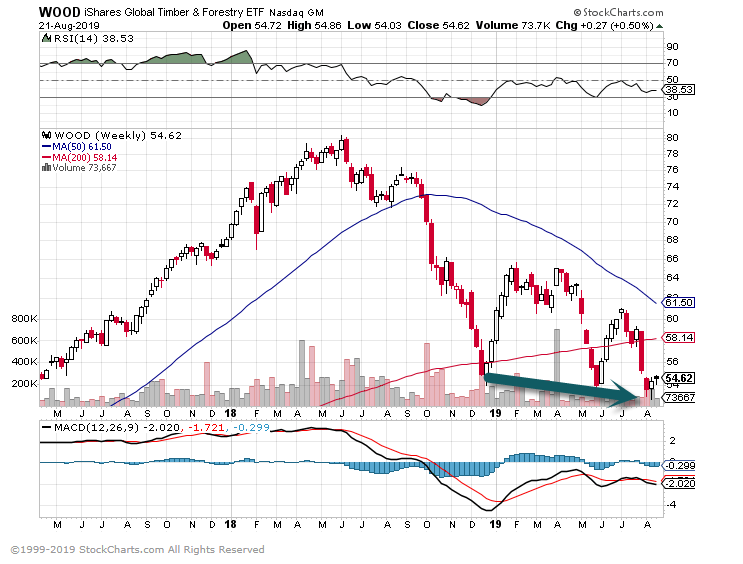

1.Home Depot on Earnings Call Estimated the Drop in Lumber Prices Cost Them $330m Year over Year.

WOOD-Lumber ETF -30% Off Highs.

2.Consumer Spending-Unleaded Gas Drops -23%…

Retail Gas Drop Since May.

Retailer ETF—Small Pullback After Making New Highs ..Look for new Highs.

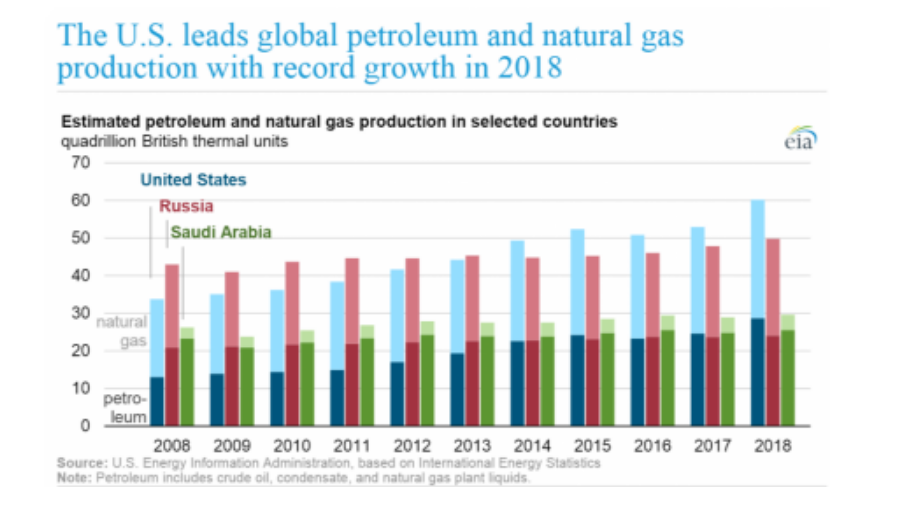

3.New Oil Production in U.S. Will Be 8X Larger Than The Next Largest Source of Growth Canada.

U.S. To “Drown The World” In Oil

Nick Cunningham

The U.S. could “drown the world in oil” over the next decade, which, according to Global Witness, would “spell disaster” for the world’s attempts to address climate change.

The U.S. is set to account for 61 percent of all new oil and gas production over the next decade. A recent report from this organization says that to avoid the worst effects of climate change, “we can’t afford to drill up any oil and gas from new fields anywhere in the world.” This, of course, would quickly cause a global deficit, as the world continues to consume around 100 million barrels per day (bpd) of oil.

Global Witness notes that the industry is not slowing down in the United States, notwithstanding recent spending cuts by independent and financially-strappedoil and gas firms. If anything, the consolidation in the Permian and other shale basins, increasingly led by the oil majors, ensures that drilling will continue at a steady pace for years to come.

It isn’t as if the rest of the world is slowing down either. The global oil industry is set to greenlight $123 billion worth of new offshore oil projects this year, nearly double the $69 billion that moved forward last year, according to Rystad Energy. In fact, while shale drilling has slowed a bit over the past year amid investor skepticism and poor financial returns, offshore projects have begun to pick up pace.

