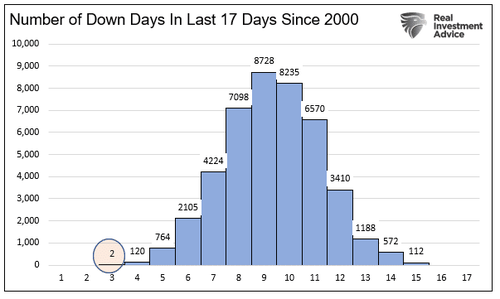

1.S&P 500 has only been Down 2 of the Last 18 Days….It’s Never Happened in 20 Years.

ZeroHedge Blog -Currently, the bulls control the market as we are in the middle of a “buying stampede.” Historically, buying stampedes last on average between 7 and 12 days. Logically, buying stampedes always get followed by selling stampedes of similar lengths. However, there are times these stampedes can last much longer than expected.

We are currently in one of those longer-term periods. As shown below, the S&P 500 has only been down in 2 of the last 18 days. How unusual is that? In the previous 20-years of the S&P 500, the number of times the market accomplished such a feat was precisely ZERO.

https://www.zerohedge.com/markets/did-fed-just-set-stock-market-crash

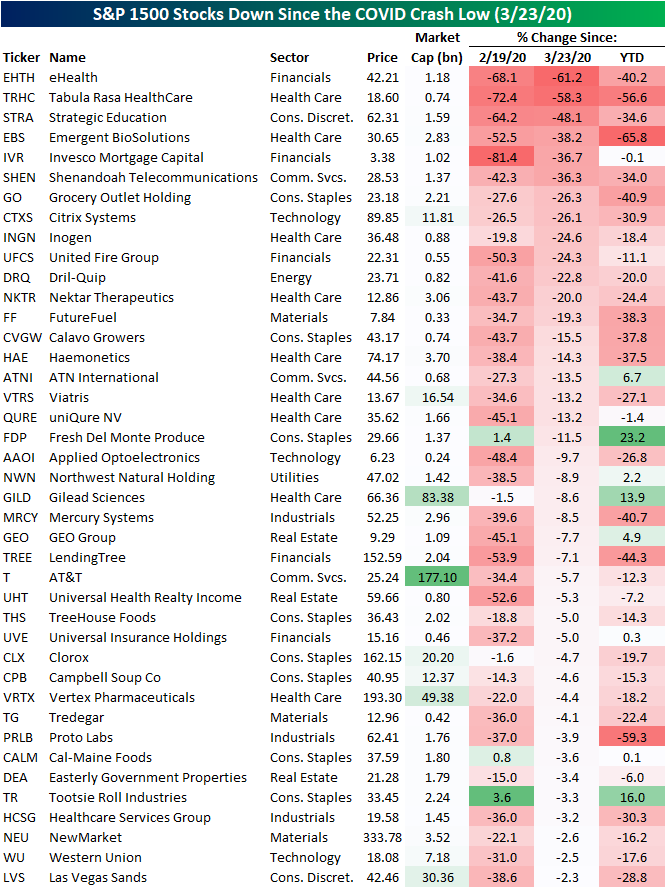

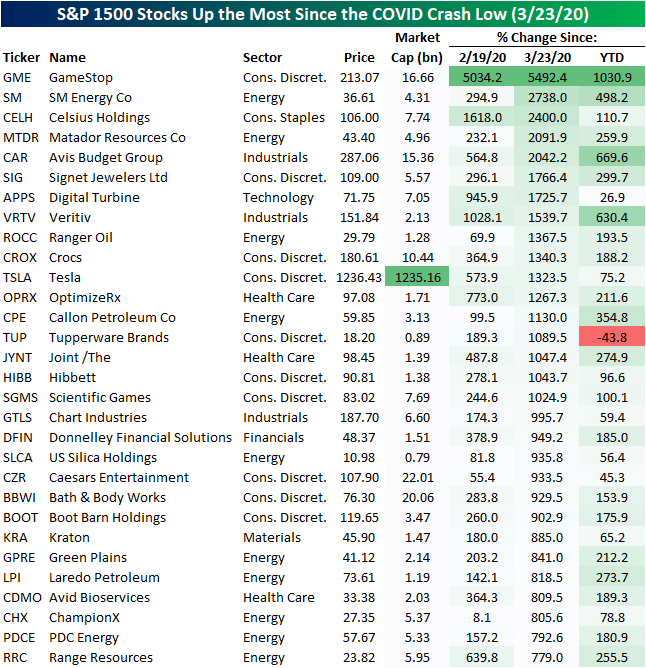

2.Best and Worst Performers Since the COVID Crash Low

Bespoke Investment Group-The major indices have consistently been hitting new record highs over the past few days with the S&P 500 having now more than doubled off the COVID Crash low on March 23, 2020. As for individual stocks, there are currently only nine S&P 500 stocks that are below their levels from March 23, 2020, and expanding the universe to the S&P 1500 which includes small and mid-caps, there are currently 41 stocks that are below their levels from that date. Obviously, March 23, 2020 may not coincide with a particular high or low point on these individual stocks’ charts, but declines since then would be quite painful to handle given that the broad market has more than doubled over the same time frame.

As shown below, eHealth (EHTH) currently is the biggest decliner versus March 23, 2020 levels having fallen over 60% with a large share of that decline occurring this year. The only other stock that has been more than cut in half since the bear market low is Tabula Rasa HealthCare (STRA). TRHC has been declining since the spring, but