1.Get Rich Overnight FOMO

Ben Carlson-A Wealth of Common Sense Blog

The current FOMO is being driven by start-up success to some extent but also the massive wealth that’s being created in crypto.

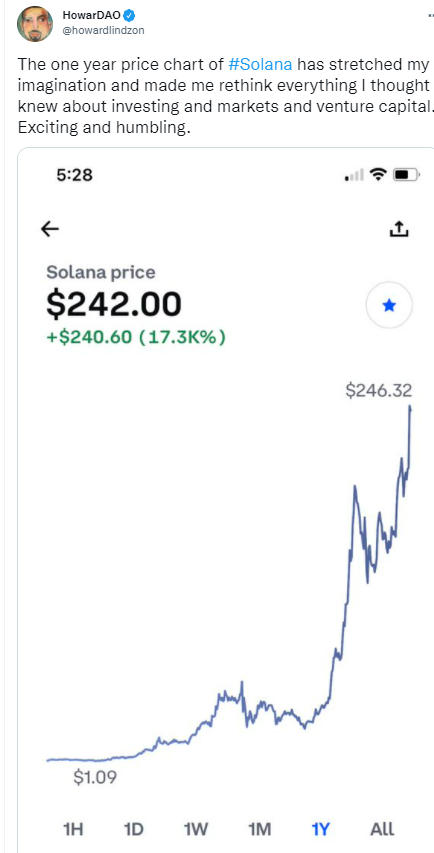

This week Howard Lindzon tweeted a one year chart of Solana:

A 17,000%+ gain in 12 months. Just a breathtaking chart.

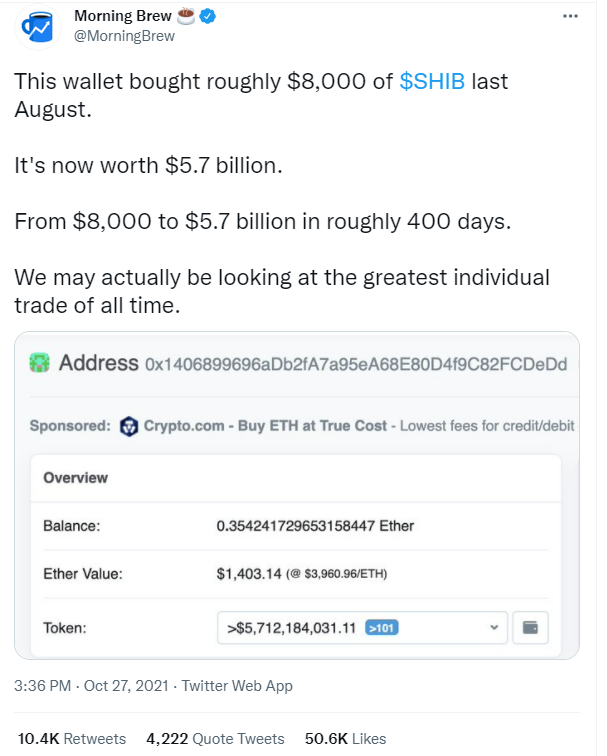

And speaking of breathtaking (or maybe gut-punching) the Shiba Inu meme coin that is going absolutely berserk. Morning Brew shared this stat that almost made me re-think everything I’ve ever learned about finance:

Someone turned $8,000 into nearly $6 billion by “investing” in a meme coin of a dog that is a derivative of another dog meme coin. It took a little over a year.

Now everyone wants to find the next Shiba or Doge or whatever else is up a million percent in the past 3 weeks.

Level 3. I’m going to become a shitcoin millionaire.

It’s not supposed to be possible to earn so much money in such a short amount of time.

The FOMO from this cycle is going to mess with people’s brains in ways we probably can’t even comprehend at the moment.

The sheer amount of wealth that’s been created, mainly by young people, in recent years is sure to have some bizarre unintended consequences in the years ahead.

