1.LIBOR-The Most Widely Used Global Benchmark for Short-Term Interest Rates….Rolling Over But Above Lows.

1 Year LIBOR Rate – Historical Chart

Interactive chart of the 12 month LIBOR rate back to 1986. The London Interbank Offered Rate is the average interest rate at which leading banks borrow funds from other banks in the London market. LIBOR is the most widely used global “benchmark” or reference rate for short term interest rates. The current 1 year LIBOR rate as of August 09, 2019 is 1.99%.

https://www.macrotrends.net/2515/1-year-libor-rate-historical-chart

Benchmark for $370 Trillion in Financial Products.

2. U.S. Weighs Selling 50- and 100-Year Bonds After Yields Plummet

By Alex Harris and Emily Barrett

August 16, 2019 4:07 PM

- Treasury conducting an outreach on ultra-long debt issuance

- Announcement follows slide in 30-year yield to record low

With interest rates on 30-year U.S. debt hitting all-time lows this week, the government is once again considering whether to start borrowing for even longer.

The U.S. Treasury Department said Friday that it wants to know what investors think about the government potentially issuing 50-year or 100-year bonds, going way beyond the current three-decade maximum.

The government stressed that no decision has yet been made on ultra-long bonds, explaining that it’s looking to “refresh its understanding of market appetite.” The idea was broached before, back in 2017, but was shelved after receiving a less-than-warm reception.

“This comes up every now and again,” said Gennadiy Goldberg, U.S. rates strategist at TD Securities. “Every time the takeaway is, there simply isn’t enough demand at that tenor, or at least there hasn’t been in the past.”

The announcement follows a plunge in the 30-year yield to a record low this week below 2%, and also comes in the wake of many other nations opting to extend their borrowing profiles with so-called century bonds. Investors have snapped up 100-year bonds issued by the likes of Austria, although the experience of Argentina underscores some of the potential pitfalls of buying such long-maturity debt.

The yield on America’s current benchmark 30-year bond spiked to its highs of the day and the curve steepened following the Treasury announcement. The 30-year rate climbed as much as 8 basis points on the day to 2.05%, before ending the session at around 2.03%. The yield spread between the U.S.’s longest-maturity debt and its two-year note widened the most in five weeks on Friday.

The Treasury’s group of market consultants, the Treasury Borrowing Advisory Committee, has long been unenthusiastic on the prospect of an ultra-long issue, said Bruno Braizinha, director of U.S. rates research at Bank of America.

The challenge for the Treasury would be to offer a yield attractive enough for the typical investor base of pension funds and institutions, while keeping a lid on the cost of borrowing for U.S. taxpayers.

By Braizinha’s estimates, the yield on a 50-year issue would be expected to come in around 10-30 basis points above the 30-year rate.

— With assistance by Liz McCormick, Benjamin Purvis, and Katherine Greifeld

(Updates with yield spread in sixth paragraph)

3.Stock/Bond Correlation Decidedly Negative…

While today bonds are less negatively correlated with stocks then was the case in December, correlations remain decidedly negative (see Chart 1). With growth still decelerating and the economic risks to the downside, Treasuries are likely to continue to rally if growth estimates fall further.

Why bonds are now the better hedge–Russ Koesterich, CFA

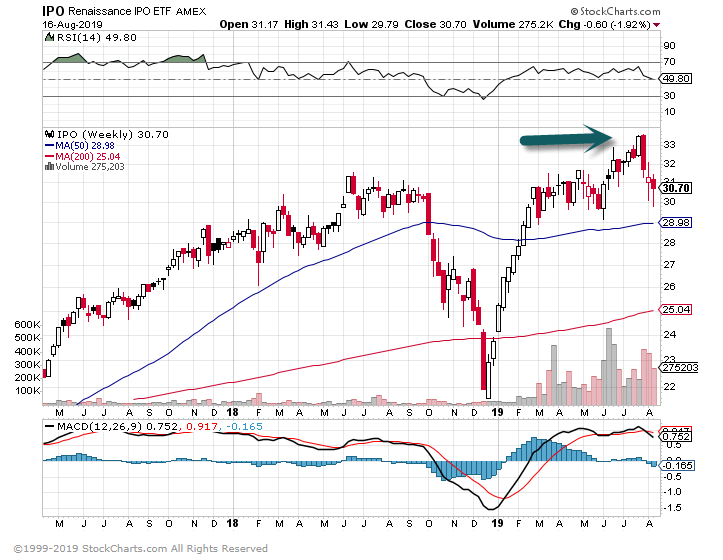

4.70% of IPOs 2019 Outperforming S&P

Big IPOs, Like Beyond Meat, Have Had a Good Year. WeWork Wants In.

