1. Sept/October Historically Weak During Election Year.

LPL BLOG

LPL Blog

2. Amazon Drone Program in Play.

ECOMMERCEAmazon’s Drone Program Gets a Lift AmazonThe traffic cops of the skies, the FAA, handed Amazon the all-important “air carrier” certificate it needs to operate a drone delivery network in the U.S. Yesterday’s approval allows Amazon’s drones to carry packages beyond the line of sight of the operator. It’s a need-to-have badge in order to start commercial service. The backstory: The race for drone delivery is about as sluggish as George R.R. Martin’s writing process. Amazon first announced its drone plans in 2013, but technical challenges and regulatory delays have pushed an actual launch well into the 2020s. The nowstory: Amazon is the third drone operator to secure FAA approval, joining UPS and Alphabet’s Wing unit. Regular commercial service isn’t expected for years, though. And why does this matter? Amazon believes the future of ecommerce belongs to the company that can deliver packages before the confirmation email arrives in your inbox. Amazon’s new class of electric drones, the MK27, can fly up to 15 miles and deliver a package weighing under 5 lbs. in less than 30 minutes. AmazonThe traffic cops of the skies, the FAA, handed Amazon the all-important “air carrier” certificate it needs to operate a drone delivery network in the U.S. Yesterday’s approval allows Amazon’s drones to carry packages beyond the line of sight of the operator. It’s a need-to-have badge in order to start commercial service. The backstory: The race for drone delivery is about as sluggish as George R.R. Martin’s writing process. Amazon first announced its drone plans in 2013, but technical challenges and regulatory delays have pushed an actual launch well into the 2020s. The nowstory: Amazon is the third drone operator to secure FAA approval, joining UPS and Alphabet’s Wing unit. Regular commercial service isn’t expected for years, though. And why does this matter? Amazon believes the future of ecommerce belongs to the company that can deliver packages before the confirmation email arrives in your inbox. Amazon’s new class of electric drones, the MK27, can fly up to 15 miles and deliver a package weighing under 5 lbs. in less than 30 minutes. |

https://www.morningbrew.com/?utm_expid=.ZTQPzZIzTFOdxoi4D0Ey0Q.0&utm_referrer=

3. Natural Gas climbed by nearly 80% from the year-to-date low in late June of around $1.48 Btus

UNG-Natural Gas Fund

Natural-gas futures gain nearly 50% in August, but rally may be ‘short-lived’

Natural-gas futures rallied in August, tacking on nearly 50% to tally their largest monthly percentage gain in more than a decade as strong demand for the fuel in power generation significantly cut U.S. supplies in storage.

In March, U.S. inventories of natural gas were 81% higher than the same a time year ago, but supplies recently stood at 20% above the year-ago level, according to Peter McNally, global sector lead for industrial materials and energy at investment research firm Third Bridge.

The “need for backup power and peaking power demand” increased in the short term, amid blackouts in California, lifting usage of natural gas, he says.

On Aug. 31, October natural-gas futures NGV20, -4.29% settled at $2.63 per million British thermal units, with front-month prices climbing by roughly 46% for the month to date. They posted the largest one-month percentage rise since September 2009, when prices rose 62.6%, according to Dow Jones Market Data.

Prices saw a big increase at the beginning of August, buoyed by “strong demand from natural gas-fired power generation,” according to a monthly report from the Energy Information Administration released on Aug. 11. The EIA estimates that natural-gas consumption for power generation rose to 43.6 billion cubic feet per day in July 2020, “higher than any month on record.”

Still, a decline in industrial natural-gas consumption, which fell by 1.4 billion cubic feet per day in July from a year earlier, likely due to slower economic activity, partially offset strength in consumption from electric power, the EIA said.

Meanwhile, the “regulatory climate” has limited future supply growth, says McNally. Duke Energy Corp. DUK, -1.40% and Dominion Energy Inc. D, -0.79% cancelled the Atlantic Coast Pipeline, which would have “taken natural gas from Appalachia to the Carolinas,” he says.

