1.Small Cap Stock Beat Down….Russell 2000 Small Cap Goes Negative for the Year and Breaks thru 200 day to Downside.

IWM Russell Small Cap-Closes Below 200day on Good Volume.

Small Cap Negative on the Year vs. S&P +8 IOO Mega Cap Stocks +10%

2.Emerging Markets Returns Also Driven by Tech…Emerging Market Tech ETF +50% 2017

The emerging market technology sector now accounts for more than a quarter of the MSCI Emerging Markets index, triple what it was a decade ago. EM tech revenue has been expanding at a 40% annual clip over the past seven years, notes Kevin Carter, founder of the Emerging Markets Internet & Ecommerce exchange-traded fund.

http://www.barrons.com/articles/can-the-tech-euphoria-last-1503111973

EMQQ Emerging Market Tech ETF +50% vs. EEM +23%

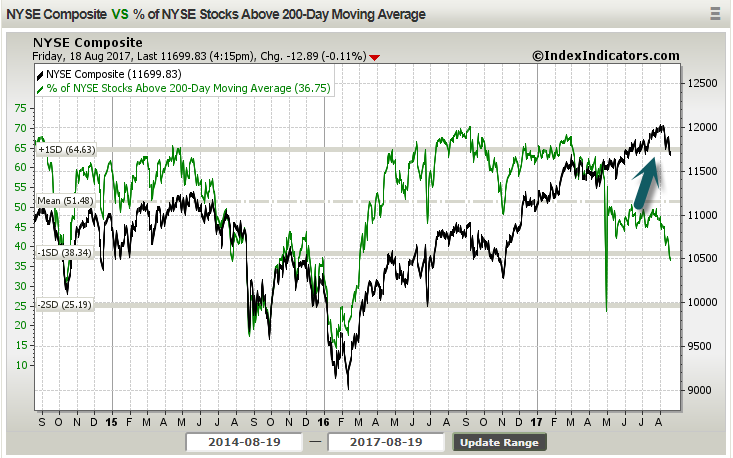

3.Percentage of Stocks Above 200day Moving Average Sinks to 2017 Lows…Diverges from the Market.

Green Line is Percentage of Stocks Above 200day Sinking and Diverging from Market….Good Measure of Breadth.

http://www.indexindicators.com/charts/nyse-vs-nyse-stocks-above-200d-sma-params-3y-x-x-x/

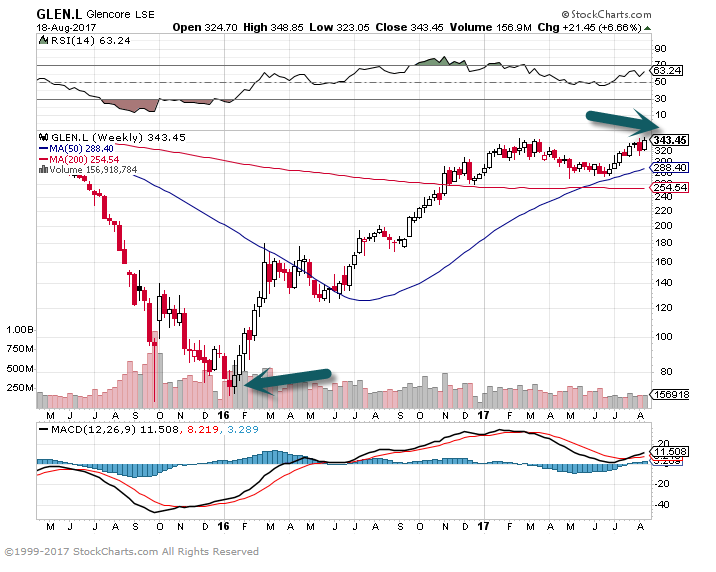

4.Follow up to Last Week’s Commodity Comments…Remember Glencore Rumors of Going Under in Beginning of 2016…The World’s Biggest Commodity Traders.

Glencore plc is a leading integrated commodity producer and trader, operating worldwide. Our unique business model covers diverse products, activities and locations all along the commodity chain.

