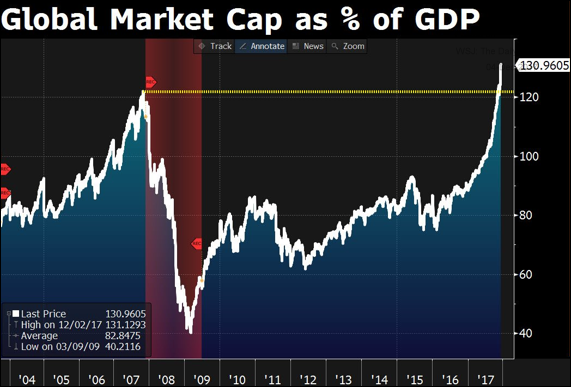

1.Global Stock Market Cap as a % of GDP

The daily shot blog https://blogs.wsj.com/dailyshot/2017/12/04/the-daily-shot-sector-rotation-accelerates-as-investors-play-the-tax-game/

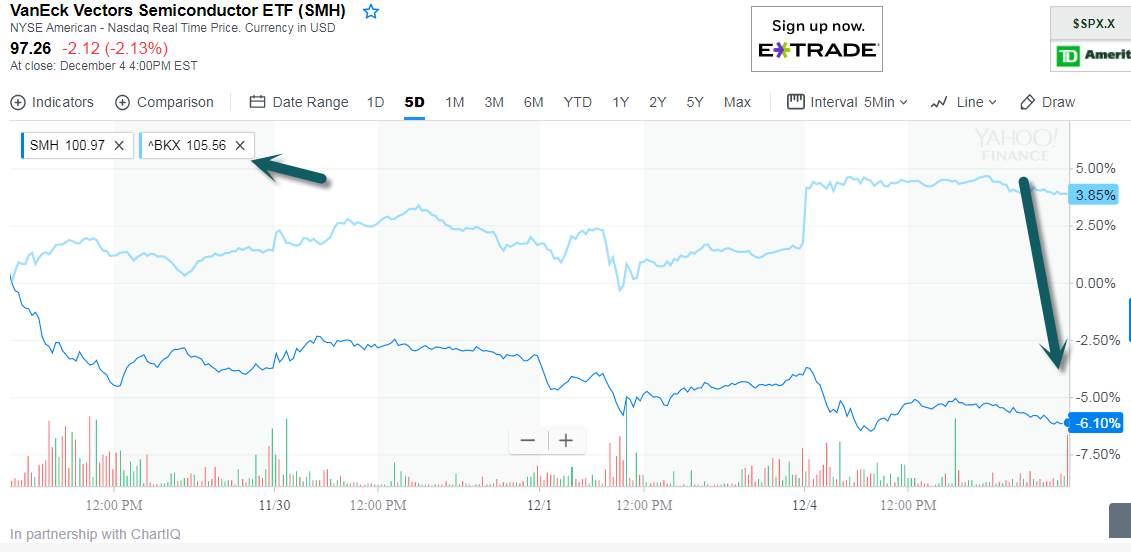

2.Major Sector Rotation this Week

2017 Leading Tech Sector Semiconductors breaks 50 day on heavy volume (second arrow)

SMH Semiconductor ETF

5 day chart…Semiconductors -6% vs. Banks +5%

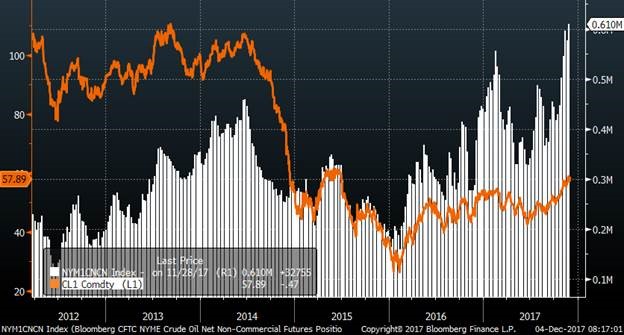

3.Hedge Funds Go All In on Crude Oil Bet

Hedge funds hike bullish bets on US crude to highest on record last week. Trouble ahead? Looks Painful when the positioning (White) reaches extremes

