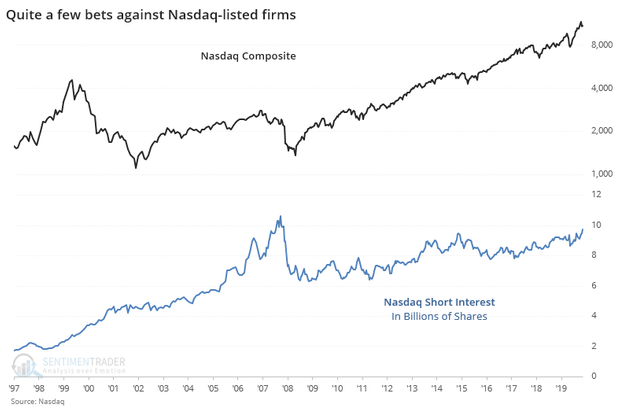

1. Short-Interest in Nasdaq Comp Hits Highest Level in 10 Years.

“Somebody, somewhere, still wants to bet against this market,” writes Jason Goepfert, head of SentimenTrader and founder of independent investment research firm Sundial Capital Research, in a Tuesday research note.

Goepfert writes that so-called short interest, or the total number of shares of a particular stock or fund that have been sold short by investors, but haven’t yet been covered or closed out, on stocks trading on the Nasdaq Composite COMP, -0.10% rose in the last two weeks of September to around the highest level in 10 years, at around 9.7 billion shares (see chart below expressed as a percentage below a chart of the Nasdaq Composite’s absolute value).

Stock-market bets against Nasdaq index hit decade peak–By Mark DeCambre

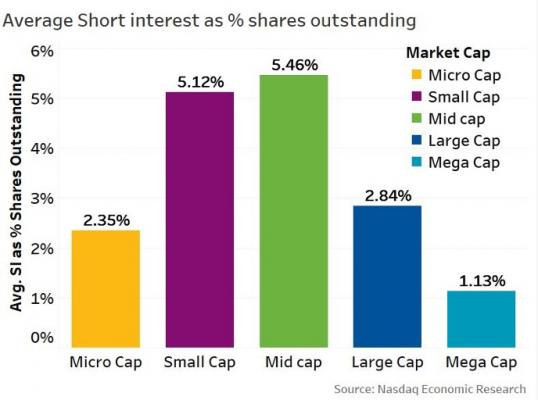

2. How Shorted is the Average Stock.

Phil MackintoshNasdaq

Just how shorted is the average stock?

Looking at short interest across all stocks provides some interesting insights.

Firstly, mega-cap stocks have relatively low short interest. But so too do nano-cap stocks. While stocks in the middle, the mid-cap stocks, tend to have much higher short interest.

That seems to indicate that hedges for futures (liquidity is overwhelmingly concentrated in S&P500 futures) don’t account for most short interest. Although ETFs like the hyper-liquid Russell 2000 ETF, IWM, which trades $4 billion per day, may contribute to additional short interest.

Chart 2: Average short interest by market cap

https://www.nasdaq.com/articles/how-short-selling-makes-markets-more-efficient-2020-10-01

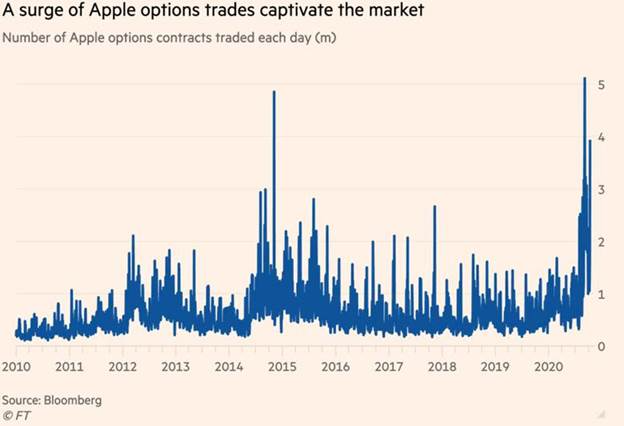

3. Apple Options Trading Surges…4 out of 10 Options Traded Monday were One Stock AAPL.

Bullish Apple calls accounted for four of the 10 most-traded options contracts Monday, while Amazon call volume was almost double the average over the prior five days after spiking to more than 340,000 contracts Friday, the most since January (Bloomberg)

From Dave Lutz at Jones Trading.

