1.Bottom-Line Earnings Beat Rates Down This Season

Mon, Aug 12, 2019

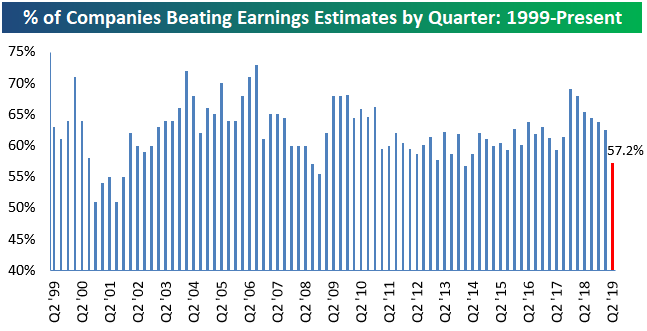

The unofficial Q2 earnings reporting period comes to an end on Thursday when Wal Mart (WMT) releases its numbers. More than 2,000 companies have reported earnings since the season began in early July, and 57.2% of them have beaten consensus analyst EPS estimates. As shown in the chart below, this quarter’s earnings beat rate is down significantly from recent quarters where 60%+ was pretty much a guarantee. If the current reading holds through Thursday, it will be the lowest beat rate since the Q1 2014 reporting period (April and May 2014).

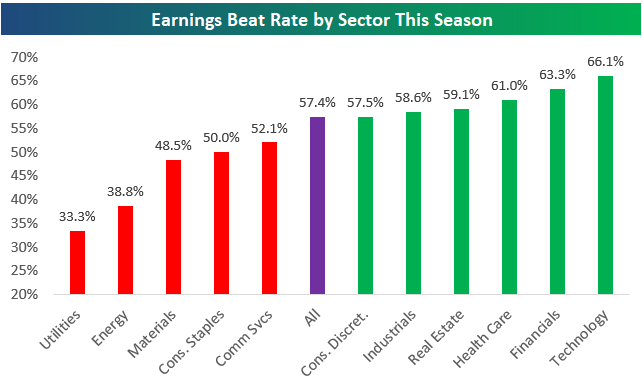

Below is a look at earnings beat rates by sector this season. Technology has the strongest beat rate at 66.1%, followed by Financials at 63.3%. Utilities and Energy have the weakest beat rates at 33.3% and 38.8%, respectively.

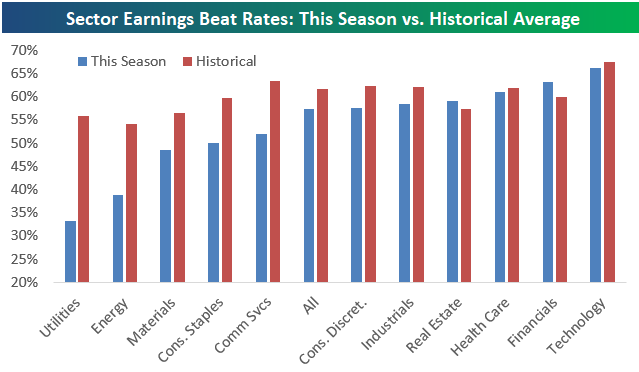

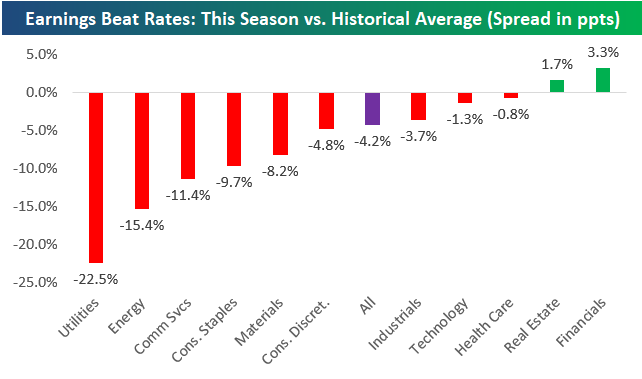

Below we show this season’s earnings beat rates by sector versus the sector’s historical earnings beat rate going back to 2001. All but two sectors have beat rates this season that are below their historical average. The Financial and Real Estate sectors are the only two that have seen stronger-than-normal beat rates. Start a two-week free trial to Bespoke Institutional to access our Trend Analyzer, Chart Scanner, Earnings Explorer and much more.

2.Bonds Meet the Four Criteria for Defining a Bubble

The good thing, though, is that there’s presently no catalyst to burst it. Also, trade wars and Argentina.

By John Authers

Forever blowing bubbles.

