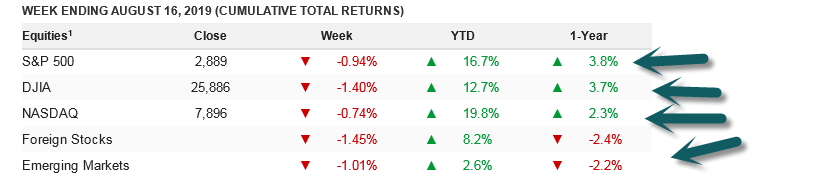

1.Investors Forget that 1 Year…The Stock Market is Only Up 2-4%…And the Nasdaq is Trailing S&P

Tech Bubble?

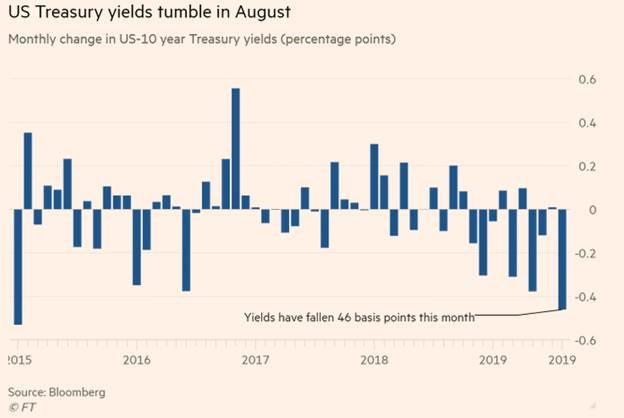

Investors are waiting and investing for a stock market crash but bonds have clobbered stocks 1 year.

|

Daniel

Rodriguez Vice President – Private Wealth Director Franklin Templeton |

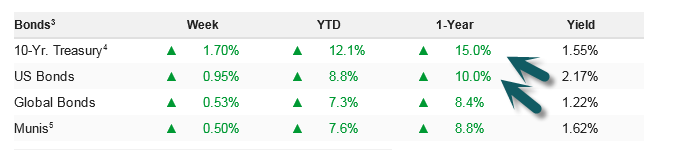

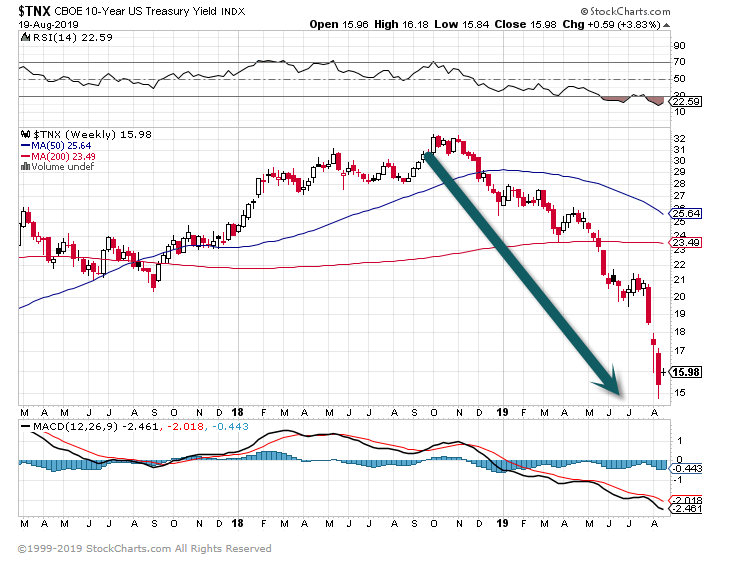

2.Looking at 10 Year Rate Drop in Stand Alone Chart.

Unreal this is a 10 year treasury bond yield 35 years + into a bond bull market.