By

David Marino-Nachison andAl Root

Beyond Meat isn’t alone in seeing its stock rise after going public, which might be why WeWork’s parent, We Co., is gearing up for an IPO. Barron’sanalyzed 42 U.S. IPOs filed in 2019 that raised more than $100 million. Some 70% outperformed the S&P 500, relative to their offer prices, and 60% did so, relative to opening prices. Here’s more on their performances, through Friday’s close:

• Twenty-nine of the stocks are up this year—and all have beaten the S&P 500, 26 by double-digit margins.

• Beyond Meat, which thumped the index by rising more than 570%, is the biggest outperformer. It also trounces the next three top risers— Shockwave Medical , Turning Point Therapeutics , and Adaptive Biotechnologies —whose shares all have more than doubled from their IPO price.

• The average change across all the stocks is a 43% rise. The average performance, relative to the S&P 500, is 45%.

• The biggest loser: Precision Biosciences , which gave up more than 40% since its late-March IPO. Six underperformed by double-digit margins, including Uber Technologies and Lyft .

The numbers look different if measured against opening prices, which reflect the opportunity for investors who weren’t in on the IPOs. By that measure, 24 are up since their debuts, and 25 outpaced the S&P 500. The average move, versus opening prices, was 10%; the average performance, compared to the S&P 500, was 12%. That calculation trims Beyond Meat’s rise to 266%—and Precision Biosciences’ fall to 50%.

5.Fear and Greed Index Measuring Retail Investor Sentiment…Extreme Fear.

https://money.cnn.com/data/fear-and-greed/

6.WeWork Lanndlords Have Little Recourse If the Company Can’t Pay

WeWork landlords exposed to $40bn in rent commitments w/little recourse if office space company fails to pay. Comp, like others in shared office sector, creates special purpose vehicles for leases, so landlords do not have direct recourse to parent comp. https://ft.com/content/83decf7a-c04d-11e9-b350-db00d509634e…

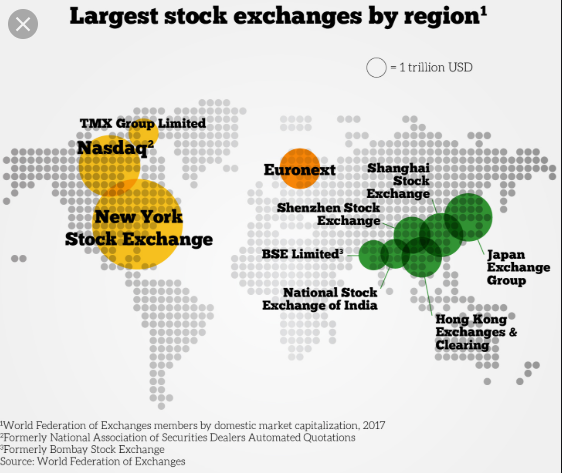

7.Hong Kong is 5th Largest Exchange in World…Larger Than Euronext.

6- Euronext, Eurozone

Headquartered in Amsterdam, the Netherlands, Euronext is a pan-European stock exchange with a presence in France, Belgium, Ireland, and Portugal. It has approximately 1,300 listed companies with a combined market capitalization of $3.92 trillion. Stocks listed at Euronext trade in euros. Its monthly trading volume is about $174 billion.

5- Hong Kong Stock Exchange, Hong Kong

The Hong Kong Stock Exchange was founded in 1891. It has close to 2,000 listed companies, about half of which are from mainland China. It has a monthly trading volume of $182 billion and a market capitalization of $3.93 trillion. In 2017, the exchange closed its physical trading floor to shift to electronic trading. Some of the biggest companies listed at the Hong Kong Stock Exchange are AIA, Tencent Holdings, PetroChina, China Mobile, and HSBC Holdings.