There has been a tendency since the financial crisis to label any market that is rallying or deemed overvalued to be in a “bubble.” The word has become overused and debased. But if we treat it rigorously, the bubble concept is still vital in navigating financial markets. And the rigorous treatment reveals that bonds really are in a bubble.

Longview Economics Chief Market Strategist Chris Watling published a fascinating research note last week applying the framework introduced by Charles Kindleberger in his book “Manias, Panics, and Crashes.” Kindleberger was an economist at the Massachusetts Institute of Technology for many years and his book has long been taken as the definitive exposition on how markets veer out of control. Watling reminds us that Kindleberger needed to satisfy four conditions before he diagnosed a bubble:

i) cheap money underpins and creates the bubble;

ii) debt is taken on during the bubble build-up, which helps fuel much of the speculative price increases (e.g. buying on margin);

iii) once a bubble is formed, the asset price has a notably expensive valuation; &

iv) there’s always a convincing narrative to ‘explain away’ the high price. Reflecting that, there’s a wide acceptance in certain quarters that the price is rational (and ‘this time it’s different’).

Most of us will see instantly that all the conditions are satisfied. Let us take them on in turn:

Cheap money:

D’Oh! There has been a lot of cheap money around, thanks mainly, but not

exclusively, to the central banks. This has a lot to do with the popularity of

bonds. This condition is satisfied.

Debt

build-up:

This is maybe the hardest one to substantiate, surprisingly. Are people really

buying negative-yielding bonds on margin? According to Watling, “risk parity

funds use debt to buy bonds on margin, while CTA momentum investors will also

be buying on margin (i.e. with implicit debt). More interestingly, though, the

biggest buyers of sovereign debt in the past decade have been the major central

banks. Their purchases have been made with newly created money. While hotly

contested conceptually (especially by proponents of MMT), ‘bank reserves’ (i.e.

newly created money) is a liability, and, in that respect, by extension a form

of debt (especially the ‘excess’ reserves component).”

Further, bonds are

central to all other asset classes as they provide the notional “risk-free

rate” used for calculating valuations. Huge amounts of leverage have pushed

down yields in other asset classes and thus indirectly pushed down on bond

yields.

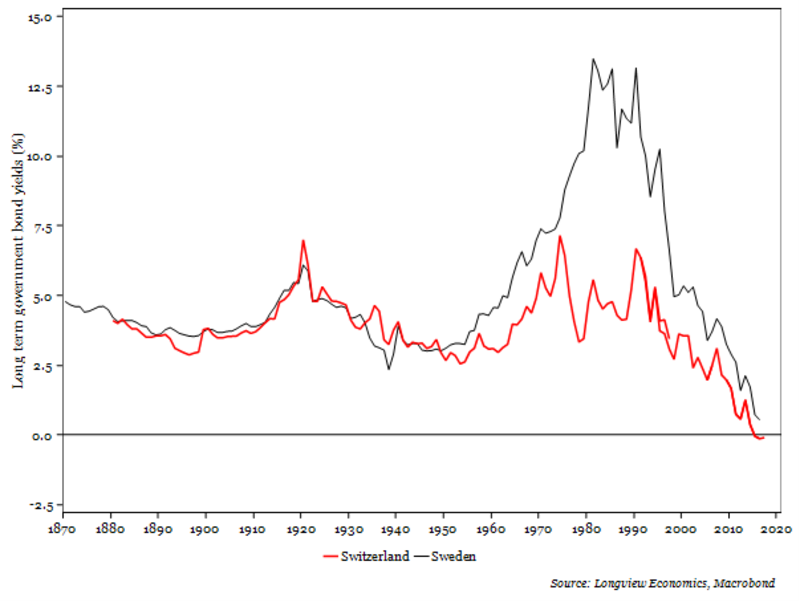

Valuation:

Yield is itself a valuation metric, so it is evident that bonds are very

expensive. Are they really so bizarrely expensive as to justify the word “bubble?” Watling

offers a couple of very long-term comparisons. These are government bond yields

from Switzerland and Sweden dating back to 1870:

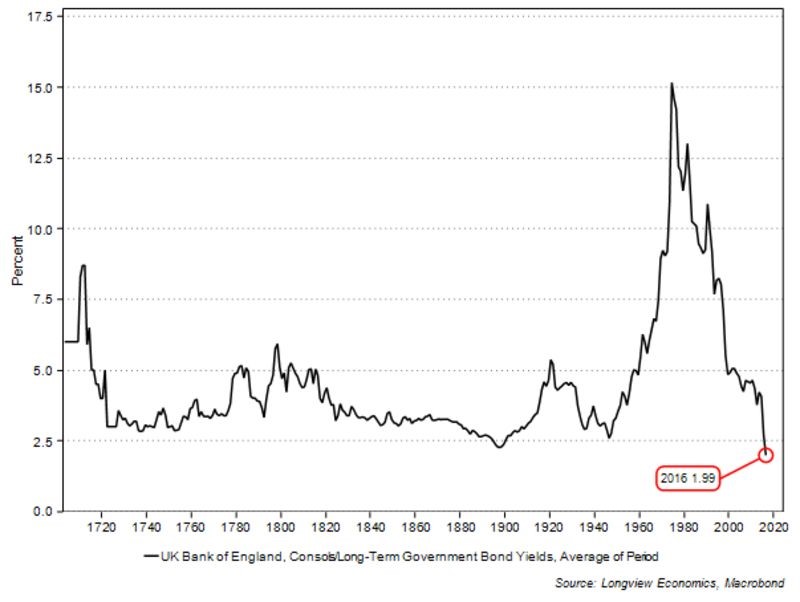

So, there is no precedent for bonds this expensive in two of the strongest and stablest European economies. Now, here is the rate on U.K. “consols,” or perpetual bonds that can be redeemed whenever the government wants, back to 1700:

Meanwhile, the latest action in the U.S. Treasury market has left an all-time low in the 30-year bond yield within sight.

https://www.bloomberg.com/opinion/articles/2019-08-13/the-bond-market-is-in-a-bubble-jz9atl25

3.Small Cap Breaks 200day Moving Average.

S&P, Nasdaq, and Dow break 50days but well above 200day …Small Cap Lags.

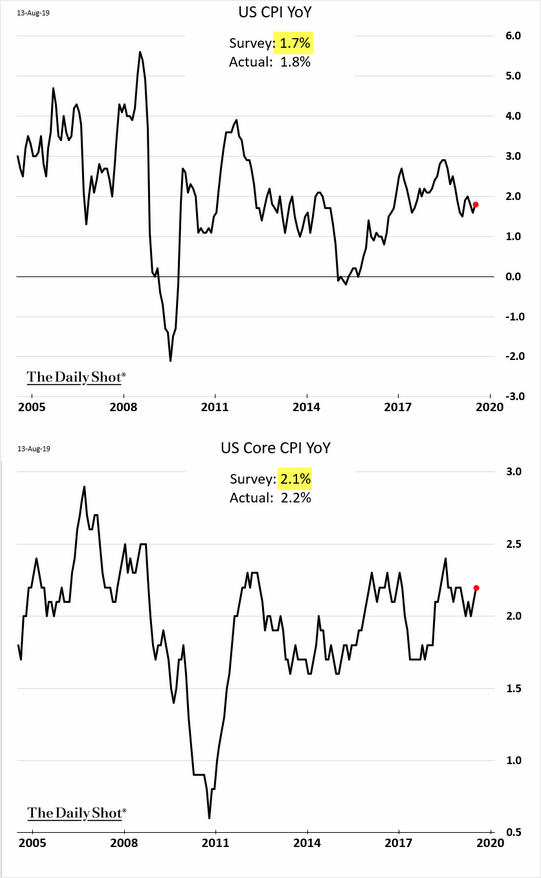

4.A Blip of Increased Inflation CPI

The Daily Shot WSJ

Let’s begin with the July CPI report, which was stronger than the market had expected. The chart below shows the headline and the core CPI.

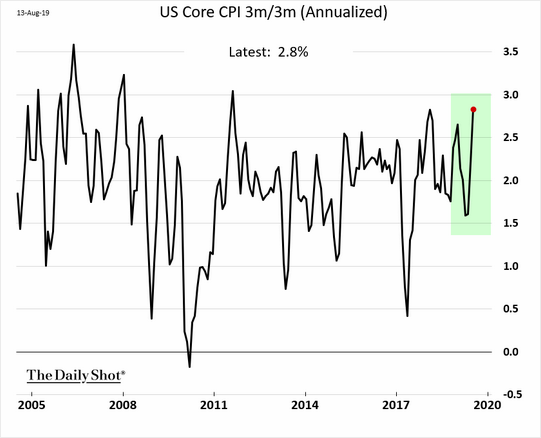

And here are the 3-month changes in the core CPI.

