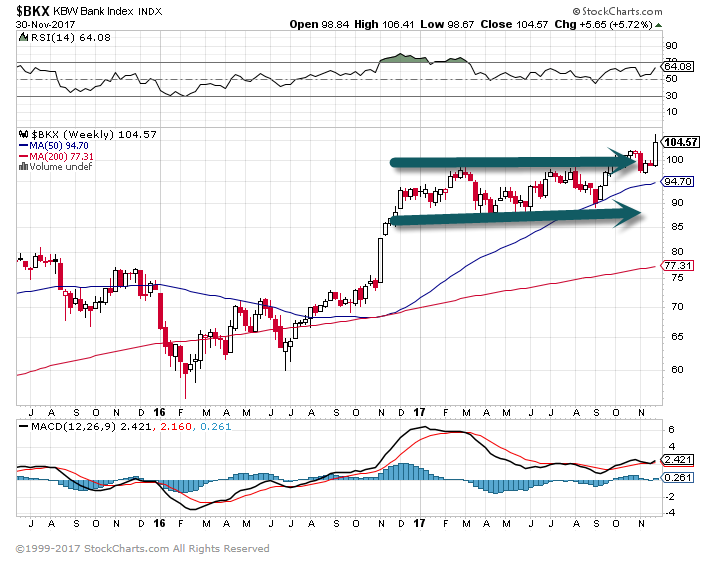

1.Bank Stocks Break Out of 1 Year Sideways Channel.

Bank stocks spike after election then went sideways for one year.

Are we seeing the beginning of sector rotation???? Tech +29% vs. Banks +4.75% YTD.

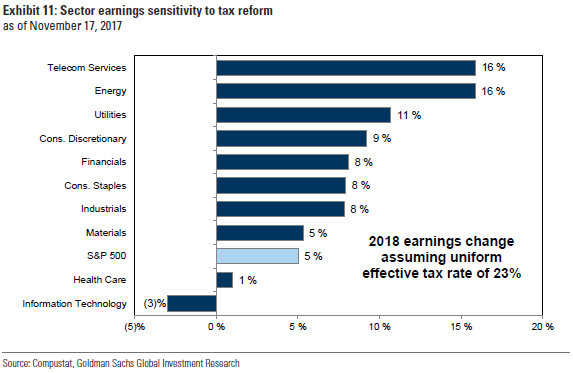

2.Tax Reform not Tech Sector Positive.

From Dave Lutz at Jones.

“After soaring 38% YTD, Tech faces tax reform headwind given 59% of sales is generated overseas and it paid the lowest median tax rate of any sector during the past five years at just 24%.”

There was a huge unwind yesterday – “After soaring 38% YTD, Tech faces tax reform headwind given 59% of sales is generated overseas and it paid the lowest median tax rate of any sector during the past five years at just 24%.”

3.In a Risk On Market….A Big Risk on Sector Biotech Just had 12% Correction.

Biotech ETF -12% off highs.

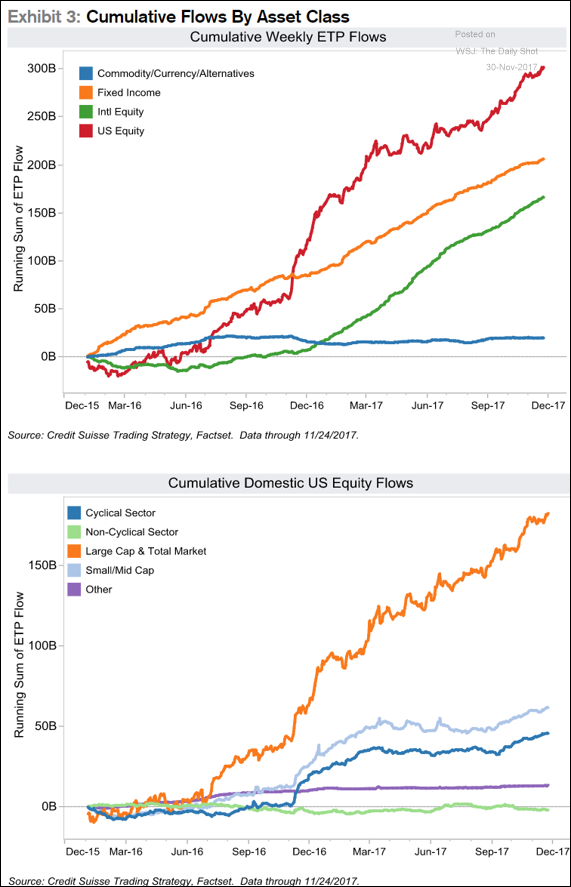

4.Equity Flows Still Dominated by Large Cap Growth…This too shall pass.

Equity Markets: Equity ETF inflows into large-caps have picked up again last week.

Source: Credit Suisse

5.China is Building Massive Silk Road

Zero Hedge.

Mao revisited

The action in the Caucasus was mirrored in Europe earlier in the week as Chinese Premier Li Keqiang and Hungary’s Prime Minister Viktor Orban opened the sixth “16+1” summit, involving China and 16 Central and Eastern European nations, in Budapest.

