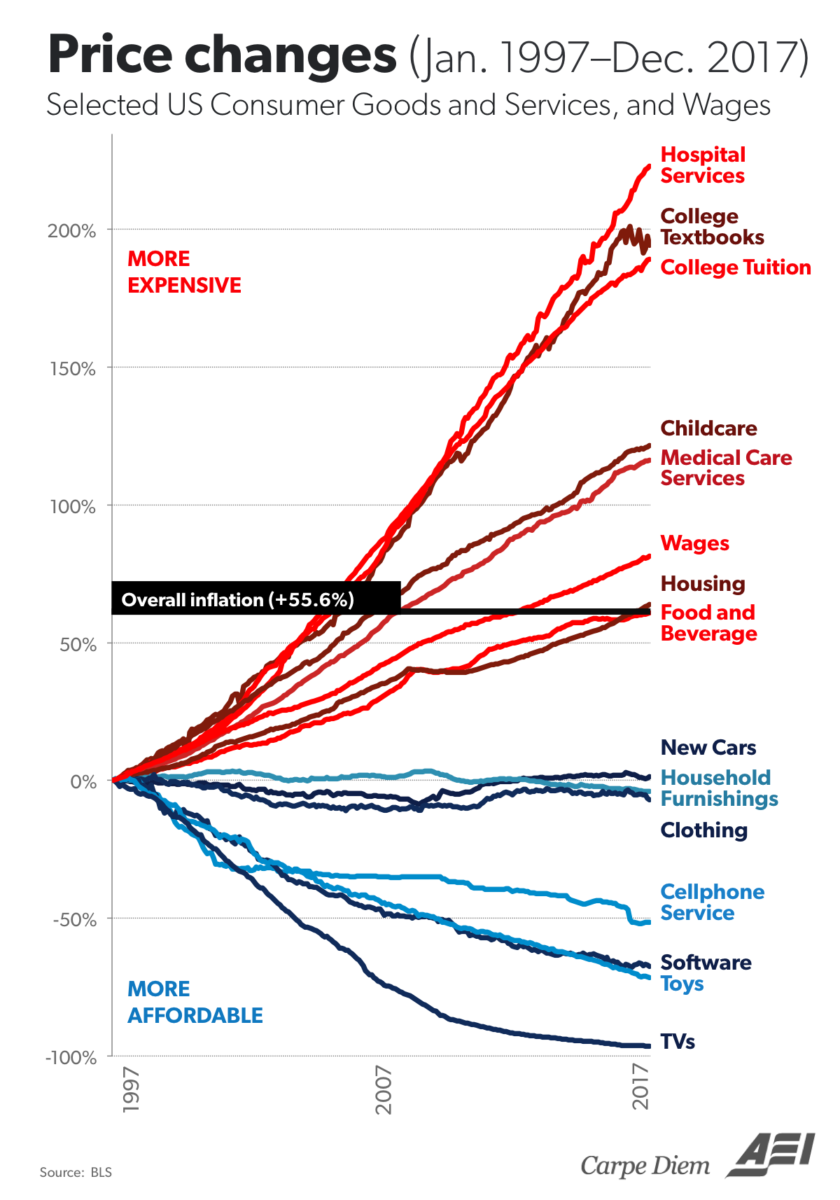

6.Inflation in One Chart…Wages Not a Threat Yet.

To those pinning the recent spike in stock-market volatility on inflation and, specifically, higher wages, Barry Ritholtz of Ritholtz Wealth Management wants you to take a close look at this chart:

http://ritholtz.com/2018/02/price-changes-1997-2017/

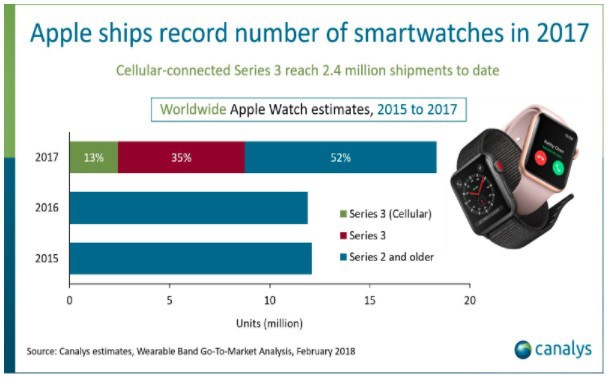

7.Apple sold more watches than Rolex, Swatch, and the rest of the Swiss watch industry combined

