1. What Did Stock Splits Look Like During the Internet Bubble vs. Today?

From Dave Lutz at Jones Trading

2. Get Ready for a Crazy Wave of IPOs. Here Are the Ones to Watch.

Sandy Miller, general partner at Institutional Venture Partners, notes that the number of public companies has fallen in half over the last 20 years, as M&A has outstripped new issues. “There’s a real hunger for new names,” he says.

Coming Attractions:

A few of the tech companies that filed for IPOs this past week.

| Company | Latest Fiscal Year Sales | Description |

| Corsair Gaming | $1.1 billion | Video game accessories |

| Palantir | 743 million | Data analytics |

| Bentley Systems | 608 million | Construction engineering SW |

| Unity Software | 542 million | Video game developer tools |

| Snowflake | 265 million | Cloud data management |

| Sumo Logic | 155 million | Data analytics |

| Asana | 143 million | Work management software |

| JFrog | 105 million | Software release management |

Source: company reports

The supply is deep. Venture-backed unicorns—pre-IPO companies with valuations above $1 billion—are piling up like kindling. According to CB Insights, there are 490 unicorns. By contrast, there are just shy of 2,000 companies trading on the Nasdaq or the New York Stock Exchange with valuations above $1 billion. In other words, if all the unicorns magically listed at once, the number of large cap U.S.-listed companies would increase by 25%. Most but not all unicorns are tech businesses, so consider this: Over the past three years, there have been a total of 100 tech IPOs. The current supply of unicorns is equal to 14 years of tech stock debuts.

https://www.cbinsights.com/research/best-venture-capital-unicorn-spotters-2/

3. The Urge to Reverse Merge

SPACs are just getting started

The “blank check” acquisition funds known as special purpose acquisition companies, or SPACs, have raised more than $30 billionso far this year, versus $13 billion in all of last year. Can they keep it up? DealBook spoke with some of the most plugged-in SPAC bankers and lawyers on Wall Street, and they cited three factors driving the boom

1. Valuations are soaring for popular SPAC targets

“The pipeline is heavily weighted to technology and growth companies,” said Niron Stabinsky, who leads SPAC deals at Credit Suisse. He said that he speaks to big venture firms “weekly” about their portfolios. Many have taken notice of recent success stories, like Virgin Galactic’s merger with a SPAC led by the former Facebook executive Chamath Palihapitiya. SPAC offerings will be “incredibly active post Labor Day,” said Paul Tropp, the co-head of Ropes & Gray’s capital markets group. That’s part of a “significant uptick” in listings expected to hit the market before election-related uncertainty sets in: Yesterday, the tech firms Asana, JFrog, Snowflake and Unity all filed to go public.

2. SPACs aren’t just an alternative to traditional I.P.O.s

“SPACs have become a new way of doing an M.&A. deal,” said Jeff Mortara, the head of equity capital markets origination at UBS. A merger with a SPAC allows the target company’s investors to retain a stake while gaining liquidity, and deal negotiations can be done directly, secretly and quickly. SPACs typically have two years from their I.P.O. date to complete a merger.

3. The flood of money to SPACs means better terms for targets

“Everything is negotiable,” the venture capitalist Bill Gurley wrote in a detailed case for SPACs on his blog this weekend. As competition between SPACs intensifies, “sponsors are continuing to negotiate deals that look better for the companies they buy,” he said in the essay, which quickly became the talk of Wall Street and Silicon Valley.

Why? Some SPAC sponsors are open to a smaller “promote” — the stake the sponsor gets essentially free after a merger. (Traditionally, a sponsor takes 20 percent.) SPACs also award warrants to the vehicle’s investors, which give them the right to buy larger stakes in the merged company at a discount; these are becoming less dilutive as sponsors shift their terms to be more favorable to the target company. In the life-sciences industry, where SPACs have “nearly replaced late-stage financing and I.P.O.s,” warrants have come down to zero in some deals, said Christian Nagler, a partner in the capital markets practice at the law firm Kirkland & Ellis.

The standard-bearer of a new approach for SPACs is the $4 billion fund sponsored by Bill Ackman’s Pershing Square, the largest to date. The fund’s warrants are structured in a way that encourages investors to stay invested longer in the merged company, and Pershing will take its “promote” only if the company it buys meets certain performance goals. Sponsors without Mr. Ackman’s reputation may find those terms hard to imitate, but some are adopting similar elements all the same, experts say.

