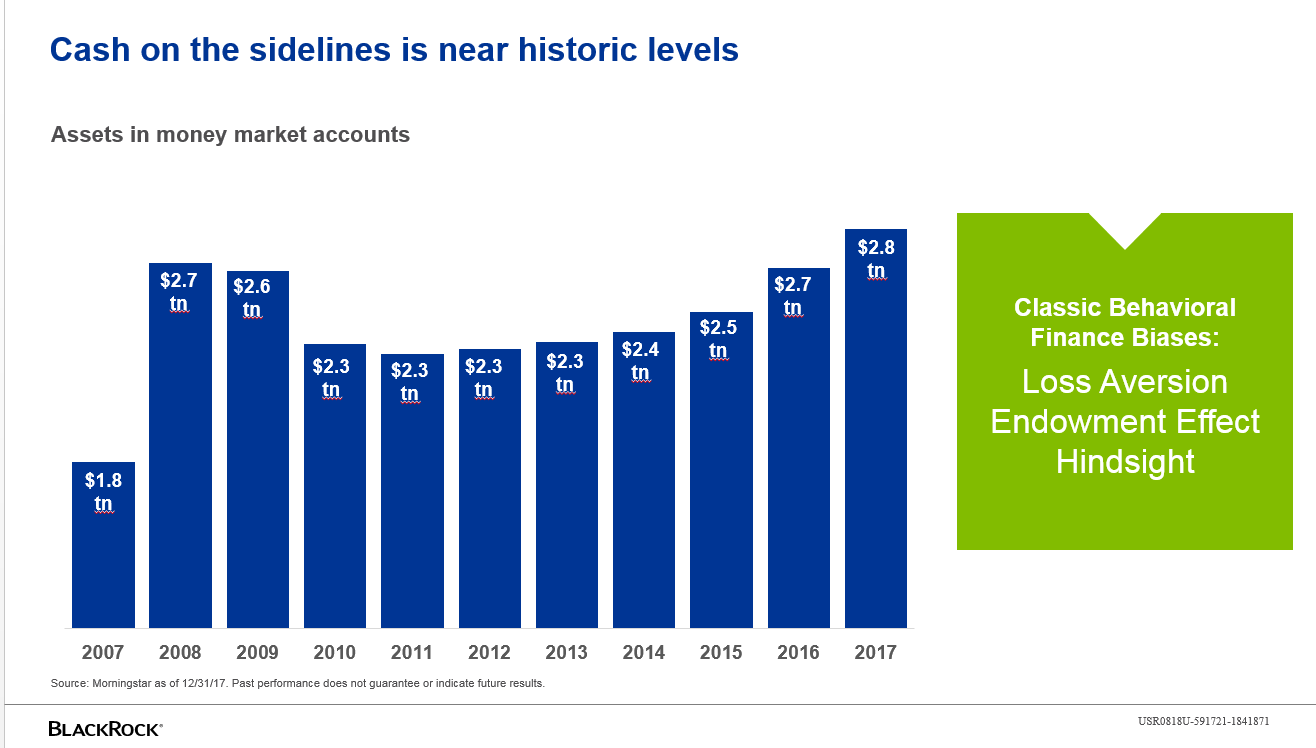

1.Cash On Sidelines at Record Levels.

