1.Muni’s Have Record 4 Months of Inflows.

Boom, Another Billion’: Muni Funds Land a Year’s Worth of Cash in Four Months

Funds have already seen $30 billion inflow, analyst says

Bid to drive down tax bills pushes munis to pricey levels

It’s only four months into 2019, and already mutual funds that invest in state and local-government debt have raked in more cash than they usually do in a year.

Investors added $1.1 billion to such funds in the week ended April 17, the fifteenth straight weekly influx, the Investment Company Institute reported Wednesday. That bumped the total to about $30 billion since January, more than they’ve drawn during any full year since 2012, according to an analysis of the data by CreditSights.

2.Euro Breaks to New Lows as Dollar Rises.

EURO Index breaking to new lows

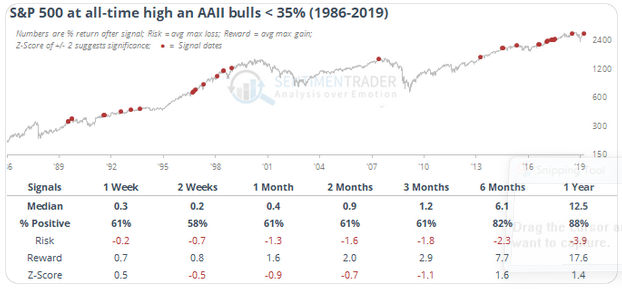

3.Retail Investors Still Cautious on Market…Sentiment Trader Stats.

SentimentTrader analyzing performance in the AAII Retail Survey – Retail still too cautious on the market, has a great track record of further Spoo returns

From Dave Lutz at Jones Trading.

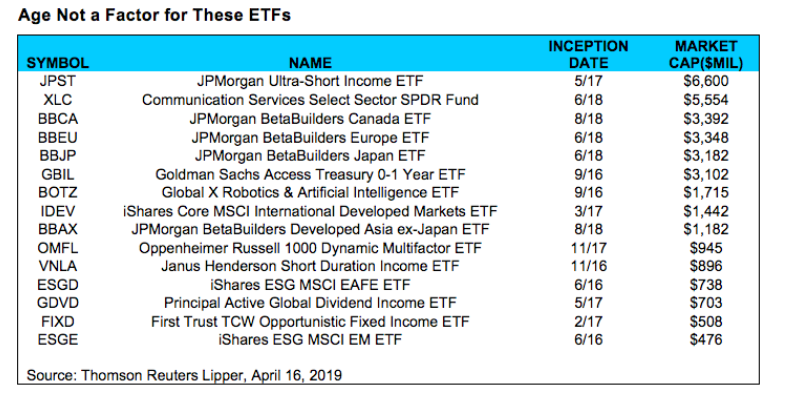

4.ETFs Less than 3 Years Old with Over $1B AUM

https://www.wealthmanagement.com/

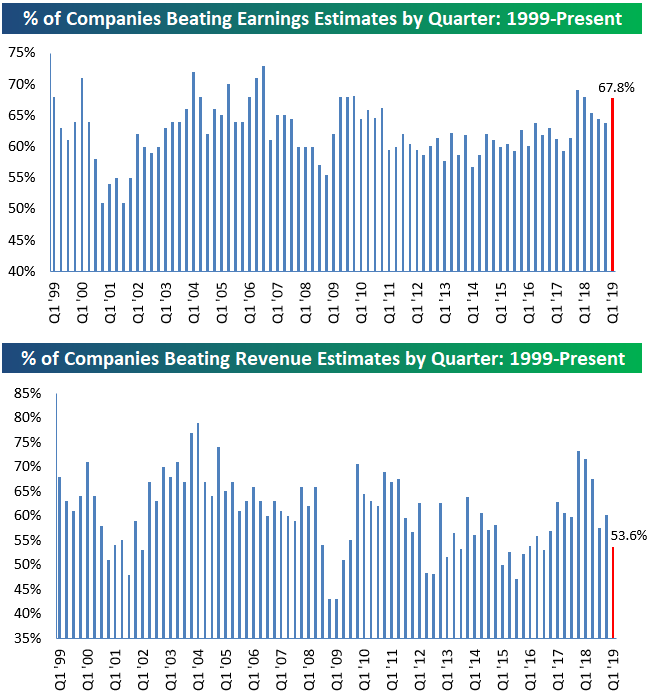

5.B.I.G. Tips – Early Earnings Season Analysis

Fri, Apr 26, 2019Log-in here if you’re a member with access to our B.I.G. Tips reports.