Companies that produce natural gas, as well as the number of active natural-gas drilling rigs, have also failed to respond to higher prices, he said. “Natural-gas drilling remains at multiyear lows”—likely due in part to financial issues, with Chesapeake Energy Corp. CHKAQ, -6.39%, a major producer, filing for bankruptcy, he says.

Natural-gas production has fallen as producers have cut back on drilling and completion activities as a result of lower oil and natural-gas prices, according to the EIA, which estimates that output declined to 86.8 billion cubic feet per day in July, down 9.5 billion from the peak in November of 2019. That, combined with the rise in power generation demand, contributed to lower-than-average U.S. supply increases in July, it said. Even so, for the week ending Aug. 21, natural-gas inventories stood around 20% above the year-ago level.

The market will be looking to natural-gas output that’s associated with oil production, says McNally. “Additional supplies of natural gas have emerged from the Permian Basin that produces natural gas associated with targeted oil production,” he says. “That associated gas supply has come off with oil production in recent months, but it is something we will be watching going ahead.”

The natural-gas supply surplus ‘remains formidable with the summer cooling season drawing to a close in September.’

— Marshall Steeves, IHS Markit

Meanwhile, Hurricane Laura, which made landfall in Louisiana in late August, also contributed to the climb in natural-gas prices, says Marshall Steeves, energy markets analyst IHS Markit, with the resulting production decline expected to be met with a similar fall in demand due to power losses.

Prices for natural gas have climbed by nearly 80% from the year-to-date low in late June of around $1.48 Btus. However, the natural-gas supply surplus “remains formidable with the summer cooling season drawing to a close in September,” which is a transitional month, says Steeves.

The natural-gas p rice rally may be “short-lived, absent another heat wave or supply disruption,” he says.

4. Europe Seeing Technology Weighting Finally Rise Above Banks-Biggest Change to Index in 20 Years.

While the third quarter usually brings more changes to Stoxx’s benchmarks as the hurdles to join or be removed are lower then during the other reviews, this year’s overhaul is the biggest change to the index membership in more than two decades as the virus pandemic accelerated investors’ appetite for growth stocks. Index membership is based on free-float adjusted market value at the end of August.

Banks Move Out as New Economy Joins Euro Stoxx 50 BenchmarkBy Jan-Patrick Barnert

5. Apple Bigger Than Entire American Small Cap Market Combined…Apple Market Cap vs. Russell 2000

Apple’s Market Cap Surpasses The Entire Russell 2000 Due To “Option Insanity” by Tyler Durden