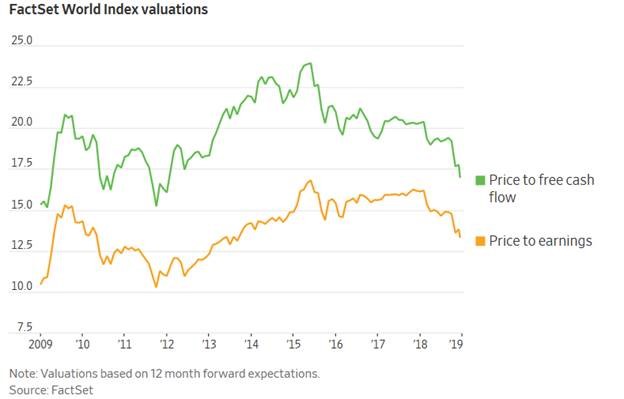

2.Stocks Cheapest in 5 Years on Some Forward Earnings Measures

WSJ

Read Full Article

3.Short-Term Technicals…Mid-Cap and Small Cap Broke Thru October Lows

Mid-Cap ETF

Small Cap ETF

Small Cap ETF

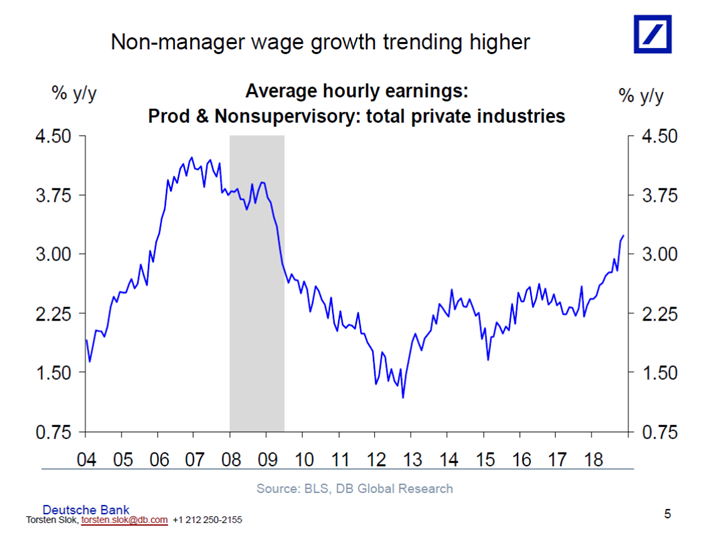

4.Wage Gains Above 4% For Some Working Class Sectors.

Average hourly earnings for non-supervisory workers continues to accelerate, see charts below and here. For our 2019 US economic outlook see here.

———————————————-

Let us know if you would like to add a colleague to this distribution list.

Torsten Sløk, Ph.D.

Chief International Economist

Managing Director

Deutsche Bank Securities

60 Wall Street

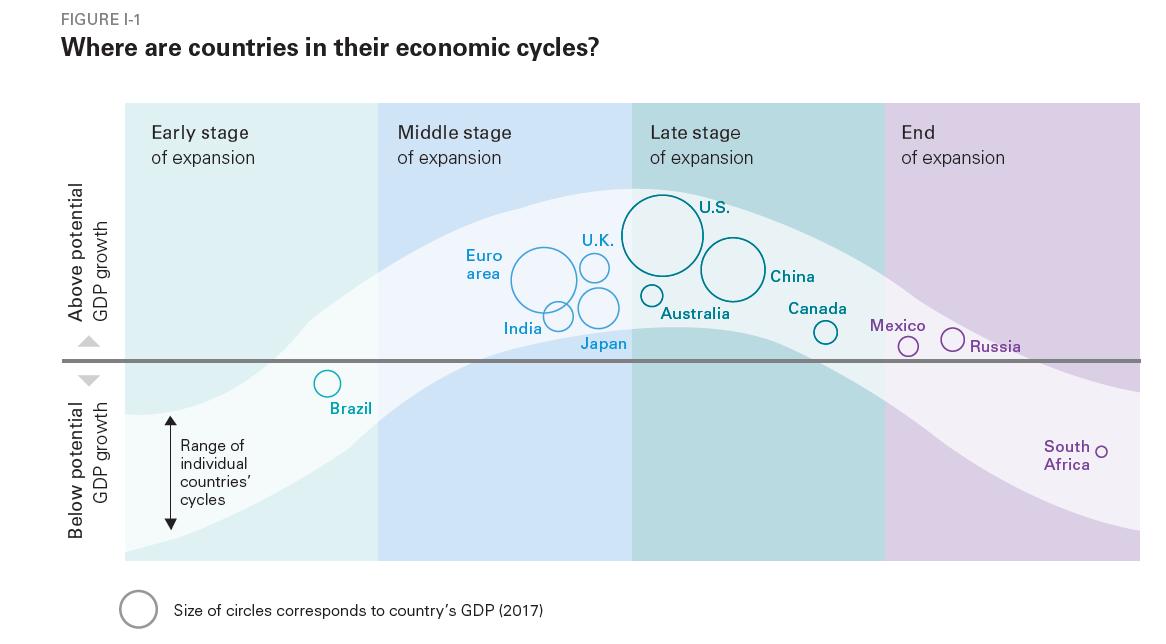

5.Where are Countries in the Cycle?