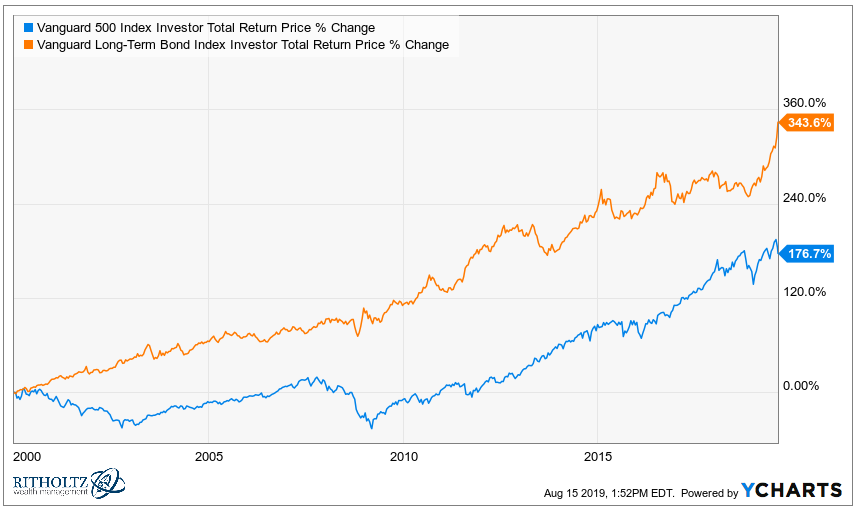

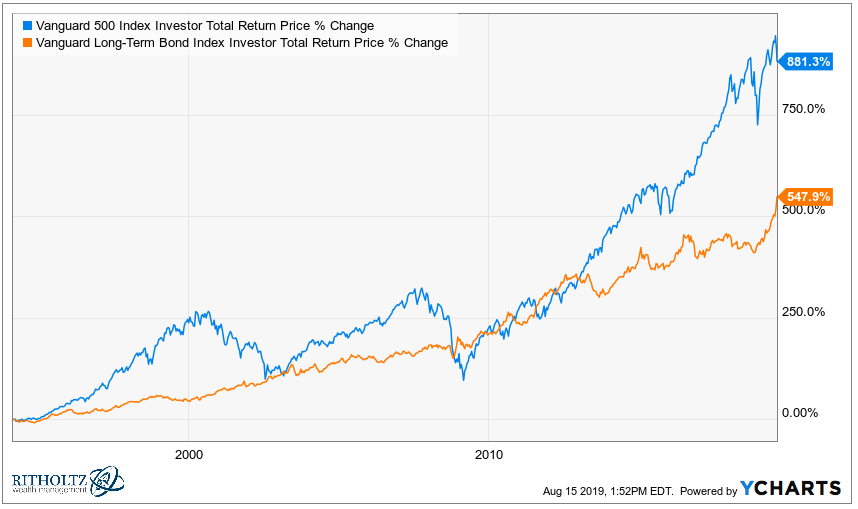

3.Using Dot-Com Crash 2000 Date….Long-Term Bonds Have Crushed Stocks.

Ben Carlson

Bond prices and interest rates are inversely related so this drop in rates has meant excellent returns for long-term bonds. In fact, since the start of 2000, long-term bonds have crushed U.S. stocks:

This is me having a little fun with numbers since the end of the dot-com bubble was basically the worst long-term entry point ever for the S&P 500. Since the inception of the Vanguard Long-Term Bond Index Fund in the mid-1990s stocks have handily outpaced long bonds:

Still, a nearly 550% return in 25-ish years is something else for long-term bonds.

An Appreciation for the Bull Market in Long-Term Bondsby Ben Carlson

https://awealthofcommonsense.com/2019/08/an-appreciation-for-the-bull-market-in-long-term-bonds/

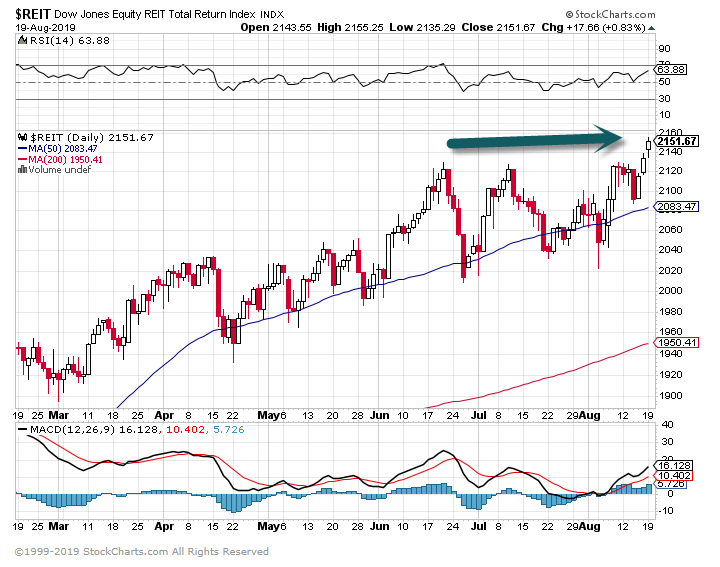

4.Rates Plummet and Utilities/REITS Hit All-Time Highs.