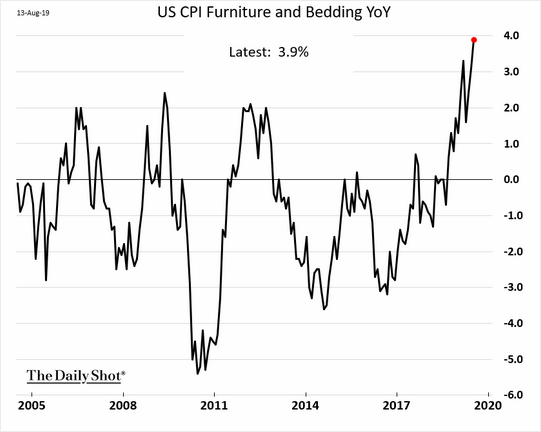

• The 25% tariffs on some $200 billion of imports from China (increased earlier this year) are making their way to the consumer. For example, the CPI on furniture and bedding hit the highest level in years.

5.Subprime Lending Post 2008 Crisis Shifted to Auto Loans.

Subprime Auto Loans Blow Up, Delinquencies at 2009 Level, Biggest 12-Month Surge Since 2010

by Wolf Richter • Aug 13, 2019 • 20 Comments • Email to a friend

But these are the good times. Automakers are not amused.

The auto industry depends on subprime-rated customers that make up over 21% of total loan originations. Without these customers, the wheels would come off the industry. And tightening up lending standards to reduce risks would cause serious damage to the undercarriage. Subprime lending is very profitable – until the loans blow up – because interest rates can be high. But those subprime auto loans are blowing up at rates not seen since the worst days of the Financial Crisis – and these are the good times!

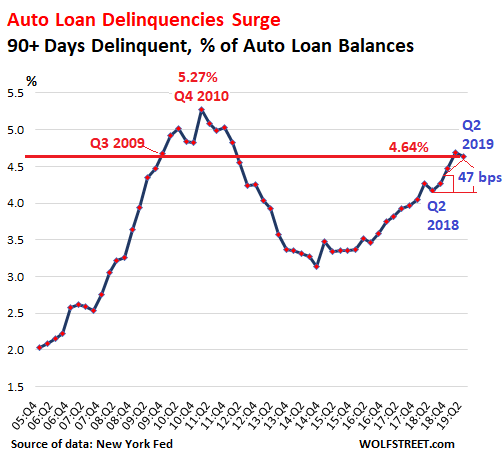

Serious auto-loan delinquencies – 90 days or more past due – in the second quarter, 2019, jumped 47 basis points year-over-year to 4.64% of all outstanding auto loans and leases, according to New York Fed data released today. This is about the same delinquency rate as in Q3 2009, just months after GM and Chrysler had filed for bankruptcy. The 47-basis-point jump in the delinquency rate was the largest year-over-year jump since Q1 2010:

But this time there is no economic crisis. The unemployment rate and unemployment claims are hovering near multi-decade lows, and employers are griping about how hard it is to hire qualified workers without having to raise wages. So, unlike during the Financial Crisis, this surge in the delinquency rate has not been caused by millions of people having lost their jobs. It’s not the economy that did it. It’s the industry.

What the lenders are sitting on.

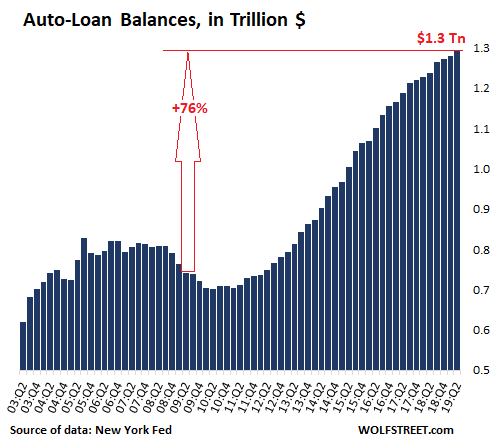

Total outstanding balances of auto loans and leases in Q2 jumped by 4.8%, or by $59 billion, from a year ago to $1.3 trillion, according to the New York Fed’s data (which is slightly higher and more inclusive than the amount reported by the Federal Reserve Board of Governors in its consumer credit data). Over the past decade, since Q2 2009, total auto loans and leases outstanding have surged by 76%:

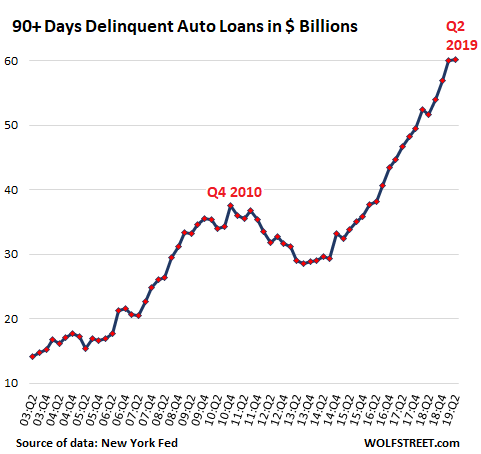

Of those $1.3 trillion in auto loans, 4.64%, or a record of $60.2 billion, are 90+ days delinquent, which gives the chart below quite an amazing trajectory. But this is not an employment crisis, when millions of people lose their jobs and cannot make the payments on their auto loans. What will this chart look like when the economy turns, and unemployment surges again, and people cannot make their car payments? No one has an appetite for making projections here.

