1. Bond Prices Did Not Move in Opposite Direction of Stocks During Recent Nasdaq -10% Selloff.

Barrons

Inker’s thesis played out in markets just a few days later. On Sept. 4, as the tech-stock selloff got under way, the Nasdaq Composite sold off by as much as 5.1% to close with a 1.3% loss. And Treasury bond prices, which move opposite to yields, also sank. The 30-year Treasury yield rose 0.12 percentage point to 1.46%, in one of the largest single-day increases since the height of the pandemic panic. The 10-year yield jumped, as well, climbing 0.09 of a percentage point.

Treasuries Lose Some Haven Luster. Here Are Some Alternatives for Safety.-By Alexandra Scaggs

10 Year Treasury Yield….Will it go lower if stocks continue sell off?

2. S&P Sectors with Big Tech Make Up 50% of the Index

Party like it’s 1999: S&P Sectors w/Big Tech (S&P Technology, S&P Communications Services (Alphabet, Facebook), S&P Consumer-discretionary (Amazon)) exceeded 50% of the S&P 500’s weigh. Until now, this only existed in the days of the dot-com bubble. (via BBG)

6:35 AM · Sep 12, 2020·Twitter Web App

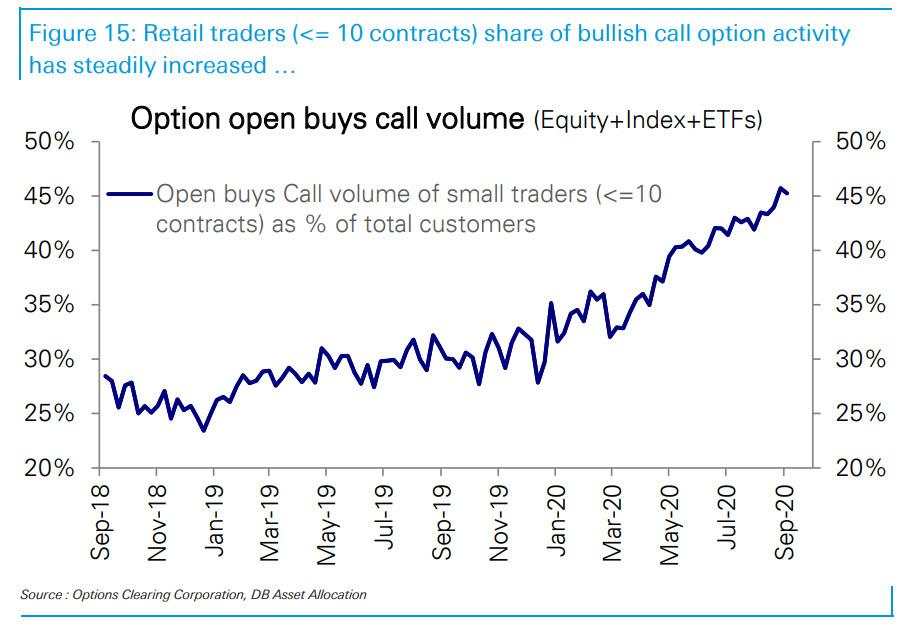

3. Retail Traders On Pace to be Majority of Options Trading.

The retail call-buying frenzy has accelerated to such an extent that as the following stunning chart from Thatte shows, retail traders are on pace to soon have a majority share in all bullish call option activity (currently at 45% and up from 30% at the beginning the year), concluding the process we first discussed in May in “How retail investors took over the stock market“…

Barrons on Retail Traders and Options

Option volume in single-stock equities averaged a record 18.4 million contracts a day in August (each contract gives the holder the right to buy or sell 100 shares of stock), up about 80% from the average monthly volume during 2019, according to Cboe Global Markets.