Apple is one of the biggest watchmakers in the world. Based on newly available statistics, it now seems certain that Apple outsold the entire Swiss watch industry combined last quarter. The company best known for making iPhones outsold Rolex, Omega, and even Swatch last quarter, combined. That’s according to Apple Watch sales estimates from industry researcher Canalys and IDC, and publicly released shipment statistics from the Federation of the Swiss Watch Industry. Canalys estimates that Apple sold 8 million Apple Watches in the last quarter of 2017. Apple’s been making watches for four years. Switzerland has been making timepieces for centuries. In some ways, the comparison with the entire Swiss watch industry is a testament to Apple’s scale. Some Swiss watches are meant to be luxury pieces, like Rolex watches, which cost tens of thousands of dollars. But other Swiss watchmakers are mass market, like Swatch, with watches that are priced in the same range as the least expensive Apple Watch, at about $180.

More Info techie 8 bits 8bits@techie8.com

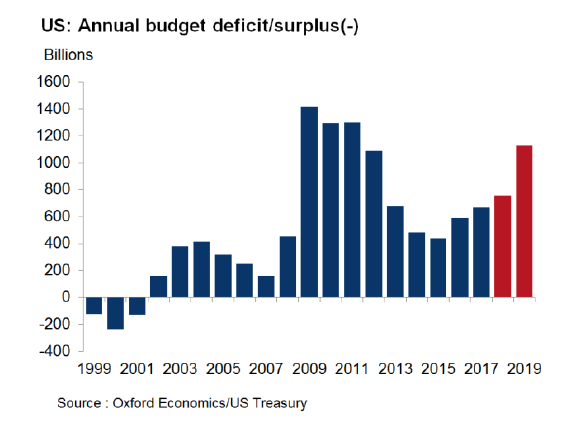

8.Debt to Increase $10 Trillion by 2028.

US Launching Crisis Level Spending

by Tyler Durden

Mon, 02/12/2018 – 16:19

In all the rhetoric over the proposed Trump budget, the Congressional spending bill, and so forth, it is easy to lose track of both the forest and the trees.

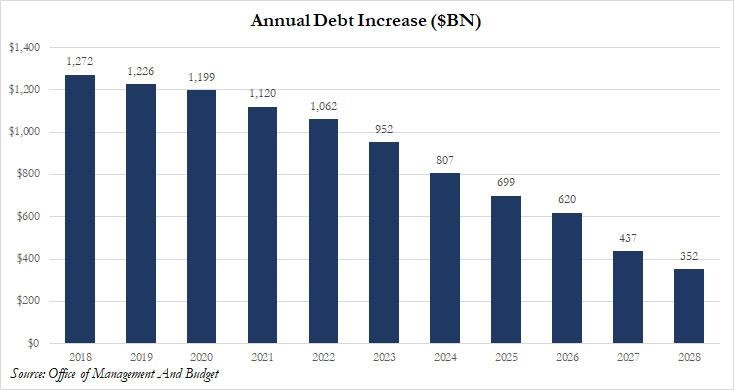

So here, courtesy of of Oxford Economics, is just one chart that shows what is really taking place: starting next fiscal year, the US is unleashing nothing short of “crisis level” spending, with the US deficit in 2019 set to top $1 trillion for the first time since 2012, and approaching the record deficit hit in 2009, when the US was hit by the worst economic crisis since the Great Depression.

But wait, there’s more: it will only get worse from there.

As Oxford Economics reports, after deficit rise sharply in 2019, topping $1 trillion, it gets even worse: “The tax cuts passed late last year, combined with the spending bill Congress passed last week will push deficits sharply higher.”