Utilities Leading Sector 12 Months

REITs 2nd Leading Sector 12 Months

5.Stock Dividend Growth Is Slowing Down Across the World

Second-quarter global dividends hit a new record, according to a new report, but the rate of growth slowed to 1.1%. Dividends were hurt by a strong U.S. dollar, as many currencies fell against the greenback during the quarter.

Those were the findings of the latest installment of the quarterly Janus Henderson Global Dividend Index.

Global dividends totaled $513.8 billion, compared with $508.1 billion in last year’s second quarter. That growth rate is down from a 14.1% increase a year ago.

Underlying growth, which includes currency translations and other adjustments, rose 4.6%, in line with the firm’s forecast. Japan, Canada, France, and Indonesia set records for dividends paid out, but they were the only countries to do that in the quarter. In last year’s second quarter, underlying growth climbed 9.1% year over year.

Janus Henderson Investors is keeping its 2019 dividend growth forecast on a dollar basis unchanged, at 4.2%. Janus Henderson noted that “the deceleration in the world economy has begun to make an impact on dividends.”

The fastest dividend growth in the quarter occurred in emerging markets, up 12.6% on a dollar-denominated basis. Japan saw the highest increase among developed regions at 10.1%, thanks to rising profitability and payout ratios.

Meanwhile, U.S. dividend growth came in at 3.9%, the smallest increase in two years. Still, Janus said, “despite a slowdown in growth in the U.S., more than four-fifths of U.S. companies raised payouts, a higher proportion than in many other large countries.”

U.S. companies tracked by Janus Henderson paid out $121.7 billion during the second quarter.

The firm observed that “the pace of dividend growth in the U.S. slowed across a range of sectors with most seeing single-digit increases.”

Some companies, Janus said, “continue to prioritize share buybacks as a way of returning cash to shareholders when compared to other major reasons.”

However, there are signs of slowing growth among the U.S. companies Janus Henderson follows for the quarterly survey. It notes that one in seven U.S. firms held their year-over-year payout ratios steady on a per-share basis, “a larger proportion than in recent quarters.”

That hasn’t stopped the Dow Jones Industrial Average from gaining 12% in 2019. The S&P 500 has risen 17%.

The firm analyzes dividends paid by the 1,200 largest global firms by market capitalization as of Dec. 31 before the start of each year. Those companies represent about 90% of the total dividends paid, according to Janus Henderson.

In 2018, global dividends totaled almost $1.4 trillion, up 9.4% from the previous year. In 2017, dividends increased by 8%, to about $1.25 trillion.

Write to Lawrence C. Strauss at lawrence.strauss@barrons.com

https://www.barrons.com/articles/stock-dividend-growth-janus-henderson-51566236437?mod=hp_LEAD_1

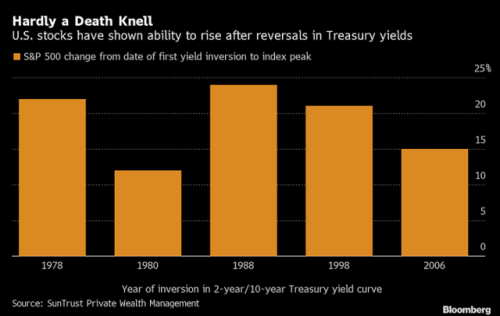

6.Another Look at the Yield Curve Not Being a Timing Mechanism.

Yield Curve great indicator but not a time the market indicator.

Yield Inversions Are Hardly a Death Knell for U.S. Stocks

Source: Dave Wilson

From Barry Ritholtz The Big Picture Blog

7.The 5th Largest Economy in the World Just Hit a Record 113 Months of Job Growth.

