1.Max Gains in Bear Market Rallies.

SPDR ETFs

Max Gains During Bear Market

https://www.ssga.com/us/en/institutional/etfs

2.Nasdaq 100 vs. S&P Pre-Corona.

3.Is Gold an Inflation Hedge?

Gold vs. S&P During Inflation—Goldman Sachs.

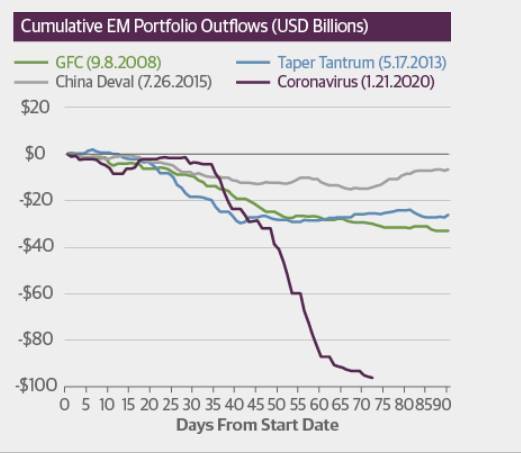

4.Emerging Market Debt to GDP at Record Levels Before Coronavirus.

Guggenheim

Debt to GDP Growth

Record Emerging Market Outflows vs. Previous Market Crisis

5.Euro-Zone Banks Trading at Far Below Book Value.

The World’s Bank Stocks Price In ‘Armageddon’ as Buyers Flee–By Justina Lee https://www.bloomberg.com/news/articles/2020-04-06/the-world-s-bank-stocks-price-in-armageddon-with-buyers-awol

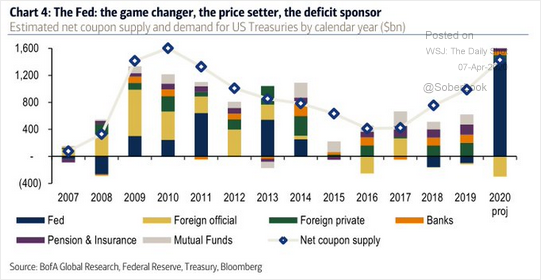

6.Federal Reserve Balance Sheet Could Reach $9Trillion.

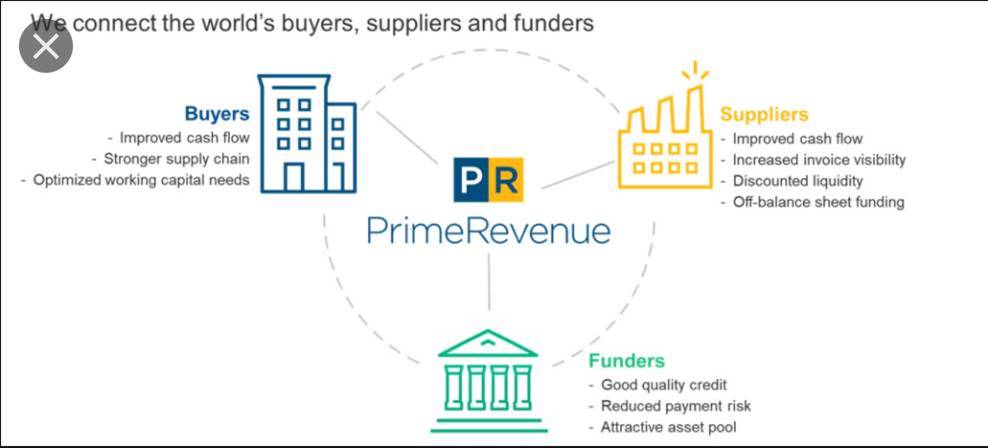

7.Supply Chain Financing a “Sleepy Risk”

By Jean Eaglesham-WSJ

A “sleeping risk” on the books of U.S. businesses could be awakened by the pandemic, as the sudden cash crunch exposes a hidden type of financing that makes balance sheets look better, credit-rating firms are warning.

The three biggest ratings firms each issued reports last month highlighting the dangers of supply-chain financing, a fast-growing, opaque technique for delaying payments to suppliers to improve cash flow.

S&P Global Inc. called supply-chain finance a “sleeping risk” that can “mask episodes of financial stress.” A prime concern is that the banks or other lenders may yank the financing from struggling companies, cutting off a source of cash at a time when it is desperately needed.