Vanguard

https://advisors.vanguard.com/iwe/pdf/ISGVEMO.pdf?cbdForceDomain=true

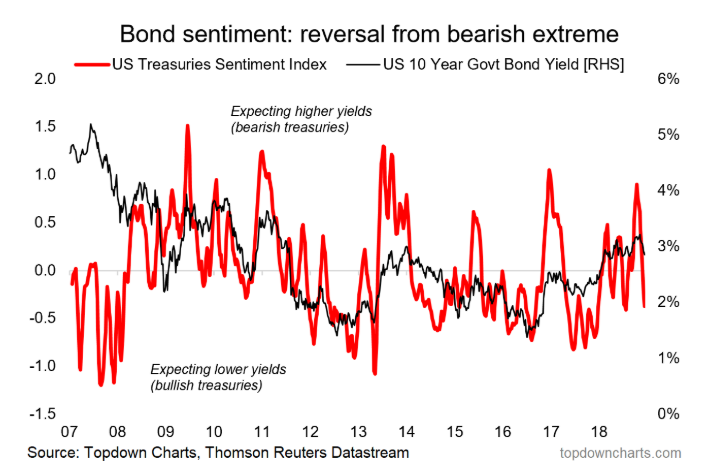

6.Bond Sentiment Reversal

Callum Thomas

Head of Research at Topdown Charts – GlobalEconomics & Asset Allocation research

https://www.linkedin.com/pulse/top-5-charts-week-callum-thomas-11d/

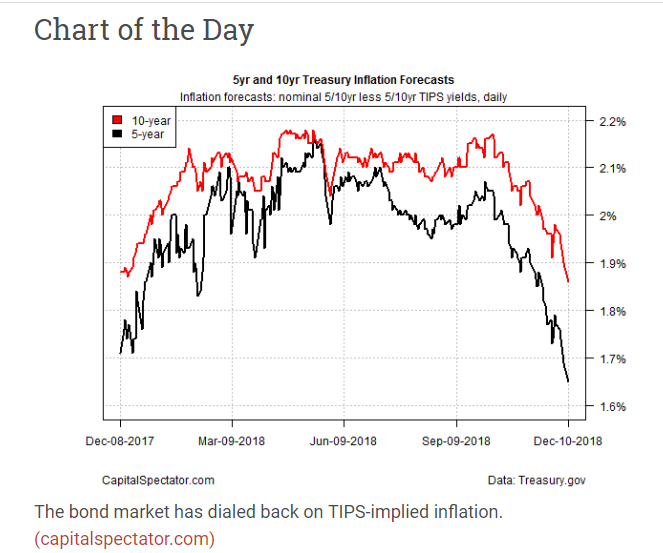

7.Another Example of Inflation Expectations Rolling Over

Treasury Market’s Inflation Forecast Plunges

The implied inflation outlook via Treasury yield spreads in recent months has been pricing in a possibility that inflation has peaked. The forecast is debatable, but right or wrong the government bond market is doubling down on that bet.

The widely followed rate difference between the nominal and inflation-indexed 5-year Notes fell to 1.65% on Monday (Dec. 10), the lowest level in 15 months, based on daily data published by Treasury.gov (black line in chart below). The ongoing slide in the market’s inflation expectations raises questions about the Federal Reserve’s plans to hike interest rates again at the Dec. 18-19 FOMC meeting. Fed funds futures are currently estimating a 77% probability that the central bank will lift its target rate by 25 basis points to a 2.25%-to-2.50% range, according to CME data.

