1.Softbank’s $4B Tech Stock Option Bet Weighing on Market?

SoftBank Group shares dropped over 7% on Monday after The Wall Street Journal reported the Japanese investment group bought $4 billion worth of options tied to around $50 billion worth of individual tech stocks.“There is a palatable maleficence level lingering about SoftBank’s large derivative position amid the recent tech selloff,” said Stephen Innes, chief global market strategist at AxiCorp. “And while there is not a great deal going on due to fast money risk neutrality after last week’s ‘wipeout,’ the supposed heft of ‘one man’s call position’ is still not sitting well with many bulls at the moment.”

Bloomberg

The Financial Times, Wall Street Journal and Zero Hedge reported that SoftBank was making massive bets on technology stocks using equity derivatives. The FT labeled SoftBank the “Nasdaq whale” that “stoked the fevered rally in big tech stocks,” though it didn’t include details of any trading.

The reports touched off concerns that billionaire founder Masayoshi Son is embarking on a risky endeavor in unfamiliar territory, which could lead to losses like those SoftBank suffered after its enormous bet on office-sharing startup WeWork. The stock decline came despite an FT report that SoftBank now has gains of about $4 billion from the derivative bets.

“SoftBank was riding the Nasdaq wave like a mutual fund,” said Mitsushige Akino, senior executive officer at Ichiyoshi Asset Management Co. “The market is falling now and investors have zero visibility, so they are selling SoftBank stocks.”

“In a world where volumes are distorted by the frantic trading of algos, any real order flows may have surprisingly large impact on prices,” Peter Tchir, head of macro strategy at Academy Securities, wrote in a note Tuesday. “By trading options, they leverage their position.”

SoftBank Stock Tumbles With Son’s Foray Into Options TradingBy Pavel Alpeyevand Takahiko Hyuga https://www.bloomberg.com/news/articles/2020-09-06/softbank-s-4-billion-trading-gains-on-u-s-stock-option-bet-ft?sref=GGda9y2L

2. Speculative Demand for Call Options Has Been “Staggering”

The Daily Shot

Equities: Let’s begin with the options market where the speculative fervor is on full display. Speculative demand for call options (mostly deep out-of-the-money contracts) has been staggering (2 charts).

Short-term call options are notoriously difficult to hedge, and dealers who sold them rapidly become short the market as shares rise (and the probability that these options will get exercised increases). Dealers are forced to buy stocks to cover their exposure (delta-hedging), pushing the market higher. That, in turn, makes the dealers short again, creating a melt-up.

Source: @sentimentrader

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @markets Read full article

https://dailyshotbrief.com/the-daily-shot-brief-september-3rd-2020-2/

3. U.S. Election Priced as Worst Event Risk in VIX Futures History

View photos

(Bloomberg) — As the U.S. stock market continues to rally to record highs, the attention of many investors is turning toward November’s elections as a source of risk.

However, hedging against that potential volatility doesn’t come cheap. In fact, it’s currently the most-expensive event risk on record based on a common way to bet on volatility known as a “butterfly trade.”

Futures tied to the Cboe Volatility Index expiring in late October closed on Tuesday at 33.5, compared with a spot VIX that closed at 26.1. Those October contracts, which are currently the second-month futures and reflect expected volatility in the month after they expire on Oct. 21, are also higher than the first-month futures expiring in September and the third month expiring in November.

One “butterfly” trade would be to buy one unit each of the first- and third-month contracts while selling two units of the second. Currently, that trade prices with a reading of -6.9, the difference in costs between the butterfly’s “wings” in September and November and the “belly” in October. That pricing reflects the premium that investors are giving to own volatility over the election. Trading of VIX futures started in 2004.

“In the history of the VIX futures contracts, we’ve never had an event risk command this sort of premium into forward-dated vol at a specific tenor,” Bloomberg macro strategist Cameron Crise wrote in a blog post. “That obviously suggests that markets anticipate some pretty incredible fireworks.” He excluded a higher premium on March 18 of this year since front-month futures expired that day, when the S&P 500 fell 5.2%.

The spread between October and November VIX futures is also wide at about -1.7 instead of about 0.2, which history suggests it should be based on the level of the spot VIX, according to Crise.

“If it starts trading above where it ‘ought’ to be, particularly given the risk premium lavished on the election, that could be a sign that punters are worried about 2000-style uncertainty,” Crise wrote, referring to the presidential contest between George W. Bush and Al Gore, which ultimately was decided by the U.S. Supreme Court. “You don’t need a particularly vivid imagination to think that that could get pretty ugly this time around.”

