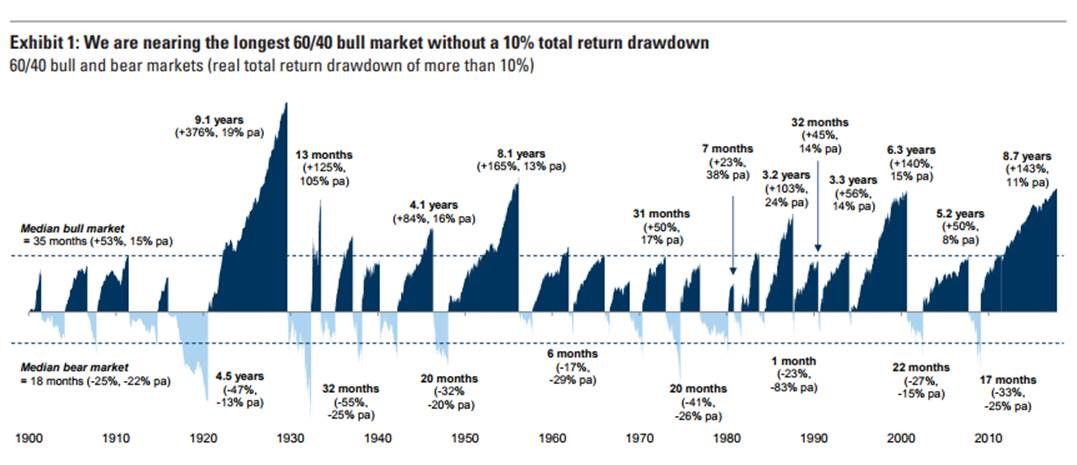

1.Nearing a Record Streak without a 10% Correction in the 60/40 Portfolio.

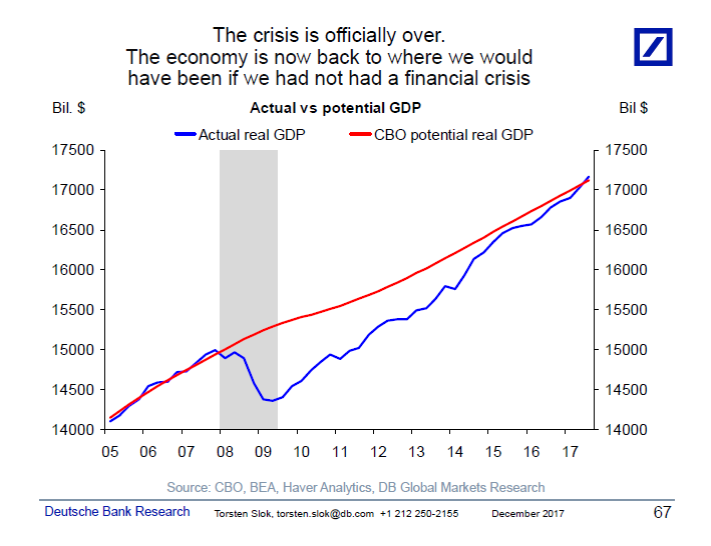

2.The Economy is Operating at Full Capacity.

I Trust Torsten Slok The Economy is Operating at Full Capacity.

One very important difference between an economics education and a finance education is that economists, and hence also the Fed, tend to think not only about growth in production but also about where production is relative to full capacity. In finance you want companies to grow, but in macroeconomics, you need to worry about where the level of production is relative to full capacity because once the economy hits full capacity, then companies and workers begin to have pricing power – demand is outstripping supply – and hence inflationary pressures start to appear.

The latest GDP data shows that the US economy is now operating at full capacity as estimated by the Congressional Budget Office, see chart below. In other words, the crisis is officially over, and economic activity is at a level where it would have been if we had not had a financial crisis. In fact, the chart below is the entire reason why the Fed is raising rates; because as actual GDP continues to move above potential GDP inflationary pressures will continue to intensify.