Our business covers over 90 commodities encompassing metals & minerals, energy products and agricultural products as well as related marketing and logistics activities.

| Metals & Minerals

These businesses include copper, zinc & lead, nickel, ferroalloys, alumina & aluminum and iron ore production and marketing. We have interests in both controlled and non-controlled industrial assets that include mining, smelting, refining and warehousing operations. |

Energy Products

These businesses cover industrial and marketing activities for coal and oil, including controlled and non-controlled coal mining and oil production operations, and investments in strategic handling, storage and freight equipment and facilities. |

Agriculture

This business is focused on grain, oilseeds products, sugar, pulses and cotton. The Agriculture business is supported by both controlled and non-controlled storage, handling and processing facilities in strategic locations. |

Our diversified operations comprise around 150 mining and metallurgical, oil production and agricultural assets. Our industrial and marketing activities are supported by a global network of more than 90 offices located in over 50 countries. We employ around 155,000 people, including contractors.

We trade in and distribute physical commodities sourced from third party producers as well as our own production. We also provide financing, processing, storage, logistics and other services to commodity producers and consumers.

http://www.glencore.com/who-we-are/what-we-do/

Glencore +357% Since Jan. 2016

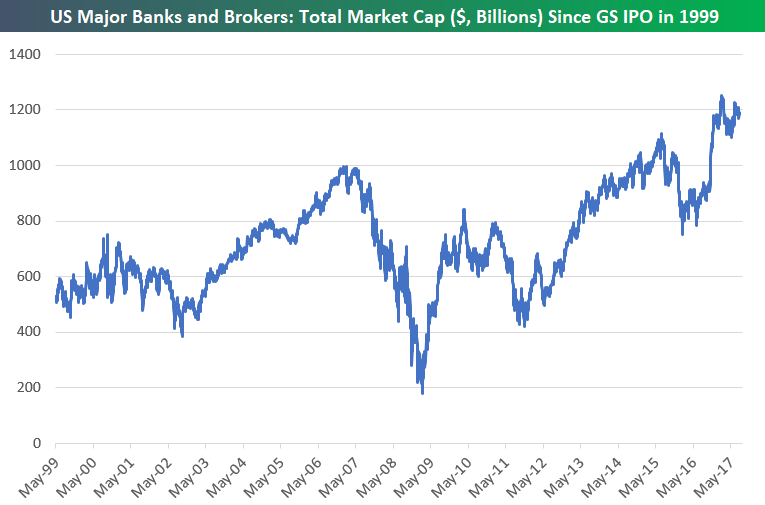

5.U.S Markets Really Work….Six Major Banks hit $200m total market cap 2009….$1.2T Last.

JP Morgan (JPM) Takes the Lead

Aug 17, 2017

Below is a look at the combined market cap of the six major US banks and brokers that we like to track — Goldman Sachs (GS), Morgan Stanley (MS), Wells Fargo (WFC), Bank of America (BAC), JP Morgan (JPM), and Citigroup (C). After dipping below $200 billion at the lows of the Financial Crisis back in early 2009, their combined market cap currently stands at roughly $1.2 trillion.

Looking at the market caps of the six individual companies, a lot has changed since the turn of the millennium. Goldman Sachs (GS) was the last to IPO of this group of six, so below is a chart showing the change in market caps for these stocks since Goldman’s IPO back in mid-1999.

Citigroup was on top in the early 2000s, and then Wells Fargo took a clear lead in the middle part of the current bull market. Now, though, it’s JP Morgan that has recently separated itself from the pack. At $324 billion, JPM has the highest market cap that any of these stocks have ever seen.

