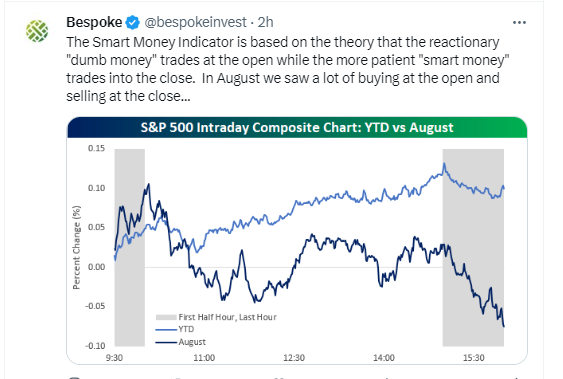

1. August Saw A Lot of Selling at the Close of Market Day

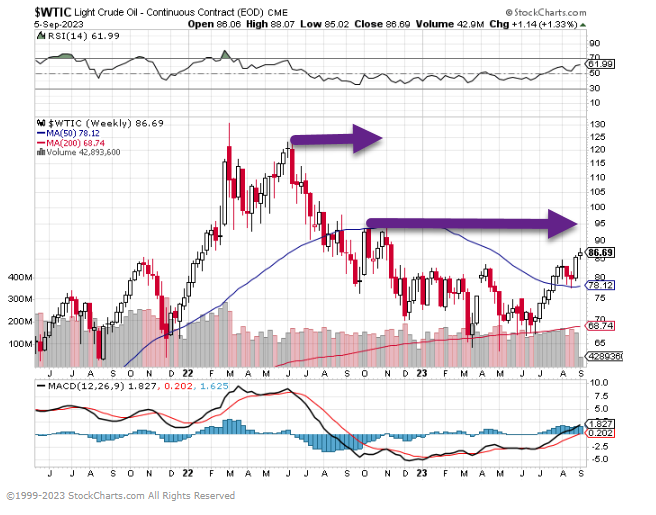

2. Crude Oil Rally Still Well Below 2022 Highs

Light Crude Oil Chart Held 200 Week Moving Average…Coming up on next resistance level