Read Full Story https://wolfstreet.com/2019/08/13/auto-loan-subprime-delinquencies-at-2009-level-biggest-12-month-surge-since-2010/

6. HomeEx-Fed boss Greenspan says ‘there is no barrier’ to Treasury yields falling below zero

‘There is no barrier for U.S. Treasury yields going below zero. Zero has no meaning, beside being a certain level.’Alan Greenspan

There is some $15 trillion in government debt that now yields less than zero, and former Federal Reserve Chairman Alan Greenspan believes there’s no reason why U.S. government bond yields couldn’t join much of the developed world in the subzero world.

Greenspan, during a phone interview with Bloomberg News on Tuesday, said “zero” has no real meaning for the U.S. bond market and that a slide below that psychological level, already traversed by many others countries, wouldn’t be inconceivable for U.S. paper.

The 93-year-old economist’s comments come as more Wall Street participants contemplate the very real possibility of negative Treasury rates.

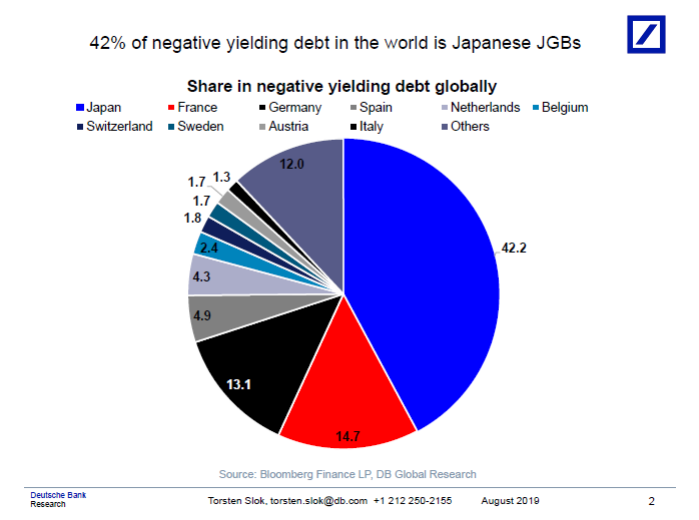

Deutsche Bank Securities’ Chief Economist Torsten Sløk on Tuesday noted that some 42% of negative-yielding debt is from Japan, known as JGBsTMBMKJP-10Y, +5.69% :

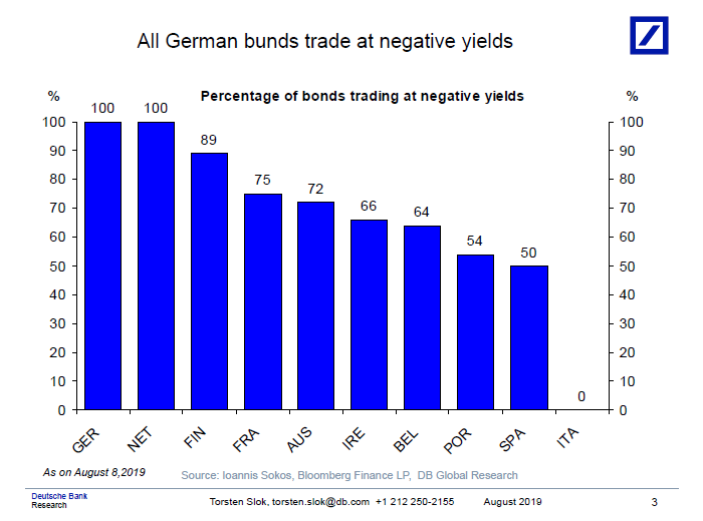

All maturities of German government debt are yielding negative, headlined by near-record lows for 10-year German benchmark bondsTMBMKDE-10Y, +7.05% , known as bunds, which yield minus 0.605% (see chart attached):

7.Blockchain Venture Update.