So next time someone tells you that “nothing is new,” and “inflation will never go up,” and “the Fed will not be able to raise rates,” then show them this chart and tell them that the economy is now operating at full capacity and when companies are operating at full capacity and full employment that is when companies and workers will get pricing power, and that is when you should begin to worry about inflation moving higher.

With this backdrop it makes sense that rates have been low for the past nine years; companies and workers had no pricing power and as a result there was no inflation. But now that production and employment have finally moved above potential it makes sense to conclude that rates will not stay at these low levels forever. This is really what the FOMC is trying to tell markets every time they issue a statement or give a speech.

Torsten Sløk, Ph.D.

Chief International Economist

Managing Director

Deutsche Bank Securities

60 Wall Street

New York, New York 10005

Tel: 212 250 2155

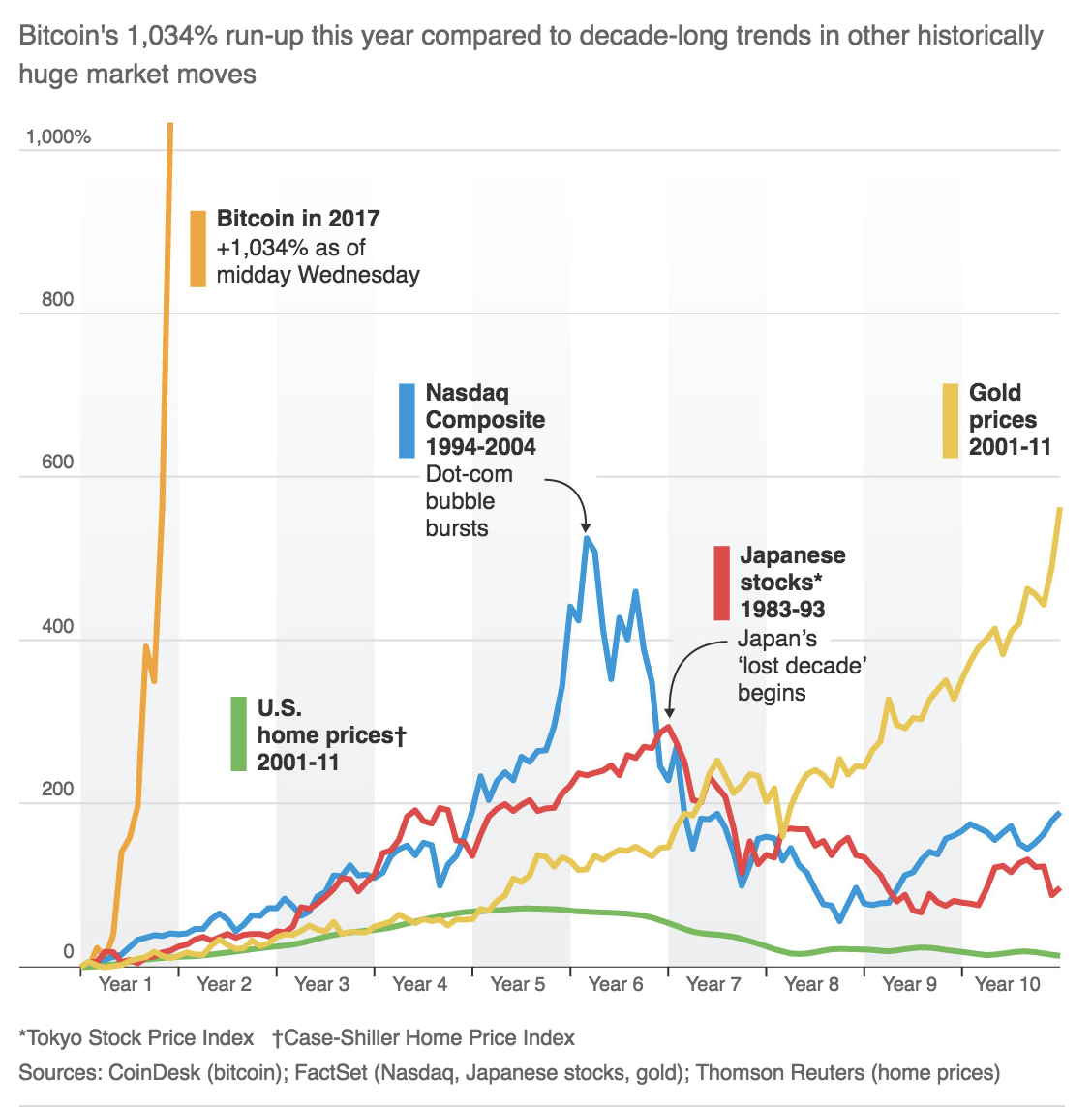

3.Bitcoin Versus Past Bubbles.

4.Pharma Has Lagged YTD…Repatriation Positive for Big Pharma?

WSJ

Among the biggest beneficiaries of the proposal: pharmaceutical companies, which have accumulated billions of dollars in overseas profits in low-tax countries, meaning they could incur big tax bills under current law if the proceeds are brought to the U.S. Amgen Inc., for example, has kept about $39 billion in cash overseas, while Pfizer Inc. has $22 billion and Merck & Co. has $20 billion, according to Credit Suisse analysts. Once freed up for U.S. use, most of those profits will likely be used for either acquisitions or buybacks, the analysts predict.

