1.Rates Move Higher Globally.

Two Year Government Bond Charts-from Dave Lutz at Jones Trading

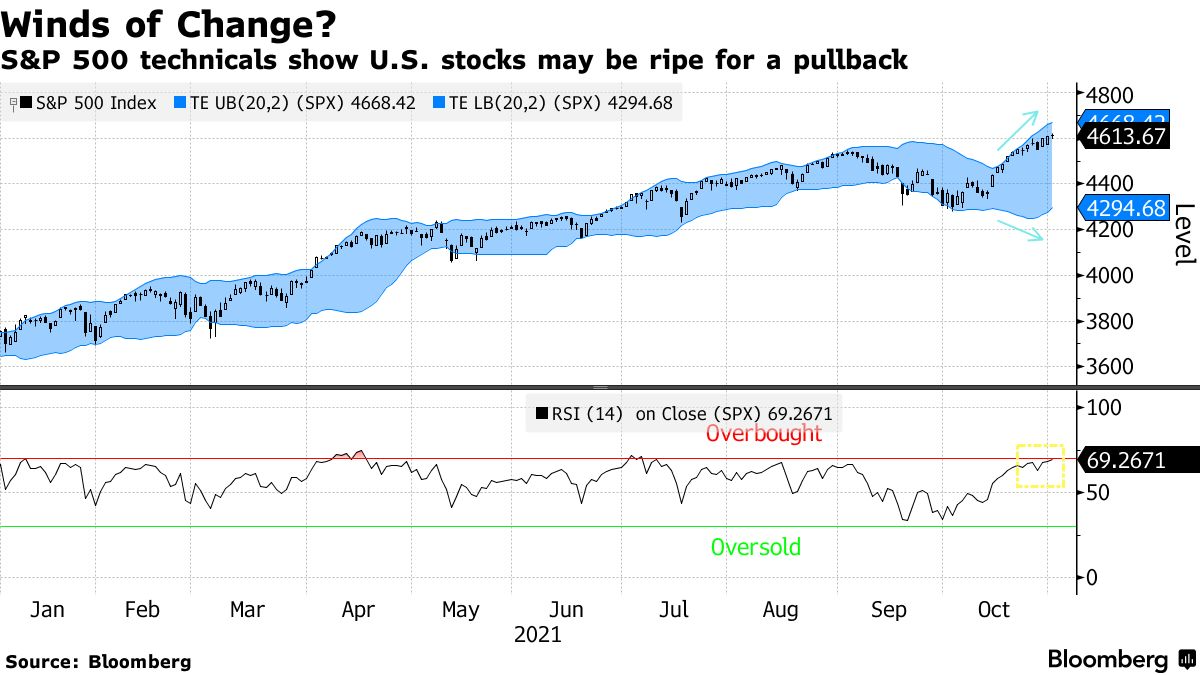

2.Short-Term Technicals

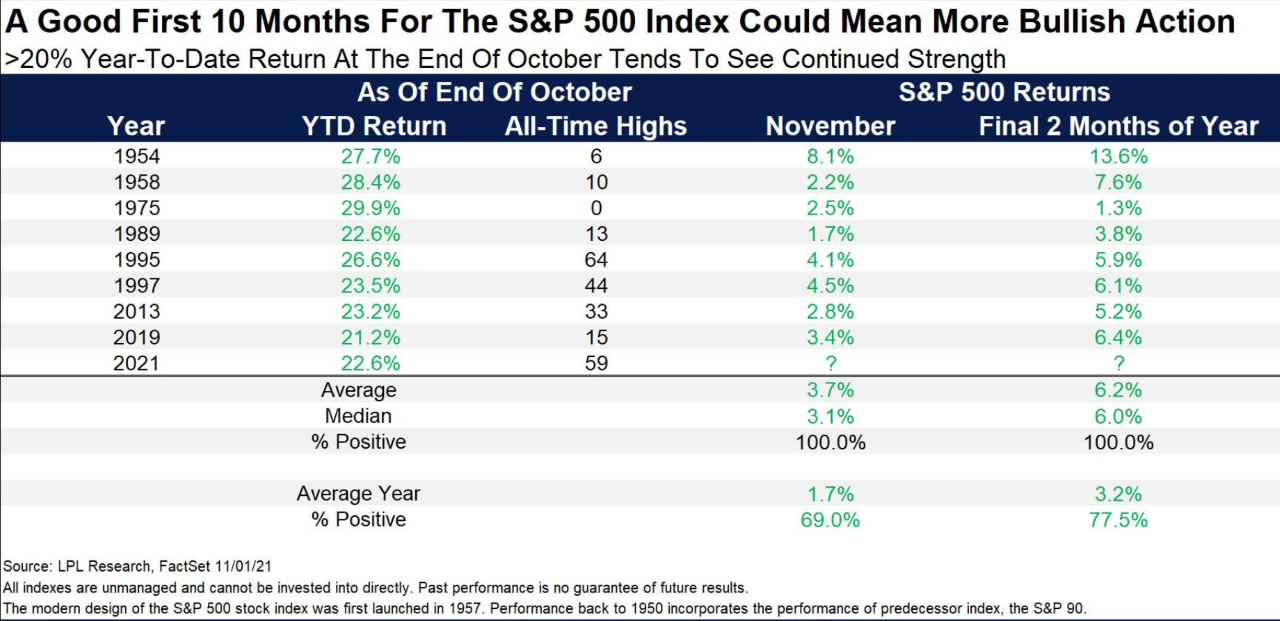

3.But Next 2 Months Favor Bulls

Ryan Detrick LPL-When the S&P 500 is up >20% for the yr heading in November did you know that stocks have never been lower in Nov or the final two months? 8 for 8 higher in Nov, up 3.7% vs. avg Nov up 1.7%. Final 2 months up 6.2% on avg vs. avg year up 3.2%.

https://twitter.com/RyanDetrick

4.Capitalism vs. Communism Part II –Stoxx 600 Europe Trailing S&P 500 by a Whopping 1300 Percentage Points Since Launch

Holger Zschaepitz-Just to put things into perspective: The Stoxx 600 may have marked a record today. But Europe’s benchmark index has lagged the US’s S&P 500 index by a whopping 1300 percentage points since the Stoxx 600 was launched in 1987.

