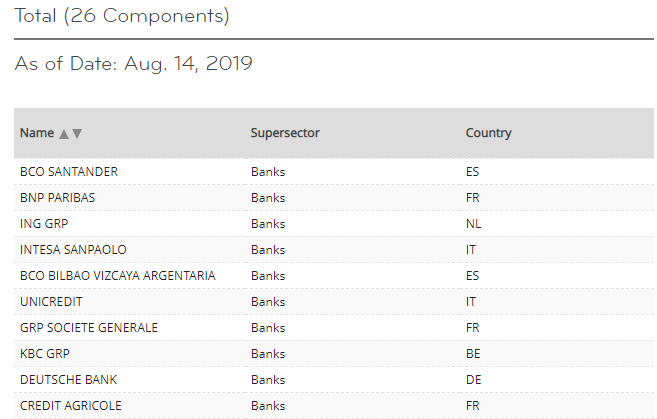

1.Euro Banks Break Thru 5 Year Lows.

EURO STOXX® Banks

- The STOXX Sector indices are available for global markets as well as for Europe, the Eurozone and Eastern Europe. Using the market standard ICB Industry Classification Benchmark, companies are categorised according to their primary source of revenue. This categorisation guarantees a professional and accurate classification of companies in their respective business environments. There are four levels of classification ranging from broad to very detailed: 10 industries are broken down into 19 supersectors, 41 sectors and 114 subsectors.

https://www.stoxx.com/index-details?symbol=SX7E

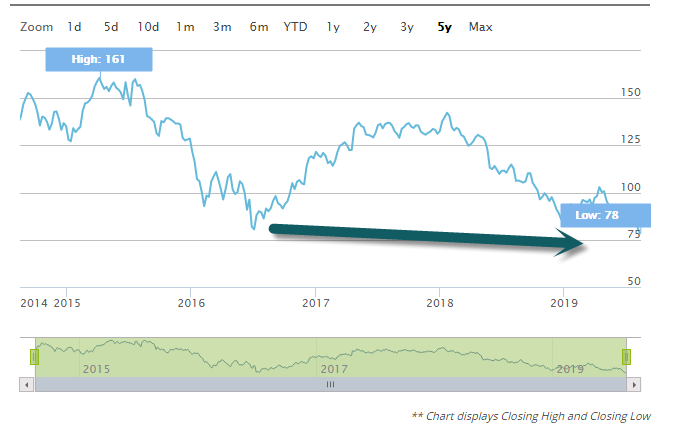

2.Euro Financials ETF right back to Dec. 2018 Lows.

EUFN Europe Financials ETF

Trading Below 1x price to book.

3.Volatility Index Below 2018 Highs.

Volatility Index.

