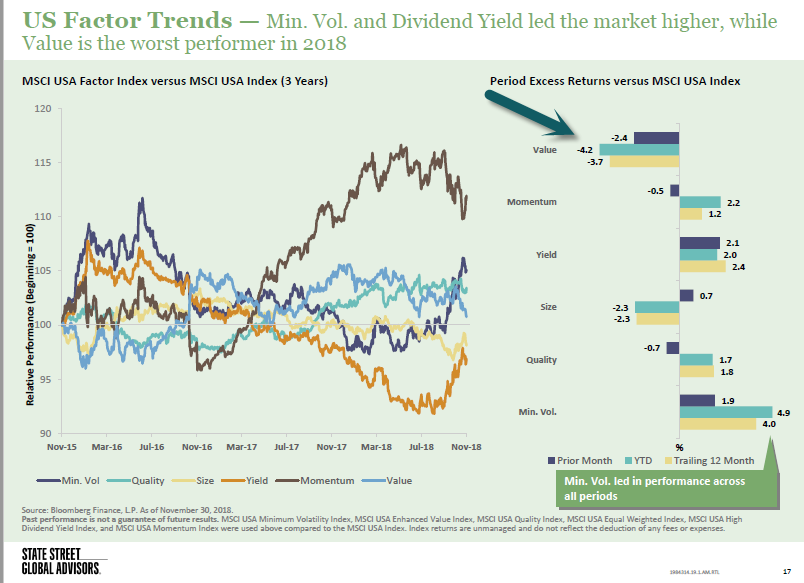

1.Factor Trends…Value Worst Performer in 2018.

After Trailing Growth This Entire Bull Market…Value Dead Last Again This Year.

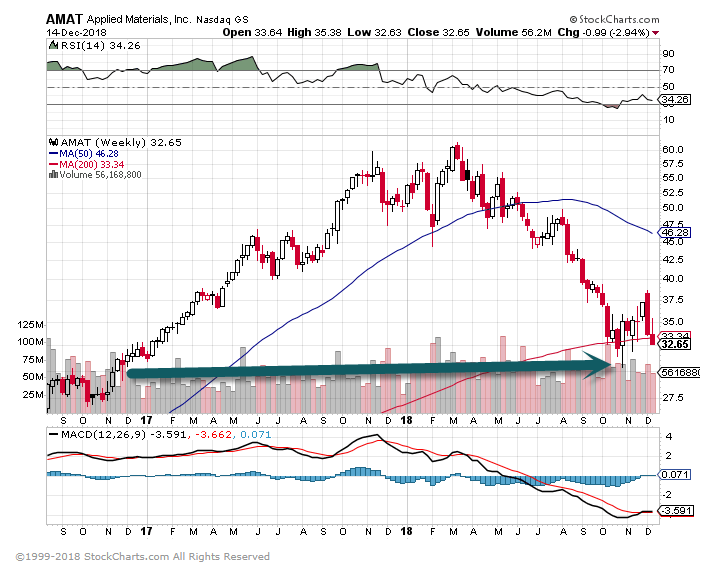

2.10% Corrections in Major Indices But Bigger Picture Over Half of U.S. Stocks Down 20% From Highs.

Risk on Sectors bigger corrections…AMAT -50% from highs.

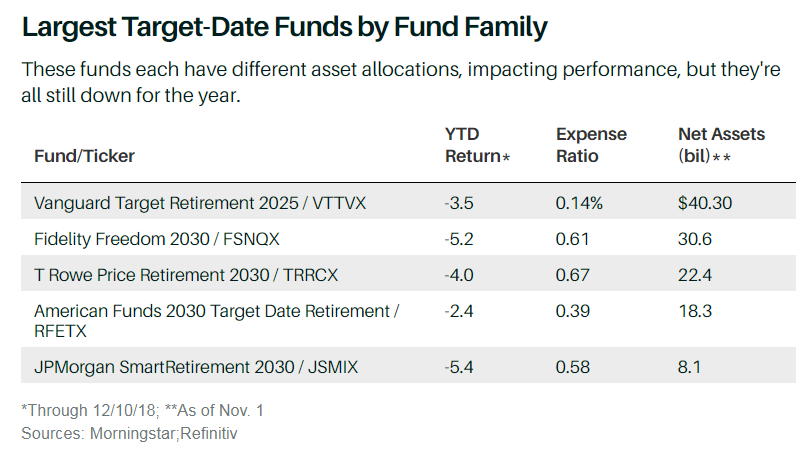

3.Diversified Portfolios Big Red Year….Target Dates Down for First Time in 10 Years.