4- Shanghai Stock Exchange, China

The largest stock exchange in China has a market capitalization of $4.02 trillion. It is a non-profit organization and has more than 1,000 listed companies. Though its origins date back to 1866, it was suspended following the Chinese Revolution in 1949. The Shanghai Exchange in its modern avatar was founded in 1990. Stocks listed at the Shanghai Stock Exchange have ‘A’ shares that trade in local currency and ‘B’ shares that are priced in the US dollar for foreign investors.

3- Tokyo Stock Exchange, Japan

Founded in 1878, the Tokyo Stock Exchange is among the top 10 largest stock exchanges in the world. It has close to 2,300 listed companies with a combined market capitalization of $5.67 trillion. Trading at the Tokyo Stock Exchange was suspended for four years after World War II. It resumed operations in 1949. The TSE’s benchmark index is Nikkei 225, which consists of the largest companies including Toyota, Honda, Suzuki, and Sony.

2- NASDAQ, United States

The NASDAQ Stock Market was founded in 1971 in New York City. NASDAQ is considered the Mecca of technology companies because many of the world’s largest technology companies such as Apple, Microsoft, Facebook, Amazon, Alphabet, Tesla, Cisco, and others are listed here. As of November 2018, NASDAQ had a market capitalization of $10.8 trillion with an average monthly trading volume of $1.26 trillion.

1- New York Stock Exchange, United States

Founded in 1792, the New York Stock Exchange has been the world’s largest stock exchange since the end of World War I, when it overtook the London Stock Exchange. It has a market capitalization of $22.9 trillion and about 2,400 listed companies. According to the 2017 data from Gallup, more than 54% Americans had invested in stocks listed at the NYSE. The NYSE alone accounts for roughly 40% of the world’s stock market capitalization.

Top 10 Largest Stock Exchanges In The World By Market Capitalization

February 19, 2019 at 11:47 am by Vikas Shukla

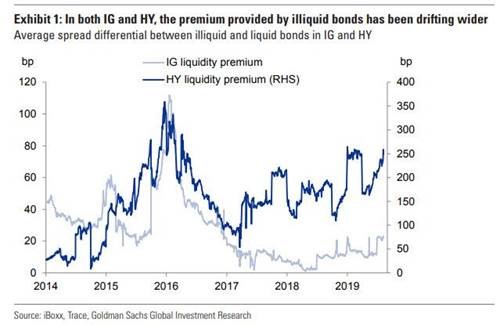

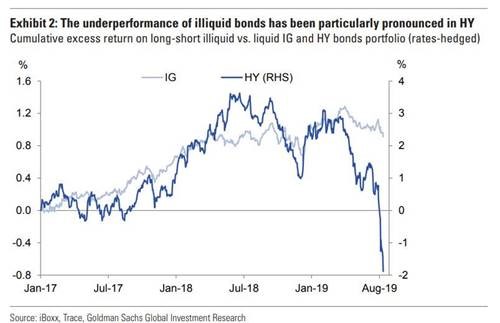

8.Liquid vs. Illiquid Bonds.

All that appears to have come to a long overdue end in recent weeks, as liquidity premiums for both IG and junk bonds have suddenly jumped higher. In a recent bond market analysis, Goldman strategists looked at the relative value performance of illiquid vs. illiquid bonds, with the results of Goldman’s estimates of the average spread pickup provided by illiquid bonds over their liquid peers in the IG and HY markets shown in the chart below.

The key takeaway from Exhibit 1 is that the illiquidity premium, i.e., the spread differential between illiquid and liquid bonds, has been drifting wider in both the IG and HY markets, reaching its highest level in two years. The underperformance of illiquid bonds is further illustrated in the next chart, which shows the cumulative excess return (rates-hedged) on a long-short strategy involving illiquid vs. liquid bonds.

As the chart clearly shows, the poor showing of illiquid bonds has been particularly pronounced in HY, with liquid bonds outperforming by 2% over the past two weeks.

As with the relative value of high vs. low price bonds, Goldman thinks the risk-reward in being long illiquid bonds remains poor despite the new highs made by the illiquidity premium, especially when considering recent market repricing events of illiquid securities such as those of Woodford, H2) Asset Management, GAM and so on.