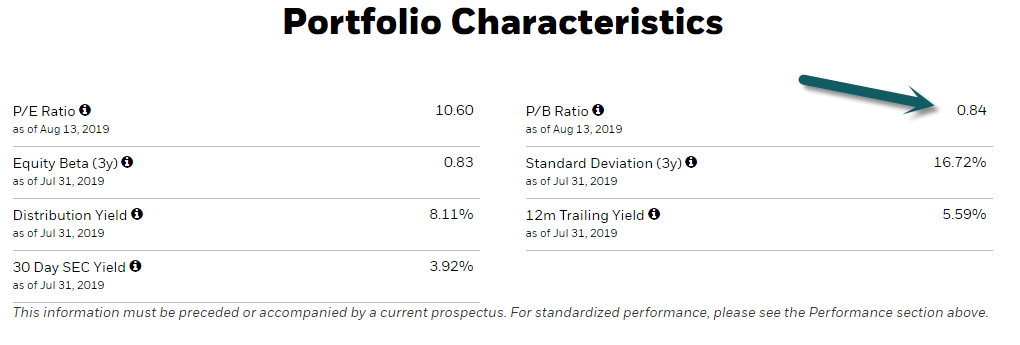

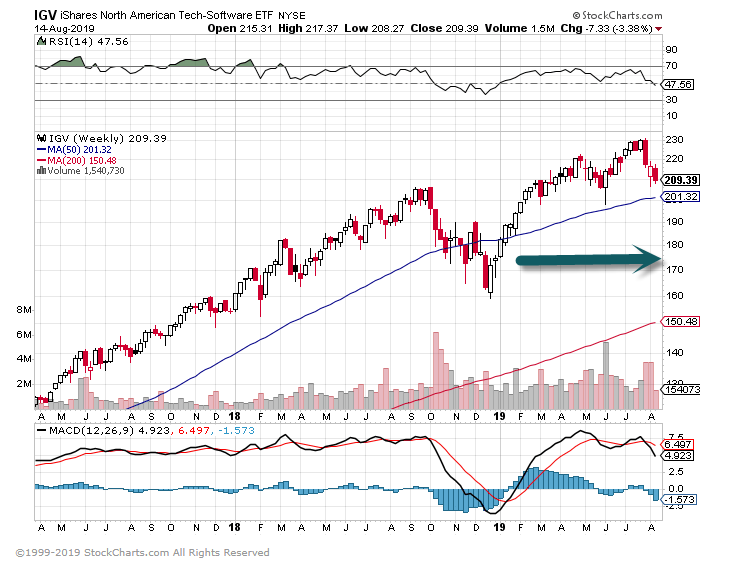

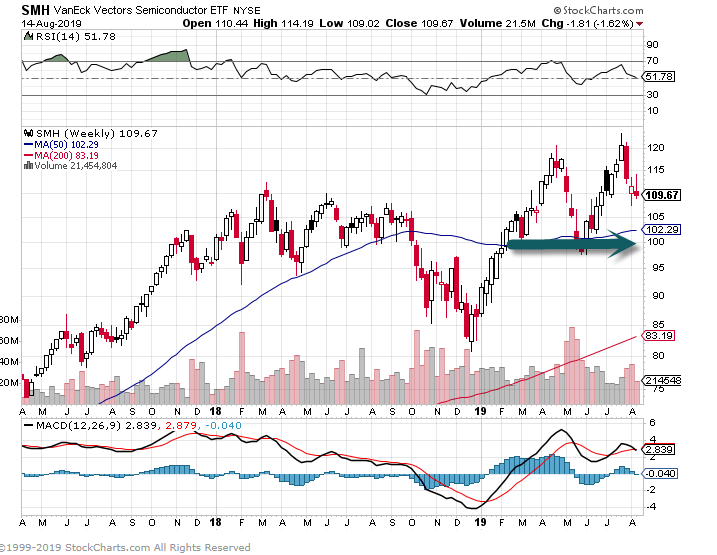

4.Tech Hot Sub-Sectors

Software ETF-pullback so far barely a blip in long-term chart

Semiconductors barely a blip …not even back to June lows yet

5.Canopy Growth, world’s largest pot company, lost $1 billion in three months

Stock falls 10% in late trading after elimination of C$1.18 billion in warrants related to Constellation Brands investment leads to earnings miss

Bloomberg News/Landov

Analysts surveyed by FactSet had estimated fiscal first-quarter adjusted losses of C$0.38 a share on revenue of C$111.9 million

Canopy Growth Corp. reported a C$1.28 billion quarterly loss late Wednesday and missed analyst estimates for revenue, sending shares down 10% in after-hours trading.

The world’s largest cannabis company by market value, Canopy GrowthCGC, -13.56% WEED, -5.76% reported fiscal first-quarter net losses of C$1.28 billion, or C$3.70 a share, compared with losses of C$91 million, or 40 cents a share, in the year-ago period. The more than $1 billion loss was due to the company extinguishing warrants related to the Constellation Brands Inc.STZ, -1.61% investment.

TimeCanopy Growth Corp.Oct 18Dec 18Feb 19Apr 19Jun 19Aug 19

US:CGC

$20$30$40$50$60

Canopy Growth fired co-Chief Executive Bruce Linton not long after its previous earnings report, amid reports of unhappiness at Constellation with continuing large losses. CEO Mark Zekulin has remained at the helm of the company, but has said he expects to exit once a new leader is found.

Net revenue rose to C$90.5 million from C$25.9 million in the year-ago period, excluding excise taxes. Of that revenue, Canopy said that C$50.4 million was Canadian recreational business-to-business, C$10.6 was direct to consumer and C$13.1 million was medical cannabis sales. Canopy also brought in $10.5 million in international cannabis revenue.

