1.MSCI All-World Index Worse Quarterly Slide Since 2008.

2.Asset Class Performance YTD and From Highs.

3. Q1 2019 Worse S&P First Quarter Drop Ever

NED DAVIS RESEARCH…History of Post 15% Drop Quarters in S&P

4.The State of the American Business

Posted April 1, 2020 by Michael Batnick

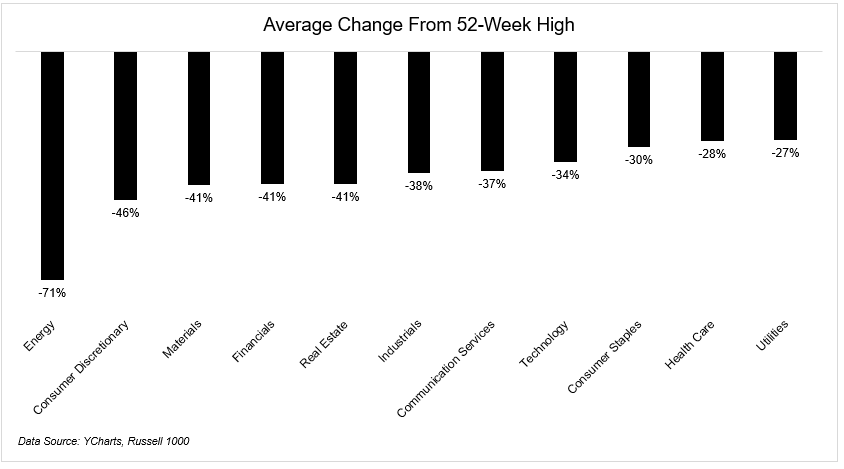

95% of all stocks in the S&P 500 are down year-to-date. The selling has been merciless, but it has not been indiscriminate. The market has done a good job reflecting what’s going on in the real economy.

Energy has been the hardest hit sector, with the double whammy of the price war between the Russians and the Saudis coupled with the dried up demand.

I wanted to look under the hood at different industry groups to see which areas have been hit the hardest.

The Irrelevant Investor https://theirrelevantinvestor.com/2020/04/01/the-state-of-the-american-business/

5.Delayed Pension Fund Re-Balancing Likely to Drive Market Volatility Going Forward.

Dave Lutz at Jones Trading

U.S. pension funds that delayed rebalancing their portfolios are likely to pump about $400 billion into stocks over the next two quarters, strategist Nikolaos Panigirtzoglou at JP Morgan said, providing a potential boost to equity markets battered by the coronavirus pandemic.

The bank said its estimate of $400 billion in equity buying by the funds over the next two quarters could prove conservative. U.S. pension funds bought $200 billion in stocks by the first quarter of 2009, in the aftermath of the global financial crisis — equivalent to $600 billion today

