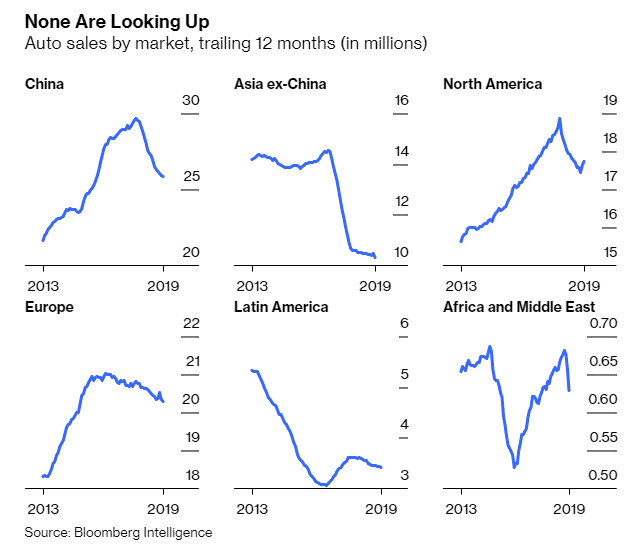

1.Global Auto Sales Drop

Zero Hedge

https://www.zerohedge.com/s3/files/inline-images/auto%202_2.png?itok=AE1RLvP6

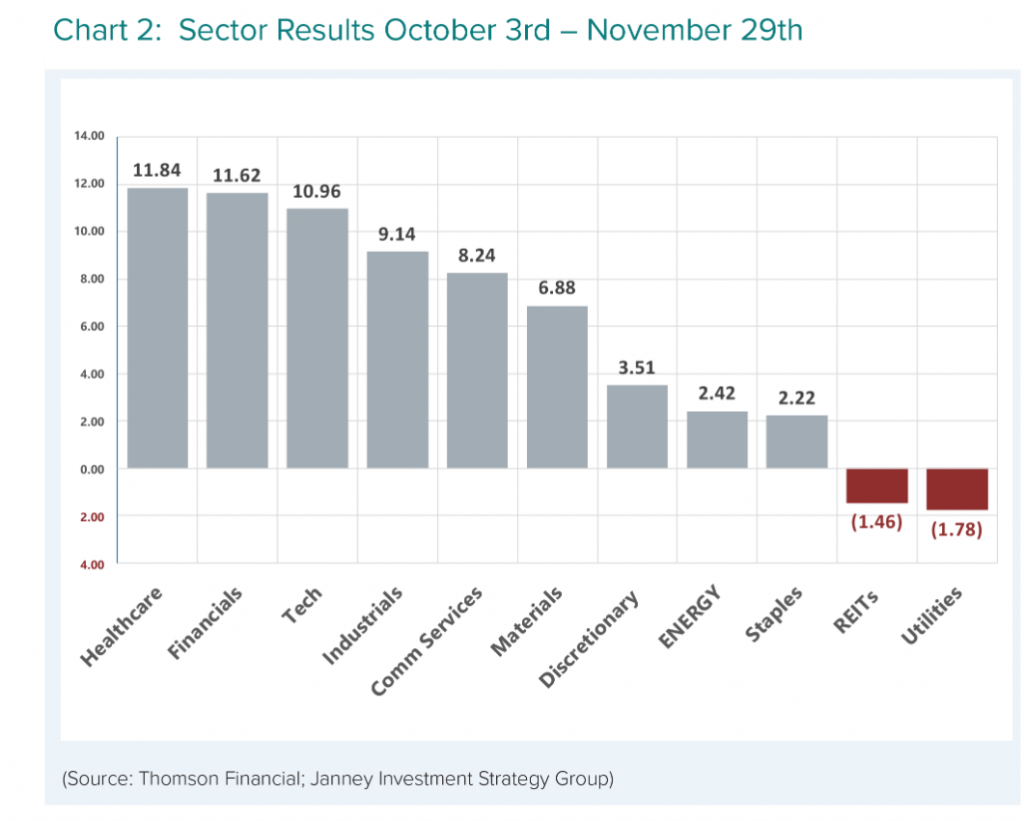

2.Sector Leadership Changes in the Last 2 Months.

