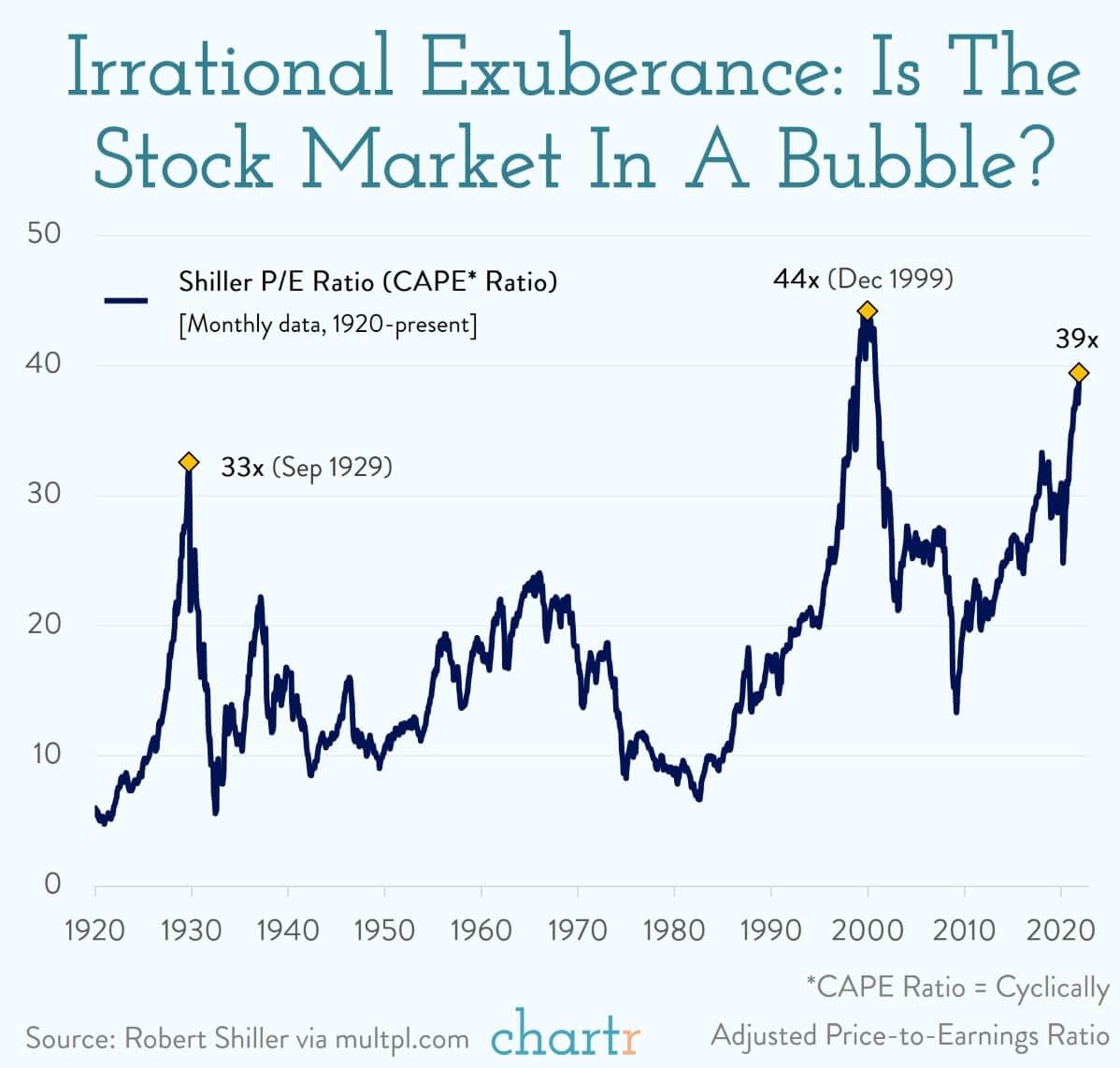

1.Shiller P/E Ratio Update.