For more articles like this, please visit us at bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

https://finance.yahoo.com/news/u-election-priced-worst-event-210637365.html

4. Non-Correlation to U.S. Stocks=Treasuries.

Long-term Treasuries tend to be less correlated with U.S. stocks than short-term Treasuries

https://www.advisorperspectives.com/commentaries/2020/09/02/why-own-bonds-when-yields-are-so-low

5. Valuations of Resource Based Equities at All-Time Lows.

Resource Equities as a Value Opportunity and Inflation Hedge

Resource-based equities14 provide an interesting mix between a significant opportunity within Value equities today (thus lowering overall duration) and a hedge against future inflation. From a Value perspective, Resource equities, particularly Energy and Metals stocks, appear to be trading at the cheapest levels they have ever been relative to the S&P 500 (see Exhibit 5).

EXHIBIT 5: VALUATIONS ARE AT HISTORIC LOWS

As of 6/30/2020 | Source: S&P, MSCI, Moody’s, GMO

Valuation metric is a combination of P/E (Normalized Historical Earnings), Price to Book Value, and Dividend Yield.

Metal producers are also an interesting subset because they are in a secular growth mode as the world transitions to more clean energy. This cannot be done without metals such as copper, lithium, nickel, vanadium, etc.15

Resource stocks have also been a very useful tool in inflationary times. Exhibit 6 shows the return of Energy and Metals stocks during the more significant (CPI greater than 5% for a year or more) bouts of inflation we have seen in the U.S.

EXHIBIT 6: DURING INFLATIONARY PERIODS, RESOURCE EQUITIES HAVE PROTECTED PURCHASING POWER BETTER THAN THE BROAD EQUITY MARKET

Source: S&P, CRSP, Global Financial Data, MSCI, GMO

Annualized data. Inflationary periods have been identified as periods where inflation, as measured by CPI, was greater than 5% per annum for a period longer than one year.

During these inflationary periods, Energy and Metals stocks kept up with or beat inflation in six of the eight periods and outperformed the broad market in all eight periods.

2Q 2020 GMO Quarterly Letter

by Ben Inker, Matt Kadnar of GMO, 8/31/20

https://www.advisorperspectives.com/commentaries/2020/08/31/2q-2020-gmo-quarterly-letter

6. Naz 100 Trading 35% Over 200 Day Moving Average.

What we do know is that Big Tech was expensive, with the S&P 500 Information Technology index trading at 27.5 times forward earnings; extended, with the Nasdaq 100 trading more than 30% above its 200-day moving average; and way too popular. Citigroup’s Panic/Euphoria model was nearly three times the level that signifies euphoria, and the percentage of bulls in the Investors Intelligence Survey was more the 40 percentage points higher than bears.

Tech Stocks Finally Got Crushed. Why the Stock Market Is on Shaky Ground.By Ben Levisohn https://www.barrons.com/articles/the-stock-markets-august-gains-turned-to-september-pain-what-happens-next-51599266176?mod=past_editions

7. Container Ships…All Available Capacity Deployed.

WSJ–Container volumes at the ports of Los Angeles and Long Beach rose by 24% and 21%, respectively, in July from June. Business at both ports had fallen by more than 6% in the first half of the year from the comparable period of 2019.

“The biggest pressure is on the West Coast, being the fastest way to get goods from Asia and get them onto the U.S. shop shelves,” said Nils Haupt, a spokesman for German shipping line Hapag-Lloyd AG . “All available capacity has now been deployed as retailers scramble to restock and this is driving the strong freight rates.”

Container Volumes Shipped to the U.S. Surge After Coronavirus Downturn–By Costas Paris

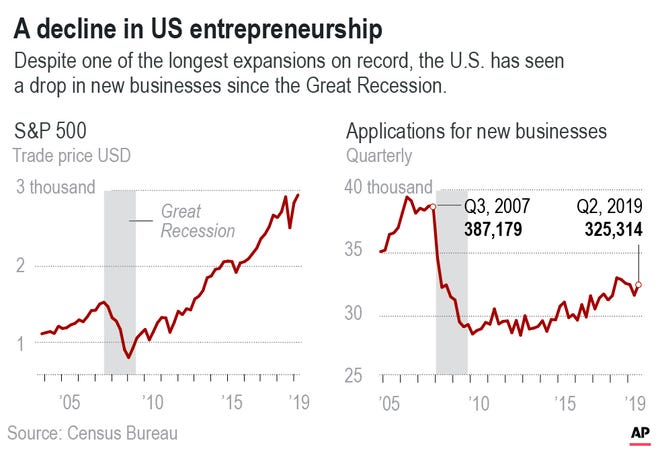

8. A slowdown in U.S. business formation poses a risk to economy

Josh Boak

AP Economics Writer

Washington – Despite a decade-plus of economic growth, Americans have slowed the pace at which they’re forming new companies, a trend that risks further widening the gap between the most affluent and everyone else.