Good full read on FOMO

https://awealthofcommonsense.com/2021/11/the-3-levels-of-fomo/

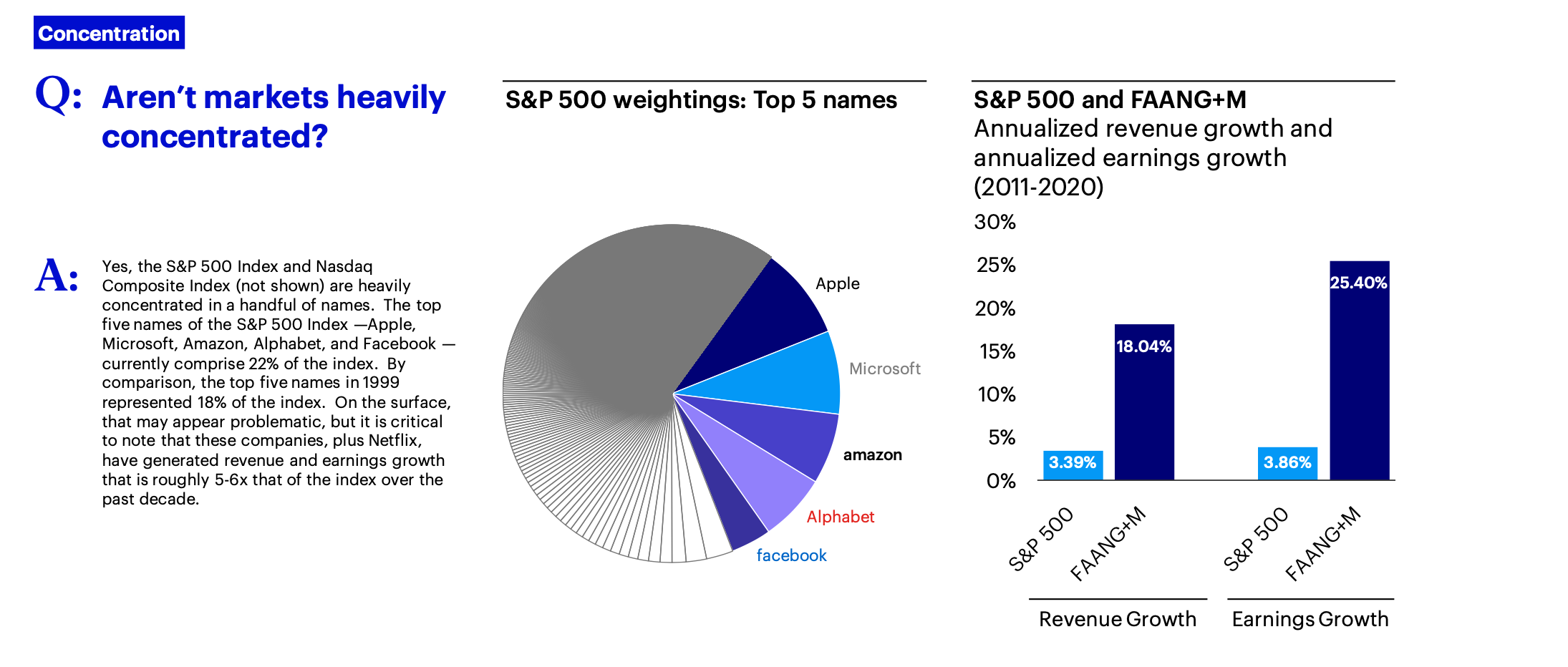

2.Top 5 S&P Weighted Names Generated Revenue and Earnings 5-6X the Rest of Index for Last Decade.

