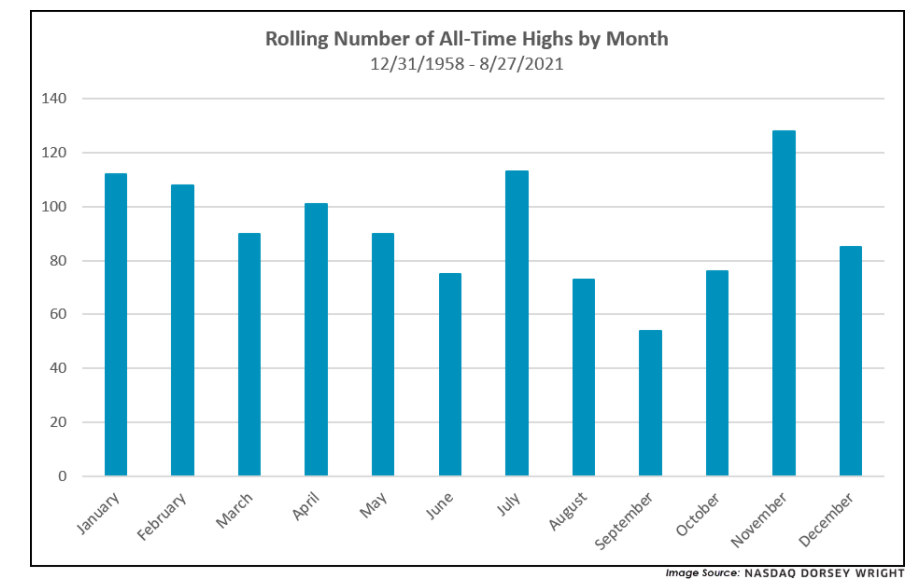

1.Seasonality–September Produces the Least Amount of All-Time Highs 1958-2021

Nasdaq Dorsey Wright-The S&P 500 (SPX) has posted over 50 record closes this year (through 8/27), a topic we recently discussed here. However, as we head into September the core benchmark could face seasonal headwinds given the historically lackluster returns. In fact, as shown in the column chart below, since the late 1950s the S&P 500 has posted new all-time highs the least frequently in September relative to other months. November leads the pack as a home to over 120 all-time highs, followed by July, January, February, and April, respectively.

https://oxlive.dorseywright.com/research/bigwire

2.It Feels Like the Market Never Goes Down BUT Speculative Assets Have Experienced Large Drawdowns in 2021

Liz Ann Sonders Schwab Spec drawdowns

Increasingly, I’ve been asked by clients during our many virtual events about whether the U.S. stock market is in a bubble akin to 1999-2000. My answer has been a bit more nuanced than a simple yes or no. The tech bubble burst in spectacular fashion in March 2000, driven by absurd valuations and massive speculative excess. Presently, at least for the S&P 500, valuations are less-stretched courtesy of the epic rebound in earnings (the surge in the E has resulted in a significant move down in the P/E).

But there has been significant speculative excess in less-traditional pockets of the market. Since late-2017, I’ve been calling these pockets “micro bubbles.” These pockets have experienced drawdowns at some point this year that have been much more severe than the traditional indexes’ drawdowns. Here are some examples of market segments or securities with greater-than-bear market level maximum drawdowns at some point this year:

Source: Charles Schwab, Bloomberg, as of 8/20/2021. For illustrative purposes only. Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. Past performance is no guarantee of future results. Goldman Sachs (GS) non-profitable technology basket consists of non-profitable U.S.-listed companies in innovative industries. Technology is defined quite broadly to include new economy companies across GICS industry groupings. ISPAC Index is a passive rules-based index that tracks the performance of the newly listed Special Purpose Acquisitions Corporations (“SPACs”) ex- warrant and initial public offerings derived from SPACs since 8/1/2017. Renaissance IPO Index tracks US-listed newly public companies that are weighted by float, capped at 10%, and removed after two years. Goldman Sachs (GS) most-shorted basket contains the 50 highest short interest names in the Russell 3000; names have a market cap greater than $1 billion.

3. THE INTANGIBLE STOCK MARKET? Tangible Assets 83% 1975 to 10% 2021 for S&P

Jonathan Barid–The ratio of tangible to intangible (e.g. goodwill) has changed substantially over the years. In 1975 fully 83% of the S&P 500’s total assets were classed as tangible. That number has now fallen to 10% versus 90% that are intangible.

The rapid evolution of technology producing the biggest change to the composition of balance sheets. Rising markets, and a shift to valuing companies more by their perceived business franchises rather than by tangible assets, has allowed for the issuance of new stock at multiples of book value, which increases the weight of intangible assets on balance sheets.

https://www.linkedin.com/in/jonathanbaird88/

4.Putting Zoom Chart in Perspective

Zoom is approaching Aug. 2020 levels…January 2020 Zoom traded at $69.