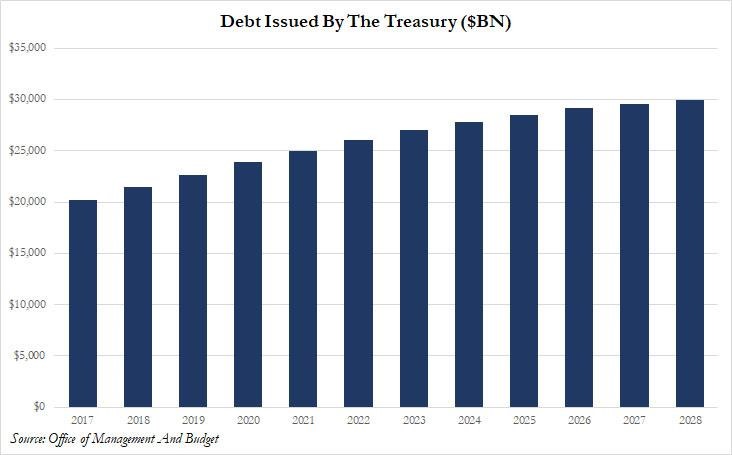

Furthermore, Trump’s own budget anticipates that US debt will hit $30 trillion by 2028: an increase of $10 trillion…

… as a result of $1+ trillion debt (and thus deficit) increases for at least the next 5 years.

To which one wonders: have the words “fiscal conservative” lost all meaning if the US is launching what is clearly crisis level deficits and crisis level spending at a time when the US economy is – allegedly -growing at a healthy pace, and what will

https://www.zerohedge.com/news/2018-02-12/us-launching-crisis-level-spending

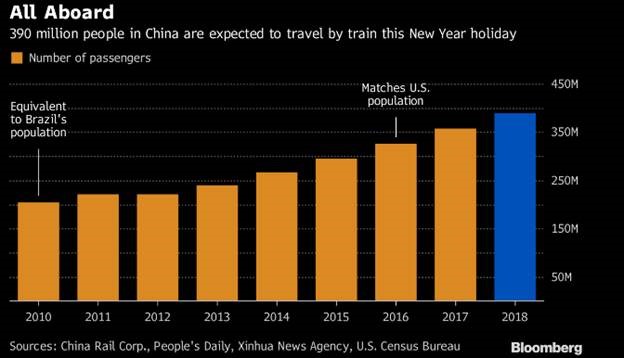

9.390M People will Travel by Train in China 2018.

Dave Lutz at Jones.

Chinese New Year celebrations for the Year of the Dog begin in China and follow across much of Asia, including Hong Kong, Taiwan, Singapore, Malaysia and Indonesia. Chinese mainland markets are closed Feb. 15-21 – China’s New Year Train Traffic More Than U.S. Population notes Bloomberg

10.9 Stoic Practices That Will Help You Thrive In The Madness Of Modernity

When Zeno of Cyprus was shipwrecked and stranded on Athens, he wasn’t expecting any good to happen.

Having lost everything and with not much else to do, Zeno wandered into a bookshop and was quickly absorbed by the teachings of Socrates. After studying with the great philosophers of his time, he decided to impart his wisdom to anyone who would care to listen.

Thus the philosophy of Stoicism was born. Zeno’s teachings would quickly spread and would be adopted by both slaves and kings alike. As he would later joke: “I made a prosperous voyage when I suffered shipwreck.”

But that’s not where the story of Stoicism ends. Centuries later, the philosophy remains as relevant — if not more so — in modern society. These stoic practices will help bring calm to the chaos we face today.

- Develop An Internal Locus Of Control

“Man is disturbed not by things, but by the views he takes of them.” — Epictetus

Much of what happens in life is not within our control. The Stoics recognised this undeniable truth, and focused instead on what they could do.

Born a slave, it would seem that Epictetus had no reason to believe he could control anything. He was permanently crippled from a broken leg given to him by his master. Epictetus would live and die in poverty.

But that wasn’t what Epictetus thought. He would say that even while his property and even his body was not within his control, his opinions, desires, and aversions still remained his. That was something that he owned.