PPH Big Pharma ETF….S&P +19% vs. PPH +11% 1 year return.

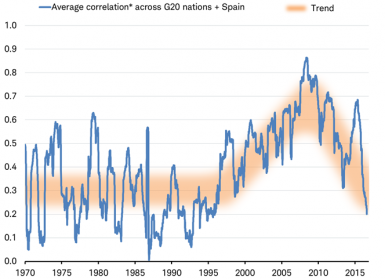

5.Global Stock Market Correlation Lowest in 20 Years.

Diversification offers best value in 20 years

With stock markets valued fairly relative to how they perform there is little reason not to be globally diversified. From a diversification perspective, there hasn’t been a better time in 20 years to be globally diversified. The trend in correlation among countries has fallen to the lowest levels since the mid-1990s, as you can see in the chart below. Many investors have never seen this low correlation before in their investing lifetimes.

Global stock market correlation lowest in 20 years

*Daily one-year rolling correlation of one month percent change in MSCI indexes for countries in G20 and Spain. Source: Charles Schwab, Factset data as of 11/20/2017.

It’s not too late to buy. Valuations support a globally diversified portfolio offering the best diversification benefits in 20 years.

https://www.schwab.com/resource-center/insights/content/are-stocks-too-expensive

found at The Big Picture http://ritholtz.com/2017/12/10-friday-reads-43/

6.Transports Spike 7% into Holiday Season….Positive Economic Sign.

Wages finally moving higher, savings rate moving lower and ecommerce exploding…..All positive for transport stocks.

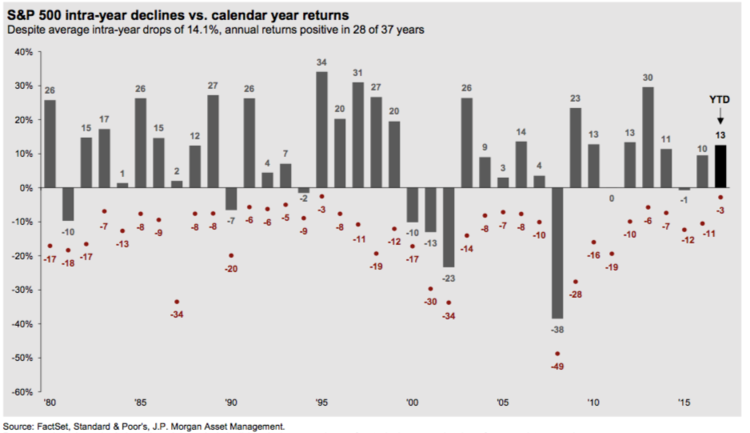

7.History of S&P Drawdowns….2017 is an Outlier.