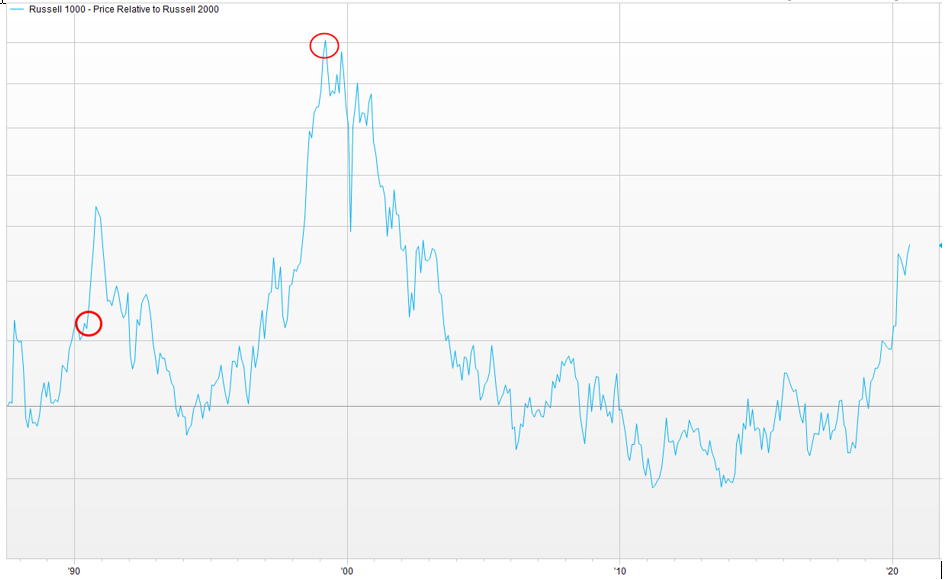

6. History of Large Cap Vs. Small Cap

From Nasdaq Dorsey Wright

Below is the Russell 1000 dividend by the Russell 2000 small cap index. When the ratio moves up, large caps are outperforming. Both instances of the market being as narrow as it now is circled in red. Large caps continued to outperform for a couple of months, but then we saw a long period of small cap outperformance. The second observation in March 1999 was right at the peak of the large cap outperformance, and we saw a decade-long run of small cap outperformance.

When markets have been as narrow as they are now we have seen things change and small caps begin to outperform. This might not happen right away, but is going to become more important to keep an eye on small cap performance over the next few months to see if we get a trend change.

7. One-in-Five Small Businesses Say They Will Have to Close Their Doors if Economic Conditions Don’t Improve in Next Six Months

Date: August 24, 2020

Thirty-two percent of small business owners reported that the extra UI benefit made it harder to hire or re-hire workers

Washington, D.C. (Aug. 24, 2020) – The NFIB Research Center released the latest COVID-19 related survey assessing the health crisis impact on small businesses. Congress is currently negotiating additional financial support for small businesses after the initial Paycheck Protection Program (PPP) loan period expired on August 8. If eligible, 44% of small businesses surveyed said they would apply or re-apply for a second PPP loan with another 31% saying they would consider applying for one.

“The health crisis is not impacting small businesses equally,” said Holly Wade, NFIB Director of Research and Policy Analysis. “Small businesses are adapting to the abrupt shifts in consumer spending, managing customer and employees’ health and safety, and complying with state and local mandates which are all creating additional stress for small business owners. Many of them still need more financial assistance just to keep their doors open and staff on payroll.”

Key findings from the survey include:

Most PPP borrowers (84%) have now used their entire loan, up from 71% in July.

· The 16% of borrowers are likely not far behind on spending.

· Most PPP borrowers (81%) applied for the loan through the financial institution that they normally use for business purposes.

· About 43% of borrowers plan to use the EZ form when applying for loan forgiveness,

Thirty-five percent of respondents have applied for an Economic Injury Disaster Loan (EIDL).

· Nearly three-quarters (74%) were approved for a loan and 9% were denied.

· About 18% still have not heard yet about the status of their loan application.

· Of those who applied for an EIDL loan, 22% of loan applicants are “very satisfied” with the EIDL program overall and another 44% were “satisfied.”

Almost half of PPP loan borrowers (47%) anticipate needing additional financial support over the next 12 months.

· If eligible, 44% of small business owners would apply or re-apply for a second PPP loan.

· Another 31% would consider applying for one.

Sales levels remain at 50% or less than they were pre-COVID sales levels for about one-in-five employers.

· Another 28% report sales levels of 50-74% from pre-crisis levels.

· Half (50%) are nearly back to where they were with some (14%) exceeding pre-COVID sales levels.

About one-in-five (21%) of small business owners report they will have to close their doors if current economic conditions do not improve over the next six months.

· Another 19% of owners anticipate they will be able to operate no longer than 7-12 months under current economic conditions.

· Over half (61%) are better situated and do not anticipate any near-term problems.

Most small business owners do not expect business conditions to improve to normal levels until next year at the earliest.

· Only 19% of owners anticipate conditions improving to normal levels by the end of the year.

· Six percent of owners say that conditions are back to normal now.