a large share of that decline is actually occurring today after it reported an EPS and sales miss in addition to lowered guidance on earnings last night. Today, the stock has fallen nearly 50% in reaction to those weak earnings. There are a handful of stocks on this list that are up on a year-to-date basis with Fresh Del Monte Produce (FDP), Tootsie Roll Industries (TR), and Gilead Sciences (GILD) the only ones that are up double digits. While below their levels from the bear market low, TR and FDP are also two of the only stocks that are simultaneously above levels from February 19, 2020 which marked the last high prior to the start of COVID Crash bear market.

As for the stocks that have gained the most since the COVID Crash low on 3/23/20, meme mania darling GameStop (GME) still tops the list having rallied 5,492%. That is twice the rally of the next best performer, SM Energy (SM). As for the rest of the top performers since the bear market low, there are another 15 that have gained over 1,000%. One of those is a member of the trillion-dollar market cap club: Tesla (TSLA). Another one of these top performers, Tupperware Brands (TUP), is also one of the only stocks that is actually lower on a year-to-date basis, and those declines are significant at a 43.81% loss. TUP got below $2/share at its lows during the COVID Crash, but then surged back into the mid-$30s in late 2020. It has since moved back down into the teens. Click here to view Bespoke’s premium membership options.

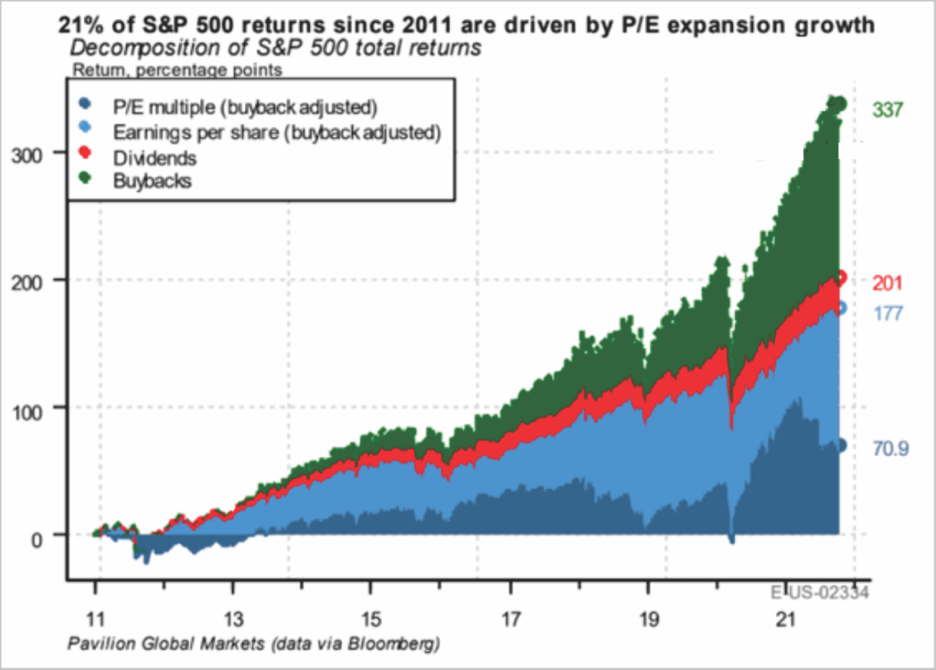

3.The S&P 500 is at Near Record High Forward P/E and P/S Levels…Breakdown of Returns Since 2011…21% of Returns from Multiple Expansion

Steve Blumenthal CMG Weath–The chart below via Pavilion Global Markets shows the impact stock buybacks have had on the market over the last decade. The decomposition of returns for the S&P 500 breaks down as follows:

- 21% from multiple expansion,

- 4% from earnings,

- 1% from dividends, and

- 5% from share buybacks.