More than 500 stocks have reported their first quarter numbers so far this earnings season, which gives us a pretty large sample size to start analyzing overall trends. Through today, 67% of stocks that have reported this season have beaten bottom-line consensus EPS estimates. That’s a strong reading relative to the historical average of roughly 60% going back to 1999 (first chart below).

While the bottom line beat rate is strong, the top line has so far been lacking. As shown in the second chart below, only 53.6% of companies have managed to report stronger than expected revenues this season. This is definitely a concern now that we’re already about a quarter of the way through the reporting period. We would note, though, that last season we saw a similar trend as the top-line beat rate started very low before rebounding by the end of the reporting period and actually showing a sequential increase.

On another note, we’ve seen an interesting shift in guidance compared to the last two quarters. We’re also seeing some negative signs when it comes to how stock prices are reacting to earnings reports. To read our full earnings analysis, become a Bespoke Premium or Bespoke Institutional member and access the rest of this report. You can start a free two-week trial at THIS PAGE.

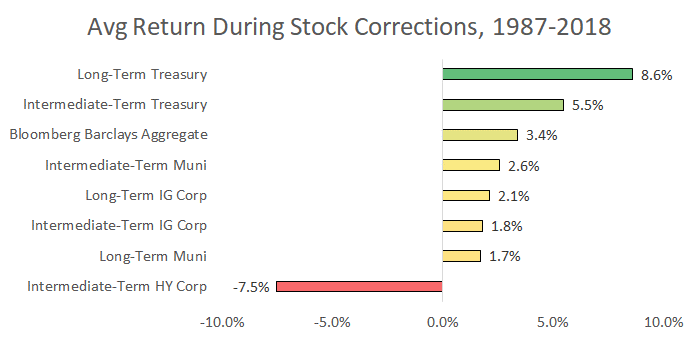

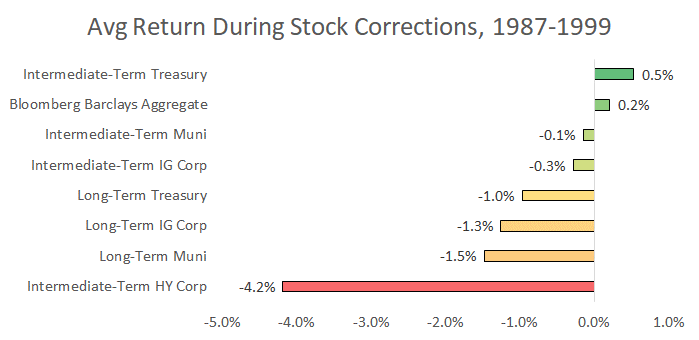

6. ANALYZING BOND PERFORMANCE IN STOCK CORRECTIONS

The charts below show the average performance figures. Since 1987, long-term U.S. government bonds have been the best performing category. But as the original table showed, yields cratered during most stock corrections over the past two decades.

The averages from 1987 to 1999 paint a different picture. Long-term bonds performed much worse. In fact, no bond category provided a meaningful portfolio offset against falling stocks.

