1.S&P Hits New All-Time Highs.

Stocks Are Hitting New Highs Because Earnings Have Been a Pleasant Surprise

Talk of an earnings recession is so last-week. With numbers in for just over 20% of S&P 500 members, the latest growth prediction stands at negative 3.3%. That’s as good as a gain, and it pushed market indexes to new highs on Tuesday.

Two things we knew going into reporting season were that the earnings growth consensus stood at negative 4.3%, and that companies would surely surprise to the upside. They almost always do. The only question was whether it would be a big surprise or a small one.

It’s a big one so far. According to FactSet, earnings have come in 6.3% ahead of expectations. The five-year average is 4.8%. At this rate, better-than-expected results might be enough to pull earnings just above break even versus a year ago, averting an earnings recession.

https://www.barrons.com/articles/stock-market-new-highs-earnings-51556051344?mod=hp_LEAD_1

2.U.S. Forward P/E 10% Premium to its Long-Term Average.

The “calm premium”

Written by

Russ Koesterich, CFAPortfolio Manager for BlackRock’s Global Allocation Team

The recent U.S. equity rally has coincided with a drop in volatility. But can that continue? Russ discusses.

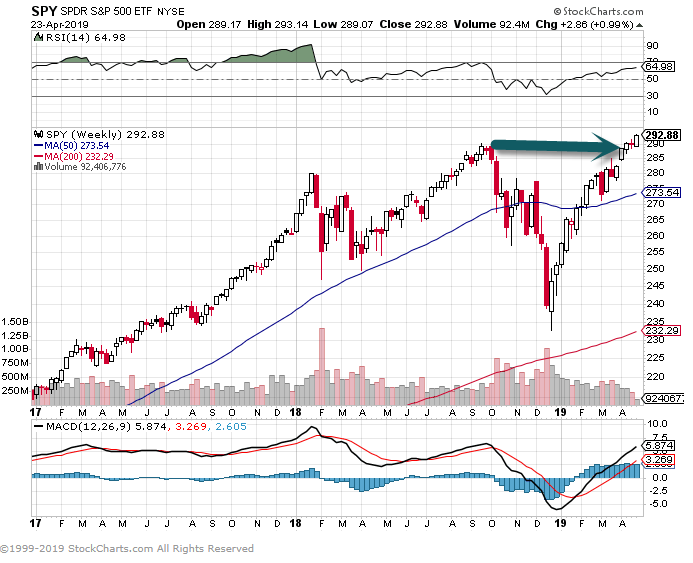

While the equity rally seems to have at least temporarily stalled, stocks remain near three-month highs. The rebound in equity prices has been driven by a sharp and relentless bout of multiple expansion. In other words, investors are willing to pay more for each dollar of earnings. In the 45 days between the market’s low on Christmas Eve and March 1st, the S&P 500’s price-to-earnings ratio (P/E) expanded by just under 20%.

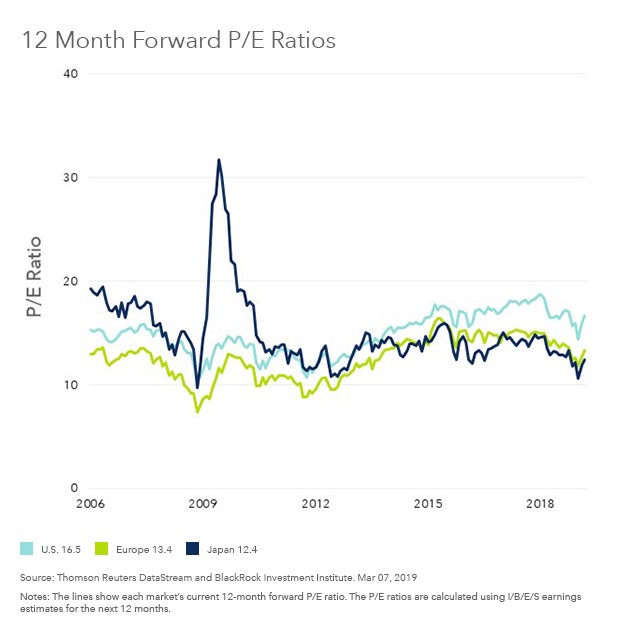

As a result, U.S. equities are once again trading at a premium to their history and virtually every other equity market. At over 18 times trailing earnings, the market is trading at a 4% premium to its post-crisis average, a 10% premium to its long-term average and a 25% premium to the rest of the world (see Chart). In an environment in which earnings growth is likely to slow, valuations will determine whether stocks can hold or even add to their already prodigious gains.