It’s easy to get frustrated today. We’re so used to comfort that even the slightest inconvenience provokes outrage within us. If the internet takes a second longer than it should or if traffic stalls for a minute, the natural instinct is annoyance if not rage.

It isn’t any of these breakdowns that are making us unhappy. The unhappiness stems from the emotional response that we have chosen. The onus is on ourselves to ensure that we don’t let external events affect our internal state of mind.

Once we internalise that, it becomes clear that we have the power to be happy regardless of our circumstances.

- Guard Your Time

“We’re tight-fisted with property and money, yet think too little of wasting time, the one thing about which we should all be the toughest misers.” — Seneca

The Stoics understood that time is our greatest asset. Unlike any of our material possessions, once lost, time can never be regained. We must therefore strive to waste as little of it as possible.

Those who squander this scarce resource on minutia or entertainment will find that they have nothing to show for it in the end. The habit of procrastination and putting things off will come back to haunt us. Tomorrow isn’t guaranteed.

On the other hand, those who give away their time freely to others will also find that they are no better than those who waste it. Most of us allow people and other obligations to impose on our time too easily. We make commitments without giving deep thought to what it entails. Calendars and schedules were meant to help us. We should not become a slave to them.

Regardless of which end of the spectrum we fall into, time is of the essence. We think we have a lot of time, but we really don’t.

- Don’t Outsource Your Happiness

“I have often wondered how it is that every man loves himself more than all the rest of men, but yet sets less value on his own opinions of himself than on the opinions of others.” — Marcus Aurelius

Much of what we do stems from our primal need to be liked and accepted by others. Disapproval from our social group had serious repercussions in the past. It would have likely meant exile and eventually death in the wilderness.

That’s still true to some extent today. But how much time and effort do we spend trying to win the approval of others? What is it costing us?

We spend money we don’t have, to buy fancy things we don’t need, in order to impress someone we don’t care about. Our choice of career or lifestyle is centred around how others perceive us, rather than what is best for us. We are held hostage and pay a king’s ransom every day, with no guarantee that we will ever be free.

In contrast, the Roman statesman Cato sought to lead a life that was independent of the opinion of others. He would wear the most outlandish of outfits and walk in the streets without putting on shoes. It was his way of accustoming himself to be ashamed only of what deserves shame, and to despise all other sorts of disgrace.

That was the only way in which he could stand up to Julius Caesar, whom he recognised was consolidating too much power. It enabled him to make the big decisions when it counted, without fear of disapproval.

We have much to learn from him. Far better for us to live life on our own terms and ignore the opinions of others. Happiness should never be outsourced.

- Stay Focused When Confronted With Distractions

“If a person doesn’t know to which port they sail, no wind is favourable.” — Seneca

Modern-day capitalism has given us an abundance of options.

Whether it’s food, travel, or entertainment, we have far more to work with than our predecessors did. Yet, this hasn’t clearly benefited us. When presented with so many options, we become paralysed by indecision.

This is known as the paradox of choice. Our brains haven’t been able to keep up with modern day advances and are overwhelmed when presented with so much information. Because it’s so difficult to make a choice, the default choice is to maintain the status quo.

It’s one of the core problems we face in our daily lives. With so many options, we never really commit to a path. We either put off making a decision or pursue multiple activities all at once. The result is that we never really make headway into anything at all.

The Stoics emphasised the need for purposeful action. We must take care not to be merely reacting to our circumstances, but to live intentionally.

- Toss Away Ego And Vanity

“Throw out your conceited opinions, for it is impossible for a person to begin to learn what he thinks he already knows.” — Epictetus

One of Epictetus’ biggest frustrations as a teacher was how his students claimed to be want to be taught, but secretly believed that they knew everything.

It’s a pain all teachers know and most of us would recognise. At the heart of it is ego and arrogance. The thought is that we’ve learnt enough and are better than our contemporaries.

Nowhere is such thinking more dangerous than today.