From Dave Lutz at Jones Trading

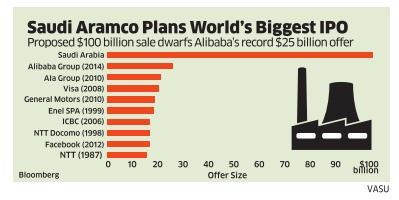

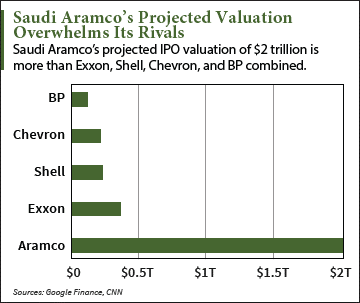

4.Saudi’s Need to Prop Up Oil Price and Slap Aramco on Tape.

Aramco Biggest IPO Ever?

Bigger than BP Chevron and Shell Combined.

City of London heavyweights fly to Saudi Arabia in battle to secure slice of Aramco’s $2 trillion IPO

- Will Martin

- An unnamed senior executive from the London Stock Exchange is holding meetings in Saudi Arabia this week.

- They will accompany the City of London’s Lord Mayor, as well as executives from PwC and Standard Life Aberdeen.

- The trip is believed to be part of the City’s attempts to attract the IPO of Saudi Aramco to London.

http://www.businessinsider.com/saudi-aramco-ipo-london-city-executives-meeting-2017-12

5.Oil Volatility Index Making New Lows.

Saudis want calm energy tape for IPO….Right now, it is working. Oil volatility making historical lows.

OVX-oil volatility index

6.Strong Like Bull.

Dec 4, 2017

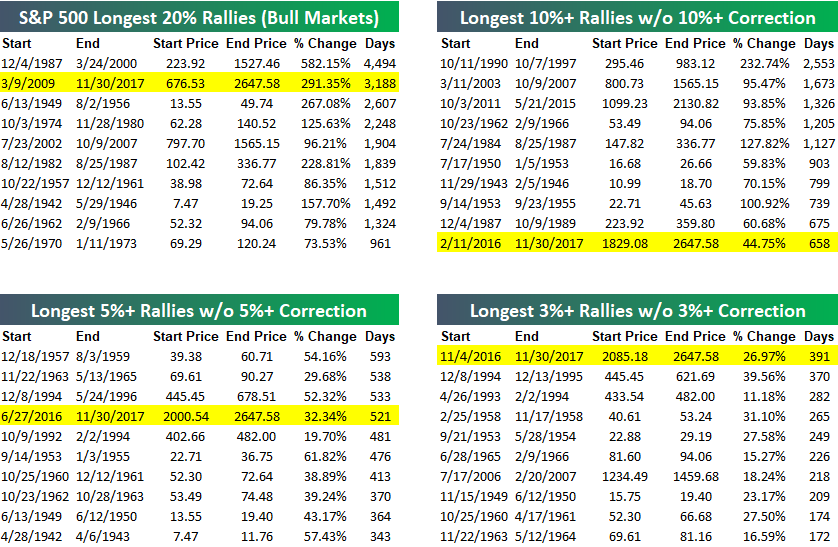

Despite a seemingly endless number of events that investors could easily use as justification to take profits, US equities just keep marching higher. While the magnitude of the gain this year has been far from record-breaking for a calendar year, the consistency has been without precedent by some measures. The tables below from our most recent Bespoke Report serve as an example of how Teflon the market has seemingly become as the S&P 500 is in its second-longest bull market, the tenth longest streak without a 10% correction, the fourth longest run without a 5% decline, and the longest rally ever without even a 3% decline. At some point the market’s luck will run out, but betting on when that will be has been tough on the wallet so far.