What’s next? Mr. Gurley predicted that SPAC fund-raising this year could be four times higher than the previous record, set in 2019, implying another $20 billion or so to come. The buoyant markets are attracting figures not known for deal making to the space, like the former Congressman Paul Ryan and the baseball executive Billy Beane, which sows doubts among some about the durability of the boom. Just SPAC mergers involving electric car companies and auto technology firms — “deals on wheels,” as one analyst put it to The Times’s Neal E. Boudette and Kate Kelly — are already worth more than $10 billion.

____________________________

Today’s DealBook Briefing was written by Andrew Ross Sorkin in Connecticut, Lauren Hirsch in New York, and Michael J. de la Merced and Jason Karaian in London.

Editors’ Picks

4. Investors Dump ‘Dead Weight’ Cash-Like ETFs at Record Pace

Katherine Greifeld

Investors Dump ‘Dead Weight’ Cash-Like ETFs at Record Pace

(Bloomberg) — Investors are abandoning cash holdings at a record clip as momentum continues to build behind 2020’s risk rally.

Roughly $5.4 billion has exited from the $20 billion iShares Short Treasury Bond exchange-traded fund — the biggest ultra-short duration ETF — over 14 consecutive weeks of outflows. That was the longest streak on record for the product, whose ticker is SHV. Meanwhile, investors have pulled $2.4 billion from the $14 billion SPDR Bloomberg Barclays 1-3 Month T-Bill ETF (BIL) over 10 weeks, according to Bloomberg Intelligence data.

Investors accumulated record amounts of cash earlier this year amid concern over the impacts of the coronavirus pandemic on the global economy, with assets in money-market mutual funds soaring to a record $4.8 trillion in late May. Now, that cash is coming off the sidelines as stocks surge and corporate bonds look increasingly appealing. Additionally, the Federal Reserve’s commitment to keep interest rates at near-zero levels for the foreseeable future is further curbing appetite for short-duration Treasury ETFs.

“It’s recognition that ‘ZIRP’ will be around for a long time, combined with a rising risk appetite,” said Kathy Jones, Charles Schwab Corp.’s chief fixed-income strategist, referring to the concept of a zero interest-rate policy. “Short-term Treasury ETFs are looking less attractive than alternatives. Equities are benefiting. We also see interest in foreign equities and high-yield and emerging-market bonds.”

The S&P 500 has surged more than 55% from March’s bottom, notching a fifth straight month of gains in August. The Fed’s credit market backstop has boosted both investment-grade and junk bonds, with the largest high-yield debt ETF climbing nearly 24% since late March. The emerging-market outlook is also considerably brighter amid the dollar’s continued weakness and the Fed’s new average-inflation targeting regime.

The exodus from ultra-short duration ETFs is also likely due to investors trying to eliminate the “cash drag” in their portfolios by reinvesting in higher-yielding assets, according to Dan Suzuki at Richard Bernstein Advisors.

“Because they’re not generating any yield, they are acting as huge dead weight in many people’s portfolios,” said Suzuki, the firm’s deputy chief investment officer. “Investors are probably chasing higher returns, which means moving up the risk spectrum.”

(Updates prices in 5th paragraph.)

For more articles like this, please visit us at bloomberg.com

https://finance.yahoo.com/news/relentless-risk-rally-spurs-record-155206736.html

5. Warren Buffett’s Berkshire Hathaway reveals $6 billion investment in 5 Japanese giants

- Warren Buffett’s Berkshire Hathaway disclosed a $6 billion bet on five of Japan’s biggest trading companies in a press release on Sunday night.

- The billionaire investor’s company revealed that it owns just over 5% of Mitsubishi, Mitsui, Itochu, Marubeni, and Sumitomo.

- “I am delighted to have Berkshire Hathaway participate in the future of Japan and the five companies we have chosen for investment,” Buffett said in the statement.

- Visit Business Insider’s homepage for more stories.

Warren Buffett marked his 90th birthday on Sunday by revealing a $6 billion investment in five of Japan’s largest trading companies.

The famed investor’s Berkshire Hathaway conglomerate has built passive stakes of just over 5% in each of Itochu, Marubeni, Mitsubishi, Mitsui, and Sumitomo over the past 12 months, it said in a press release. Its National Indemnity subsidiary made the investments and will officially notify Japanese regulators of the positions when trading begins on Monday.

“I am delighted to have Berkshire Hathaway participate in the future of Japan and the five companies we have chosen for investment,” Buffett said in the press release.