In other words, in the absence of share repurchases, the stock market would not be pushing record highs of 4600 but instead levels closer to 2700.

To put that into context, the high-water mark for the S&P 500 in October 2007 was 1556. In October 2021, after 14 years, the market would be 2700 without share buybacks. Such would mean that stocks returned a total of about 3% annually or 42% in total over those 14 years.

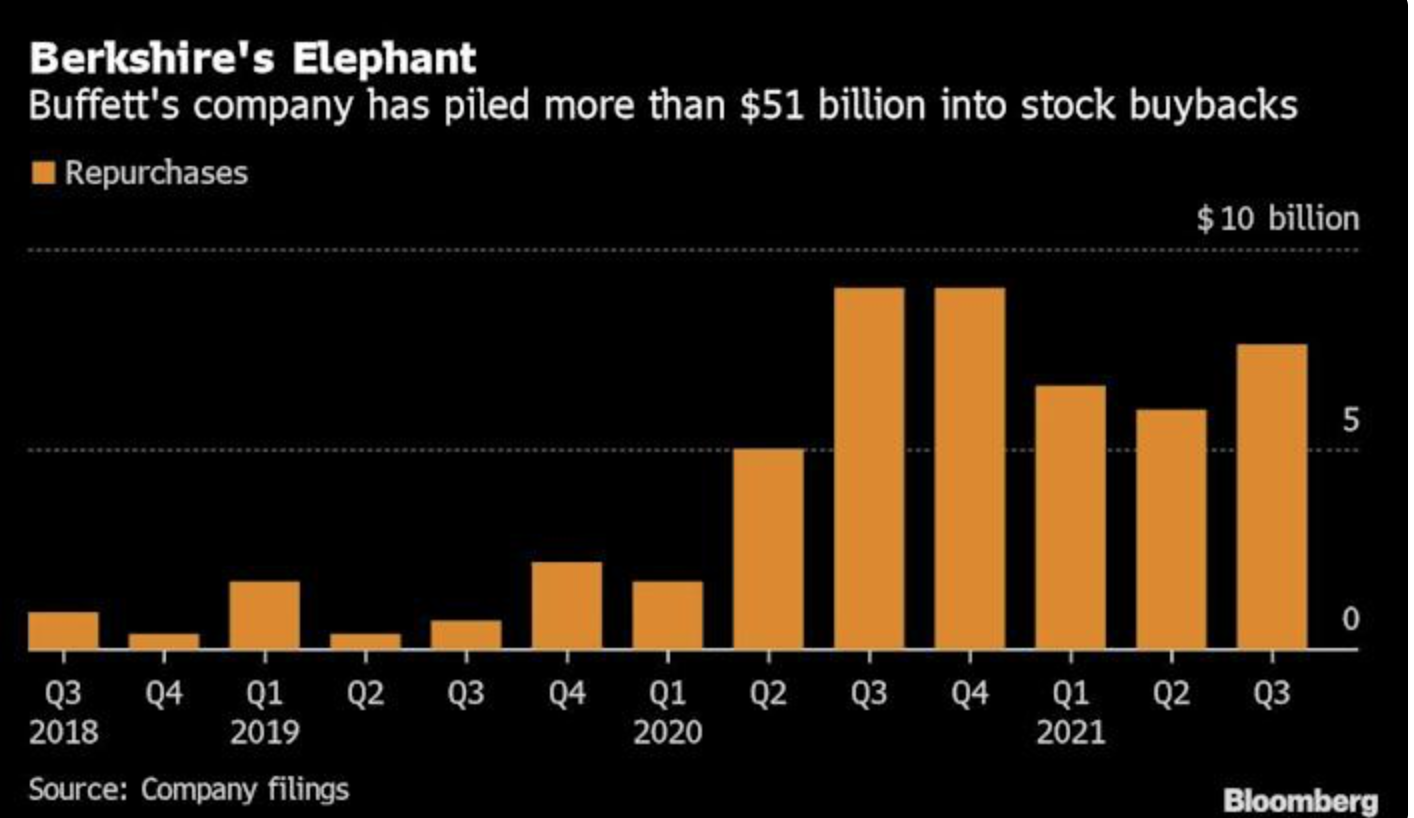

4.Buffett Can’t Find Whale Takeover so Spending on Buybacks.

