1.It May Be A Slow IPO Market But Venture Capital Backed Tech Breaks Out to New Highs.

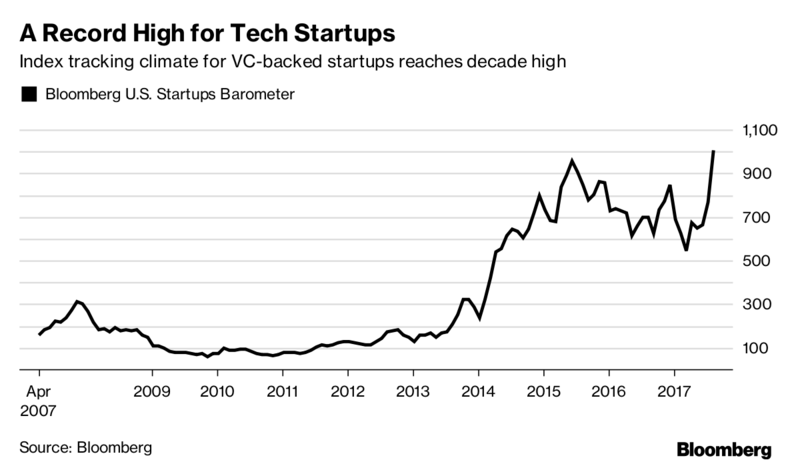

Funding Conditions for Tech Startups Soar to a New Record

An index tracking business conditions for U.S. private companies surged 44 percent from a year earlier.

By

Isabel Gottlieb

August 11, 2017, 8:00 AM EDT

There’s rarely been a better time for American technology startups.

The Bloomberg U.S. Startups Barometer, which tracks the business conditions for U.S.-based private technology companies, reached a record high. A 44 percent increase from a year earlier was driven by a surge in the number of businesses that raised money for the first time, reflecting investors’ appetite to back the riskiest companies. The index, which goes back to 2007, doesn’t account for the frenetic days of the dot-com bubble.

“If you’re leaving Google or Facebook to go do your startup, this is probably the best time ever to do so,” said Wesley Chan, managing director at the venture capital firm Felicis Ventures. “There’s a lot of frothiness in early stage and seed investing.”

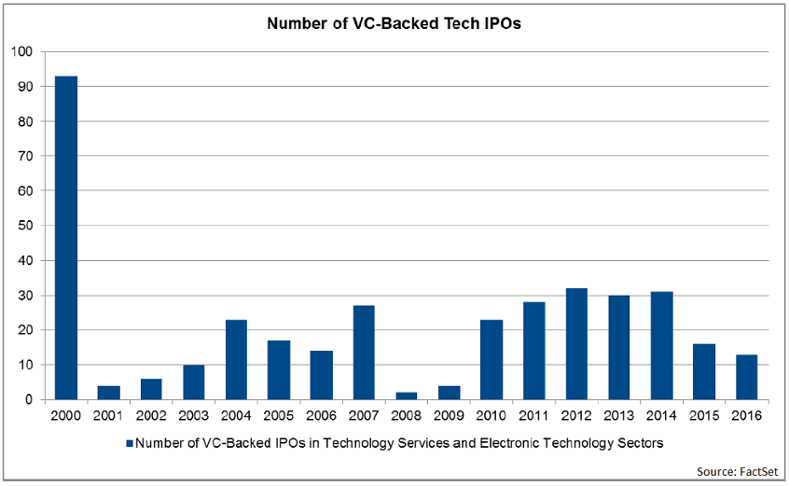

2.Will this Spark a Venture Backed Tech IPO Boom at Some Point????

Tech IPOs Below 30 per year for 17 years.