“Brace For A New Regime” Goldman Warns As Market Finally Pukes Illiquid Bonds

9.THE US Navy wants to build a fleet of ten robot warships over the next five years.

The huge ships referred to as Large Unmanned Surface Vehicle (LUSV) would function as scouts for the main battle fleet, carrying radar and sonar as well as anti-air and cruise missiles.

The new LUSV will build upon the unmanned Sea Hunter, seen here in Portland in 2016

Proponents of the ships see the role of the vessels as carrying out “3D work” – dull, dirty and dangerous.

A Draft Request for Proposal, posted on the FedBizOpps website, said: “The LUSV will be a high-endurance, reconfigurable ship able to accommodate various payloads for unmanned missions to augment the Navy’s manned surface force.

“With a large payload capacity, the LUSV will be designed to conduct a variety of warfare operations independently or in conjunction with manned surface combatants.

‘LIGHT FRIGATE’

“The LUSV will be capable of semi-autonomous or fully autonomous operation, with operators in-the-loop (controlling remotely) or on-the-loop (enabled through autonomy).”

The US Navy hopes to build two ships a year, costing £330million per pair, over five years, according to US Naval Institute News.

Each ship would be about 200 to 300ft in length with a displacement of about 2,000 tonnes.

The ships are described as essentially “a light frigate” and will also have some limited accommodation for a human crew, if necessary.

The plan is to have the ships as generally unarmed but with the ability to carry missiles if needed.

LUSVs will also be capable of acting as floating scouts, sailing over ahead of manned ships to detect threats early.

CRUISE MISSILE CAPABILITY

The Pentagon’s Strategic Capabilities Office originally spearheaded LUSV under a programme called Overlord which initially tried to convert a fast commercial vessel into an unmanned ship capable of travelling for thousands of miles and weeks.

The US is also acquiring a fleet of unmanned submarines.

Boeing was paid £35.4m by the US Navy in February this year for four Orca Extra Large Unmanned Undersea Vehicles, according to The National Interest.

The 51-feet-long Orca can travel up to 6,500 nautical miles.

In February this year the China Shipbuilding and Offshore International Company unveiled a small robotic warship that could give China the edge over the US fleet.

The JARI unmanned surface vehicle is 49 feet long and displaces 20 tons of water, Defence News reported. It can sail for around 500 miles at a top speed of 42 knots, according to the trade publication.

https://www.thesun.co.uk/news/9747088/us-navy-robot-warship-unmanned/

10.DETOX YOUR BRAIN TONIGHT

Washing Away Neurotoxins May Be The Best Detox Yet

Ever heard of a brain detox? Toxins can build up in the brain at an alarming rate. Brain cells have a very taxing function. So much so, in fact, that it appears that they are not able to do their work and clear out the toxic by-products of their metabolism at the same time. This is different than most other cells in our bodies. Our heart cells, for example, need to keep operating without a break every second for our entire lives. What the very latest research seems to show about brain functioning is that brain cells have such a tough job of that they are constantly running in overdrive mode just by being conscious. The only way to really clear out the toxins is for the brain to power down into sleep mode…or detox mode.

While we’re awake, our brain cells accumulate various metabolic by-products such as the inhibitory neurotransmitter adenosine, which diminishes our mental focus. New research shows that during sleep, some brain cells shrink, opening up the interstitial space between cells by about 60 percent so that cerebrospinal fluid can wash away neurotoxins and other by-products of brain cell function that accumulate while we are awake.

An entire system of plumbing for this has only recently been discovered, in part because it nearly disappears while we are awake. This is the primary way that the brain detoxes, and it works ten times better while we sleep than it does when we’re awake. In addition to adenosine and other metabolites, this system has been shown to clear out beta-amyloid, a neurotoxin associated with Alzheimer’s disease. One understanding of diseases like Alzheimer’s is that it they are accompanied by an accumulation of beta-amyloid into plaques around brain cells, so it is quite possible that “rinsing away” the neurotoxins through more or better sleep could play a beneficial role.

So, one vital function of sleep is to help the brain detox. It detoxifies like an oil change for your car, and it has similar consequences for going too long between treatments.

What do you do to get a good night’s sleep?