It’s Not Just SoftBank: How Retail Investors Are Fueling the Nasdaq’s Wild Ride-By Avi SalzmanAndrew Bary

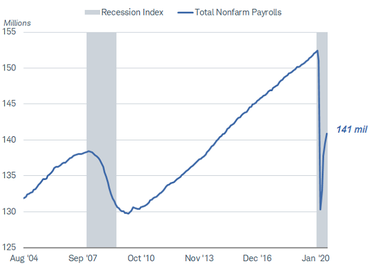

4. Payrolls climbing back, but still far below the February peak

Source: Bloomberg. US Employees on Nonfarm Payrolls Total SA and the Monthly Recession Index (NFP T Index, USRINDEX Index). Monthly data as of 8/31/2020.

Schwab Market Perspective: Rotation

By Liz Ann SondersBy Jeffrey KleintopBy Kathy Jones

https://www.schwab.com/resource-center/insights/content/market-perspective

5. Chemicals and Materials Showing Relative Strength.

All-Star Charts Here’s how these guys look on a relative basis:

Found at www.abnormalreturns.com

6. Active Managers Do an About Face

Fri, Sep 11, 2020

The National Association of Active Investment Managers (NAAIM) has an index which tracks the exposure of its members to US equity markets. Each week, members are asked to provide a number that represents their exposure to markets. A reading of -200 means they are leveraged short, -100 indicates fully short, 0 is neutral, 100% is fully invested, and 200% indicates leveraged long. Two weeks ago, in our Bespoke Report, we highlighted the fact that the exposure index had moved to one of the highest levels in its 15-year history. Now, just two weeks later, these same active managers have reigned in their exposure considerably as this week’s reading dropped from just under 100 to 53.1.

This week’s drop was the second-largest one week decline in the index’s history and just the 10th time that the index lost more than a third (33 points) in a single week. The most recent occurrence was back in early March in the middle of the Covid crash, and every other prior period where the index saw a similar drop, the S&P 500 was also down every time by an average of 2.3%. Therefore, it’s not much of a surprise to see the big drop this week given the big declines in the market. But what about going forward? Do big drops in the NAAIM Index mean a bounce back for markets or further declines? Find out in this weekend’s Bespoke Report newsletter where we cover this much more in depth.

https://www.bespokepremium.com/interactive/posts/think-big-blog/active-managers-do-an-about-face

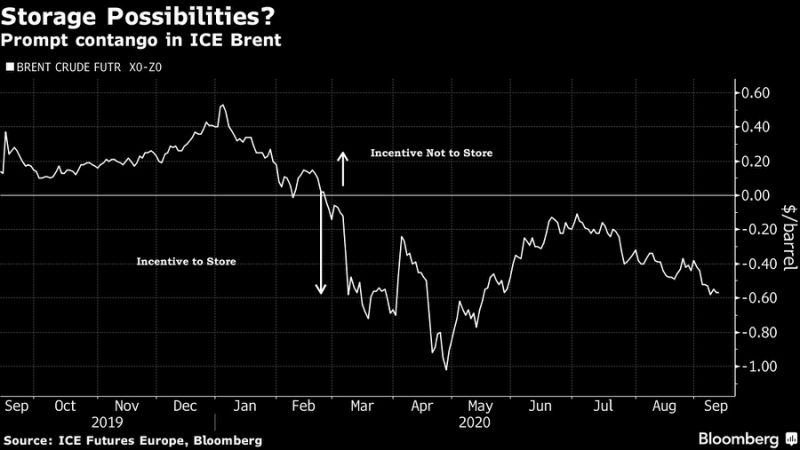

7. Oil Traders Snap Up Tankers in Sign Second-Wave Glut Is Near

—Sheela Tobben and Javier Blas

Oil Traders Snap Up Tankers in Sign Second-Wave Glut Is Near

(Bloomberg) — Some of the world’s biggest oil traders are gearing up for a possible resurgence of a coronavirus-induced glut of crude and fuels, snapping up giant tankers for months-long charters so that they can be ready to store excess barrels if necessary.