Blockchain Investment Soars In H1 2019: A Look At Trends

Investors Continue To View Blockchain A High Return Investment

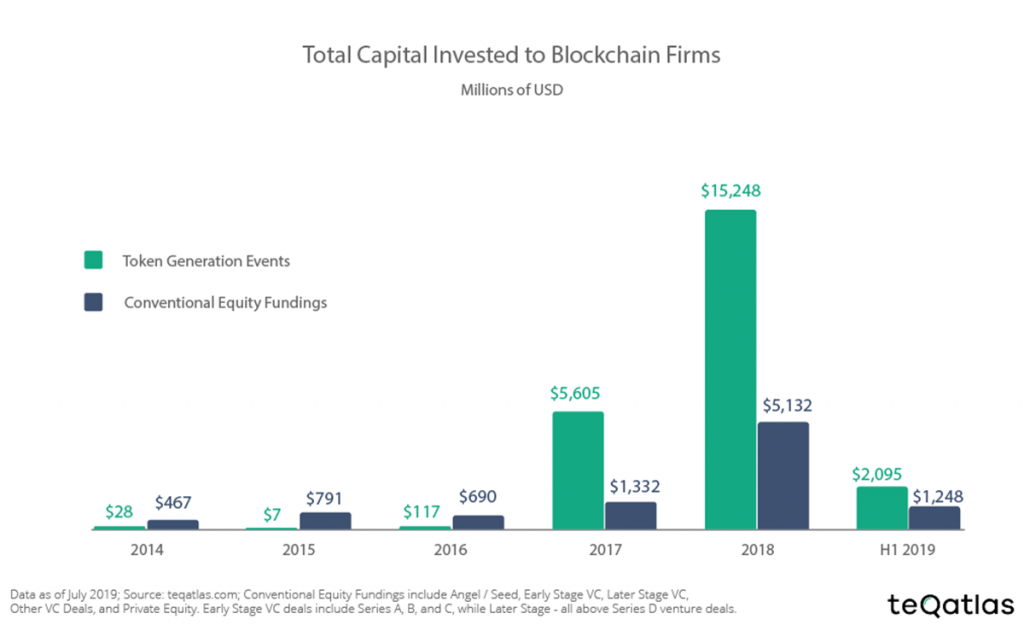

In the first half of 2019, total capital investment into blockchain companies has been the opposite of what we saw in the previous year, which saw a dramatic rise in the amount of capital investment. The previous year saw a record-breaking $15.2 billion investment in TGEs (token generation events) and $5.1 billion in conventional equity funding. In contrast, approx. $2 billion in TGE capital were raised in the first half of this year. The upward trend is losing steam in the first half of 2019, after four years of positive growth.

The research still reports a positive, upward trend in terms of venture capital (VC) injected into blockchain companies. Conventional equity rounds have accumulated $1.2 billion in the first 6 months of 2019, as compared to $1.3 billion for all of 2017.

How Did Blockchain Companies Fare In Deal Activity?

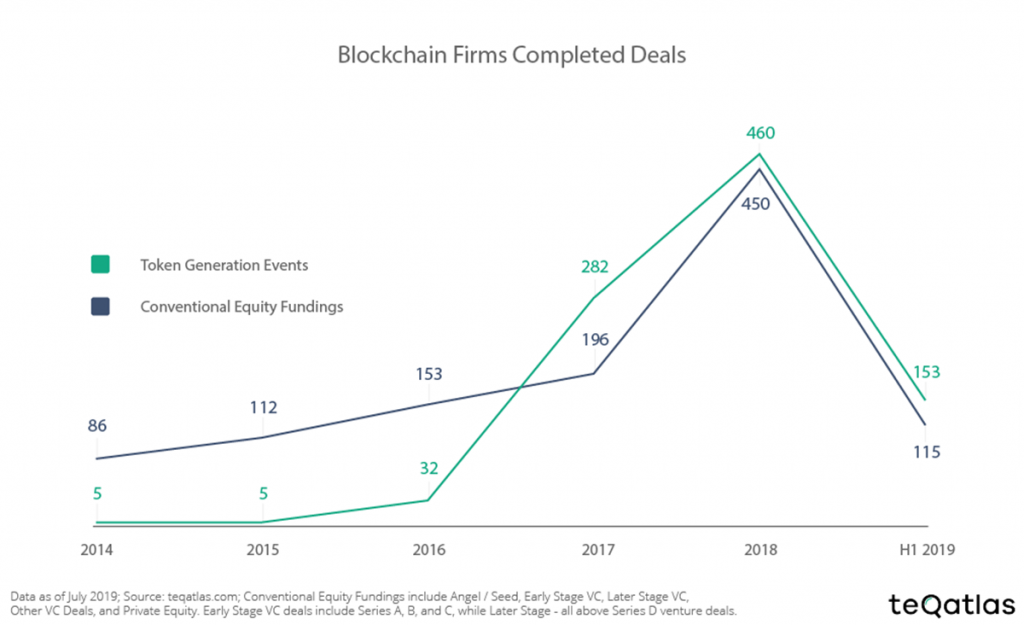

Throughout the research, 2018 continued to remain the benchmark for blockchain companies. The height set during the blockchain boom is hard to replicate as the effects of the dramatic fall in value still affect the industry.