INVESCO

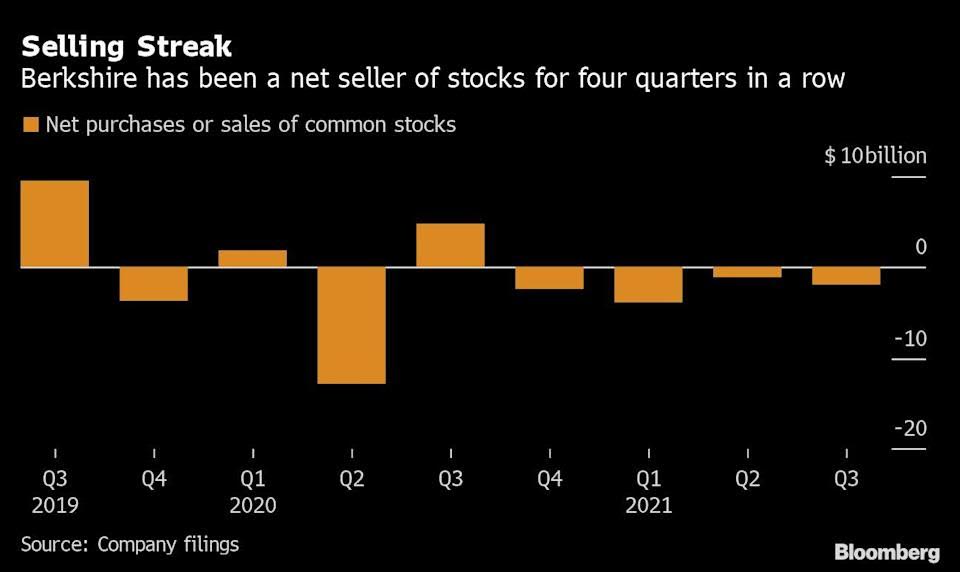

3.Buffett Net Seller of Stocks Four Quarters in a Row.

Buffett Signals Caution With Berkshire on Stock-Selling Streak

Buffett Signals Caution With Berkshire on Stock-Selling Streak

Katherine Chiglinsky(Bloomberg) — Warren Buffett is signaling wariness with the soaring stock market as the billionaire investor extends a selling streak.

Buffett’s Berkshire Hathaway Inc. was a net seller of equities for the fourth straight quarter, a trend not seen in data going back to 2008. The company ended up selling almost $2 billion more in stocks than it purchased during the period, adding to a cash pile that climbed to a record $149.2 billion.

The selling streak indicates Buffett has struggled to find bargains with the stock market hitting all-time highs. A big, splashy acquisition also eluded the conglomerate, as the 91-year old and his investing deputies confronted a combination of sky-high price tags and fierce competition from the wave of special purpose acquisition companies.

“The big issue here is that Berkshire was a net seller of stocks again this quarter,” Jim Shanahan, an analyst with Edward Jones, said in a telephone interview. “That’s the primary culprit” of the cash pile continuing to rise.