(Bloomberg) — Warren Buffett has spent more money buying back Berkshire Hathaway Inc.’s stock in recent years than he did amassing his biggest equity bet on Apple Inc.

Berkshire spent nearly $20 billion more repurchasing its own stock since the middle of 2018 than it deployed accumulating its Apple stake through the end of last year. In total, Buffett poured about $51 billion into buybacks since a change to its policy more than three years ago, and appears to have continued snapping up at least $1.7 billion of stock since the end of September.

Buffett, Berkshire’s chairman and chief executive officer, has built Berkshire into a sprawling conglomerate valued at more than $650 billion, but that immense size has heaped pressure on his need for what he deemed an “elephant-sized” acquisition to ramp up Berkshire’s growth. Buffett has been foiled on his recent deal hunt, outbid at times by aggressive private equity firms. That’s left him increasingly relying on buybacks, with more than $20 billion of repurchases so far this year, as a way to put some of Berkshire’s record cash pile to work.

“The bull case would say they bought back $20 billion worth of their stock because they’re confident in their future outlook and that should be a catalyst for the stock, and my sense is it probably will,” Cathy Seifert, an analyst at CFRA Research, said. “The bear case, which is also relevant to point out, is this is a company that has had, as a stated desire, the need to make additional acquisitions and they haven’t been able to do that.”

https://finance.yahoo.com/news/buffett-berkshire-appetite-surpasses-cash-173252893.html

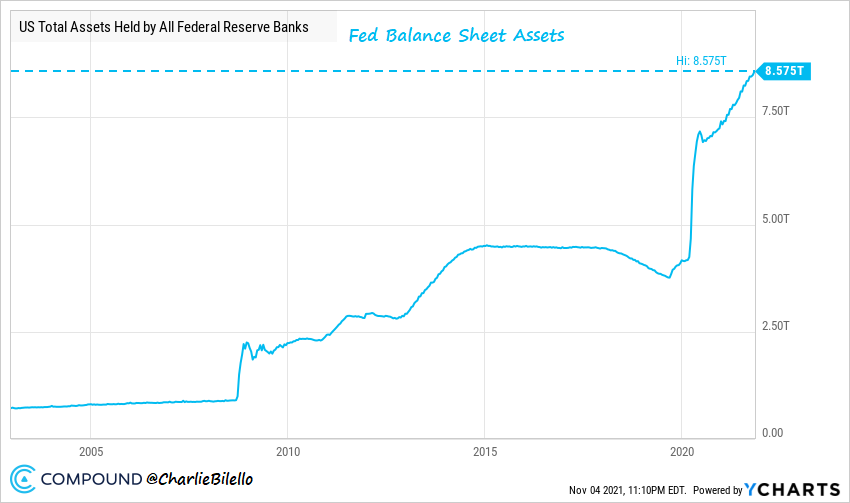

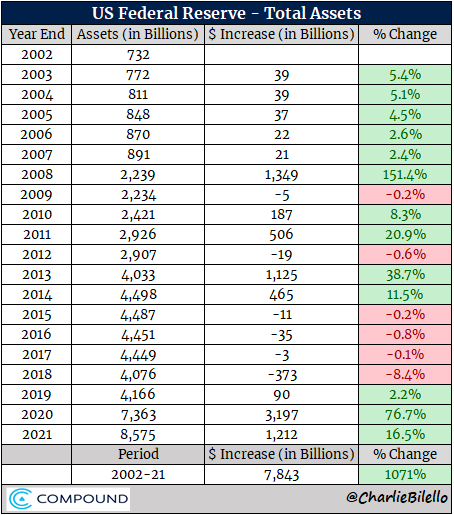

5.The Beginning of the End of Easy Money…Feds Balance Sheet Increased by Over 1000% During Covid

Charlie Bilello-As expected by everyone, the Fed finally announced a tapering of asset purchases at this week’s FOMC meeting. The plan: reduce purchases of Treasuries by $10 billion per month and purchases of mortgage-backed securities by $5 billion (from current totals of $80 billion in Treasuries and $40 billion in MBS).

But a slowdown in the purchases is still an increase, and the Fed’s balance sheet hit another new high this week at $8.575 trillion.

Incredibly, this is an increase of $1.2 trillion in a year (2021) that has featured the highest US inflation rates in 30 years and the highest US growth rates in 40 years.