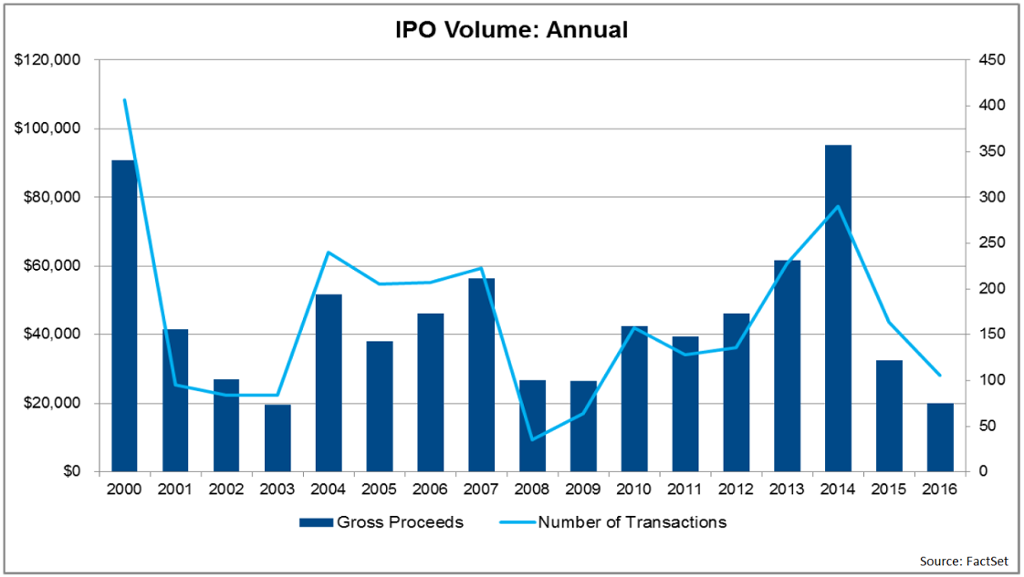

Total IPO Volume Weak

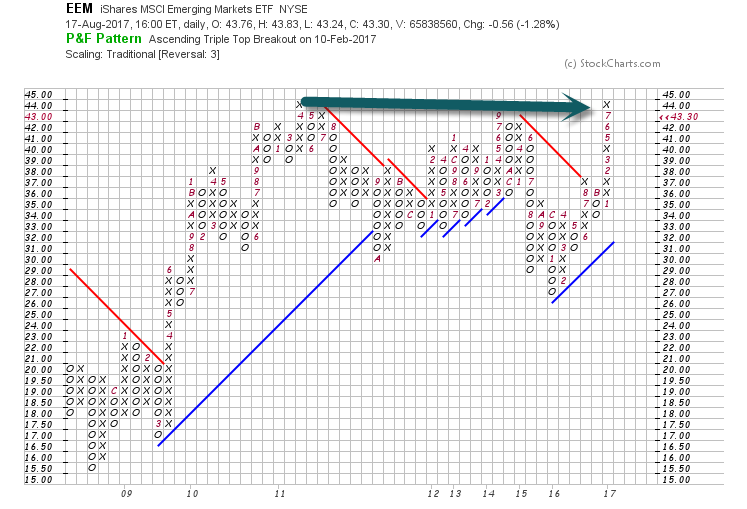

3.Emerging Markets ETF Flow…A Fifth of Emerging Market Assets Now ETFS.

From Dave Lutz at Jones

EM ANGST– FT: “EM worries over swelling influence of ETF flows” – EM ETFs now have almost $250bn under management with $196bn in equities and $48bn in fixed income. That represents close to a fifth of total EM mutual fund assets under management. Just two years ago, the figure was just above 12 per cent. The figures highlight how the boom in passive investing is not limited just to developed markets that have more liquid assets.

The worry is that if flows into EM ETFs abruptly reverse — perhaps caused by global central banks tightening monetary policy, or renewed concerns over China’s economy — then there won’t be enough buyers to absorb the outflows, causing prices to “gap” lower – This is particularly a concern in EM bond markets, which are far less liquid, or actively traded, than those in the developed world. EMB, the EM Debt ETF, has seen shares outstanding explode by 40% YTD

Remember from last week…We are one tick away from breakout of 10 year range in emerging markets.