ANALYZING BOND PERFORMANCE IN STOCK CORRECTIONS

https://movement.capital/analyzing-bond-performance-in-stock-corrections/

From Abnormal Returns Blog www.abnormalreturns.com

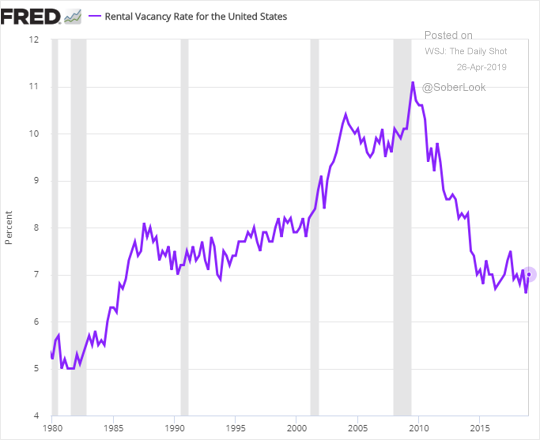

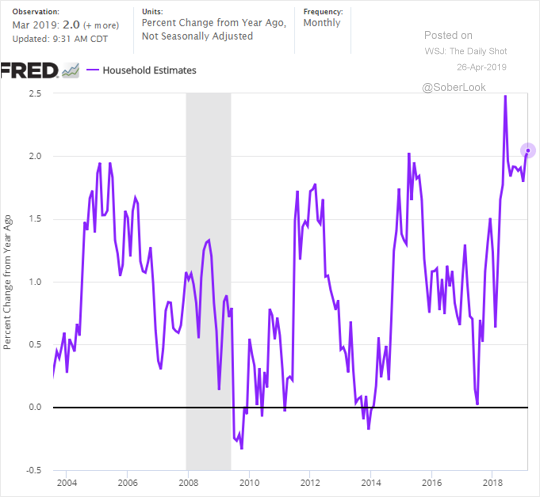

7.2 Important Housing Charts

Rental Vacancies Still Near Cycle Lows.

Household formation remains near multi-year highs, which is a tailwind for the housing market

The Daily Shot

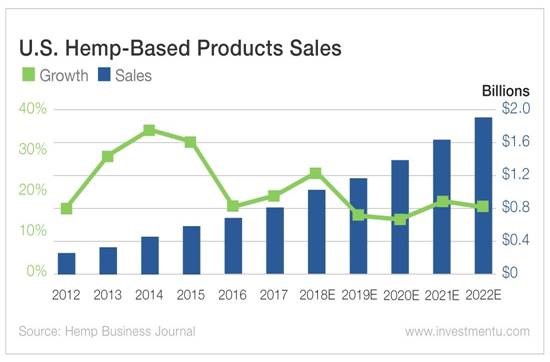

8.Hemp Based Product Sales.

It’s Actually Pretty Easy Being Green

by James HiresSaturday, March 16, 2019

Our modern world is built on plastic. Plastics have made our lives healthier, more comfortable and more convenient. Unfortunately, they’ve also damaged the planet horribly.

Right now there’s a patch of plastic waste the size of Texas floating in the Pacific Ocean. Oil-based plastics can take decades to break down, centuries even. Some may never fully disintegrate.

We can recycle plastic, true. But most of it ends up in landfills or the ocean, poisoning our land and water with harmful chemicals. But there is a solution. And believe it or not, we’ve known about it for centuries…

Hemp.

This wonder crop has dozens of uses ranging from biofuel to packaging. It can also be turned into a biodegradable plastic. Even better, hemp plastic can be as strong as steel and a fraction of the weight.

The massive failure known as the war on drugs outlawed hemp. It kept the crop suppressed simply because it’s a cousin to the psychoactive marijuana plant.

But just like its psychoactive relative, hemp is well on its way to legalization. As of December 2018, it’s legal for cultivation. It’s still heavily restricted, but for first time since the 1940s, hemp can be grown legally in the United States.

Hemp also grows rapidly. It takes only four months to go from seed to harvest. It’s renewable, unlike petroleum. And it doesn’t contain the harmful chemicals that oil does, which can cause cancer and disrupt the body’s hormone production.

Hemp plastics can replace their oil-based counterparts in automobiles, food packaging and construction materials.

Companies like Daimler AG (OTC: DDAIF) and Volkswagen (OTC: VLKAY) have begun using hemp plastics in their cars. Lotus built a concept called the Eco Elise that uses all hemp body panels. The interior, from the seats to the dashboard, was also made from hemp.

Sound far-fetched? It isn’t. Henry Ford experimented with a car that used soybean-based bioplastics in the 1940s.

Hemp-based plastics are dent-resistant, more flexible than carbon fiber and biodegradable. They’re rust-proof and safer in car accidents. And they don’t shatter and make shrapnel like modern car plastics.

Researchers in Australia and England experimented by replacing metal and plastic car parts with a hemp substitute. Doing this reduced the car’s weight by 30% at no cost to structural integrity! And that’s just one use of this miracle plant.

CBD oil and the medicinal uses of cannabis are big right now. But the former could just be a fad. Industrial hemp, like what Hemp Inc. (OTC: HEMP) produces, offers a viable alternative to petroleum-based plastics.

Hemp lets us keep the convenience of our plastic world without the drawbacks. That could be very good for your portfolio if you buy in now while most of these companies are trading for just a couple of dollars or even pennies.