“The five major trading companies have many joint ventures throughout the world and are likely to have more of these partnerships,” he continued. “I hope that in the future there may be opportunities of mutual benefit.”

Shares in Itochu, Marubeni, Mitsubishi, Mitsui, and Sumitomo all rose between 4% and 10% on Monday.

Buffett’s company highlighted its longstanding positions in Coca-Cola, American Express, and Moody’s in the statement, underscoring its intention to maintain the Japanese investments for the long term.

Berkshire has the option to boost its stakes as high as 9.9% in any of the five companies. Buffett pledged to seek approval from the relevant board of directors to raise it beyond that point.

Investing in Japanese companies is a departure from the norm for Berkshire, as it has historically favored American businesses such as Apple and Bank of America. However, it has made a few foreign bets on companies such as Brazilian payments group StoneCo.

6. QQQ vs. EFA (developed Europe) 5 Year Chart….U.S. Tech Sector Now Worth More Than Entire European Stock Market.

QQQ +179% vs. EFA +8%

The US tech sector is now worth more than the entire European stock market, Bank of America says

Henny Ray Abrams/AP Photo

- US tech stocks have overtaken the entire European stock market in market value as investors crowd into mega-caps to ride out the coronavirus pandemic.

- The tech sector is now worth $9.1 trillion, Bank of America said Thursday, while European stocks — including those in the UK and Switzerland — are worth a collective $8.9 trillion.

- The five largest US tech stocks — Apple, Microsoft, Alphabet, Amazon, and Facebook — are worth a collective $7.5 trillion and make up nearly 24% of the S&P 500.

- Amazon has jumped the most in 2020 so far, while Alphabet’s Class A shares have gained the least.

- Visit the Business Insider homepage for more stories.

US tech stocks surpassed the entire European stock market in market value after surging through the summer on outsize investor interest, Bank of America said in a note to clients.

The sector has notched several extraordinary superlatives through the coronavirus pandemic. Tech names fueled the US market’s rapid leap out of bearish territory and now host historically high investor crowding. Most recently, the group drove the S&P 500 to a record high, while the US remains deep in an economic slump and economists fear a double-dip recession.

Tech stocks’ market cap totaled $9.1 trillion as of Thursday, Bank of America said. That, for the first time, dwarfed the total value of all European stocks — including those listed in the UK and Switzerland — which stood at $8.9 trillion.

To emphasize the speed at which tech stocks have grown, the bank noted that Europe’s market cap in 2007 was roughly four times the size of the sector.

Much of that value is concentrated in the top five tech giants: Apple, Microsoft, Alphabet, Amazon, and Facebook. Together the companies make up nearly 24% of the S&P 500 and are worth roughly $7.5 trillion. Apple alone is valued at over $2 trillion.

Investors largely shifted capital into tech giants at the start of the pandemic, betting that the mega-caps’ cash piles and insulation from widespread lockdowns would outperform the market. Some strategists have deemed the names overcrowded, and others say they fear that antitrust measures could erode the companies’ success. But that hasn’t stopped the sector from continuing its run-up through the summer.

Of the five giants, Amazon has surged the most through the year. The stock is up roughly 85% in 2020, thriving on a surge of online retail activity as Americans stayed at home.

Alphabet’s Class A shares are up the least year-to-date compared with its mega-cap peers. Still, the shares have gained roughly 22% in 2020 and more than 7% over just the past month.

7. Dollar Breaking 200 Day Moving Average

A weak dollar is impacting an uneven global market recovery

Dion Rabouin, author of Markets

After sinking on Friday, the dollar is teetering near its lowest in more than two years, and threatening to decline even further after Fed chair Jerome Powell confirmed plans to let inflation run hot in the future, likely meaning 0% U.S. interest rates for quite some time.

Why it matters: For the U.S. currency to fall in value, other currencies must rise and that can be especially harmful to export-oriented economies like the eurozone and Japan, whose central banks may be forced to take action in the coming months.

What it means: A strong currency makes a country’s exports more expensive and therefore less attractive, denting a needed source of income, especially as the world tries to recover from the coronavirus pandemic.

- But with the European Central Bank and Bank of Japan both already holding negative interest rates and having significantly expanded their respective quantitative easing programs, weakening their currencies may require extreme measures.

The big picture: The U.S. has done a far worse job handling the coronavirus pandemic than most of Europe and Japan, but that has led to a weaker currency and a much stronger bounce in stock prices. The benchmark S&P 500 has gained 8.6% this year, with the Nasdaq up 30%.