Interest Rate Sensitive REITS and Utilities Fading

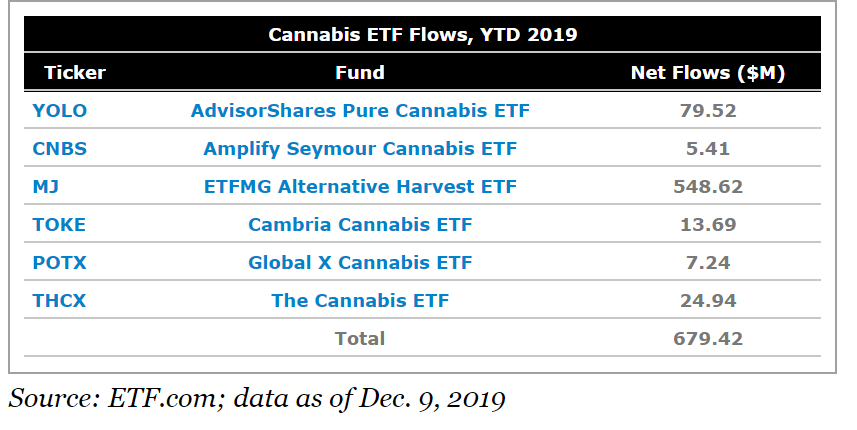

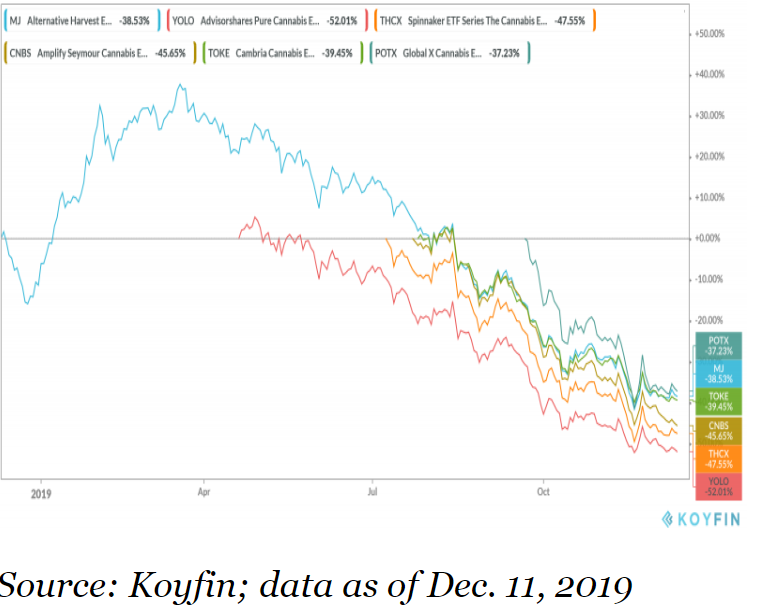

3.Number of Cannabis ETFs Growing ….All Down 30-50% in 2019

All Down 30-50% in 2019

https://www.etf.com/sections/features-and-news/year-marijuana-etfs

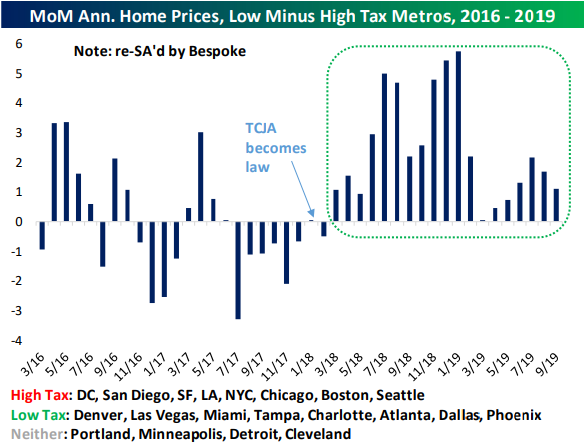

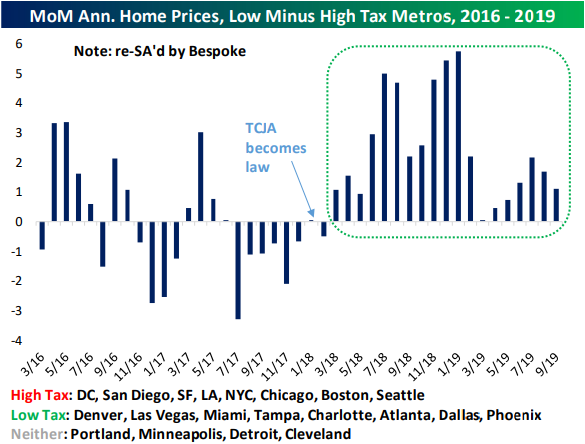

4.How SALT Has Iced Home Prices in High Tax States

Wed, Dec 11, 2019

In the past couple of days, we’ve released

a few more sections of our 2020 Outlook Report including those

on Washington, Commodities, and Housing. In addition to gauging the

overall health of the economy and potential for future economic growth, in

the Housing section, we also discussed home

price trends using the gold standard for housing prices: the Case-Shiller Home

price indices. Below is a complimentary excerpt from the Housing section of our 2020 Outlook Report. To view the

entire section and gain access to all of the other sections (plus the rest of

our research offering), join Bespoke Premium with this 2020 special offer.

The Case-Shiller indices saw home price growth slow sharply in 2018 from the

6% to 7% YoY range all the way down to the 2% range, but in 2019 home price

appreciation began to pick back up. One significant cause of the

fluctuations in home prices over the past couple of years has been the

implications of tax policy.

Prior to the passage of the Tax Cuts & Jobs Act (TCJA) at the end of

2017, relatively high and low tax metro areas had no consistent home price

trends relative to each other. The Trump tax bill capped SALT (state and

local taxes) deductions, however, which hurts higher-tax metro areas like DC,

LA, New York, and Chicago more than lower-tax metro areas like Denver, Las

Vegas, Charlotte, and Dallas. This has resulted in home prices rising more in

low-tax jurisdictions versus high-tax jurisdictions in each month since early

2018 as shown in the chart below. This trend is not likely to last forever,

especially as the effects have already waned in 2019 compared to 2018, but the