https://www.capitalspectator.com/treasury-markets-inflation-forecast-plunges/

From Abnormal Returns Blog

https://abnormalreturns.com/2018/12/11/tuesday-links-preparation-drills/

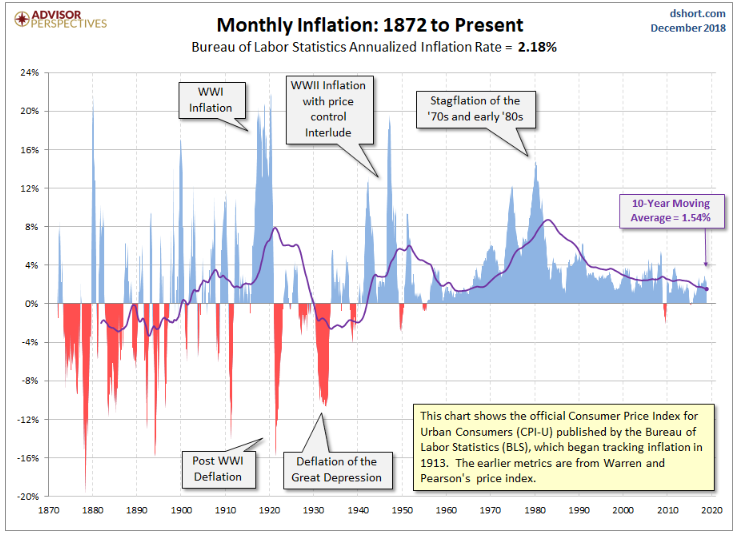

8.Inflation 1872 to Present

A Long-Term Look at Inflation by Jill Mislinski, 12/12/18

https://www.advisorperspectives.com/dshort/updates/2018/12/12/a-long-term-look-at-inflation

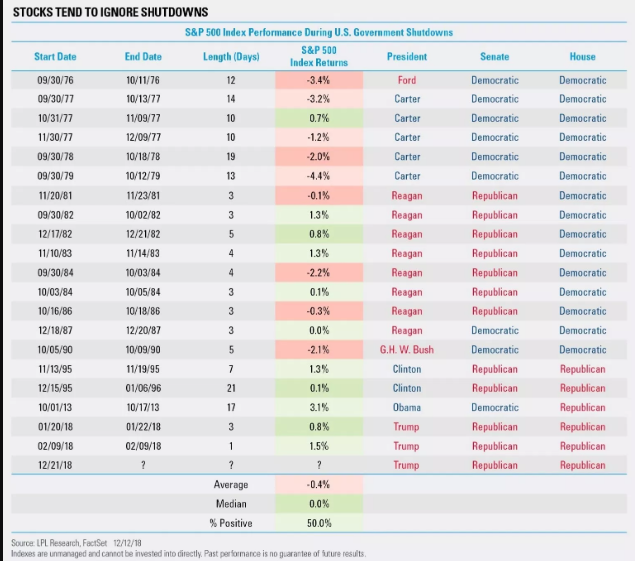

9.Stocks Tend to Ignore Shutdowns

Posted by lplresearch

Next week could bring the third government shutdown of 2018, especially after the fireworks out of Washington yesterday. In a widely watched live TV debate, President Trump sparred with Senate Minority Leader Schumer and House Minority Leader Pelosi regarding funding for the proposed wall on the Mexican border and potentially shutting down the government.

What exactly does a shutdown mean for stocks? “Although shutdowns get a lot of media hype, the reality is that stocks tend to take them in stride. In fact, the S&P 500 has gained during each of the five previous shutdowns,” explained LPL Senior Market Strategist Ryan Detrick.

As our LPL Chart of the Day shows, shutdowns rarely push stocks significantly lower and have corresponded with a flat median return in the previous 20 shutdowns going back more than 40 years.

One would think shutdowns in December might be rare, but they’re actually fairly common. Three shutdowns in the same year, however, is not. Could this year be the first since 1977 with three separate shutdowns? If yesterday’s drama was any indication, the odds may have increased. However, next summer’s debt ceiling debate will be a more important issue when Treasury interest payments are at risk.

https://lplresearch.com/2018/12/12/what-happens-if-the-government-shuts-down/

10.What Straight-A Students Get Wrong

If you always succeed in school, you’re not setting yourself up for success in life.

By Adam Grant

Dr. Grant is an organizational psychologist and a contributing opinion writer.

A decade ago, at the end of my first semester teaching at Wharton, a student stopped by for office hours. He sat down and burst into tears. My mind started cycling through a list of events that could make a college junior cry: His girlfriend had dumped him; he had been accused of plagiarism. “I just got my first A-minus,” he said, his voice shaking.

Year after year, I watch in dismay as students obsess over getting straight A’s. Some sacrifice their health; a few have even tried to sue their school after falling short. All have joined the cult of perfectionism out of a conviction that top marks are a ticket to elite graduate schools and lucrative job offers.