Supply-Chain Finance Is New Risk in CrisisExperts say the economic slowdown could expose weak spots in the arrangements

5 things you should know about supply chain finance

· It is not a loan – Supplier finance or reverse factoring is an extension of the buyer’s accounts payable and is not considered financial debt. For the suppler, it represents a true sale of their receivables.

· It does not need to be tied to a single bank – Supply chain finance with SCiSupplier provides multibank capability by providing availability to more than 50 financial institutions worldwide.

· It is not factoring – With our solutions, 100 percent of each invoice-minus a very small transaction fee-is paid to the supplier, and there is no recourse burden on the supplier once the invoice is paid.

· Supply chain finance is not just for large companies – It provides value for firms of all sizes and credit ratings, including SME suppliers.

· It does not require a bank – Our programs can be self-funded by the buyer, established without the participation of a bank for funding, or composed of a mixed program where financing is shared by the buyer, capital markets, and financial institutions

8.Contact Tracing

Morning Brew

| PUBLIC HEALTHTerm of the Day: ‘Contact Tracing’Francis ScialabbaHealth authorities are breaking out the Yellow Pages to fight COVID-19. Last Friday, Massachusetts Gov. Charlie Baker detailed a “powerful tool” to stop the coronavirus’s spread: contact tracing. How it works: When a patient tests positive, you make a list of everyone they came in close contact with. Then, you find those people and make sure they self-isolate before infecting others. That sounds straightforward, but contact tracing a new patient typically takes three days, according to Stat, which is “an insurmountable hurdle in the U.S., with its low numbers of public health workers and tens of thousands of new cases every day.”It’s worked elsewhereSouth Korea used high-tech contact tracing to tame its outbreak. The government compiled GPS data, credit card swipes, and other info into a public log showing where COVID-19 patients had traveled.Some countries (including the U.S.) are trying other methods, including looking at smartphone location data and developing Bluetooth systems that provide warnings if you’ve crossed paths with an infected person.The hangup: Despite its widespread use in places like Singapore, contact tracing has raised concerns about privacy and governments following citizens’ whereabouts. Still, it’s a term you’ll be hearing a lot more of in the coming weeks. |

9.Two Back to Work Scenarios

Wolf Street–So what’s the endgame here?

Do we try to eradicate the virus — without a vaccine? Do we try to manage infection rates, to let the population “build immunity through suffering” until a vaccine is available? How can we revive the economy without risking thousands of deaths in fresh outbreaks?

Some things are clear: The recovered cases can get back to normal. The infirm elderly need to be protected as much as possible. Everyone else is in between, and without a treatment or vaccine, every economic or social activity comes with some level of infection and mortality risk.

I can see two limiting-case scenarios. Both require that right now, everyone work together to suppress the virus, in every way we can. But we need to start the discussion of “what’s next” since it’s a tough policy choice, perhaps the biggest of the decade.

The first scenario, “put out the fire,” is modeled on Korea. Use shelter-in-place and face masks to suppress the growth of the virus, then use rapidly-growing testing capacity to trace and isolate the infected. With a return to “containment,” everyone else can get back to work. South Korea is doing well, and only has 100 new cases per day nationwide. But even South Korea hasn’t been able to put out the fire completely. And “get back to work” involves major changes in how work is done, to reduce infection risks every minute, every day.

The second scenario, “controlled burn,” envisions an “infection risk budget,” with a goal to keep caseloads at a level that hospitals can sustainably support, while allowing as much economic output as possible. If we risk too many infections, hospitals overflow and thousands die – reruns of New York, Milan and Wuhan. But if we can minimize the risk throughout daily life, and keep our homes safe, then that frees up room in the budget.

With that extra room, more people could get back to work and get the economy going. Even if those activities might cause a bit of spreading, it might be worth the risk (for arena sports, cruise ships and other mass social gatherings, it might not). A “controlled burn” would take a long time, but eventually everyone who needs to work will have immunity or received a vaccine, and we’ll have normal life again (provided the virus doesn’t mutate too fast). But in the absence of an effective treatment or vaccine, it will cost thousands of lives to build herd immunity this way. Is there a better way?

No matter which path is taken, policymakers will have to decide how to balance lives vs. livelihoods. And the rest of us need to learn how to prevent spread at every level, both to preserve lives and to revive jobs. By Wisdom Seeker, for WOLF STREET.

10.Corona ..What Do I Do Graph?