1.First Quarter Letter.

The Black Swan Has Landed–April 1, 2020–Matt Topley

First Quarter Letter 2020–FOREVER IN BLUE JEANS

Money talks

But it doesn’t sing and dance and it don’t walk

And long as I can have you here with me

I’d much rather be forever in blue jeansHoney’s sweet

But it isn’t nothing’ next to baby’s treat

And if you’d pardon me, I’d like to say

We’d do okay forever in blue jeans

Neil Diamond https://www.azlyrics.com/lyrics/neildiamond/foreverinbluejeans.html

Introduction

Money talks but it can’t sing, it can’t dance and it can’t walk. Pop star, Neil Diamond, understood this long before the coronavirus put our lives on hold. But the plan the Fed and Congress put in place to rain money everywhere will hopefully allow us to sing, dance and walk until this crisis is over.

First, my thoughts and prayers go out to everyone impacted by the pandemic, especially patients and all the brave medical personnel on the front lines. In this new reality, it may seem like working from home in blue jeans is going to last forever; it won’t. We’ll eventually get back to normal, but I believe Congress won’t be able to bail out corporations as easily today as it did with banks, airlines and cruise lines during the 2008-09 global financial crisis. It is my opinion that taxpayers and voters won’t put up with airlines spending 96 percent of their free cash flow on stock buybacks and they won’t tolerate helping “American” cruise lines stay afloat, when those companies—domiciled offshore– pay almost no U.S. taxes.

When we got through the global financial crisis in 2009, I was emotionally exhausted. But I consoled myself with the fact that it would be at least a quarter of a century before we’d have to live through volatility like that again. But here we are, barely a decade later, and it’s déjà vu all over again. Just a few weeks ago, we had a perfect storm of plummeting stocks, plunging oil prices and rock bottom interest rates all at the same time. This perfect storm caused the worst liquidity crisis since 2008. At one point there was a bid/offer spread of 100 basis points on U.S. Treasuries, leaving the rest of the bond market frozen. An entire frightening week went by in which no corporation could borrow money in the credit markets.

Meanwhile, the stock market saw the fastest 30 percent drop in history. In fact, it was only the fourth time in 75 years that a conservative 60/40 portfolio was down 20 percent. Not only that, but the stock market volatility index (aka the VIX) reached a high of 82.69 breaking the previous record set in 2008

A record month for records

Consider this: During one two-week stretch in March, the Dow Jones Industrial Average experienced its best single day since 1933 as well as its two worst since days since the Black Monday crash of 1987.

According to Dorsey Wright research, the Dow registered 10 separate days in March 2020 that ranked among the largest single-day moves since 1985. The Dow had five of its 20 best single day returns in March 2020 as well as five of its 20 worst single-day returns. To put these extremes into perspective, we have seen only two days since 2009 that ranked in the 20 best or 20 worst days since 1985 – December 26, 2018 when the Dow gained 4.98% and August 8, 2011 when the index lost 5.55%. No other month since 1985 has had nearly as many eye-popping single-day moves as March 2020 did.

I know it’s hard to fathom, but in March, we surpassed the crashes of 1929 and 1987 with the fastest 30 percent correction ever. Even during the Internet bubble of 2000, it took over 250 days for the market to lose 20 percent–it took just 22 days during the March madness of 2020.