3. Energy Prices Up and Airlines Down

JETS corrects back to Spring levels with rise in crude oil

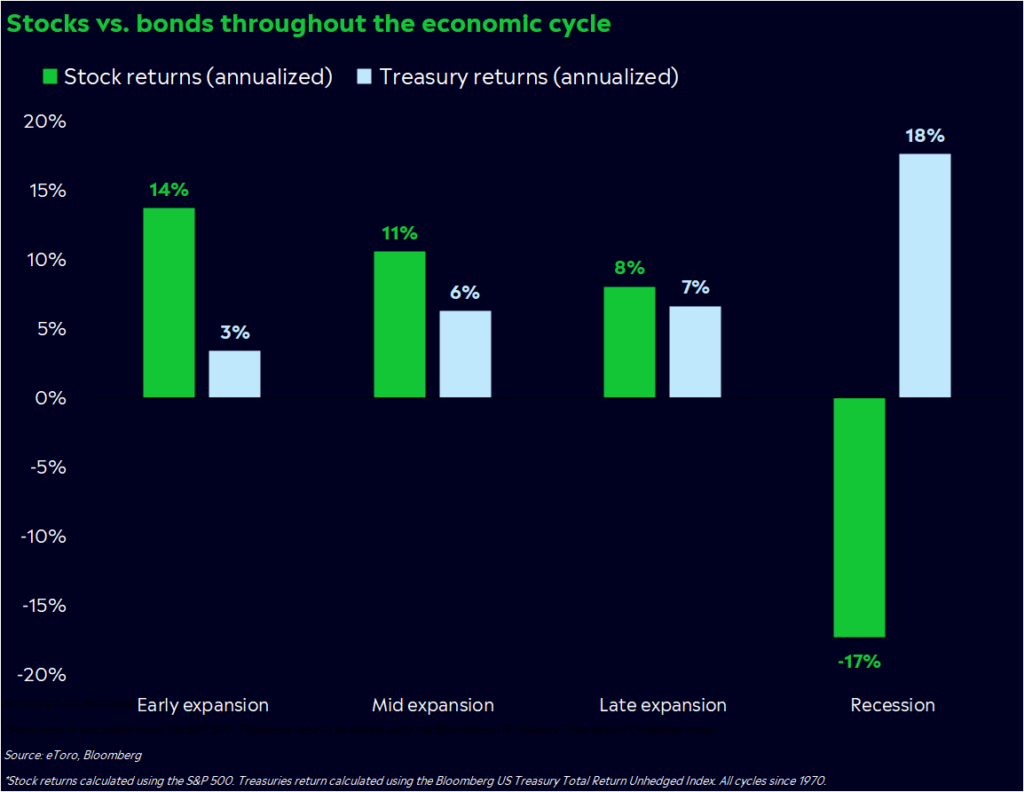

4. Recessions and Bonds….Long-Bond Lost Decade

@Callum_Thomas Recession Realities: But one thing I have to keep coming back to is the tyranny of the stats — historically treasuries put in their best performance, and stock-beating performance during recessions. I would note, you don’t need a recession for bonds to do ok, but you do need a recession for bonds to do spectacular (hence why bonds are often referred to as diversifying assets… at least outside of inflationary shocks!).

Source: @callieabost

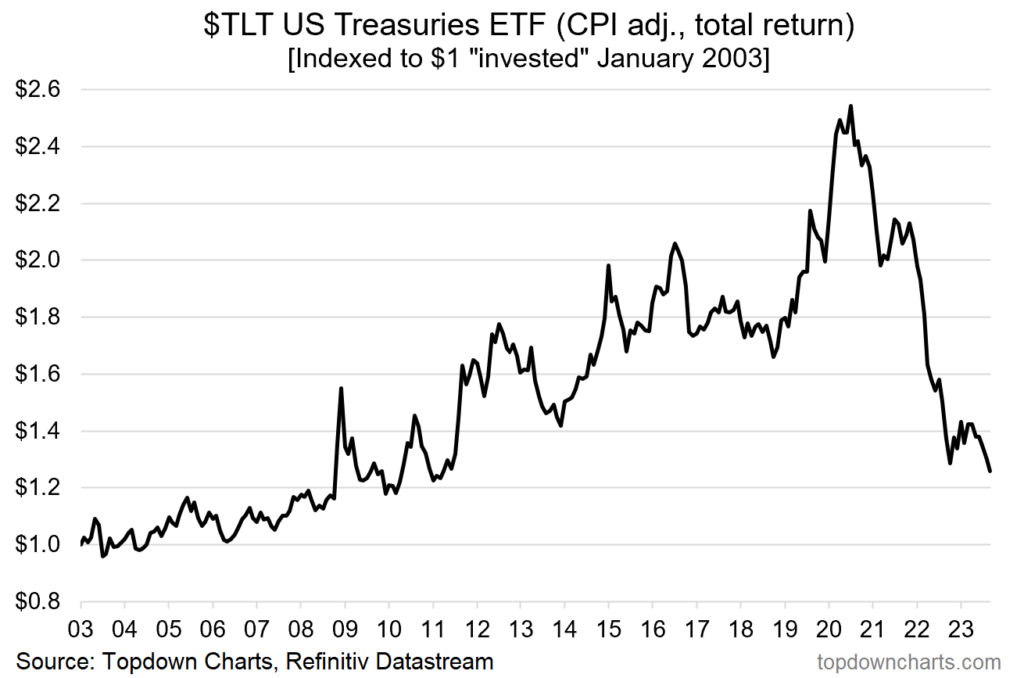

Treasury Troubles: In real (CPI adjusted) total return terms, long-term US treasuries have seen a lost decade, and a catastrophic -50% drawdown off the peak in mid-2020 (p.s. for anyone who’s new to bonds remember: yields up = price down). Essentially this is what happens when an otherwise safe and conservative asset meets an inflation (+ monetary policy) shock.