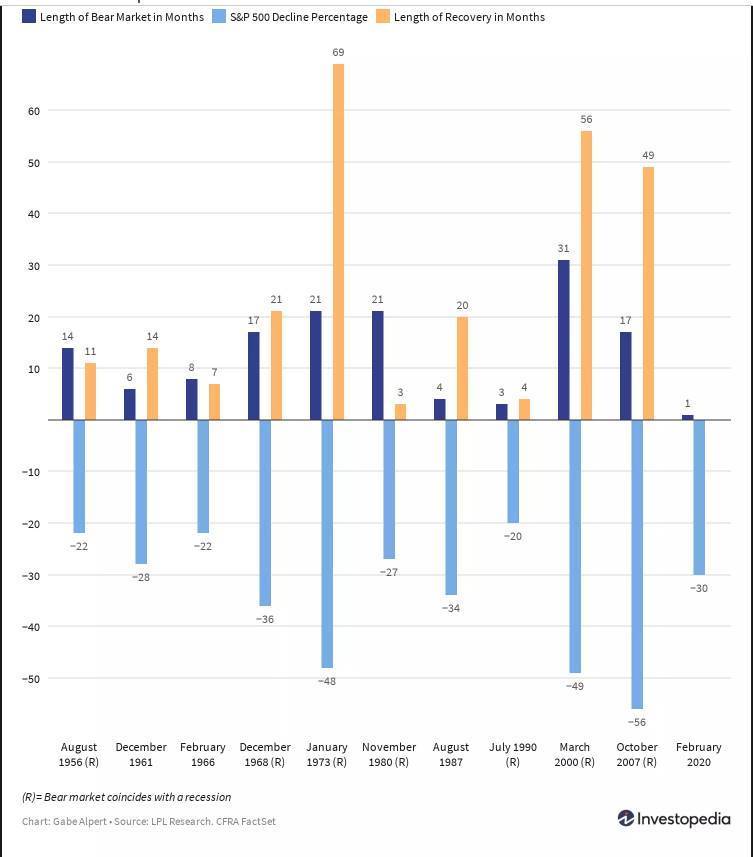

6.Length of Bear Markets and Length of Recoveries.

https://www.investopedia.com/terms/b/bearmarket.asp

7.Oil-rich wealth funds seen shedding up to $225 billion in stocks

Tom ArnoldLONDON (Reuters) – Sovereign wealth funds from oil-producing countries mainly in the Middle East and Africa are on course to dump up to $225 billion in equities, a senior banker estimates, as plummeting oil prices and the coronavirus pandemic hit state finances.

FILE PHOTO: A trader wears a mask as he works on the floor of the New York Stock Exchange (NYSE) as the building prepares to close indefinitely due to the coronavirus disease (COVID-19) outbreak in New York, U.S., March 20, 2020. REUTERS/Lucas Jackson

The rapid spread of the virus has ravaged the global economy, sending markets into a tailspin and costing both oil and non-oil based sovereign wealth funds around $1 trillion in equity losses, according to JPMorgan strategist Nikolaos Panigirtzoglou.

His estimates are based on data from sovereign wealth funds and figures from the Sovereign Wealth Fund Institute, a research group.

Sticking with equity investments and risking more losses is not an option for some funds from oil producing nations. Their governments are facing a financial double-whammy – falling revenues due to the spiraling oil price and rocketing spending as administrations rush out emergency budgets.

Around $100-$150 billion in stocks have likely been offloaded by oil-producer sovereign wealth funds, excluding Norway’s fund, in recent weeks, Panigirtzoglou said, and a further $50-$75 billion will likely be sold in the coming months.

“It makes sense for sovereign funds to frontload their selling, as you don’t want to be selling your assets at a later stage when it is more likely to have distressed valuations,” he said.

Most oil-based funds are required to keep substantial cash-buffers in place in case a collapse in oil prices triggers a request from the government for funding.

A source at an oil-based sovereign fund said it had been gradually raising its liquidity position since oil prices began drifting lower from their most recent peak above $70 a barrel in October 2018.

In addition to the cash reserves, additional liquidity was typically drawn firstly from short-term money market instruments like treasury bills and then from passively invested equity as a last resort, the source said.

It’s generally a similar trend for other funds.

“Our investor flows broadly show more resilience than market pricing would suggest,” said Elliot Hentov, head of policy research at State Street Global Advisors. “There has been a shift toward cash since the crisis started, but it’s not a panic move but rather gradual.”

The sovereign fund source said the fund had made adjustments to its actively-managed equity investments due to the market rout, both to stem losses and position for the recovery, when it comes.

Exactly how much sovereign wealth funds invest and with whom remain undisclosed. Many don’t even report the value of the assets they manage.

On Thursday, the Norwegian sovereign wealth fund said it had lost $124 billion so far this year as equity markets sunk but its outgoing CEO Yngve Slyngstad said it would, at some point, start buying stocks to get its portfolio back to its target equity allocation of 70% from 65% currently.

Slyngstad also said that any fiscal spending by the government this year would be financed by selling bonds in its portfolio.

DEFENDING THE CURRENCY

State-backed, energy-rich funds account for a significant chunk of the roughly $8.40 trillion in total sovereign wealth assets, funds they’ve built up as a bulwark for when oil revenues dry up.

Sovereign funds have become major players on global stock markets, accounting for roughly 5-10% of total holdings, and an important source of income for Wall Street asset managers.

