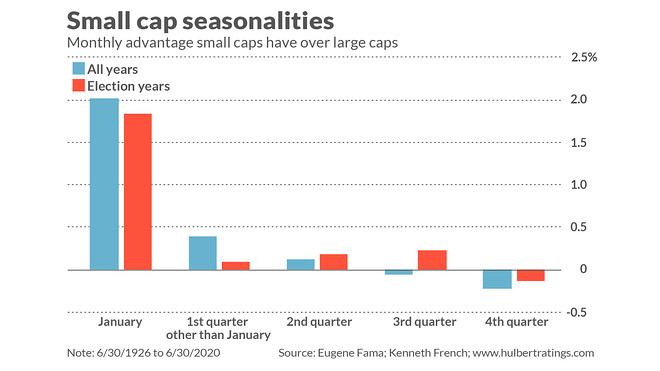

1. Small Caps Lag In 4th Quarter

Now is not a good time to be actively investing in small-cap U.S. stocks. That’s because small-caps typically lag their larger counterparts during the fourth quarter.

Take a look at the accompanying chart, which plots the average monthly return advantage that the smallest stocks have over the largest. (The exact definitions of these two hypothetical portfolios are provided on the website maintained by Dartmouth College professor Ken French.)

Opinion: Small-cap stocks typically lose in the fourth quarter and this group of wealthy investors are to blame

BY: Mark Hulbert

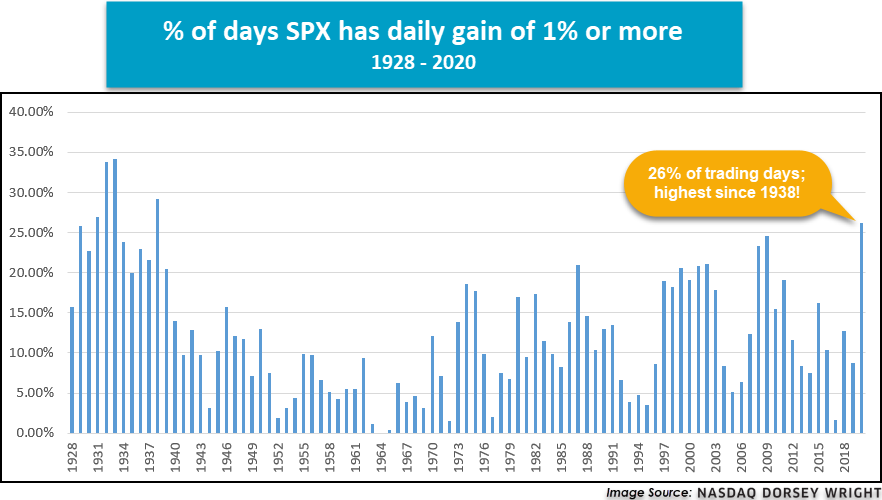

2. S&P 500 Daily Gain of 1% or More 26% of Trading Days in 2020….Highest Since 1938

In a year of rarities, we have recently had another uncommon market occurrence. So far this year, we have seen the S&P 500 index (SPX) produce a daily gain of 1% or more in 26% of trading days (48 instances out of 183 trading days). This is the highest percentage in a year since 1938! On the flip side, the SPX has dropped 1% or more in 21% of trading days this year, which is the highest percentage since 2009. The graph below shows the percent of days the SPX has gained 1% or more for each year, going back to 1928.