https://twitter.com/Schuldensuehner

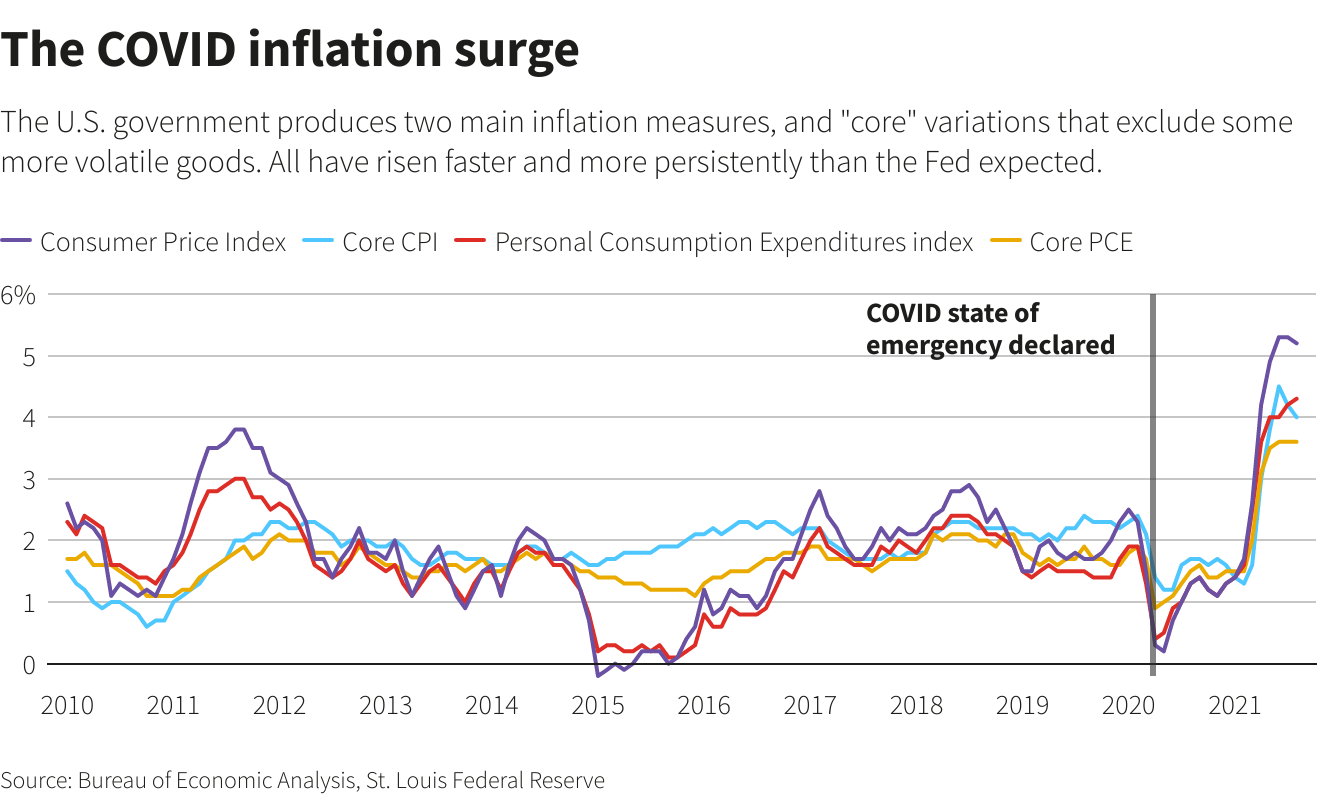

5.Wage Inflation Not Transitory

Reuters-Aspects of the job market, particularly the labor force participation rate, are unlikely to have recovered to pre-pandemic levels, and would seemingly still be short of the “maximum employment” the Fed has promised to restore before raising interest rates. But at that point, the Goldman team wrote, Fed officials would “conclude that