TCJA has certainly been a big penalty for homeowners in high tax metros, and

the data proves that out.

©2019 Bespoke Investment Group

https://www.bespokepremium.com/interactive/posts/think-big-blog/salt-has-iced-home-prices

5.Percentage of Investment Grade Corporate Rated Single A or Higher at an All-Time Low.

Jeffrey Gundlach on the Corporate Bond Market:

The percentage of the investment grade corporate bond market that’s rated single A or higher is at an all-time low. It used to be two-thirds of the corporate bond market was rated single A or higher, 25 years ago. Now it is 35% of that market. So, the rating is actually worse. So, the yield spread should be higher than average. Not at near a low level. So, that is a very bad sign.

Gundlach Interview.

2019 Big Run Up in Investment Grade Corporate

6.How to Master Your Emotions and Make Good Investment Decisions

Investment U

By Mark Ford

Originally posted December 11, 2019 on Liberty Through Wealth

- Is the glass half full or half empty? Whether you’re an optimist or a pessimist, your tendency could be hindering your ability to achieve career success and attain a rich life.

- If it is, Mark Ford explains how you can move forward.

Boldness in taking on new business opportunities is considered a virtue by many… and timidity a vice.

I’m not so sure.

When I am bold, I often gamely invest my time and money into projects that are foolish, unnecessary, and/or unlikely to succeed. When I am feeling timid, I shy away from good and likely opportunities.

Emotional tendencies matter. If you know your basic nature, you’ll be able to make better business and investment decisions by taking contravening measures against your dominant mood.

But how do you figure out such a thing?

Determining Your Basic Nature

Are you fundamentally an optimist or a pessimist? Answering the following questions should help you find out.

- When offered investment or business opportunities, are you instantly and positively excited?

- Do you often take on projects that you regret later on?

- Do you enjoy meeting new people, seeing new sights and going on adventures?