The chartering spree is likely to alarm Saudi Arabia, Russia and their allies as it indicates that the oil traders believe the crude market is moving into a surplus after OPEC+ managed to create a deficit earlier this summer with its output cuts.

Trafigura Group, the world’s second-largest independent oil trader, in recent days booked about a dozen supertankers that can hold a total of 24 million barrels of oil, according to people familiar with the matter. All in, about 18 similar charters have been arranged with Royal Dutch Shell Plc, Vitol Group and Lukoil among those also hiring the vessels, according to shipbrokers’ lists of bookings seen by Bloomberg. State-controlled China National Chemical Corporation Ltd, known as ChemChina, has also joined, the lists show.

While the bookings don’t stipulate that they are for storage — they are so-called time charters at fixed daily rates — it will give traders extra capacity to store if doing so becomes profitable or necessary. Earlier this year, millions of barrels got kept on tankers, even making it into Donald Trump’s press briefings, because demand collapsed and producer nations didn’t initially cut their output in response.

That led to a profit bonanza for the traders because spot oil prices became so depressed that it rewarded companies to park barrels on ships — one of the market’s most expensive forms of storage — and sell them later. This time around, the same trade has turned profitable on paper, but not to the same extent as earlier this year.

Trafigura booked the 12 supertankers because a collapse in freight rates meant there’s limited downside to the charters, but also with one eye on being able to deploy them on storage if necessary, the people said. Even if it didn’t store, Trafigura could use the vessels to deliver cargoes. A Trafigura spokeswoman declined to comment.

Some floating storage may be economic again as declining OPEC exports reduce demand for ships and Chinese imports are delayed moving ashore, Citigroup Inc. analysts including Ed Morse wrote in a note. Once China’s backlog eases, demand for floating storage will likely subside, they said.

Rates in the tanker market tumbled recently because producers have been withholding millions of barrels of supply to counteract a collapse in demand that Covid-19 caused, and refineries had been using up their stored barrels. Last month, the Organization of Petroleum Exporting Countries and its allies began to ease up on those output curbs, adding barrels back to the market, but still pumping far below pre-coronavirus times.

Shares of oil tanker companies jumped. Those of Frontline Ltd., advanced 5.9% to 69.10 Norwegian kroner in Oslo on Friday. Euronav NV climbed 5.2% to 8.165 euros in Brussels. The two firms operate large fleets of supertankers. Wider equity markets were mixed in Europe.

The charters could begin as soon as this month and will last for at least 90 days, according to the brokers’ lists. Some of the vessels will be used for refined products such as diesel.

Vessel owners may be reluctant to accept further multi-month charters because there are signs that the tanker market could pick up in the coming months, said Randy Giveans, head of energy maritime shipping equity research at Jefferies LLC.

For more articles like this, please visit us at bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