California’s 113-month job growth ties record set in 1960s

By ADAM BEAMAugust 16, 2019

SACRAMENTO, Calif. (AP) — California’s job growth is now in its 113th month, tying the expansion of the 1960s as the longest on record as the world’s fifth largest economy continues its recovery from the Great Recession, officials announced Friday.

The country’s most populous state needs between 8,000 and 9,000 new jobs each month to keep up with its growing workforce. But for the past nine years, California has averaged 29,200 new jobs each month, according numbers released Friday by the state Employment Development Department.

The more than 3.2 million jobs California has added since 2010 account for more than 15% of the country’s job gains over that time. Friday, the state’s unemployment rate dipped to 4.1% for July, tying a record low first set in 2018.

“In every way the American economy is substantially impacted by how California is doing,” Democratic Gov. Gavin Newsom said Friday at an unrelated news conference. “We continue to be optimistic, but not naive.”

The United States’ trade war with China could put California’s job gains in peril, according to Michael Bernick, a former director of the California Employment Development Department who is now special counsel with the Philadelphia-based law firm Duane Morris.

Analysts have been warning for a year that tariffs on Chinese imports could threaten U.S. job growth. So far, that hasn’t happened, but the Trump administration recently intensified the conflict by imposing 10% tariffs on $300 billion in Chinese imports, raising fears China would respond with tariffs on U.S. exports.

Earlier this month, federal trade officials announced they would delay tariffs on about 60% of those imports until December.

“There is no reason we can’t expect continued strong employment throughout 2019 in the absence of some external event. And the tariffs are that potential event,” Bernick said.

California’s booming economy was felt earlier this year when Newsom signed a state spending plan that included an estimated $21.5 billion surplus, the largest in at least 20 years. But Newsom and others have been cautious about spending it, warning the country is due for a recession given the unusual length of the recovery.

“It is what keeps me up at night,” California Treasurer Fiona Ma said Thursday about a possible recession. “Our president moves the market every day through his Twitters, and that is very unnerving for us.”

California’s unemployment rate was lowest in the San Francisco Bay Area, where the country’s tech industry is headquartered. Bernick said while Silicon Valley itself does not account for many jobs in the state, the money it produces has fueled a surge in accompanying industries including finance, real estate and retail.

The unemployment rate was highest in the Central Valley, reflecting the seasonal demands of the state’s $20 billion agriculture industry. Imperial County in Southern California had an unemployment rate of more than 20% as surveys reported more than 14,000 people were out of work.

Associated Press reporter Don Thompson contributed.

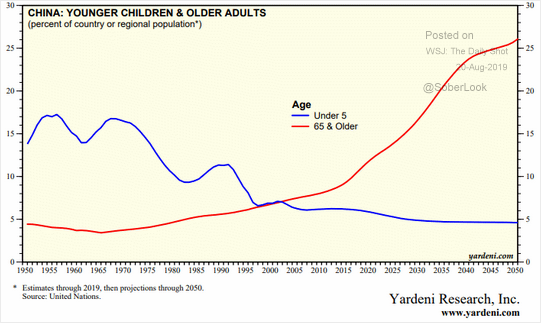

8.China’s Massive Demographic Problems in One Chart.

Finally, here is an illustration of China’s massive demographic challenge.

The Daily Shot https://blogs.wsj.com/dailyshot/2019/08/20/the-daily-shot-hong-kongs-economy-is-in-trouble/

9.A group of states may launch investigations into big tech companies like Facebook and Google possibly next month

Facebook’s CEO Mark Zuckerberg Associated Press/Francois Mori

- Representatives from as many as a dozen states met with DoJ officials to discuss a multi-state effort to investigate big tech companies like Facebook and Google.

- The states may announce their own, but coordinated, investigations as early as next month, the Wall Street Journal reports.

- Calls for investigations into big tech is one area that both US political parties agree on.

- Visit Business Insider’s homepage for more stories.

States including North Carolina, Mississippi, Texas and others have met with top Justice Department officials in Washington last month to discuss a multi-state effort to investigate big tech companies for anti-trust violations, the Wall Street Journal reports, citing unnamed sources.

The multi-state effort may be announced as soon as next month, the Journal reports, and would represent the third major government investigation underway into some of the largest American tech companies.