https://oxlive.dorseywright.com/research/bigwire

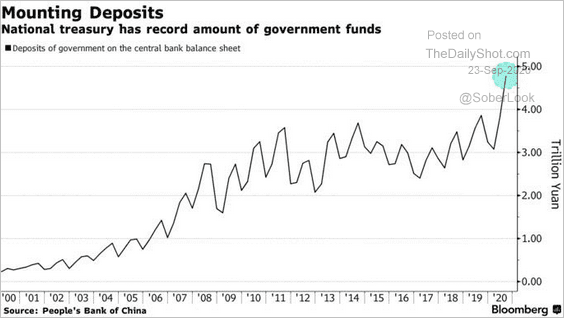

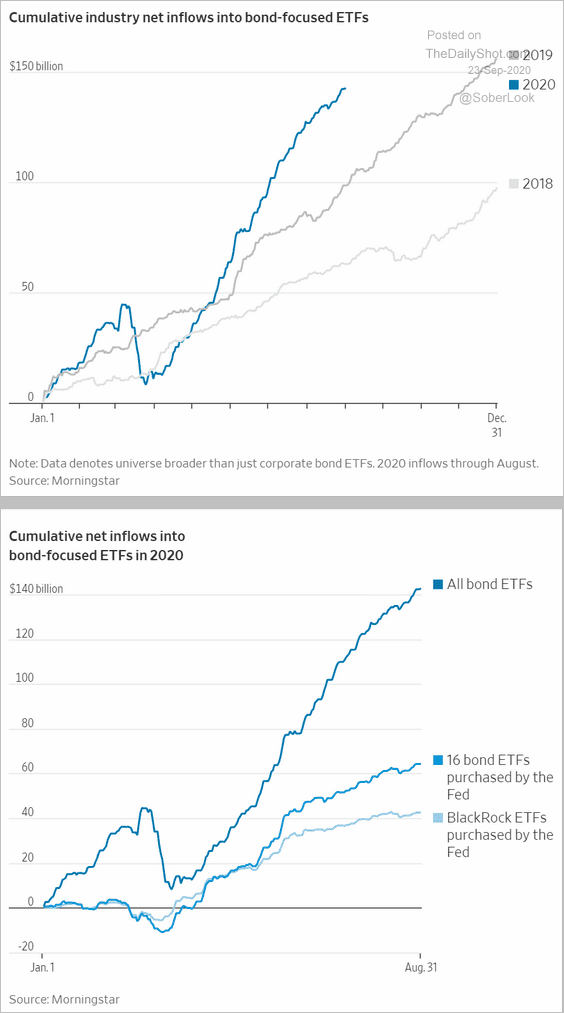

3. Massive Debt Issuance Spike in Treasuries…Massive Fund Flows Into Bonds.

The Daily Shot

The spike in government deposits with the central bank points to massive debt issuance to fund stimulus programs.

Credit: Bond ETF inflows have been unusually strong in this recovery.

https://dailyshotbrief.com/the-daily-shot-brief-september-23rd-2020/

4. Tech Stock IPO First Day Pops

https://www.protocol.com/tech-ipos-are-popping-a-lot

5. German Bank Index Drops 10% in 3 Days on Corruption Allegations

Holger Zschaepitz, @Schuldensuehner

Good Morning from #Germany where German banks index got another hit by new corruption allegations. Dropped a further 10% in the past 3 trading days. All listed German banks have a combined mkt cap of ridiculous €21bn.

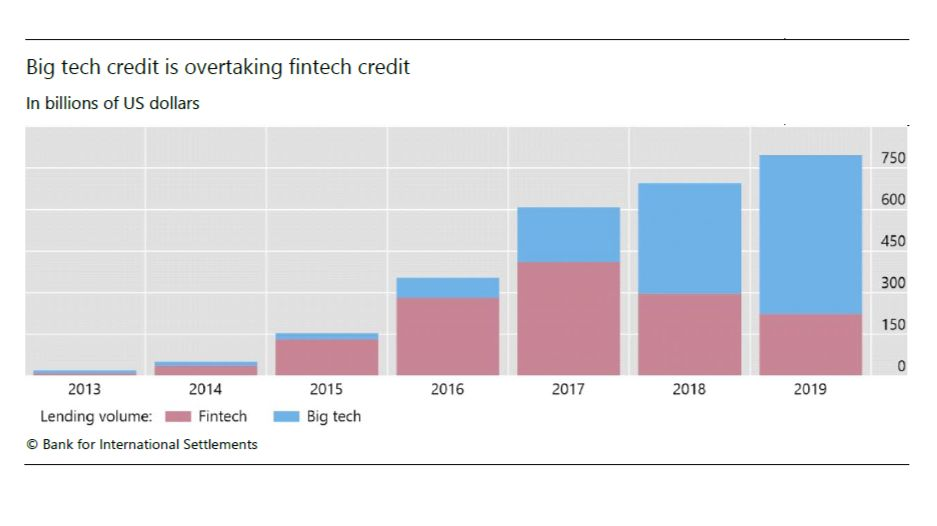

6. Big Tech Moving Into Lending …Overtaking Fintech….

Credit extended by big tech firms (Microsoft, Google, Ant, etc.) has surpassed credit extended by dedicated p2p/direct lenders. Interesting implications for central bankers who don’t have good tools to influence this growing source of credit. https://bis.org/publ/work887.htm…

Bank for International Settlements, @BIS_org

#Bigtech credit is booming, reaching an estimated USD 572 billion in 2019, while #fintech credit has declined to USD 233 billion, driven by developments in China #techfin #platforms #p2plending #marketplacelending https://bis.org/publ/work887.htm…

Summary

Focus

Credit markets around the world are undergoing a deep transformation. While banks, credit unions and other traditional lenders remain the chief source of finance in most economies, with capital markets playing an important role in some cases, new intermediaries have recently emerged. In particular, digital lending models such as peer-to-peer and marketplace lending have grown in many economies in the past decade. These types of credit, facilitated by online platforms rather than traditional banks or lending companies, are referred to as “fintech credit”. Moreover, in the past few years, many large companies whose primarily business is technology (big techs) have entered credit markets, providing “big tech credit” either directly or in partnership with financial institutions.

