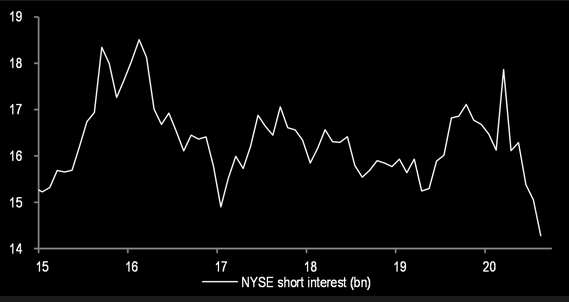

1. Short-Interest in NYSE Stocks at Multi-Year Low.

BloggersnoteShort interest in equities at multi-year lows

From Dave Lutz at Jones Trading

2. Triple Levered Nasdaq ETF Hitting Record Inflows.

Levered Tech

Not only has bullish activity ramped up again in the options market, leveraged bets are soaring in the exchange-traded fund space. A triple-leveraged ETF that tracks the Nasdaq just notched its best streak of inflows on record — throughout the selloff. The $7.8 bln ProShares UltraPro QQQ fund attracted over $1.5 bln in the eight days through Friday, the most for such a span since trading began in 2010. It has become a popular vehicle for day traders, who pushed volume to a record earlier this month. After steadying Monday, the Nasdaq is down 7% so far this month (the TQQQ fund -21%). – BBG

Christopher Preston

ILC/Trading and Operations

River and Mercantile Solution

3. U.S. Municipalities Selling Taxable Bonds at Near Record Pace

Danielle Moran

U.S. Municipalities Selling Taxable Bonds at Near Record Pace

(Bloomberg) — State and local governments haven’t sold this many taxable bonds in a decade.

The sellers have issued $92 billion in debt subject to federal income taxes so far this year, according to data collected by Bloomberg. That’s almost a third of all the long-term municipal bonds sold in 2020 and is the most since 2010, when the Build America Bond program sunset at the end of that year.

“I’m astonished at the pace of taxable municipal bond sales,” said Kathleen McNamara, a senior municipal strategist at UBS’s wealth management arm.

https://finance.yahoo.com/news/u-municipalities-selling-taxable-bonds-174904199.html

4. U.S. Household Income Hits A Record.

We’ve never had it so good: US Household Income hit a fresh record high before the pandemic recession. Household incomes increased by 8.7% to $68,700. That record came as individual workers saw their earnings climb and as the total number of people working increased.

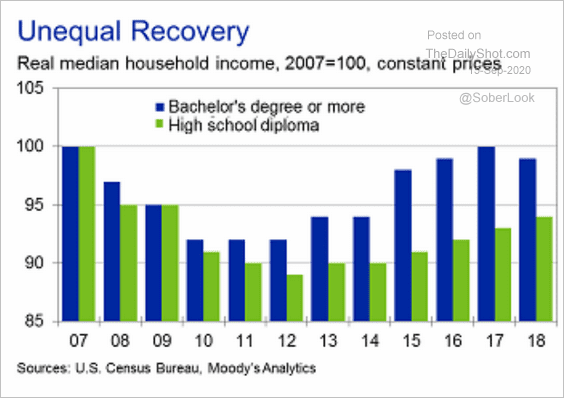

5. Real Median Household Income By Education Level.

https://dailyshotbrief.com/the-daily-shot-brief-september-15th-2020/

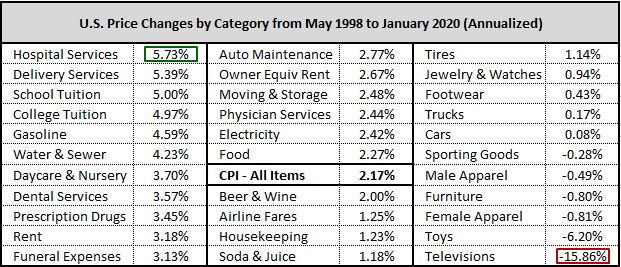

6. What’s Driving Inflation? The Irrelevant Investor

Posted September 13, 2020 by Michael Batnick

One of the basic concepts in economics is that things get more expensive over time. But there is a lot of nuance in such a simple idea. Not everything goes up by the same amount, and in fact not everything goes up.

As you can see in the table below, Televisions, toys and furniture have all gotten less expensive over the last 20 plus years,. What makes the cost of some items go up while others go down?

Sponsored by Advertising Partner

This idea, among others was explored in a new piece by “Jesse Livermore”, called Upside-Down Markets. In it he said:

Industries that aren’t able to appreciably increase their productivity tend to experience above-trend inflation. They rely on a labor supply whose cost is increasing faster than inflation, but they aren’t able to use that supply any more efficiently to generate output, so they have to pass the cost on to consumers, raising prices at a pace that exceeds inflation as well.