6.Bakkt will allow customers to trade ether on its platform in the ‘next few weeks’

Gavin Michael, CEO of Bakkt, rings a ceremonial bell at the NYSE on October 18.

REUTERS/Brendan McDermid

- Users of Bakkt will be able to buy, hold, and sell ether directly through its app by the end of the year.

- Bakkt also said institutional clients can choose the Bakkt Warehouse for custody of ether.

- The digital asset firm went public on October 18 amid growing crypto demand.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

Users of digital asset platform Bakkt Holdings will be able to buy, hold, and sell ether directly through its app by the end of the year, a spokesperson told Insider.

“We have received all required approvals and have already built the necessary technology to begin offering ethereum on the Bakkt platform. These capabilities will be live on the platform in the next few weeks,” the spokesperson said via email.

The Alpharetta, Georgia-based firm, which went public on October 18, also said institutional clients can choose the Bakkt Warehouse for custody of ether, according to a statement.

“At Bakkt, providing flexible opportunities for users to enjoy their digital assets is a top consideration, and adding Ethereum brings a popular and growing cryptocurrency to our roster,” Bakkt CEO Gavin Michael said in the statement.

Bakkt’s addition of the second-largest digital asset by market cap to its suite of offerings, which already include bitcoin trading, is a nod to its rapid growth.

Ether has notched a 509.7% year-to-date gain compared to bitcoin’s 110.4% surge. The two assets command more than half of crypto’s $2.8 trillion market cap, according to CoinGecko.

As ether and bitcoin scale record highs, analysts have been anxiously awaiting “the flippening,” a hypothetical point at which ether overtakes bitcoin in market valuation to become the largest cryptocurrency. For now, bitcoin remains dominant with a market cap of $1.16 trillion compared to $534.5 billion for ether.

An ethereum futures ETF will be available before one that holds bitcoin directly – and approval could come in the 1st quarter of 2022, Bloomberg analysts say

- The approval of a bitcoin futures-based ETF means a similar offering for ether is imminent.

- Bloomberg analysts believe the first ether futures-based ETF could launch in the first quarter of 2022.

- And while a spot bitcoin ETF is possible, continued opposition from the SEC makes it less likely.

An ether futures-based ETF may launch as early as the first quarter of 2022, beating out the anticipated launch of a bitcoin spot ETF that directly holds the cryptocurrency, according to a Tuesday note from Bloomberg analysts.

Last month, the SEC approved the launch of a bitcoin futures-based ETF, which utilizes monthly futures contracts to gain exposure to the price movements of bitcoin.

Ether futures-based ETF applications were filed with the SEC earlier this summer. But VanEck and ProShares both withdrew their applications on August 20, suggesting the SEC is not yet ready to greenlight them.

However, that approval could come next year, according to the Bloomberg note. Ether futures currently have open interest of about $1.2 billion, according to data from the CME. That’s about the same amount bitcoin futures had when SEC Chairman Gary Gensler outlined requirements for futures-based ETFs in early August, the analysts pointed out.

To be sure, a futures-based method is more costly and less reliable in matching price movements than holding a cryptocurrency directly, similar to gold and silver ETFs. Still, the ProShares Bitcoin Strategy ETF was the fastest ETF launch to hit more than $1 billion in assets under management.

But while investor demand remains strong amid an ongoing bull market in crypto, don’t expect the SEC to take the next step soon with bitcoin.

“Though a spot Bitcoin ETF is possible in 2022, SEC approval may take longer due to concerns about regulation in the underlying bitcoin market,” the Bloomberg note said.

And a recent application for a leveraged bitcoin futures ETF has little chance of approval from the SEC, signalling that the agency still has a tough stance towards cryptocurrency regulation as it seeks to protect investors.

