1.Mega Caps Continue to Rule

S&P Equal Weighted Relative Strength Roll Over.

https://blogs.wsj.com/dailyshot/

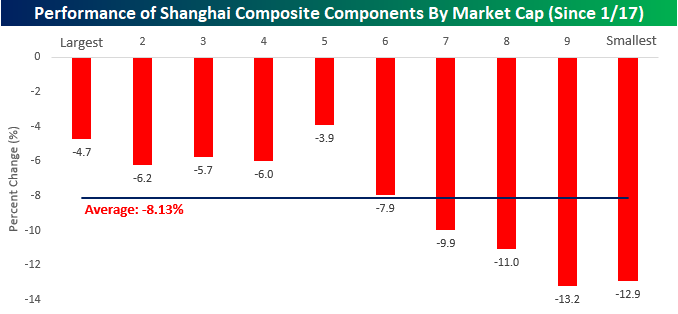

2.Chinese Stocks Holding Up Better Than Expected But Also Large Cap Based.

Chinese Stocks Diverge Based on Market Cap-Bespoke

Just like in the US where large caps have been outperforming their smaller-cap peers recently, we’re seeing signs of the same trend playing out in the Chinese equity market as well; especially since the recent highs in January. For starters, though, it’s pretty amazing to think that China’s Shanghai Composite Index is down just 7% from its recent highs. With a large percentage of the country’s citizens virtually under house arrest and many businesses and factories across the country closed, a 7% decline seems like a walk in the park. Admittedly, those declines were a lot steeper at this time last week, but the magnitude of the bounce, even if it was aided by government stimulus, is impressive.

While the Shanghai Composite is down just 7%, the average stock in the index is down a full percentage point more at 8.13%. Looking at how stocks have performed based on market cap shows that there has been a clear relationship between size and performance. The chart below shows the average performance of the approximately 1,500 stocks in the Shanghai Composite Index since the close on 1/17 grouped by decile according to market cap. While the decile of the largest stocks in the Shanghai Composite is down less than 5%, the three deciles with the smallest components are all down 11% or more.

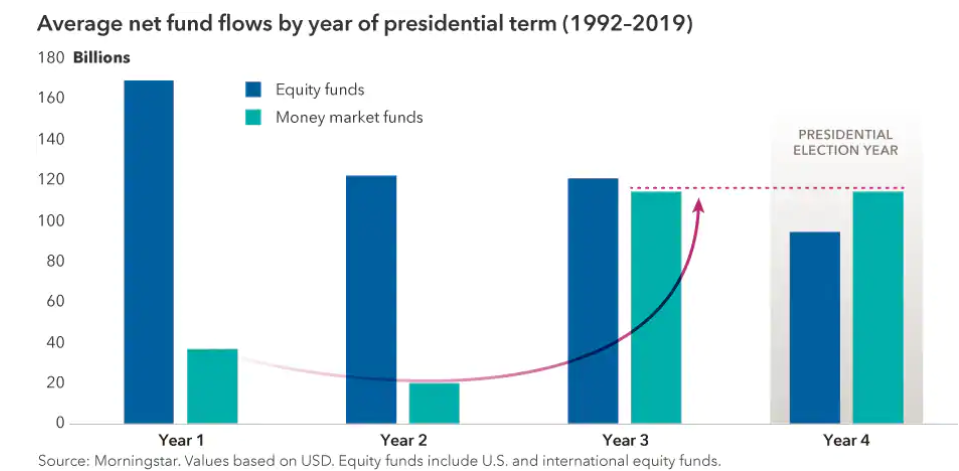

3.Average Net Fund Flows by Presidential Term….Year 4 Sees Defensive Flows into Cash.