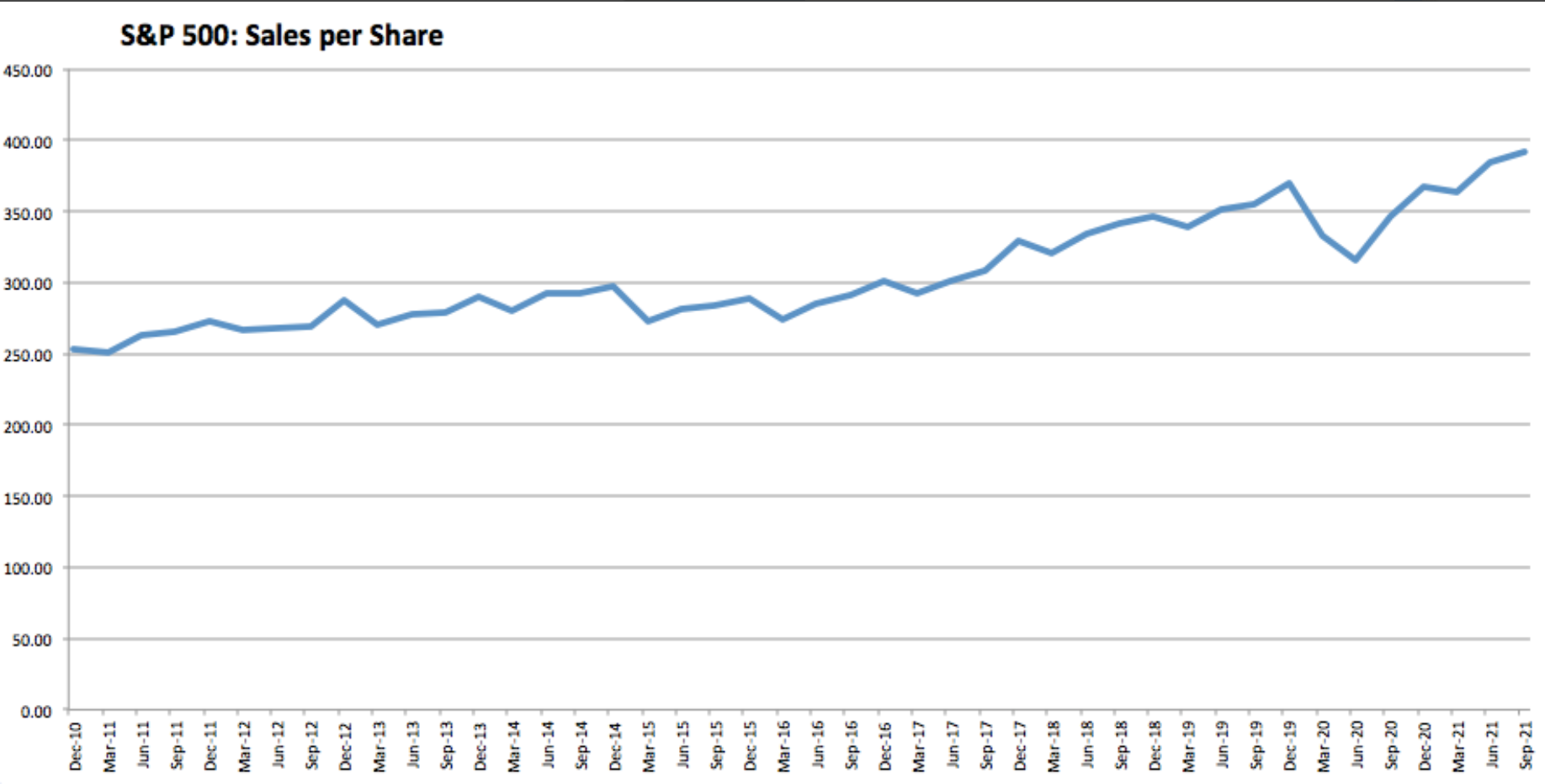

4.S&P Sales +13% Quarter Over Quarter.

82% of $SPX has reported 3Q earnings. Sales up +13% yoy driven by tech, industrials and healthcare, all w/ growth in the double digits. Sales +6% higher than pre-pandemic (4Q19)

Urban Carmel

https://twitter.com/ukarlewitz/status/1457897030097854469/photo/1

5.EU Banning Payment for Order Flow

EU Set to Ban Trading Practice Helping Power Meme-Stock Mania

By

- Parallels potential U.S. move to stem payment for order flow

- MiFID review also looking to facilitate consolidated tape

Regulators are concerned that video-game like prompts have encouraged excessive trading on app-based brokerages that fueled a explosive surge in value for GameStop Corp. and other stocks this year.

Want the lowdown on European markets? In your inbox before the open, every day. Sign up here.

The European Commission is planning to ban payment for order flow, paralleling potential U.S. moves to stem a practice that hit the headlines during the meme-stock mania.

A forthcoming review of the Markets in Financial Instruments Directive will include a ban amid other measures to increase transparency, such as a consolidated tape of information about transactions, people familiar with the matter said.

The U.S. Securities and Exchange Commission is separately weighing a ban on payment for order flow, in which trading firms pay retail brokerages to execute their trades. Regulators are concerned that video-game like prompts have encouraged excessive trading on app-based brokerages that fueled a explosive surge in value for GameStop Corp. and other stocks this year.

While the day-trading frenzy is far more muted in Europe than the U.S., the practice of zero-commission trading is starting to cross the Atlantic. That prompted the bloc’s markets watchdog to warn firms and investors in July of the risks arising from payment for order flow.

6.Five Observations About Economic Growth Expectations

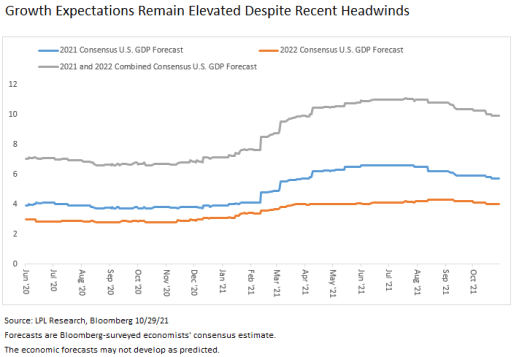

According to the consensus estimate of Bloomberg-surveyed economists, the U.S. economy, as measured by real gross domestic product (GDP), is expected to grow 5.7% in 2021 and4% in 2022, before reverting to closer to historical 2.4% growth in 2023. While consensus estimates do change over time, they are a good starting point for taking your bearings. Seeing how expectations have been changing can also offer some depth on what’s going on behind the scenes. Today we take a look at five things we can learn from changing U.S. growth expectations, as seen in LPL’s Chart of the Day.

