1. VIX Drops 38% Election Week…The Largest Weekly Drop Since Last Presidential Election.

VIX 4thLargest Weekly Drop on Record

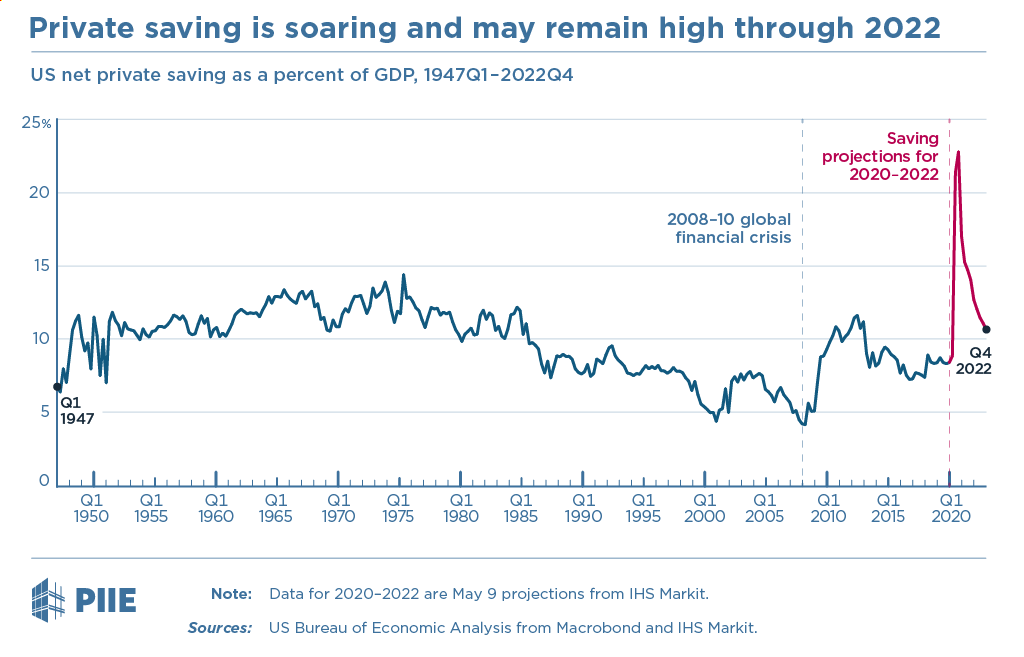

2. Personal Savings $2.5 Trillion in U.S. Seeing a Huge Boost During Covid.

Business Insider–A ‘growth bomb’ is brewing in the US with consumers sitting on $2.5 trillion in savings — and it’s poised to give the economy a huge boost, one Wall Street chief strategist says

Reuters

- The US economy could be set for a surge in growth as consumers start to spend the money they saved during the COVID-19 pandemic, according to The Leuthold Group.

- When the personal-savings rate has been this high in the past, economic growth has surged, according to historical data from Leuthold.

- “More than $2.5 trillion of sidelined savings is the fuel for a growth bomb waiting to explode,” Leuthold said.

- Visit Business Insider’s homepage for more stories.

A $2.5 trillion cash pile hoarded by consumers may be all it takes to fuel the economic recovery from the COVID-19 pandemic, according to The Leuthold Group’s chief investment strategist James Paulsen.

Consumers have increased their personal savings rate amid the pandemic as budgets were cut and spending out at places like restaurants and theaters declined significantly.

The savings rate surged to 35% as the economy went into a recession earlier this year, and now sits at 15%, which is still size percentage points above its historical average. Once consumers are convinced that the economy is on good footing and its safe to get out and spend, economic growth should soar.

“More than $2.5 trillion of sidelined savings is the fuel for a growth bomb waiting to explode,” Paulsen said, citing historical data.

When the personal savings rate was above average while consumer sentiment was higher than its current level, average annualized GDP growth nearly doubled to 4.44%.

And on top of the heightened savings rate among consumers, a lack of inventory for a wide range of consumer goods should necessitate “considerable job creation,” according to Paulsen, as companies rush to replenish their supply of goods.

A surge in housing during the pandemic has led to a shortage of common consumer goods, and according to US manufacturing and trade inventories as a percent of nominal GDP, US inventories are the leanest ever, Paulsen highlighted.

Meanwhile, the economic recovery won’t be entirely reliant on another round of fiscal stimulus, according to Paulsen.

“Additional fuel isn’t needed,” Paulsen said, referring to more stimulus. Instead, “the fuse just needs to be lit,” referring to consumers beginning to spend their savings pile.

An increase in consumer sentiment from its pandemic lows is materializing, so perhaps that fuse will be lit soon.

“With a pool of excess idle fuel [savings], it has only taken a bit more confidence to produce a healthy advance in the economy,” Paulsen concluded.

Learn more about the financial services industry.