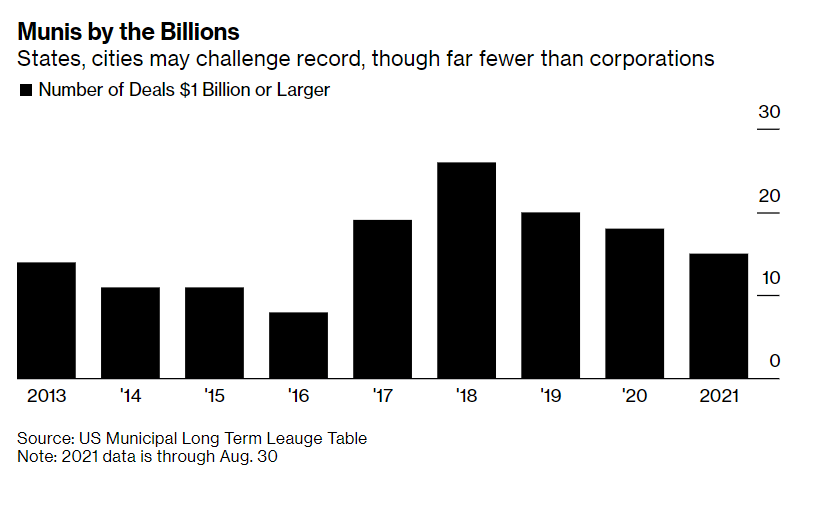

5.Muni’s Posting First Negative Return in 6 Months.

By Danielle Moran and Skylar Woodhouse https://www.bloomberg.com/news/articles/2021-08-31/-can-t-go-up-forever-muni-bonds-see-first-loss-since-february?sref=GGda9y2L

6.China Private Equity and VC Tripled Over 4 Years….Communist Party Taking Aim

Axios-China takes aim at private funds–Dan Primack, author of Pro Rata

Xi Jinping at the Communist Party centenary in July. Photo: Qilai Shen/Bloomberg via Getty Images

China’s increased scrutiny of capital markets isn’t restricted to tech IPOs. It’s also taking a harder look at private funds.

Driving the news: China’s top securities regulator, Yi Huiman, today said in a speech that VC and buyout fund managers must better align their interests with those of limited partners, adding that the government is dedicated to rooting out embezzlement and public equities masquerading as private equities.

- Huiman also decried public solicitation for private funds, which he said are at “in a critical period of transformation and development.”

By the numbers: Chinese private equity and VC funds manage an estimated $2 trillion, more than tripling over the past four years. A lot of that growth was actively encouraged, and sometimes even directly enabled, by a government that believed its private sector was too reliant on bank lending.

The bottom line: This was a shot across the bow; a “clean your room or else” sort of message. If it’s not heeded, Chinese regulators might be much more prescriptive, or even punitive, the next time around.

https://www.axios.com/china-private-funds-regulation-5c7d16c6-9b86-4ec9-b07d-2cca55d1eb0c.html

How Chinese investors and private equity firms can boost growth https://www.consultancy.asia/news/3547/how-chinese-investors-and-private-equity-firms-can-boost-growth

7.In Case You Were Wondering if Retail is “ALL IN”…Fidelity wants to hire 9,000 employees by the end of this year to meet soaring demand from retail investors

Aug. 31, 2021, 03:55 PM

Customers leave a sales office of Fidelity Investments in Boston, August 27. Fidelity announced that..

Thomson Reuters

- Fidelity is planning on hiring 9,000 new US employees by the end of the year.

- The brokerage said 9% of the new jobs will be in technology, with some working on Fidelity’s digital asset trading experience.

- Fidelity added 1.7 million new retail accounts in the most recent quarter.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

Fidelity is planning on hiring 9,000 new US employees by the end of the year to to meet its growing customer base amid a boom in retail investing.

The brokerage firm said Tuesday that it’s hiring across all job functions to meet demand from its 38 million customers. 44% of the new jobs will be in client-facing positions, while 9% will be in technology, helping to create new products like enhancing Fidelity’s digital asset trading experience, the company said.

The hiring spree comes as no-fee trading and a steady bull market entices new investors to brokerage firms including Fidelity, Robinhood, and Charles Scwhwab. Fidelity added 1.7 million new retail accounts in the second quarter, a 39% year-over-year increase. Out of those accounts, 697,000 were opened by investors 35 years or younger, representing a 65% increase from the same quarter last year.