“16+1” is yet another of those trademark Chinese diplomatic “away wins.” Some of these nations are part of the EU, some part of NATO, some neither.

From Beijing’s point of view, what matters is the relentless BRI infrastructure and connectivity drive. Beijing may have invested as much as US$8 billion so far in Central and Eastern Europe.

China is having a ball in the Western Balkans – especially in Serbia, in Montenegro, and in Bosnia and Herzegovina, where EU financial muscle is absent. China has invested in multiple connectivity and energy projects in Serbia – including the much-debated Belgrade-Budapest high-speed rail link. Construction of the Serbian stretch started this week, with 85% of the total cost (roughly €2.4 billion) coming from the Export-Import Bank of China.

http://www.zerohedge.com/news/2017-12-01/caucasus-balkans-chinas-silk-roads-are-rising

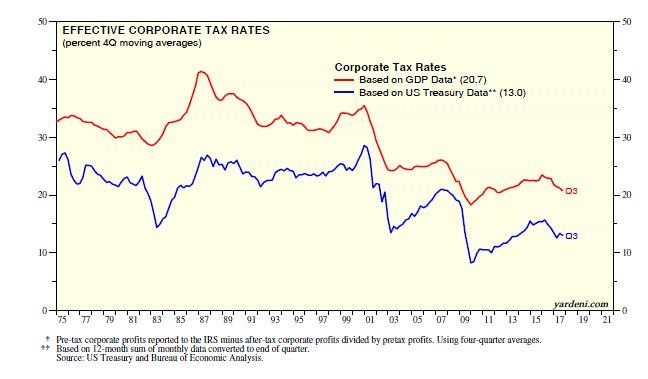

6.Corporate Taxes: Facts vs Fiction

- Published on Published on November 29, 2017

In the realm of economics, there are lots of theories. There are also lots of urban legends. Both are often propagated despite lots of facts that question their credibility. Daniel Patrick Moynihan, the former senator from New York, once said, “Everyone is entitled to his own opinion, but not to his own facts.” In today’s world of “fake news,” sorting out fact from fiction is a challenge. In the realm of economics, there’s no shortage of data, which can be very helpful in discerning the difference between information and disinformation.

Which brings me to the subject of the US corporate tax rate, which Republicans are aiming to cut. The widespread view, especially among Republicans, is that the corporate tax rate is too high. They aim to pass a tax reform package before the end of the year that will lower the statutory rate from 35% to 20%. I’m all for tax cuts. However, I’m having a problem with the data:

(1) GDP data. Yesterday’s GDP release for Q3 included corporate pretax and after-tax corporate profits. The data show that corporations paid $472.9 billion in taxes over the past four quarters through Q3. This series has been hovering in record-high territory around $500 billion since Q2-2014.

Dividing this tax series by pretax profits of $2281.4 billion over this same period shows that the effective tax rate has been significantly below the statutory rate since the start of the previous decade. During Q3, it was only 20.7%!

(2) Treasury data. But wait … the plot thickens: Actual corporate tax revenues collected by the IRS have been consistently less than the corporate taxes included in the GDP measure of corporate profits since the start of the former data series in 1972. For example, over the past four quarters through Q3, the Treasury reported collecting $297.0 billion in corporate tax revenues, 37% less than the $472.9 billion shown by the GDP measure, on a comparable basis.

The shocking result is that the effective corporate tax rate based on actual tax collections was only 13.0% during Q3, and has been mostly well below 20.0% since the start of the previous decade.

What gives? I’m not sure, but I am inclined to follow the money, which tends to support the story told by the IRS data. If so, then Congress may be about to cut a tax that doesn’t need cutting. Or else, the congressional plan is actually reform aiming to stop US companies from using overseas tax dodges by giving them a lower statutory rate at home. We may not be able to see the devil in the details of the bill until it is actually enacted.