Irrational exuberance

Answering that question is a bit like answering how long is a piece of string. Just limiting the question to US stock markets helps to narrow the focus, as does getting some help from Nobel laureate Robert Shiller.

Shiller is the creator of the Cyclically-Adjusted Price-to-Earnings Ratio (CAPE).

A simple price-to-earnings ratio compares how much one share costs with how much it earns. A share that costs $100, and earns $5 a year, has a P/E of 20x. It’s a rough but simple way to compare valuations between different companies, or history.

Shiller took that simple metric and… made it more complicated (but also probably better). Instead of just looking at one year of earnings, Shiller compares the price with the average from the last 10 years (adjusted for inflation). Doing that helps to smooth things out, as any company can have one good or bad year.

Lucky for us, Shiller has been calculating this CAPE ratio for the US stock market as a whole, for decades and decades.

So where are we now?

The latest CAPE ratio for the S&P 500 Index is 38x. That’s pretty close to the all-time record, which was 44x back in 2000. For those with a short memory, that was just before the dotcom bubble burst and markets (particularly tech) crashed hard.

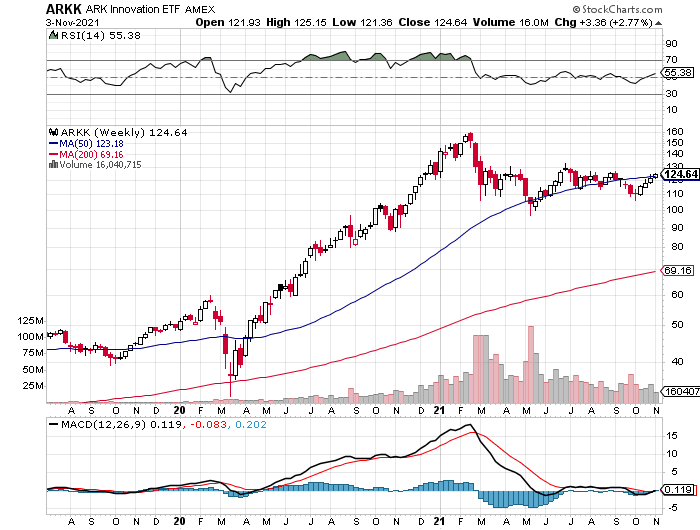

2.ARKK ETF Update…Still $30 Below Highs.

ARKK had a +10% week but still well below highs.