https://www.bespokepremium.com/think-big-blog/

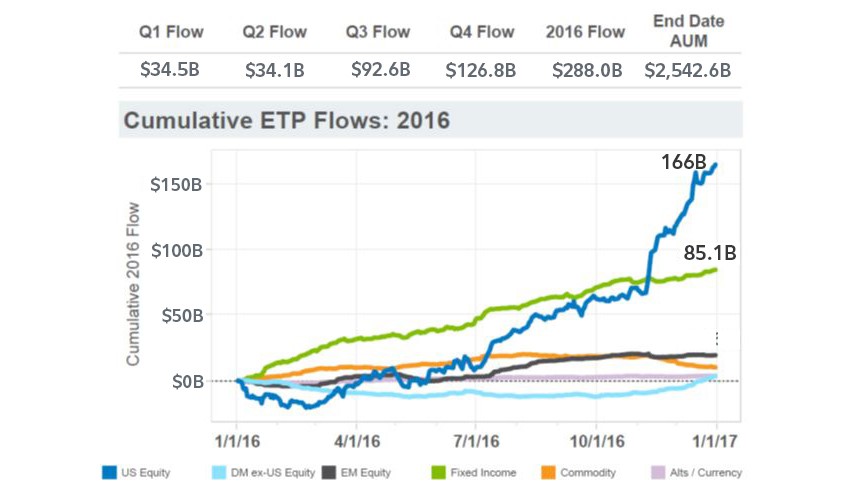

6.U.S. Stocks Dominate Flow.

U.S. stock funds soar

After a solid first half, demand for ETPs accelerated in the third quarter, as investors increasingly sought out U.S. equity (i.e., stock) funds and fixed income (i.e., bond) funds. Then, fund flows took off like a rocket ship post-election, with 56% of the entire year’s cumulative flows occurring after November 8 (see U.S. Domiciled ETP Summary chart).

After a pullback in the early part of 2016, demand for U.S. stock funds picked up beginning in July, then accelerated post-election, hitting $166 billion by the end of the year—more than all other categories combined.

U.S. domiciled ETP summary

Source: BlackRock® iShares® Follow the Flow Report, as of January 7, 2017.

https://www.fidelity.com/viewpoints/active-investor/fund-flows-review-2016

Found at Barry Ritholtz Blog…

http://ritholtz.com/2017/08/sunday-reads-103/

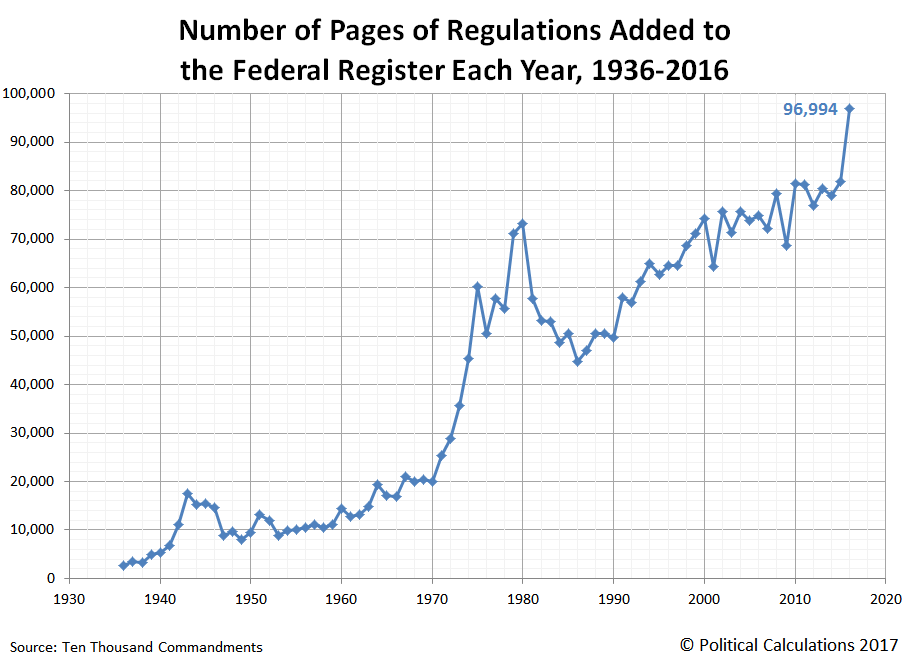

7. Regulatory Actions Since 1936

I don’t make any political statements on Top 10….Just thought chart was interesting look at regulation.