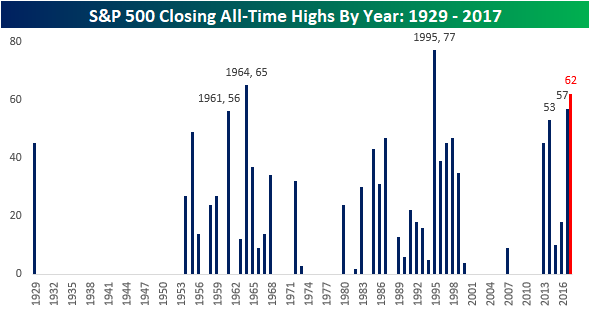

With the S&P 500 showing steady gains throughout the year, it seems a day doesn’t go by where we aren’t seeing new record highs. The chart below shows the number of all-time record closing highs for the S&P 500 on an annual basis since 1929. With 57 records (not including today) so far this year, 2017 ranks as the third most all-time closing highs for a calendar year behind 1995 (77) and 1964 (65). Unfortunately, with 19 trading days left in the year, it is now mathematically impossible for this year to overtake or even tie 1995’s 77 record highs, but 1965’s total of 65 is still within reach. Even that, though, will be tough as eight of the year’s final 19 trading days would need to be record highs to just tie for second all time. If the final few weeks of 2017 simply keep up the current pace of the first eleven months of the year, 2017 would finish with a total of 62 all-time closing highs. Still not a bad total by any stretch.

https://www.bespokepremium.com/think-big-blog/

7.China Online Shopping Days Dwarf Cyber Monday and Black Friday.

We just closed the books on the biggest online shopping day in U.S. history.

Cyber Monday hauled in $6.6 billion in sales, up nearly 17% from last year.

And the online shopping day’s margin of victory over Black Friday e-commerce sales increased to more than $1 billion.

Black Friday online sales came in at just over $5 billion – once again notching a short-lived record. Meanwhile, Thanksgiving saw online sales increase to $2.87 billion.

But these numbers are nothing compared with those of the world’s largest online shopping day… an anti-holiday that is ballooning at an eye-popping pace.

China’s November 11 “Singles Day” celebration dwarfs anything the U.S. could ever hope to produce.

This year, Singles Day sales topped $1 billion in the first two minutes.

And the two biggest winners – Alibaba (NYSE: BABA) and JD (Nasdaq: JD) – raked in more money in one day than was spent online in the U.S. during Cyber Week.

Alibaba’s Singles Day sales hit a record $25.3 billion. JD came in second at $19.1 billion.

To put that in perspective, Alibaba’s revenue – just for Singles Day – was more than the market caps of American Eagle Outfitters (NYSE: AEO), Kohl’s (NYSE: KSS), Macy’s (NYSE: M) and Nordstrom (NYSE: JWN) combined.

And total spending on Singles Day this year increased 40% year over year.

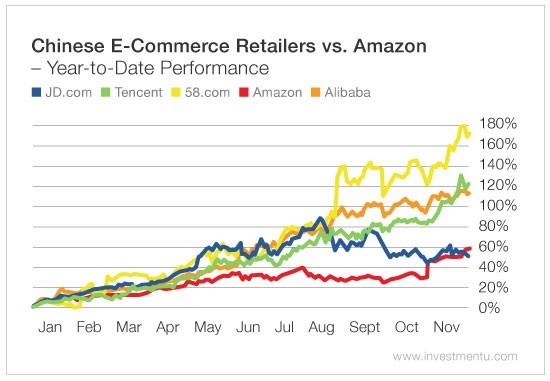

But, just like in the U.S., this online shopping holiday is demonstrating a dramatic shift in consumer attitudes. And we’ve seen shares of Alibaba, Tencent (OTC: TCEHY), 58 (NYSE: WUBA) and others perform substantially better than Amazon’s (Nasdaq: AMZN)…

8.We Talked About Nasdaq Volatility Finally Popping Now Small Cap

RVX small cap stock volatility rallying.

9.The 12 Signs a Cheap Stock Is a ‘Value Trap’

Stocks that look cheap may never substantially rebound.

by

Nicholas Colas

The historically high price-to-earnings ratios being placed on equities today make cheap stocks even more alluring. That makes sense, but be advised that the market is littered with “value traps” — stocks that look cheap but never substantially rebound.

