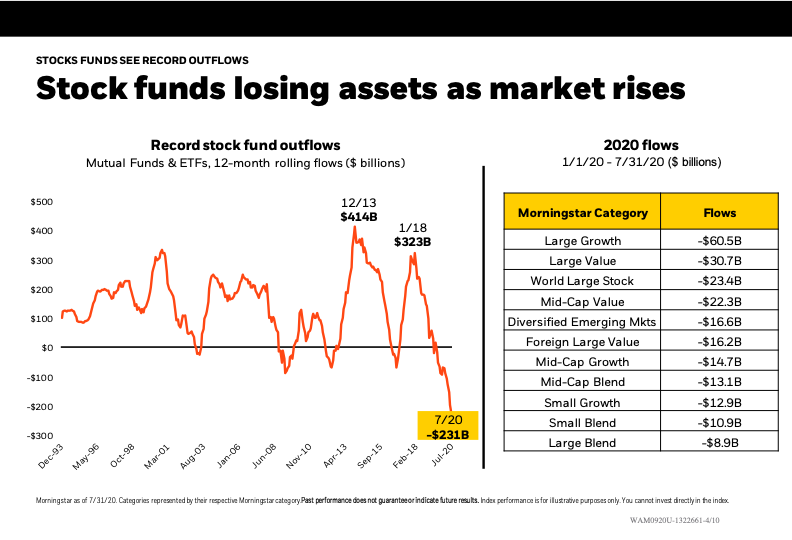

1. Stock Investors Selling Stocks on Rally

Blackrock

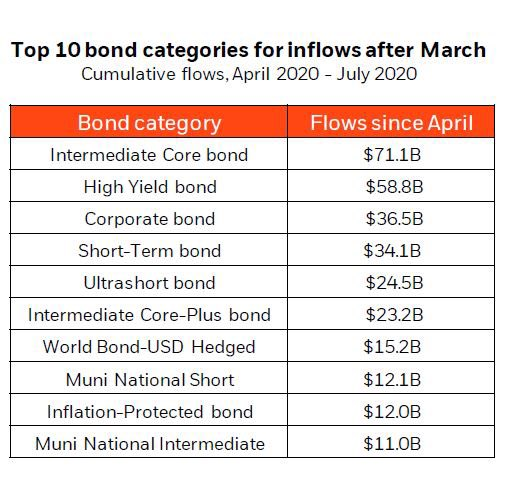

2 .Where Did The Money Flow During Recovery ? Bonds

Where did money flow at the beginning of one of the greatest stock market recoveries ever? Bonds!

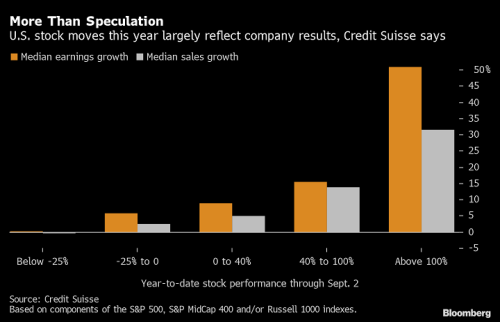

3. Stocks with Best Earnings Outperforming.

U.S. Stock Moves This Year Show Ties to EPS, Sales Growth

Source: Bloomberg Radio’s Dave Wilson

From Barry Ritholtz Blog https://ritholtz.com

4. Japan Small Cap Growth Stocks

Here’s a chart I haven’t looked at in awhile. The Japanese MOTHERS Index (small-cap growth companies) are having an insane year

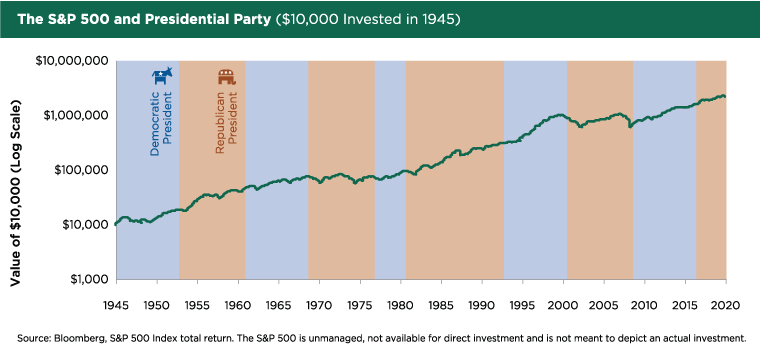

5. Another Look at Presidential Elections and the Market.

The market doesn’t “win” or “lose” on election day.

We don’t think this election presents an exclusively good or bad outcome for the financial markets. Historically, the stock market has returned 13.9% during election years. Looking more closely, the average return in the six months leading up to November elections was 6.1%, and the average return in the following six months was 6.5%.1

The average total return for stocks in the two years following an election year is 10.5% per year, with only four instances in which the market was down over that two-year period. This indicates an election outcome doesn’t represent a larger downside catalyst.1

In elections since World War II that have resulted in a change in the party occupying the White House, the average stock market return in the following year was 5.8%. When the incumbent party retained the White House, the average return was 15.5%. This includes four instances in which Democrats retained the White House and five times when Republicans retained the presidency.