“Two key takeaways from current growth expectations is that we’ve likely lost some growth to current headwinds from inflation, supply chain bottlenecks, and a tight labor market that won’t be recovered,” observed LPL Chief Market Strategist Ryan Detrick, “but even with that 2021 and 2022 combined are still expected to be the best stretch of two year growth since the 1980s.”

Looking more closely, here’s a deeper look at our five key takeaways from the forecast paths:

1) With two-year growth between 2021 and 2022 expected to come in around 9.9%, it’s hard to see a meaningful threat of stagflation, although there are risks. The year-to-date average for the “misery index” (trailing Consumer Price Index (CPI) inflation plus the unemployment rate), at 9.3%, is below even where it was from 2010 to 2012. Over the 10-year period from 1974 to 1983, the index averaged almost 16% and the average was not below 12% for any single year. It’s difficult to see what we’re experiencing now as comparable and current Bloomberg consensus expectations are for the misery index to fall to 7.5% for year-end 2022 and a benign 5.9% for year-end 2023.

2) Some growth will be lost. At its peak, the combined expected growth for 2021 and 2022 was 11.1%. Since then, the 2022 growth expectation has declined 0.9%, but that lost growth was not pushed forward into 2023. 2023 growth expectations fell 0.2% over the same period. Some of the lost activity due to supply chain disruptions and challenging labor markets simply will not return.

3) Despite the recent declines in growth expectations, they are still significantly higher than they were at the start of the year. At the end of 2020, combined U.S. growth in 2021 and 2022 was 7.1%. We are still over 2.5% above that level, even with recent downgrades.

4) Should 2021-2022 growth align with expectations, it will be the best two-year stretch since the Reagan 80s and would outpace the best two years of the prior expansion (2017-2018) by a wide margin. In fact, if we end 2021 with 5% growth, a likely outcome given growth year to date, it will be the first year above 5% since 1984.

5) Be careful with forecasts. We have seen them move substantially before and there is certainly a chance that they could again. Keep in mind also that this is the consensus best estimate, but views among individual forecasters vary widely and even the consensus can see quite a bit of movement over time.

While more than 1% has come out of the consensus growth forecast for 2021 and 2022, in absolute terms, the outlook is still quite strong. Looking back, the best single year of the last expansion was 2018 at 2.9%. That means there can still be quite a bit of downside from the current 2022 consensus view of 4.0% and next year would still be better than at any point last cycle. The risk for equity markets is that the consensus expectation is likely roughly priced in and meaningful further downgrades from here may push markets to adjust expectations. Nevertheless even 4.0% growth would provide a solid economic backdrop for markets and pessimism about supply chain disruptions may be passing their peak, leaving room for a potentially “surprising” upside surprise.

Five Observations About Economic Growth Expectations | LPL Financial Research (lplresearch.com)