Good investing,

James

https://www.investmentu.com/article/detail/59953/its-actually-pretty-easy-being-green#.XMY9mTBKjIU

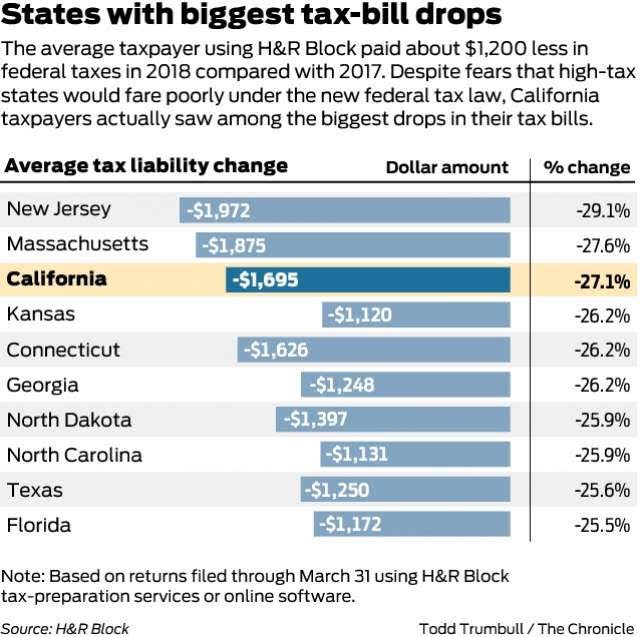

9.States with Biggest Tax-Bill Drops.

Source: San Francisco Chronicle

From Barry Ritholtz Blog

https://ritholtz.com/2019/04/weekend-reads-366/

10.The 4 Universal Laws of Wealth Creation (Follow These or Stay Broke)

by Craig Ballantyne | Apr 22, 2019 | Wealth

Early to Rise

Like most pragmatic entrepreneurs, I have a “bone to pick” with the movie, The Secret.

It’s all very hokie, over simplistic and missing a major component required to get you to the next level of financial freedom (I’ll tell you what it is in just a minute).

However, despite my general disdain for the film, there was one scene that stuck with me for a positive reason.

In the movie, the filmmakers follow John Assaraf into his office where he pulls out an old picture and shares the power of having a vision board.

To paraphrase, John said, “One day when I was looking through my old boxes after moving into my new home.”

“I found my old vision board…and it was a picture of a beautiful mansion. Suddenly I realized it was the house I was now living in.”

Now I’m a huge believer in the power of creating a vivid vision for both your personal and professional life and I’ve found (after two decades of experience), the more specific you are in the articulation of your vision, the greater the chance you have of achieving it.

BUT…

This is not due to the Law of Attraction. It’s due to the law of ACTION Attraction (the first law of wealth I will explain below).

After building five 7-figure businesses in five different industries (and coaching countless 6, 7, and 8-figure entrepreneurs), I’ve realized that wealth creation is not something that occurs by chance.

It’s a science, and a more or less exact one.

And like any other field of science, there are certain immutable and unbreakable laws you must follow to create wealth.

If you follow them, you will get rich. Period.

If you don’t, you will struggle for decades no matter how hard you work or how much money you make (because there is a difference between making money and creating lasting wealth).

And in today’s essay, I’ve assembled the four most important laws you must uphold to earn, keep, and grow your money so you can create real wealth and financial freedom.

While these might not make for a “make believe movie” script (because they require hard work…something the average person will avoid at all costs)…

…If followed, they will allow you to achieve your goals and earn the money you desire faster than you ever thought possible.

- The Law of Implementation

The fact that you’re reading this article right now puts you in the top 5% of the world.

Very few people are willing to dedicate time to their education and personal growth.

And the fact that you’re here, learning about wealth creation–instead of scrolling through Instagram, watching ‘epic fail’ compilations on YouTube, or sneaking another episode the latest Netflix original–shows me that you are not part of the 95% of our population content with mediocrity.

Which is great…But it’s not enough.

To create real wealth, education is only the first step. Without implementation education becomes a perverse form of procrastination that will turn you into an “underachieving high-achiever”…someone who ‘knows’ how to get to the next level, but simply can’t seem to do it.

So, if you want to build and empire and have access to “Legacy Wealth” that will ensure your children, grandchildren, and great grandchildren are taken care of long after you’re gone, you must join the 1%.