One of the areas that has increased prices faster than the overall economy is colleges, which Livermore says:

Are in the business of selling a prestigious credential, and one of the determinants of the prestigiousness of the credential is a low student-to-teacher ratio. In 1998, it took one professor to teach a college course at a specified student-to-teacher ratio. Today, it takes that same number, by definition.

On the other end of the spectrum are things like sporting goods and televisions, which has seen prices fall due to globalization. Livermore says:

Durable goods industries such as clothing, toy, furniture, and electronic manufacturing are more able to arbitrage differences in international labor costs than services industries such as child care that can’t offshore their production as easily. As a consequence, durable goods industries have experienced less inflation, if not outright deflation.

As we’ve seen over the past decade, inflation is one of the least understood concepts in all of economics. We can’t predict it, can’t control it, and don’t even know for sure where it comes from. Thanks to this brilliant post, I know a little more about this topic than I did yesterday.

Source:

Upside Down Markets: Profits, Inflation and Equity Valuation in Fiscal Policy Regimes

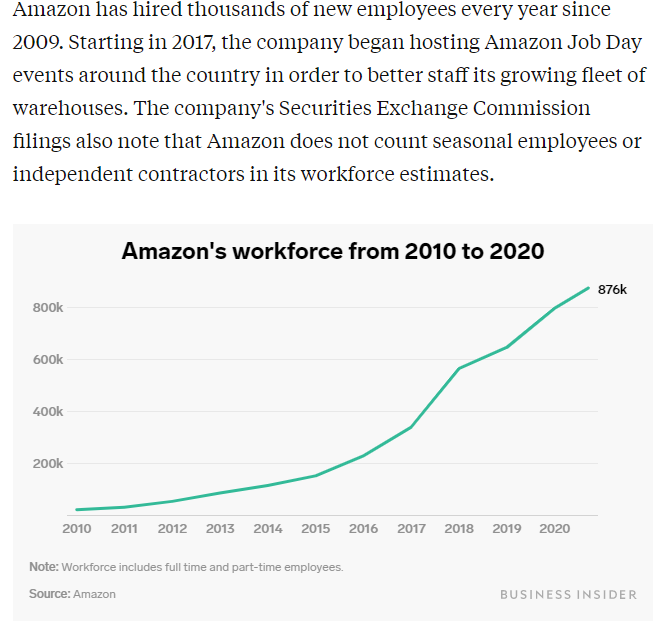

7. Amazon Workforce from 2010-2020

Two charts show Amazon’s explosive growth as the tech giant prepares to add 133,000 workers amid record online sales

3 hours ago

https://www.businessinsider.com/amazon-number-of-employees-workforce-workers-2020-9

8. Snapshot of World Economy

https://www.linkedin.com/feed/update/urn:li:activity:6711663494674182144/

9. Four Questions to Help Demystify Your Relationship With Money

An author seeks to prompt critical thinking about money and the status and power that are accrued from it. Several experts offered their own take.

“Wealth doesn’t look anything like what Hollywood is selling us,” said Jennifer Risher, who wrote a book about her experiences with wealth.Credit…Jim Wilson/The New York Times

Jennifer Risher took a job in campus recruiting at Microsoft in 1991. She was 25 and given stock options worth several hundred thousand dollars. While working there, she met her husband, David, who had more stock options than she did. He later left to work for Amazon when it was still just selling books and got even more valuable options there.

In a few years, they were worth tens of millions of dollars and on their way to a comfortable life. When Ms. Risher looks back, was it luck or good decisions that helped her land that Microsoft job?

She poses that question and others in her book, “We Need to Talk: A Memoir About Wealth,” which is out next week. They are an effort to prompt critical thinking about money and the status and power that are accrued from it.

“Wealth doesn’t look anything like what Hollywood is selling us,” Ms. Risher said. “I want to demystify wealth — an experience millions of people have but can’t talk about. There’s a normalcy to it when all your friends are similarly wealthy.”

In a country that is politically, economically and racially divided, Ms. Risher is asking her readers for a level of introspection that can be difficult. The timing of her book could end up making her a target of anti-rich opprobrium, several wealth advisers told me.

But asking tough questions about money is an important exercise in understanding what we have, how we got it and how we feel about it.

Of course, the questions people typically pose about their wealth depend on their perspective. Ms. Risher, for example, grew up white and middle class, with a father who worked in the insurance business and a mother who worked at home when Ms. Risher and her brother were young, before resuming a career as a librarian.

