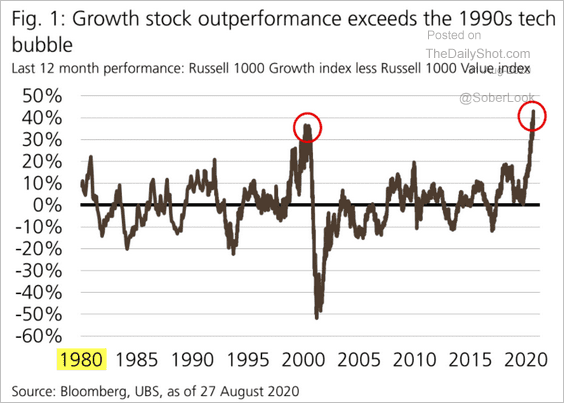

1. It’s Official…Growth Stock Outperformance Over Value Stocks Exceeds Internet Bubble.

https://dailyshotbrief.com/the-daily-shot-brief-august-31st-2020-2-2/

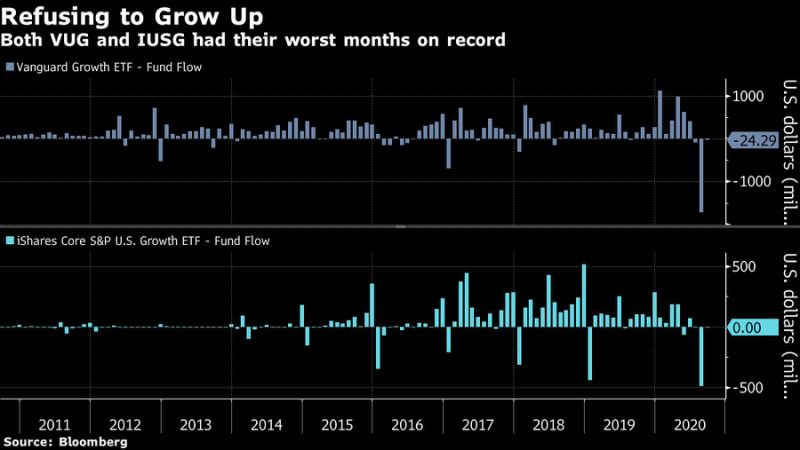

2. But Two Giant Growth Funds Suffer Biggest Selling Stampede on Record

Two Giant Growth Funds Suffer Biggest Selling Stampede on Record

Two Giant Growth Funds Suffer Biggest Selling Stampede on Record

(Bloomberg) — After this year’s surge in high-growth stocks, two big exchange-traded funds tracking those companies are losing steam.

Both the $65 billion Vanguard Growth ETF (VUG) and the $10 billion iShares Core S&P U.S. Growth ETF (IUSG) posted their largest outflows on record last month, according to data compiled by Bloomberg. Funds focused on growth lost more than $2.4 billion in August, the most since 2016. Meanwhile, value ETFs attracted $1.9 billion — their best month since March.

High-growth companies such as megacap technology names with solid balance sheets have been among this year’s hottest trades. But their historic rally has fueled some skepticism about further gains amid concern that they may be too expensive relative to so-called value stocks.

“There’s hesitation that the significant outperformance led by a handful of megacap names like Amazon.com and Apple can continue to climb much higher,” said Todd Rosenbluth, head of ETF and mutual fund research at CFRA Research.

Yet signs of a slow economic recovery from the pandemic-induced recession and a spike in global coronavirus cases may still make a compelling case for growth shares. Those companies beat expectations by a stronger margin and more frequently than their value counterparts in the second-quarter earnings season.

Despite the monthly outflows for the sector, the performance ratio of the iShares Russell 1000 Growth ETF (IWF) hit new highs relative to its value counterpart (IWD), according to a recent report from Bloomberg Intelligence.

To Athanasios Psarofagis, an ETF analyst at Bloomberg Intelligence, there’s reason to believe that investors could still be favoring growth, but through more targeted approaches.

“For sure, growth ETFs will be heavy on tech, but there is also a lot of other stuff, and I just think people only want tech,” said Psarofagis.

Technology ETFs lured $2.1 billion in August, while thematic sector products received $3.2 billion — their best month since 2018. The $143 billion Invesco QQQ Trust Series 1 (QQQ), which tracks the Nasdaq 100 Index, added $2.1 billion last month. Meanwhile, the Ark Innovation ETF (ARKK), whose biggest holding is Tesla Inc., recently had its largest inflow on record.