Source: Chart Of The Day – Treasuries Troubles

5. Dollar Stores Charts Give Back All of 2022 Gains

DLTR closes below 200week moving average…4 lower highs

Dollar General -50% from 2022 highs

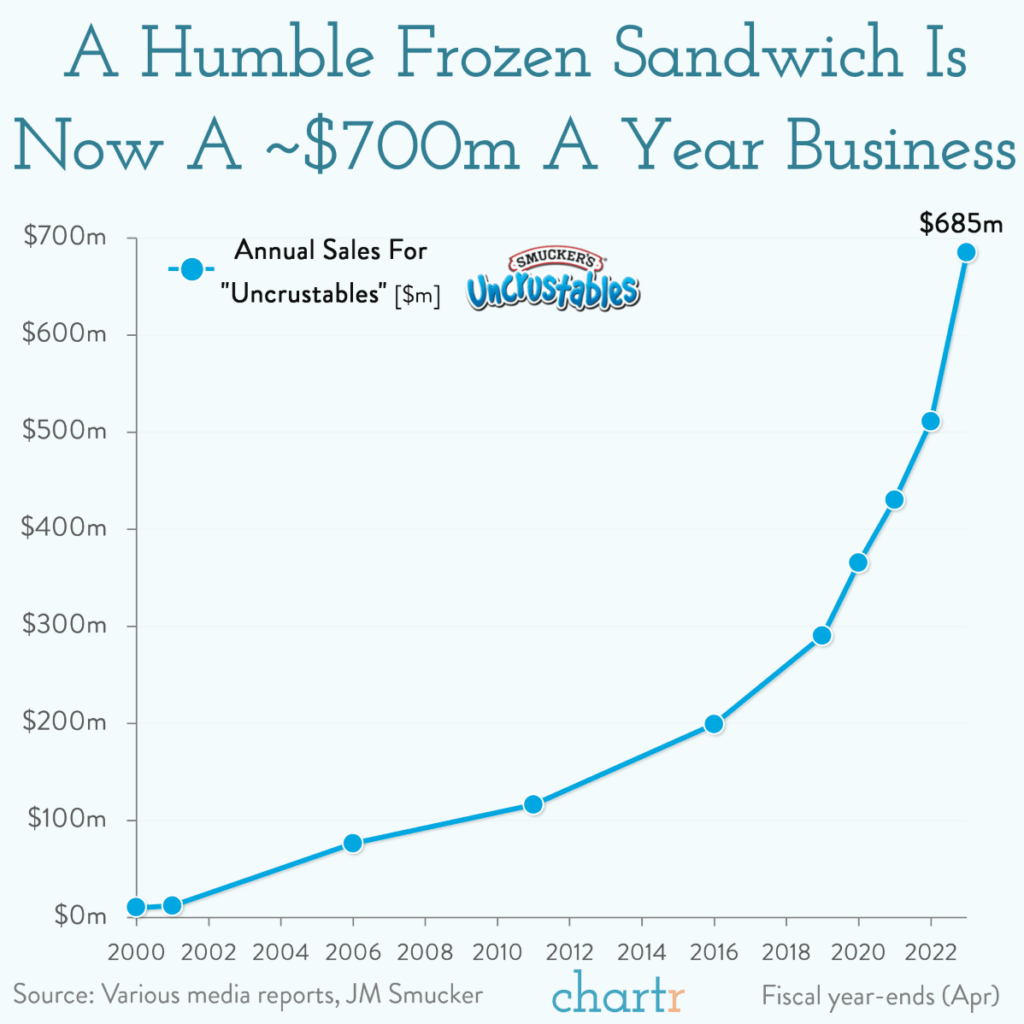

6. Peanut Butter and Jelly $700m Per Year Revenue

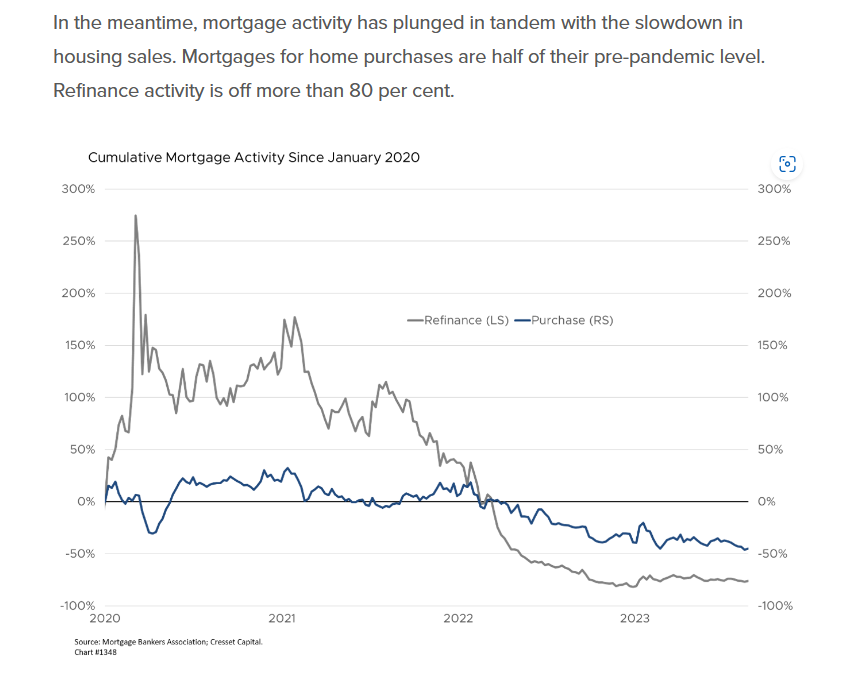

7. Mortgage and Re-Fi Activity Chart