Your top 6 investing questions for 2020 answered-Capital Ideas Blog https://www.thecapitalideas.com/articles/top-investing-questions-answers

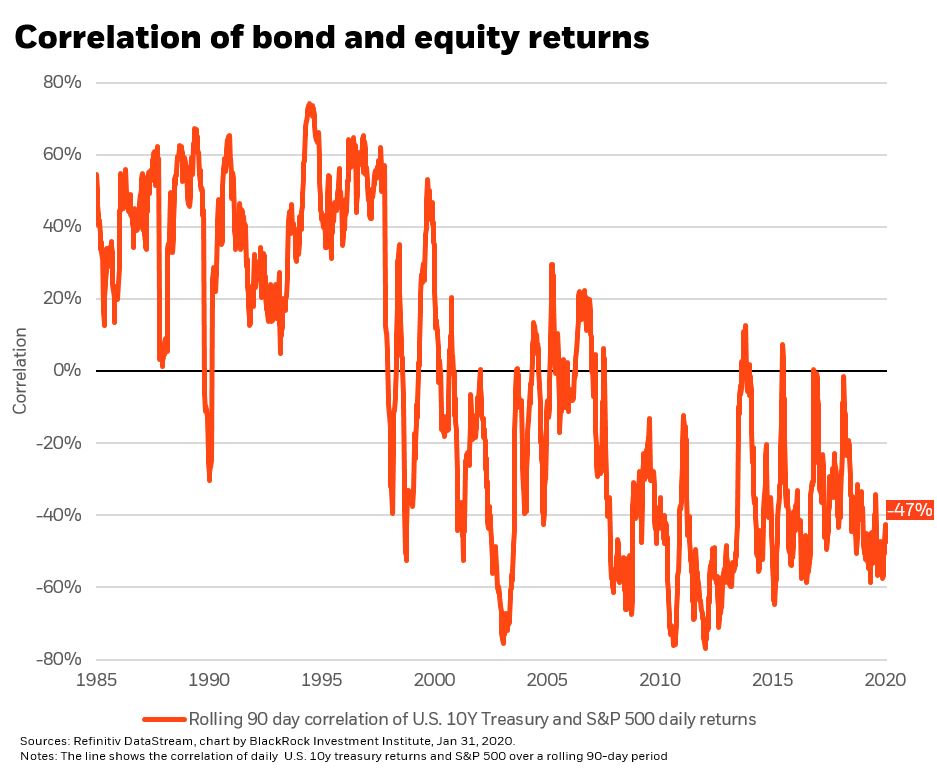

4.Investors Holding Bonds To Offset Stock Volatility.

Blackrock Blog –Conversely, and the real reason for holding bonds, if stock volatility returns Treasuries are likely to rise and yields will drop even lower. Despite all the anxiety about low bond yields, stock bond correlations remain very negative. In other words, bond prices still tend to rise, and yields fall, when stock prices drop (see Chart 1).

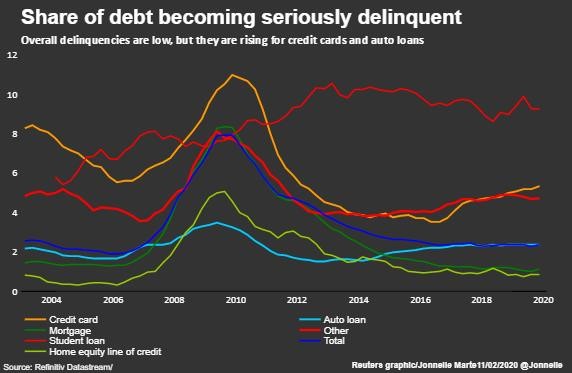

5.Share of Debt Becoming Seriously Delinquent

U.S. household debt tops $14 trillion and reaches new record–Jonnelle Marte https://www.reuters.com/article/us-usa-fed-household-debt/u-s-household-debt-tops-14-trillion-and-reaches-new-record-idUSKBN20521Z?utm_source=morning_brew