Target-Date Funds Are Tanking, but Don’t Throw in the Towel

Daren Fonda

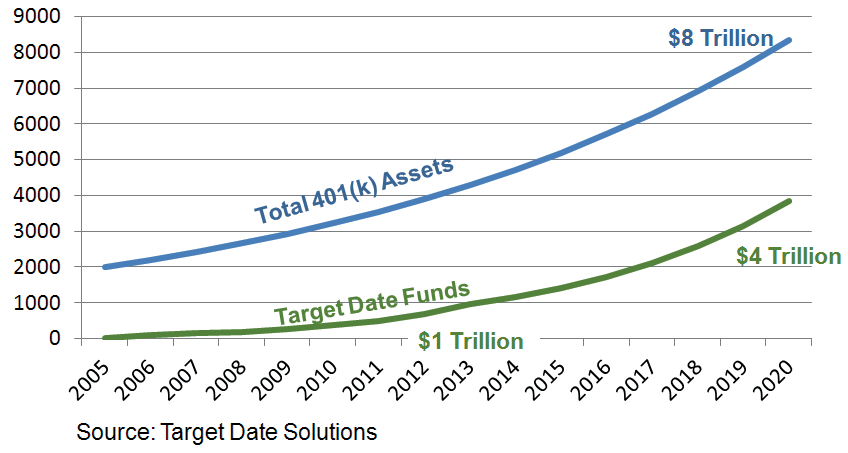

Target dates are growing at 30% per year on track to be half of all 401k assets.

https://www.huffpost.com/entry/target-date-funds-statist_b_5630852

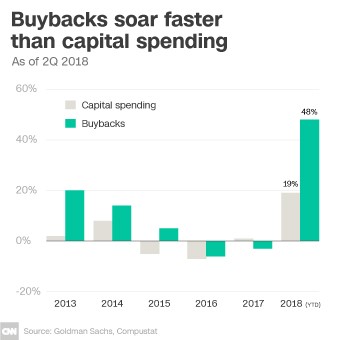

4.50% of Earnings Growth in 2018 from Buybacks and Tax Cuts…Buybacks Still Growing Faster than Capex.

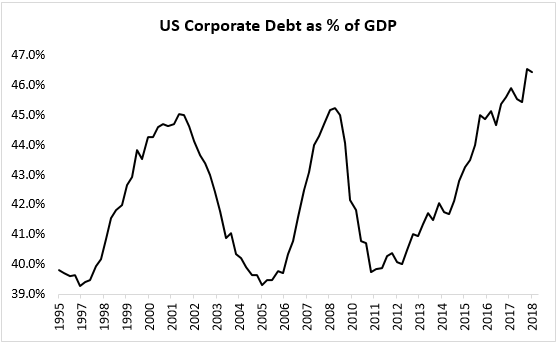

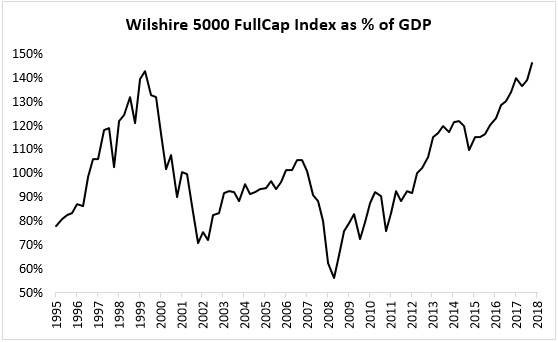

5.Households and Banks Repaired Balance Sheets in Great Recession…Corporations Loaded Up on Debt…Cyclical Highs in Debt for Public Companies.

Source: Jefferies Trading Desk

Here is the Wilshire 5000 market cap as a % of GDP. It is at cyclical highs and implies equity valuations are full relative to total economic output.

Here is US corporate debt as % of GDP. It is at cyclical highs.

Source: Jefferies Trading Desk

Percy Allison

Equity Trading, Desk Strategist

Jefferies LLC

6.Biotech Another Sector -15% Correction But Still Above YTD Lows.

BBH Biotech ETF 2 Year Box

7.Leader of Europe Germany -26%

Germany approaching end of 2016 lows.

8.Retail Stock Index Breaks to New Lows for 2018.

XRT Retail Stocks New Lows.