The information of today is not only insufficient for solving the problems of tomorrow but can very well be the obstacle for sharper thinking as well.We are in an age where we’re merely one step away from being disrupted in virtually every industry. Even in ancient times Marcus Aurelius has remarked, “the universe is change, life is an opinion”.

This is why the most brilliant minds of today spend a good portion of their time reading. They understand that there is always wisdom to be gleaned, whether from the past, present, or future.

We would be wise to do the same. Always stay a student.

- Consolidate Your Thoughts In Writing

“No man was ever wise by chance” — Seneca

Of the many things we can do daily, none are as important as looking inward. The act of self-reflection forces us to question ourselves and examine our own assumptions of the world. It’s how the answers to some of the world’s biggest questions have surfaced.

Keeping a journal remains one of the most effective ways for mindfulness. It boosts creativity, increases gratitude, and serves as therapy all at once. The benefits are numerous. Your thoughts and feelings become clearer in writing than in your mind.

The Stoics were well aware of that. The most powerful man in the Roman empire, Marcus Aurelius would dutifully take the time to record his observations and feelings whether at war or in peace. It’s what we know today as Meditations.

While everyone from athletes to entrepreneurs benefit from Marcus Aurelius’ wisdom today, it is clear that the biggest beneficiary of his writing and thinking was himself. The clarity of thought and accountability brought by his journal kept him virtuous when anyone in his position would have likely erred and become a tyrant.

Take the time to journal. It’s not difficult and the rewards are immense.

- Stand Your Ground

“In doing nothing men learn to do evil.” — Cato

In a profession that is often based on compromise, Cato was stubborn and steadfast in his beliefs. He was taught that there were no shades of grey. All virtues were one and the same virtue, all vices the same vice.

It seems like an unreasonably high standard. It’s undeniable that many feats have only been made possible through compromise. Yet it seems that the pendulum has swung too far today: we forgo our principles in the name of tolerance or for profit.

Cato infuriated both his political allies and enemies for his sheer refusal to compromise. He demanded that his friends and family adopt the same stance, without leaving room for any flexibility. But adherence to this impossible standard also earned him unshakable authority. By default, he became Rome’s moral arbiter of right and wrong.

We can’t all be like him, but there is a lesson to be learnt. If you stand for nothing, you’ll fall for everything.

- Imagine The Worst That Could Happen

“Nothing happens to the wise man against his expectation” — Seneca

Much has been said about the power of positive thinking in recent times. We are taught that optimism and affirmations are the key to leading a happier life. But that’s not what the Stoics believed.

They felt that this practice invited passivity into our daily lives. It encourages us to simply hope for things to get better instead of taking concrete action. Rather than deny the harsh realities of life, they decided to embrace it.

They regularly conducted an exercise known as premeditatio malorum, which translates to a premeditation of evils. The goal was to imagine the worst events that could possibly happen to them. For some, it was a loss of reputation. To others, it was financial ruin and poverty. But common to all was the eventuality of death.

What would things look like if everything went wrong tomorrow?

How would I cope with that situation?

Should this change the way I live today?

These were some of the questions they asked themselves. The exercise never failed to yield valuable rewards. The Stoics took cautionary measures to ensure that the undesirable outcome would not eventuate. Even when it failed, they lived better for they had contemplated how they would weather the adversity they were faced with.

We should be brutally honest with ourselves and never be afraid to confront reality. That is the best way we can prepare for success and be ready for failure.

- Remember That Nothing Endures

“Alexander the Great and his mule driver both died and the same thing happened to both.” — Marcus Aurelius

In the grand scheme of things, none of what we’ve achieved matters.

It’s a sobering thought. We all experience the world like we are at the centre of reality. That creates an illusion where our importance is inflated. We see ourselves as the protagonist in our own story.

But the truth is this perception exists only in our minds. Everyone around us walks around with a similar mindset, but each of us are insignificant in the long run. Even the brightest minds such as Edison and Newton would eventually be relegated to a footnote.

There is no need for us to conform to irrational expectations and external pressures. Neither do we need to chase accomplishments in the hope of building a legacy. None of us these things last.

All that matters is we live life on our own terms. It is the only way we can truly say that we have lived a good life.