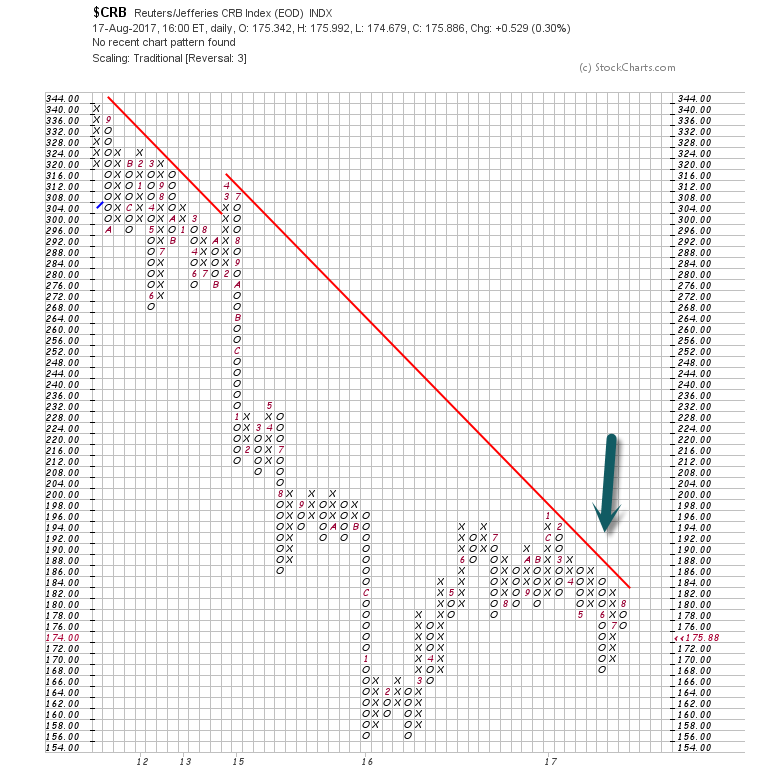

4. A Ton of Movement in Commodities the Last Couple Weeks.

Copper Broke Above 6 Year Downtrend RED line

Commodities broad index still has not broken above RED line

Commodities broad index still has not broken above RED line

5-6.Good Read….A Completely Different Way To View The S&P 500

FollowRob Isbitts

Co-Founder and Chief Investment Officer at Sungarden Fund Management, LLC

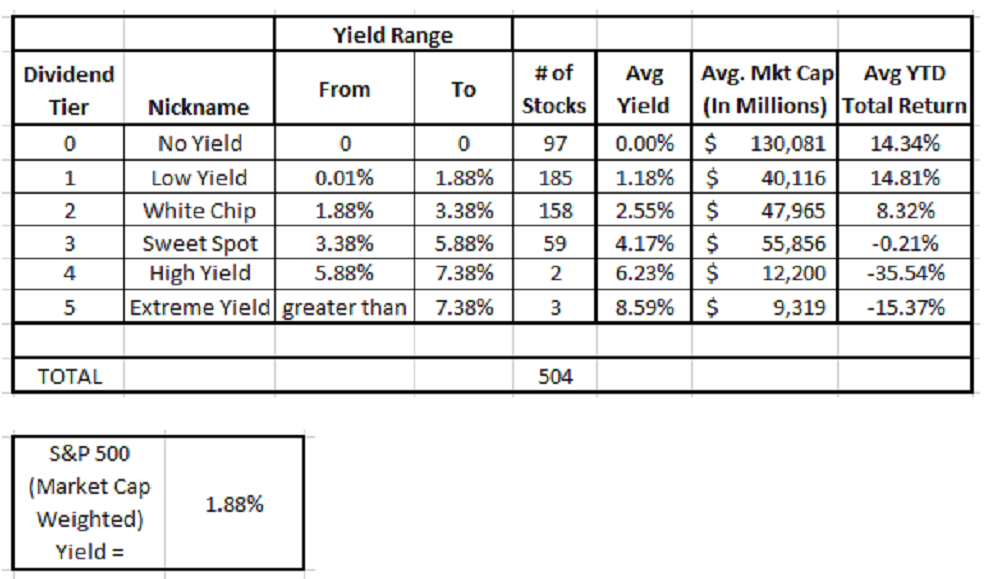

Breaking it down by “Dividend Tiers” brings new perspectives for income investors