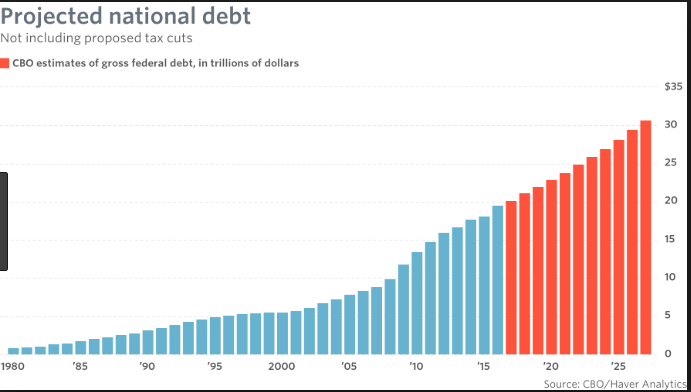

9.Quick Jump Projected from $20 Trillion to $30 Trillion in National Debt.

https://www.marketwatch.com/story/gop-tax-plan-assures-rising-national-debt-forever-2017-09-27

10.Nobel Laureate Daniel Kahneman: Never Trust Your Gut Unless You Can Say Yes to These 3 Questions

The renowned psychologist sheds some light on when it makes sense to rely on intuition.

By Jessica StillmanContributor, Inc.com@EntryLevelRebel

Daniel Kahneman.

Are gut instincts the brilliant distillation of all our wisdom and experience, or just an expression of our brain’s laziness and biases? Do they lead us to oversimplify and stereotype or help us avoid danger before we can even fully process the threat?

These questions are the stuff of heated academic debate. Malcolm Gladwell famously laid out the pro-intuition case in his bestseller Blink, while Nobel prize-winning psychologist Daniel Kahneman summed up the position of intuition skeptics in Thinking, Fast and Slow.

But while the experts argue, the rest of us have to go on and make real world decisions. Should we all ignore our guts or go with our intuition? The answer, according to Kahneman depends on the context.

Stroke of genius or dumb shortcut?

Kahneman’s problem with gut instincts — or what he terms our brain’s fast-thinking “system one” — is that it relies on rules of thumb that often turn out to be wildly wrong. We try to get a handle on how common something is by how many examples of that thing we can remember, for example. The problem with this is that it leads us to wildly overestimate the frequency of highly memorable but actually extremely rare occurrences, like airplane crashes. As Kahneman explains in his book, our intuition is riddled with these errors.

On the other hand, we all know intuition isn’t totally useless. If you get the feeling your spouse is angry with you, you had best head straight off to the florist’s shop. Or, consider the case of a veteran firefighter saving the lives of his men with a gut instinct that a particular blaze was about to turn deadly, a story Kahneman shares in his book.

So how can you recognize when your gut is about to save your life (or your marriage) and when it’s just a dumb shortcut?

ADVERTISING

According to ThinkAdvisor, in a recent talk at the World Economic Forum, Kahneman offered a thankfully simple answer to this decidedly hard question. It took the form of three questions. If you can say yes to each, then go ahead and trust your gut. Otherwise, you’d better check your instinct against some actually data and hard reasoning:

- Is there actually some regularity in this area you can pick up and learn?Intuition develops from experience, so for your gut to spot trends and patterns, reliable trends and patterns must actually exist. What areas of life have sufficient regularity for our brains to develop accurate intuitions? “Chess players certainly have it. Married people certainly have it,” Kahneman told the audience. However, the stock market is simply too noisy and irregular for anyone to understand on gut instinct.

- Have you had a lot of practice in this area? Again, successful intuitions are born of long observation of environments with some level of pattern and regularity. Good gut instincts therefore require a lot of practice — and we’re not talking just a few weeks. Years and years or experience, like the fire chief had under his belt, are generally needed.

- Do you receive immediate feedback in the area?Practice isn’t just about doing something over and over again. You can saw away badly at the violin for years and never come any closer to being able to play Beethoven. For practice to work, you also need feedback, and not just any kind of feedback. Psychology shows the kind that works best is immediate and concrete. If you want to train your intuition, “you have to know almost immediately whether you got it right or got it wrong,” Kahneman explained.

So next time your gut is screaming at you to do or not do something, take a moment to check in with science. Is this an area where patterns actually exist? Do you have long experience of the subject? Have you tested your understanding of it against reality previously? If you can’t answer yes to all three of these questions, take a step back and think through the problem more rationally.