While they have been hit hard by the approximate 20% slide in global equity prices, the oil-based funds’ governments in Abu Dhabi, Kuwait, Qatar, Bahrain, Saudi Arabia, Nigeria and Angola have also seen their finances strained by a nearly two thirds drop in oil prices this year.

Gulf sovereign wealth funds could see their assets decline by $296 billion by the end of this year, according to Garbis Iradian, chief Middle East and North Africa economist at the Institute of International Finance (IIF).

Around $216 billion of that fall would be from stock market losses and a further $80 billion from drawdowns taken by cash-squeezed governments.

The central banks of Saudi Arabia, the United Arab Emirates and Qatar have offered a total $60 billion in stimulus, although expectations of tighter liquidity have already pressured Gulf currencies, pegged for decades to the U.S. dollar.

“There’s a question of whether some of these funds are going to be used to support currencies, as some legal frameworks allow this,” said Danae Kyriakopoulou, chief economist of the Official Monetary and Financial Institutions Forum (OMFIF), a think tank.

“In the previous 10 years some countries moved reserves from their central banks to sovereign funds, allowing them to invest in more risky assets as they have greater flexibility.”

“Now, that may be a problem, because you have more reserves in the sovereign fund than the central bank when you may need the reserves to defend the currency.”

Saudi Arabia is among countries that have in recent years moved reserves from its central bank to beef up its sovereign investment vehicle, Public Investment Fund, which holds stakes in Uber and electric car firm Lucid Motors, and had around $300 billion in assets under management in 2019.

In 2015, the last time crude prices collapsed, Saudi Arabia’s central bank, which then oversaw a larger chunk of the kingdom’s investments, mainly in securities such as U.S. Treasury bonds, ran down its foreign assets by over $100 billion to cover a huge state budget deficit.

This month, Saudi Arabia’s Finance Minister Mohammed al-Jadaan said the country would look to borrow to finance its deficit after announcing an economic support package worth more than $32 billion.

Editing by Carmel Crimmins

Our Standards:The Thomson Reuters Trust Principles.

8.Good Time to Review the Market Cycle of Emotions.

The Market Cycle of Emotions

When things are great, we feel that nothing can stop us. And when things go bad, we look to take drastic action. Because emotions can be such a threat to an investor’s financial health, it is important to be aware of them. This awareness can then protect you from the negative consequences of impulsive and irrational reactions to these emotions.

Stage 1: Optimism, thrill and euphoria

Investors all start with optimism. We commonly expect things to go our way, or we tend to expect a return for the risk of investing.

As expectations are met, it is common to get excited about the possibility of even greater returns and the excitement becomes thrilling as the returns exceed expectations.

At the top of the cycle is when investors experience euphoria. But it is here where investors are at the point of maximum financial risk. When we believe everything we touch turns to gold, we fool ourselves into believing we can beat the market, we cannot make mistakes, that excessive returns are commonplace and that we can tolerate higher levels of risk.

Stage 2: Complacency, denial, hope

The second phase of the cycle occurs when the market stops meeting our new lofty expectations and begins to turn. At first, we anxiously watch the market for any signs of direction. Anxiety turns to denial and then quickly to fear, as the value of the investments decline. Many people will then start to act defensively and may think about switching out of riskier assets to more defensive shares or other asset classes such as bonds.

Stage 3: Panic, capitulation, despondency

In the third phase of the cycle, the realities of a bear market come to the fore and an investor may become desperate. Many panic and withdraw from the market altogether – afraid of further losses. Those who persevere become despondent and wonder whether the markets are ever going to recover and whether they should be there at all.

Ironically, at these times, an investor will commonly fail to recognize they are actually at the point of maximum financial opportunity.

Stage 4: Skepticism, caution, worry

In the fourth stage of the cycle, investors may experience some skepticism when markets start to rise. They often have a sense of caution or worry, wondering if market growth will last.—and may be reluctant to invest money in the market at a point when prices are still relatively low and opportunities are attractive.

What are the consequences of this emotional roller-coaster?

Emotions turn rational investors into irrational investors. So it is important to remember that markets move and investments will always go in and out of favour.

Developed, diversified long-term financial plans are placed in jeopardy when investors are confronted by extraordinary events because we are guided by our emotions. This is where the role of the financial advisor is of utmost importance – your advisor can help you separate your emotions from reality and endeavour to steer you on the path of rational investing.