· Over half of owners (52%) anticipate it taking until sometime in 2021 and 20% believe sometime in 2022.

The CARES Act provided additional financial assistance of supplemental unemployment insurance benefits through July 31. The program presented a significant challenge to some small business owners.

· About one-third (32%) of small business owners reported that the extra $600 per week has hurt their business by making it harder to hire or re-hire workers.

· However, the UI program has also helped support customer spending, with 9% of owners feeling like they benefited from the program by putting more money in their customers’ pockets.

· Three percent of owners said they had to offer a higher wage to encourage a worker to come back to their job, and 4% reported having an employee agree to continue working but only with reduced hours in order to also receive the $600 per week benefit.

The threat of legal action against small business is a serious concern for 21% of owners and a moderate concern for another 34% of owners.

· Just under one-third (31%) are not too concerned and 14% are not concerned at all, likely due to limited contact with the general public or having few employees, if any.

About one-in-five (21%) of small employers have had an employee take COVID-19 related paid sick leave or family leave as mandated and offered through the Families First Coronavirus Response Act (FFCRA).

· Only 30% of employers have claimed the tax credit or an advance refund for reimbursement of these costs.

This publication marks NFIB’s 11th Small Business COVID-19 survey assessing the health crisis impact on small business operations, economic conditions, and utilization of the targeted small business loan programs. The first series was published in early March 2020 with subsequent publications every 2-3 weeks, found here. The full survey is available here.

Related Content: Press Release | Economy | National

8. Why the private space industry embraces risk

Miriam Kramer, author of Space

The space industry has always accepted some level of risk and failure, but as the commercial space industry matures, companies are using failure to their advantage to try to help their businesses succeed.

Why it matters: By taking on more risk and pushing their systems to the limits, space companies may be able to reach ambitious goals — like building a city on Mars or mining the Moon for resources.

The big picture: A rocket’s failure could have once signaled major trouble for a rocket company’s business, but that’s not necessarily the case anymore, experts say.

- Instead, after a setback, some space companies now have the flexibility to use that failure and return to flight more quickly and with a better launcher than before.

What’s happening: Companies are taking more risks to work out bugs in a system faster and to ultimately make a better product.

- SpaceX is testing its Starship designed for interplanetary missions by staging test flights quickly, effectively allowing them to fail and iterate so they won’t repeat that failure.

- Instead of working to build the perfect rocket on the first try, small rocket builder Astra is using an iterative process to create a better rocket through risk and failure.

Where it stands: The industry at large is also giving commercial companies more leeway when an accident does occur, according to Eric Stallmer of the Commercial Spaceflight Federation.

- A Rocket Lab rocket failed to deliver a payload to orbit in July, but the company bounced back fast with a successful return-to-flight mission on Sunday.

- That quick turnaround is notable because earlier failures from other companies sidelined those businesses for several months.

- Stallmer added that new sensors and other pieces of technology are allowing companies to track everything happening on a rocket and quickly identify the root cause of an accident.

Between the lines: Risk and failure tolerance are the signs of a maturing private industry.

- Risk tolerance could also be a way for companies to break through in an increasingly crowded market.

- “You have to accept a higher amount of risk,” industry analyst Peter Marquez told Axios, drawing a comparison to investing in riskier stocks for a higher return.

Background: During the early days of the space program, failure was key to the development of systems that would take people to orbit and eventually the Moon.

- Longtime government contractors like Boeing and Lockheed Martin, which likely took more risks earlier on, are now in mature positions in the industry where high-profile failures could spell problems for their businesses.

- But upstarts are incorporating those ideas about risk into their businesses now, capitalizing on failure and using it as a means to an end.

Yes, but: “It’s not that failure is more tolerated” from a business and technical perspective, United Launch Alliance’s Tory Bruno told Axios. “It’s that the nature of the industry, the nature of the payloads that we’re putting into space as an industry has changed.”