The chart above highlights the calendar year return for the S&P 500 along with the intra-year decline for the index. In essence, it shows that markets have generally closed each calendar year in positive territory, but have also experienced, on average, a 14% decline in any given calendar year. The market rewards investors who are patient, but it does test their mettle on a regular basis. 2017 has been the exception to that rule, with the market only experiencing a 3% correction this year, so far.

From Wharton Hill Advisors.

https://www.whartonhillia.com/viewpoints/2017/12/1/viewpoints

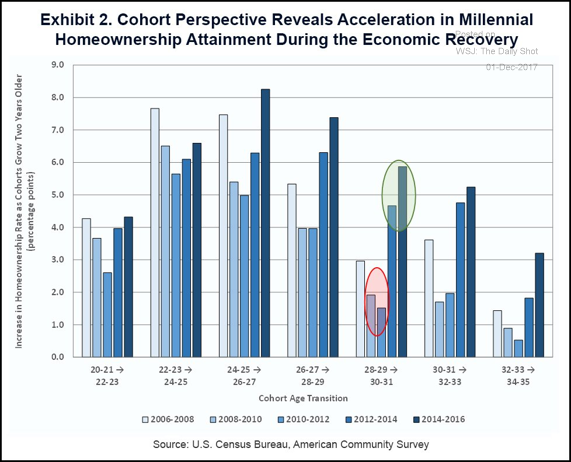

8.Millennials Ready to Start Buying Homes…Tight Supply and Declining Affordability

The United States: Millennials are buying homes later in life, but they are starting to embrace home-ownership. However, tight housing supplies and declining affordability could slow this trend.

Source: @ALROnHousing, @FannieMae; Read full article

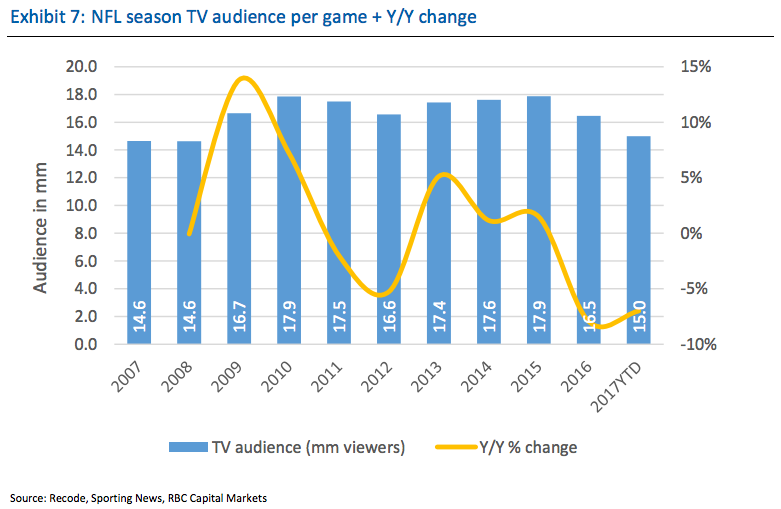

9.NFL Viewership Lowest Since 2008…Drops from 16.5m to 15m year over year.

Sinking NFL viewership is threatening to crush ad sales

TV ratings for the National Football League have declined in each of the past two seasons.

- RBC Capital Markets says that this is going to hurt ad sales as investors shy away in an increasingly competitive landscape.

When it comes to TV ratings, the National Football League needs a Hail Mary.

Average game viewership has fallen to 15 million this season, down from 16.5 million last year, and the lowest since 2008, according to data compiled by RBC Capital Markets.

The firm also finds that the league’s audience is down on a year-over-year basis, and notes that it hasn’t seen meaningful growth since 2013, when the measure climbed 5%. RBC says this has had an adverse effect on how advertisers view the prospect of buying time slots during NFL games.