You can also help to avoid the emotional roller coaster by being aware of the emotions you are likely to experience. The five most common behavioural pitfalls are:

- Overconfidence – when investors over-rate their ability to select winning shares or investment managers.

- Loss aversion – research1 indicates a loss causes about twice as much pain as a gain causes pleasure. During periods of market volatility investors experience the sense of loss more acutely.

- Chasing past performance – we see this time and time again, but unfortunately, individual investors who abandon a well-diversified portfolio for bonds, or even cash, may be jeopardizing their future financial security.

- Timing the market – It is difficult to correctly predict the market’s movements.

- Failure to rebalance – the risk/return characteristics of an investor’s portfolio should be independent of what’s happening in the market and this means selling high and buying low.*

The temptation to fall into one of these traps can be resisted by developing and committing to a well defined, long-term investment plan. This may be the best way to protect yourself from your emotions.

1Kahneman, D. and Tversky, A. (1979) “Prospect Theory: An Analysis of Decision under Risk”

Diversification does not assure a profit and does not protect against loss in declining markets.

*As with any type of portfolio structuring, attempting to reduce risk and increase return could, at certain times, unintentionally reduce returns. Rebalancing your portfolio may create tax consequences on the taxable portion.

https://russellinvestments.com/ca/insights/the-market-cycle-of-emotions

9.The Hill FDA authorizes new two-minute test for coronavirus

By BY PETER SULLIVAN – 03/31/20 12:41 PM EDT

The Food and Drug Administration issued emergency approval to a two-minute test for coronavirus, its maker, Bodysphere Inc., said Tuesday.

The move could help increase the U.S. testing capability, which has been improving but is still not where it needs to be, according to governors.

“Results are delivered on site in as fast as two minutes,” Bodysphere said in a press release. “This is a game changer as today in the United States, most COVID-19 testing results take between two to seven days.”

The company said it is positioned to “have millions of test kits on the front lines in weeks” and is working with federal agencies to distribute the tests.

The move comes on top of another rapid test, from Abbott Laboratories, that was approved last week and can report results in 5 minutes.

The new test from Bodysphere uses antibodies in the blood to determine current or past infection, the company said.

The Trump administration has taken heavy criticism for the extremely slow initial rollout of testing, and many governors say their states’ testing capacity is still limited.

As the private sector is ramping up its efforts, more tests are becoming available, which will be key.

Experts say much more wide-scale testing is needed to be able to ease up on blunt social distancing measures, because sick people need to be identified so they can be isolated.

10. 6 things your leader wants you to know

Kristen Hadeed

When I think back on the turning points in my company’s history, I find it amazing—and humbling—to think that many of those things did not happen because of me. They happened because someone in my company had the courage to speak up.

I’ll never forget the day a member of my leadership team, Maria, walked into my office and told me she needed to speak to me … alone. She had been working at my company for a couple years by this point, and I could tell by the look on her face that whatever it was that she needed to tell me was big. She closed the door, looked me straight in the eye, and said that she didn’t feel I was holding people to the core values on our wall. Woof. She was right. Shortly after that, I called a company-wide meeting to talk about our values and identify the ways we could better live them both as individuals and as a team.

The time that Tim, a developer in my former software company, called a meeting with me will never escape my mind either. He could see the writing on the wall. Our software startup wasn’t having the kind of success we had predicted it would, and he knew we needed to get out while we could. Not doing so would put us into more debt and would cause more heartache in the end. It’s because of him that we closed the company. I wasn’t brave enough to make the choice on my own.

And I’ll always remember the moment that Amanda, who is now our Chief of Student Maid, told me she felt the policies at Student Maid instilled fear in our students. A team member had told her she was too afraid to call out of work even though she was really sick; she thought if she did, she’d lose her job. It’s because of Amanda and that conversation that we changed our approach to accountability. We looked at each and every policy and made them more human, more compassionate. Student Maid is now known for its family feel and a culture that’s built on psychological safety—but were it not for Amanda’s feedback, we would have never made that transformation.