https://finance.yahoo.com/news/oil-traders-snap-tankers-sign-110923651.html

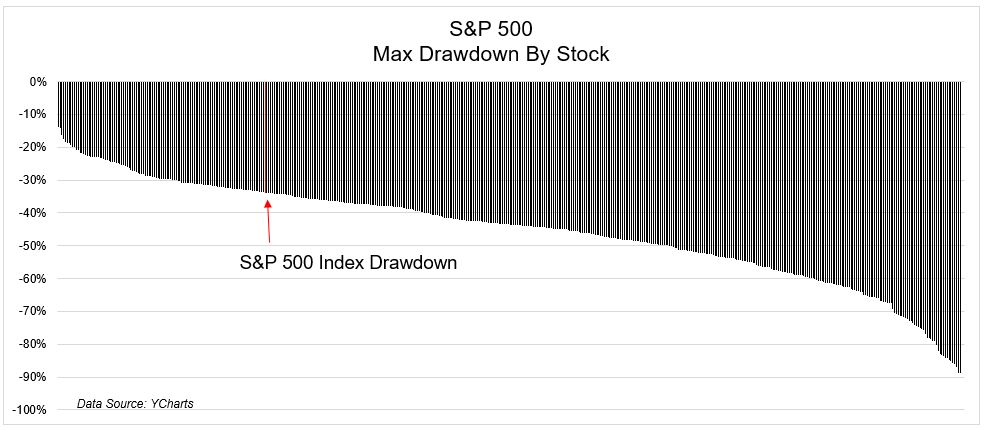

8. 66% of U.S. Stocks Underperformed S&P Last Year and 76% Had a Bigger Drawdown

Most Stocks Suck

Posted September 10, 2020 by Michael Batnick

Most stocks have underperformed the stock market this year. To add insult to injury, they also experienced deeper drawdowns.

66% of S&P 500 stocks have underperformed over the last year, while 76% had a deeper drawdown, as you can see in the chart below.

9. Eliminate Back Pain Forever with These 5 Easy Exercises

NEVER BE THAT GUY COMPLAINING ABOUT A “BAD BACK.”

·

A strong back is a healthy back. Period. And these are the perfect exercises that will make it easier and more natural for you to stand and sit with good posture for longer periods, and with far less pain (if any). These moves are especially effective against lower back pain because they work the stabilizing muscles that keep your spine aligned.

Once you’ve mastered them, feel free to add a progression of one-legged squats to this workout. Do them with the raised leg in front of you, then out to the side, then behind. They’re great for your gluteal muscles, and glutes are crucial for erect posture and a healthy back. And while you’re giving yourself a tune-up, don’t miss our 100 Easiest Ways to be a Healther Man Right Now.

1

Cat-Camel

This mild yoga-like move gets you ready for the other exercises. It’s not a stretch, so don’t push it.

How: Go slow! On your hands and knees (shoulder-width apart), lower your head between your arms as you push up with a rounded back. Reverse the movement at the top, extending your neck forward and up as you arch your lower back. Do five to eight repetitions. And while you’re getting limber, be sure to read about The World’s Single Best Stretch.

2

Curlup

This move works all of your abdominal muscles while maintaining the back’s natural arch.

How: Lie faceup on the floor with your left leg straight, right leg bent, and right foot flat on the floor. Put your hands under the arch in your lower back. Slowly raise your head and shoulders without bending your lower back. Hold for 7 or 8 seconds, breathing deeply. Do 4 repetitions, then switch legs. But don’t forget the old saying that “abs are made in the kitchen.” Here are the 10 Best Carbs for Your Abs.

3

Side Bridge

This forces your lateral stabilizer muscles to work hard. That will help them fully support your spine.

How: Lie on your left side with your body propped on your left elbow and forearm and your knees straight. Put your right hand on your left shoulder and slowly raise your hips until your body forms a straight line. Hold for 7 or 8 seconds. Do 4 or 5 repetitions, then switch sides.

4

Bird Dog

This is a less stressful “Superman” move for your lower- and middle-back extensors, the muscles that help you bend backward.

How: On your hands and knees, slowly raise and straighten your right leg and left arm while contracting your abdominal muscles to brace your lumbar spine. Hold for 7 or 8 seconds, breathing deeply. Lower them, repeat 4 times, then switch sides. Remember: a strong back is one of the essential ways to Look Great Without Wearing a Shirt.

5

Staggered Pushup

This recruits core stabilizers.

How: Set up as you would for a regular pushup, but move one of your hands down toward the side of your torso and rotate it so the fingers point away from your body. Do a set of 10 reps, switching hands after the set. For more great advice for healthy living, don’t miss our 10 Surefire Signs Your Heart is Super Strong.

For more amazing advice for living smarter, looking better, feeling younger, and playing harder, sign up for our newsletter—delivered every day!

10. Twelve Habits of Genuine People

By Travis Bradberry | April 11, 2019 | 1

@shukla23 via Twenty20

Genuine people have a profound impact upon everyone they encounter. In this article, originally published on LinkedIn Pulse, Dr. Travis Bradberry unveils the unique habits that cause them to radiate with energy and confidence.