“The sustained decline is what worries investors about media’s willingness to offload the NFL’s monetization risk,” analyst Steven Cahall wrote in a client note.

NFL viewership has been on the decline. RBC Capital Markets

RBC says possible reasons for the ratings skid include player protests, the NFL’s ongoing concussion controversy, competition from politics, increased offerings from cable and entertainment providers, and an oversaturation of games. And there’s also what Cahall considers to be the most obvious explanation:

“When a Sunday or Monday Night game is 42-7 late in the 3rd quarter, the viewer may now opt to catch up on Stranger Things or Billions instead of watching through to the end,” he said. ” Five or ten years ago, an unexciting 4th quarter might still have been the best thing on TV.”

http://www.businessinsider.com/sinking-nfl-viewership-is-threatening-to-crush-ad-sales-2017-12

10.How Can You Tell If Someone Has True Leadership Skills? This Famous Study Narrows It Down to 1 Rare Trait

In 2001, this best-selling management consultant identified one leadership behavior found in the most successful CEOs. Some things just don’t change over time.

In Jim Collins’ landmark book Good to Great (published in 2001), his research team spent five years examining 1,435 “good” companies and discovered 11 unique companies from that bunch that transformed themselves into “great” companies, outperforming, at the time, the S&P 500.

Their secret formula? Collins found they had exceptional leaders displaying a paradoxical mix of intense professional will and extreme personal humility. They were described as modest, with a determination to create results by shifting the focus away from themselves and continually recognizing the contributions of others.

That was then, this is now, you say. Sure, lets admit that some of the companies in Collins’ study have since waned in financial performance or shut down (like Circuit City). That aside, the same balance of fearlessness when it comes to making decisions coupled with personal humility, you’ll still find prevalent in leaders of the most successful companies on the planet today.

Having studied and witnessed such leaders in action myself over the course of twenty years, I have determined that the humble leaders Collins spent years studying practice these eight habits, still totally relevant today.

- They let other people talk.

Humble leaders are self-confident enough to allow the other person to have the glory. There is something very liberating in this strategy. For the leader, it serves as a way to empower and give people a voice; for the follower, respect and trust in the leader increases.

- They admit being wrong.

Humble leaders speak three magical words that will produce more peace of mind and respect than a week’s worth of executive coaching with me: “I was wrong.” And three more: “You are right.”

- They rarely impose.

Humble leaders rarely slip into preaching or telling others what to do without permission, or imposing their point of view at will without discretion.

- They seek input.

Humble leaders seek others’ input (including their own followers) on how they are showing up in their leadership path. They might ask, “How am I doing?” It takes humility to ask such a question. And even more humility to consider the answer.

- They give their people credit.

Humble leaders deflect the spotlight away from them and allow their team members to be in the spotlight. There is something very liberating for employees when they receive credit.

- They speak their truth.

Humble leaders refuse to cut corners and don’t say things to sugarcoat, to try to please others or to try to look good in front of their peers. They don’t betray themselves or others by using words or making decisions that are not aligned with who they are.

- They are teachable.

Humble leaders choose open-mindedness and curiosity over protecting their point of view. They gladly accept the role of learners because they know it will make them better. They know that each person has something important to teach them. They ask questions, and are sincerely interested in the answers.

- They involve others.

Humble leaders create an environment in which risks are taken, allowing those around them to feel safe to exercise their creativity, communicate their ideas openly, and provide input to major decisions. Because there’s trust there, not fear.

Parting thoughts.

The humble leader is a clear-cut winner because they achieve results, but not at the expense of people. This relational approach opens up all kinds of possibilities but it’s not something people can “fake it till they make it.”

Humble leaders are this way because character and integrity run through their veins. Thinking of this for yourself, when you operate from integrity, you gain the trust of the people you work with closely. They see you as dependable and accountable for your actions, and they feel safe in your presence. There’s clear competitive advantage in mastering humility.