Analysts surveyed by FactSet had estimated fiscal first quarter adjusted losses of C$0.38 a share on revenue of C$111.9 million. Canopy did not provide any per-share adjusted-earnings information.

The company said it sold more than 10 metric tons of pot in the fiscal first quarter, up 13% sequentially. Canopy increased its harvest 183% sequentially to 41 metric tons for the quarter.

In a statement, Zekulin said that the company has two objectives as it completed the fiscal first quarter.

“First, the company remains focused on laying the foundation for dominance in an emerging global opportunity. This means investments in developing intellectual property, building brands, building international reach, and ensuring scaled production capability for current and future products,” the CEO said in a statement.

“Second, we are fixated on the process of evolving from builders to operators over the remainder of this fiscal year, meaning that as our expansion program comes to a close in Canada, and as new value-add products come to market in Canada, we demonstrate a sustainable, high margin, profitable Canadian business.”

For the fiscal second-quarter, analysts expect losses of C$0.36 cents a share on sales of C$145.1 million.

U.S.-traded shares of Canopy Growth has gained 16.2% this year, with the S&P 500 index SPX, -2.93% rising 14.2%.

Big Drop in last few months.

Longer-term chart …stock was 20 points lower in 2018.

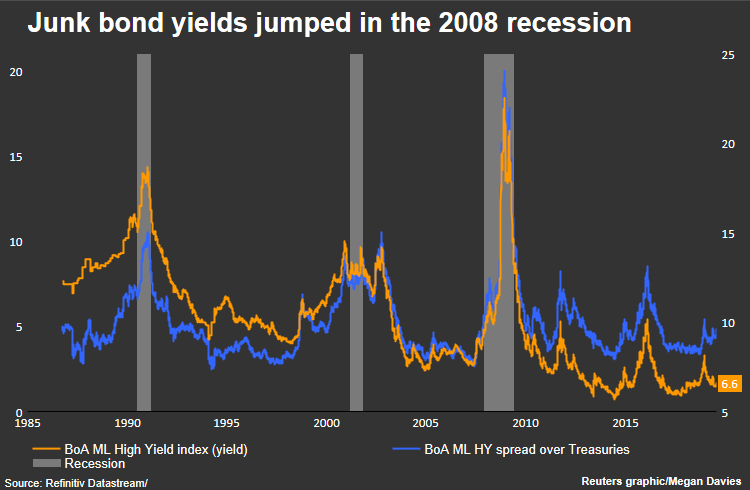

6.High Yield Spreads Not Widening Yet.

HIGH-YIELD SPREADS

The gap between high-yield and U.S. government bond yields rose ahead of the 2007-2009 recession and then widened dramatically.

Credit spreads typically widen when perceived risk of default rises. Spreads have fallen from their January highs.

Predicting the next U.S. recession

https://www.reuters.com/article/us-usa-economy-watchlist-graphic-idUSKCN1V31JE

7.GE shares drop after Madoff whistleblower Harry Markopolos calls it a ‘bigger fraud than Enron’

KEY POINTS

- General Electric shares fell after Madoff whistleblower Harry Markopolos targets the conglomerate in a new report, calling it “a bigger fraud than Enron.”

- The 175-page report claims GE was hiding the depths of its financial problems and would need to significantly raise its insurance reserves.

- “My team has spent the past 7 months analyzing GE’s accounting and we believe the $38 Billion in fraud we’ve come across is merely the tip of the iceberg,” Markopolos says in the report.

Harry Markopolos, an independent financial fraud investigator and former money manager, stands for a portrait in New York, U.S., on Monday, March 1, 2010.

Bloomberg | Bloomberg | Getty Images

General Electric shares fell Thursday after Madoff whistleblower Harry Markopolos targeted the conglomerate in a new report, saying it has allegedly been hiding the extent of its financial problems in fraudulent financial statements.

A website has been set up to disseminate the report, www.GEfraud.com, where Markopolos calls it “a bigger fraud than Enron.” The financial investigator writes that after more than a year of research he has discovered “an Enronesque business approach that has left GE on the verge of insolvency.”