https://www.blackrockblog.com/2019/03/13/the-calm-stock-premium/

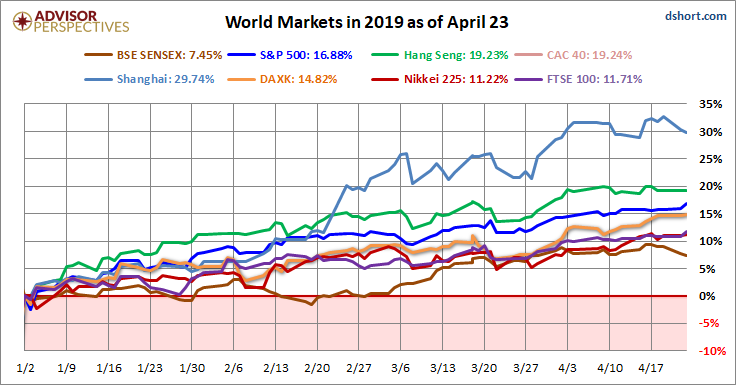

3.World Markets Update

by Jill Mislinski, 4/23/19

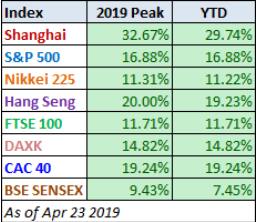

All eight indexes on our world watch list posted gains through April 23, 2019. The top performer is the Shanghai SSE with a 29.74% gain and in second is our own S&P 500 with a gain of 16.88%. In third is Tokyo’s Nikkei 225 with a gain of 11.22%. Coming in last is India’s BSE SENSEX with a gain of 7.45%.

Here are all eight world indexes in 2019 and the associated table sorted by YTD.

https://www.advisorperspectives.com/dshort

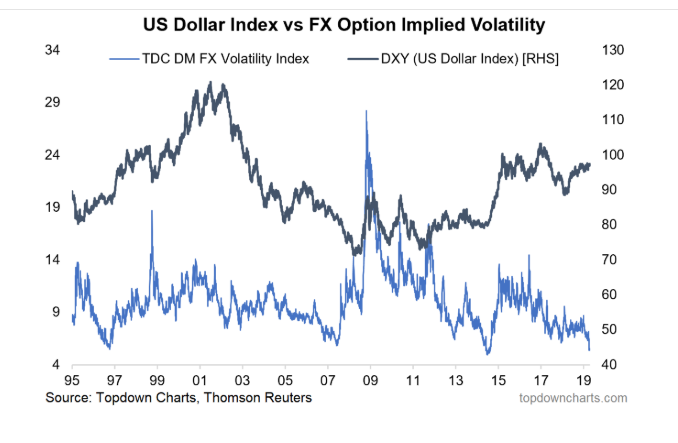

4.U.S. Dollar Volatility Hits Lows…

US Dollar Volatility: Something interesting is going on with the US dollar right now… or perhaps it would be more accurate to say nothing interesting is going on with the US dollar! …and that’s what makes it interesting.

US dollar volatility has crunched down to a record low, and more importantly, the US dollar index (and many exchange rates) is trading a very tight range. Forgive the cliché but this looks like the “calm before the storm”. We’ve seen this type of pattern prior to some major moves in global FX markets before, and it begs the question: why would it be any different this time? (source)

https://www.linkedin.com/pulse/top-5-charts-week-callum-thomas-6526296753308819457/

5.Stock-Market Margin Debt, after Plunging in Q4, Has Not Bounced Back Despite S&P 500 Historic Surge

by Wolf Richter • Apr 23, 2019 • 15 Comments • Email to a friend

There are many forms of stock market leverage, but “margin debt” – the amount individuals and institutions borrow from their brokers against their portfolios – is the only form that is actually reported on a monthly basis.

Other forms of stock market leverage include “securities-based loans” (SBL) that brokers extend to their clients (some brokers report the balances in their annual reports but they don’t have to), loans at the institutional level such as with hedge funds, loans by companies to their executives to buy the company’s shares, etc. So overall stock market leverage is far larger than margin debt, but no one really knows how large.

But reported margin debt gives us a feel for which direction overall stock-market leverage is going. The chart below shows just how steep the year-over-year plunges have been, the steepest since the Financial Crisis:

Stock market leverage is an accelerator when stocks go up as investors borrow money to buy stocks. And it’s an accelerator on the way down when margin calls and the fear of margin calls turn investors into forced or motivated sellers.