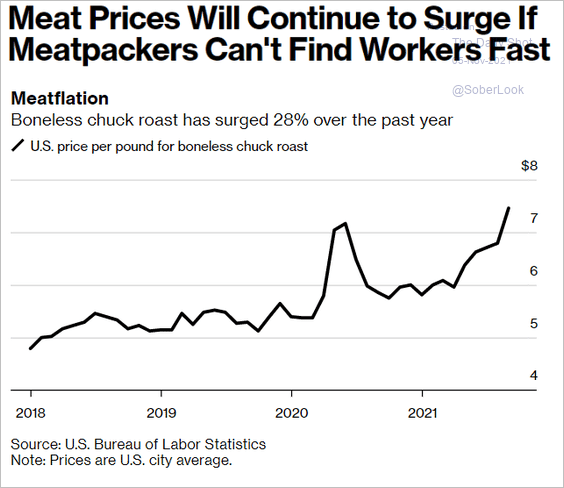

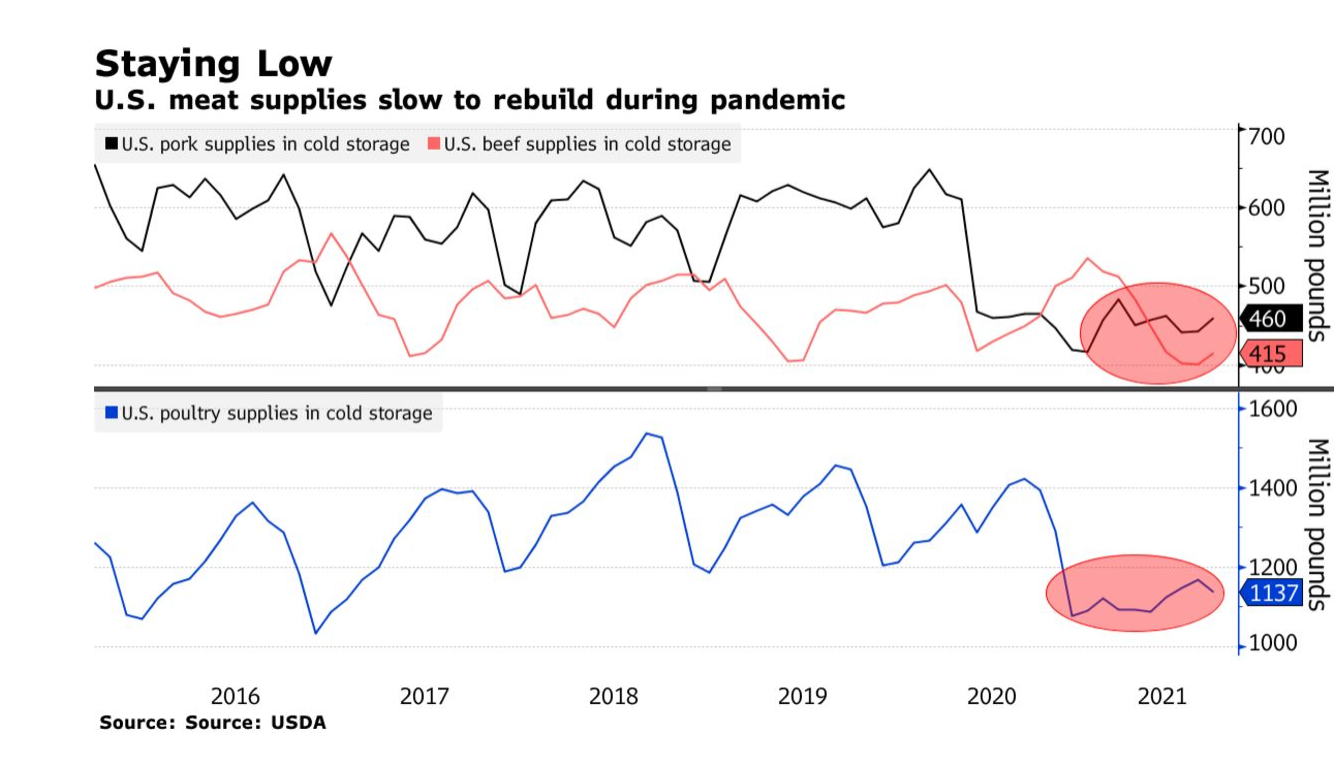

7.Meat Prices not Coming Down Soon?

Food for Thought: US meat prices:

With the pandemic igniting a collective reassessment of work, imagine posting openings for low-wage jobs that could require standing for 12-hour shifts, working six-day weeks and repeatedly lifting 70-pound objects in conditions that range from steaming hot to bloody and ice cold. And on top of all that, your industry recently made headlines for Covid-19 outbreaks that killed workers.

This is precisely what meatpackers are facing. Of all the industries experiencing crunches for hourly labor, it’s hard to find one with a greater recruiting challenge. Companies have tried all the usual tricks to lure applicants, including offering signing bonuses of as much as $3,000, but they’re still short workers and, as a result, there are an increasing number of sparse shelves.