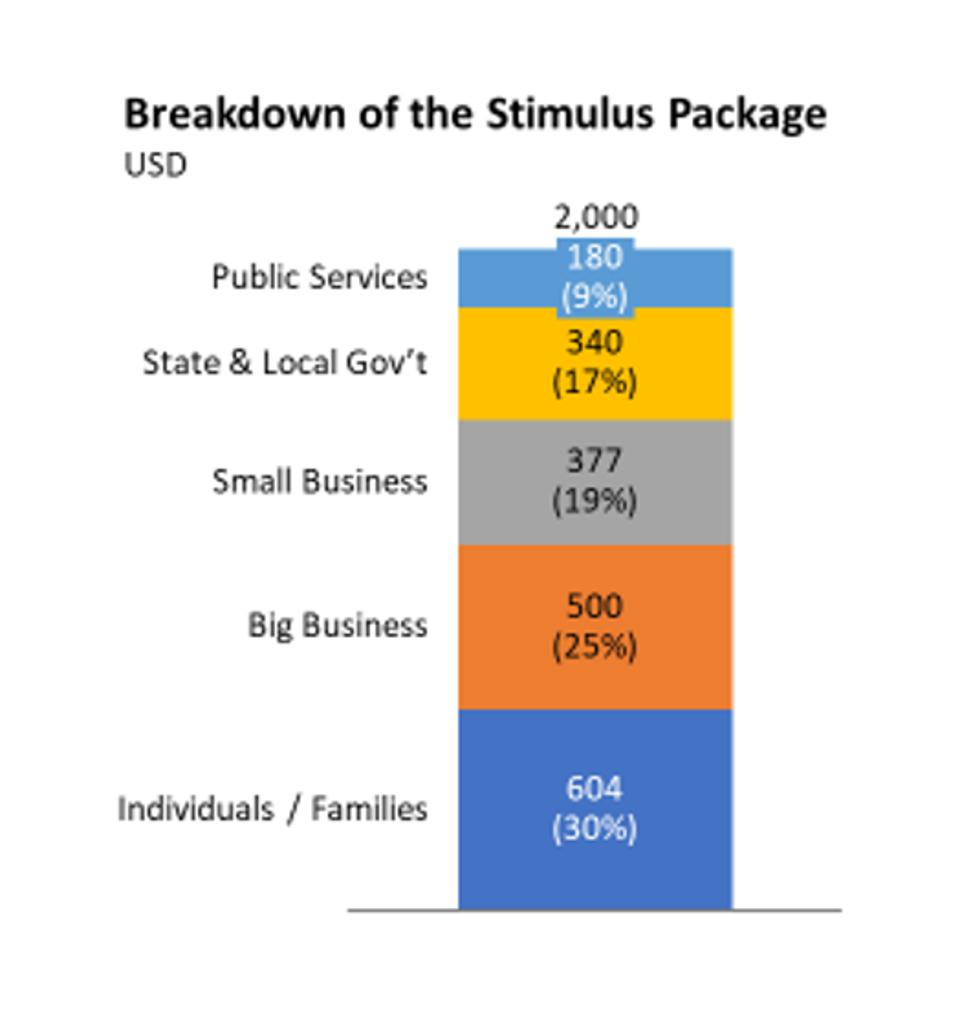

3. Breakdown of Stimulus Packages…Another $2 Trillion Plus Above Savings Build Up?

Here is a quick breakdown:

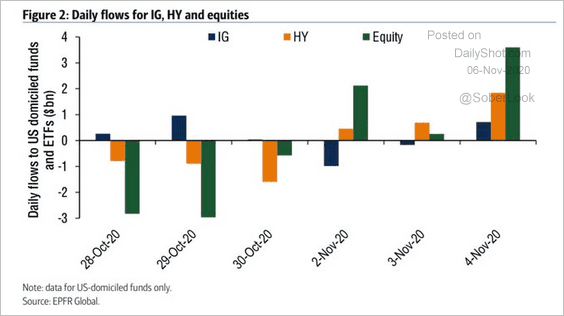

4. Risk On in Bond Markets as Well…Money Poured into Corporates Over Treasury

Credit: Corporate bonds saw substantial inflows this week as Treasury yields tumbled.

Source: BofA Global Research, @WallStJesus

The Daily Shot.https://dailyshotbrief.com/the-daily-shot-brief-november-6th-2020/

5. Gun Background Checks Dwarf All Records….+40% Year Over Year

Triggered Americans

After three months of declines, gun background checks in the United States rose again in October, rising from 2.892 million up to 3.305 million. That’s the highest monthly reading since July as the wave of civil unrest started to abate. While off the highs seen earlier this year, October’s number of background checks was the fifth-highest monthly total on record and higher than all but one monthly reading prior to 2000. Just to illustrate how much of a surge we have seen in background checks for firearms this year, the chart below shows the total number of background checks in the first ten months of each year since 2000. At the current total of 32.1 million, total background checks are dwarfing every other year on record. This year’s total number of background checks is already higher than any full-year total since 2000, and even September’s YTD total of 28.8 million would have surpassed every other prior year on record.