But that trend might turn out to be just a blip. The U.S. is still expected to account of the bulk of new drilling and the vast majority of new production, with much of that coming from shale. Already, the U.S. is the world’s largest producer of both oil and natural gas. And the pace has accelerated in recent years. In 2018, U.S. oil and gas production increased by 16 and 12 percent, respectively. According to the EIA, the U.S. surpassed Russia in terms of gas production in 2011, claiming the top spot, and it surpassed Saudi Arabia in oil production last year.

https://finance.yahoo.com/news/u-drown-world-oil-230000356.html

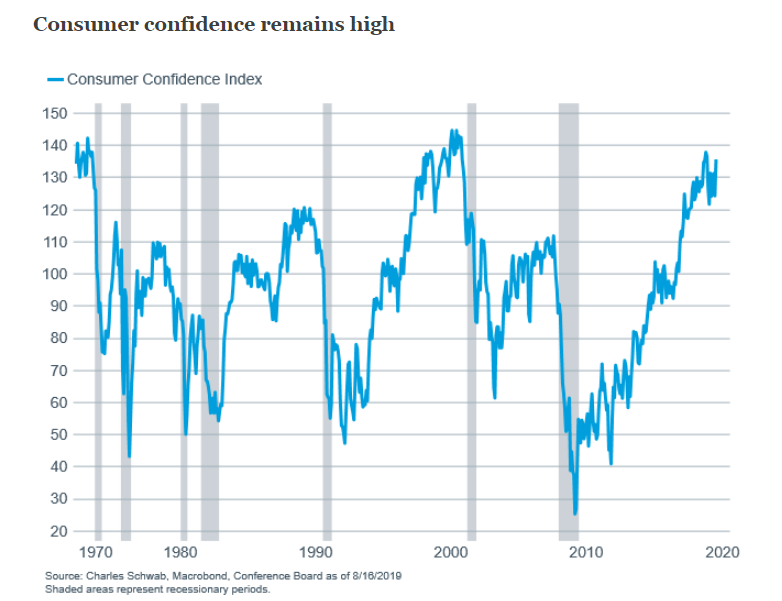

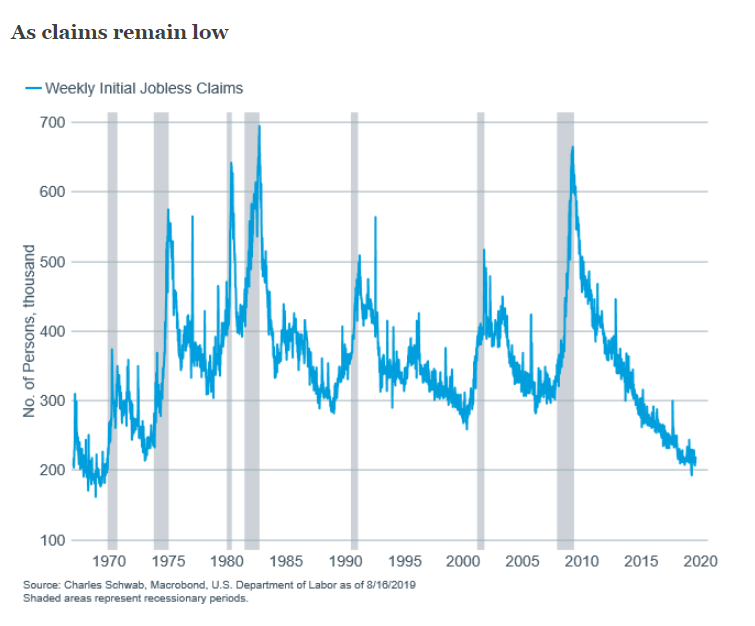

4.Consumer Confidence High and Claims Low.

Liz Ann Sonders Schwab.

https://www.schwab.com/resource-center/insights/content/market-perspective

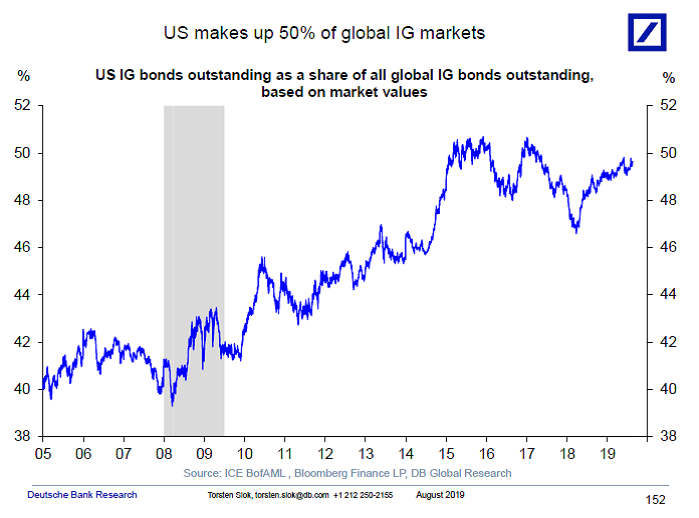

5.In the Last Decade, the U.S. Went from 40% of Investment Grade Bond Market to 50%. The Highest Rates and Most Investment Grade Offering Driving Global Manager to More U.S. Bonds.