Bianco cites a study released last year by the Competitive Enterprise Institute, which argued that the cost of regulation to businesses exceeds what they pay in taxes. To gauge the extent of this, he counts the number of pages added to the Federal Register, where new regulations must be published. Through July 31, the annualized pace was 61,330 pages, which actually is down sharply from nearly 97,000 in 2016, the Obama administration’s last year, and the lowest figure since the 1970s. At that rate, this year will see the biggest decline in regulatory actions since the Federal Register was introduced in 1936.

http://www.barrons.com/articles/trumps-secret-weapon-deregulation-1503108922

Federal Register

From Wikipedia, the free encyclopedia

The Federal Register, abbreviated FR or sometimes Fed. Reg., is the official journal of the federal government of the United Statesthat contains government agency rules, proposed rules, and public notices.[1] It is published daily, except on federal holidays. The final rules promulgated by a federal agency and published in the Federal Register are ultimately reorganized by topic or subject matter and codified in the Code of Federal Regulations (CFR), which is updated annually.

The Federal Register is compiled by the Office of the Federal Register (within the National Archives and Records Administration) and is printed by the Government Publishing Office. There are no copyright restrictions on the Federal Register; as a work of the U.S. government, it is in the public domain.[2]

https://en.wikipedia.org/wiki/Federal_Register

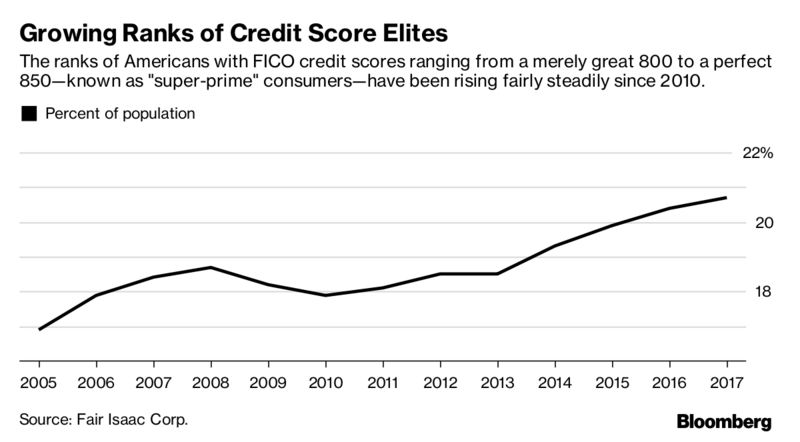

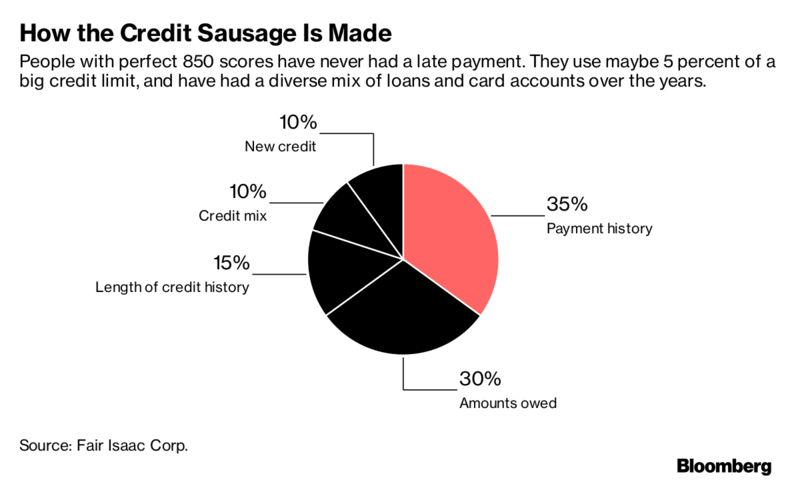

8.Read of the Day…Americans Continue to Repair Balance Sheets.

A big reason for this is that American consumer finances are generally in good shape. While the overall level of household debt has returned to its pre-recession peak, it remains low when compared with income, says Mark Zandi, chief economist at Moody’s Analytics. Debt service—principal and interest payments as a percent of income—is at an all-time low, helped by mortgage refinancing over the past decade.

It used to be that your credit score was a big mystery, or you had to pay to see it. Now credit card companies can’t wait to show you your score, for free. But those three-digit numbers you get every month aren’t necessarily the ones lenders use. In reality, you have dozens of scores, some based on previous versions of FICO scoring models and others developed by the three big credit bureaus. And your score will vary by the lender’s industry—mortgage, auto loan, credit card, and telecom services.