- The currency appreciation is weighing on stock indexes in the eurozone and Japan, which have recovered much more slowly than U.S. equities this year.

- Germany’s DAX is up 5% for the year in dollar terms, but in euros the index remains 1.6% lower than where it began 2020, with similar outcomes for the Italian benchmark FTSE MiB (-10.5% YTD in dollars, -15.6% in euros) and France’s CAC 40 (-11.3% YTD in dollars, -16.3% in euros), per FactSet data.

- Japan’s Nikkei index is flat on the year in dollar terms, but about 3% lower in yen.

Where it stands: The euro has risen to $1.19 and is trading just below the two-year high it touched earlier in August, threatening to break back toward its early 2018 levels around $1.25, while the dollar has fallen to 105.30 yen, eyeing 100 yen per dollar.

- The Swiss franc, Swedish krona and Danish krone all have gained at least 6.5% versus the dollar this year.

Worth noting: Commodities, which are largely priced in dollars, also look poised to further benefit from the greenback’s slide. Gold and silver have had breakout years, each up more than 30% for the year, and other commodities are picking up — copper has risen 12% since July 1, and cocoa is up 23.6%.

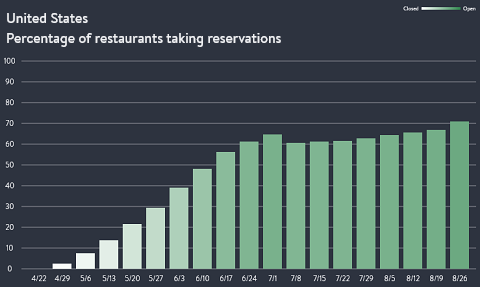

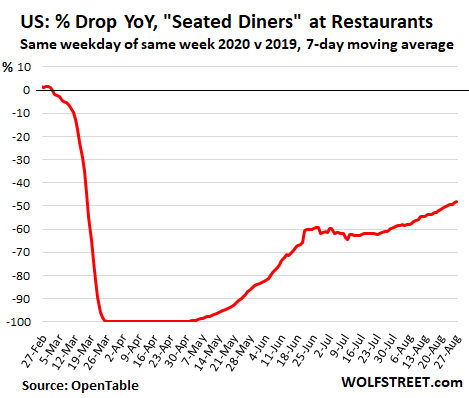

8. Update on Restaurant Reservations

In the US, about 75% of the restaurants that took reservations before the pandemic are now taking reservations again, up from zero in April, according to data from OpenTable which provides online reservation services for 60,000 restaurants. Back on July 1, already 65% of the restaurants were taking reservations again, but then new outbreaks spreading across the country, particularly in the South, triggered some retrenching (chart via OpenTable):

The State of the American Restaurant, City by City–by Wolf Richter • Aug 29, 2020 • 108 Comments https://wolfstreet.com/2020/08/29/the-state-of-the-american-restaurants-city-by-city/

9. Follow Up From My Link Yesterday to Most Under 40’s Ever in U.S…..Population in U.S. Median Age is Trending Higher.

Thanks to Joe D at Philly Inquirer for Passing Along.

https://www.statista.com/statistics/241494/median-age-of-the-us-population/

10. Why Misinformation Goes Viral

Psychological factors affect the spread of misinformation during crises.

In the continued war on misinformation, LinkedIn and Facebook just removed millions of posts containing misinformation about the coronavirus. And it is believed that is but a fraction of the posts. When John Oliver tackled the flood of misinformation surrounding the COVID-19 pandemic, he mentioned the “proportionality bias” — that big events beg big explanations — to explain why misinformation, particularly conspiracy theories, have had a heyday with the current crisis. However, the science suggests that it is more than just the proportionality effect at play making this crisis exceptionally fertile grounds for seeds of misinformation.

Negativity Bias. For starters, our evolutionary heritage leads us generally to pay more attention to negative information than to positive information. This negativity bias was important to the survival of our species, as attending to the tiger prowling the encampment was more imperative than celebrating the latest birth. We see this reflected in our news which disproportionately features headlines about the latest travesty while feel-good stories are relegated to the back pages. And recent research has shown that this attention to negative news is evident at the physiological (and neurological) level across samples in 17 different countries.

Ultimately, this means that if something bad is happening, it’s got our attention. A once-a-century pandemic killing hundreds of thousands certainly qualifies. Thus, already, we are on the outlook for information. Further, evidence suggests that negative information is viewed as more credible than positive information. So not only are we paying attention but we are also primed to believe it.