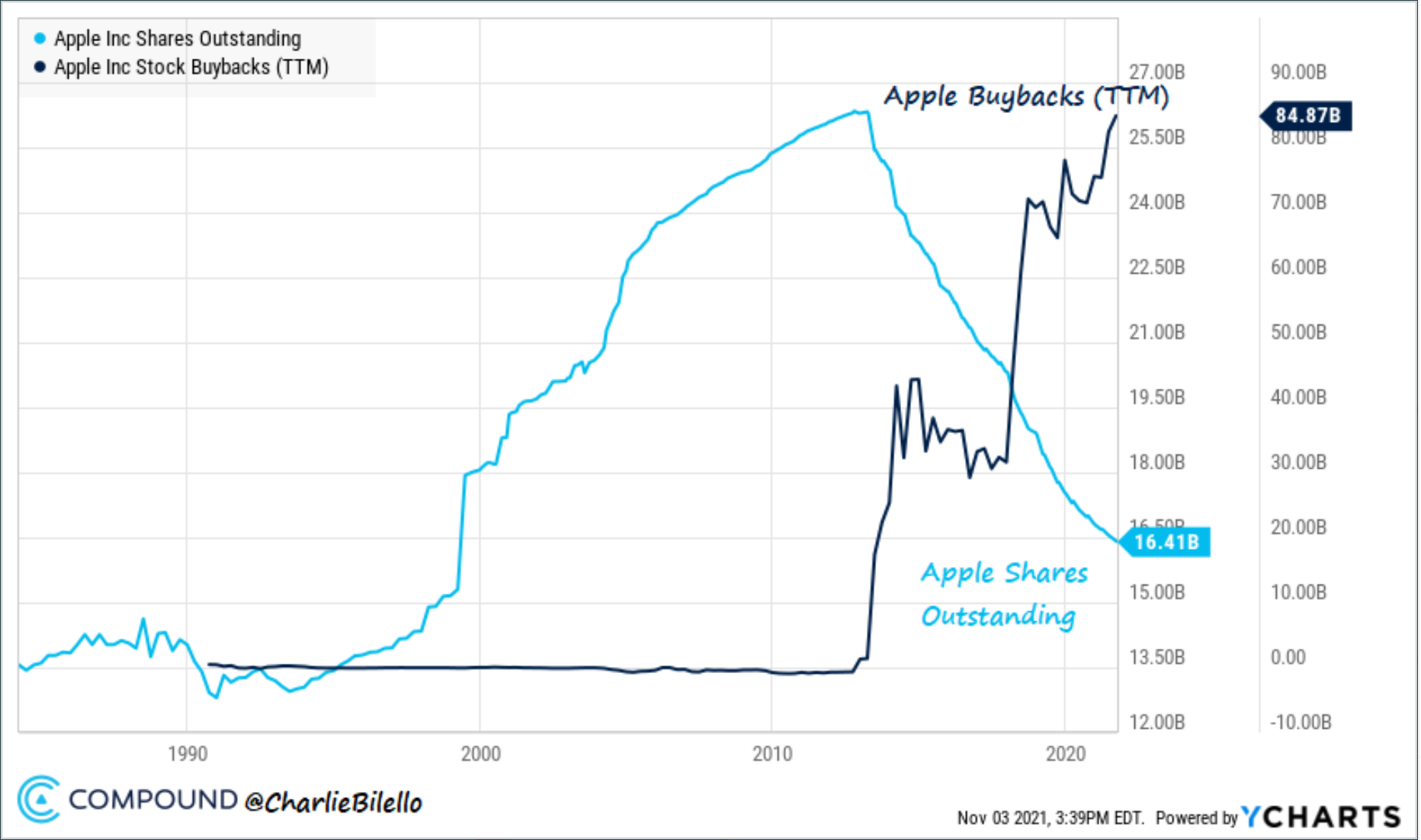

3.Apple’s 8 Years of Buybacks=Greater than Market Cap of 490 S&P Companies

Apple has bought back $435 billion in stock over the past 8 years, which is greater than the market cap of 490 companies in the S&P 500.

4.DeFi — the ‘Wild West’ of crypto — is next on regulators’ hit list

Ryan Browne@RYAN_BROWNE_

KEY POINTS

- After a crackdown on Binance and other cryptocurrency firms, regulators are now turning attention to the world of decentralized finance.

- Decentralized finance, or “DeFi,” lets users take part in traditional financial activities like lending but with no middle men involved.

- Regulators are concerned about DeFi services marketing themselves as decentralized when that may not be the case.

The fast-growing decentralized finance industry could be about to get a rude awakening.

Decentralized finance, or “DeFi” as it’s commonly referred to, is a trend in cryptocurrencies that first started gaining traction in 2020.

It’s been called the “Wild West” of crypto — hoards of computer programmers trying to bring traditional financial products such as loans to the blockchain.

The idea sounds promising. In theory, anyone could lend and borrow digital money at competitive interest rates, with no middle men involved. Investors are lured by the promise of earning up to double-digit percentage yields on savings in certain digital tokens.

But with major hacks and scams plaguing the space this year, regulators are becoming increasingly worried about the risk of crime as well as harm to consumers.

“I think they’re going to pay more attention to the space,” Sid Powell, co-founder of DeFi lending platform Maple Finance, told CNBC.

Almost $90 billion has been deposited into Ethereum-based DeFi protocols so far, according to data from The Block.

“It’s probably inconceivable that you have meaningful growth of DeFi which does not need to complement existing regulation in future,” Powell said.