By

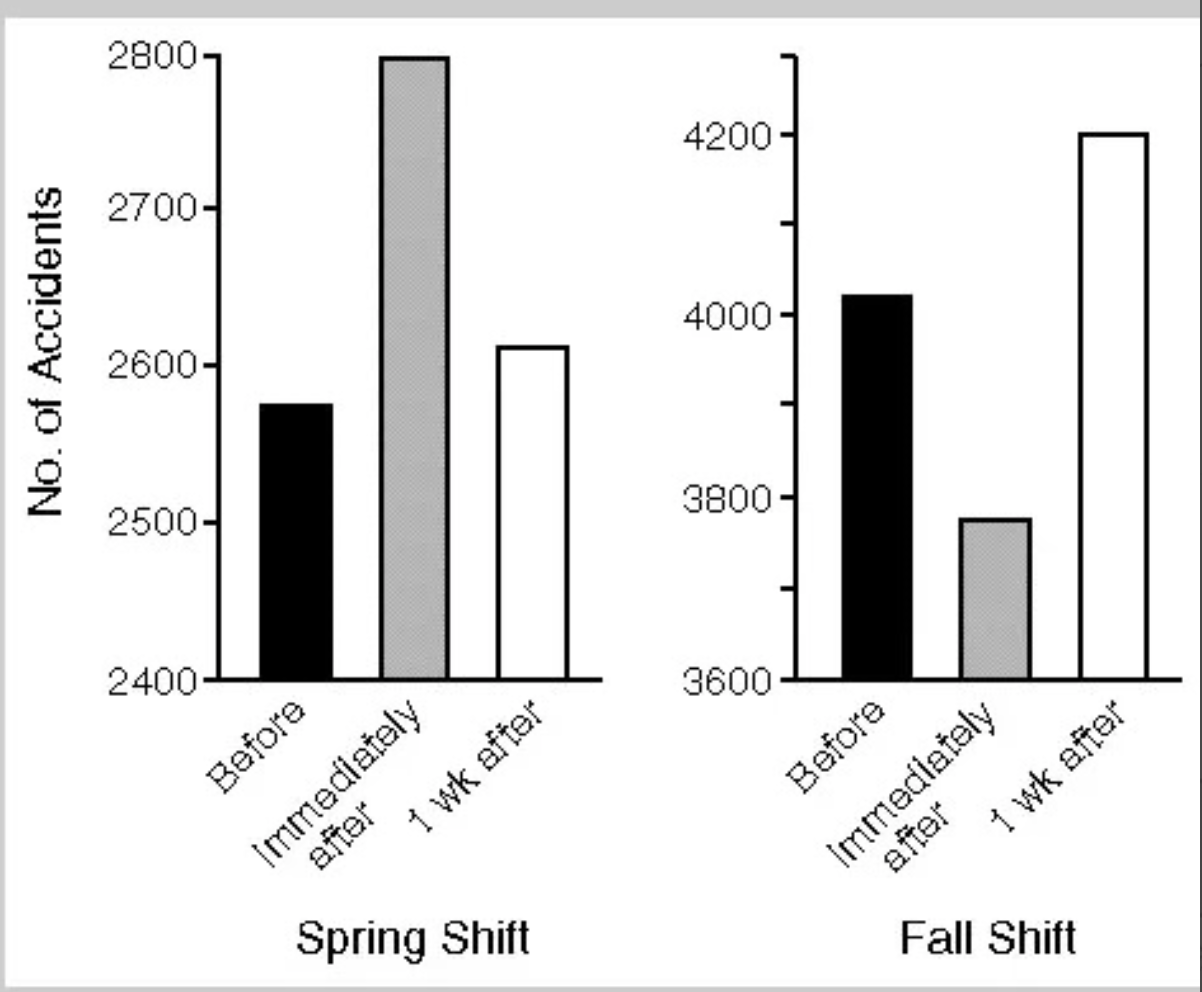

8.Daylight Savings Time Stats

It’s time to stop changing clocks 2x a year. It costs us far more than sleep: -8% more car accidents -5% more heart attacks -More injuries at work -Lower SAT scores -5% harsher sentences in court 19 states support year-round Daylight Saving Time. 31 to go https://theconversation.com/the-dark-side-of-daylight-saving-time-91958

9.Covid: Pfizer says antiviral pill 89% effective in high-risk cases

By Jim Reed and Philippa Roxby

BBC News

A pill to treat Covid developed by the US company Pfizer cuts the risk of hospitalisation or death by 89% in vulnerable adults, clinical trial results suggest.