I have written extensively in recent years about the gargantuan outperformance of the S&P 500 versus many sub-segments of the stock market. It is fair to say that during the past few years, when it comes to this popular indicator, the whole has been worth more than the sum of its parts. So, what I try to do in this space is to dissect what investors and media flippantly refer to as “the stock market,” because unless you are a young investor with an investment time horizon of multiple decades, the skewing that has occurred within the S&P 500 in the latter stages of this 8 1/2 year old bull market is like heavy drinking before the hangover…but the hangover is inevitable.

I have covered this skewing from two angles that are crucial for investors to understand if their portfolio is being tapped to fund their lifestyle currently, or will be within the next 10 years:

- The Nasdaq is slaughtering the NYSE Composite. These two stock exchanges make up nearly all the U.S. Stock market. This also has had the effect of lifting the S&P 500 to new heights, as a limited number of successful Nasdaq glamour stocks have had an outsized positive impact.

- Stocks with higher yields have not participated in this year’s S&P 500 rally. This will be strikingly clear in a moment when I show you some statistics I compiled. Suffice it to say that if you are motivated by acquiring steady dividend cash flow in your portfolio, that part of your mission has been smooth as usual. But you are probably underwhelmed by the additional price gains those high-yield stocks have delivered this year. This is a tradeoff investors accept when they choose to earn a substantial part of their total return from the predictable cash flow of dividends. The dividends flow in, but the price gains are less consistent. This is not only because the stock market is an often volatile place, but also due to the whims of investors regarding higher-yielding stocks. And when the market is focused on hi-fliers and companies that pay no dividends, they get the lion’s share of the assets. That can at times limit the amount of buying pressure directed toward other market segments. High frequency traders and index funds dominate daily trading these days, and they are not dividend-investing types. It is easy to forget that you accepted that when the media is touting all-time highs in the headline indexes, and you may also forget that investing for life’s objectives is a not a sprint. As one who has been an active, professional participant in the markets for over 30 years, do not forget that!

Now, let’s peek at some numbers. I took the current holdings in the S&P 500, and divided them according to what I call “Dividend Tiers.” I created this approach because too many investments, including many ETFs, try to sound like they are dividend-focused but they are not. Their yields are too low. So while they invest in stocks that pay dividends and check that box, the yields on those stocks don’t amount to enough to fund most people’s retirements. “Dividend yield” sounds enticing, but not if it is followed by the words “of 1-2% per year.” Most retirement plans are geared toward producing 4% returns or higher. If you can get that from the dividend on an annual basis, that gives you the luxury of waiting out the market’s cycles, and potentially adding some price return to that lifestyle-funding yield you are getting year in and year out. This is precisely what is being lost on some investors right now in the current Nasdaq-infused S&P 500 mania.

In the chart below, I summarized my findings. I looked at the different yield segments within the S&P 500 (which actually has 504 holdings), noted how many stocks fell into each segment, and recorded the average (equal-weighted) year to date return of each stock and yield group through August 8th.

Note that there are many reasons a stock’s yield lands it in one of these categories. Some of the high yield stocks got there because their stock prices were pummeled this year, and that lifted their yield to the point where they moved into the last group. Others had the opposite effect, whereby their stock prices rallied enough to take them from, say, White Chip status to the Low Yield group. I am working on a more comprehensive study of these segments for an upcoming research paper, so I suspect this will not be the last time you see this type of analysis from me.

DEFINING DIVIDEND TIERS

“No Yield” speaks for itself. “Low Yield” stocks pay a dividend, and therefore qualify for the many “Dividend-Paying Stock” strategies that exist today. But their yields won’t pay the bills without dipping into principal unless your portfolio is at least 8 figures in size, or you are extremely frugal.

“White Chips” are a name I created for those stocks in the 2.00%-3.49% range, as they are predominantly what we would refer to as “Blue Chip” stocks. And since Red has a negative connotation in investing, we call these “White Chips.”