Any way you cut it, value is profoundly out of favor, and not just in 2017. Although proponents of these investments typically are patient people, the long-term differential is large enough to be worrisome. Over the last 10 years, growth has outperformed value by more than 100 percent in small caps and by 50 percent in large caps.

Take General Electric, for example. The company’s shares are down 42 percent since the beginning of the year. Its price/earnings ratio is down by a similar amount in that period. And as we analyzed the growth/value performance data across the board, it became clear that the problem goes a lot deeper than just one company.

The Russell 1000 Growth Index is up 27 percent for the year, while the Value Index is only 7 percent higher; the Russell 2000 Growth index is up 19 percent, but the Value Index version is only 5 percent higher; the S&P 500 Growth Index is up 24 percent, but the Value Index is up only 8 percent.

So, here is how to tell if you own a value trap:

No. 1: The company is at the peak of an operating cycle and is still troubled. After more than seven years of economic recovery, most public companies should be showing strong earnings. If they are not, something else is wrong. One legitimate exception: commodity-sector companies such as oil and gas.

No. 2: Management compensation structures haven’t changed as the stock has declined or underperformed. If earnings (and/or the stock price) have declined but management pay structures haven’t adapted to address that problem, fundamental changes of behavior in the C-suite are unlikely.

No. 3: The company or industry dominates a smaller U.S. city. Managers have to live somewhere, and if that location is full of like-minded people, then change is harder to execute. As one example, in the early 1990s the chairman of General Motors thought of moving the company headquarters to Geneva. That might have helped bring fresh thinking.

No. 4: The business keeps losing market share. Value traps often occur with companies that are ceding ground to new competition. Until market share trends higher, the stock seldom does.

No. 5: There are other powerful stakeholders. Unions and governments hold real sway in many large public companies, for example. But if return on shareholder capital has to fight with other entrenched interests, the pace of change will be slower.

No. 6: The capital allocation process isn’t changing fast enough or is unclear. The funny thing about many value traps is that they still have decent current free cash flow. The “trap” comes from not using that capital efficiently to reinvigorate the business. By definition, the old ways of allocating capital don’t work any more. So what is management doing differently, and how is that change outlined to shareholders?

No. 7: The company isn’t changing how it evaluates line managers. This one is deep in the weeds, but it is important. For a company to escape “value trap” status, it has to change its operational DNA. And that means pushing those changes down to the operating level where customers see the difference.

No. 8: Management’s near-term goals are not achievable, and/or managers have failed at the majority of prior-year goals. Value stocks are a good investment when operational results improve according to a predetermined management plan. That’s when markets start to build in a better valuation multiple. But if management sets out unrealistic goals, even modest improvement doesn’t get that bump. That’s why “underpromise and overdeliver” is so important.

No. 9: The company has more financial leverage than it can sustain through a multiyear turnaround. Debt is the actual trigger for the most deadly value traps, snapping shut before management can turn things around. This can come in many forms, including working capital requirements, leases and short-term refinancing.

No. 10: The strategic vision is cloudy. Value traps almost always suffer from fuzzy management strategies. If the whole thing — financial analysis included — doesn’t fit on one page, it probably won’t work.

No. 11: The chief executive and chairperson of the board are the same person. Ask any CEO how much time managing their board takes, and the number will likely be 25 percent to 40 percent of their day. Deeply entrenched value traps are by their nature corporate turnarounds, whether the boss realizes it or not. They need 100 percent of senior management attention.

No. 12: Even activist investors stay away. In the end, any good value story with non-lethal problems should attract activist shareholders. If it doesn’t, you can scratch an important catalyst off the list.

https://www.bloomberg.com/view/articles/2017-11-30/the-12-signs-a-cheap-stock-is-a-value-trap\

10.7 Principles for Healthy and Sustainable Success

I recently met Dave Meltzer, the CEO of Sports 1 Marketing at the NYC Business Expo. Meltzer is a public speaker and author of the bestsellers “Connected To Goodness” and “Compassionate Capitalism.” He went from being a millionaire in his twenties, a multi-millionaire in his thirties to being bankrupt. Today, he shares his principles for sustainable and healthy success.