most if not all of the remaining weakness in labor force participation is structural or voluntary,” and proceed with rate hikes to be sure inflation remains controlled.

Inflation, wage data, challenge Fed ‘transitory’ narrativeBy Howard Schneider

https://www.reuters.com/business/inflation-wage-data-challenge-fed-transitory-narrative-2021-11-01/

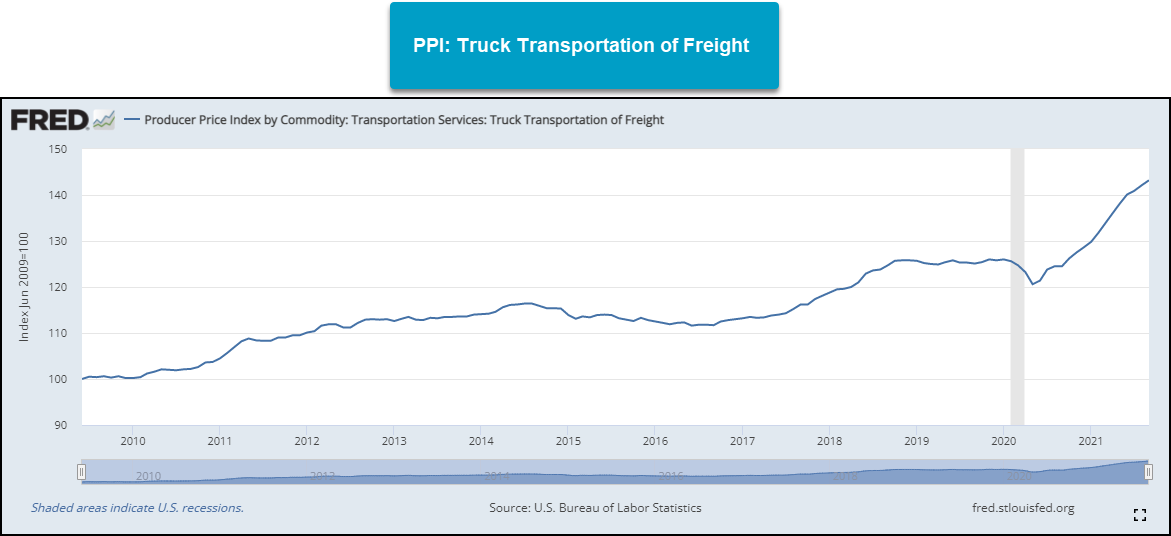

6.Price Index for Trucking Transportation into the Holidays.