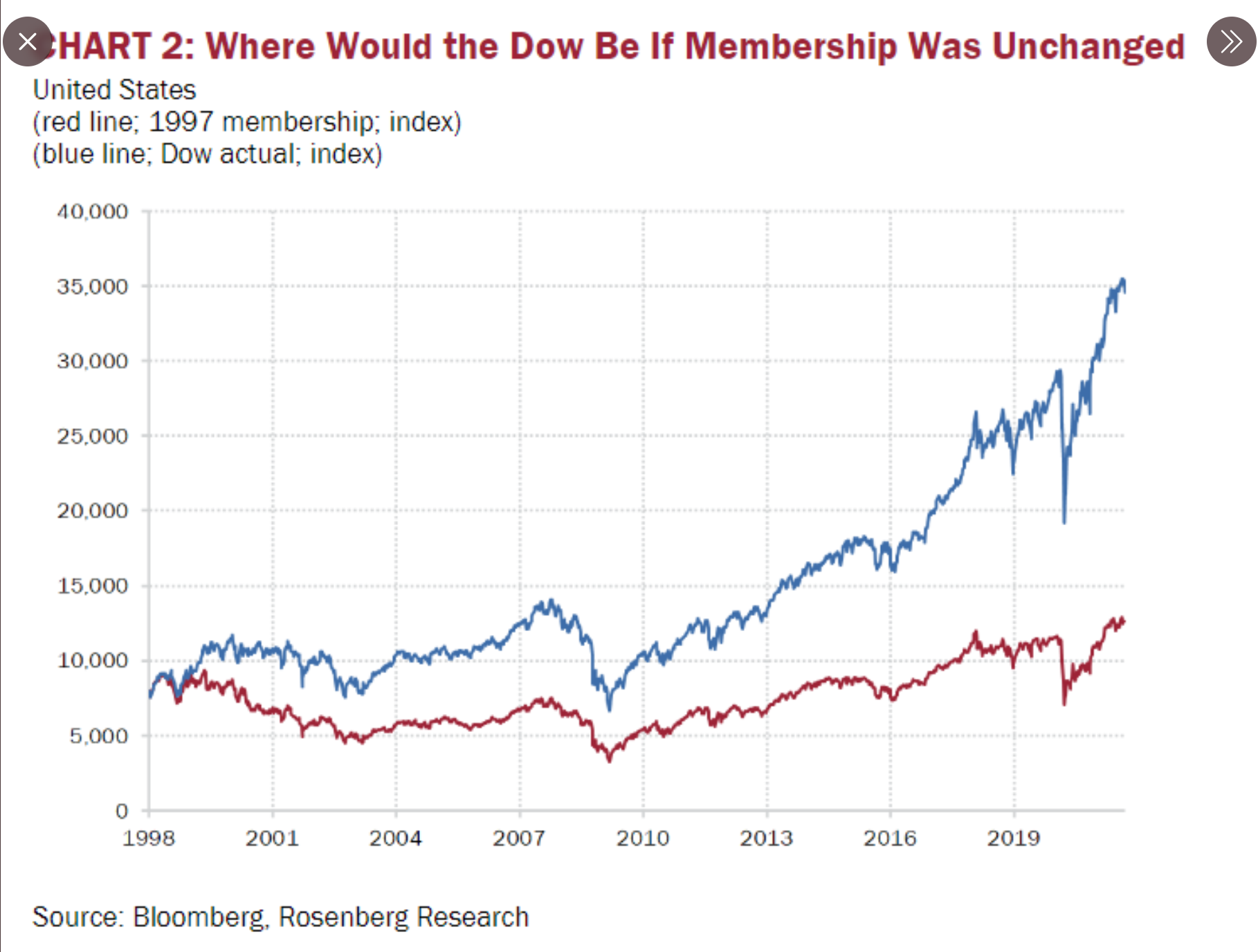

5.Where the Dow Would Be Without Change in Components Since 1997

Fascinating look at where Dow would be if the components hadn’t changed since 1997. (-65%) Chart:

https://twitter.com/cullenroche

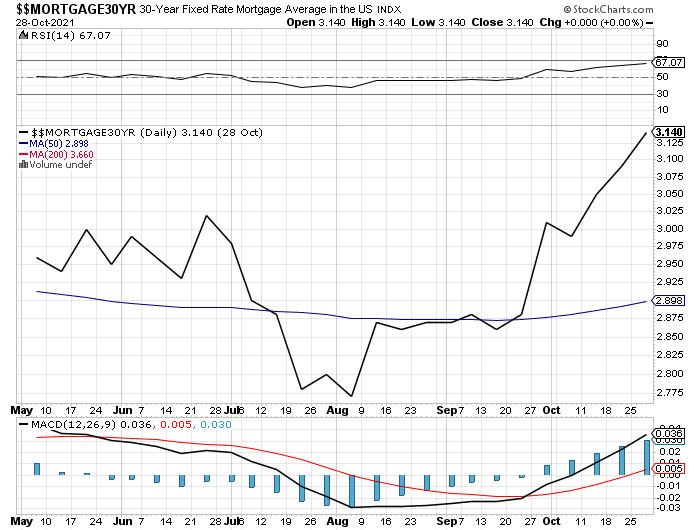

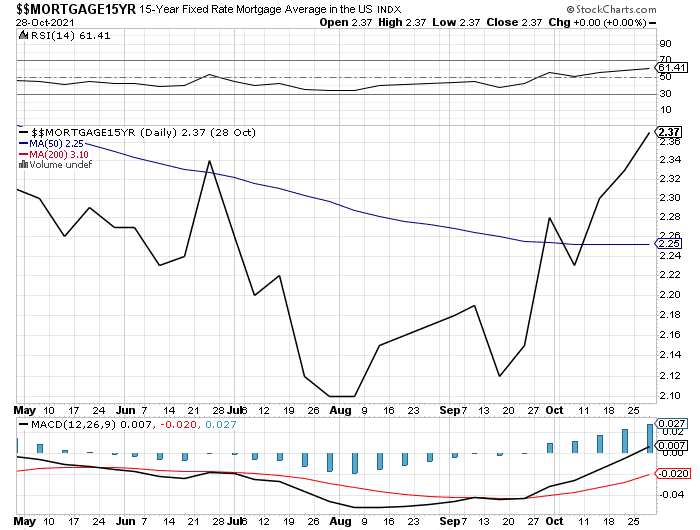

6.Update on Mortgage Rates.