Despite the wind-down of margin debt in Q4, stock market leverage remains high – at about the same level as on the way up in March 2017. And for now, even as the S&P 500 is closing in on its September 2018 high, investors – perhaps still leery – have not jumped with both feet back into leveraging up their stock portfolios to the max.

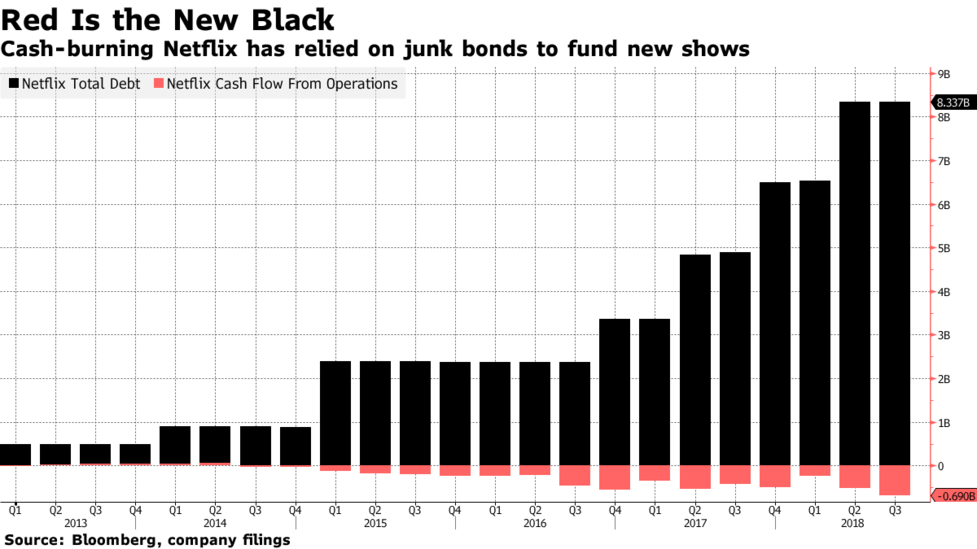

6.Netflix Burning Thru Cash and Issuing Junk Bonds to Fund New Shows.

Will Netflix Junk Bonds Wilt Amid the Content Wars?

The company has borrowed easily before, but heightened competition looms this time around.

By

Brian Chappatta

Photographer: Lionel Bonaventure/AFP/Getty Images

By now, tapping the debt markets is nothing new for Netflix Inc. Just as it did in October, the streaming giant plans to issue $2 billion of junk-rated bonds denominated in dollars and euros. It has borrowed at least once a year since 2013 in an effort to build up a huge library of shows that gives subscribers a reason to renew month after month.

What is new, though, is the level of competition bearing down on Netflix from behemoths like Apple Inc., AT&T Inc. and Walt Disney Co. Bond investors ought to take the escalating content war seriously when placing orders for this new deal. After all, it could throw a wrench into the company’s timeline for turning cash-flow positive.