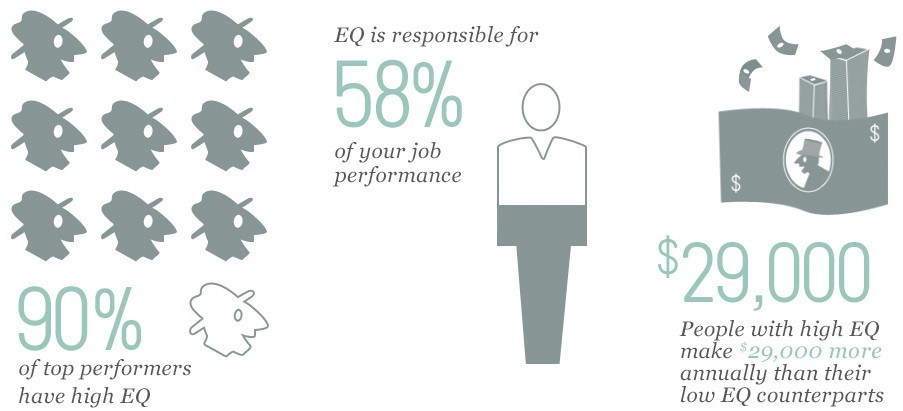

There’s an enormous amount of research suggesting that emotional intelligence (EQ) is critical to your performance at work. TalentSmart has tested the EQ of more than a million people and found that it explains 58% of success in all types of jobs.

People with high EQs make $29,000 more annually than people with low EQs. Ninety percent of top performers have high EQs, and a single-point increase in your EQ adds $1,300 to your salary. I could go on and on.

Related: Why You Need Emotional Intelligence to Succeed

Suffice it to say, emotional intelligence is a powerful way to focus your energy in one direction with tremendous results.

But there’s a catch. Emotional intelligence won’t do a thing for you if you aren’t genuine.

A recent study from the Foster School of Business at the University of Washington found that people don’t accept demonstrations of emotional intelligence at face value. They’re too skeptical for that. They don’t just want to see signs of emotional intelligence. They want to know that it’s genuine—that your emotions are authentic.

According to lead researcher Christina Fong, when it comes to your co-workers, “They are not just mindless automatons. They think about the emotions they see and care whether they are sincere or manipulative.”

The same study found that sincere leaders are far more effective at motivating people because they inspire trust and admiration through their actions, not just their words. Many leaders say that authenticity is important to them, but genuine leaders walk their talk every day.

It’s not enough to just go through the motions, trying to demonstrate qualities that are associated with emotional intelligence. You have to be genuine.

You can do a gut check to find out how genuine you are by comparing your own behavior to that of people who are highly genuine. Consider the hallmarks of genuine people and see how you stack up.

“Authenticity requires a certain measure of vulnerability, transparency and integrity.” –Janet Louise Stephenson

1. Genuine people don’t try to make people like them.

Genuine people are who they are. They know that some people will like them, and some won’t. And they’re OK with that. It’s not that they don’t care whether or not other people will like them but simply that they’re not going to let that get in the way of doing the right thing. They’re willing to make unpopular decisions and to take unpopular positions if that’s what needs to be done.

Since genuine people aren’t desperate for attention, they don’t try to show off. They know that when they speak in a friendly, confident and concise manner, people are much more attentive to and interested in what they have to say than if they try to show that they’re important. People catch on to your attitude quickly and are more attracted to the right attitude than what or how many people you know.

2. They don’t pass judgment.

Genuine people are open-minded, which makes them approachable and interesting to others. No one wants to have a conversation with someone who has already formed an opinion and is not willing to listen.

Having an open mind is crucial in the workplace, as approachability means access to new ideas and help. To eliminate preconceived notions and judgment, you need to see the world through other people’s eyes. This doesn’t require you to believe what they believe or condone their behavior; it simply means you quit passing judgment long enough to truly understand what makes them tick. Only then can you let them be who they are.