- When talking about a new business or investment with friends or colleagues, do you tend to exaggerate the benefits and profit potential?

- Do you often take on social obligations you later regret?

If you answered yes to three or more of the questions above, I would call you generally optimistic. You may even be overly optimistic.

Now answer these five questions.

- Do you feel that, generally speaking, you have more challenges and obligations than you can properly handle?

- In social situations, do you find yourself often thinking about business obligations or problems? Do you have difficulty staying in the “here and now”?

- Would you rate your boss and colleagues negatively?

- Do you often feel anxious or even sad about going on business trips or attending business functions?

- Do you fantasize about retiring or quitting your job and getting another one?

If you answered yes to three or more of these last five questions, you might have pessimistic tendencies. If you answered yes to all five, you are probably overly pessimistic.

Admittedly, this is not a scientific test. But optimism and pessimism aren’t really scientific terms.

And as I said above, emotional tendencies matter when it comes to business decisions. To push back against your dominant mood, here is what I recommend doing…

Optimists, Curb Your Enthusiasm

Understand that there is a part of your brain that is not operating efficiently. That is the part that, in other people, causes doubt and fear.

Be happy that you have a frame of mind that gives you the feeling that you can accomplish just about anything, but promise yourself that you’ll run all your important impulses through an outside filter.

Don’t sign any contracts or agree to any business deals without running them by a trusted lawyer and accountant first. Tell your advisors that their job is to spot the problems and to be tough on you when you try to dismiss them with quick rhetoric. (That’s what you’ll want to do when they toss a pail of cold water on your fire.)

Don’t buy anything expensive on the spot. Don’t hire anyone on the spot. Don’t fire anyone on the spot. Don’t take a job on the spot.

Don’t send out “reactive” emails on the spot. Wait 24 hours, and then either delete or modify the email. If, in reading the email 24 hours later, you get angry again and want to send it out unchanged, hold off for another 24 hours. Don’t send out that first email under any circumstances. You will regret it.

Don’t ever say anything in an email about anyone unless you wouldn’t mind them reading it… because they surely will. The same rule applies to anything written in letters or spoken on the phone or in person.

Pessimists, Fill Your Glass a Bit More

Accept the fact that you have some deficiency in your brain chemistry. Recognize that your instinctive tendency to see the dark side can sometimes limit your success by dampening your enthusiasm or the enthusiasm of others.

Be happy that you have a natural ability to detect the potential problems in every situation. Use that talent to assess the risks and problems inherent in any major venture you undertake.

Make it a habit to always say something positive before you say whatever it is that’s on your mind.

After you get through writing your daily task list, spend five or 10 minutes visualizing every task. Imagine yourself happily achieving the objective. Even if you find the job odious and the person you are doing it with repugnant, find some way to imagine actually enjoying the experience.

This may seem like advice that borders on the silly – it certainly did to me when I first tried it – but you’ll be amazed at how well it works.

Practice smiling in the mirror. Do this as often as you can stomach it. And then do it some more. Again, this advice may seem ludicrous… but it will work.

When talking on the phone, smile. The person on the other end is cueing off the energy from your voice. If you want him to respond enthusiastically to your ideas, you need to breathe that enthusiasm into the tone of your voice.

Every time you see someone for the first time, greet him or her with a firm handshake, a smile and a confident “eye lock.”

Recognize What Mood You Are In

You may find that your mood swings between optimism and pessimism. If you are like me, that swing can be very large.

After going through a rather deep depression some time ago, I began to chart my mental state in terms of how I felt, what I thought about and what sort of functionality I had.

At the bottom of the scale, I felt suicidal, had repetitively negative thoughts, and could not get out of bed or even carry on a conversation. At the top of the scale, I was euphoric. I loved everyone and everything I encountered.

By logging my moods, I discovered that when I was below a 6, I made bad decisions. I shied away from every challenge or opportunity, including many that could do me nothing but good.

When I was above an 8, I often made bad decisions in the other direction. I would take on almost any new project or invest in any new business opportunity.

Nowadays, I follow a rule that keeps me in good stead. I never make business or investment decisions unless I’m in the 6 to 8 range.