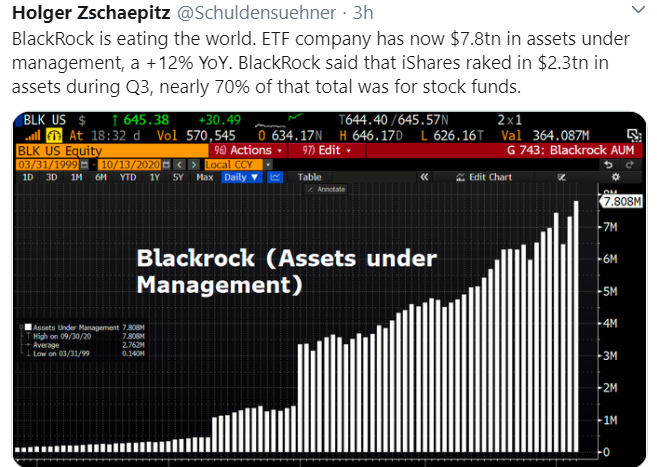

4. Blackrock $7.8 Trillion in AUM.

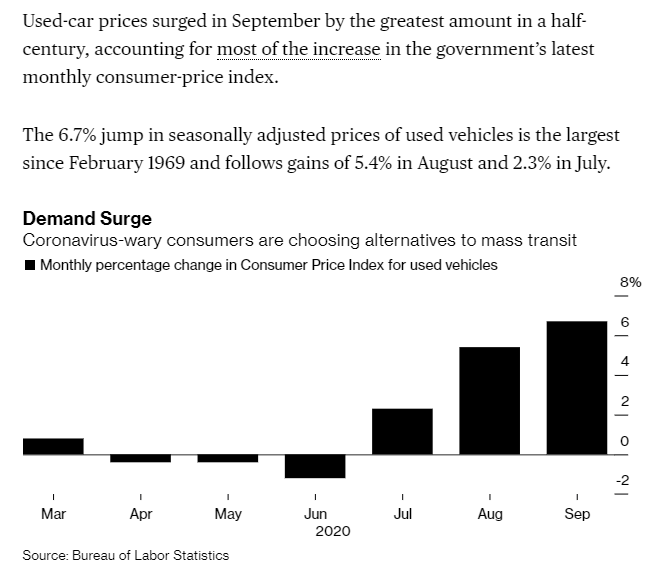

5. Used Car Prices Surge to at Highest Rate in 50 Years.

Used-Car Prices Jump by Most in Half-Century, Boost Price Index–By Melinda Grenier

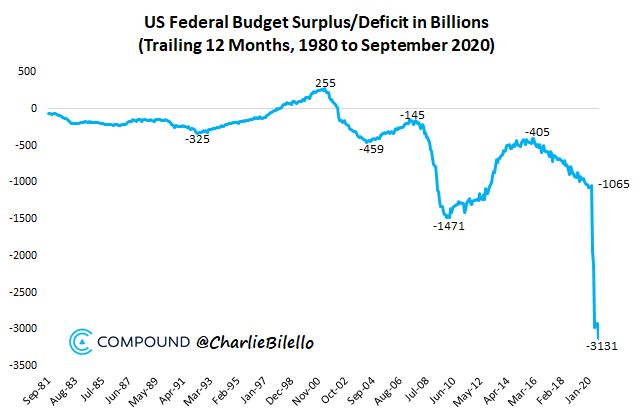

6. U.S. Budget Deficit 1980-2020…….2014-2015 we were making up from the GFC…Then Boom

https://twitter.com/charliebilello/status/1314309651807248384/photo/1

7. U.S. Map of Small Business Closings.

The Big Picture

In the U.S. as a whole, data suggests that nearly a quarter of all small businesses remain closed. Of course, the situation on the ground differs from place to place. Here’s how cities around the country are doing, sorted by percentage of small businesses closed as of September 2020:

https://www.zerohedge.com/personal-finance/mapping-uneven-recovery-us-small-businesses