“My team has spent the past 7 months analyzing GE’s accounting and we believe the $38 Billion in fraud we’ve come across is merely the tip of the iceberg,” Markopolos said in the 175-page report.

Markopolos’s case centers around GE’s long-term care insurance unit, which the company had to boost reserves for by $15 billion last year . By examining the filings of GE’s counterparties in this business, he alleges that GE is hiding massive losses that will only increase as policy-holders grow older. He claims that GE has filed false statements to regulators on the unit, or eight other insurance regulators have done so.

GE confirmed the existence of the report in a statement to CNBC, but said it has not seen it. A more detailed report will be posted later Thursday. The website asks for users to submit a name and email to receive the report.

“We have never met, spoken to or had contact with this person. While we can’t comment on the detailed content of a report that we haven’t seen, the allegations we have heard are entirely false and misleading,” the statement said.

The Wall Street Journal first reported on the missive and said that it has viewed it, sending GE shares lower. The stock was down by 5.9% in premarket trading Thursday.

Markopolos is a Boston-based accounting expert who gained notoriety after pointing out irregularities with Madoff’s investment strategy, and how it was impossible to generate the returns the fraudster claimed years before the Ponzi scheme was exposed. He was largely ignored at the time. More recently, Markopolos helped uncover a foreign currency trading scandal at a group of banks.

The Markopolos group looking into GE includes forensic accounting veteran John McPherson, co-founder of MMS Advisors, which specializes in the insurance industry.

“GE has been running a decades long accounting fraud by only providing top line revenue and bottom line profits for its business units and getting away with leaving out cost of goods sold, SG&A, R&D and corporate overhead allocations,” the report said.

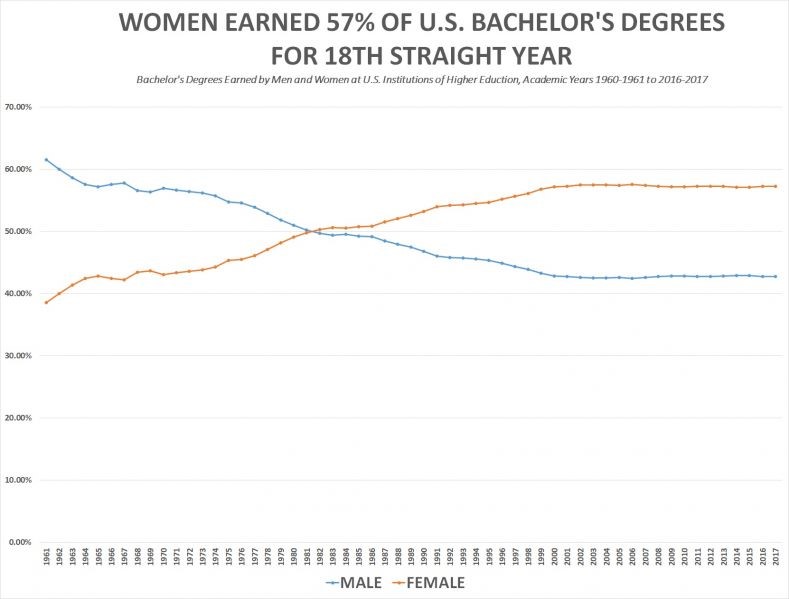

8.Women Earn 57% of U.S. Bachelor’s Degrees—For 18th Straight Year

By Terence P. Jeffrey | June 8, 2018 | 5:15 PM EDT

(Screen Capture)

(CNSNews.com) – Women earned approximately 57 percent of the bachelor’s degrees awarded by U.S. institutions of higher education in the 2016-2017 academic year, according to data released this week by the National Center for Education Statistics, which is part of the U.S. Department of Education.

That, according to NCES data, makes 2016-2017 the eighteenth straight academic year in which women have earned approximately 57 percent of the bachelor’s degrees awarded by U.S. colleges and universities.

The NCES this week released a “first look” report—“Postsecondary Institutions and Cost of Attendance 2017-18; Degrees and Other Awards Conferred, 2016-2017; and 12-Month Enrollment, 2016-2017″—that listed the number of bachelor’s degrees awarded in the 2016-2017 academic year by U.S. institutions that participate in Title IV federal student financial assistance programs (plus the U.S. military academies).