- The money from commercial payloads and even inexpensive government ones can likely be recovered relatively quickly, making that type of mission failure less serious than others that may include expensive spy satellites or other multibillion-dollar tools.

- And some missions — like SpaceX’s first hu man flight for NASA earlier this summer — are too high-stakes to tolerate high risk.

https://www.axios.com/private-space-industry-risk-9a595298-d2f3-44a5-bcd3-cf7e8d20964a.html

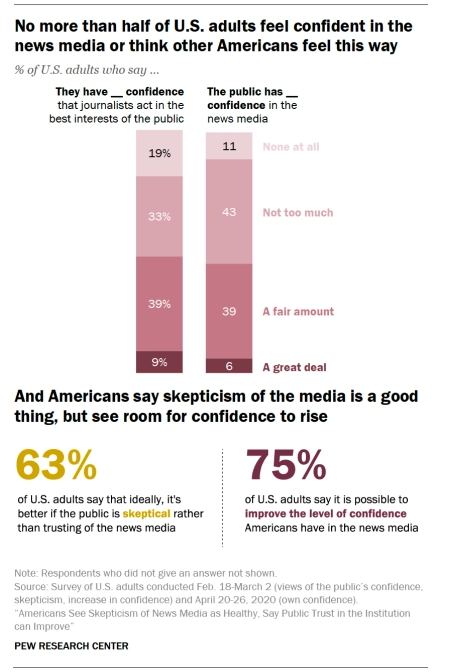

9. Pew Poll on Americans View of News Media.

Americans See Skepticism of News Media as Healthy, Say Public Trust in the Institution Can Improve-72% of U.S. adults say news organizations do an insufficient job telling their audiences where their money comes from

BY JEFFREY GOTTFRIED, MASON WALKER AND AMY MITCHELL

10. Seven Employee Behaviors That Point You Don’t Have An Innovative Culture-Valuewalk

“Look around,” he urges leaders. “If you don’t see these seven employee behaviors in action, you don’t have an innovative culture. The proof is in how people act, every day.”

BEHAVIOR 1: Managing Self.

The best thinkers, the best learners, the best collaborators, and the best listeners have learned how to manage their Inner World—their ego, mind, body, and emotions. This means people have a quiet ego and are open-minded and good at “not knowing.” They don’t reflexively defend, deny, or deflect when someone challenges them. They are willing to change their position when they get better evidence. When talking to others, they have a quiet mind and are fully present and focused totally on listening and trying to understand what the other person is saying. They control their negative emotions and rarely fly off the handle.

Red Flags: A person who can’t “manage self” has to always be right. Others may describe them as defensive, arrogant, judgmental, or super-opinionated. A person who frequently interrupts people or who multi-tasks while listening to others. And A person who behaves in disrespectful ways or can’t control their emotions. A person who raises their voice or who glares at people.

BEHAVIOR 2: “Otherness.”

No one achieves success by themselves. In the Digital Age, their success will be highly dependent upon their ability to build caring, trusting relationships at work that enable the highest levels of thinking and learning with others. Otherness is a mindset—a belief that they need the help of others to see what they don’t see because of their tendencies to seek confirmation of what they believe.

Otherness is a behavior—behaving in ways that show they respect the human dignity of the other person. Success in the Digital Age will require Otherness. A competitive survival-of-the-fittest mindset will be the quickest pathway to failure. Their biggest competition in the Digital Age will be themselves, not others.

Red Flags: A person who rarely asks others for help. A person who believes he is better than most people. And A person who views each conversation as a win-lose, zero-sum game. And A person who will not prevent someone from doing something wrong because they want them to fail. A person who gossips negatively about others. A know-it-all. Finally, a braggart.

EMPLOYEE BEHAVIOR 3: Emotionally Connecting in Positive Ways

The science is clear: Positive emotions enable better learning, better decision-making, and more willingness to explore, create, and innovate. A positive emotional work environment comes about because people bring their positive emotions to the conversation.