I will never forget these people and the impact they had on the trajectory of my company. Maria, Tim, and Amanda had the courage to lead me. And I can think of many other people who did the same over the years. Not all were big moments, but I still won’t forget them: The people who were brave enough to tell me they wanted more in their roles. Those who had the courage to give me feedback that hurt at the time but helped me grow and become better at my job.

Too often we forget that our leaders are human beings, and that they need to be led too. The truth is we need to lead each otherThese days, I spend most of my time outside my company helping organizations transform their environments into places where people feel cared for and where they love coming to work. What I notice is a huge disconnect across the board: Those at the “top” of organizations want to empower their people to take real ownership of their roles and recognize the potential they have to make an extraordinary impact in the organization. And those who aren’t at the “top” are waiting to be led. They have ideas. They notice areas that need to be improved. They recognize practices that are hurting the company and the people in it. Yet they’re waiting for permission to do something about it.

If this sounds like you, here’s what your leader wants you to know:

- If you have an idea, present it: It doesn’t matter how long you’ve been here. We want your ideas and we want to see what you see. Sometimes we are so far removed from the day-to-day of the business we can be out of touch with what’s really happening in the organization, so your perspective is incredibly valuable. It doesn’t matter how big or small your idea is, and it doesn’t matter how attainable or unattainable it may seem. The worst we can say is no, but maybe we can find another solution together if that’s the case. Don’t wait for us to ask you to share your ideas with us—you might be waiting a long time because we don’t always think to ask. We’re busy, just like you are. Request a meeting and be persistent until you get one.

- If you want to spark cultural change, spark it: You—more so than us—have a better grasp on the culture and the areas in which we need to improve. From our viewpoint, sometimes all we see are rainbows and butterflies. People aren’t always willing to share how they really feel with us. The best way to transform a culture is from the ground up. If you want to spark change, gather your colleagues together and spark it. Don’t ask for permission—do it, and then tell us about it later.

- If you’re disappointed, say it: We know there’s got to be something we can be doing better (probably many things). We need you to be brave and tell us. Why? Because so few people tell us, and if you feel this way, there’s a big chance many other people do as well. How are we supposed to grow as leaders if no one has the courage to point out where we’re failing? We need feedback too. We need it more than anyone.

- If you need a boundary, set it: We know we push the limit sometimes. We ask you to stay late and come in early. We email you on the weekends. We ask you to take on more work because we trust you and you’re really good at what you do. But that doesn’t always mean you have to say yes. It doesn’t mean you have to answer on a Saturday. Sometimes we are so passionate about our own work that we unintentionally abuse the boundaries of those we work with. The bottom line is we don’t want you to burn out. We want you to be able to do what you need to do outside work so that when you come back, you can be at your best. We won’t get our feelings hurt if you have to tell us no. In fact, sometimes we need you to remind us that we need breaks too.

- If you want something, ask for it: We aren’t mind-readers. If you want a raise, tell us. If you feel you’ve outgrown your role, speak up. If you want to work remotely, say it. It doesn’t mean the answer will be yes, but the conversation isn’t likely to happen if you don’t initiate it. We want you to be happy, so if there’s something you need in order to be more fulfilled, we absolutely want to know. But you have to take ownership of your happiness. Putting the ownership in our hands is a recipe for disaster.

- If you’re waiting on something, demand it: We know we over-promise and under-deliver sometimes. We know we tell you we are going to have you what you need by Wednesday, and now it’s Friday and you still don’t have it. Yes, we’re busy, but it’s no excuse. If you need something from us and we are holding you up because you don’t yet have it, remind us. We may have forgotten. We may have not realized it was a priority. We may not recognize we are preventing you from taking the next steps. Or, we might be completely overwhelmed and need you to help us get it done. Either way, hold us to our promises.

And most of all, remember that we’re human. We aren’t perfect and we do make mistakes. All the time. Please don’t put us on a pedestal. We need you to help us. We need you to be honest with us. We need you to lead us. It’s the only way we can build something great together.

(PS: I know not all leaders think this way. Maybe you’ve tried all of the things above and you’ve been met with nothing but resistance. If you’ve done all you can and your leader isn’t doing their part, you have every right to leave. And you should. You deserve better.)