“Sweet Spot” stocks are more in the annual dividend payout range of what many retirement plan withdrawal rates call for, 4-6%. There were more Sweet Spot stocks in the S&P 500 a few years ago, but the latter phases of this long bull market lifted their prices up and their yields down. The next market correction (and there is one coming, despite what some with green eyeshades will tell you) will probably create more investment opportunities from the White Chip list, as they drift back into Sweet Spot territory.

A key point here is that while the S&P 500 is not loaded with Sweet Spot stocks, if you look outside the S&P 500 to mid-cap and small-cap stocks, as well as several ADRs (US-traded foreign companies), the universe expands quite a bit. But in this S&P 500-focused culture, many of these strong income payers are neglected, at least for now.

“High Yield” and “Extreme Yield” also speaks for themselves. However, note that there is such a thing as too high a yield to make an investment attractive (at least to me). As with all of this discussion, each stock should be evaluated on many factors, of which its dividend yield is one. There are only 5 stocks between the two groups within the S&P 500, which is even more evidence that being an index-fund investor and being a yield-seeker are two very different paths.

CONCLUSIONS FROM THE DATA

- The S&P 500 Index is not chock-full of dividend investing opportunities. I know that, my colleagues know that, and other dividend-oriented investors know that. But the common perception amongst investors and the media is that we are all playing in the same sandbox. We are not. And there are plenty of stocks in the S&P 500 that yield in a range that is worthy of consideration for a dividend-income portfolio these days, the index in aggregate is dominated by companies that don’t make the cut, or at best are toward the lower end of the dividend yield range that such investors would consider for investment. About 1/8th of the current stocks in the index (64 out of 504) are yielding above 3.38%. No wonder the media refers to some 2% yielders as “great dividend stocks.” In their sandbox, that’s OK.

- Dividend investors must cast a wide net to achieve their goals.Fortunately, there are over 3,500 stocks listed in the US as well as many thousands elsewhere. So the ocean for dividend yield is wide and deep. The S&P 500 is merely one harbor in one city within that larger ocean. One indicator of this is the fact that Small cap Value investing, a favorite of so-called “Modern Portfolio Theory” investors, is generally having a rough year.

- Well over half of the stocks in the S&P 500 pay no dividend at all, or yield less than 1.88%. But, this is where 2017’s returns have been concentrated so far.

- There is a more significant tradeoff between dividend collecting and “total return” (dividends plus market price appreciation) than in recent years.So far in 2017, dividend investors had no place to hide within the S&P 500 unless they were willing to drop their yield significantly. This year reminds us that every investor needs to determine for themselves the relative importance of dividend cash flow now, and price appreciation over time. Because as you can see, sometimes the market does not offer both simultaneously.

- This is merely a time frame of 7 months and a week. What I hope you get out of this article is that while the objectives of appreciation and income should be compartmentalized by the investor. Otherwise, a pattern of performance envy, yield-reaching, speculation and the downfalls of each can rear their ugly head very quickly.

- “The Market” is way up this year…or is it?If your priority can be described as growth or aggressive growth, you are probably doing well this year, as opposed to 2016 when the relationship between higher-yielding stocks and lower-yielding ones was reversed. And if you are more income-oriented, you are enjoying your dividends but your total return is in a slump. Viewing this part of the stock market’s cyclical nature is a good perspective to have. But if your mind starts to play tricks on you, and convinces you that there is something “wrong” with your income-driven equity portfolio this year, you are walking right into the lion’s den. This will be more obvious during the next correction and/or bear market, but by then the lions will have been fed well.

For research and insight on these issues and more, click HERE.

Comments provided are informational only, not individual investment advice or recommendations. Sungarden provides Advisory Services through Dynamic Wealth Advisors.

7.European Stocks Have Never, Ever Been This Cheap Relative To American Markets

by Tyler Durden

European stocks are offering the biggest discount on record relative to U.S. peers, according to one metric.

Members of the Stoxx Europe 600 Index are trading at 1.8 times the value of their assets, almost half that of S&P 500 Index constituents, the largest gap since Bloomberg started tracking the data in 2002.