Findings

We find that in 2019, fintech and big tech credit (together “total alternative credit”) reached nearly USD 800 billion globally. Big tech credit has shown particularly rapid growth in Asia (China, Japan, Korea and Southeast Asia), and some countries in Africa and Latin America. By contrast, fintech credit volumes declined in 2018-19 due to market and regulatory developments in China. Outside China, fintech credit is still growing. We find that these alternative forms of credit are more developed in countries with higher GDP per capita (at a declining rate), where banking sector mark-ups are higher and where banking regulation is less stringent. Fintech credit is also more developed where there are fewer bank branches per capita. We find that these alternative forms of credit are more developed where the ease of doing business is greater, investor protection disclosure and the efficiency of the judicial system are more advanced, the bank credit-to-deposit ratio is lower, and where bond and equity markets are more developed. Overall, both fintech and big tech credit seems to complement other forms of credit, rather than substitute for them, and may increase overall access to credit.

https://www.bis.org/publ/work887.htm

7. Oversupply of Weed

“STOP GROWING SO MUCH WEED!“

Francis Scialabba

MKM Partners analyst Bill Kirk to Aurora Cannabis.

Shares of the Canadian marijuana producer fell 29% yesterday after reporting quarterly results that were less dank than expectations.

- Shares hit a four-year low. Remember, four years ago…weed wasn’t even legal in Canada (that happened in 2018).

What’s going on? Aurora misjudged the market for legal cannabis in Canada, focusing on premium products instead of more popular budget items, reports MarketWatch.

- And that’s what Kirk was getting at. “Aurora grows more stuff that people don’t want than they grow stuff people want,” he said.

Looking ahead…Miguel Martin, Aurora’s third CEO this year alone, admitted the company “slipped from its top position in Canadian consumer,” and his focus is to get back to the top “immediately.”

Morning Brew https://www.morningbrew.com/?utm_expid=.ZTQPzZIzTFOdxoi4D0Ey0Q.0&utm_referrer=https%3A%2F%2Fwww.google.com%2F

Aurora Cannabis Crashes to New Lows

8. Q2 Commercial Real Estate Deal Volume…It Will Be Interesting to See Comparison vs. Q3

Already there are clues this might be coming, says William Pattison, head of real estate research and strategy at MetLife Investment Management (MIM). “It’s very common right now for tenants whose leases are maturing to renew them on a shorter-term basis while they figure out what to do.”

9. The Number of Stores Offering In Store Checkout Set to Rise to 10,000 by 2024

Here are some of the key takeaways from the report:

· The number of stores with autonomous checkout is set to rise from 350 in 2018 to 10,000 by 2024, with their payment volume positioned to jump from under $70 million to over $20 billion — and that’s just the tip of the iceberg.

· Adoption of the technology will be driven by the convenience it offers consumers, the savings and revenue it brings retailers, and the technology’s eventual ability to scale.

· Payments companies should invest in autonomous checkout now — by developing their own solution, partnering with a third-party provider, or acquiring an established player — to entrench themselves in the emerging industry.

· When evaluating which companies to work with, and how, payments firms should consider each prospect’s shopping experience, accepted payment methods, expansion plans, and more.

· No matter how payments companies enter the space or which providers they choose to work with, they’ll need to move quickly and emphasize the importance of communication between all parties involved.

10. Six Negative Mindsets That Increase Your Anxiety

And simple, practical tools to overcome these patterns

Source: Thibault Debaene/Unsplash

There is a lot to be anxious about these days! Even those of us who are not normally anxious may be more anxious than usual because of all the uncertainty surrounding very important aspects of our lives like our health, finances, societal institutions and the future of the planet. We may even be uncertain what to believe with all the gaslighting and fake news that is out there. You may not be able to stop being anxious, but you can stop your anxiety from taking you down a dark tunnel, wasting your energy, and causing you to make unwise choices. In this article, I describe 6 negative mindsets that anxiety can create and how to redirect so you can get back on track.

1. Being vigilant

If you suffer from anxiety, you focus a lot of attention on anticipating how things could go wrong or how your safety, financial security, or relationships may be threatened or unstable. You live in the land of “What ifs.” The problem is that the more you focus on something threatening, the more you reinforce brain pathways linked to worry and anxiety, making them stronger. Also, you are more likely to notice negative things that are not important to pay attention to, like a spider crawling on a rock outdoors, or a scowl on the face of somebody you don’t know and aren’t interacting with. When your attention is on these things, you may not be able to be present and mindful. You may also seek out negative information on the internet and social media and spend too much of your day watching negative news reports.