Jack Ablin Cresset Capital

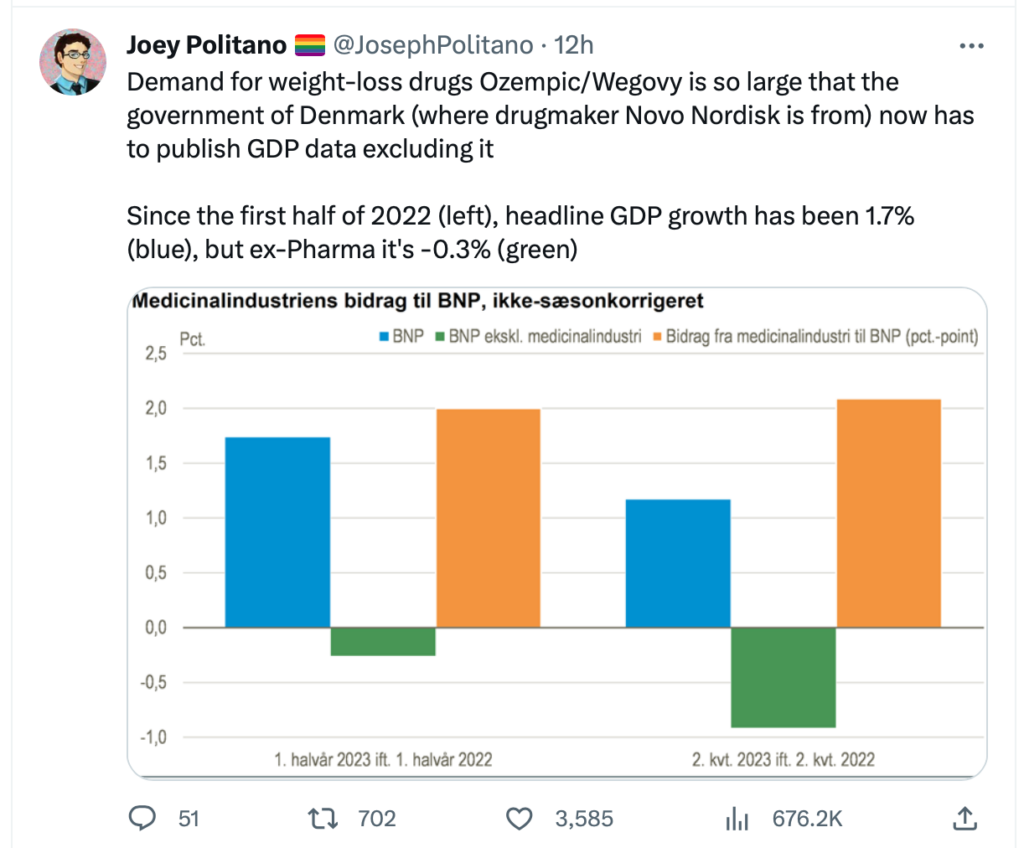

8. Denmark Now Prints GDP With and Without Weight Loss Drug

9. Fidelity 401k Millionaires Save 17% of Pay

10. American Happiness Ratings 1972-2018

Found at Irrelevant Investor Blog

https://theirrelevantinvestor.com/2023/09/06/animal-spirits-the-market-cap-of-taylor-swift/