Not only is this year’s increase in background checks the highest on record, but the y/y increase in this year’s first ten months relative to last year is also the largest increase on record. Prior to 2020, the largest y/y change over the first ten months of the year was 2016’s increase of 26.3%. This year, though, background checks are up by over 40%! We’ve seen a number of statistics this year showing that uncertainty on the part of Americans towards the economy and country, in general, is at record highs, and the increase in the number of Americans purchasing firearms is just another real-life example. Click here to view Bespoke’s premium membership options and unlock full access to our research and interactive tools.

https://www.bespokepremium.com/interactive/posts/think-big-blog/triggered-americans

6. Peloton Subscribers +133% Year Over Year.

7. Tech Stocks Leading Globally Not Just U.S…..

All-Star Charts Blog

We’re going to take a close look at these Chinese tech giants and see if we can glean some insight into the internals of CQQQ in addition to other International Indexes.

First of all, the chart looks a good deal different than it did when we posted the Mystery Chart earlier this week.

This isn’t just because it was inverted, but also because the ETF has made a swift move this week, booking about an 8% gain.

Click Chart to Enlarge Image.

Look at this beautiful uptrend. The ETF tends to consolidate for several years and then make another leg higher. This summer it resolved to the upside from its most recent consolidation (once again). It then flagged above former resistance turned support for a couple months before breaking higher in the direction of the underlying trend just this week.

Now let’s take a look at how Chinese Technology stocks are performing relative to stocks around the globe. Here is a ratio chart of CQQQ vs the All Country World Index $ACWI.

It just broke out of a 3-year base to fresh all-time highs. As long as this breakout holds, we expect this ratio to have some serious legs. In other words, Chinese Tech should continue to outperform the broader market for the foreseeable future.

Found at Abnormal Returns Blog. www.abnormalreturns.com

8. Covid Hardest Hit by State-Visual Capitalist

Found at Barry Ritholtz Blog. https://ritholtz.com/2020/11/weekend-reads-442/

9. Tesla Is Now Selling $250 Bottles Of Tequila

by Tyler Durden

Tesla, which has now somehow been bestowed with a $407 billion market cap, has decided to go into the tequila business.

The car company disruptive technology company launched its own brand of tequila on Thursday after CEO Elon Musk had joked about doing so back on April Fool’s Day in 2018. Musk said then that the company was looking to launch “Teslaquila”. Now, they have something with a different, but similar, name.

The bottles of “Tesla Tequila” are going for $250 each and appeared to have sold out within hours of the product going live on Tesla’s website, according to Reuters.

The product comes in bottle shaped like a lightning bolt, held up by a small stand.

When Musk first tried to trademark the name “Teslaquila” in Mexico back in October 2018, the Tequila Regulatory Council argued that the name was too similar to “tequila”, which is a protected word.

Mexico’s Tequila Regulatory Council approved of the new name, however, stating: “Tesla is now a certified brand of tequila under the strict regulations regarding our national drink.” The council said it would be made by Destiladora del Valle de Tequila, a major producer of tequilas.

Tesla says the drink is being made by Nosotros Tequila, one of Destiladora del Valle de Tequila’s brands. The producer also makes bourbon, vodka and Canadian whisky. Tesla’s website says the tequila is only available in New York, California and Washington.

Hey, it beats having to go through the trouble of conjuring up a new product reveal to take in extra cash, doesn’t it? Maybe Musk can send the NHTSA a bottle…

10. 7 Steps for Overcoming Stage Fright and Overconfidence

🎙Chief Storyteller | Author | Speaker | Broadcaster | Communications Director

It won’t be long until we meet in person again. After months of online presentations, how comfortable will you feel presenting to a live audience? Fear of public speaking is already a concern for most, so being out of practice could increase anxiety. As a public speaking instructor and coach, I have seen the gamut of nervousness—from tears to overconfidence. Yes, overconfidence can be as crippling as fear. These seven steps will help you conquer either, putting you on a path to deliver effective, meaningful, and memorable presentations.

First, know that a small case of the jitters is actually a good thing when you are about to make a presentation, especially if you know how to channel it. Severe nervousness, however, is the reason most people either loathe speaking in public or avoid it altogether. When you understand the two most common sources of nervousness, you will be better able to control it.