Click to Read Full Letter

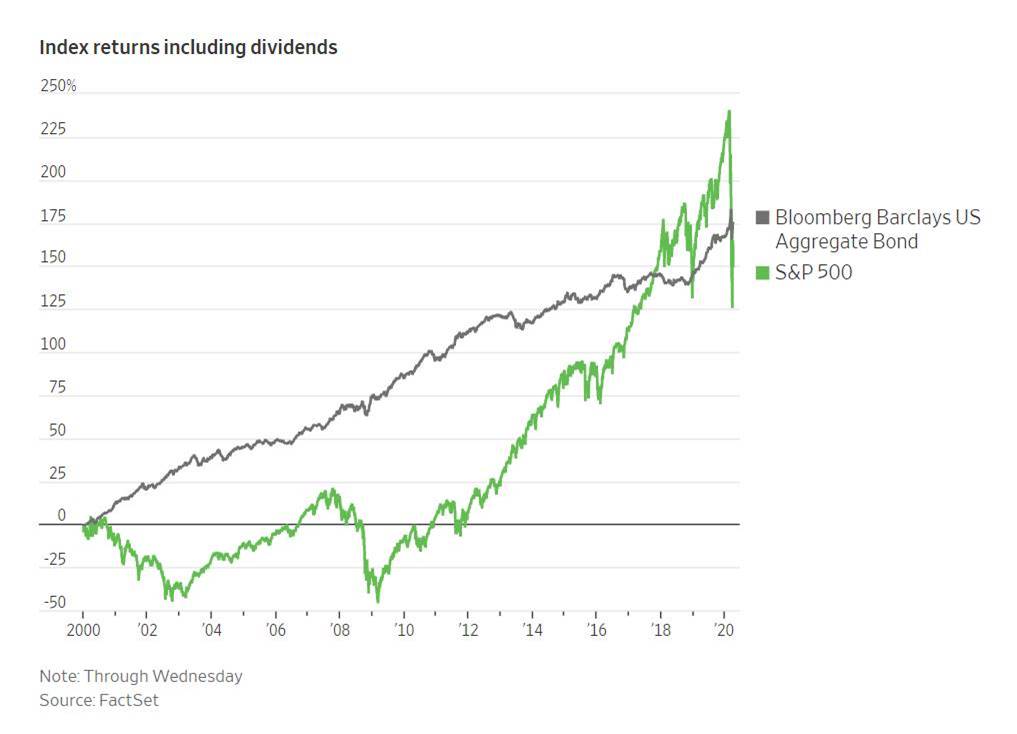

2.Bonds Now Beating Stocks Since 2000.

Bonds Are Now Outperforming Stocks in Battle for Returns This Century-By Caitlin McCabe

The leading bond-market investment benchmark’s outperformance against the S&P 500 underscores the extent of the recent carnage in the stock market

3.Sector Returns Since Coronavirus Crisis.

Advisor Perspectives

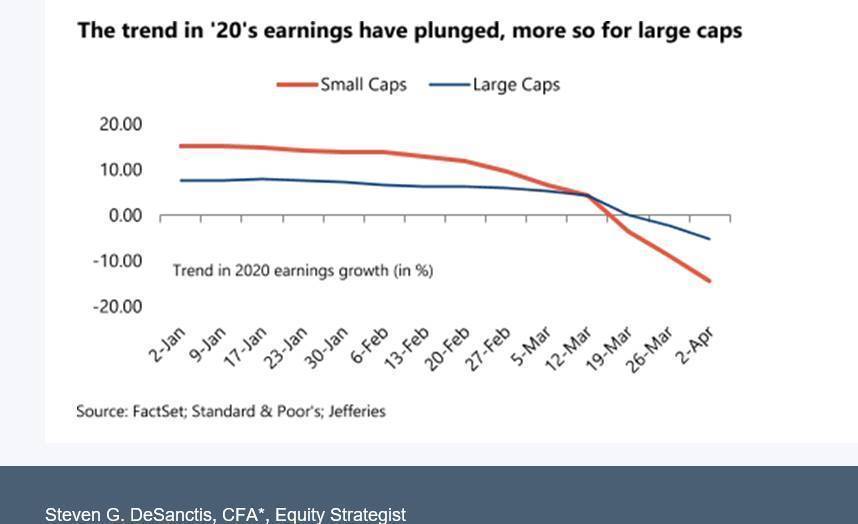

4.Earnings Plunge Worse for Small Caps Vs. Large Caps.

Jefferies.

5.Russell 2000 Growth Companies Have Record Leverage.