You don’t have to use my system to get the same effect. Simply recognize that if you have significant mood swings, you should defer decisions when you are feeling especially good or bad.

In other words, say yes to new opportunities only when you are not being swayed by your emotions. Whether optimistic, pessimistic or something in between, recognize that whatever your goals are, you’ll have a better chance of achieving them if you approach them with a level mood.

Good investing,

Mark

7.Average Family of 4 $80 Bucks for Night Out at Movies….Compared to $12 a Month Unlimited Streaming.

Wilmington Trust

8.Quiet Your Ego

by Dan Solin, 12/10/19

Photo by Kristina Flour on Unsplash

Advisor Perspectives welcomes guest contributions. The views presented here do not necessarily represent those of Advisor Perspectives

Click here to watch a video and learn more about Evidence Based Advisor Marketing.

If your ego is too loud, it stops you from reaching your goals and having a happier, more fulfilling life.

That’s the message from Scott Barry Kaufman, a psychologist at Columbia University, in an insightful article published in Scientific American.

The problem

Kaufman defines your ego as, “that aspect of the self that has the incessant need to see itself in a positive light.” He claims that, “the more the ego is quieted, the higher the likelihood of actually reaching one’s goals.”

His views are shared by Mark R. Leary, the author of The Curse of Self. Leary observed that “egoism” can “profoundly affect people’s lives, interfering with their success, polluting their relationships with other people, and undermining their happiness.”

Kaufman and Leary advocate self-awareness and reflection. Both are essential for reaching your goals. Problems arise when our egos are so “noisy” they actually impede the goals we are trying to achieve. Kaufman puts it this way: “A noisy ego spends so much time defending the self as if it were a real thing, and then doing whatever it takes to assert itself, that it often inhibits the very goals it is most striving for.”

The solution

Instead of adopting a defensive posture in an effort to prove you are “right,” and being concerned about self-enhancement, Kaufman suggests you quiet your egos, which will foster a sense of well-being, health, self-esteem and other benefits.

Having a quiet ego means being less concerned about getting across your point of view and more concerned with identifying with the experience of others. Instead of dominating a conversation, show your interest in what others are saying. Not only is your behavior a form of kindness, it will be perceived by the other person as being compassionate.

Everyone prefers associating with kind people over those with other traits.

Tips for implementing

Those with quiet egos have a “detached awareness,” which permits them to see both sides of an issue. They are open to reexamining their thoughts, positions and beliefs.

They have an “inclusive identity.” They are cooperative and compassionate toward others, rather than focusing on themselves.

Marketing Services For Evidence-Based Advisors…and a New Book!

We offer consulting services on how to convert more prospects into clients through Solin Consulting, a division of Solin Strategic, LLC. Our evidence-based persuasion strategies have significantly increased conversion rates for our coaching clients. I’m available to speak at events. I also provide individualized coaching using videoconferencing.

We offer a full range of digital marketing services exclusively to evidence-based advisors through Evidence Based Advisor Marketing, LLC . These services include: web and content creation and the creation of innovative videos. You can see websites we have designed, content we have drafted and videos we have produced here.

Click here to request a free, no obligation website evaluation.

I’m working on a new self-help book for the general public. It’s called:

Why it’s important

Success as an advisor is largely dependent on your ability to make an emotional connection with prospects and clients. A “noisy” ego leaves little room for focusing on others. Your bandwidth is absorbed by a preoccupation with yourself – how you are being perceived, your views on the issues, your background and expertise. The list goes on…and on.

When you quiet your ego, you appreciate it’s not about you. It’s about your ability to focus intensely on your prospect, client, loved ones and colleagues.

On a macro level, Kaufman observes, “I don’t think it’s an overstatement to say that the cultivation of these skills in our society would lead to greater mental health, useful reality-based information, as well as peace and unity among humans.”

Get Dan’s investing insights by signing up for his free, weekly newsletter here.

Subscribe to Dan’s YouTube investing channel here.

To be listed on our Middle America’s Plan website as a Preferred Advisor who offers MAP to clients, click here.