That upbringing set Ms. Risher up to attend a private liberal arts college on the East Coast. It did not set up her to understand the tens of millions of dollars that she and her husband would acquire.

The approaches also differ among academics and advisers whose job it is to prompt families to be introspective about their wealth. I reached out to several this week to get their views on Ms. Risher’s questions and ask them what difficult ones they recommend people ask themselves.

Why is it OK for you to have money when other people don’t?

“I think that’s a really important question, particularly if you come into money fast,” said Bradley T. Klontz, associate professor of financial psychology at Creighton University. “If you don’t have a good answer to that, you’re going to sabotage yourself. You’re going to find ways to get rid of it.”

Ms. Risher is looking to demystify wealth in her book, “We Need to Talk: A Memoir About Wealth.”Credit…Jim Wilson/The New York Times

One thing to understand in answering that question is the risk of social comparison. No matter how much money you have, people are wired to compare themselves with others.

“It’s the deep subconscious terror that if we feel we’re going to be separated from our tribe, we’re going to die,” Dr. Klontz said.

It’s also something that can cause people with money to do less than they could, he said. His follow-on question is about what meaning a life of wealth should have.

How can we help you lead a better, more fulfilling life at home during the pandemic?

Ask us a question or tell us what’s on your mind.

“Our built-in purpose is to fight for our daily survival,” he said. “What is my purpose when that purpose is taken away?”

Without having intention, the wealthy tend to become disconnected from the variety of people they knew before they became affluent.

“We’re here to make the world a better place, however we’re defining the world,” Dr. Klontz said. “It’s the responsibility and the opportunity.”

What does living well mean to you?

What comes to mind when you hear this question says more about you than the question itself. It’s open ended, which makes it great for discussion. But it also forces people to be contemplative.

“People can find surprises about themselves,” said Keith Whitaker, president of Wise Counsel Research, a consultancy on family wealth and philanthropy. “Living well at one point meant success in my career. Or it meant being the best parent I could be. Or living well meant forgiving myself for mistakes or choices that turned out differently.

“All these things don’t have anything to do with money, but money can be a means for happy choices or unhappy choices,” he added. “Knowing what living well means provides the North Star for those choices.”

Dr. Whitaker said that even the most introspective people started by listing the superficial trappings of living well — homes, cars, boats, trips. But when people are allowed to sit with those answers, they often come up with more.

“It’s then that they realize, ‘I don’t just want those things,’” he said. “‘I want those things with good friends, or good relationships with my children and grandchild.’ Or ‘I want those things with a sense of integrity.’”

That’s where these questions can move people to think about their money as more than just a way to buy what they want. It gets people to think about how they want to be involved in their family, their community and the world.

“Many of the families and individuals I work with are really questioning the withdrawal from the world that wealth can buy you,” Dr. Whitaker said. “With the pandemic, people are saying: ‘I don’t want less responsibility. I want more responsibility with wealth.’ But that requires first asking, ‘What do my responsibilities entail?’”

What is the No. 1 job you want money to do?

For Michael Liersch, head of advice and growth strategies at Wells Fargo Private Bank, this question is the first of three related ones that he puts to every family he works with. (The others: Do you feel that you have enough? Who should be involved in these conversations?)

Dr. Liersch pointed out the importance of framing the question. Finding the most neutral, open-ended way to ask the question creates a greater likelihood of getting a more productive response.

“You can frame questions in a way that will drive you to or from a certain situation,” he said. “You want to bring people into that conversation, not push them away.”

One thing Dr. Liersch tries to do in these conversations is set the stage to get answers and ideas out there for family members to discuss. But he also tries to show people that answering these questions just once isn’t enough, particularly now, when views on wealth and privilege diverge greatly.

“Research would suggest the more intentional we are with creating our guiding principles, the more likely we are to achieve them,” he said.

How does money connect you to other people?

This was a question Ms. Risher asked herself as she looked back on major life choices, including living in the same neighborhood as fellow tech workers, sending her children to private school and sharing her wealth with family and friends.

“Even with people who have a lot of wealth, money isn’t connecting us,” she said. “When money is a barrier to those connections, that’s a problem. Our silence around money just makes it more powerful than us. We aren’t able to see reality.”

In her book, she wrote about a friend who later told her that Ms. Risher and her family hadn’t been invited to the circus because the friend was afraid they would want to sit in expensive front-row seats. Ms. Risher said she was shocked at first, but then heartened that the friend could raise the issue with her.