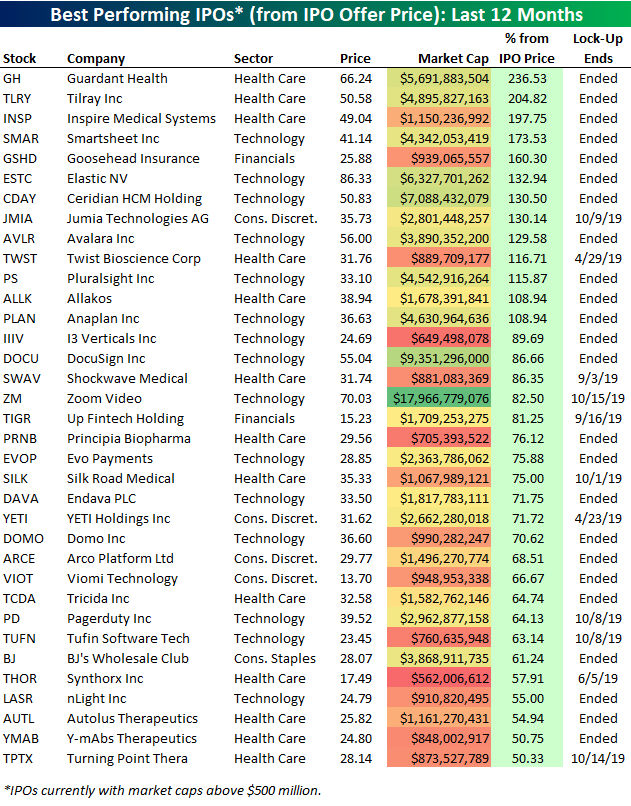

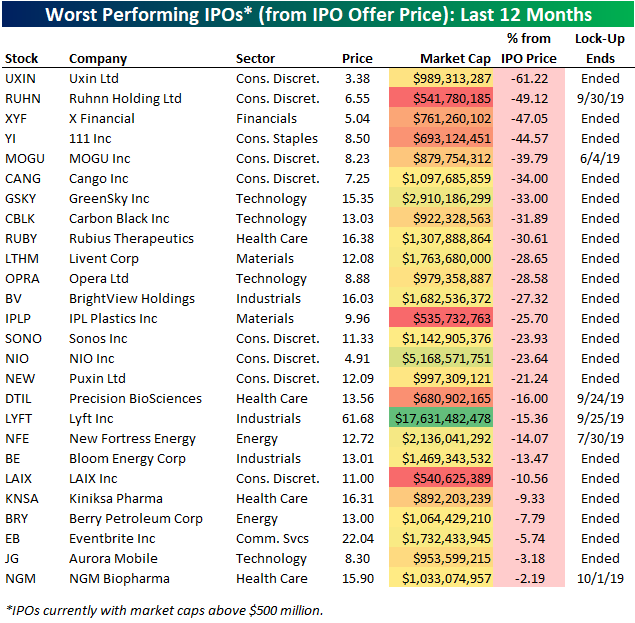

7. Best and Worst Performing IPOs

Bespoke Investment Group

We ran a screen of companies that went public within the last 12 months to find the ones that are up the most from their IPO price. Below is a list of the 35 best performers.

Two recent Health Care IPOs are up more than 200% from their IPO price — Guardant Health (GH) and Tilray (TLRY). Inspire Medical (INSP) — another Health Care stock — ranks 3rd best with a gain of 197.75%. Zoom Video (ZM) is the largest stock on the list with a market cap of $17.97 billion. ZM just went public last Thursday and is already up 82.5% from its IPO price! Note that Zoom’s lock-up expiry (the date that shareholders within the company can sell shares) isn’t until October 15th.

Other notables on the list of biggest IPO winners include digital signature company DocuSign (DOCU), sales tax software company Avalara (AVLR), and the popular cooler and mug company Yeti Holdings (YETI). Yeti’s lock-up actually ends today, so it will be interesting to see how the stock trades near term.

Below are companies that went public within the last 12 months that are down from their IPO price. (Note that only companies with market caps above $500 million are included on this list and the one above.)

Ride-sharing app Lyft Inc. (LYFT) is by far the biggest standout on the list of IPO losers. Since the company went public at the end of March, its shares are down 15.36%. With a lock-up date of September 25th, corporate insiders have a long time to watch these shares rise and fall without being able to exit.

Start a two-week free trial to Bespoke Premium to unlock all that Bespoke’s research has to offer!

©2019 Bespoke Investment Group

Terms & Privacy · Follow us on Twitter · Read our B

https://www.bespokepremium.com/interactive/posts/think-big-blog/best-and-worst-performing-ipos

8.