The 1% who don’t just consume more content, more articles, more podcasts, and more courses. But who actually go out in the real world and create value by implementing what they’ve learned.

And that is the first universal law of wealth creation.

Universal Law of Wealth Creation #1: You must implement the information in your head and take massive action to achieve the results you desire.

Because education without implementation is futile.

You don’t get paid for what you know. You’re only paid for what gets done.

So if you want to make your first million and build an unshakable financial infrastructure…Educate yourself. Then IMMEDIATELY take action to implement what you’ve learned.

Learn, implement, fail, implement again, succeed, repeat.

If you will follow this formula over a long enough timeline and bounce from failure to failure with no loss of enthusiasm…You will build the wealth you desire and live the life of your dreams.

- The Law of Problem Solving

I see so many entrepreneurs out there who are struggling to make money.

It’s not that they’re lazy or bad people. It’s that their business is fundamentally flawed because they don’t understand the second law of creating wealth.

Universal Law of Wealth #2: You are paid in direct proportion to the size of the size, frequency, and quantity of problems you can solve.

Listen. I’m glad that you’re passionate about your new ‘confidence coaching’ program, and I’m sure your new course to help people find their purpose is the greatest thing since A New Earth.

But your passion isn’t going to pay the bills because your solutions aren’t solving people’s biggest problems.

If you want to make real wealth and create systems and businesses that generate consistent and predictable cash on command, you need to help people solve real problems.

Specifically, you must help them:

- Change their body (lose fat, gain muscle, or have more energy)

- Make more money

- Have more sex

- Spend more time doing things they enjoy

People are struggling with real pain each and everyday. They have mortgages they’re behind on, relationships that are filled with conflict, bodies that aren’t working, and lives that feel out of control.

Unless you can find a way to either directly or indirectly solve these problems and make their life feel like it’s ‘working’ better…They’re not going to give you money.

This doesn’t necessarily mean that the offer you have today can’t make money, it might mean you simply need to pivot its positioning to speak directly to one of these three problems.

“Get more confidence” becomes, “Develop the confidence you need to overcome your social anxiety and fearlessly date the man/woman of your dreams.” (problem solved: have more sex/improve relationships)

“Find your passion” becomes, “Discover your highest calling so you can create a business doing what you love and profit from your passions.” (problem solved: make more money, spend time doing things you love).

“Fix your mindset” becomes, “Discover the subconscious ‘blocks’ that are stopping you from achieving the health, wealth, and relationships you desire.” (problems solved, make more money, have more sex, change your body, and have time for the things you love).

When you can develop effective solutions to help people solve their biggest problems and clearly market that solution with simple and easy-to-understand language…your business will change forever.

There’s no shortage of problems that people need solved.

Make sure that you’re solving the right problems and solving them quickly, consistently, and frequently enough and you’ll be well on your path to lasting wealth and abundance.

- The Law of Relationship

Let me tell you a little story about my friend James.

Now James grew up in a family where money was always scarce. His family wasn’t poor, but they lived paycheck to paycheck and never had enough left over at the end of the month for new clothes or vacations.

Growing up, whenever his parents talked about money they would always say things like:

- There’s never enough to go around.

- No matter how much you make, something always comes up

- Look at that [house, car, clothing brand], I’m glad we’re not that superficial.

- Money is the root of all evil.

- The more you make, the more they take.

When James grew up and left home, he decided that, despite his upbringing…he wanted to become rich. At least, he thought he wanted to become rich.

But it seemed like, no matter how hard he tried, there was never enough to go around. He started earning 6-figures but then, somehow, he finished the month with nothing left and ‘something always came up’. And when he got his first tax bill after making ‘real’ money? He almost had a heart attack.

He’d adopted a broken relationship with money from his parents and, even though he consciously wanted to become rich, his subconscious beliefs and attitudes towards money were sabotaging his efforts and stopping him from achieving the financial success he desired.

Which brings us to the third law of wealth;

Universal Law of Creating Wealth #3: To create real wealth you must develop a healthy relationship with money.

Listen, if you believe (even on a subconscious level) that money is the root of all evil or that rich people are bad, you will never make the money you want.

How could you?

If money is the root of all evil, why would you want more of it?

If you believe rich people are ‘bad’ and see yourself as a good person, you can’t become rich!

Luckily, all of your negative money mindsets can be eradicated by accepting one simple truth:

Money is nothing more than a tool.