“The fact that she trusted me enough to talk about money made me feel closer to her,” she said. “It also woke me up and showed me how out of touch I could be. If we talk more, it raises awareness of how broken our country is right now.”

Paul Sullivan is the Wealth Matters columnist. He is also the author of The Thin Green Line: The Money Secrets of the Super Wealthy and Clutch: Why Some People Excel Under Pressure and Others Don’t. @sullivanpaul

10. These 5 Habits Will Help You Stay Focused All Day. A Psychologist Explains Why

Finding it hard to concentrate these days? Here’s how to get back on track.

BY MINDA ZETLIN, CO-AUTHOR, THE GEEK GAP@MINDAZETLIN

Getty Images

Are you having a hard time staying focused on work, especially in these high-stress days? Some simple techniques can make a big difference, psychologist Traci Stein explains in a recent Psychology Today post. Give her techniques a try and see how your own focus improves, and build them into daily habits to keep that benefit going into the future. You can find the full list here. These are some of her best tips.

1. Take care of your physical needs.

“Of course, the most basic foundation for focusing is to take good care of yourself,” Stein writes. This means getting regular exercise, which has been shown to help you increase focus later on, as well as other cognitive benefits. A few minutes a day of meditation — which Bill Gates does — will also enhance your ability to stay focused.

Beyond that, make sure you’re getting good nutrition which also supports brain function. Most important of all, get plenty of sleep. Sleep has fantastic benefits for both your brain health and your overall health. And when you’re tired, it’s much harder to focus on anything.

2. Plan for your “escape behaviors.”

What are escape behaviors? Stein defines them as “those things you do to alleviate the stress or boredom that crops up whenever you have to work on a specific task or assignment.” They vary from person to person but can include things like mindless snacking (I do that), getting sleepy, checking your email (guilty!), checking social media, or suddenly getting very sleepy.

The key to dealing with escape behaviors is to anticipate them because you know yourself well enough to know which are likely to crop up during any given workday, Stein writes. If you’re liable to get sleepy, try switching to a standing desk for a while (I find upbeat music helps too). And have tea or water on hand because sleepiness is often dehydration in disguise. If you’re liable to snack, prepare a reasonable portion of a healthy snack to keep by your desk for that day. If you’re tempted to read email or check social media, anticipate that by turning off notifications. Consider signing out of your email program while you’re focused on other work, and/or putting your smartphone someplace out of reach.

3. Plan regular breaks.

It’s often difficult to stay fully focused for lengthy periods of time and trying to force yourself to do that will only work against you. So plan for frequent breaks. One popular approach is to use the Pomodoro Technique, which calls for 25 minutes of focused work followed by a 5-minute break, with at least a 15-minute break every two hours. Or, work for 52 minutes and then take a 17-minute break, which one experiment showed is the ideal rhythm for maximum productivity.

Whichever approach you use, it’s important that you don’t skip taking a break once you’ve worked for your allotted time. Those breaks can be a good time to indulge in your escape behaviors so you don’t feel too deprived when you deny them to yourself during work times.

4. Give binaural beats a try.

“Binaural beat technology is a type of brainwave entrainment that uses auditory tones to shift one’s predominant brainwave state into something more appropriate or relevant to the task at hand,” Stein explains. It works by playing different frequency tones in each ear. “The brain will hear the difference between these tones, rather than hearing each one separately,” she explains.

With your brain listening to the frequency difference between the tones, you can calm and relax your mind with a lower-frequency difference, or improve your alertness and focus with a higher-frequency difference.

You can find binaural beats in many places, including YouTube and Spotify. For obvious reasons, you need to listen to binaural beats through a headphone for them to work properly.

5. Forgive yourself for losing focus.

These are stressful times. Most of us are stuck at home more than we’d like to be, and we may be working remotely, sometimes with school-age children around. So you can’t expect yourself to maintain the same level of focus and productivity that you would in a more normal era — it’s unrealistic and it’s unfair. “Understand that it’s normal to feel fatigued, and scattered, and wish things were different right now,” Stein writes.

However productive or unproductive you are at any given moment, getting angry or upset about it will only make things worse. So accept the fact that you won’t always live up to your own expectations of focus and productivity. Those expectations were probably unrealistic anyhow.

Instead, praise yourself for whatever level of focus you are able to maintain, and whatever work you manage able to get done. That will make the workday more pleasant. And being happier may help you get more done.

SEP 14, 2020

Like this column? Sign up to subscribe to email alerts and you’ll never miss a post.

The opinions expressed here by Inc.com columnists are their own, not those of Inc.com.

https://www.inc.com/minda-zetlin/focus-productivity-techniques-habits-traci-stein.html

Disclosure

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.