When we look historically at an incumbent Republican win (a potential outcome in this election), the average market return in the following year was 8.6%. When the incumbent Republican party lost and the Democratic party moved into the Oval Office, the market averaged a return of 14.1% in the following year. The bottom line: Markets have performed well following a wide variety of election outcomes.2

We expect market fluctuations to increase as we approach the election, given the polarized political climate and potential policy shifts. Historically, market volatility has risen in the two months ahead of an election but has subsided by an average of 16% in the month afterward,3 with smaller post-election fluctuations reflecting reduced political uncertainty regardless of the outcome. We suspect the same can play out this time, with election anxiety being replaced by a focus on the economic recovery, which may instigate volatility in its own right. However, a disputed or inconclusive result on Nov. 3 (similar to the 2000 election recount) would likely produce elevated market volatility that extends beyond election day.

https://www.edwardjones.com/market-news-guidance/guidance/election-market-facts.html

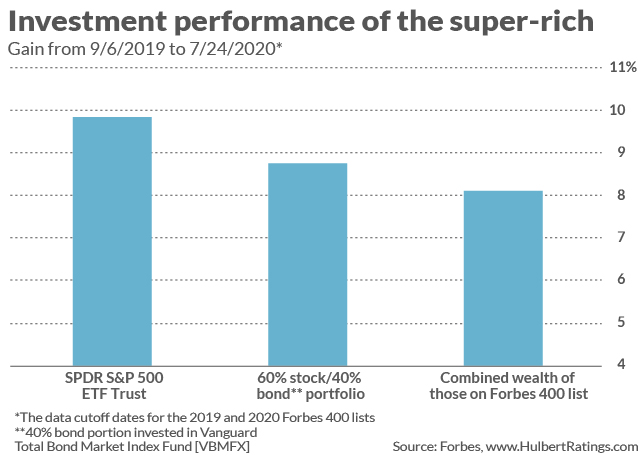

6. Forbes 400 List Portfolio’s Trailed 60/40

Opinion: Here’s the big secret of how the richest Americans made their wealth

Published: Sept. 15, 2020 at 6:55 a.m. ET

Mark Hulbert

Forbes 400 list shows that Wall Street is not where great fortunes are built

Don’t look to the richest Americans for investment advice. That’s the conclusion I draw from the latest edition of the Forbes 400 list of richest Americans, which was released earlier this month. Over the past year, the wealthiest Americans on balance did not do as well with their investments as the S&P 500 SPX, +1.27% . In fact, they didn’t even do as well as a standard 60/40 portfolio of stock- and bond index funds.

This puts in a different light the $240 billion by which the richest Americans became richer over the last year. Some commentators have made a big deal out of this big increase coming while much of the U.S. economy is struggling from the pandemic.

But in percentage terms this increase amounts to 8.1%, which is not as good as the stock market. Between September 6, 2019 and July 24, 2020, the dates on which Forbes calculated their 2019 and 2020 lists, the S&P 500 (with dividends reinvested) gained 9.8%. A 60% stock/40% bond portfolio that invested the fixed-income portion in the Vanguard Total Bond Market Index Fund VBMFX, would have made 8.8% over this period. (See chart below.)

The rich view the stock market primarily as a vehicle for preserving the purchasing power of their already-amassed fortunes.

7. Distrusting Big Pharma and the FDA

Data: Ipsos/Axios survey; Note: ±3.2% margin of error for the total sample; Chart: Andrew Witherspoon/Axios

Fewer than 1 in 10 Americans have a great deal of trust in the Food and Drug Administration or pharmaceutical companies to look out for their interests, in the latest installment of the Axios-Ipsos Coronavirus Index.

Why it matters: This two-headed credibility crisis — over the medicine that’s supposed to keep us safe and the regulators tasked with ensuring it does — shows how difficult it may be to get Americans to converge around a vaccine when the time comes.

- This also underscores the dangers of politicizing government agencies tasked with administering science and protecting the public.

What they’re saying: “It’s going to be hard for the authorities to communicate what people should be doing and how to be doing it,” said pollster Chris Jackson, senior vice president for Ipsos Public Affairs.

- “There’s going to be a huge organizational challenge in how do we get people pulling in the same direction — because nobody’s really trusted.”

Between the lines: While both have their doubters, the FDA is the more trusted of the two for now.

- 57% of Americans have some degree of trust in the FDA, though only 8% of those categorized it as a great deal of trust while the balance said they have a fair amount of trust.

- Another 42% said they had either not very much trust in the FDA or none at all.

- For pharmaceutical companies, the attitudes were flipped: 42% had some trust in the industry, though only 6% said they had a great deal of trust. Meanwhile, 57% said they had not very much or none at all.

- Hispanic respondents have the most trust in both institutions; white respondents have the least.

By the numbers: More than half of respondents age 65 or older — but only one-third of adults under 30 — say they trust pharmaceutical companies.

- Proximity to cities is a better predictor of skepticism about the FDA or pharmaceutical companies than party ID.

- 60% of urban respondents and 57% in suburbs, but only 49% in rural areas, express trust in the FDA. When it comes to pharmaceutical companies, only one-third of rural residents express trust, 10 percentage points lower than for suburban or urban areas.

The big picture: Week 24 of our national survey reflects overall stability in U.S. attitudes toward the pandemic even as parents and school systems weigh how to return to class.

- 35% of respondents with children under 18 say they’ve sent their kids back to in-person classes, while 54% have returned their kids to class via virtual or distance learning.

- 64% of Americans say they feel about the same risk of contracting the virus as they did in April; 15% say they feel they’re at greater risk, while 20% feel they’re at lower risk.

- About 9 in 10 respondents say they’re wearing a mask and keeping a 6-foot distance from others.

- 1 in 4 Americans have now been tested for the virus.

- 6 in 10 know someone who’s tested positive, and 23% know someone who’s died.

Methodology: This Axios/Ipsos Poll was conducted Sept. 11–14 by Ipsos’ KnowledgePanel®. This poll is based on a nationally representative probability sample of 1,019 general population adults age 18 or older.

- The margin of sampling error is ± 3.2 percentage points at the 95% confidence level.

8. Leadership Skill Grid

Disclosure

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.