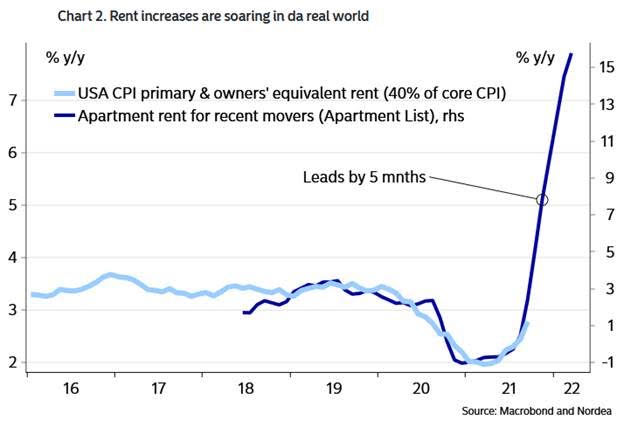

7.Rents Soaring

From Dave Lutz at Jones Trading

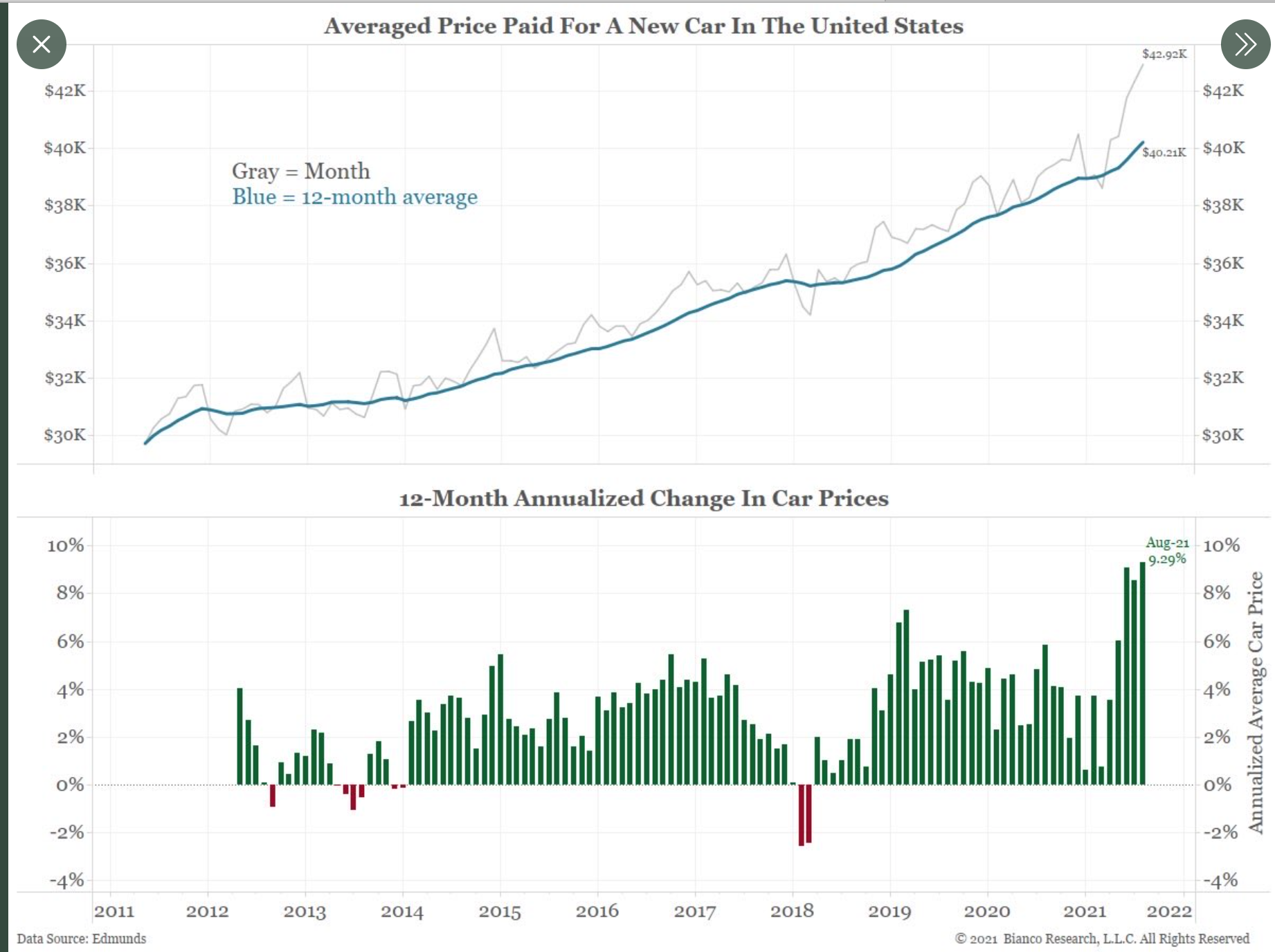

8.Average car price in U.S. has reached ~$40k, which is up 9.3% over past year

Liz Ann Sonders-Schwab

9.Jim Reid Deutsche Bank Mid-Term Elections One Year Away

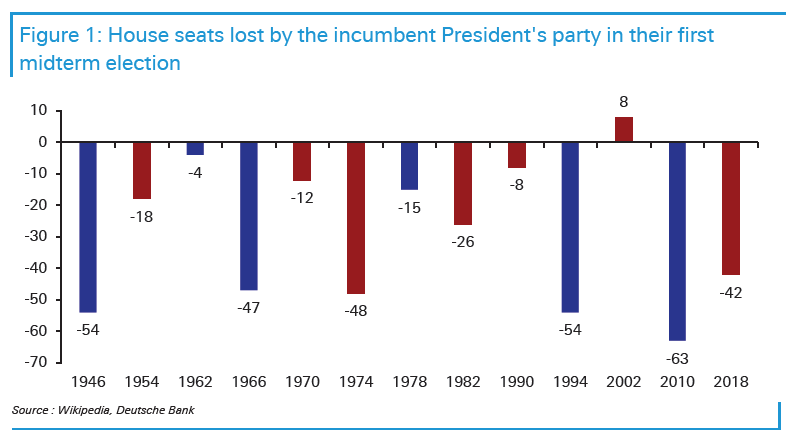

We are one year from the US midterm elections, which will likely be a pivotal moment for Joe Biden’s presidency, as a Republican takeover of either the House or Senate would give them power to block any legislation.

The signs do not look promising for the Democrats. Only last week they lost the governor’s race in Virginia, a state Biden won by 10 points in 2020. And history isn’t on their side either: there’s only been one occasion since WWII when the incumbent president’s party has gained House seats in their first midterm vote, and that was when President George W. Bush still had high approval ratings following the 9/11 attacks the previous year. Furthermore, the Democrats’ narrow House majority means the Republicans need just 5 more seats to be back in control. In the Senate, where 34 seats are up for election, the Republicans need to flip just one.

If the Republicans win either chamber, legislative accomplishments would then largely rely on bipartisan agreements. It’s no coincidence that President Obama’s major legislative wins all came in the first 2 years of his 8-year presidency (when Democrats had both chambers), including the post-GFC stimulus, Obamacare, and the Dodd-Frank Act. Similarly for President Trump, his major legislative achievement in the 2017 tax overhaul was when Republicans controlled both chambers too.

A concern markets will have about divided government is the potential for further wrangling over the debt ceiling. The 2011 crisis saw S&P downgrade America’s AAA credit rating, and a repeat could cause further jitters. Having said that the debt ceiling has been raised or suspended 13 times since then, spanning different congressional compositions. At a minimum we’ll likely be back to brinkmanship if we don’t see a longer-term raising in the months ahead.