7.Old Fashion Ha Freight Delivery Beating Space Travel 2021..S&P Kensho Space Index vs. S&P 500® Air Freight & Logistics Index

Richard Bernstein-Just as investors ignored the opportunities in the energy sector during the Technology Bubble, today’s investors continue to flood space-related companies with capital regardless of the significant need for capital in boring earth-bound logistical infrastructure. As the basic rules of investment suggest, too much capital is indeed hindering returns. Despite all the hoopla about Star Trek-like ventures into space, earth-bound logistics companies have been significantly outperforming space stocks during the recovery from the pandemic (See Chart 4).

Source: Bloomberg Finance L.P. For Index descriptors, see “Index Descriptions” at end of document.

https://www.advisorperspectives.com/commentaries/2021/10/30/a-world-of-opportunity-1

8. 80% of Venture Marked Up or Exited Last Quarter….Another Record

The State of Venture Capital-by Michael Batnick

The U.S. public stock market closed at an all-time high in October. Private markets are enjoying the same up only type of activity.

In a new report from AngelList, they shared that:

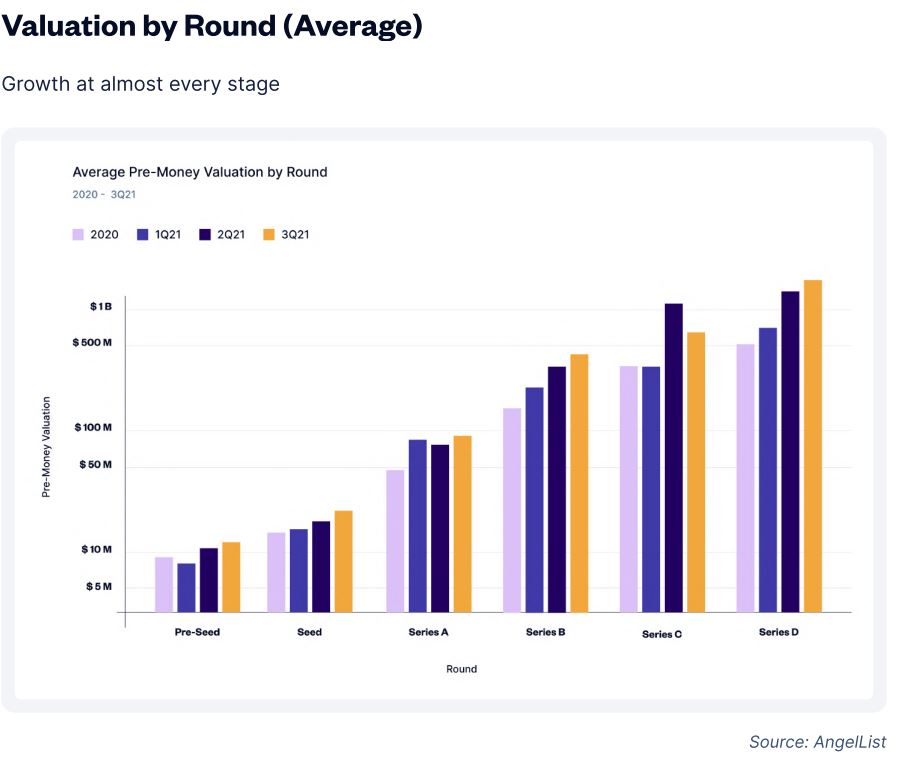

In 4Q20, 80% of startups that changed valuations were marked up or had a positive exit—a new record for startups on AngelList at the time. That record was broken in 1Q21 (85%) and then again in 2Q21 (90%).3Q21 fell just short of setting a new record for positive activity. Instead, it’ll be the second-best quarter ever for early-stage venture (Series A or prior): roughly 87% of events that happened to startups in the AngelList portfolio in 3Q21 were positive ones (i.e., markups and positive exits)

Private companies are growing bigger, faster, and stronger. The median pre-seed round is $8 million. Series B valuations are up 31% to $375 million. For context, and I know this a million years ago, but when Amazon went public in 1997, they were valued at $438 million.