8. Roblox…Gaming Platform Announces IPO $8B Valuation

Roblox

| Yesterday, gaming platform Roblox very unconfidentially announced it has confidentially filed with the SEC to go public early next year. The company is still debating whether to go the traditional IPO route or do a direct listing, but either way it’s hoping to cinch an $8 billion valuation.What is Roblox?You might not have heard of it before, but Roblox has 115+ million monthly active users, including a third of U.S. kids under the age of 16. In July alone, Roblox logged over 3 billion hours of play. At a high level, Roblox is a platform and marketplace for user-generated 3D content—maybe even the platform. Founded in 2004, the company provides tools for users to build games and earn a 30% cut on purchases within their creations.As of February, 2+ million developers have used Roblox to create over 50 million games. This year, developers are on track to book over $250 million. Roblox isn’t playing aroundThe company was last valued at $4 billion in February after raising a $150 million Series G round. When the pandemic left millions of people spending more time at home, Roblox benefitted from the broader boost to the video game industry.U.S. consumer videogame spending hit a record $11.6 billion in Q2, up 30% annually.And Roblox isn’t the only gaming platform eying the public markets. Last month, game engine maker Unity Software IPOed at a $13.6 billion valuation; its shares are up over 60% since then. Zoom out: Like Epic Games’s hit Fortnite, Roblox is trying to build the metaverse, an immersive virtual world where people interact and share experiences beyond the confines of a single game. Covid-19 has given their efforts a big speed boost. |

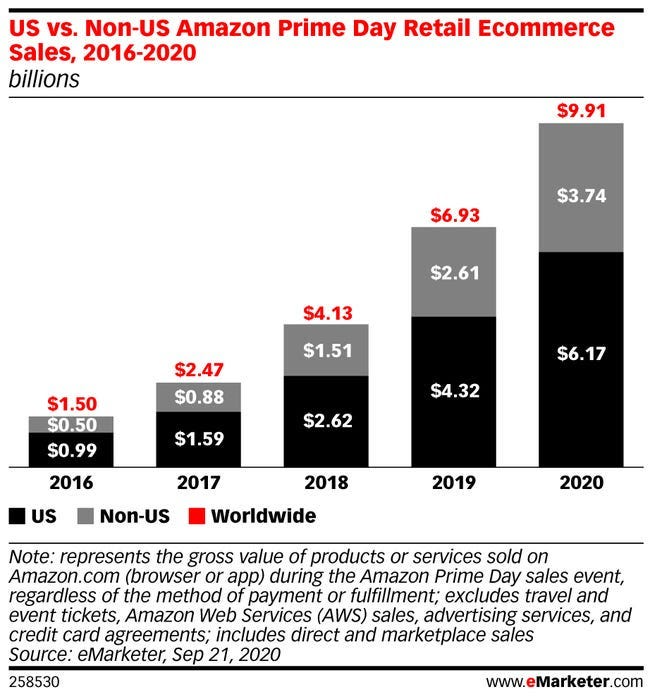

9. Amazon Prime Day 2020—Close to $10B

Business Insider

https://www.businessinsider.com/amazon-prime-day-will-generate-over-9-billion-in-sales-2020-10

10. The Holy Trinity of Healthy Relationships

How to forge true connections

October 11, 2020 | Social Intelligence

The pandemic has thrust students of all ages more forcefully into the arms of technology. Now that the Zoom-enabled school year is underway, I’ve pondered just how far technology will go toward replacing old-fashioned, one-on-one human interaction.

It is indeed amazing what robots and chatbots can do. I schedule 90% of my meetings using an artificial intelligence “assistant” and not once has anyone guessed that their calendar appointment, reminder, and chirpy “Thanks!” came from an algorithm. And it has occurred to me that the two undergraduate classes I am now teaching remotely, attended by fewer than 100 students in total, could in theory balloon to a million at nearly zero marginal cost.

And yet my experience teaching remotely has convinced me that human beings are built for human relationships. We don’t mind buying paper towels on our browsers, but there is no one-click equivalent to feeling understood, respected, and cared for by another person.

The most rewarding part of my time with students is not when I’m clicking through slides, doing my best to look directly at the webcam and speak with clarity into the microphone. What I really look forward to each week are my office hours, which I intentionally designed to be one-on-one. During these brief conversations, my students share what’s on their mind, their questions, worries, and what-do-you-think-about-this ideas. I tell them what I’m thinking and feeling, too, and apart from taking place by video call, it’s as basic an interaction as you can imagine.

And yet it’s magical. More and more, I am getting to know my students as people. And they’re getting to know me, too.

Research suggests that healthy interpersonal relationships share three essential elements: The first is understanding—seeing the other person for who they are, including their desires, fears, strengths, and weaknesses. The second is validation—valuing the other person’s perspective, even if it differs from your own. And the third is caring—expressing authentic affection, warmth, and concern.

Don’t underestimate your power to make a difference in the life of a young person. What everyone, including me, is craving right now is genuine human connection.

Do make time for one-on-one conversations. An algorithm can metabolize a million bits of data in the blink of an eye, but an algorithm cannot look you in the eye and ask, sincerely, “How are you feeling?”

With grit and gratitude,

Angela

Disclosure

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.