The drug – Paxlovid – is intended for use soon after symptoms develop in people at high risk of severe disease.

It comes a day after the UK medicines regulator approved a similar treatment from Merck Sharp and Dohme (MSD).

Pfizer says it stopped trials early as the initial results were so positive.

The UK has already ordered 250,000 courses of the new Pfizer treatment, which has not yet been approved, along with another 480,000 courses of MSD’s molnupiravir pill.

Health and Social Care Secretary Sajid Javid called the results “incredible”, and said the UK’s medicines regulator would now assess its safety and effectiveness.

“If approved, this could be another significant weapon in our armoury to fight the virus alongside our vaccines and other treatments,” he said.

The Pfizer drug, known as a protease inhibitor, is designed to block an enzyme the virus needs in order to multiply. When taken alongside a low dose of another antiviral pill called ritonavir, it stays in the body for longer.

Three pills are taken twice a day for five days.

The combination treatment, which is still experimental because trials haven’t finished, works slightly differently to the Merck pill which introduces errors into the genetic code of the virus.

Pfizer said it plans to submit interim trial results for its pill to US medicines regulator the FDA as part of the emergency use application it started last month. Full trial data has not yet been published by either company.

The US has already secured millions of doses of the pill, according to President Joe Biden.

The company’s chairman and chief executive Albert Bourla said the pill had “the potential to save patients’ lives, reduce the severity of Covid-19 infections, and eliminate up to nine out of 10 hospitalisations”.

Trial results

Vaccines against Covid-19 are seen as the best way of controlling the pandemic but there is also demand for treatments that can be taken at home, particularly for vulnerable people who become infected.

Interim data from trials of the treatment in 1,219 high-risk patients who had recently been infected with Covid found that 0.8% of those given Paxlovid were hospitalised, compared with 7% of patients who were given a placebo or dummy pill.

They were treated within three days of Covid symptoms starting.

Seven patients given the placebo died compared to none in the group given the pill.

When treated within five days of symptoms appearing, 1% given Paxlovid ended up in hospital and none died. This compared to 6.7% of the placebo group being hospitalised and 10 of them dying.

Patients in the trial, which has not yet been published or verified, were elderly or had an underlying health condition which put them at higher risk of serious illness from Covid. They all had mild to moderate symptoms of coronavirus.

Dr Stephen Griffin, associate professor in the School of Medicine at the University of Leeds, said: “The success of these antivirals potentially marks a new era in our ability to prevent the severe consequences of Sars-CoV2 [coronavirus] infection, and is also a vital element for the care of clinically vulnerable people who may be unable to either receive or respond to vaccines.”

Pfizer is also studying the treatment’s impact on people at low risk of Covid illness and on those who have already been exposed to the virus by someone in their household.

2px presentational grey line

Developing truly effective antiviral drugs is notoriously difficult, so having two that look highly potent against Covid is a remarkable feat.

Viruses are much simpler beasts than bacteria or parasites.

That sounds like they should be easier to defeat, but in reality it means there are far fewer weak spots for drugs to exploit.

There is also a wide variety of different types of virus that exploit our bodies in different ways, which means scientists often have to go back to the drawing board for each one.

Then they hide inside our body’s own cells, which means drugs that seem potent in the lab may not work as well in the body.

There have been successes, notably in HIV, but reports concluded one antiviral for flu ended up being about as effective as paracetamol.

The question now is whether the success of these pills in clinical trials can be repeated in the real world, as people with Covid will have to be identified and treated within a matter of days of their symptoms developing.

https://www.bbc.com/news/health-59178291

10. Humility is simple to understand but hard to practice.

Farnam Street Blog

Tiny Thought

“It is impossible for a man to learn what he thinks he already knows.” — Epictetus

Humility is the anecdote to arrogance. Humility is a recognition that we don’t know, that we were wrong, that we’re not better than anyone else.

Humility is simple to understand but hard to practice.

Humility isn’t a lack of confidence but an earned confidence. The confidence to say that you might not be right, but you’ve done the diligence, and you’ve put in the work.

Humility keeps you wondering what you’re missing or if someone is working harder than you. And yet when pride and arrogance take over, humility flees and so does our ability to learn, adapt, and build lasting relationships with others.

Humility won’t let you take credit for luck. And humility is the voice in your mind that doesn’t let small victories seem larger than they are. Humility is the voice inside your head that says, ‘anyone can do it once, that’s luck. Can you do it consistently?’

More than knowing yourself, humility is accepting yourself.