Each of us has a negative chatterbox in our head. The ability to control that negativity directly affects anxiety levels. For example, if you fear you’ll forget to deliver key elements of your presentation, the negative chatterbox will be happy to reinforce that fear. The trick is to squelch the bad voice by replacing it with a positive alternative a la Rhonda Byrne’s The Secret. Harness the law of attraction. Remember, the secret is to train the subconscious on positive reinforcement. If you fear you’ll forget what you want to say, constantly repeat an affirmation such as, “I know my subject and I know exactly what I want to tell my audience.” If you simply repeat, “I won’t forget my topic,” your subconscious will only hear “forget.” Choose the right phrase so your subconscious delivers the positive result you seek. Try this on anything that gives you agita.

The other most common source of public speaking anxiety stems from a sense of hyper-responsibility. This is when we feel responsible for every little thing going on at the time of our presentation, including with each member of the audience. Freeing yourself of this burden requires you consciously remind yourself that you are not responsible for the amount of sleep anyone in the audience got, whether anyone had a bad day, the weather, or the construction across the street (unless you also happen to be the developer who won that bid, in which case, kudos to you). You get the point. Also, in most cases the speaker is not responsible for a lousy sound system, lighting, seating arrangements, etc. For this reason, I strongly advise against apologizing to your audience for any of the aforementioned. Doing so will only chip at your credibility. Why draw attention to anything unpleasant? It won’t score you points.

While most people have some level of fear about speaking in public, those who are over-confident have some serious obstacles to overcome, too. Over-confidence could lead to a false sense of security, a cockiness that quips, “I got this. The audience will melt like butter in my hands.” On the surface, that might sound like just the attitude to adopt to overcome stage fright but something eerily ironic happens to the over-confident. They often appear aloof, seem disjointed, are prone to freezing, become repetitive, or lack authenticity.

Yes, over-confidence can be as debilitating as severe stage fright.

Follow these seven steps for organizing your presentation to build confidence without stumbling into the perils of crippling fear or over-confidence.

- Get to know your audience. Surely there is some research you can do to get an idea about who will be on the receiving end of your presentation. Whether it is live or online, your job is to speak directly to your audience, keeping their interests a priority.

- Prepare with focus. Once you have defined the purpose of your presentation and chosen a topic, choose two to five main points you want to impart. Most people cannot remember more than three main points, so keep your presentation focused.

- Build your presentation from the inside out. Develop your key points by supporting them with evidence—sourced data, a story, or a hypothetical example. Create transitioning statements that will guide you and your audience as you move from one point to the next. Only after you develop the main part of your presentation should you create a clever, attention-grabbing opening. Once you do, be sure to create an equally memorable closing statement. I’ve seen countless speakers prepare all but the close, leaving the audience confused. The close is your opportunity to drive home your message and to make a lasting impression.

- Choose visual aids. Only after you’ve researched your audience and topic and prepared and organized your message should you consider visual aids. This includes creating a PowerPoint. As I state in Impact, Deliver Effective, Meaningful, and Memorable Presentations, you are the presentation; PowerPoint is just a visual aid. Prepare only slides or visual elements for that which needs further explanation or emphasis. Visual aids should support what you are saying. They are for the audience. They should not be your crutch or cue cards.

- Practice! Imagine going through all the trouble to prepare as describe above only to leave the delivery to chance. That’s not a winning strategy. Think of your presentation as a sporting event. You would not go onto the field or court without having practiced. Why go onto a stage without practicing every last detail of your presentation? Professional athletes employ deliberate practice tactics, where they purposely get out of their comfort zones to master even the most minute aspect of their form. Professional speakers do the same.

- Prepare stage notes. Reading is boring and memorizing is risky. Both remove spontaneity from your talk, so do neither. Instead, take the outline you likely created while organizing your speech and craft a presentation outline, something to which you can refer as you cruise with the top down. Think of your outline as a roadmap and use it to keep yourself on a logical path. Whether your outline is riddled with bullets, littered with numbers, punctuated with boldface and italic text, or a combination of all those elements is up to you.

- Practice! This is not a typo. Practice may not make you perfect, but it will make you better. You will be less anxious, more confident yet considerate of the audience, and ultimately more effective.

The audience will only buy what you are saying if they buy into who you are—your credibility, integrity, and demeanor. These seven steps will help you get there, and if they leave you a little jittery, great! Turn those jitters into adrenaline. Make them work for you instead of against you. Your enthusiasm on stage is a contagion that will motivate you and your audience.

About me:

I am passionate about communication! My career began in broadcasting, transitioned into corporate communications, and now I do both. I also ghostwrite and coach professionals at every level in the art of Public Speaking and interpersonal communication. You can find some well organized speaking tips in my book Impact: Deliver Effective, Meaningful, and Memorable Presentations. For some nostalgia and laughs check out my cultural narrative Gravy Wars: South Philly Foods, Feuds & Attytudes and my stage show La Famiglia. Visit www.LorraineRanalli.com to learn the rest of my story. Let’s work together to tell the plethora of stories behind your brand and your organization.

Disclosure

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.