Barrons

Having manageable debt is crucial in the current environment, as many companies levered up their balance sheets in recent years to buy back stock. Now that the U.S. will probably enter a recession, that debt could be difficult to repay. “There has never been more leverage in companies in the Russell 2000 Growth [small-cap index],” says Craigh Cepukenas, manager of (ARTSX). “If you look at the historical Russell 2000 Growth net debt to [cash flow ratio] number, it’s approaching three times. If you went back to January 2010, it was under one-time leverage.” He also says that money-losing, profitless companies now make up a third of the benchmark, and “that’s completely unprecedented.”

How Stock Market Selloffs Can Help You Stress-Test Your Investment Portfoli0By Lewis Braham

IWO Russell 2000 Growth-YTD down over 30%…breaks below 2018 lows.

6.Consumers are in Much Better Shape Financially than 2008.

Consumers are in far better shape than they were heading into the last crisis. “Coming into 2007, we had the highest household debt-service ratio in history,” Smead Capital Management portfolio manager Cole Smead tells Barron’s. “We entered this with the lowest household debt-service ratio since 1981, and a positive savings rate.”

Household Debt to Income Ratio FRED charts

https://fred.stlouisfed.org/series/TDSP

7.$100B in Federal Government Package for Hospitals. Will It Move the Needle?

HCA hit $59 in March from a High of $150 in early 2020

8.Publicly Traded Telehealth Company TDOC.

TDOC Chart 2020 YTD +85%

9.Amazing facts you didn’t know about cars….30,000 Parts

In a bid to blow you away and keep you informed at the same time, we compiled a list of amazing facts about cars you have never heard.

Did you know the average car has over 30,000 parts?

http://autofactorng.blogspot.com/2016/04/amazing-facts-you-didnt-know-about-your.html

Auto-Parts Suppliers Teeter as Car Production Halts–Shutdowns ripple through supply chain, prompting some to consider layoffs, delayed payments and adjustments to loan terms-WSJ

10.How to free up your mind to do what you can – wherever you are

Philly Inquirer

by Martin Seligman, Updated: April 5, 2020- 5:00 AM

This is not the first time that great universities have had to shut their doors during an epidemic. And there is perhaps a lesson for all students about what can happen during a shutdown.

In 1665, Cambridge University closed as the bubonic plague swept across England.

Isaac Newton, a 22-year-old student, was forced to retreat to the family farm, Woolsthorpe Manor. Isolated there for more than a year, on his own he revolutionized the scientific world. Newton said that this shutdown freed him from the pressures of the curriculum and led to the best intellectual years of his life.

Here is what he did:

Optics: He discovered the fundamentals of color. It was already known that sunlight passed through a glass prism produced the rainbow spectrum—bands of red, orange, yellow, and so on. But were these a fundamental aspect of light as opposed to some artifact produced by prisms? To find out, he passed a single-colored beam from the first prism through a second prism and got the same color once again. The glass did not change it.

Gravity: Sitting in the orchard behind his farmhouse, he considered two orbs in his view, the moon and a single apple. Newton wondered if the force that drew the apple to the earth was what held the moon in orbit. These musings led him to later construct the laws of gravity and motion that tied everything in the universe together.

\Calculus: He wrote three papers inventing calculus. (Shortly afterward, Gottfried Leibniz came up with the same principles.) Thinking about the rate of change as an object accelerated falling to earth, he realized that one could get an accurate total of the area under a curve by summing the rectangles, down to the infinitely small rectangles, that made up this area.

In 1667, Newton returned to Cambridge, the plague having abated. He presented all this work to his mentor and professor, Sir Isaac Barrow. Two years later, Barrow resigned his chair in favor of Newton.

Don’t let current circumstances interrupt learning.

Do imagine what you might do when freed from conventional routines and requirements. When it comes to curiosity and creativity, the mind knows no boundaries.

Martin Seligman, author of The Hope Circuit, is the director of the Penn Positive Psychology Center and Zellerbach Family Professor of Psychology at the University of Pennsylvania. This post appeared in Thought of the Week — actionable advice about the science of character — from Character Lab, founded by Penn psychology professor Angela Duckworth. You can sign up to receive more at characterlab.org.

Posted: April 5, 2020 – 5:00 AM

Martin Seligman

https://www.inquirer.com/life/character-lab-martin-seligman-isaac-newton-20200405.html