7 principles for healthy and sustainable success:

- Gratitude

Dave said to me “Say Thank You every morning and every night before you go to bed for 30 days straight. I bet most people can’t do it. And yet gratitude is the one thing that makes your past brilliant, your present happy and your future bright.”

Trading your expectations for gratitude is one of the most important components of reducing stress and anxiety. It helps the brain to focus on what’s working well and therefore see and create more opportunities. Typical of high-achievers is an over critical approach to life and business, which on one hand brings them to a certain level of success but on the other hand robs them from a good quality of life.

- Empathy/Forgiveness

In Dave’s own words, he said,“There are so many mistakes being made being an innovator. It’s something that can’t be avoided. You have to forgive yourself to be happy and if you can’t forgive yourself then there is no way you’re able to forgive others.”

Being able to let go of past failures is key to moving forward and being fully focused on present challenges and possibilities. Holding on to things you regret or holding a grudge takes away mental space. Forgiving others and yourself is deeply connected with emotional intelligence and understanding why a certain action was taken – or not, and developing empathy.

- 3.Accountability

Dave had this to say about accountability: “You have to take responsibility for your life no matter what happens. If you are accountable you are in control. Ask yourself: What did I do to attract this situation in my life and what can I learn from it.”

The ego loves to blame others and outer circumstances for things that went wrong. Funnily enough it also loves being responsible for good results whenever possible. Leveling up your game in life and business starts with realizing that you are 100% responsible for the outcomes you create. That means to realize that you’re in control, which gives you the chance to change situations, take actions and turn things around.

“Accountability breeds response-ability.” – Stephen Covey

- Enjoying the pursuit of your potential equals happiness

According to Dave, “It’s not about the outcome you produce, it’s about the pursuit of the potential you have that brings you fulfillment in business and in your personal life.”

No outcome will ever satisfy you if the way there didn’t challenge you. Challenges make you grow, learn, go beyond your comfort zone and develop you into a newer and better version of yourself. Only reaching goal after goal on the search for fulfillment while feeling miserable between achievements will set you up for misery. Happiness lies in the pursuit, not in the outcome.

- Detach you happiness from the outcome

Dave said to me, “Success is not black and white. Learn to detach yourself from the outcome and enjoy the process.”

High-Achievers love to measure their results and have the tendency to tying their worth and outcomes closely together, which puts them on an emotional rollercoaster. Focus on your efforts and how you can congratulate yourself on them.

- Good enough

In Dave’s own words, he said, “Ask yourself what you are trying to prove to yourself or the world through all the successes and goals you’re reaching. Do you feel unworthy or not good enough when you don’t create results?”

High-Achieving leaders often have the need to be accepted and approved of. If mediocrity is not an option for you, then ask yourself where your drive is coming from and if that reason serves you or is standing in your way of living a fulfilled life.

“The summit is what drives us, but the climb itself is what matters.” – Conrad Anker

- Ego

According to Dave, “Our ego needs to be right. Our ego wants us to feel superior. It needs to feel separate and get recognition. Working on dissolving the ego creates more connection with others, the world around us and let’s us be driven by passion instead of fear and force.”

In order to discover more fulfillment, happiness and emotional well-being you need to switch your approach and go beyond reaching success! If you want to create resilience, sustainable performance and thrive, you have to let go of the idea that the outcomes you produce are making you happy.

Detach yourself from the result and enjoy the pursuit of your potential. Life is about experiences. Stop letting your ego stand in your way of feeling content and focus on how you can be grateful of your past, present and future. Gratitude is the feeling you want to carry with you no matter what. It’s the very feeling that makes you feel alive.

Which one of these principles do you need to work on? Let us know your response in the comments below!

https://addicted2success.com/success-advice/7-principles-for-healthy-and-sustainable-success/