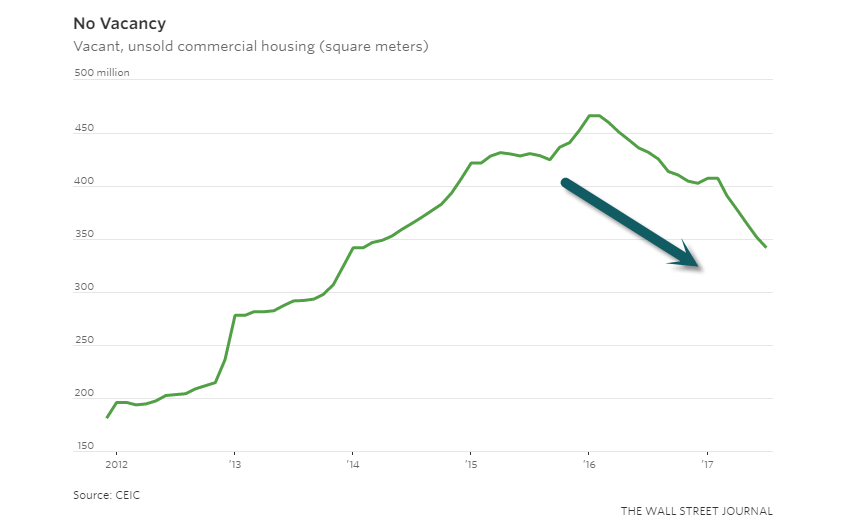

9.Remember all the Chinese “Ghost Cities” You Tube Videos that Fueled Short Story from Hedge Funds….Vacant Housing Continues to Drop in China.

The biggest bullish factor for Chinese construction remains intact: Massive housing inventories, which depressed construction growth for years, are still falling. Vacant, unsold housing floor space in China fell 10 million square meters in July to the lowest level since February 2014, according to data released earlier in the month. Vacant floor space is down 20% on the year.

https://www.wsj.com/articles/a-pillar-of-chinese-growth-starts-to-show-cracks-1503039667?tesla=y

10.You to a Higher Standard than You Hold Yourself

Benjamin P. HardyFollow….B. Harvey becoming one of my favorite writers.

There’s some interesting research in social psychology explaining how most people form their peer groups. Especially as children and adolescence, but often as adults, people select their friends based on proximity more than anything else.

Even in a college classroom, who are you going to make friends with? It’s not those who have similar personalities and interests. It’s the people you literally sit next to.

Socioeconomically, there is loads of research showing a person’s economic mobility is highly determined by the county they live in. In certain counties, your chances of improving your financial situation are very good. In others, like the county our three foster children came from, your chances of improving your financial situation are slim-to-none.

Put most simply, what stands in nearest proximity to you has enormous implications. As Jim Rohn has wisely said, “You are the average of the five people you spend the most time with.” Similarly, Tim Sanders, former Yahoo! director, said, “Your network is your net worth.”

If you’re feeling stuck and struggling to make the progress you want, take a look around you. Most people adapt to whatever environment they find themselves. They have what psychologists call an “external locus of control,” where they believe factors outside of them dictate the direction of their lives. Consequently, they don’t take responsibility for shaping the environment that will ultimately shape them.

Who are the people in nearest proximity to you?

How did they become your peer group?

Was it on purpose or based on convenience?

Do these people hold you to a high standard?

Or, do they hold you to an even lower standard than you hold yourself?

The Fastest Way to Change Your Life

If you want to improve and succeed in your life, you need to surround yourself with people who have higher standards than you do. As Tony Robbins has said, your life is a reflection of your standards, or what you’re willing to tolerate. Most people are willing to tolerate unhealthy relationships, poor finances, and jobs they hate. If not so, those things wouldn’t be in their lives.

The common approach to personal growth and change is to exert more willpower, or to improve your mindset, or to be more gritty. And all of these things certainly have their place.

But if your environment radically contradicts the goals you’re trying to pursue, your life will always be an uphill battle.

A much better and faster approach is to purposefully change your environment. For example, I have a friend, Nate, who is a successful real estate investor. He also sells real estate education products.