The longest expansion on record, which began in mid-2009, has failed to restore entrepreneurship to its pre-recession level, according to a Census Bureau report based on tax filings.

Between 2007 and the first half of 2019, applications to form businesses that would likely hire workers fell 16%. Though the pace of applications picked up somewhat after 2012, it dipped again this year despite President Donald Trump’s assertion that his tax cuts and deregulatory drive would benefit smaller companies and their workers. Applications are down 2.6% so far this year compared with the same period last year.

Business formation has long been one of the primary ways in which Americans have built wealth. When fewer new companies are established, fewer Americans tend to prosper over time.

In addition, smaller companies account for roughly 85% of all hiring, making them an entry point for most workers into the workforce. Even with the unemployment rate at a near-record-low of 3.7%, a decline in the creation of new companies means there are fewer companies competing for workers, a trend that generally slows pay growth. The pace of pay growth has stalled for the past five months even as hiring has remained healthy.

“What you see is reduced social and economic mobility,” said Steve Strongin, head of global investment research at Goldman Sachs. “It means that most of the growth is occurring in the corporate sphere, which keeps wage growth down and improves profits.”

Smaller companies and startups were generally cautious about expanding as they emerged from the Great Recession, in many cases choosing not to hire. The 2008 financial crisis delivered a warning to many would-be entrepreneurs that scaling back their ambitions might help them survive another recession.

“People became a lot more risk-averse after the Great Recession because so many people were hurt,” said Nicholas Johnson who founded Su Casa, a chain of four furniture stores based in Baltimore that employs 30 workers.

Johnson, 45, started Su Casa about 20 years ago. Emerging from the recession, he kept his staffing levels low to reduce his costs. Still, that meant having to pay well above the minimum wage to attract and retain workers who were specialized in home decor.

“I am super-concerned about an upcoming recession because we got so lean that I can’t get lean again,” Johnson said. “There is no more fat to trim.”

Goldman Sachs on Thursday is releasing a survey of business owners who took part in its “10,000 Small Businesses” program, which has provided management training to several thousand small companies since 2010. The survey concluded that entrepreneurs typically struggle to find qualified workers and to navigate complex regulations. Both factors tend to slow the formation of new companies.

Among the business owners who were surveyed, nearly eight in 10 said they favor a higher local minimum wage well above the federal baseline of $7.25 an hour. Focus groups conducted as part of Goldman’s survey indicate that smaller companies believe wages have failed to keep pace with the costs of living and the retention of employees.

Just 20% of the surveyed business owners said they felt that Trump’s 2017 tax cut would increase their companies’ growth, according to the online survey of 2,285 alumni of the Goldman program.

Social and demographic forces are also thought to be limiting opportunities for entrepreneurs and smaller companies. America is aging, many young adults are weighed down by student debt and larger retailers have used their scale to offer lower prices than smaller companies can afford to do so.

Roughly two-thirds of the decline in startups between the late 1970s and 2007 resulted from a slowdown in the growth of the U.S. workforce, according to research by Fatih Karahan of the Federal Reserve Bank of New York, Benjamin Pugsley of the University of Notre Dame and Aysegul Sahin of the University of Texas-Austin.

But the recovery from the Great Recession, which was induced by the housing bust, also reordered the economy in ways that complicated the creation of smaller businesses. Several sectors of the economy enjoyed no rebound at all in company formations compared with the number of business closures.

The economy now includes 116,459 fewer construction companies than it did in 2007, a roughly 15% decline, according to the Census Bureau. There are 54,045 fewer retailers that employ fewer than 20 people, a consequence in part of a shift to online shopping and the rise of national chain stores. More than 26,000 small manufacturers have shuttered.

The spillover effects have had damaging consequences in many cases. Downtowns in the industrial Midwest have empty storefronts. Home construction has been relatively weak, causing prices to accelerate. This has limited affordability and made it harder for people to join the middle class through home ownership.

Construction jobs often pay solidly middle wages. And home ownership is down 8 percentage points for people under 35 when compared to previous generations.

“If you’re thinking about the American Dream, trying to get into the middle class, homebuilding represents both of those objectives,” said Robert Dietz, chief economist at the National Association of Home Builders. “The unmet potential for homebuilding has been one of the frustrations” of this recovery.

John Dearie, founder of the Center for American Entrepreneurship, who holds roundtables around the country with small business owners, said he hears frequently about problems for younger companies caused by a shortage of skilled workers, immigration policies that thwart access to talent and difficulties in obtaining bank loans.

The number of tech startups – from software to computer systems design companies – has grown about 20% since 2007. But that sector represents just 2% of the roughly 6 million companies in the United States.

Dearie said he worries that the United States is losing its competitive edge because the obstacles for would-be startups are slowing the formation of innovative businesses.