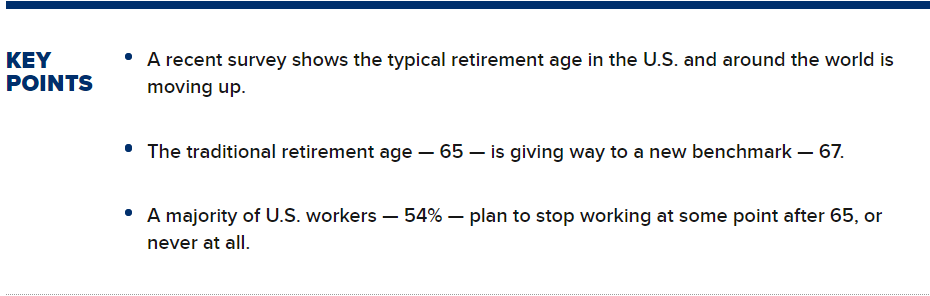

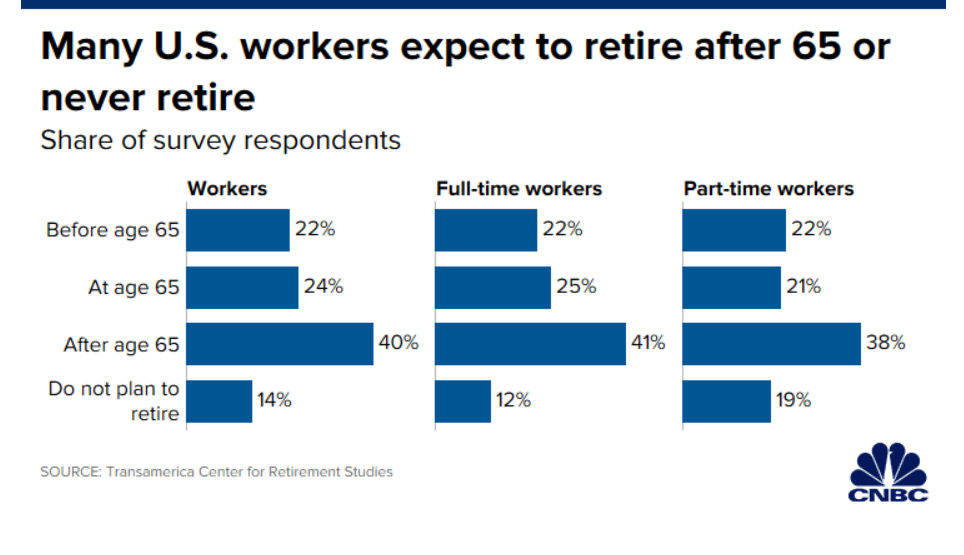

6.U.S. Workers Retirement Age.

This age could be the new benchmark for retirement Lorie Konish https://www.cnbc.com/2020/02/11/this-age-could-be-the-new-benchmark-for-retirement.html?__source=twitter%7Cmain