The Wall Street Journal first reported that Fidelity is adding 9,000 jobs, stating that the brokerage’s total workforce is expected to grow more than 22% this year to over 60,000 employees.

“These increases come at a time when Fidelity continues to see record growth and business results across its businesses,” said the company.

At the end of the second quarter, Fidelity had $11. 1 trillion in assets under administration, representing what investors held in brokerage and retirement accounts on the firm’s platforms, and in its funds.

8.States with Best-Paying Tech Jobs

From Zerohedge

These Are The US States With The Top Tech Salaries In 2021 https://www.zerohedge.com/technology/these-are-us-states-top-tech-salaries-2021

9.Home Prices 2000-2021 Year Over Year Growth.

From Doubleline

https://twitter.com/DLineMinutes

10.5 Habits Of People Who Always Get Promoted

FAST COMPANY Some employees just seem to be ahead of the curve and reap the rewards. Here’s how to be that person.

BY GWEN MORAN3 MINUTE READ

Most of us have had that coworker that seemed to be a perfect fit for the company or team. She always had the right answers. He seemed to know what needed to be done before the company leaders even did. And that “sixth sense” and insight was rewarded with responsibility, autonomy, accolades, and advancement.

“When employees bring those qualities, they’re perceived as leaders in the company, no matter what position they hold,” says Katharine Halpin, CEO and founding principal of The Halpin Companies, Inc., a leadership consultancy in Phoenix, Arizona. “They take ownership for problem solving and dissolving conflict. They naturally have this sort of alignment with the company.”

The good news is that becoming a super-employee isn’t some rarified secret. It’s a combination of skill set and mindset that you can begin to develop for yourself by focusing on these five key habits.

1. THEY CHOOSE THE RIGHT ENVIRONMENT FOR THEIR TALENTS

It’s hard to be a super-employee if the company’s needs are very different from your abilities, talents, and values, Halpin says. In addition, a 2015 research report by the Cicero Group found that one of the most important factors in employees consistently producing great work was recognition. Thirty-seven percent of respondents said that being recognized by a manager or by the company was the most important driver in great work. So, choosing to work where your work is valued is important.

2. THEY PAY ATTENTION TO WHAT THEIR BOSS VALUES

Super-employees are studying the preferences and goals of their direct supervisors, their supervisors’ supervisors, and the company at large, says Gayle Lantz, founder of WorkMatters, Inc., a leadership consultancy in Birmingham, Alabama. They may be striving to participate in projects and meetings that aren’t part of their jobs, but which give them access and information to what company leaders think and need.

“They’re doing things above and beyond what other employees are doing, and they’re showing interest. They’re motivated and showing they want to learn what it’s like to be at the top,” she says.

3. THEY FOCUS ON BOTH DAILY RESPONSIBILITIES AND BIG-PICTURE THINKING

Exceptional performers are able to maintain dual focus on both the task at hand, as well as how it fits into the bigger picture, Lantz says. If they don’t understand something, they get the information they need to make its importance clearer.

When you start looking at everyday tasks from both perspectives and truly understand what you need to do and why it needs to be done, you become more strategic and begin to anticipate what needs to be done–sometimes before others know what needs to be done, she says. In addition, you’re better able to prioritize so that your activities and energy are focused where they are of most value to the company, Halpin adds.

4. THEY MAKE SPACE FOR BIGGER THINKING

Keeping some open time in the day, such as scheduling time between meetings and blocks of time for simply thinking or working on projects that require concentration, can also supercharge performance, Halpin says. Super-employees are vigilant about scheduling everything from daily meetings to big projects to ensure that they have the best possible chance at a successful outcome.

“Sometimes, it’s just very practical actions–getting to places early, not rushing from meeting to meeting if you can help it–to give yourself time to do what you need to do. That may be thinking about the purpose of your next meeting, or getting a snack or drink so you’re not hungry or thirsty,” she says. Being harried, distracted, hungry, or otherwise uncomfortable because you’re too rushed is not going to allow you to do your best work and be most insightful, she adds.

High performers are in tune with the people around them and can sense when they need something. They possess soft skills like empathy and are able to relate well to other people because they take the effort to try to understand them, Lantz says.

“A large part of any business is helping people work together well. Super-employees make that a top priority. They look at relationships as something that’s critical to success in the business–not just doing the work,” she says.

RELATED: PRODUCTIVITY TIPS FROM THE BUSIEST PEOPLE

ABOUT THE AUTHOR

Gwen Moran is a writer, editor, and creator of Bloom Anywhere, a website for people who want to move up or move on. She writes about business, leadership, money, and assorted other topics for leading publications and websites

https://www.fastcompany.com/3047794/5-habits-of-the-best-employees