It’s not ‘good’. It’s not ‘bad’. It’s not the root of all evil or the cause of all your misery.

It is nothing more than a medium of exchange between two parties. It’s a tool the same way a shovel, or a hammer, or an axe are tools.

And when you reframe your relationship with money and realize the fault lies with the person wielding the tool (ie, you), not the tool itself, everything will change.

You’ll no longer think, “There’s never enough money to go around.” Instead you’ll say, “Wow! I don’t have the money I want, I must not be providing enough value or managing my assets well enough to deserve the wealth I desire.”

It is from this place and this place only that your path to wealth creation can begin.

By developing a positive relationship with money, you’ll see it for what it really is and begin to understand the true root causes of your financial distress.

And when you accept that money is vehicle for freedom, impact, and the lifestyle you deserve…you won’t feel an ounce of guilt for your desire to become very, very, very rich.

- The Law of Generosity

A young friend recently told me a story about a strikingly odd ‘coincidence’ that happened when he was 18.

At the time he was making about $500 a month online and had recently dropped out of college with his sights set on an 11 month backpacking trip through Latin America. Between taxes, his flights, travel insurance, and all the other expenses that go into a year long trip, he came to the end of the last week before his trip and realized something…

He had only enough money left over to either 1) Make his usual quarterly donation to Pencils of Promise or 2) Buy a new pair of hiking shoes for the trip.

Now, he genuinely needed the hiking shoes for the trip–trekking the Inca Trail in a pair of beat up Converse didn’t seem like the best idea–but he knew that there were other people out there who needed the money more.

Trusting that something would work out, he submitted his donation and, with less than $40 in his bank account, went to a local outdoors store in a futile hunt for a pair of boots that fit his budget.

And when he did, something weird happened.

He found the exact pair of shoes he was going to buy in his exact size…for $27.

Someone else had purchased them at Christmas, realized they didn’t fit and returned them…forcing the store to slash the price by more than 80%.

Now, I won’t go as far to say that the “universe” conspired together to get my friend his hiking boots…But I will say that the world works in very odd ways.

And every rich person I know (at least the ethical ones) will share similar stories about how they managed to get the money they needed to start their business, save a product, or launch a new campaign by first giving more to others (Tony Robbins has a similar story of giving his last $17 to a young boy and then receiving a check in the mail the following day for more than $1,300 from an old loan).

Which brings us to the final universal law of wealth creation.

Universal Law #4: The more you give, the more you get.

Listen. The fact that you have a device on which you can read this article shows me that you’re blessed. You have food on the table and more money than a huge portion of the world.

And it is your duty and obligation to give back.

To shift the focus from “me” to “we.” To remove scarcity and fear from your mind and replace it with gratitude and abundance.

I’m not suggesting that you go out and give away so much you don’t have enough left over to buy shoes for your children. But I am saying that, no matter how big or small, you must find a way to start giving back.

No matter where you are right now, someone else has it worse and you can afford to donate 5-15% of your take home income to charities, causes, and individuals you believe in.

I don’t know why it happens, but I can promise you that, if you will do this consistently with appreciation instead of expectation, money will start to come into your life in ways you cannot expect.

Conclusion: Get It While The Getting is Good

We live in an era of unprecedented opportunity.

Human beings have never had access to the resources and information we have today and it has never been easier to create the wealth and impact you desire.

But here’s the thing…

No one knows how long this “Golden Era” will last.

Markets, societies, and countries all rise and fall. And right now, in 2019 and beyond, is your opportunity to take advantage of the good times to protect yourself when things get hard.

The getting is good now. So take action and go get it.

Create the wealth you desire today and capitalize on the abundance of opportunities in front of you.

If 20-something dropouts can create billion dollar companies from their laptops, you can create the income and freedom you desire.

So long as you’re willing to take action.

Get it while the getting is good my friends…Because the getting has never been better.

#

Whether you join the 5 a.m. club or not, THIS is the millionaire-vetted Morning Routine that will help you earn more, work less, and live your perfect life TODAY!

Sign up now to get our FREE Morning Routine guide—the #1 way to increase productivity, energy, and focus for profitable days. Used by thousands of fitness, business, and finance industry leaders to leapfrog the competition while making time for the people who really matter. Learn more here.

https://www.earlytorise.com/4-universal-laws-of-wealth-creation/