With negative interest rates in Europe and Japan, European real money managers and Japanese banks are forced to hunt yield to deliver steady returns. For regulatory reasons, they are mainly allowed to buy investment grade sovereign bonds and investment grade corporate bonds. A decade ago the US market made up 40% of the IG universe, today it is 50%, see chart below. In other words, for global real money managers, there is no other alternative than to buy significant amounts of US Treasuries and US corporate IG bonds.

With a slowdown underway in global growth, not only will interest rates in Europe and Japan stay negative for longer, we are also likely to also see more downgrades from IG to HY in Europe and Asia. This will further increase the share of the US IG bond market. Add another US fiscal expansion with lower payroll taxes and the amount of US Treasuries outstanding will increase further.

In sum, negative interest rates in Europe and Japan for several years forces foreigners to buy more US IG, which pushes US Treasury yields lower, tightens US corporate IG spreads, and pushes the dollar higher. This virtuous cycle for US assets continues until the day when the US enters a recession. Then corporate default rates will move up and earnings growth will slow down.

For more see also my latest client presentation here.

———————————————–

Let us know if you would like to add a colleague to this distribution list.

Torsten Sløk, Ph.D.

Chief Economist

Managing Director

Deutsche Bank Securities

6.Here’s four reasons why investors might snap up negative-yielding bonds

1U.S. investors have struggled to get their heads around negative yielding debt

By

SUNNYOH

JOYWILTERMUTH

U.S. investors have looked with incredulity at the near $17 trillion of negative-yielding bonds across the world amid global economic concerns and easier monetary policy by central banks.

Textbook finance theory, itself, has struggled to explain why investors might want to tie their money in debt that if held through the entirety of its existence would give back less money than what had been invested, said Kathryn Kaminski, portfolio manager at AlphaSimplex.

Opinion: If the stock market is irrational, what do you call the bond market?

Nonetheless analysts say there are reasons for investors and traders to buy subzero-yielding bonds. Here are just a few of them:

Bagholders

Investors who scoop up negative-yielding bonds are betting on the value of the securities to keep rising, in effect, wagering that there are other “bagholders.”

With the European Central Bank widely expected to restart their asset purchasing program, European bond-buyers could be relying on the central bank to hoover up their portfolios of negative-yielding securities.

Although investors buying bonds with subzero interest rates are, in effect, paying for the privilege to hold on to an investment, that cost can be more than offset if the security’s price rises.

In July, an auction for €4 billion euros of 10-year German government bondsTMUBMUSD10Y, +2.03% sold at a negative yield of 0.26%, but at a premium price of 102.6 cents to the euro. The benchmark bund is now trading at a price of a 106.9 cents to the euro, meaning that investors who scooped up debt at last month’s auction would have reaped a gain of around 4% from the price increase alone.

“Everyone is buying this stuff like crazy, because there is too much money in the system from quantitative easing and too much money going to government bonds,” said Jim Bianco, founder of Bianco Research, in an interview with MarketWatch.

On the other hand, market participants say it is unclear if buying fixed-income securities in expectation of further price gains remains a sustainable trend.

Safe assets

Market participants say there are a few bolt-holes that are capable of weathering the deterioration of the U.S. economy and geopolitical tensions. When risk assets sell off, the issue of negative yields on government bonds may be overshadowed by their proven ability to rally during times of market distress.

“This realization that it is important to have high-quality income in fixed income portfolios has created a mini-panic in the market,” said Thanos Bardas, co-head of global investment grade at Neuberger Berman, underscoring that as of last week, all maturities of German bunds have been trading at negative yields.

Cross-currency hedging

Negative yields don’t mean negative income for some.

Unlike European and Japanese investors, U.S. investors are often paid to hedge against fluctuations of foreign currencies because U.S. interest rates are much higher than in other developed markets like Europe and Japan.

It is why American fund managers can still earn money from holding a negative-yielding European government bond. Currency hedging can provide an additional 3% annualized return for U.S. investors buying euro-denominated debt, according to Jens Vanbrabant, senior portfolio manager at Wells Fargo Asset Management.