30 Year Fixed Rates

15 Year Mortgage Rates

7.History of American Home Equity Loans….No Big Spike with Drop in Rates

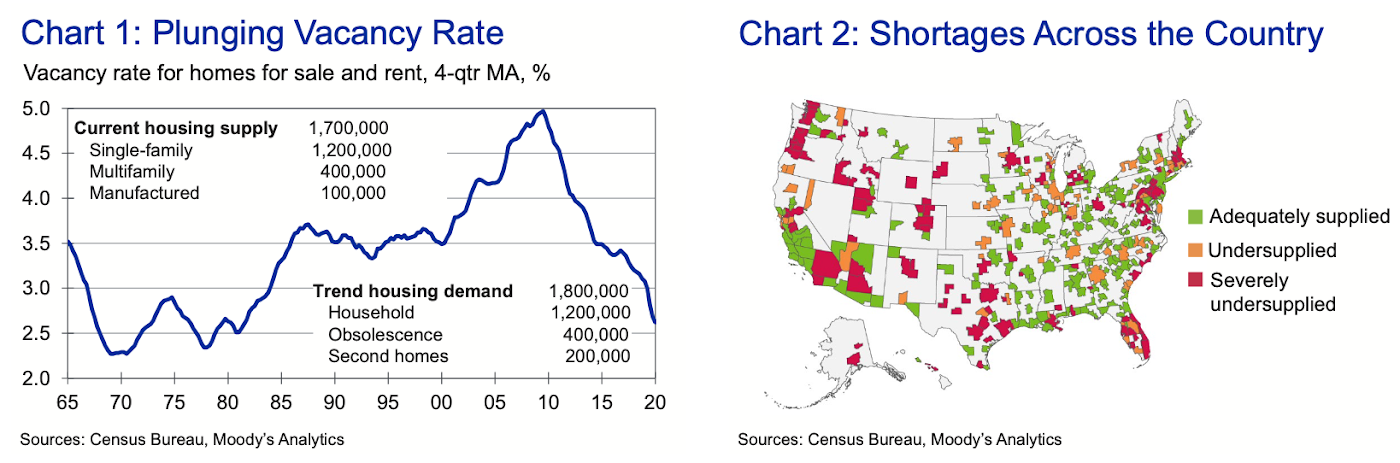

8.We are Short Units in All Housing

There is not enough housing for sale or rent in communities across the country

From Barry Ritholtz The Big Picture Blog https://ritholtz.com/2021/11/10-tuesday-am-reads-355/