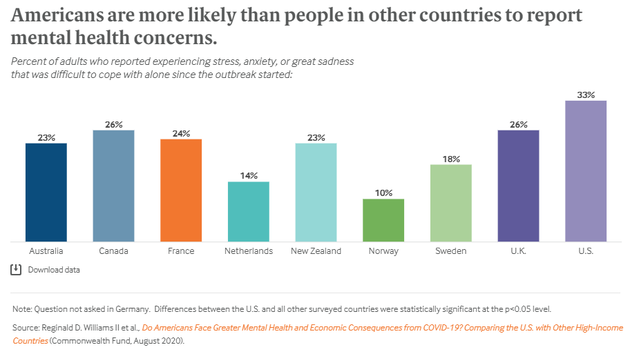

Social Risk Amplification. This negativity bias gets a boost when information is shared. In a recent interview, it was said that the spread of misinformation is like a “screwed up game of telephone.” In fact, using these “diffusion chain experiments” is a common choice in experimental studies examining the transmission of information. In a 2015 study researchers had strings of 10 participants pass along information about the risks and benefits of a controversial drug (i.e., triclosan). Overall, all messages became shorter and increasingly inaccurate. However, by the end of the “diffusion chain” information about the benefits had been relatively lost whereas information about the risks continued to spread. Further, individual biases about risks led to the amplification of risks down the chain. A follow-up 2020 study showed that this amplification effect is even stronger when people are feeling stressed and unfortunately, new research shows that Americans are even more stressed about the coronavirus than other nations.

American Stress Levels Compared

Source: Reginald D. Williams II et al., Do Americans Face Greater Mental Health and Economic Consequences from COVID-19? Comparing the U.S. with Other High-Income Countries (Commonwealth Fund, August 2020).

Dread Risks. As if that weren’t enough to provide a megaphone for misinformation during stressful times, social risk amplification is even more likely when people are experiencing what are called dread risks, i.e., life-altering, disastrous, random, events that present a threat to mortality. In a 2018 study, researchers using an 8-person diffusion chain experiment paradigm randomly assigned groups to transmit low- or high-dread risk messages. As the message passed from person to person the high-dread chains became more and more negative in their transmission of the message relative to the low-dread chains, and those messages became more and more distorted. We saw a real-life example of this with the transmission of information about the Ebola outbreak in 2015 via Twitter and Facebook where the diffusion chains are no longer just 8 or 10 people long but spread across millions of users each with their own megaphones of various wattage.

Frustration with the Scientific Method. To further complicate matters, the current pandemic features a novel coronavirus. Meaning there wasn’t a wealth of accurate information from science at the outset of the outbreak because how could there be? It was new. Scientists are racing to find answers. Science, however, is constrained by the scientific method which is much slower than the pace at which fearful stressed citizens want information. It takes considerable time, customarily, to build a scientific consensus. Thus, in this race for information, science often lags behind misinformation because the Twitter user recommending alcohol to combat COVID-19 is not similarly constrained.

article continues after advertisement

This scientific method can further be frustrating to individuals when the process of replication and peer review kicks in and leads to the modification or retraction of findings. These updates are more likely to occur when there is a race for answers and thus usually meticulous methods are viewed as less important than expediency. When recommendations are altered based on new evidence, this is a sign that science is working. However, when sources who are supposed to “have the facts” change course, it can result in a tainted truth effect damaging trust in those sources. Meanwhile, our Facebook friends are not held to the same standard.

Fear and Shallow Processing. Consequently, the wrong information, if repeated and said with certainty, can be more persuasive than the latest science, especially when we don’t take the time to process messages (e.g., read beyond the headline). Shallow processing is even more likely on the internet, where information flies by at the speed of a scroll and among people who are afraid such that they are looking for any type of action to protect themselves.

Due to this perfect storm of contributing factors we are seeing the spread of misinformation take on pandemic proportions (now available in 25 languages). Scientists often feel like they are combating two viruses. As citizens wishing to avoid infection, we need to practice good information hygiene in addition to good personal hygiene—starting with recognizing some of the signs that something you encounter might be misinformation, just as you would be on high alert when you hear someone cough or sneeze. Further, engage in basic fact-checking. Be the investigator, find the source of the information, and weigh the evidence supporting their claims. If you don’t have the time to do the investigation, do not share. You could save a life by stopping the spread of misinformation.

Disclosure

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.