Roll down

Another way investors can benefit from subzero interest rates is to take advantage of the yield curve’s slope, which still can be steep even for negative-yielding bond markets in Germany and Japan.

The yield curve represents the gap between shorter-term yields and longer-term yields, with a steep curve indicating a large difference.

For example, a trader might buy a negative-yielding 3-year bond and sell it after a year. Since debt prices move in the opposite direction of yields, the value of the 3-year bond should be higher than, say, a 2-year bond, all else being equal.

So long as the interest rates for shorter-term bonds are more negative than their longer-dated counterparts, the price for the long-term bond should generally rise as it moves closer to maturity, said Michael Chang, a rates strategist at Société Générale.

He cautioned that making money from “rolling down the yield curve” is only a short-term strategy, and that traders must sell the bond well before maturity, because the security will trade only at par when it expires.

Pimco says global debt investors often have employed this tactic to make money from Japan’s meager returning government bond market.

SPONSORED CONTENT

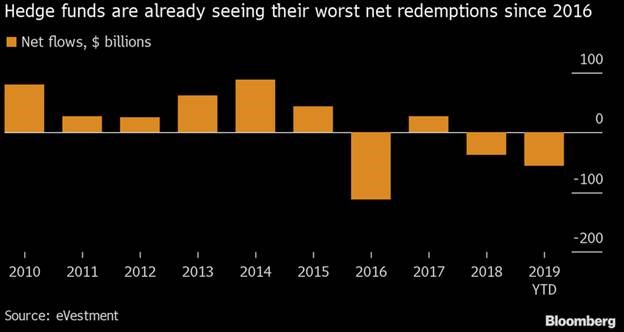

7.Net Outflows From Hedge Funds $55B in 2019….50% More Than All of 2018.

Hedge funds have already bled 50% more money this year than in all of 2018, as the industry struggles to win back investors fed up with high fees and poor performance – Investors yanked $8.4 billion in July, bringing net outflows this year to $55.9 billion. That’s up from $37.2 billion for all of last year.

The pain for hedge funds isn’t spread evenly, with 37% of funds posting net inflows this year. So-called event-driven funds have fared the best, with inflows of $10.3 billion through July. Long/short equity funds are having the hardest time, with net outflows this year of $25.5 billion

FROM DAVE LUTZ AT JONES TRADING

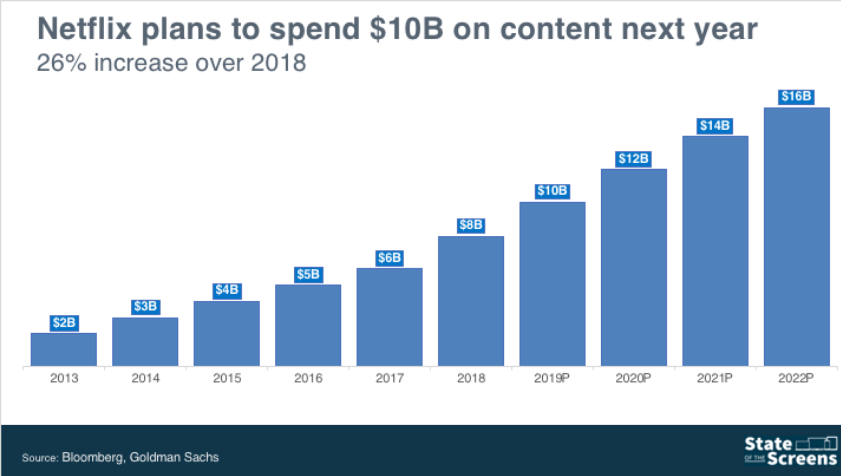

8.Netflix -20%+ from Highs….Biggest Original Content Movie “The Irishman” Launching This Fall.

Netflix Struggles to Come to Terms With Theater Chains Over ‘The Irishman’ Release

By Brandon Katz • 08/21/19 10:23am

Will Netflix release The Irishman in theaters? Netflix

Will Netflix release Martin Scorsese’s mob drama The Irishman in theaters? The director certainly hopes so. Scorsese was well-aware that a wide theatrical release was a long shot when he took the picture to Netflix in 2017 after Paramount passed over budget concerns. But the streamer has reportedly been eyeing its biggest traditional release yet for The Irishman. Last year, Roma received an exclusive three-week theatrical run before being made available to subscribers online. Yet neither Netflix nor the major theater chains appear close to a mutually beneficial compromise for The Irishman.

The streaming service is in talks with AMC Theaters and Cineplex, two of the largest exhibitors in North America, according to The New York Times. Though the negotiations are separate, both exhibitors have reportedly dug their heels in over the same impasse.