In terms of deals, the grand total of investment rounds in the blockchain industry in the first half of 2019 was 268.

For comparison, blockchain companies attracted 910 deals in 2018 and 478 deals in 2017. At the same pace, 2019 might just oust 2017 in terms of blockchain deal activity.

Surprisingly enough, if you add private equity into the equation, the total number of conventional funding rounds almost equal the growth numbers in 2018.

A breakdown of all the blockchain investment funds also reveals that TGEs were more successful in raising money than Venture Capital rounds – with the former amassing 26% more on average.

Author: Jacob WolinskyJacob Wolinsky is the founder of ValueWalk.com, a popular value investing and hedge fund focused investment website. Prior to ValueWalk, Jacob was VP of Business Development at SumZero. Prior to SumZero, Jacob worked as an equity analyst first at a micro-cap focused private equity firm, followed by a stint at a smid cap focused research shop. Jacob lives with his wife and three kids in Passaic NJ. – Email: jacob(at)valuewalk.com – Twitter username: JacobWolinsky – Full Disclosure: I do not purchase any equities to avoid even the appearance of a conflict of interest and because at times I may receive grey areas of insider information. I have a few existing holdings from years ago, but I have sold off most of the equities and now only purchase mutual funds and some ETFs. I also own 2.5 grams of Gold

8.8 of the Top 10 Best-Performing ETFs are China Funds.

In fact, eight of the top 10 best-performing EM ETFs are China funds. That includes the Global X MSCI China Consumer Staples ETF (CHIS), up 37.7%; the CSOP FTSE China A50 ETF (AFTY), up 32.9%; and the KraneShares CICC China Leaders 100 Index ETF (KFYP), up 29.8% (see Figure 2).

The fact that China ETFs are outperforming to such a strong degree in the face of such negative news flow is pretty impressive.

Analysts point to relatively cheap valuations following last year’s drop in China stocks and potential government buying as factors that could be propping up China ETFs in 2019.

https://www.etf.com/publications/etfr/emerging-markets-wild-ride

9.Weekly mortgage refinances spike 37% in one week as rates fall further

PUBLISHED AN HOUR AGOUPDATED 18 MIN AGO

KEY POINTS

- -Mortgage application volume jumped 21.7% last week compared with the previous week, according to the Mortgage Bankers Association. Volume zoomed 81% from a year ago.

- -The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances decreased to its lowest level since November 2016, 3.93%, from 4.01%

- -That drove a stunning 37% jump in refinance volume for the week, the highest level since July 2016. Refinance applications were nearly three times higher than a ago.

A real estate agent and a potential home buyer in Coral Gables, Fla.

Another sharp drop in mortgage rates sent even more homeowners to their lenders, hoping to save money on their monthly payments.

Mortgage application volume jumped 21.7% last week compared with the previous week, according to the Mortgage Bankers Association’s seasonally adjusted index. Volume zoomed 81% from a year ago.

The surge was a direct response to another drop in mortgage rates. The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) decreased to its lowest level since November 2016, 3.93%, from 4.01%, with points decreasing to 0.35 from 0.37 (including the origination fee) for loans with a 20% down payment. That rate was 88 basis points higher a year ago.

That drove a stunning 37% jump in refinance volume for the week, the highest level since July 2016. Refinance applications were nearly 196% higher than a year ago.

“The 2019 refinance wave continued, as homeowners last week responded to extraordinarily low mortgage rates. Fears of an escalating trade war, combined with economic and geopolitical concerns, once again pulled U.S. Treasury rates lower,” said Joel Kan, MBA’s associate vice president of economic and industry forecasting.

Mortgage rates have fallen 15 basis points in just the last two weeks and are down 80 basis points this year, prompting borrowers to take advantage and lower their monthly payments. For most, refinancing only makes financial sense if the rate can be lowered at least 75 basis points. Interest rates were lower in 2012 and part of 2013, and refinance volume was much stronger then. The majority of those who now would benefit from a refinance are more recent homebuyers.