It would also likely put an end to any further stimulus, with Republicans already railing against the inflationary impact of Biden’s policies—a potential argument for team transitory even if there’s plenty of inflationary stimulus in the system for now. That said, 12 months is still a very long time in political terms, and if we’ve learnt anything from election outcomes over recent years, it’s that plenty of surprises could still happen along the way.

10.What’s the Difference Between Knowledge and Information?

How do you know when you really know something?– Gina Barreca Ph.D.

KEY POINTS

- Information might lead to knowledge but is not the same as knowledge, nor does it replace knowledge.

- Knowledge depends on having a context into which information can be accurately placed; context is one of the keys.

- What you understand thoroughly, are familiar with from a variety of angles, can explain, and can, if asked, teach to someone else is knowledge.

- Knowledge it is not merely a transference of an unexamined parcel of data from one set of hands to another.

Everybody my age wanted to be an archeologist. I used to look out of the windows of our 1967 Buick Skylark hoping I’d spot dinosaur skeletons when we went for Sunday drives. (This was on the south shore of Long Island, as if a triceratops would have dropped dead after snacking at Nathan’s.)

The students I’ve been teaching for the last twenty years or so all wanted to be forensic scientists. They believed they’d be able to solve a decades-old mystery by finding half a sneaker in the woods behind Kohl’s.

Everybody longs to take the tiniest bit of information—a bone shard or the smallest spot of blood—and discover the whole story behind it. There’s an innate drive, it seems, to uncover information and then place it into a wider perspective. We want to fit a previously unidentifiable smidgen of evidence that will then, eureka!, cause a massive body of knowledge to fall into place.

Does information necessary lead to knowledge? Does the accumulation of detail necessarily lead to a greater sense of understanding?

In trying to figure this out, I asked my public and private Facebook friends (a diverse group of more than 8k), “What’s the difference between information and knowledge?”

More than 250 readers replied with their own stories—this despite the fact that in my first post I spelled the word “knowledge” incorrectly. (Spelling, like posture, is not one of my innate skills, talents, or gifts.)