World-beating gains in U.S. equities since the bull market kicked off in 2009 has widened the distance between the two, while recent volatility has also rendered its derivatives the most expensive relative to Europe since August 2015’s China deval collapse…

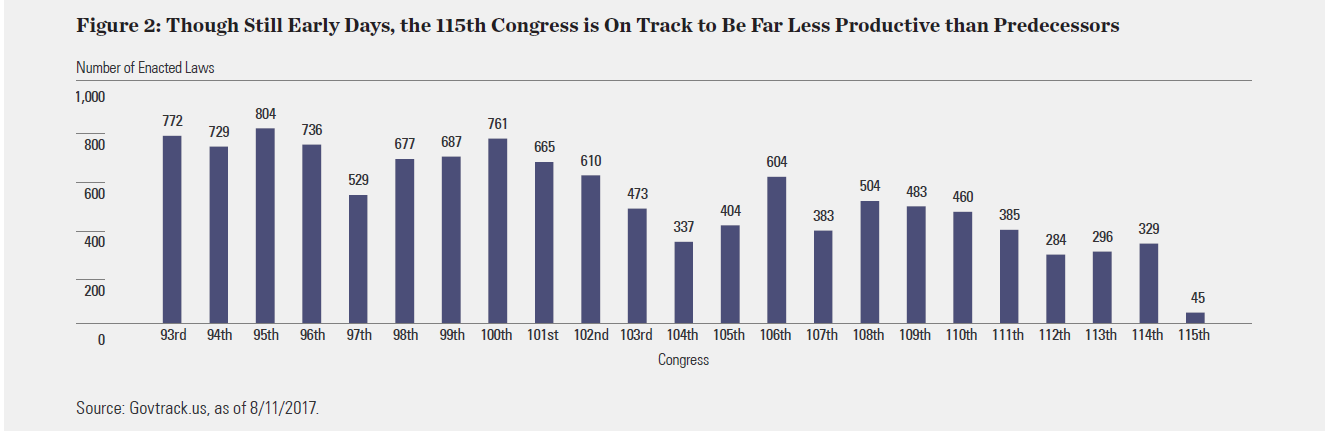

8.Trump’s Congress not on Track to Achieve His Goals.

From SPDR Funds.

9.Read of the Day….The World’s Biggest Tech Companies Are No Longer Just American…Follow up to Yesterday’s Alibaba Comments.

By PAUL MOZURAUG. 17, 2017

Alibaba’s headquarters in Hangzhou, China. The company’s revenue has jumped by more than 50 percent from a year ago. CreditWang He/Getty Images

HONG KONG — The technology world’s $400 billion-and-up club — long a group of exclusively American names like Apple, Google, Facebook, Microsoft and Amazon — needs to make room for two Chinese members.

The Alibaba Group and Tencent Holdings, Chinese companies that dominate their home market, have rocketed this year to become global investor darlings. They are now among the world’s most highly valued public companies, each of them twice as valuable as tech stalwarts such as Intel, Cisco and IBM.

While American technology giants dominate people’s online lives in Western countries, Tencent and Alibaba have soared by essentially carving up China, the world’s single-largest internet market with more than 700 million online users. That is roughly twice the size of the population of the United States. Chinese people also spend more money online than Americans.

Their surge, which has taken place inside a tightly controlled internet space that has blocked international companies like Facebook, has increasingly set them apart from the rest of China. Despite headline numbers that suggest stable growth, the Chinese economy is grappling with many problems, including heavy debt and continued reliance on rusty industries like steel. Yet Alibaba and Tencent this week both reported financial results that blew past investor expectations, suggesting the future of the Chinese technology world is bright.

Their rise is emblematic of a rebalancing of global technological influence. In recent years, places from Paris to Seoul have claimed the mantle of the next Silicon Valley. Yet the cluster of fast-growing start-ups and internet behemoths coming out of China has emerged as the one true rival in scale, value and technology to the West Coast homes of the American technology renaissance.