They understand the power of slowing down to be fully in the moment, and they express their positivity by smiling, by their tone of voice, by their calmness, and by the words they choose to use.

And they behave in respectful ways to others even if they disagree with what is being said. They express gratitude often (i.e., “thank you,” “I appreciate that,” “you are kind”). A positive emotional environment in a meeting liberates people in that people can sync their positivity with each other and be fully engaged without the limitations of worries, insecurities, and fears. People can be their Best Selves, so you have the opportunity to have high-quality conversations that can result in team flow that can lead to “wow” results.

Red Flags: People are rude to each other. People use body language that says, I am not really listening to you or I am dominant. And people put down others. People are closed-minded or not engaged. People are constantly interrupting or raising their voices and moving forward, getting ready to attack verbally.

BEHAVIOR 4: Effective Collaboration

This begins with leaders: They know how to set up meetings so that people feel psychologically “safe” to join in. Leaders have created an environment where collaboration is not a competition—an environment where people care about each other and trust that no one will do them harm. During meetings, people are fully present, attentive, and connected to each other. Everyone gets to speak. People challenge the status quo and seek the best possible idea, regardless of the status or position of who suggested it.

Red Flags: The highest-ranking people dominate and aggressively push their views. Meetings are not genuine open discussions—the answer is predetermined, and the real goal is consent and compliance. Some people don’t speak up at all. Too often, critiques get personal.

EMPLOYEE BEHAVIOR 5: Reflective Listening

People who exhibit this behavior allow others to talk. They reframe what they think the other person is saying, to make sure they understand. They ask clarifying questions before telling, advocating, or disagreeing. When they do disagree, they critique the idea, not the person.

Red Flags: People don’t make eye contact. They interrupt. And they multi-task during meetings. They are great “tellers,” not listeners. Their egos are wrapped up in showing the speaker that they are the smartest person in the room.

BEHAVIOR 6: Courage

In the Digital Age, everyone will have to excel at going into the unknown and figuring things out. That takes courage—the courage to try. A person with courage is willing to experiment, even though they know they might fail. They also understand that most learning comes from having conversations with people who have different views. They don’t mind having respectful difficult conversations. You’ll find them volunteering for new projects, openly sharing their views, and asking for lots of feedback.

Red Flags: People are unwilling to take risks. They seem guarded and closed-lipped. Because they fear making mistakes or looking bad, they rarely step out of their comfort zone.

BEHAVIOR 7: Evidence-Based Decision-Making

When employees possess this behavior, they are not married to their ideas. They are more open-minded. They never assume. And they are always seeking data, even if it will disconfirm their theory or even force a return to the drawing board. They seem to get the statement “I am not my ideas” on a deep level.

Red Flags: People defend their ideas even when there’s no data to support them. They rarely ask for the input of others (and if it’s given, they don’t listen to it). They are invested in being “right.”

“If you see most of these seven foundational employee behaviors in action, you’re on the right track,” concludes Hess. “If you see a lot of red flags, you’re in trouble.

“The good news is that people can change their behaviors,” he adds. “It takes a lot of intentional work. But as is always true, the first step is admitting you have a problem—and the second is realizing the upside of changing outweighs the downside of not changing.”

About the Author:

Edward D. Hess is professor of business administration, Batten Fellow, and Batten Executive-in-Residence at the Darden School of Business and the author of Hyper-Learning: How to Adapt to the Speed of Change. He is the author of 13 books, over 140 articles, and 60 Darden case studies. His work has appeared in over 400 global media outlets.

For more information, please visit edhess.org.

About the Book:

Hyper-Learning: How to Adapt to the Speed of Change (Berrett-Koehler Publishers, September 2020, ISBN: 978-1-523-08924-6, $29.95) is available at bookstores nationwide and from major online booksellers.

Disclosure

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.