9.Why Are So Many Investment Decisions Based on Biased and Contrived Stories?

I recently read Will Storr’s excellent book ‘The Science of Storytelling’[i]; which is an exploration of how our brains process stories and why they are such a fundamental component of human experience. Whilst it is primarily designed as an aid for writers seeking to better craft their narratives; for me, it also served to underscore the underappreciated but essential role that stories play in financial markets.

Linking storytelling and investments is not a revelatory observation – investors are often lured into a poor decision by a compelling story and no financial bubble in history has been absent some beguiling narrative – however, their importance is hugely understated. Rather than a susceptibility to stories being a behavioural quirk; the human brain’s reliance on narratives to make sense of the world means that they define much of our investment behaviour. The noisy, chaotic and unpredictable nature of financial markets is anathema to our mind’s desire for order and clarity; stories reduce our discomfort and allow us to navigate the ever-capricious waters. It seemingly matters not that most of the yarns we spin are works of fiction.

Storytelling in financial markets is always driven by cause and effect. There are two forms of this – either we predict a cause and effect before the event, or we look to rationalise an effect by defining a particular cause subsequent to the occurrence. Although we might not always consider them as such both of these scenarios are about creating narratives – Y will happen because of X, or Y has happened because of X. Investors do this for every conceivable situation – from justifying the hourly change of a stock price to the impact of a fifty-year demographic shift on asset class returns. Everything must have a cause and effect underpinning the narrative.

In many other circumstances a straight and true line can be drawn between cause and effect – even if something might not be forecastable, it can be understood after the event. We might not be able to foresee a plane crash; but in most cases we have sufficient information to gauge its cause after the incident. Unfortunately, in the random and reflexive world of investment, accurately defining these aspects in either predictions or during a post-mortem is hugely problematic. We know only too well about the hopelessness of forecasting and observe on a daily basis the myriad competing explanations for even the most irrelevant market or economic change.

If gleaning cause and effect in financial markets is so difficult, why do we spend most of our time talking about it? As Storr succinctly notes: “Cause and effect is the natural language of the brain. It understands and explains the world.” The alternative would be to exist in a financial environment defined by randomness and chaos – whilst this may be closer to the reality, it would not make for a comfortable existence.

In addition to the importance of cause and effect for our narrative-driven brains; Storr also highlights how the types of stories we tell are dependent on the mental models that we develop and then seek to defend. This has unquestionable relevance for investors – we all utilise models for interpreting the financial world; these can be structural (I might be a Keynesian economist) or temporary (I might be bullish on equity markets over the next six months). The belief sets that we maintain mean that when we create our stories we do so in a prejudiced fashion; as Storr explains: “Our storytelling brains transform reality’s chaos into a simple narrative of cause and effect that reassures us that our biased models…are virtuous and right”.

The importance of these models to our sense of identity means that much of our tale telling is in the defence of those models. Financial market participants are not coolly and impartially attempting to identify cause and effect; rather we are creating stories that corroborate our views and our beliefs, and often rail against those with conflicting perspectives or opinions. We see this constantly in the varied and often entirely contradictory interpretation of the latest release of economic data. If you understand an individual’s angle, mental model or incentive, then you are likely to have a good idea of the story that they may tell.

Does the importance of narratives in how our brain interprets the world mean that investors are condemned to exist in an environment of incessant, often meaningless and always biased storytelling? To an extent, but it depends on how much we choose to engage. Financial markets provide an unrelenting torrent of outcomes which we can seek to forecast or explain via stories – indeed, much of the industry is fuelled by these precise activities – and whilst the notion of storytelling seems harmless, for investors it is likely to mean over-trading, over-confidence, stress and partiality. Investors need to be comfortable stepping away (it doesn’t matter what the market did yesterday or why), be willing to say they have no idea what will happen or why it happened; and focus on some robust, evidence based, principles – all supported by a good story, of course.