SEE ALSO: What Does Martin Scorsese Really Think About Netflix?

“A crucial sticking point has been the major chains’ insistence that the films they book must play in their theaters for close to three months while not being made for available for streaming at the same time, which does not sit well with Netflix,” according to the report. “Talks broke down in July, only to pick up again two weeks ago, the people said.”

Netflix is committed to serving its 151 million worldwide subscribers above all else, especially after a rough quarterly earnings report last month led to widespread concern throughout Wall Street. As of now, the company is unwilling to agree to AMC and Cineplex’s terms and are not currently negotiating with fellow exhibitors Regal or Cinemark. Conversely, the major theater chains are unwilling to entertain a smaller theatrical window as they believe it will undercut the existing agreements they hold with traditional studios such as Disney, Warner Bros., Universal, Paramount and Sony. With neither side budging at this time, the release of The Irishman, which will premiere September 27 at the New York Film Festival, is currently unclear.

One motivating factor for Netflix is the opportunity to compete for Academy Awards as The Irishman is expected to be a contender this year. To qualify for the Oscars, a film must have a one-week run in a commercial theater in Los Angeles County, per the outlet. Yet as voters showed with Roma, the presumptive favorite for Best Picture, there is a reluctance from the old guard to anoint a streaming product with the top prize unless it plays by the traditional rules. To improve its chances, Netflix knows The Irishman must be screened in theaters one way or another.

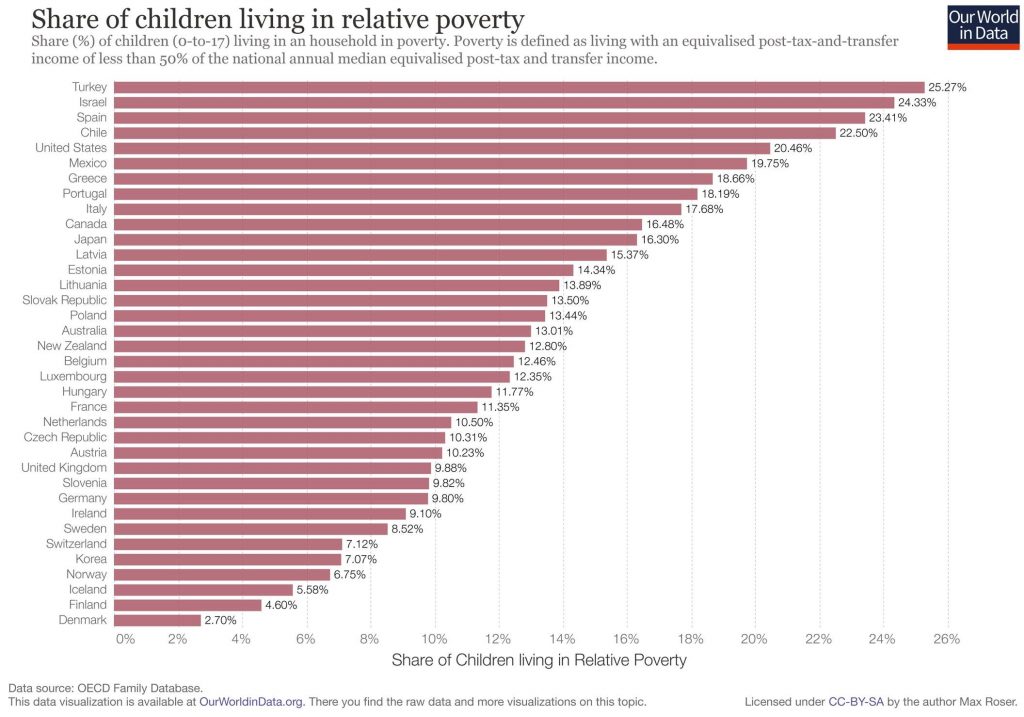

9.Share of Children Living in Relative Poverty.

The concept of relative poverty, on the other hand, is defined with respect to an income level that may change over time and across countries. Most often, relative poverty in a country is measured with respect to the median income in the same country (i.e. the income of the person in the middle of the income distribution). Because it is defined in relative terms, it is a measure of economic inequality.

The visualization below shows relative childhood poverty. That is, the share of children living in relative poverty. The OECD defines childhood poverty as the share of children living in a household with a post-tax-and-transfer income of less than 50% of the national annual median income (i.e. half of the disposable income of the person in the middle of the distribution).

https://ourworldindata.org/income-inequality

10.Are You An Inclusive Leader?

Six Must Have Qualities for Inclusive Leadership