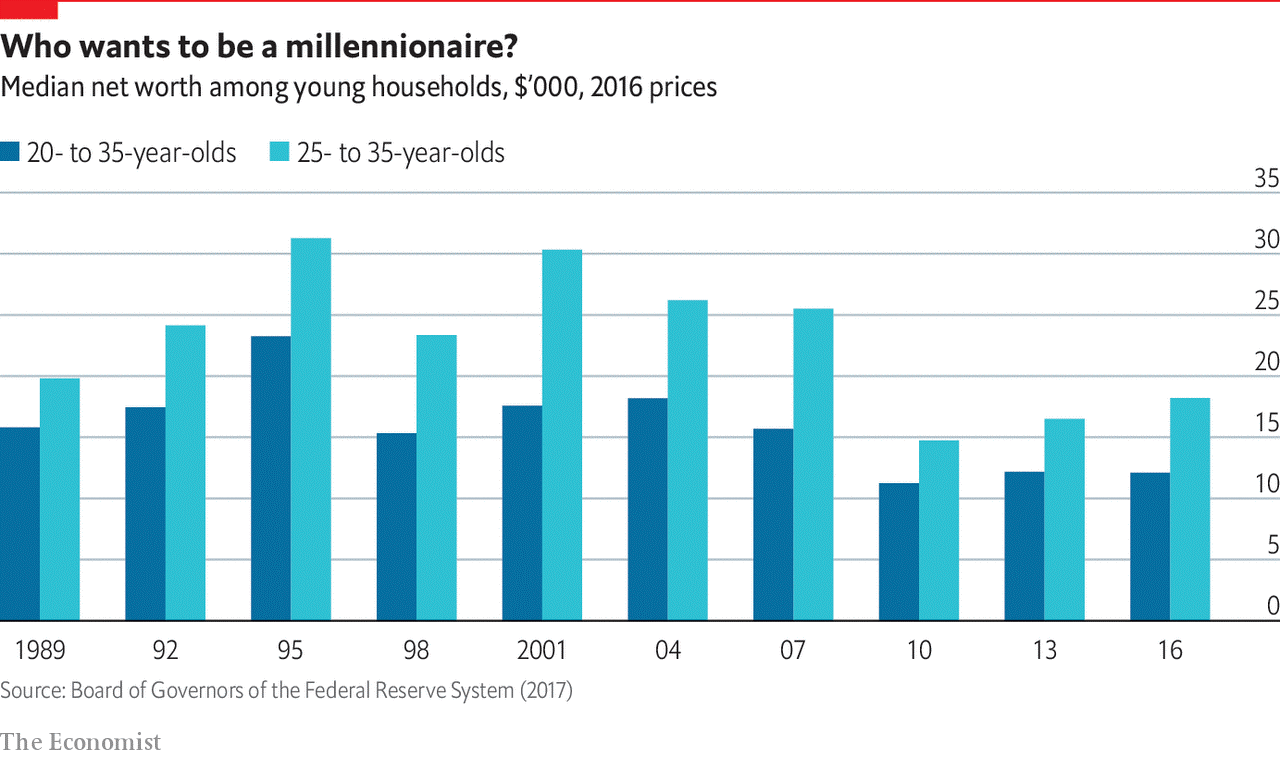

9.American millennials think they will be rich

The data suggest they probably won’t be

Apr 22nd 2019

MORE THAN half of American millennials, the generation of people born b etween 1981 and 1996, believe that they will one day be millionaires; one in five think they will get there by the age of 40. These are the findings from a survey conducted in 2018 by TD Ameritrade, a financial-services company.

etween 1981 and 1996, believe that they will one day be millionaires; one in five think they will get there by the age of 40. These are the findings from a survey conducted in 2018 by TD Ameritrade, a financial-services company.

But a working paper by the Brookings Institution, a think-tank, offers a sobering antidote to this youthful optimism. It finds that millennials are less wealthy than people of a similar age were in any year from 1989 to 2007. The economic crisis of 2008-09 hit millennials particularly hard. Median household wealth in 2016 for 20- to 35-year-olds was about 25% lower than it was for the similar-aged cohort in 2007.

https://www.economist.com/graphic-detail/2019/04/22/american-millennials-think-they-will-be-rich

10.Doug McMillon has been the CEO of Walmart for 5 years. Here are 5 lessons he’s learned in that time.

Walmart CEO Doug McMillon poses for a selfie with an employee. Walmart

- WalmartCEO Doug McMillon has held the top spot at the world’s largest retailer for five years.

- In the company’s annual letter to shareholders for 2019, McMillon shared some of the lessons he has learned in that time.

- The lessons relate to leadership, risk, and employees.

- Visit Business Insider’s homepage for more stories.

Doug McMillon has now been CEO at Walmart for five years.

In the company’s annual letter to shareholders for 2019, McMillon shared some of the lessons he has learned in that time.

- The first lesson relates to leadership and realizing that you can’t “lead from behind.” “As a leader during transformation, you have to be out in front — show that you want to learn, be curious, introduce new ideas, ask questions,” McMillon writes.

- The next relates to risk — something Walmart has had to embrace to keep up in a rapidly changing retail environment. “There is no growth without change, and there is no meaningful change without risk,” McMillon writes. “So, get comfortable with an intelligent level of risk.”

- He also writes about being forward-thinking and avoiding only making decisions in the moment. “We’re playing the long game. Our priority is to position our company for long-term success,” McMillon writes. “History has shown us that companies that focused too much on the short term were doomed to fail.”

- He also shouts out Walmart’s employees, whom the company calls associates, as becoming more comfortable with Walmart’s now-speedy pace of change and even leading the charge in some cases. “People will surprise you. Several times a week, I see or hear about something creative our associates have done,” McMillon writes. “It’s inspiring to see their ingenuity and pace.We’ve always said that our people make the difference. We’re certainly seeing that today.”

- The final lesson he shared was related to trust. “As we strive to make our company better, we will also look for ways to build trust by communicating the good work our people are doing and its impact,” McMillon writes. “Included is the work we are doing to strengthen our culture of integrity and improve our compliance talent, processes and systems.”

Read more: Walmart CEO Doug McMillon just released his annual letter to shareholders — read it here