Lower mortgage rates did not help juice the home purchase market quite as much. Mortgage applications to buy a home rose 2% for the week and were 12% higher than a year ago. Buyers today are still facing a very pricey market, and while the drop in rates helps affordability some, it’s not quite enough in some markets. Prices are also rising most at the lower end of the market, where demand is strongest.

Mortgage rates have plateaued so far this week, despite continued turbulence in international markets.

10.7 Reasons Why Emotional Intelligence Is One Of The Fastest-Growing Job Skills

Here’s why hiring managers say they often value emotional intelligence more highly than IQ.

BY HARVEY DEUTSCHENDORF3 MINUTE READ

According to the World Economic Forum’s Future of Jobs Report, emotional intelligence will be one of the top 10 job skills in 2020.

The awareness that emotional intelligence is an important job skill, in some cases even surpassing technical ability, has been growing in recent years. In a 2011 Career Builder Survey of more than 2,600 hiring managers and human resource professionals, 71% stated they valued emotional intelligence in an employee over IQ; 75% said they were more likely to promote a highly emotionally intelligent worker; and 59% claimed they’d pass up a candidate with a high IQ but low emotional intelligence.

The question, then, is why companies are putting such a high premium on emotional intelligence. Here are seven of the top reasons why highly emotionally intelligent candidates are so valuable.

1. THEY CAN HANDLE PRESSURE HEALTHILY

Dealing with workplace pressures and functioning well under stress demands an ability to manage our emotions. People with higher levels of emotional intelligence are more aware of their internal thermometer and therefore better able to manage their stress levels. They tend to have better-developed coping mechanisms and healthy support systems that keep working effectively even in tough situations. The increasing rate of change in the workplace is likely to increase work-related stress and boost the value of those who can manage it.

2. THEY UNDERSTAND AND COOPERATE WITH OTHERS

People with highly developed emotional intelligence are less defensive and more open to feedback, especially when it involves areas of improvement.

As teamwork becomes increasingly important in the workplace, people who are able to understand and get along with others will become ever more sought after. Highly emotionally intelligent people have well-developed people skills that let them build relationships with a diverse range of people across many cultures and backgrounds. That’s an asset in an increasingly globalized workplace.

Everyone wants to be heard and understood. The ability to listen well and respond to others is crucial for developing strong working relationships. Many of us, though, aren’t as good as we could be at really listening to what others are saying. Because of their ability to understand others, highly emotionally intelligent people are in a better position to put their own emotions and desires aside and take others into account. Their ability to pick up on people’s emotions, through tone of voice and body language, come in handy in team settings.

4. THEY’RE MORE OPEN TO FEEDBACK

Open, timely, and honest feedback is essential to job performance–especially at a time when annual performance reviews are in decline. People with highly developed emotional intelligence are less defensive and more open to feedback, especially when it involves areas of improvement. Their high level of self-regard lets them look positively at areas where they can do better, rather than taking feedback personally.

Highly emotionally intelligent people are in a better position to put their own emotions and desires aside and take others’ into account.

Collaboration doesn’t just present logistical issues–it also comes down to responding to teammates’ feelings. People with high emotional intelligence are able to use their sensitivity to where others are coming from to build trust and cohesiveness. This allows teams to focus on the task at hand rather than become embroiled in internal bickering and politics. Their sensitivity to the needs of others acts as a lubricant that helps team members work together.

6. THEY SET AN EXAMPLE FOR OTHERS TO FOLLOW

Highly emotionally intelligent people don’t get easily flustered when things don’t go according to plan. And their knack for getting along with others makes it more likely that others will take note and try to emulate them. That’s why high emotional intelligence is a key to influencing people in an organization regardless of official title. An ability to rise above daily irritations earns people with high emotional intelligence the respect from those above them as well as from their colleagues.

7. THEY MAKE MORE THOUGHTFUL AND THOROUGH DECISIONS

Because of their ability to see things clearly from another’s point of view, highly emotionally intelligent people are able to make better judgements about how their decisions will impact others. Not only does this result in better decision making overall, but it also helps manage damage control when certain decisions lead to negative consequences. Being able to judge the outcomes of their choices lets highly emotionally intelligent people behave more proactively.

People who show an enhanced ability to adapt to change, manage their emotions, and work well with a diverse range of people are already valuable in most workplaces. But with the rates of change and pressures in the workplace rising, they’ll become even more sought after than ever.

ABOUT THE AUTHOR

Harvey Deutschendorf is an emotional intelligence expert, author and speaker. To take the EI Quiz go to theotherkindofsmart.com