I was one of them. I started college with the goal of graduating with a 4.0. It would be a reflection of my brainpower and willpower, revealing that I had the right stuff to succeed. But I was wrong.

The evidence is clear: Academic excellence is not a strong predictor of career excellence. Across industries, research shows that the correlation between grades and job performance is modest in the first year after college and trivial within a handful of years. For example, at Google, once employees are two or three years out of college, their grades have no bearing on their performance. (Of course, it must be said that if you got D’s, you probably didn’t end up at Google.)

Straight As may not matter as much if you are a middle to upper class white guy. But try to get ahead or taken seriously as a minority or woman or even a working class rural white guy with your awesome creativity and see if you can make it or pay the bills. This pierce is not only simplistic and filled with inaccurate stereotypes, but it reeks of privilege. Creativity is largely useless without a strong knowledge base. And it rarely leads to financial security much less success.

Academic grades rarely assess qualities like creativity, leadership and teamwork skills, or social, emotional and political intelligence. Yes, straight-A students master cramming information and regurgitating it on exams. But career success is rarely about finding the right solution to a problem — it’s more about finding the right problem to solve.

Informed opinions on today’s vital issues.

In a classic 1962 study, a team of psychologists tracked down America’s most creative architects and compared them with their technically skilled but less original peers. One of the factors that distinguished the creative architects was a record of spiky grades. “In college our creative architects earned about a B average,” Donald MacKinnon wrote. “In work and courses which caught their interest they could turn in an A performance, but in courses that failed to strike their imagination, they were quite willing to do no work at all.” They paid attention to their curiosity and prioritized activities that they found intrinsically motivating — which ultimately served them well in their careers.

Getting straight A’s requires conformity. Having an influential career demands originality. In a study of students who graduated at the top of their class, the education researcher Karen Arnold found that although they usually had successful careers, they rarely reached the upper echelons. “Valedictorians aren’t likely to be the future’s visionaries,” Dr. Arnold explained. “They typically settle into the system instead of shaking it up.”

This might explain why Steve Jobs finished high school with a 2.65 G.P.A., J.K. Rowling graduated from the University of Exeter with roughly a C average, and the Rev. Dr. Martin Luther King Jr. got only one A in his four years at Morehouse.

If your goal is to graduate without a blemish on your transcript, you end up taking easier classes and staying within your comfort zone. If you’re willing to tolerate the occasional B, you can learn to program in Python while struggling to decipher “Finnegans Wake.” You gain experience coping with failures and setbacks, which builds resilience.

Straight-A students also miss out socially. More time studying in the library means less time to start lifelong friendships, join new clubs or volunteer. I know from experience. I didn’t meet my 4.0 goal; I graduated with a 3.78. (This is the first time I’ve shared my G.P.A. since applying to graduate school 16 years ago. Really, no one cares.) Looking back, I don’t wish my grades had been higher. If I could do it over again, I’d study less. The hours I wasted memorizing the inner workings of the eye would have been better spent trying out improv comedy and having more midnight conversations about the meaning of life.

So universities: Make it easier for students to take some intellectual risks. Graduate schools can be clear that they don’t care about the difference between a 3.7 and a 3.9. Colleges could just report letter grades without pluses and minuses, so that any G.P.A. above a 3.7 appears on transcripts as an A. It might also help to stop the madness of grade inflation, which creates an academic arms race that encourages too many students to strive for meaningless perfection. And why not let students wait until the end of the semester to declare a class pass-fail, instead of forcing them to

decide in the first month?

Employers: Make it clear you value skills over straight A’s. Some recruiters are already on board: In a 2003 study of over 500 job postings, nearly 15 percent of recruiters actively selected against students with high G.P.A.s (perhaps questioning their priorities and life skills), while more than 40 percent put no weight on grades in initial screening.

Straight-A students: Recognize that underachieving in school can prepare you to overachieve in life. So maybe it’s time to apply your grit to a new goal — getting at least one B before you graduate.

Adam Grant, an organizational psychologist at Wharton and contributing opinion writer, is the author of “Originals” and “Give and Take” and is the host of the podcast “WorkLife.”

Follow The New York Times Opinion section on Facebook, Twitter (@NYTopinion) and Instagram.

https://www.nytimes.com/2018/12/08/opinion/college-gpa-career-success.html