The states involved are run by Attorney’s General who are members of both political parties, Democrats and Republicans. Their investigations into companies like Alphabet’s Google and Facebook would likely be done in coordination with investigations by the U.S. Justice Department.

Representatives from about a dozen states attended the meetings. Enlisting the help of the states in a bipartisan probe could help GOP officials defend against accusations that federal investigations into tech companies are politically motivated.

Last month, The Department of Justice said it had launched a broad probe into top “online platforms” for search, social media, and e-commerce. It didn’t name, names but the wording left no doubt that the subjects included Alphabet,Facebook, Amazon, and Apple.

The Federal Trade Commission, which recently fined Facebook $5 billion for privacy violations, is carrying out an antitrust probe into Facebook. On Monday, FTC Chairman Joseph Simons, discussed the potential of breaking up Facebook’s past acquisitions of companies like Instagram and WhatsApp, according to the Financial Times.

Simons told the FT that reversing those mergers could be more difficult because of Facebook’s recent efforts to integrate the backend technology of the various products. But he noted that there might be “additional evidence” that Facebook used the acquisitions to “snuff out” competition.

Beyond investigations into big tech by the Trump Administration, Democratic candidates have also been calling for investigations and other regulation of big tech companies and new technologies. Elizabeth Warren has called for breaking up Amazon, Google, and Facebook. On Monday, Bernie Sanders also called for banning sales of facial recognition technology to law enforcement agencies.

10.You Know Less Than You Think

Realizing how little we know may improve our political conversations.

Many of us care deeply about our political beliefs, and we’re often very confident about the beliefs that we hold. But, we usually do not understand the details of the political issues we care about so strongly. Instead, we are fed simple explanations of these issues from partisan media sources.

However, we tend to think that we know a lot more about the world than we actually do. This phenomenon is called the “Illusion of Explanatory Depth,” a term coined by Yale psychologists Leonid Rozenblit and Frank Keil. In a series of experiments, Rozenblit and Keil found that people frequently overestimate the extent to which they know about how basic things in the world work – like how a zipper operates or how a refrigerator works. But, when pressed to explain how these things work, they struggle to come up with explanations and discover how little they know.

This sense of overconfidence can fuel political polarization. In one study, Philip Fernbach and colleagues found that people think they know much more about complex policy positions than they actually do. But, when asked to generate explanations for how these policies work – describing, for instance, the details of instituting a national flat tax or transitioning to a single-payer healthcare system, people recognized the gaps in their knowledge. Moreover, trying to generate explanations also caused them to express less extreme opinions about these issues, presumably because they realized their opinions were rooted in overconfidence.

Letting go of this overconfidence and approaching political conversations with a sense of humility can help us overcome polarization. One study by psychologists Tenelle Porter and Karina Schumann found that intellectual humility is associated with a greater willingness to listen to opposing viewpoints about contentious political issues.

Appreciating

the complexity of political issues can also improve our political

conversations. Psychologist Peter T. Coleman runs the difficult conversations

lab, where he studies how political opponents can have better conversations about

contentious issues like abortion or immigration. For one of his experiments, Coleman

presented a group of conversations partners with a short, simple summary of

both sides of an issue. Another group was presented with a more

complicated analysis of the issue that showed a range of opinions. Participants

in the group that read the more complex analysis tended to have more nuanced

and satisfying conversations.

We often do not understand our political opponents, which can make them much

easier to dismiss. Research suggests that Republicans and Democrats both do a

terrible job of estimating the demographic make-up of

their political opponents. For instance, Republicans think that 36% of

Democrats are atheists (when only 9% are), and Democrats think that 44% of

Republicans are earning more than 250K per year (when only 2% do). Furthermore,

both Democrats and Republicans think that their own side is motivated by love

for their party, but their political opponents are motivated by hate, a cognitive bias called motive attribution asymmetry.

Conversations with our political opponents often seem futile. To make them more effective, try to complicate things. Recognize the limits of your own knowledge, and try asking people to explain the details of certain policy positions they cling to so they can see the holes in their own knowledge, too. Realizing how little we know might be the first step to improving political divisions —but, who am I to think I know anything?

https://www.psychologytoday.com/us/blog/words-matter/201908/you-know-less-you-think