Despite making high six-figures, he’s an extremely frugal guy. For years, he drove a beat up Toyota Camery from the 1990’s. The car ran great and the gas mileage was fantastic. But the car didn’t create an environment of confidence in Nate’s perspective clients.

He decided to upgrade his car to better match his business goals and vision in life. He spent over $110,000 on a decked-out Tesla.

Four very interesting things happened after he made this investment:

- Most of Nate’s “platform” is on Facebook. He often talks about the deals he’s doing, or teaching financial/real estate principles. After getting his Tesla, and posting awesome videos of the car and posts teaching the philosophy of why he bought it, he got over 2,000 friend requests from people involved in real estate within a month.

- During that month, the sales of his real estate education products tripled. This increase in sales allowed the car to be paid-off in just two months of when he purchased it. Nate’s environment now matched the education products he was selling to people about building financial freedom. Also, his environment now triggered immediate authority — which according to psychological research is one of the primary persuasive triggers.

- With his new car, some of the biggest real estate investors and real estate education sales people in his area began reaching out to him. He was now seen as “credible.” Nate began being invited to private events with his role models. You could argue how surface level all of this is, and you’d be half right.

- Nate’s own psychology changed. Driving around in the coolest car on the road made him feel awesome. His confidence shot through the roof.

Research in psychology describes a concept known as “pre-cognition,” which shows that you can predict your own psychological/emotional state by targeting biological or environmental stimuli. If you want a release and rush of endorphins, go running and or take a ice-bath. If you want to feel peaceful, go into nature. Nate’s confidence shot through the roof for a few reasons.

- Firstly, as noted, his environment created amazing feelings.

- Secondly, and perhaps far more importantly, he was seeing the fruits of his labors. He was investing himself in big things and demonstrating to himself how serious he was about the work he was doing and the vision he was aspiring towards.

- Thirdly, he was consciously generating a self-fulfilling prophecy in real-time. He created an environment that was now creating him. And the fruits were already apparent.

- These fruits added even more confidence, creating a continuous confidence building feedback loop.

It’s important to note that Nate’s confidence doesn’t come from owning a Tesla. True security is never external, but can only exist internally.

Yet, too many people separate the internal and external with fine lines. The lines are more blurred. The external and internal, in reality, play-off each other. When you change your external environment, it alters your psychology, which then can loop back to continuing to enhance the environment in a virtuous upward cycle.

Surround Yourself With People Who Transform You

Over the past 10 or so months, I’ve hired Ryan Holiday, author of several bestselling books, to help me with the book I’m writing. Working with Ryan has shown me just how low my own standards for my work are. For instance, every time I send him a draft, he shows me why and how it could be 10X better, and he holds me to that standard.

It’s not that my standards are inherently low. It’s more that I don’t know what I don’t know. Working with Ryan has streamlined my understanding of what is possible and what it takes to create something powerful.

Just like my friend’s Tesla, I had to pay to improve my environment. At least when it comes to business, the best advice is rarely free. Moreover, it is only by investing in what you’re doing that you’ll experience the psychological shift needed to achieve your goals. Once invested, your identity towards what you are doing changes. You demonstrate to yourself that you have skin in the game. You’ve put yourself physically, not just emotionally, in a position where you must move forward. The role of leadership becomes natural and instinctive. Survival and thriving become one in the same.

Just as Ryan holds me to higher standard than I hold myself, my business partner, Richard Paul Evans, does as well. Like Ryan, Evans has a much higher vantage point and far different experience than I have. Together, we are doing author training seminars. Evans has written 36 New York Times Bestsellers. He’s been speaking and doing events for 20 years.

Evans holds himself to an insanely high standard. Simultaneously, he expects me to perform at very high levels as well, because my performance is a reflection on him. It’s not a bad problem for me to have because it creates intense pressure to succeed. To quote former NBA star, Robert Horry, “Pressure can bust pipes or it can make diamonds.”

Surrounding yourself with people who have higher standards than you is the fastest way to change. In fact, I believe it’s the only way to truly and permanently change. If you don’t change your environment, and instead attempt to overcome your environment through willpower, you’ll lose every time. Your progress will be very slow.

Are you surrounded by people who hold you to a high standard?