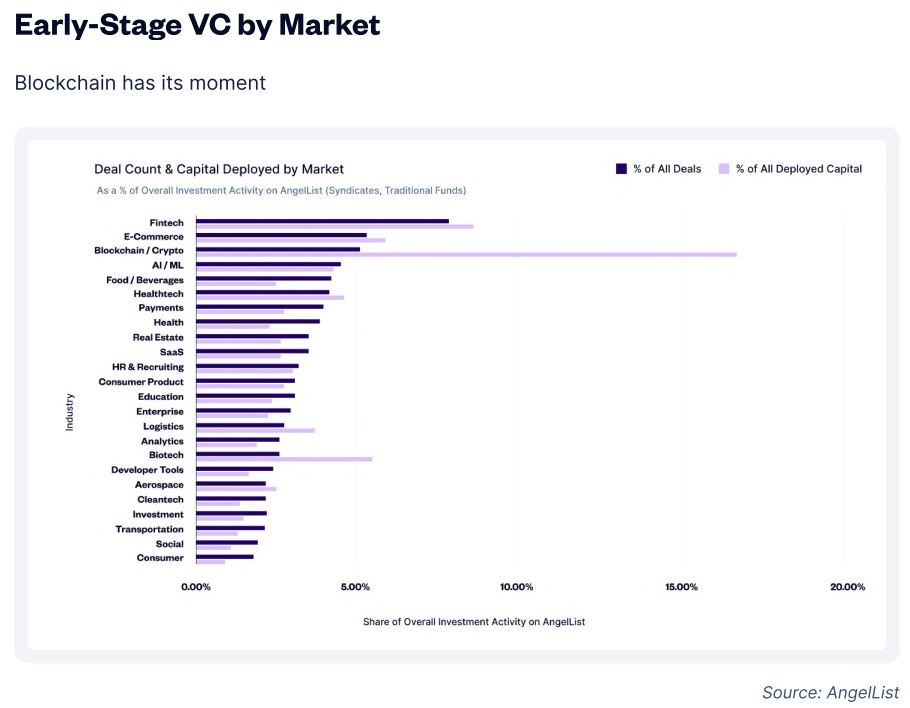

The fastest-growing area in private markets are crypto and blockchain companies. Interestingly, one of the biggest players in the space is not a traditional venture capital fund. It’s a corporation, Coinbase. In Q3, they made a record 49 investments, averaging a new deal every 1.8 days.

On AngelList, blockchain/crypto investments made up 5% of all deals but garnered 16.6% of all deployed capital.

https://theirrelevantinvestor.com/2021/10/30/the-state-of-venture-capital/

9.Fortress Technologies Buys 4,500 Bitcoin Mining Machines From Bitmain

The purchase will more than triple Fortress’ hashrate.

Crypto mining machines (Shutterstock)

Bitcoin mining company Fortress Technologies has ordered 4,500 Bitmain Antminer S19j Pro machines as it seeks to capture a greater share of mining revenue.

- The purchase will more than triple Fortress’ hashrate from 195 petahash per second to 645 PH/s, the company announced Monday. A petahash is a measure of computational power.

- The machines are scheduled for delivery in monthly instalments from April to September 2022.

- Financial terms weren’t disclosed, and Fortress didn’t immediately respond to CoinDesk’s request for details.

- The purchase follows two weeks after Fortress bought 180 Whatsminers M30S machines, which are expected to be installed by the middle of this month.

- Fortress, which is listed on the Toronto Venture Exchange (TSX-V: FORT), underwent a shake-up of its leadership team in September following the departure of CEO Aydin Kilic, who joined publicly traded crypto mining firm Hive Blockchain as president and chief operations officer.

- At the time, Fortress named Antonin Scalia CEO and Drew Armstrong chief operating officer. Both executives came from Galaxy Digital.

Read more: Hive Blockchain Orders Another 6,500 Bitcoin Mining Machines From Canaan

10.Carli Lloyd 5 Rules