While it’s obvious that there are many perspectives raised by the question, the conversation about what distinguishes knowledge and understanding from mere facts and information fired up our collective imagination.

“Information is the notes,” declares mental-health worker Amy Severinghaus, “But knowledge is the music.” You need information to have knowledge, but without knowledge, information lies lifeless. And that’s because, as Cotten J. Smith, an advisor to not-for-profit associations, put it, “Information exists independently of people (or any sentient being). Knowledge requires a ‘someone’ to know it.”

Who decides what is relevant? What is relevant changes all the time, like soup de jour, and you can’t get mad if the soup de jour it’s not the same as it was yesterday.

Having knowledge is different from picking up information. We can all collect facts; all human communities have done so in order to survive. Most of the world has access to various forms of mythologies, materials, experience, scientific studies, and news articles that seem to offer explanations for whatever questions we offer the universe, and every generation believes it has the final say on what’s really going on. But these explanations change over time, across cultures, and throughout history.

What appears as a fact at one point or in one place can be nullified when observed from different angles. There are people alive now who still ask the following questions: Doesn’t the sun really rotate around the earth?, Isn’t the earth undeniably flat?, Did men actually land on the moon?, Are JFK and Elvis still alive?

You can find “information” supporting all the theories that give rise to such questions. And sometimes it can seem as if misguided information takes the stage and gets the spotlight. As Pat McCulloch argues, “Information is the bully that pushes knowledge around,” and that can lead to bad influences as well as good ones.

What happens during the study of a subject and the acquisition of knowledge is not the same, therefore, as what happens at UPS: It is not merely a transference of an unexamined parcel of data from one set of hands to another.

Being knowledgeable about a subject doesn’t necessarily mean you’ve spent years reading books on the topic in an isolated ivory tower. It might not involve much formal schooling at all. But it does depend on having a relevant context into which to put the details.

Kuba Glazek, one of those former students of mine at the University of Connecticut, who did go into forensic science (without finding a sneaker), centers his distinction between information and knowledge on a singular factor: experience.

Says Dr. Glazek, “I am a human factors consultant at Rimkus Consulting Group, a forensic consulting company with offices around the country and globally. My work entails analyzing the human element in accident causation. I examine evidence, inspect accident sites, review scientific literature, generate expert opinions, write reports, and serve as an expert witness in legal proceedings.

“I examine the evidence in any particular case through the lens of my training in cognitive psychology, expertise in forensic analysis, and pertinent scientific literature to help my clients understand whether the actions of the people involved were reasonable under the circumstances. For example, a passenger vehicle impacts a pedestrian. Footage from a home security camera from across the street was obtained by the police. The video shows the pedestrian manipulating multiple items in her hands as she walks into the street without looking out for oncoming traffic. The motor vehicle’s front dips (indicating braking) 1.2 seconds after the pedestrian enters the street. All of this information is useful in my analysis, as I can determine who was or was not paying attention to their respective task. Attention, perception, motor control, and reaction time are pertinent human factors in this (imaginary) scenario, and my opinions would be generated with them in mind.”

The details are crucial, and we would all have a gut reaction to learning them; the knowledge behind offering an expert opinion, however, is a dispassionate one that emerges from a deep and thorough understanding of widely different ways of approaching the topic.

Wrote James Kobielus, “Information is the odds, but knowledge is where you place your wager.” Kobielus, a senior research director in data management, goes on to suggest that “If we can borrow a conceptual framework from quantum mechanics, information is the superposition of all possible outcomes, but knowledge is what, in the act of choosing from a field of possibilities, collapses the probabilities down to one outcome you end up owning.”

Being able to understand and interpret doesn’t depend as much on the topic as it does on ability of the person facing the question. Knowledge helps us endure uncertainty; information, when not vetted or observed carefully, plays into uncertainty and feeds off chaos. As Sharon Alleman, an executive who works in finance, puts it, “Knowledge is understanding the consequences of the information.”

What you understand thoroughly, are familiar with from a variety of angles, can explain and can, if asked, teach to someone else is knowledge.

Information is essential, and gathering information is the best way to approach a topic—as long as your information comes from diverse, sane, and vetted sources. Ultimately, however, it is insufficient. As author Jim Carpenter wrote, “Information is what knowledge has for breakfast.”