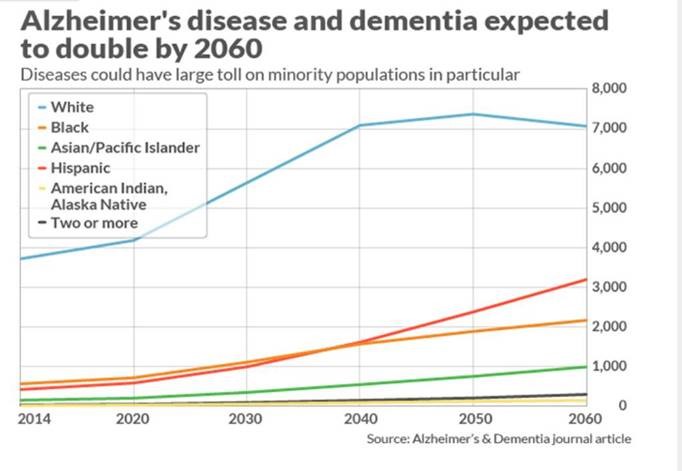

7.Alzheimers Disease Update

The Morning Brew

| The uphill climb to treat Alzheimer’s disease got even steeper yesterday. Drugs from Eli Lilly and a Roche subsidiary disappointed in a highly anticipated trial that averaged up to five years. The results were “really crushing,” principal investigator Dr. Randall Bateman told the NYT. Neither of the drugs slowed cognitive decline in the 104 trial participants who took medication. The participants all have a rare genetic mutation that essentially guarantees they’ll develop Alzheimer’s in their 30s–50s. After the trial, Bateman admitted there is no way to treat patients with the mutation. His team doesn’t have a quick way to notify the volunteers of the results, either. Scientists will keep trying. In October, Biogen shocked the medical community by reviving aducanumab, an Alzheimer’s drug it had shelved months earlier. The next step is submitting the treatment for regulatory approval. Zoom out: In 2018, Alzheimer’s affected about 5.7 million people in the U.S. Current treatments only ease symptoms temporarily; they do not slow memory loss or the deterioration of thinking skills. https://www.morningbrew.com/ |

8. 9 Things to Know about the Effects of Scarcity

How scarcity can change the way you feel and act.

Economics is the study of how we use our scarce resources — like time and money — to achieve our goals. At the core of economics is the idea that “there is no free lunch” because we “can’t have it all.” To obtain more of one thing, we give up the opportunity of getting the next best thing. Scarcity is not just a physical limitation. Scarcity also affects our thinking and feeling.

1. Setting priorities. Scarcity prioritizes our choices and it can make us more effective. For example, the time pressure of a deadline focuses our attention on using what we have most effectively. Distractions are less tempting. When we have little time left, we try to get more out of every moment.

2. Trade-off thinking. Scarcity forces trade-off thinking. We recognize that having one thing means not having something else. Doing one thing means neglecting other things. This explains why we overvalue free stuff (e.g., free pencils, key chains, and FREE shipping). These transactions have no downside.

3. Unfulfilled desires. Restriction on desirable things orients the mind automatically and powerfully toward unfulfilled needs. For example, food grabs the focus of the hungry. We will enjoy our lunch more for being deprived of breakfast. Literally, hunger is the best sauce.

4. Mentally depleted. Poverty taxes cognitive resources and causes self-control failures. When you can afford so little, so many things need to be resisted. And resisting more temptations depletes willpower. This explains why poor people sometimes struggle with self-control. They are short not just on cash but also on willpower.

5. Mental myopia. The context of scarcity makes us myopic (a bias toward here and now). The mind is focused on present scarcity. We overvalue immediate benefits at the expense of future ones. We procrastinate important things, such as medical checkups or exercising. We only attend to urgent things and fail to make small investments, even when the future benefits can be substantial.

6. Scarcity marketing. Scarcity is the feature that increases the perceived value of a product. Many stores strategically create a perception of scarcity to motivate impulse buying. For example, the pricing practice of limiting the number of items per person (e.g., two cans of soup per person) can lead to increased sales. The sign implies that the items are in short supply and shoppers should feel some urgency about stocking up. The fear of missing out can have a powerful effect on shoppers.

7. Forbidden fruit. People desire more of what they can’t have. Scarcity functions like an obstacle to goal pursuit, which intensifies the value of the goal. For instance, warning labels on violent television programs, designed to decrease interest, often backfire and increase the number of people who watch the program. Sometimes people want things precisely because they cannot have them: “The grass is always greener on the other side.”

8. Playing it cool. The scarcity effect explains why coyness often is considered an attractive attribute. Playing hard to get is a most effective strategy for attracting a partner, especially in the context of long-term love (or the marital) in which a person wishes to be sure of their partner’s commitment. A “hard to get” player likes to appear busy, create intrigue, and keep suitors guessing. As Proust noted, “The best way to make oneself sought after is to be hard to find.”

9. Focus on more meaningful activities. Scarcity can also liberate us. Scarcity contributes to an interesting and meaningful life. When time is limited, goals related to deriving emotional meaning from life are prioritized. Midlife often intensifies the feeling that there is not enough time left in life to waste. We overcome the illusion that we can be anything, do anything, and experience everything. We restructure our lives around the needs that are essential. This means that we accept that there will be many things we won’t do in our lives.