For more articles like this, please visit us at bloomberg.com

3. Robinhood faces SEC investigation over deals with high-speed trading firms, report says

Summary List Placement

- Robinhood is under investigation by the Securities and Exchange Commission over its deals with high-speed trading firms, The Wall Street Journal reported on Wednesday.

- The investigation is focused on Robinhood’s failure to fully disclose its practice of selling customers’ orders to market-makers, sources told The Journal.

- A settlement fine could exceed $10 million, but a deal is unlikely to be announced this month, the sources told the newspaper.

- Visit the Business Insider homepage for more stories.

- The Securities and Exchange Commission is investigating Robinhood over its deals with high-speed trading businesses, The Wall Street Journal reported on Wednesday.

- The investigation is in advanced stages and focuses on Robinhood’s failure to fully disclose its practice of selling customers’ orders to market-makers, sources familiar with the matter told The Journal. The brokerage could be forced to pay a fine of more than $10 million if it settles with the SEC, a source told the newspaper.

- A fine hasn’t been negotiated between the two sides, one source said. A deal is unlikely to be announced this month, sources told The Journal.

4. Stock Options with Less Than 2 Weeks Maturity Now Compromise 75% of Option Volume

From Nick Lampone Dalzell Trading https://www.linkedin.com/in/nicholas-lampone-9277986/

5. Asset Class Returns Rising Vs. Falling Dollar.

6. Art Cashin (legendary Trader) on the short-term effects of stock splits

Posted August 31, 2020 byJoshua M Brown

The legendary floor trader Art Cashin weighs in on the Tesla and Apple stock splits, which became effective today, in an emailed note. Excerpting a piece of it below…

Let’s begin with stock splits. I watched as several self-styled pundits on the financial media were beside themselves trying to explain how stocks were actually gaining ground after split. There were all the standard logical rationalizations. You have not increased the company’s worth by the action of splitting up as people buy yet the capitalization goes up, etc., etc. I give you five singles for a five-dollar bill, yet we haven’t really changed the value in any form.

The real point I can’t believe all of them have missed has to do with shorting the stock, particularly stocks like Tesla, Amazon and Apple where there are large short positions due to skeptics. When someone sells a stock that he doesn’t own (short), he then has to borrow it from someone who owns it so he can make delivery. He promises then to re-deliver an identical type of stock from whom he borrowed. When the stock splits, it complicates life for short sellers and often they have to go into various negotiations that are the equivalent of a short squeeze to buy back the stock, rechanging it for stock that will be due after the split is effective.

So, it was perfectly natural to watch Apple split and then have people begin to buy it and Tesla split and people begin to buy it and, while as I say, the self-styled experts amazed me I guess by their apparent lack of experience. So anyway, I wanted to make the point that stock splits can have a serious upward push on stocks, particularly heavily shorted. I guess that’s what comes with over 60 years’ experience on the Street.

This is a piece of the story that I myself had not considered. As I type, Tesla, now having split, is up another (another!) ten percent on the day while the just-split Apple tacks on another five percent in market value. I don’t how you can calculate the exact amount of these audacious moves in price are directly related to short-seller buy-ins and other related mechanics, but it’s probably a bigger factor than many (myself included) have considered.

Art is the best. Love that guy.

Photo comes from my own collection – Barry and Art did a fireside chat at a conference we threw back in 2013. Our camera phones weren’t so great back then.

For disclosure information please visit: https://ritholtzwealth.com/blog-disclosures/

7. 10 Year Treasury Rate Hooks Back Down

10 Year Yield Rolls Back Over

30 Year Yields

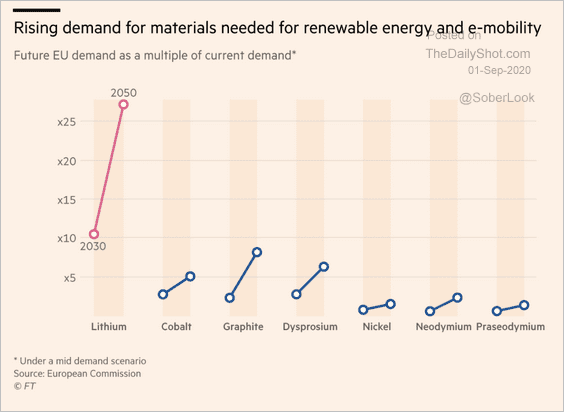

8. Commodities: This chart shows rising EU demand for materials used in electric cars and renewable energy.

Commodity Demand around electric cars growing at 25x

Source: @financialtimes Read full article

Source: @financialtimes Read full article

https://dailyshotbrief.com/the-daily-shot-brief-september-1st-2020/

9. VisualCapatalist World Population

10. Great Leaders Focus on the Why and the What – not the How.

Guest post by Steve Coughran:

my two decades of business experience, I have encountered many different flavors of leadership. Some leaders are strong-willed and autocratic, some are open-minded and democratic, some employ laissez-faire, employee-centric leadership styles, and most fall somewhere in the middle. While leadership style varies, in my experience, leaders across the board provide employees with a sincere depiction of the Why, an explicit description of the What, and freedom on the How.

Many of you reading are likely familiar with Simon Sinek’s Start with Why. His premise suggests that great leaders motivate with the “Why”, a deep-rooted purpose, before defining the “What”, the product or service, or the “How”, the process. Expanding on Sinek’s thoughts, I believe that not only do great leaders deprioritize the “how,” but the most influential bosses leave the “how” to their employees to figure out.

Have you ever been in a work situation where your boss or manager is explaining in specific detail how to do your job? It’s frustrating when managers live in the weeds. Poor leaders provide specificity around how to complete a task but fail to share the big picture, the why, behind the request. No one likes to be micromanaged. Unfortunately, many leaders result to meddling with the process in attempts to maintain a false sense of power. Micromanagers focus explicitly on the how, which often results in short-term success at the expense of the long-term strategy, overall scalability, and employee satisfaction.

Great leaders give little input on the how. Of course, this approach first requires leaders to equip employees with the tools and skills to solve for the how. They must invest heavily in training to ensure employees are prepared to think through the processes.

Training alone, however, isn’t enough to produce the desired results. After reinforcing the why and enabling employees, they get specific about the what. Great leaders share explicit expectations. When I first launched a high-end design build firm, I learned the hard way the importance of clearly communicating expectations. I was feeling on top of the world as my company flourished; customers were lining up for projects, and I had a diverse and talented staff to uphold my brand. To maintain this status, I was also working like a dog, putting in eighty-hour workweeks to keep up with demand. I jumped at my first opportunity to take a two-week vacation, leaving the company reins in the hands of one of my top managers. We were working on a high-end project, but I trusted my employees. I gave little instruction—my manager knew the business as well as I did—and was off to relax on a beach in Mexico and forget about work for a while.

I returned frustrated with the lack of progress. While I was away, the high-end project suffered from operational issues that led to cost overruns and schedule delays resulting in an upset client and some delayed payments. While I was upset with my team, I too was responsible for the situation. What did I count on my managers and employees to do while I was away? More importantly, how would I ensure they held up their end of the bargain? I failed to create an accountability structure. Through this experience, I learned a critical lesson: strong leaders follow up.

Great leaders build accountability structures that clearly define the desired results. Results are laid out specifically and comprehensively, often incorporating qualitative and quantitative data. By leaving little room for confusion, leaders establish fair expectations, which provide a foundation for equitable evaluation and constructive feedback. They create a “return and report” culture where employees are sent off with an understanding of the overarching strategy and the goals of the assignment. They present their findings after independently problem solving.

Giving employees freedom shows that you trust them (which according to research is critical for workplace engagement and productivity). Additionally, by encouraging employees to think, leaders boost their team’s development. Seeing how the employee problem solves allows his or her manager to clearly examine their comprehension of the task, the big picture, and detect any gaps in understanding or skills. They can then address these knowledge gaps with training and coaching, bringing the employees’ development full circle.

As we all continue along the journey to become the best leaders we can be, keep in mind Simon Sinek’s words of wisdom, “There is a difference between giving direction and giving directions.” Emphasize your purpose, explain your product or service, and leave the rest to your well-equipped team.

About the author: Author, CFO of an international billion-dollar company, and management consultant, Steve Coughran has over two decades of experience driving business excellence. His newest book is Outsizing: Strategies to Grow your Business, Profits, and Potential. For more information visit www.SteveCoughran.com.

https://www.greatleadershipbydan.com/2019/10/great-leaders-focus-on-why-and-whatnot.html

Disclosure

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.