3. They forge their own paths.

Genuine people don’t derive their sense of pleasure and satisfaction from the opinions of others. This frees them up to follow their own internal compasses. They know who they are and don’t pretend to be anything else. Their direction comes from within, from their own principles and values. They do what they believe to be the right thing, and they’re not swayed by the fact that somebody might not like it.

4. They are generous.

We’ve all worked with people who constantly hold something back, whether it’s knowledge or resources. They act as if they’re afraid you’ll outshine them if they give you access to everything you need to do your job. Genuine people are unfailingly generous with whom they know, what they know and the resources they have access to. They want you to do well more than anything else because they’re team players and they’re confident enough to never worry that your success might make them look bad. In fact, they believe that your success is their success.

5. They treat EVERYONE with respect.

Whether interacting with their biggest clients or servers taking their drink orders, genuine people are unfailingly polite and respectful. They understand that no matter how nice they are to the people they have lunch with, it’s all for naught if those people witnesses them behaving badly toward others. Genuine people treat everyone with respect because they believe they’re no better than anyone else.

6. They aren’t motivated by material things.

Genuine people don’t need shiny, fancy stuff in order to feel good. It’s not that they think it’s wrong to go out and buy the latest and greatest items to show off their status; they just don’t need to do this to be happy. Their happiness comes from within, as well as from the simpler pleasures—such as friends, family and a sense of purpose—that make life rich.

7. They are trustworthy.

People gravitate toward those who are genuine because they know they can trust them. It is difficult to like someone when you don’t know who they really are and how they really feel. Genuine people mean what they say, and if they make a commitment, they keep it. You’ll never hear a truly genuine person say, “Oh, I just said that to make the meeting end faster.” You know that if they say something, it’s because they believe it to be true.

8. They are thick-skinned.

Genuine people have a strong enough sense of self that they don’t go around seeing offense that isn’t there. If somebody criticizes one of their ideas, they don’t treat this as a personal attack. There’s no need for them to jump to conclusions, feel insulted and start plotting their revenge. They’re able to objectively evaluate negative and constructive feedback, accept what works, put it into practice and leave the rest of it behind without developing hard feelings.

9. They put away their phones.

Nothing turns someone off to you like a mid-conversation text message or even a quick glance at your phone. When genuine people commit to a conversation, they focus all of their energy on the that. You will find that conversations are more enjoyable and effective when you immerse yourself in them. When you robotically approach people with small talk and are tethered to your phone, this puts their brains on autopilot and prevents them from having any real affinity for you. Genuine people create connection and find depth even in short, everyday conversations. Their genuine interest in other people makes it easy for them to ask good questions and relate what they’re told to other important facets of the speaker’s life.

10. They aren’t driven by ego.

Genuine people don’t make decisions based on their egos because they don’t need the admiration of others in order to feel good about themselves. Likewise, they don’t seek the limelight or try to take credit for other people’s accomplishments. They simply do what needs to be done without saying, “Hey, look at me!”

11. They aren’t hypocrites.

Genuine people practice what they preach. They don’t tell you to do one thing and then do the opposite themselves. That’s largely due to their self-awareness. Many hypocrites don’t even recognize their mistakes. They’re blind to their own weaknesses. Genuine people, on the other hand, fix their own problems first.

12. They don’t brag.

We’ve all worked with people who can’t stop talking about themselves and their accomplishments. Have you ever wondered why? They boast and brag because they’re insecure and worried that if they don’t point out their accomplishments, no one will notice. Genuine people don’t need to brag. They’re confident in their accomplishments, but they also realize that when you truly do something that matters, it stands on its own merits, regardless of how many people notice or appreciate it.

Genuine people know who they are. They are confident enough to be comfortable in their own skin. They are firmly grounded in reality, and they’re truly present in each moment because they’re not trying to figure out someone else’s agenda or worrying about their own.

Related: The Secrets of Being Authentic (and Why It’s Important)

Disclosure

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.