—

[i] The Science of Storytelling by Will Storr

Found at www.abnormalreturns.com

10.3 Simple, Regular Practices That Will Help You Come Up With New Ideas

Brainstorm, brainstorm, brainstorm, stall. In a culture that demands constant innovation and disruption, it can feel like our imaginations become worn down through constant calls for the new. To fight such burnout, how can we refresh our eyes? How can we see things in new and inspiring ways? One possibility is to turn to the metaphor of the trees and the bee, whose relationship gives fruit as the result of cross pollination. In our work, coming into contact with the ideas of another “tree” can be similarly productive.

In agriculture, cross pollination is an important staunch against the environmental risks of monoculture, in which we rely too much on one plant type; it “freshens” plant reproduction with pollen from outside. In a business or creative setting, monoculture has its own risks, as we habitually turn to the same sources, people and habits for new ideas. Over time, these ideas can take on a same-y predictable taste. Or, worse still, the turn to the old-and-reliable can mean disaster if something comes in and disrupts your environment.

Related: Try This Brainstorming Exercise to Come Up With Better Business Ideas

Luckily, there are good models of creative thinkers who have behaved like the bee, moving from disciplinary tree to disciplinary tree, spreading the pollen of ideas from one to another:

- Leonardo da Vinci is perhaps the most famous example of the richness offered by gaining knowledge and experience from markedly different fields. In addition to being a master painter, he was also a deeply engaged scientific thinker, and the interaction between the fields is clearly on display in his paintings that capture the human form with a level of detail and realism unusual for the time.

- Equally beloved, but working on a smaller scale, Beatrix Potter was a naturalist, whose closely-observed drawings of mushrooms, birds and other life can be felt in the Peter Rabbit stories, which share the feeling of small wildlife carefully rendered.

- The flow isn’t only from the sciences to the arts, either. Already, descriptions of code as “elegant” suggest that judgments of beauty circulate in the tech world, too. Steve Jobs, for one, radicalized personal computing in part because of his belief that the computer might aspire to the level of art.

Even if you’re not so ambitious in your pursuit of exotic new trees as a da Vinci or even a Potter, you can build the cross pollination habit through simple, regular practices.

1. Make a date with yourself.

In The Artist’s Way, Julia Cameron suggests a weekly practice she calls the “artist’s date.” Importantly, the artist’s date is not a date to work on your own regular creative work. Instead, it’s a date to feed your inspiration by looking at something artistically nourishing and stimulating.

So, if you are someone who writes computer code for a living, you might go to an art exhibition one week or browse your independent bookstore for a new novel the next. If you are a writer, you might go for a walk in an arboretum on Monday mornings or take a cooking class on a Friday each month. It may be that in contemplation of a painting of a seashell, you are inspired to solve an immediate problem, but the purpose of the artist date is less directive. Instead, the idea is to enrich you, to fill you with wide-ranging, stimulating and nourishing material for a creative living.

2. Read about creative lives.

Start building a library of others who have lived inspirationally full and productive lives, whatever their background. Biographies and how-to guides from other fields can be wonderful sources of inspiration that also open you up to the way a day and a life might be structured: What might you gain from working as Stephen King suggests in On Writing, or reading about and emulating the morning routine of a favorite athlete?

In Deep Work, for example, computer scientist Cal Newport describes the inspiring life of psychoanalyst Carl Jung, who worked in tower in the forest to develop theories away from the distractions of his day. Although there’s a wide chasm between contemporary computer science and Jung’s somewhat idiosyncratic psychology, Newport draws inspiration from his work habits to explain why he avoids the social media chatter of our own moment.

3. Get in touch with your “beginner’s mind.”

It can be refreshing to one’s self as a knowledge-seeking being to be very bad at something, to get viscerally in touch with what it means to learn as a process, full of curiosity and uncertainty. In disciplines with which we are familiar, we tend to comet to problems and projects with a sense of our approach already established. But how do you approach fly fishing? Crochet? Trapeze flying? Extremely novel experiences require close attention and intensely focused thought of a kind we may have lost in relation to our most frequent and yet most important work.

To experience the new and learn more about the world makes life richer and more meaningful, a gift in itself. But at a more practical level, it gives us not just material, but different ways of thinking that allow us to innovate and explore our work in exciting new ways.

Happy exploring!

Related: A 4-Question Guide to Unlock Your Creativity