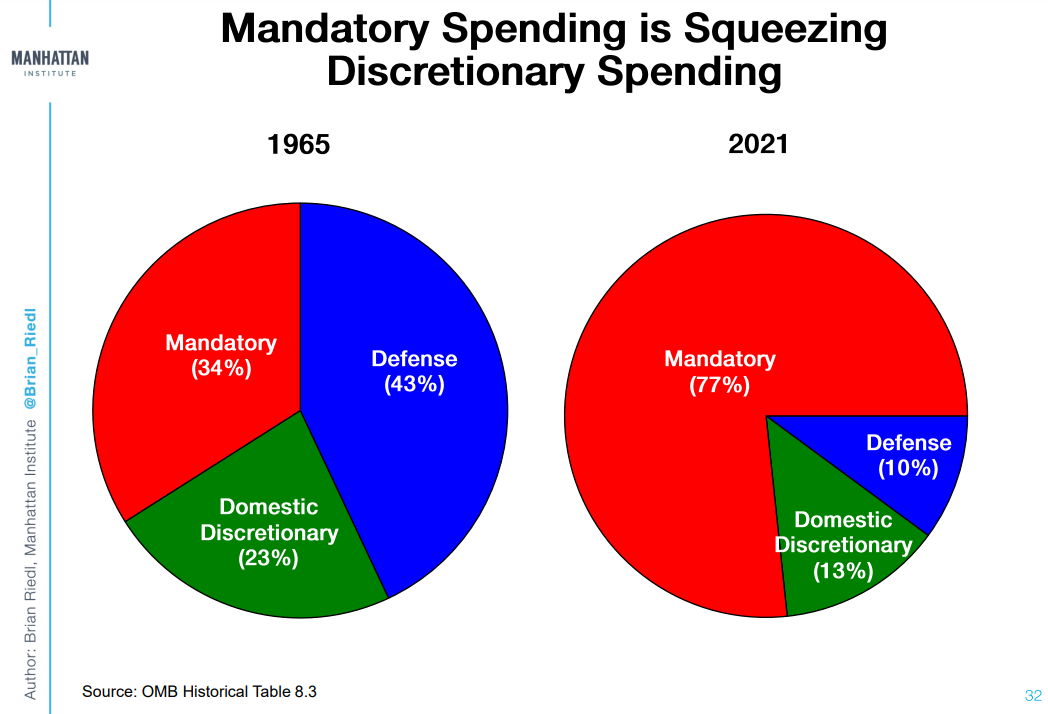

9.Government Debt 1965-2021

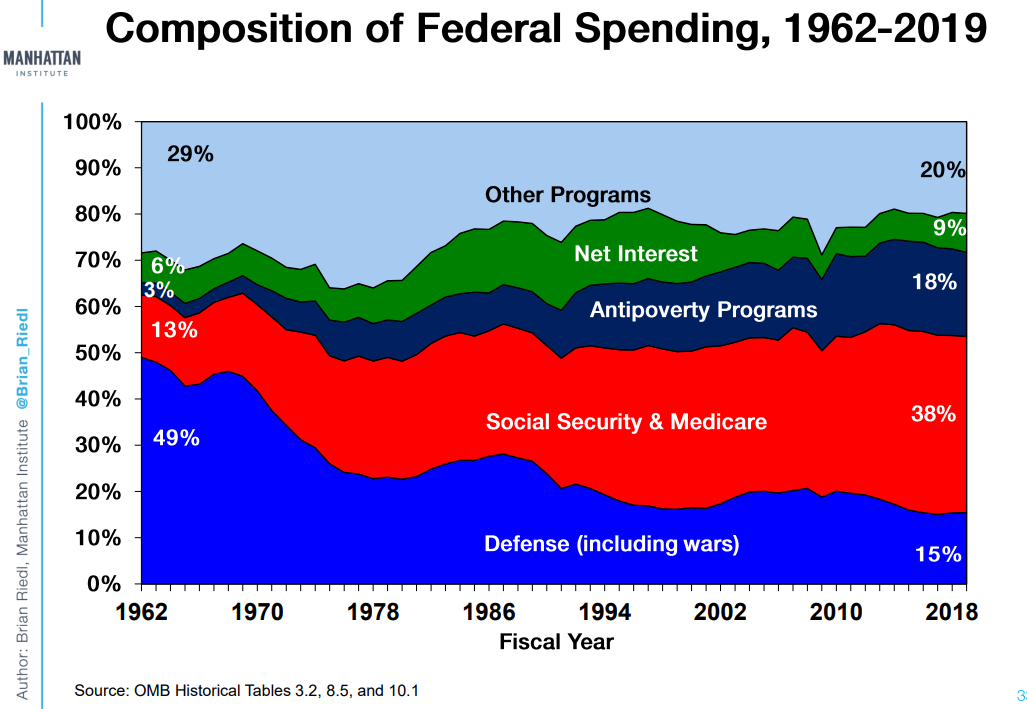

Ben Carlson A Wealth of Common Sense…It’s also interesting to see how government debt has evolved over time. Brian Riedl put together a bunch of charts that show the main reason for higher government debt and it may surprise you.

Mandatory vs. discretionary spending is vastly different than it was back in the 1960s:

There’s a reason for this.

The baby boomers are the biggest generation of all-time to live as long as they are. When Social Security and Medicare were first introduced no one really planned on those programs taking care of 70+ million people for multiple decades.

Now look at how these programs are taking up a bigger piece of the pie over time:

The United States Has Been Going Broke For Decadesby Ben Carlson

https://awealthofcommonsense.com/2021/10/the-united-states-has-been-going-broke-for-decades/

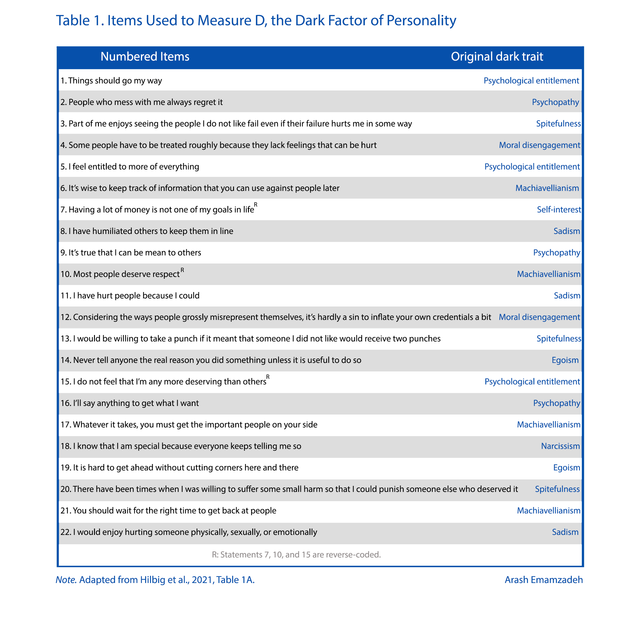

10.Dark Personality Factors

Arash Emamzadeh-Psychology Today

What’s at the Root of Narcissism and Other Dark Traits

The Dark Factor of Personality (D) seems to be at the heart of dark personalities and socially offensive psychopathology.

What these unpleasant traits and dark personalities appear to have in common include the following:

- Overvaluing oneself.

- Devaluing others.

- Subjective justifications for the above.