He ran off a list of innovations that were derived from entrepreneurs: The cotton gin, the steam engine, railroads, the telegraph and telephone, electrification, the automobile, the airplane, air conditioning and refrigeration, the computer, internet applications and wireless communication.

“Declining startup rates,” Dearie said, “amount to nothing less than a national emergency.”

9. Winners and Losers By State in Covid Relocation Boom

New Yorkers Flee for Florida and Texas as Mobility SurgesBy Steve Matthews and Alexandre Tanzi https://www.bloomberg.com/news/articles/2020-08-31/new-yorkers-flee-for-florida-and-texas-as-mobility-surges?sref=GGda9y2L

10. Finding a Business Idea

Some less obvious, lower-risk suggestions

Source: No author listed, NeedPix, Public Domain

A number of my clients are tempted to start a business, often because they’ve been laid off because of COVID and are having a tough time landing a decent job.

I tell them that the idea is the least important part; success is mainly about execution. Nevertheless, many of them remain eager to hear some ideas. Here’s a buffet of the kinds of things I often suggest.

Don’t innovate; replicate. The leading edge too often bleeds, guinea pigs often die. It’s less risky to take an successful business concept and execute well. My favorite example is Noah Alper, who founded Noah’s Bagels. There already were a number bagel shops in the area but Noah came up with a better recipe and opened a store in a neighborhood with lots of bagel lovers. Little by little, he expanded to 38 stores whereupon he was bought out for $100 million.

So, think of stores that are doing well, visit (subject to COVID restrictions) and see what you can learn. Could you do it better, less expensively, or in a different location, or online?

Passion may not be required. Some people need to be passionate about the product or service, but other people realize that as long as the product is worthy, they’ll derive plenty of satisfaction just from seeing those sales and satisfied customers. To broaden your options, you might want to consider a wide range of ethical businesses, not just those selling products you’re passionate about.

Use inside knowledge. In your line of work, have you observed pain points, something that’s frustrating, especially to people in power? If not, might you query your friends? That resulted in a client learning that a railroad that operated on both sides of a major river spent a fortune on cab fares transporting employees from one side of the river to the other. The client offered to run a shuttle service, saving the company lots of money while making my client a good living. Another example: A client worked in the wine industry, where he learned that wineries find shipping a pain, so he opened a business that ships for a number of wineries in the Napa Valley.

Source an undervalued product? I’ll change irrelevant specifics to avoid breaching client confidentiality, but a client, whom I’ll say is an electrical engineer, contacted manufacturers of I’ll say commercial lab equipment, bought, as-is, returned or obsolete. He repaired them and sold them to countries in which such equipment would be welcomed.

Serve less competitive markets. The just-mentioned client used that principle: He sold in locales where the latest-and-greatest would be too expensive. Another example: I had a client who bought used brand-name jeans for a couple bucks a piece by driving around to lots of Salvation Army and Goodwill stores. When he accumulated a shipping container full, he sent it to a developing nation where a local sold them for $8 a piece to eager customers.

Conversely, I had a client who, once a year, flew to central Europe where he placed ads in local newspapers for used vintage or antique violins. They’re in greater supply there than in the US and so could sell them at a tidy profit. When he had a shipping container full, he had it shipped to his home, where he stores the violins for sale—Picture a garage full of fiddle

Choose a dull-normal product. Few people graduate from a prestigious college wanting to start a business in mobile home park maintenance, used truck part brokerage, or a commercial printing machine service. Yet, according to the book, The Millionaire Next Door, which summarized interviews of 750 millionaires, the most common route to wealth was owning such a “dull-normal” business. I had a client who decide to own a hot dog cart, and sold his franks on a busy downtown street. After learning the business hands-on, he hired someone to run that cart, expanded to six carts, and retired before he was 40.

Go further up the supply chain. Say you’re passionate about beer. The obvious and thus too crowded choices are to start a craft brewery or brewpub. A less risky option is to start a beer business that’s further up the supply chain, for example, purveying spices for beer making. (One concoction is called Grains of Paradise.) Of course, that may not be as sexy as welcoming people to your brewpub but getting in further up the supply chain may be a safer route to good income while still enabling you to be part of the beer community.

Search for new laws and policies, As you read the local or national news, keep your antennae out for business opportunities. For example, North Carolina mandated that henceforth, all students must take earth science. Well, a burned-out science teacher read that, whipped up a workshop for teachers and pitched every school district in the state: “I’ve developed a workshop that will prepare your teachers to teach earth science.” She was busy immediately.

The takeaway

I want to reiterate that what I’ve done in this post is the easy part: suggesting ideas. Thomas Edison was not wrong: Success is 5% inspiration, 95% perspiration. I’d add, “smart perspiration.”

I read this aloud on YouTube.

https://www.psychologytoday.com/us/blog/how-do-life/202009/finding-business-idea

Disclosure

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.