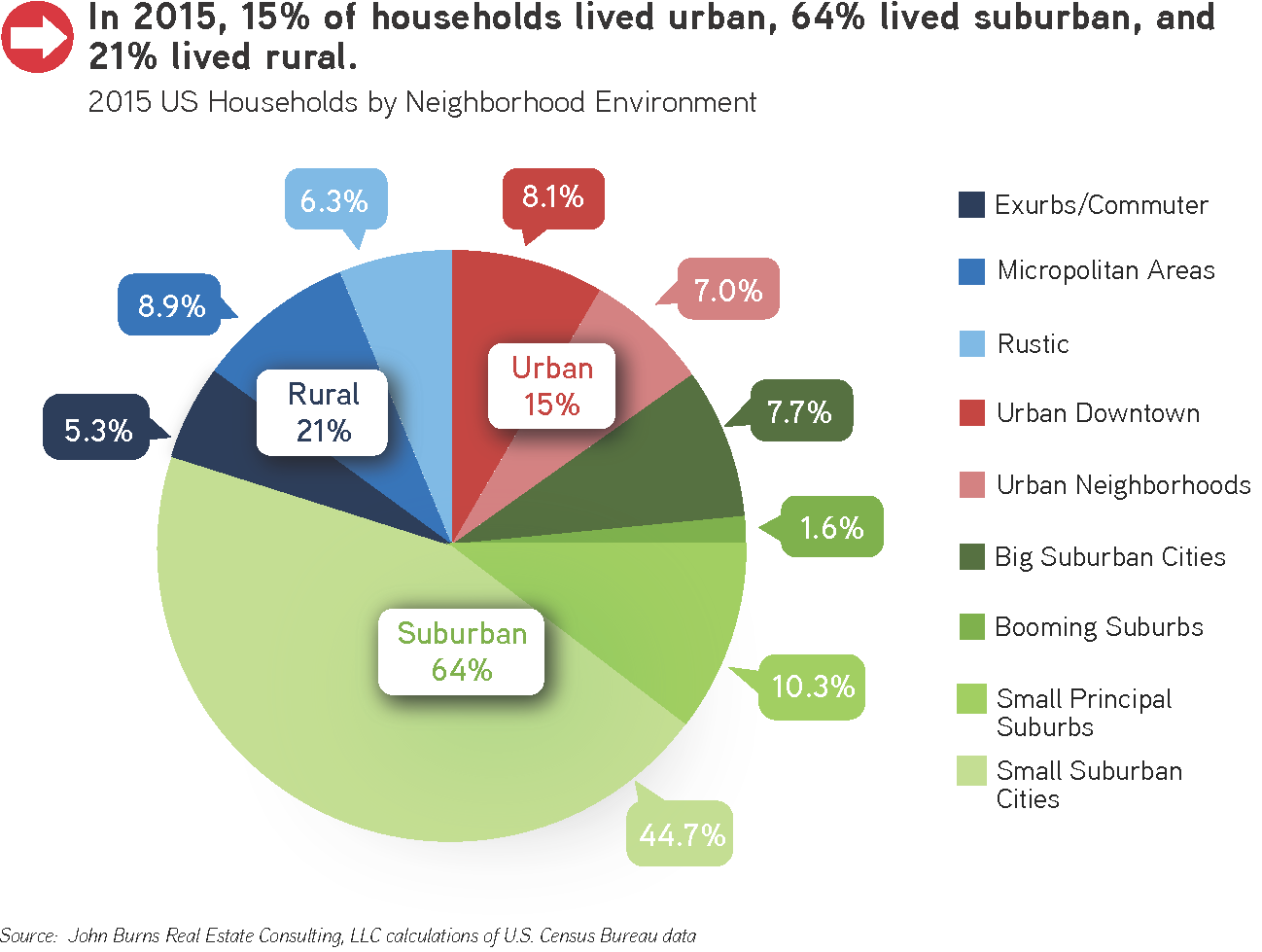

7. We are far less urban than we think.

Only 8% of Americans live in an urban downtown. More than half of the respondents believed that 22% or more of Americans lived in urban areas—a massive difference. Of course, urban definitions can vary, but our definitions include all of the cities that have professional sports teams except for Green Bay and three others. Even including all of the neighborhoods in those cities, we can only get to 15% of Americans living urban. 64% of Americans live in the suburbs, and 15% live rural.

https://www.linkedin.com/pulse/correcting-demographic-misperceptions-john-burns/

8.Plan, Focus, Act.

Plan. Focus. Act.

Don’t do a dozen things. Don’t even do half a dozen things. If you want to do great things, you have to be doing fewer things.

This is a lesson I’ve learned both the hard way (through personal experience) and the easy way (through coaching advice).

If you try to do too many things at once, it can hold back a business. Why? Because you’re wasting energy and money on high overhead, dispersed focus, and wasted resources.

The better approach to greatness is often simplification. So here’s another mantra for you:

Simplify, simplify, simplify.

Take the 12 things you are doing and see if you can cut that to six. Then take the six and see if you can cut that to three.

After all, a business with half of the employees and half of the gross revenue but double the profit is still the better business.

So, here’s your new (combined) motto for the rest of 2017: Plan, focus, act. Simplify, simplify, simplify.

That’s it.

The good news is that the “work” has already been done by so many others before you. There’s a clear road to success that’s already paved.

The bad news is that this road takes each one of us up a steep mountain with lots of obstacles. It’s not easy, but it’s simple and clear.

If you commit to this MO for the rest of the year—by getting organized, doing the work, setting up reliable accountability, communing with other like-minded positive people, and persisting through struggle, you’ll turn have perfect days EVERY day.

So where do you start?

Write down a step-by-step plan of action:

- What is your #1 priority for the rest of 2017?

- What is the #1 action step you can take in the next 24 hours to move your priority project forward?

- What can you do in 72-hours to conquer this priority project?

Continue answering these questions for the next few weeks until you have a detailed, 30-day action plan.

Use this plan to stay focused and avoid detours and distractions. And most important, take massive action on your plan, like Zeke did.

When you do this, you’ll move ahead faster on what matters in life. You will finally finish your priority projects and achieve your big goals and dreams.

You’ve got this. I know you do.

And remember—If you need help getting focused, reach out to me. I’m here to help.

Here’s to another Perfect Day.