What to do

Make a conscious effort to pay attention to positive, non-threatening things you encounter, like your dog’s wagging tail, the beautiful ocean print on your wall or your child’s shriek of delight when she sees a ladybug. Focusing on your senses can calm you down and get you out of your brain’s worry network. Try to stay in the present more by redirecting attention when you notice your brain is worrying about the future.

2. Interpreting ambiguous situations as threatening

People with anxiety have a biased attention so that you are more likely to see a great deal of threat in situations where there is a slight possibility of something bad happening. If you are waiting for medical test results, you will convince yourself that you have whatever dreaded disease they are testing for, even if there is only a 5 per cent likelihood of a positive result. If you get a letter from the bank, you will be convinced before you open it that you have been a victim of identity theft or that your mortgage application has been turned down.

What to do

Make a conscious effort to consider different possible meanings of a situation, not just the most negative one. Take a step back and broaden your view. Anxiety tends to narrow your focus to just the threatening parts. Or make a decision to reserve judgment until you get more information. Then distract, distract, distract.

3. Overestimating the probability of something bad happening

If you have anxiety, you may see even a slight chance of something bad happening as a considerable threat. This may lead you to spend a lot of extra time, money, and energy planning for things that most probably won’t happen. You may force yourself to drink green juice every day, so you don’t get vitamin deficiency when you actually eat a balanced diet. You may be too scared to stay home alone when your partner is away because somebody may break in, even though nobody has broken into a house in your upscale neighborhood since the 70s and you have an alarm system.

What to do

Let facts and statistics influence your choices rather than anxiety. Think about what is most likely to happen based on how often negative things have or haven’t happened in the past.

4. Catastrophizing

Catastrophizing means just what it sounds like – thinking something is a catastrophe when in actuality it is something you have sufficient resources to deal with without excessive damage. You may panic when the stock market goes down, even though you won’t need the money for 30 years. You may think every ache and pain is a sign of a serious illness or you may think that if you don’t get a promotion you are going to get fired. Catastrophizing makes upsetting things worse and creates states of worry and panic that keep you up at night.

What to do

Ask yourself whether you could survive if the negative event did happen. Think about the personal qualities and resources you have to cope. Think about the people in your life who care about you and could help you get through it. Think about past situations where you have been resilient.

5. Not paying attention to safety signals

Safety signals are signs that a situation is less dangerous than it could be, that you are protected, or that a danger is over. For example, if you were criticized for speaking up as a child, you may fail to notice that your partner actually listens to you without judgment. If you are scared of getting into a car accident, you may not notice that your partner is actually a skilled and alert driver. You may, without evidence, distrust a partner who has never lied to you and acts with integrity in day to day life. You may fear swimming in the ocean because you almost drowned when you were 9, even though you are an adult now and the ocean is calm. There are parts of your brain that are designed to detect signals of safety or danger but these may not be working properly if you have an anxiety disorder.

What to do

Consciously pay attention to those aspects of a situation that help you feel safer. Think about your own ability to keep yourself safe. Think about whether a past trauma or stressful past experience is influencing your response to the current situation. Think about what is different now than before that makes it safer (e.g., you are an adult and can make healthy choices and set boundaries).

6. Avoiding

When you feel anxious, you may get an uncomfortable feeling in your chest, throat, or stomach and your thoughts might be highly distressing and unpleasant. As a result, you may begin to avoid things that make you anxious. You may take a pill when you have only a small amount of discomfort because you fear being in pain. You may avoid dating because you are scared of being rejected. You may not speak up in meetings because you fear people will think you are stupid. The problem with avoidance is that it is reinforced in the moment. When you make the decision not to try, you start to feel relief and your body calms down. But avoidance makes anxiety worse in the long run because you never learn that the feared result won’t happen. Your discomfort won’t turn into severe pain. You can withstand rejection and move onto the next person. Or your colleagues may react very positively to your ideas. But if you don’t take a risk, you will never learn that what you think is dangerous is actually manageable.

What to do

Make a plan to confront the things you fear. If you like, you can start with something easier like speaking up to your partner and work your way up to confronting the nasty neighbor. The best way out of an anxiety-provoking situation is through! When you confront what you fear, your fear will go down and your confidence and skills will improve. Over time, you will begin to see the situation as less dangerous and to learn you can tolerate feeling anxiety in service of your goals.

Disclosure

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.