https://www.zerohedge.com/markets/wall-street-sets-its-sights-sp-5000

2. Global REIT Index Above Pre-Covid Levels

3. DeFi Total Value Locked +15,000%

What Is Total Value Locked (TVL)?-If you have been using DeFi tracking sites, the chances are high that you have run into total value locked (TVL) as a reference point. To put it simply, total value locked represents the number of assets that are currently being staked in a specific protocol: this value is not meant to represent the number of outstanding loans, but rather the total amount of underlying supply that is being secured by a specific application by DeFi completely.

Total value locked is a metric that is used to measure the overall health of the DeFi and yielding market. You can track total value locked on many services.

There are three main factors that are taken into consideration when calculating and looking at decentralized financial service’s market cap TVL ratio: calculating the supply, the maximum supply as well as the current price.

In order to get the current market cap, you need to multiply the circulating supply by the current price. In order to get to the TVL ratio, you would need to take that market cap number and divide it by the TVL of the service.

From a theoretical standpoint, the higher the TVL ratio is, the lower the value of an asset needs to be; however, this is not always the case when we look at reality. One of the easiest ways to implement the TVL ratio is to help determine if a DeFi asset is undervalued or overvalued, and this can be done by looking at the ratio. If it is under 1, it is undervalued in most cases.

https://coinmarketcap.com/alexandria/glossary/total-value-locked-tvl

https://news.cryptorank.io/defi-total-value-locked-overview-2/

Excellent Read

Crypto’s Rapid Move Into Banking Elicits Alarm in Washington-NY Times By Eric Lipton and Ephrat Livni

In recent months, top officials from the Federal Reserve and other banking regulators have urgently begun what they are calling a “crypto sprint” to try to catch up with the rapid changes and figure out how to curb the potential dangers from an emerging industry whose short history has been marked as much by high-stakes speculation as by technological advances.

In interviews and public statements, federal officials and state authorities are warning that the crypto financial services industry is in some cases vulnerable to hackers and fraud and reliant on risky innovations. Last month, the crypto platform PolyNetwork briefly lost $600 million of its customers’ assets to hackers, much of which was returned only after the site’s founders begged the thieves to relent.

An ad for BlockFi at Union Station in Washington. Unlike a bank, BlockFi does not check credit scores, relying instead on the value of customers’ cryptocurrency collateral.Credit…Samuel Corum for The New York Times

“We need additional authorities to prevent transactions, products and platforms from falling between regulatory cracks,” Gary Gensler, the chairman of the Securities and Exchange Commission, wrote in August in a letter to Senator Elizabeth Warren, Democrat of Massachusetts, about the dangers of cryptocurrency products. “We also need more resources to protect investors in this growing and volatile sector.”

The S.E.C. has created a stand-alone office to coordinate investigations into cryptocurrency and other digital assets, and it has recruited academics with related expertise to help it track the fast-moving changes. Acknowledging that it could take at least a year to write rules or get legislation passed in Congress, regulators may issue interim guidance to set some expectations to exert control over the industry.

Zac Prince, BlockFi’s chief executive, said that the company was complying with the law but that regulators did not fully understand its offerings. “Ultimately, we see this as an opportunity for BlockFi to help define the regulatory environment for our ecosystem,” he wrote in a note to customers.

https://www.nytimes.com/2021/09/05/us/politics/cryptocurrency-banking-regulation.html

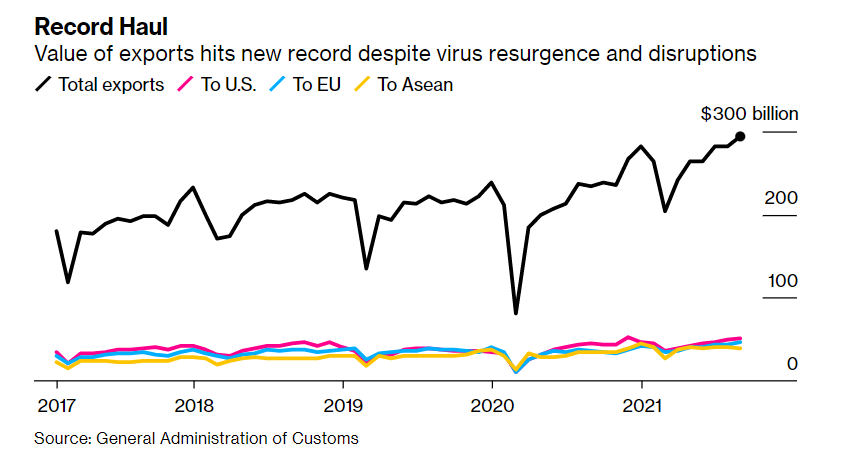

4. Value of Exports Globally Hits New Highs Despite Delta

Bloomberg–Exports climbed as suppliers likely boosted year-end orders

https://www.marketwatch.com/story/investors-are-ignoring-the-parallels-between-stocks-today-and-heady-years-of-1929-1999-and-2007-do-this-next-says-strategist-11631013007?mod=home-page