10.The Four Modes of Thinking, and How They Impact Performance

Robert B. Tucker , CONTRIBUTOR

Shutterstock

Hi there, this is your brain speaking. Just wondering what thinking mode you are operating in today? Seems simple, but it’s important to know what’s going on up there. Success in today’s hyper-competitive world depends on what’s happening upstairs in that frontal lobe of your brain where problem-solving, creativity and other cognitive functions take place. Our research with thousands of managers and individual contributors throughout North America and in 48 countries suggests that we need three to four times as many ideas every day to perform at peak levels in our work. Anything less than a constant flow of ideas won’t be sufficient as we enter a future of constant change.

Fortunately, doing a quick, unannounced spot check on your thinking mode couldn’t be easier. Use the list below to identify which of the four dominant thinking modes you are operating in right now. Then check out the tips following on how to alter your thinking style.

Defeatist Mode: This mental state is dominated by worry, frustration, and fear of what might go wrong. Guess what: we’re all thrust into this mode some of the time. It’s an inescapable part of the human experience. In Defeatist Mode, our monkey mind (as the Buddhists call it) feeds us all kinds of negative and unproductive chatter of the doom and gloom variety. We’re rehashing painful past events and replaying tapes of personal setbacks and sadness. We dwell on things we “could have, should have, and would have” done. Defeatist Mode is a negative use of the imagination. Our “idea factories” are shut down, and our idea-producing performance is stalled.

Sustainer Mode: In this state of mind, we’re mostly “going through the motions,” sustaining the status quo. We incessantly check our devices. We multitask, and we grind it out – on autopilot. In Sustainer Mode, if an idea does happen to flutter into mind, we’re apt to ignore it or conjure reasons it will never work, or will be shot down by bosses, spouses or others. Our voice of judgment, that inner critic we all have to deal with, is temporarily in charge. “Ah, that will never work,” or “the boss wouldn’t go for that,” or “you’ve got way too much to do already, you can’t possibly find time to do something with that,” are all indicators of this frame of mind. From a performance standpoint, this mode is also an inevitable part of life. Many jobs are primarily about execution and following established policies, procedures and protocols. The downside of spending long periods in this mode is that it can deaden and diminish creativity, rather than causing us to challenge the status quo with game changing ideas.

Dreamer Mode: If this is your mental state at present, give your brain a kiss! You’re on a performance path, at least as far as generating ideas is concerned. Something has stimulated these endorphins of possibility and it’s important to identify what. Perhaps you took a walk in nature, or had a pleasant conversation with an old friend who genuinely listens to you and is supportive. Maybe you got some good news that set you off in a positive direction. In Dreamer Mode, you come up with ideas easily and without too much effort —lots of them in fact. You have thoughts like: “wouldn’t it be great if.” Functional MRI brain scans show the brain’s pleasure centers lighting up when we’re in this state. We’re all here occasionally, enjoying that dopamine rush of feelings that the future is bright, and all is right with the world, if only for a little while.

Opportunity Mode: In this mode, our idea factories are operating at peak performance levels. Opportunity Mode builds upon the Dreamer Mode, but there’s an added element: an action-taking component. You are not content just to hatch ideas – you have intention to make those dreams a reality. Since innovation is not only coming up with ideas, but also bringing them to life, the downside of Dreamer Mode is that we never execute, never really enjoy the rewards of accomplishing, or of performing at peak levels. When Martin Luther King told the crowd “I have a dream” from the steps of the Washington Monument, he wasn’t just fantasizing. This was the visual embodiment of a man in manifestation mode, and his speech changed the course of history. Opportunity Mode is a confident, positive, glass-is-half-full, can-do state of mind. Your attitude is of unbridled enthusiasm; you’re willing to try anything and everything until you succeed. Problems turn into opportunities. Obstacles are simply challenges to be overcome. The impossible just takes you a little longer.

How to Shift Modes and Raise Performance

Robert B. Tucker is a keynote speaker and consultant to over 200 of the Fortune 500. He’s written seven bestselling books on innovation

Rob Isbitts

Rob Isbitts